Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In an important development on October 8, 2025, U.S. President Donald Trump announced that Israel and Hamas had reached an agreement on the first phase of a peace plan. ...

Key takeaways:

● Solana ETFs and ETPs recorded $706 million in weekly inflows, outpacing XRP’s $219 million, per CoinShares.

● SOL funding rates stayed below the 6% neutral level, signaling reduced appetite for leveraged bullish positions among traders.

Solana’s native token, SOL, climbed back to $229 on Tuesday after briefly dipping to $218. The move came as investors responded positively to the US Federal Reserve’s release of minutes from its Sept. 17 meeting, which reaffirmed expectations of additional interest rate cuts in 2025.Traders remain optimistic that SOL could advance toward the $300 mark, a target that appears realistic given the strong bullish sentiment reflected in derivatives metrics and onchain data.

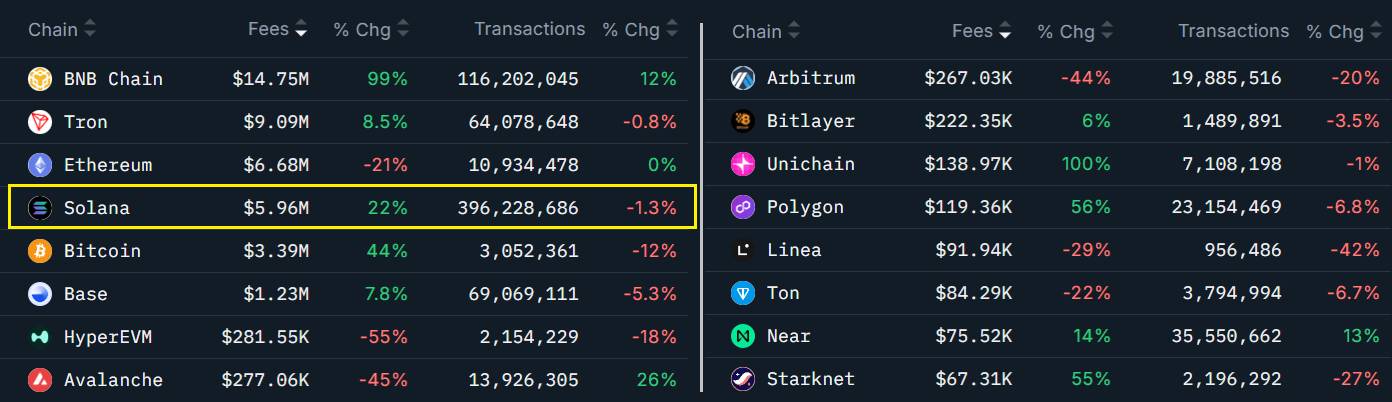

Blockchains ranked by 7-day fees. Source: Nansen

Blockchains ranked by 7-day fees. Source: NansenSolana recorded a 22% increase in seven-day network fees, driven by rising activity across decentralized exchanges (DEXs). Meanwhile, its main rival by deposits, Ethereum, saw the opposite trend, with network revenue falling 21% during the same period. Solana continues to dominate in transaction count, surpassing the combined total of Ethereum and its layer-2 ecosystem.

Weekly Solana DEX (left) and perpetual (right) volumes, USD. Source: DefiLlama

Weekly Solana DEX (left) and perpetual (right) volumes, USD. Source: DefiLlamaDEX volumes on Pump rose 78% over the past seven days, followed by a 73% increase on Meteora and a 46% rise on Raydium. Solana regained its leading position in decentralized exchange activity, posting $129 billion in 30-day volume and surpassing Ethereum’s $114 billion, according to DefiLlama data. Notably, the fastest-growing rival, Hyperliquid, has stalled at around $31 billion.

Network fees remain a key element for any blockchain focused on decentralized applications, particularly when the revenue helps offset inflationary pressures. Unless the system is centralized, maintaining validators incurs costs, and staking participants expect a reasonable return. In short, weak network activity discourages holding the native token and can trigger sell pressure.

Solana’s total value locked (TVL) rose 8% in 30 days, supporting further growth in network fees. Standout performers included a 20% rise in Kamino deposits, 12% in Drift, and 12% in Orca. By comparison, Ethereum’s TVL increased 3% over the same period, while Tron deposits grew 6%. As a result, Solana has solidified its position as the second-largest network, with $14.2 billion in TVL, representing an 8% market share.

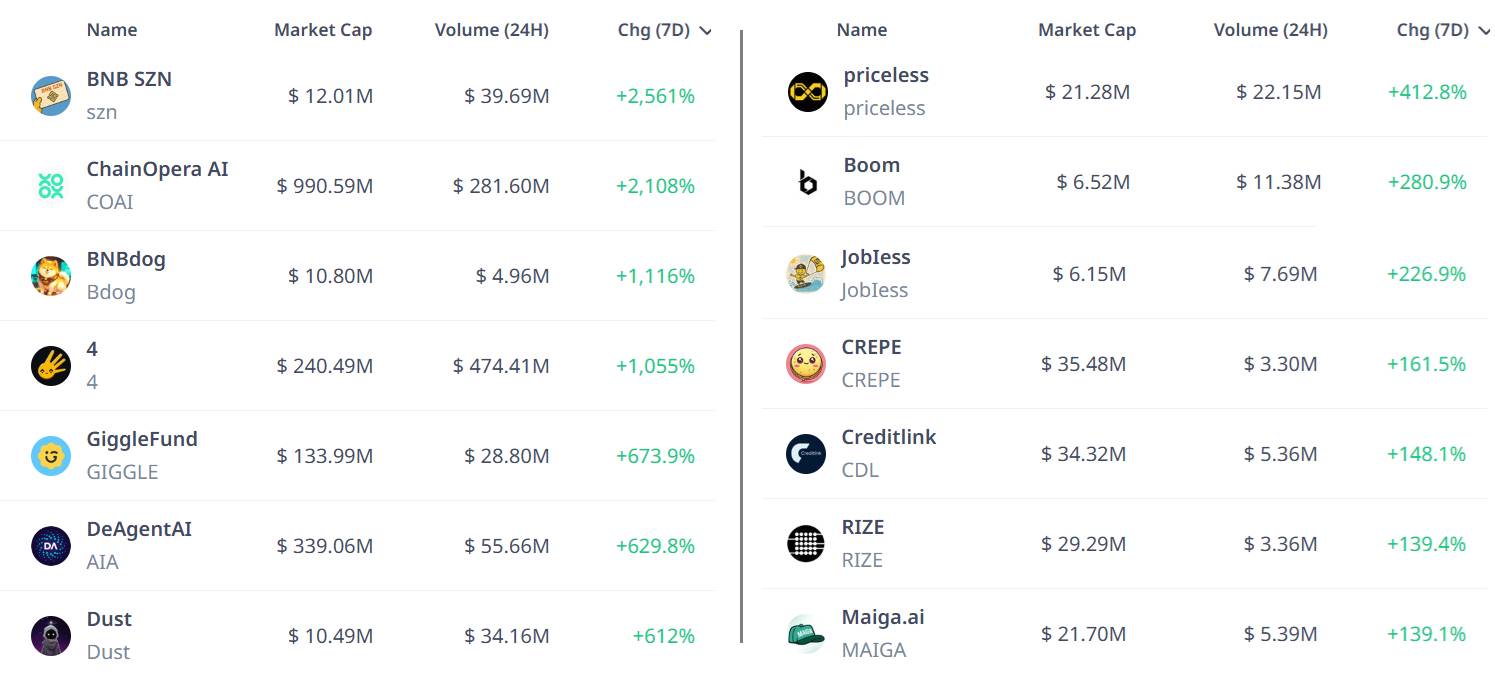

The rapid surge in activity on the perpetual futures trading platform Aster has redirected traders’ focus toward BNB Chain, following a wave of memecoins that soared 150% or more within seven days. As a result, even though SOL’s price rose 3% during the same period, BNB’s remarkable 28% rally weighed on sentiment among Solana ecosystem investors.

Top 7-day performances of BNB Chain tokens, USD. Source: Cryptorank.io

Top 7-day performances of BNB Chain tokens, USD. Source: Cryptorank.ioData from SOL perpetual futures provides insight into whether traders have lost confidence after the failed attempt to break above $250 on Sept. 18. Many SOL holders are likely frustrated, especially as some rival tokens have recently reached new all-time highs, including BNB at $1,357 on Tuesday and Mantle at $2.81 on Wednesday.

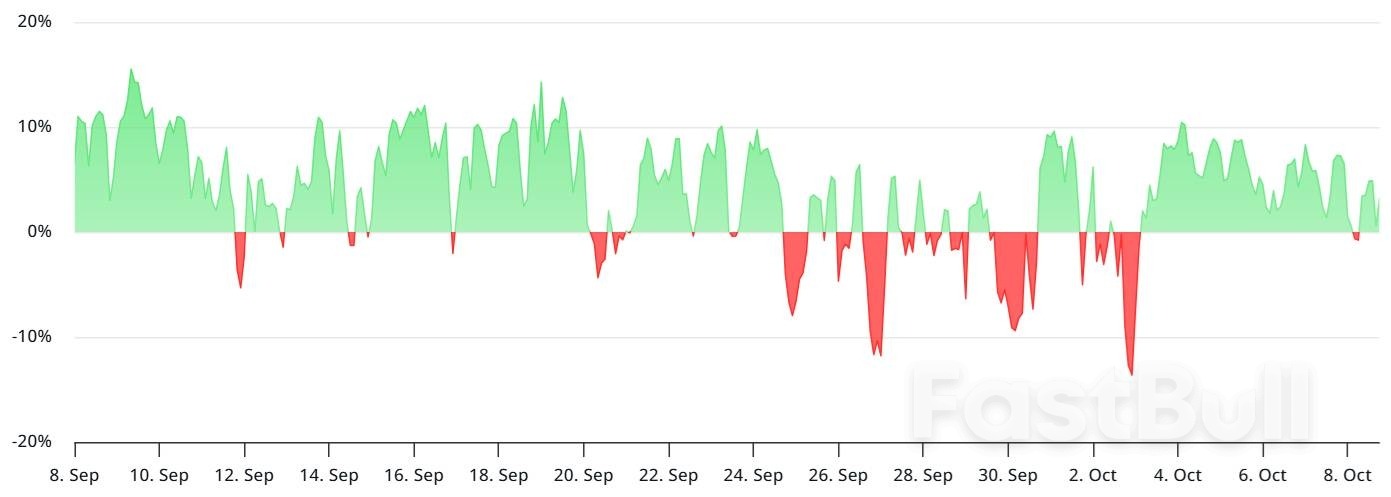

SOL perpetual futures funding rate, annualized. Source: laevitas.ch

SOL perpetual futures funding rate, annualized. Source: laevitas.chThe funding rate on SOL perpetual futures has remained below the 6% neutral threshold, signaling weak demand for bullish leveraged positions. This cautious stance among traders may be partly attributed to the growing traction of competing blockchains, which have drawn attention away from Solana despite record weekly inflows into its exchange-traded products.

CoinShares reported that Solana ETFs and ETPs attracted $706 million in inflows during the seven days ending Sept. 5, far surpassing the $219 million recorded by XRP instruments. Investors now anticipate that the US Securities and Exchange Commission will approve multiple spot Solana ETFs on Friday, a development that could drive additional institutional inflows and potentially push SOL’s price beyond $300.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up