Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Indonesia's fiscal deficit is set to breach its legal limit due to new spending, with analysts divided on the outcome.

Analysts at Citigroup are warning that Indonesia's fiscal deficit is on track to surge past its legal limit this year, driven by major spending initiatives from the new government. The key drivers include a nationwide free meals program and extensive rebuilding efforts in flood-damaged provinces on Sumatra island.

In a recent note, Citi revised its forecast for Indonesia's 2026 budget deficit to 3.5% of gross domestic product (GDP), a significant increase from its previous estimate of 2.7%. This projection assumes the government will amend the State Finance law before the second half of the year to lift the long-standing 3% fiscal deficit cap.

This development follows a budget shortfall of 2.9% of GDP in 2025, which was the widest deficit in at least two decades, excluding the pandemic era. The strain on state finances is intensifying as soft economic growth and weaker commodity prices impact revenue, just as President Prabowo Subianto prepares to boost social spending.

Citi also projects that Indonesia's debt-to-GDP ratio will climb from an estimated 39% in 2025 to approximately 42% by 2029. However, the bank notes that a breach of the fiscal cap could be avoided if the government opts for sharp spending cuts to maintain fiscal discipline.

The anticipated rise in government spending stems from several large-scale programs:

• Free Meals Program: Citi expects this initiative to reach its full scale of 83 million beneficiaries by the second quarter, pushing its total cost to around 300 trillion rupiah ($18 billion).

• Sumatra Flood Rebuilding: Reconstructing the flood-hit provinces may require an estimated 60 trillion rupiah over an unspecified period.

• Regional Transfers: Payments to regional governments could also increase as Prabowo aims to advance difficult reforms this year.

These costs could also deplete the government's contingency spending buffers—funds set aside to cover revenue shortfalls or emergency expenses.

While Citigroup anticipates a breach, Bank of America Corp. maintains that the budget deficit will likely be kept under the 3% GDP threshold this year. However, BofA economists expressed concern over Indonesia's lackluster revenue collection.

In a note, they argued that the government's target to increase state revenue by 14% annually in 2026 appears ambitious given the current trend. Revenue collections actually shrank in the early months of 2025, and only a 16% jump in December revenue likely prevented the deficit from exceeding the legal limit last year.

Still, BofA suggests the government has options. It could tap into its sizable contingency fund allocated for 2026 or simply rein in its spending plans to stay within the established fiscal boundaries.

Gold (XAU) breaks record above $4,550 as safe-haven demand increased on geopolitical tensions and expectations of US interest rate cuts. A weaker than expected US jobs report supported the rally in the precious metals.

The main reason for increase in gold price despite the overbought conditions is the increase in geopolitical tensions. According to some reports, President Trump is considering military action in Iran in the wake of civilian unrest. Meanwhile UK and Germany are planning to increase their presence in Greenland and this escalates Arctic tensions. These developments have added a degree of uncertainty around the world that strengthens the traditional role of gold as a safe haven during a crisis.

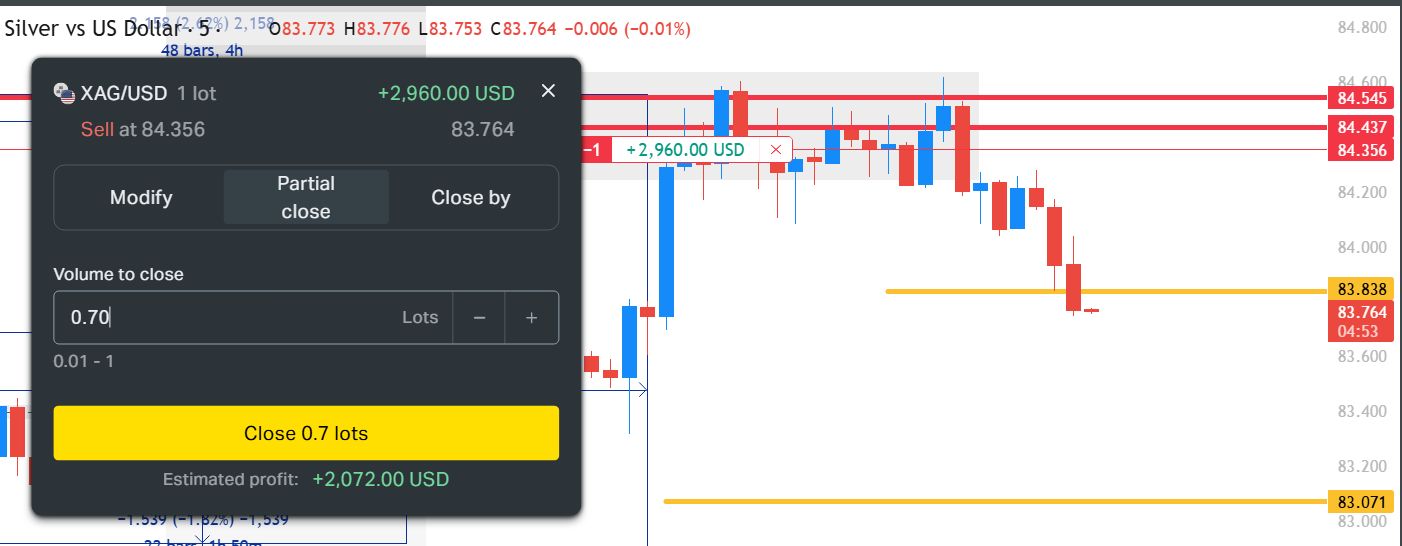

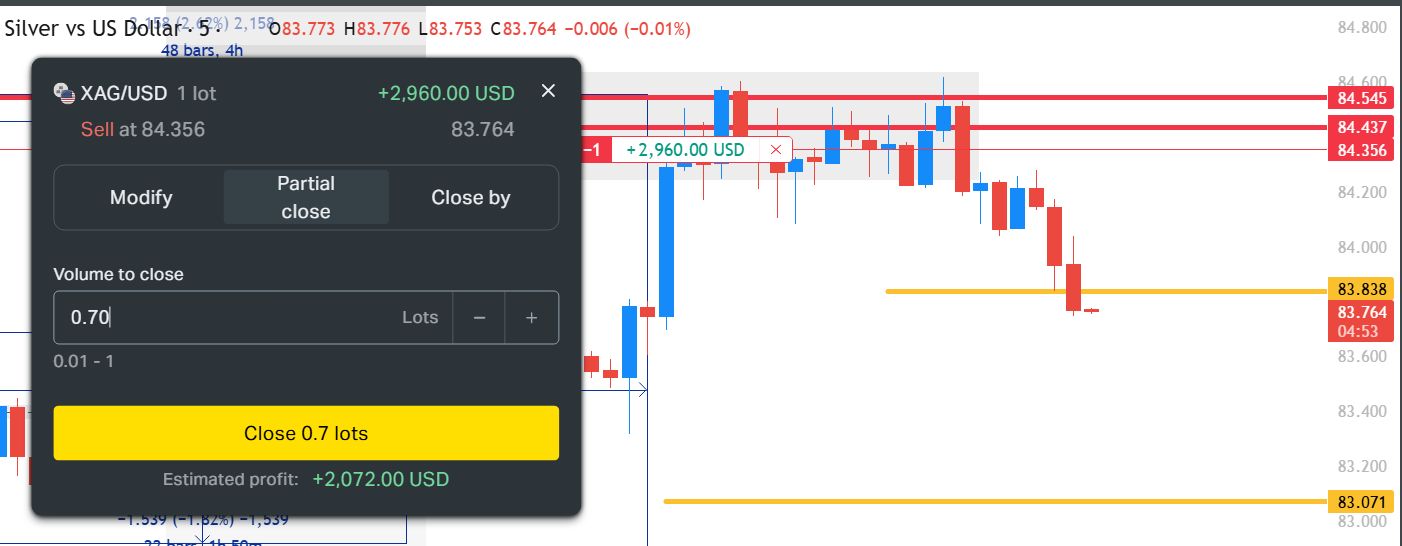

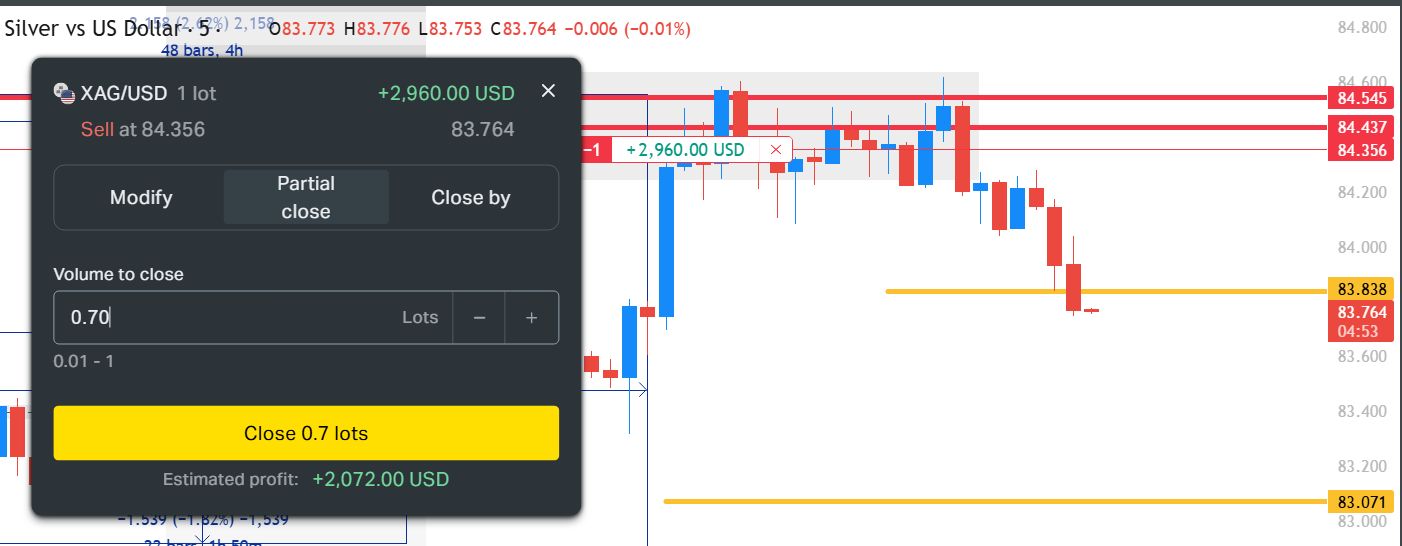

On the other hand silver prices are supported by the same combination of macro risks and dovish expectations. However, silver does have industrial demand which provides another layer of strength. The recent pullback has been shallow which indicates ongoing bullish interest. With gold setting records silver (XAG) is catching up, and the psychological target of around $100 is now not far away.

The market is now awaiting the U.S. CPI inflation report that is due on Tuesday. This data may provide confirmation for the Fed rate cut paths. A softer inflation print may add more fuel to the rally in gold and silver.

The daily chart for spot gold shows that the price has made excellent support at $4,260 after breaking higher and currently looks strong. The rebound from $4,260 looks constructive and is pointing higher in the coming days.

The price action is now completing a new ascending broadening wedge pattern and this pattern suggests much higher levels in 2026.

The 4-hour chart for spot gold illustrates that the correction off $4,550 met strong support at $4,260 and created an inverse head and shoulders above this level.

The picture of the inverted head and shoulders in the red shaded area means a strong bullish pattern. This bullish price action suggests more upside in the next few days.

The daily chart of spot silver shows that the silver price is trading within ascending broadening wedge pattern and looks set to trade higher. The immediate resistance is still in the $90 to $100 level.

The formation of a cup and handle pattern inside the ascending broadening wedge is a good sign of continued upside for next few days. As long as the strong support of $70 is respected, it is certain that the next move in the silver market will be higher.

The 4-hour chart of spot silver shows that silver is forming bullish price action within the ascending broadening wedge pattern. The target of the ascending broadening wedge is still between $90 to $100.

The formation of the ascending broadening wedge pattern shows high volatility as the price is approaching the psychological level of $100.

The daily chart of the US Dollar Index shows that the index rebounded from 97.50 support and hit 200 day SMA. The index is now consolidating between the 50 day and 200 day SMA and looks uncertain.

Since both averages are approaching the 99 level, the next move in the US Dollar Index is uncertain. A break below 97.50 will signal more downside towards 96.50. However, a break above 100.50 is needed to cancel the bearish pressure in the US Dollar Index.

The 4-hour chart for the US Dollar Index shows a period of very strong consolidation between the 96.50 and 100.50 levels. Despite this consolidation, the overall price action is still negative.

A break below 97.50 is needed to take the index further down. However, a break above 100.50 will take the index to 102 level.

Japan’s ruling Liberal Democratic Party (LDP) is reportedly preparing to dissolve the Lower House for a snap election, potentially as early as February. This strategic move appears designed to leverage Prime Minister Sanae Takaichi's remarkably high public approval ratings and solidify the LDP's grip on power.

According to public broadcaster NHK, preparations are already underway, with the Ministry of Internal Affairs and Communications instructing prefectural election boards to get ready for a possible general election.

The timing is driven by Prime Minister Takaichi's strong public standing. A Nikkei survey puts her approval rating at a historic 75%, marking the third consecutive month it has stayed above the 70% threshold. This popularity persists even as her government navigates a diplomatic dispute with Beijing, sparked by her November comments suggesting Japan's Self-Defense Forces might intervene in response to Chinese military action against Taiwan.

If called in February, the election would occur just four months into Takaichi's term. It would also be the first national test for the LDP's new coalition with its junior partner, the Japan Innovation Party (JIP). Speaking to Takaichi, JIP leader Hirofumi Yoshimura noted that the prime minister's perspective on the election's timing has shifted to a "new stage," signaling that discussions are advancing.

While Takaichi's personal ratings are high, her coalition's control over the legislature is thin. The LDP and JIP, along with three independents, hold 233 seats—a slim majority in the 465-seat Lower House.

The situation is more challenging in the Upper House, where the coalition is in the minority with only 119 of the 250 seats. A successful snap election could strengthen the coalition's mandate and provide a more stable foundation for its policy agenda.

The opposition is gearing up for a fight. Yoshihiko Noda, leader of the Constitutional Democratic Party of Japan (CDP), the country's largest opposition party, has vowed to oust the ruling coalition.

The CDP currently holds 148 seats in the Lower House and is reportedly exploring an alliance with Komeito, the LDP's former coalition partner. Komeito, which controls 24 seats, broke its long-standing partnership with the LDP in October 2025 during Takaichi's run for prime minister, citing "illegal political financing practices" within the LDP. The LDP-Komeito alliance had been a cornerstone of Japanese politics since 1999.

Despite her political strength, Prime Minister Takaichi faces a complex set of economic challenges that could become central issues in an election campaign. Key concerns include:

• A Weakening Yen: The Japanese yen has fallen to its weakest level against the dollar in a year, recently hitting 158.19.

• Persistent Inflation: Consumer inflation has remained above the Bank of Japan's target for 44 consecutive months, putting pressure on households.

• Economic Contraction: Revised GDP figures for the third quarter revealed that the economy shrank by 0.6% quarter-on-quarter and 2.3% on an annualized basis, a deeper contraction than initially estimated.

President Donald Trump has suggested he may exclude Exxon Mobil from a U.S.-led initiative to rebuild Venezuela's oil industry, citing his dissatisfaction with the company's cautious approach.

"I'd probably be inclined to keep Exxon out," Trump told reporters Sunday aboard Air Force One. "I didn't like their response. They're playing too cute."

The president's comments appear to stem from a White House meeting on Friday where Exxon's Chief Executive Officer, Darren Woods, expressed significant reservations about the plan.

During the meeting with nearly 20 oil industry executives, Woods reportedly described Venezuela as "uninvestable." This skeptical assessment stands in contrast to the president's ambitious push to reconstruct the nation's energy sector following the capture of former President Nicolás Maduro.

Woods’s caution is rooted in Exxon's past experiences. The company has had its assets seized by the Venezuelan government twice and ultimately left the country after its operations were nationalized in the mid-2000s under President Hugo Chávez.

"If we look at the legal and commercial constructs and frameworks in place today in Venezuela today, it's uninvestable," Woods stated at the meeting. However, he added that Exxon would be ready "to put a team on the ground" if it received an invitation from the Venezuelan government along with adequate security guarantees.

Reviving Venezuela's oil sector after years of mismanagement and underinvestment is a monumental task. Estimates suggest it could require $100 billion and take a full decade to complete.

Despite recent U.S. actions to control Venezuelan oil exports, significant questions remain about how long-term investments can be protected in a country plagued by corruption and instability. When asked what guarantees he offered the oil companies, Trump said, "Guarantees that they're going to be safe, that there's going to be no problem. And there won't be."

It remains unclear how the president might formally exclude Exxon from any future plans. The company did not immediately provide a comment.

While other executives at the meeting also expressed caution, some were more optimistic about the opportunity in Venezuela.

Chevron, Exxon's largest U.S. competitor, has maintained operations in the country. Vice Chairman Mark Nelson told attendees that Chevron is prepared to increase its output from the current 240,000 barrels per day. He projected that production could rise by approximately 50% within the next 18 to 24 months.

Similarly, Josu Jon Imaz San Miguel, CEO of the Spanish company Repsol, said his firm was "ready to invest more in Venezuela today" once the necessary legal and commercial frameworks are established.

Federal Reserve Chair Jerome Powell has accused the Trump administration of launching a criminal investigation into his conduct as a direct assault on the central bank's political independence.

In a statement on Sunday, Powell asserted that the probe is a retaliatory measure for the Federal Reserve’s decisions on interest rates. "The charges are a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President," he said.

The US attorney for Washington, D.C., opened a criminal investigation into Powell on Friday, The New York Times reported. The inquiry centers on two main points:

• The renovation of the Federal Reserve's headquarters.

• Whether Powell misled Congress about the scale of the construction project.

Powell, whose term as Fed chair is set to end in May, framed the investigation as a pivotal moment for the future of American monetary policy.

He argued the core issue "is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions—or whether instead monetary policy will be directed by political pressure or intimidation."

The investigation follows a prolonged period of public criticism from President Donald Trump, who has consistently attacked Powell and the Federal Reserve for not cutting interest rates as he demanded.

The President has previously threatened legal action over the Fed building's renovations and has openly stated his intention to fire Powell. In a related move, Trump fired Fed governor Lisa Cook amid accusations of mortgage fraud, though the Supreme Court later blocked her removal.

With Powell's term concluding, the Trump administration has already assembled a list of potential loyalist candidates to lead the central bank, many of whom are expected to favor lower interest rates.

Kevin Hassett, a key economic adviser to Trump, is widely seen as the leading candidate to replace Powell. Despite this, Hassett has stated that the President's opinions on interest rates would hold "no weight" on the agency's decisions if he were in charge.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up