Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

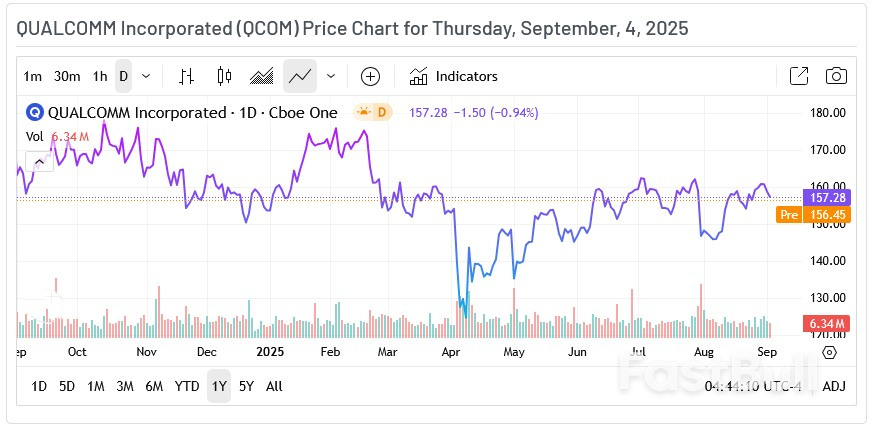

Qualcomm outpaces Nvidia, up \~8% since August on undervaluation, analyst upgrades, and diversification, though momentum depends on semiconductor sector trends.

President Donald Trump’s pick to fill a vacant seat on the Federal Reserve’s Board reiterated his commitment to central bank independence at a confirmation hearing Thursday, pushing back on concerns from Democrats that he would merely do Trump’s bidding.

Stephen Miran opened his hearing before the Senate Banking Committee by stating his commitment to central bank independence and promising to make decisions based on his own analysis. He also said a central bank’s most important job is preventing depressions and hyperinflation. The Trump administration official, who said he has spent much of his career studying monetary policy, last year wrote a paper detailing numerous proposals to overhaul the Fed, including ways to undercut its independence.

“If I’m confirmed to this role, I will act independently, as the Federal Reserve always does,” Miran said in response to a question from Senator Tim Scott, the Republican who heads the Banking Committee.

The first Democrat to speak, Senator Elizabeth Warren of Massachusetts, opened her questions by asking Miran to state whether he believed Trump lost the 2020 election.

Miran side-stepped the inquiry by saying: “Joe Biden was certified by Congress as the President of the United States.”

Miran similarly avoided giving a direct answer to a question on whether the Bureau of Labor Statistics had, as Trump has claimed, faked jobs data to influence the 2024 election, and Warren seized on his prevarication.

“You have made clear that you will do or say whatever Donald Trump wants you to do or say,” she said.

Miran has been fast-tracked by Republicans eager to confirm another supporter of lower interest rates to the Fed. He could be confirmed in time to attend the Sept. 16-17 meeting of the Federal Open Market Committee — the Fed’s rate-setting body.

Fed officials have been reluctant to lower interest rates this year as they wait to see how policies including tariffs impact the economy, even as Trump repeatedly called for cuts. The two Trump appointees to the board dissented from a vote to hold rates steady again at the July FOMC meeting, saying they preferred to lower them.

Trump’s threats to fire Chair Jerome Powell earlier this year, his recent move to fire Governor Lisa Cook — which she is contesting in court — and his promise to gain a “majority, very shortly” on the Fed in order to lower interest rates have increased concern about the Fed’s independence. Most global central banks are insulated from the political process and research shows that leads to lower inflation and better economic outcomes in the long term.

The hearing will be the first chance to gauge how strongly Republicans are willing to oppose a Trump nominee. While some have emphasized the importance of Fed independence, none have yet suggested they would oppose Miran.

Miran, currently chair of the White House Council of Economic Advisers, had unanimous support from Republicans earlier this year when he was confirmed to that post. Four of those Republicans would have to turn against Miran on his confirmation to the Fed at a time when Trump remains overwhelmingly popular with the party’s base.

Washington officials have sued President Donald Trump over his deployment of thousands of National Guard troops to the nation’s capital, escalating local opposition to the administration’s moves to exert more control over the city’s day-to-day affairs.

The city contends that the mobilization of more than 2,200 troops since mid-August violates US laws meant to bar the US military from carrying out domestic law enforcement activities — a dynamic that DC officials described as an involuntary occupation. The lawsuit, filed in federal court on Thursday, also alleges Trump illegally called in National Guard units from other states.

It’s the second lawsuit DC Attorney General Brian Schwalb has filed challenging Trump’s push to federalize policing in the city. It comes on the heels of a US judge’s ruling this week that Trump unlawfully deployed National Guard troops and US Marines to Los Angeles, which the administration is appealing. Trump has warned that he’s considering deployments to other US cities, including Chicago, prompting fierce push-back from Democratic state and local leaders.

“The deployment of National Guard troops to police District streets without the District’s consent infringes on its sovereignty and right to self-governance,” the city’s lawyers wrote in the complaint. “The deployment also risks inflaming tensions and fueling distrust toward local law enforcement.”

The White House and Justice Department didn’t immediately respond to requests to comment.

Trump announced last month that he would deploy National Guard troops to Washington and invoked the city’s home rule charter to temporarily take over the Metropolitan Police Department. He declared a “crime emergency,” even though statistics maintained by the Justice Department, as well as the city, show that crime rates have dramatically fallen in the past year.

Schwalb first sued after Attorney General Pam Bondi issued a directive installing a Trump administration official as the leader of the local police force. Bondi withdrew that order after a federal judge in Washington suggested she was likely to rule that it exceeded Trump’s authority under the home rule law.

While the 1973 Home Rule Act places time limits on the president’s takeover of the local police force, Trump controls Washington’s National Guard reserve force, setting the city apart from the rest of the country, where state officials exercise authority.

An 1878 law, the Posse Comitatus Act, and other US regulations generally prohibit the use of active-duty US servicemembers from carrying out domestic law enforcement operations. Presidents historically have only activated National Guard troops after receiving requests from a state’s governor, though the chief executive can unilaterally order deployments in limited circumstances.

DC’s lawsuit, like the case in Los Angeles, accuses Trump of violating the Posse Comitatus Act and another related law by directing National Guard units to address crime in the city, including ordering them to patrol neighborhoods while armed and deputizing them to carry out searches and arrests.

Schwalb’s office is also arguing that Trump unlawfully brought in troops from other states without first formally calling them into federal service and did so without getting approval from DC officials, which is required by an interstate emergency management compact that Congress approved.

The case is District of Columbia v. Trump, 25-cv-3005, US District Court, District of Columbia (Washington, DC).

When churning flood waters swept away a group of tourists in Pakistan’s Swat Valley in June, the whole country felt a sense of déjà vu.Just three years ago, extensive floods had swallowed entire hotels and families vacationing in the “Switzerland of Pakistan” and caused more than 1,700 deaths and billions in damage in other districts. Today, extreme rainfall has once again inundated swathes of the country, underscoring its status as among the world’s most climate-vulnerable.

The relentless tragedies highlight how woeful Pakistan’s disaster preparedness remains, as lofty climate funding pledges from advanced, higher-emitting countries and multilateral donor agencies fail to materialize. The shortfall is emblematic of the grim irony facing small, less-developed economies that contribute minimally to climate change but bear the brunt of its impacts.Less than half of the roughly $11 billion pledged by the European Union, China, Asian Development Bank and others in the wake of the 2022 floods has reached Pakistan, said the UN Office for the Coordination of Humanitarian Affairs, citing government data. Projects have been or are being identified for about three quarters of the total pledged amount, according to the Ministry of Economic Affairs.

Meanwhile, the country — which is also confronting multiple economic and political crises — has cited World Bank calculations that it needs $348 billion in investment through 2030, including $16 billion just to recover from the last disaster.“The number one problem for Pakistan’s ability to do what it needs to do is the lack of financing,” said Mohamed Yahya, the United Nations Resident and Humanitarian Coordinator for the country.What has been disbursed of that pledge — about $4.5 billion as of June — has gone to rebuilding housing, transportation, drainage, and toward flood risk management. The ADB has provided $528 million for initiatives including a reconstruction project in Sindh province and to rebuild climate-resilient infrastructure elsewhere, a spokesperson said in an email.But officials say it’s far from enough.

Globally, the UN estimates the funding gap for climate adaptation is at least $187 billion a year. That’s in part because developed countries have been slow or reluctant to follow through on funding commitments announced on the international stage. Many EU countries, facing fiscal pressure at home, are trying to push economic giants like China to share the climate aid burden.A pullback from the fight against climate change in some Western countries — including the US’ withdrawal from the Paris Agreement — is further slashing aid.Financing is also slow to flow because it’s often offered in the form of loans or is redirected from other projects, making it less palatable to emerging markets as it increases their debt burden and routes capital back into developed markets.

And finally, developing countries often lack the ability to use climate financing effectively. Pakistan’s Finance Minister Muhammad Aurangzeb said in August that his country had failed to develop enough investable flood-related projects to benefit from the pledges that came after the 2022 floods, according to local news reports.The South Asian nation has also been buffeted by corruption, political upheavals, and poor resource management, leaving it with little fiscal room to bear the costs of climate adaptation.The government has “to ensure that they do their homework in terms of needs of the communities across Pakistan and then develop plans accordingly,” said Imran Khalid, an environmental scientist based in Islamabad. Urban planning needs to be improved to prepare for excessive rainfall, and systems put in place to manage complex financing and large-scale projects, he added.

Pakistan’s national adaptation plan says funds should be channeled toward infrastructure for drought-flood cycles in agricultural areas, developing early warning systems, and constructing wetlands and open spaces to capture runoff. Last month, Climate Change Minister Musadik Malik said in parliament the government is developing a strategy to disburse and track climate-related flows.The country is making some progress on improving disaster preparedness. In July, it launched a remote sensing satellite for round-the-clock disaster assessment in collaboration with China. The government is also working with the UN to train officials and install early warning systems in the vulnerable valleys of Gilgit-Baltistan and Khyber Pakhtunkhwa.

It can’t come too soon for Pakistan, a country with more than 7,200 glaciers — the highest tally outside polar regions — whose melt combines with annual monsoons to make floods its most frequently occurring natural disaster. Rainfall at one point this season was 82% higher than a year ago, the national weather agency said. Nearly 900 people have died, thousands have been forced to evacuate, and acres of crops destroyed.“If devastating events continue to happen along the way, at various points, they can add to the economic burden,” said Zeeshan Salahuddin, a partner at Tabadlad, a think tank based in Islamabad. “And this is why Pakistan really needs to focus more on finding innovative finance solutions.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up