Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key RateA:--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)A:--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)A:--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)A:--

F: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)A:--

F: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)A:--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)A:--

F: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)A:--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Mexico Trade Balance (Nov)

Mexico Trade Balance (Nov)--

F: --

P: --

Canada GDP YoY (Oct)

Canada GDP YoY (Oct)--

F: --

P: --

Canada GDP MoM (SA) (Oct)

Canada GDP MoM (SA) (Oct)--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)--

F: --

P: --

U.S. PCE Price Index Prelim QoQ (SA) (Q3)

U.S. PCE Price Index Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. GDP Deflator Prelim QoQ (SA) (Q3)

U.S. GDP Deflator Prelim QoQ (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)--

F: --

P: --

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)

U.S. Real GDP Annualized QoQ Prelim (SA) (Q3)--

F: --

P: --

U.S. Durable Goods Orders MoM (Oct)

U.S. Durable Goods Orders MoM (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Uncertainty over how the U.S. would enforce Trump's intent to block sanctioned tankers from entering and leaving Venezuela tempered geopolitical risk premiums.

The festive period officially starts next week, with many traders vacating their desks until the first full week of January, making way for thin trading volumes and very few top-tier releases. However, plenty of action is expected in the first full week of January 2026 when the US jobs report returns to its usual schedule.

But what are the risks of volatility episodes such as flash crashes or geopolitical flare-ups during these quiet days when any sudden moves could be amplified due to extremely low liquidity?

With tensions elevated between the US and Venezuela, further escalation is possible. President Trump could decide to take more action over the country by expanding the military strikes on drug traffickers at sea to Venezuelan land – something he's already warned about. The US this week imposed a blockade of all sanctioned oil tankers from entering or leaving Venezuela and Trump could well decide to pile yet more pressure on President Madura.

Fresh tensions would probably boost oil prices and to a lesser extent Gold.

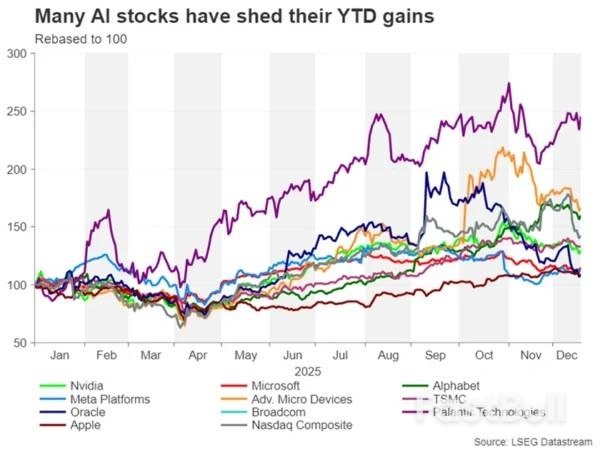

There's also a danger of panic selling on Wall Street if AI jitters persist. Equity markets haven't staged much of a Santa rally this year despite expectations of more Fed rate cuts. But whilst some valuations are clearly overstretched, the AI revolution is only beginning, hence, new winners could enter the scene just as others unexpectedly become losers in the race.

Still, this year's slightly prolonged duration of holiday-thin liquidity increases the risk of a negative AI-related headline triggering a new round of selloff in tech stocks if fresh doubt is cast on valuations.

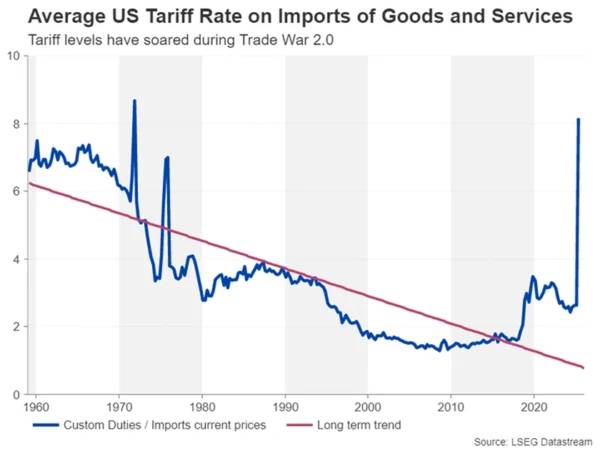

However, investors on the whole will probably prefer to stay on the sidelines, as they await two key decisions in early January. First, the US Supreme Court will deliver its ruling on Trump's tariffs, ending months of uncertainty about whether most of the levies announced since April are legal or not. However, a ruling against the tariffs may not necessarily be the best outcome, as this could worsen the uncertainty and potentially cost the US government billions if it's forced to refund the tariff revenue to businesses.

The other big decision is who President Trump will nominate to head the Federal Reserve when Jerome Powell's term ends in May 2026. Given that Trump keeps changing his mind and there's a new favourite on a weekly basis, a surprise choice cannot be ruled out. Moreover, picking someone who can achieve consensus within a split FOMC will be crucial. Nevertheless, whoever Trump selects, the new Fed chair will almost certainly be more dovish than Powell, so the announcement is possibly a low-risk event for the markets.

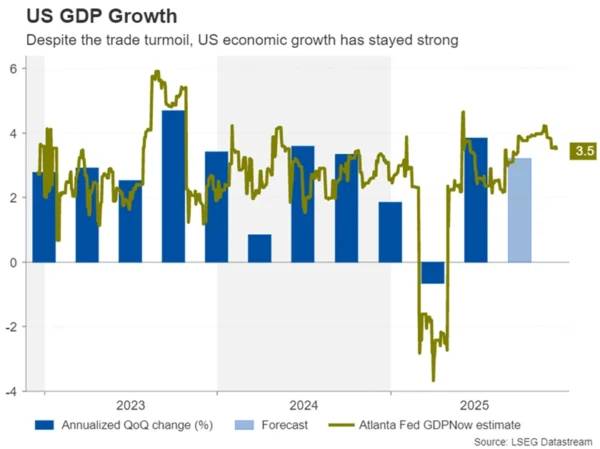

Switching the focus to economic data now, the US agenda is by far the busiest. The advance GDP reading for Q3 is the first highlight next week. Due on Tuesday, the report is expected to show that the US economy grew by a solid annualized rate of 3.2% in the third quarter, somewhat slower than the 3.8% seen in Q2. Durable goods orders for October and the latest consumer confidence index are also out the same day.

On Tuesday, December 30, the Fed will publish the minutes of its December policy meeting. With not a whole lot of Fed speakers out and about during the Christmas and New Year period, the minutes will be scrutinized for any clues on the timing of the next Fed rate cut, as well as to see how strong the inflation concerns still run among the policymakers that voted to keep rates on hold.

Moving into January, things will begin to heat up as the ISM manufacturing PMI for December is out on Monday, January 5, followed by the JOLTS job openings, the ADP employment report and ISM services PMI on Wednesday.

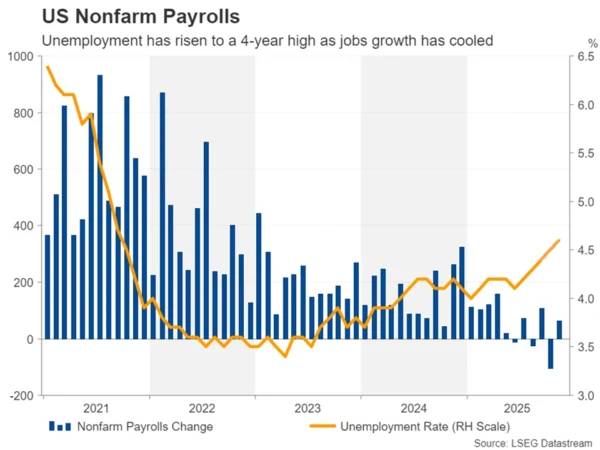

Most important of all, the December jobs report will be released without any delay on Friday, January 9. After the mixed payrolls figures and the much softer-than-expected CPI report for November, any further weakness in the labour market in December would fuel expectations of a January rate cut.

In particular, if the unemployment rate, which hit a four-year high of 4.6% in November, continues to rise, the Fed hawks will find it increasingly tough to defend their stance.

Finally, the University of Michigan's preliminary consumer sentiment survey for December will also get published on Friday.

For the US dollar, the ISM PMIs and NFP data are likely to have the biggest impact. The risks for the greenback are currently tilted to the downside so a bad set of prints could exacerbate any selling pressure.

Employment numbers are also due in Canada on January 9. The Canadian dollar's mini rally versus the greenback paused for breath during the past week after the weak November CPI prints. But an upbeat labour market report could recharge the bulls.

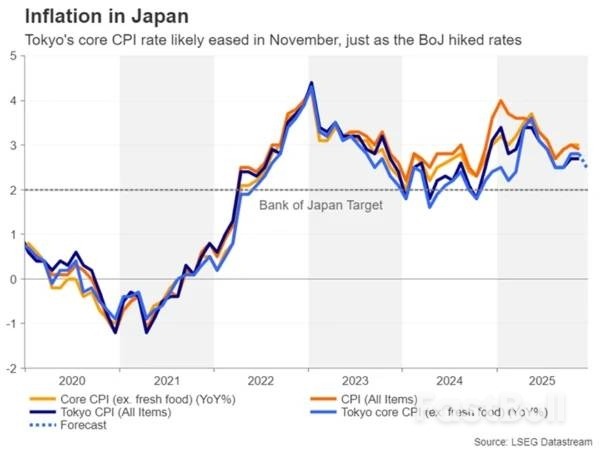

As most traders wind down over the long Christmas weekend, it will be business as usual in Japan. December CPI data for the Tokyo region is out on Friday, December 26, along with the November readings for industrial production, retail sales and unemployment.

Following the Bank of Japan's rate hike in December, the focus is now on how soon the next increase will come. The BoJ will publish the Summary of Opinions of that meeting on Monday, December 29, but before that, any uptick in inflationary pressures could lift BoJ rate hike odds, boosting the yen.

Similarly, investors may want to watch wage growth and household spending numbers that are scheduled for January 8 and 9, respectively.Australian CPI eyed for RBA clues

Elsewhere in Asia, Chinese manufacturing PMIs out on New Year's Eve and January 2 might attract some attention for the Australian dollar. But aussie traders will mainly be keeping their eyes on domestic November CPI data due on Wednesday, January 7.

Although the Reserve Bank of Australia is unlikely to announce any changes in policy at its next meeting in February, any fallback in monthly CPI, which unexpectedly jumped to 3.8% y/y in October, could push back the timing of a potential rate hike, weighing on the aussie.Euro and Pound might shrug off the data

In Europe, it will be extremely quiet apart from Q3 GDP figures out of the UK this Monday, and the Eurozone's flash CPI estimate for December on Wednesday, January 7.

With both the Bank of England and European Central Bank having just held their last policy decisions of the year, neither release is likely to move the euro and pound.

The ECB is firmly on pause at least until the middle of 2026, while any disappointing growth numbers for the UK may not be enough to significantly alter the BoE rate outlook after the Bank delivered a surprise hawkish cut.

Canada's gross domestic product report for October on Tuesday will mark Statistics Canada's final major data release of 2025, and we anticipate a 0.2% decline in growth.

It's slightly higher than StatsCan's preliminary estimate released a month earlier for a 0.3% contraction. If October's decline is realized, it would represent the steepest monthly drop in GDP since February.

Still, early indicators such as hours worked and our tracking of consumer spending suggest a possible recovery in November. We continue to expect a soft 0.5% annualized increase in GDP for Q4.

In October, we see weakness mostly from goods-producing sectors, while output among service industries remained essentially unchanged.

Non-conventional oil production in Alberta contracted sharply (-5%) in October after four consecutive months of expansion. Manufacturing output declined as well, partially reversing September's gains. StatsCan's October mineral production data indicated modest recovery in mining output, following declines in the prior two months, helping to cushion some weaknesses in other sectors.

For services, home resales rose 0.8% month-over-month in October, bolstering real estate activity. Arts and entertainment saw a boost from the Blue Jays' playoff run, although the gain was likely reversed quickly in November. Offsetting stronger activities was the Alberta's teacher strike temporarily weighing on education services. Wholesale and retail volumes also fell, by 0.7% and 0.6% respectively.

Early November indicators suggest signs of stabilization. Hours worked increased a larger 0.4%, and our tracking of RBC consumer spending data indicates continued strength, especially in discretionary purchases as the holiday shopping season ramps up. This is consistent with StatsCan's advance retail indicator, which shows sales rebounded by 1.2% in November. Overall, we continue to expect modest growth in Q4.

Delayed Q3 U.S. GDP report will be released on Tuesday after the U.S. government shutdown. We look for headline GDP growth of an annualized 2.5% quarter-over-quarter—a deceleration from Q2's 3.8%. Much of Q3's expansion was driven by household consumption, particularly within services. Excluding volatile net trade, final domestic demand likely remained resilient, albeit growing slightly slower than in Q2.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up