Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

OECD warns Australia's rising debt requires urgent, politically challenging tax reform or spending cuts.

Australia is on a collision course with a rapidly growing national debt unless the government takes decisive action to overhaul its tax system or slash spending, according to the Organization for Economic Co-operation and Development (OECD).

In its annual economic assessment, the OECD issued a stark warning, urging a "greater sense of urgency" from policymakers. With federal and state budgets projected to remain in deficit for years, compounded by the pressures of an aging population and an expensive energy transition, the organization cautioned that Australia's public finances are on an unsustainable path.

Without a major fiscal adjustment, the report forecasts that Australia's budget deficit will widen, pushing the national debt-to-GDP ratio onto a "steep upward path."

The OECD laid out several key reforms to boost government revenue and stabilize the economy. The recommendations target consumption, property, and the resources sector, aiming to shift the tax burden away from personal income.

Key proposals include:

• Property and Fuel Levies: Increasing recurring taxes on housing, which the OECD notes could help cool home price growth and ease cost-of-living pressures.

• Consumption Tax Overhaul: Raising the Goods and Services Tax (GST) from its current 10% rate—a figure considered low by international standards—and applying it more broadly.

• Resource Sector Revenue: Boosting taxes on the resources industry to capture more income from royalties.

The report suggests that these changes would create a more growth-friendly tax environment. However, Australia's tax framework is widely seen as a relic of the 20th century, failing to effectively tax the economy's fastest-growing areas.

Meaningful tax reform has long been a politically dangerous topic in Australia. Lawmakers often fear voter backlash, a sentiment rooted in past failures. In 2010, a previous Labor government's attempt to introduce a mining tax during a commodity boom contributed to the downfall of a first-term prime minister.

Since then, few significant reforms have been attempted. The OECD notes, however, that Prime Minister Anthony Albanese, re-elected in a landslide last year, is now in a strong position. A second-term government is traditionally seen as the ideal time to pursue difficult but necessary reforms.

Currently, Australia's underlying cash deficit is forecast to be nearly A$37 billion ($25 billion), or 1.3% of GDP, for this fiscal year. Projections show the annual deficit narrowing only slightly to 1.1% of GDP by fiscal 2029.

The OECD's report also touched on monetary policy, offering a different perspective from the Reserve Bank of Australia (RBA). According to the OECD, the RBA's own models estimate the neutral interest rate is currently 3.1%, which is half a percentage point below the central bank's current 3.6% cash rate.

While RBA Governor Michele Bullock recently signaled that the next rate move could be a hike due to persistent inflation, the OECD suggested a different path may be possible. It argued that if the labor market continues to soften and inflation returns to the RBA's 2-3% target range, "policy settings could be eased modestly further in 2026."

However, the organization also acknowledged the recent upside surprises in inflation data. It endorsed the RBA's current "data-dependent and flexible approach," a stance that has led many economists to expect either a prolonged pause in rate changes or another hike if price pressures intensify.

With the RBA's first meeting of the year scheduled for February 2-3, upcoming quarterly inflation data could prove decisive. Currently, money markets are pricing in approximately a one-in-three chance of an interest rate hike next month.

U.S. Energy Secretary Chris Wright has told oil executives that Venezuela's crude production could increase by 30% in the short- to medium-term. Speaking at a private meeting in Davos, Switzerland, he projected output could rise from its current level of 900,000 barrels per day (bpd), according to three executives who attended.

The closed-door discussion took place on the sidelines of the World Economic Forum and follows the recent capture of Venezuelan leader Nicolas Maduro by U.S. forces.

Reviving output from Venezuela, which holds the world's largest oil reserves, is now a primary goal for U.S. President Donald Trump. His administration plans to control the country's oil resources indefinitely through a $100 billion plan aimed at rebuilding its oil industry.

On Tuesday, Trump stated that his administration has already taken 50 million barrels of oil out of Venezuela and is selling some of it on the open market.

Earlier this month, Trump met with over 15 oil executives at the White House. During that meeting, Exxon CEO Darren Woods noted that Venezuela would need to amend its laws before it could become an attractive destination for investment.

Despite the administration's goals, oil analysts and industry executives remain skeptical about a rapid recovery for Venezuela's oil sector. They argue that the country's degraded infrastructure requires billions of dollars and several years to rebuild after a long period of under-investment and sanctions.

Venezuela's production capacity has collapsed over the decades. In the 1970s, the nation pumped 3.5 million bpd, accounting for 7% of global supply. Today, its output represents just 1% of the world's total.

Furthermore, Venezuela's oil reserves are among the most expensive to develop globally. Its crude is exceptionally thick and heavy, demanding specialized equipment for extraction, transportation, and refining into usable fuels.

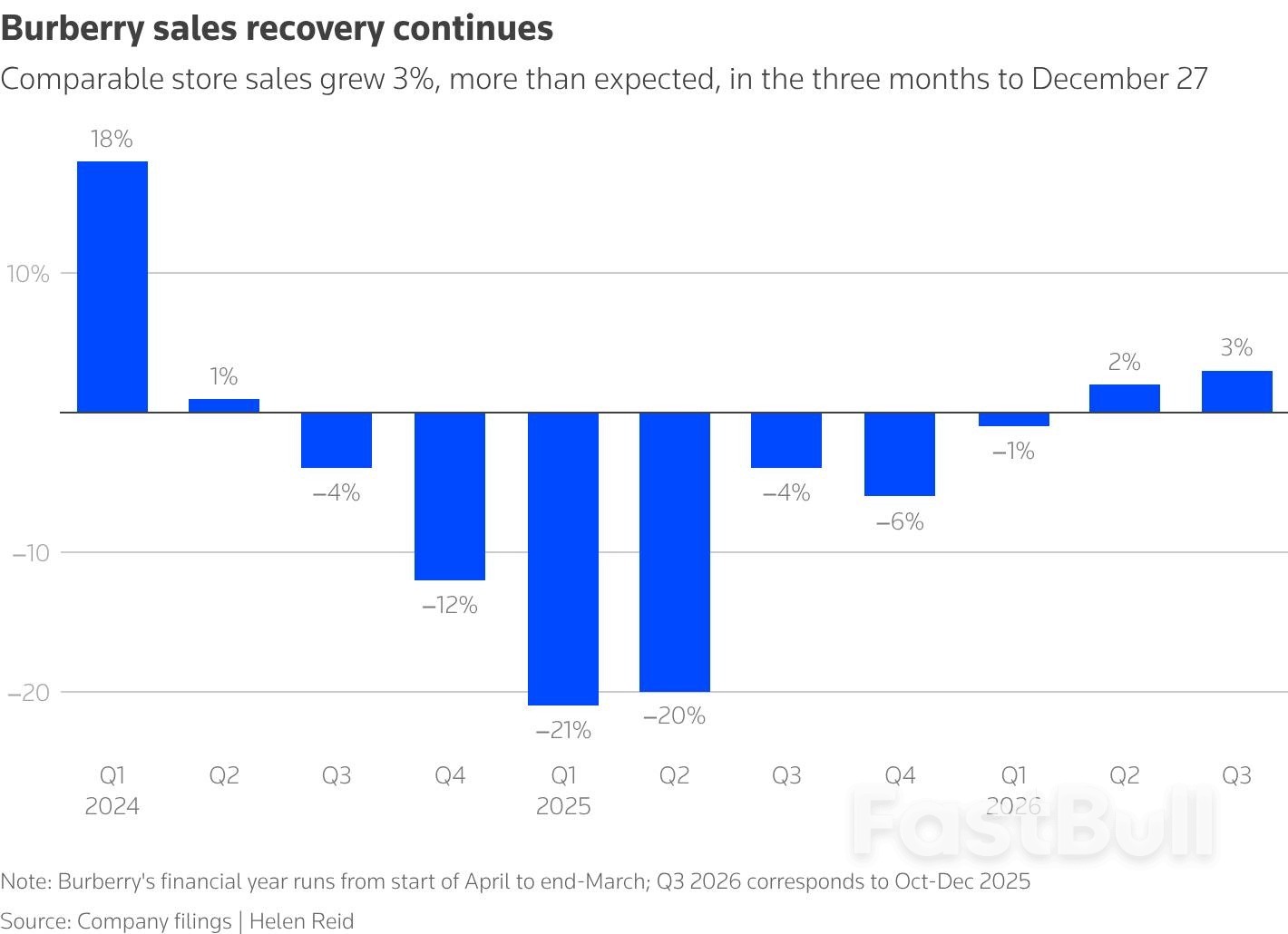

Burberry (BRBY.L) beat expectations for sales growth in the key holiday quarter as its marketing push featuring British celebrities resonated with shoppers and helped attract more Gen Z consumers in China, sending its shares up more than 4%.

Joshua Schulman, who became CEO in July 2024 as sales were sliding, is leading a turnaround focused on trench coats, scarves and the brand's British heritage, while cutting costs after reducing the workforce by 20% last year.

"In China in particular we were really driven by the growth in Gen Z, which we had called out in the previous quarter, but really accelerated as we came into the peak of outerwear and scarf season," Schulman said on a call with journalists.

The company's shares, which gained about 29% in 2025, were up 4.4% by 0940 GMT.

Burberry's comparable store sales rose 3% in the three months to December 27, beating analysts' expectation of 2% growth, according to a company-compiled consensus.

Sales in China rose 6% on a comparable basis as the brand continued its recovery in the crucial luxury market, led by "double-digit" growth in sales to Gen Z customers.

Burberry has staged new marketing efforts in China including a branded ice rink with an outerwear and scarf store in a mall in Beijing, and a pop-up shop on a ski slope in Chongli, complete with a ski lift wrapped in Burberry check.

"We've increased localisation of the storytelling and we've introduced new influencers and brand ambassadors (in China)," said Schulman.

Burberry launched a campaign ahead of Chinese Lunar New Year to mark the Year of the Horse, an opportunity for the brand whose logo is an equestrian knight on horseback.

J.P. Morgan analysts said Burberry's update could be received positively by investors in the wider luxury sector, "providing relief on the state of the luxury consumer, in China in particular."

Luxury brands have been struggling for the past two years as consumers slashed spending on handbags and designer clothes, driving sales down across the industry after a post-pandemic boom.

Beyond China, Schulman said Burberry was attracting more younger shoppers globally, particularly to its scarves.

Overall, the company said its markdown period was shorter and "shallower" than last year, with more customers willing to pay full price.

"Traffic (in stores) is still quite challenging everywhere, but we are really, really encouraged by what we're seeing in terms of conversion - strong conversion everywhere, so customers coming in and certainly liking what they're seeing," said Burberry's chief financial officer Kate Ferry on a call with analysts.

Burberry has taken several steps to lure shoppers back, including tightening the link between design decisions and commercial teams, and holiday campaigns with celebrities such as British actor Olivia Colman, who starred as Queen Elizabeth II in "The Crown."

Burberry said it expects full-year adjusted operating profit to be in line with the consensus forecast of 149 million pounds ($200 million).

Chart showing quarterly

Chart showing quarterly($1 = 0.7442 pounds)

The global oil market is heading for a major supply surplus in the first quarter of 2026, according to a new report from the International Energy Agency (IEA). The influential body, which advises industrialized nations, warns that excess supply is already large enough to offset the geopolitical risks currently pressuring the market.

In its latest monthly oil report, the IEA projected that global oil supply would outpace demand by a staggering 4.25 million barrels per day (bpd) in the first quarter. A surplus of this magnitude represents about 4% of total world demand and is larger than many other forecasts.

Despite the underlying supply glut, oil prices have climbed approximately 6% since the start of the year. This rise has been fueled by market concerns over potential disruptions. Global benchmark Brent crude was trading at $65.02 as of 11:42 GMT on Wednesday.

Recent geopolitical events contributing to market anxiety include:

• Venezuela: The U.S. captured President Nicolas Maduro early in the month and encouraged oil companies to invest in the country. However, short-term supplies have been disrupted, with a U.S. blockade lowering exports by 580,000 bpd from December to early January.

• Iran: The threat of possible U.S. strikes has raised concerns about reduced supplies from the region.

• Kazakhstan: A combination of drone attacks and technical problems has curtailed the country's output.

Even with these flashpoints, the IEA notes that the market's oversupply provides a significant buffer. "Barring any significant disruptions to supplies in Iran, Venezuela, or further cuts from other producers, a significant surplus is likely to re-emerge in the first quarter of 2026," the agency stated. "For now, bloated balances provide some comfort to market participants and have kept prices in check."

The rapid increase in global oil supply stems from two primary sources. The OPEC+ alliance, comprising the Organization of the Petroleum Exporting Countries, Russia, and other allies, began increasing its output in April 2025 following years of production cuts.

Simultaneously, production has ramped up in countries outside the alliance, particularly the United States, Guyana, and Brazil. While OPEC+ has decided to pause its output hikes for the first quarter of 2026, the market is still contending with the earlier increases.

For the full year of 2026, the IEA now forecasts an implied market surplus of 3.69 million bpd. This is a slight downward revision from the 3.84 million bpd surplus projected in its previous report.

A key factor in this adjustment is a modest upgrade to the global oil demand forecast. The IEA raised its demand growth prediction by 70,000 bpd to 930,000 bpd for the year. The agency attributes this to a normalization of economic conditions following last year's tariff turmoil and oil prices that are lower than a year ago.

The IEA’s forecast of a deep surplus is not universally shared. Rival forecaster OPEC holds a more optimistic view on demand, predicting oil consumption will rise by a much stronger 1.38 million bpd this year. Based on OPEC's figures, the market in 2026 appears to be nearly balanced between supply and demand, a stark contrast to the IEA's glut scenario.

The IEA projects the surplus will be most pronounced in the first quarter, partly due to seasonal factors. Global oil refiners typically schedule maintenance shutdowns during this period, which temporarily reduces crude demand. "With seasonal refinery maintenance about to commence, reducing demand for crude, further reductions in crude production will be needed," the Paris-based agency concluded.

On the supply side, the IEA revised its global growth forecast for the year upward to 2.5 million bpd. Crucially, it projects that around 52% of this new supply growth will come from producers outside the OPEC+ alliance.

The Japanese yen is gaining ground against major currencies as traders position themselves for the Bank of Japan's (BoJ) next move. Market focus is locked on the conclusion of the central bank's two-day policy meeting this Friday, which is expected to provide critical clues about the timing of its next interest rate hike.

Several dynamics are contributing to the yen's upward momentum. Anticipation is building that Japanese authorities may intervene to halt further depreciation of the currency. This sentiment, combined with a broader risk-off mood in the markets, enhances the appeal of the safe-haven JPY.

Further bolstering this view were recent comments from Japan's finance minister, Satsuki Katayama, who suggested that Japan and the U.S. could cooperate to address the yen's recent weakness. The possibility of additional policy tightening by the BoJ is also seen as a significant supportive factor for the currency.

The yen's rally comes amid wider market uncertainty. European stocks traded lower, with investors unnerved by ongoing trade jitters linked to Greenland.

Meanwhile, the "Sell America" trade appears to be taking a pause, and the euro is holding firm near recent highs. Market participants are also looking ahead to speeches by U.S. President Donald Trump and ECB President Christine Lagarde at the Davos summit.

During European trading, the yen demonstrated notable strength across the board:

• Against the Euro (EUR/JPY): The yen rose to 184.82 from a one-week low of 185.54. The next resistance level is seen around 183.00.

• Against the Pound (GBP/JPY): The yen advanced to 211.97 from an early low of 212.65, with potential resistance near 210.00.

• Against the Swiss Franc (CHF/JPY): The currency climbed to 199.26 from 200.31. The next key level to watch is the 197.00 resistance area.

• Against the U.S. Dollar (USD/JPY): The yen strengthened to 157.82 from 158.28. Resistance is anticipated around the 156.00 mark.

• Against the Canadian Dollar (CAD/JPY): The yen moved to 114.09 from 114.39, with the next resistance target at 112.00.

Traders will be closely monitoring a series of economic data releases during the New York session. Key reports include:

• U.S. MBA mortgage approvals data

• Canada's Producer Price Index (PPI) and raw material prices for December

• U.S. pending home sales for December

• U.S. construction spending for September

President Donald Trump is set to significantly increase his domestic travel in the lead-up to the November midterm elections, aiming to promote his economic policies and win over American voters concerned about the cost of living.

White House Chief of Staff Susie Wiles confirmed the new strategy, telling reporters that Trump plans to travel "every week" and will intensify this schedule as the elections draw closer. The goal is to secure control of Congress by directly addressing economic anxieties.

As part of a coordinated White House effort, Cabinet members will also scale back international trips to concentrate on domestic stops. This initiative is designed to amplify the administration's economic message at a time when affordability is a primary concern for voters.

The renewed travel plan includes a trip to Iowa on Tuesday, a state pivotal to Trump's political rise, where he will discuss the farm economy and energy. This follows a recent visit to a Ford Motor Co. facility in Michigan, where he promoted his tariff agenda and efforts to boost domestic manufacturing.

While the administration has previously announced plans for more travel, this new push signals a campaign-level intensity that has not yet fully materialized.

The travel announcement came shortly before Trump was scheduled to deliver a major speech on affordability at the World Economic Forum in Davos. His populist platform includes several key proposals designed to address rising costs for Americans.

According to National Economic Council Director Kevin Hassett, the president's agenda features several bold initiatives:

• Housing: A ban on institutional investors purchasing single-family homes.

• Credit: A temporary cap on credit card interest rates at 10% for one year.

• Mortgages: Directing Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds to help lower lending rates.

• Retirement Savings: Allowing Americans to use funds from their 401(k) retirement plans for a down payment on a home.

On Tuesday, Trump signed an executive order outlining a process to limit institutional home purchases, though it did not immediately implement new regulations.

The administration is ramping up its focus on the cost of living as high prices for groceries, housing, and healthcare continue to strain household budgets. Republicans are under pressure to maintain their narrow majority in Congress. A loss in either the House or the Senate could jeopardize Trump's legislative agenda and expose him to greater oversight.

This economic messaging has been inconsistent in the past. Trump previously dismissed affordability concerns as a Democratic "hoax" before later insisting that his economic record was strong and that his policies simply needed more time to work. The upcoming travel blitz represents a clear effort to unify this message and present a proactive stance on the economy ahead of the crucial November elections.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up