Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The U.S. dollar weakened, stock futures fell, and Treasuries rallied after Fed Chair Jerome Powell revealed that the White House threatened him with indictment...

President Donald Trump has declared that credit card companies will be "in violation of the law" if they fail to cap their interest rates at 10% for one year.

Speaking to reporters on Air Force One, Trump reiterated his demand, setting a January 20 deadline for lenders to comply. He sharply criticized existing rates, which he claimed are punishing consumers unfairly.

"Some of them are charging 28, almost 30%," Trump stated. "People don't know they're paying 30%. They're working and have no idea they're paying 30%." He concluded that major lenders have "really abused the credit cards."

Despite the strong warning, Trump did not cite any specific legislation or provide a legal basis for how lenders would be breaking the law by maintaining their current rates. The demand appears to be a presidential directive without explicit statutory backing.

The issue of high credit card interest rates, often exceeding 20% in recent years, has previously drawn attention from lawmakers. However, legislative efforts to impose caps have consistently faced strong resistance from the financial industry.

In response to the president's call, major banking trade groups, including the Bank Policy Institute and the Consumer Bankers Association, adopted a measured tone. While acknowledging the president's goal, they pushed back on the proposed solution.

"We share the president's goal of helping Americans access more affordable credit," the groups said in a joint statement.

However, they argued that the evidence shows a 10% interest rate cap would backfire. The groups warned such a move "would reduce credit availability and be devastating for millions of American families and small business owners who rely on and value their credit cards."

The industry's long-standing position is that slashing rates would make lending to higher-risk borrowers unprofitable, potentially cutting off their access to credit and leaving them with options like payday loans and pawn shops.

The United States is set to host a meeting of G-7 ministers this week to address a critical economic vulnerability: the global dependence on China for rare earths. The summit highlights a coordinated push among allied nations to develop alternative supply chains for minerals essential to modern technology and military hardware.

Canadian Finance Minister Francois-Philippe Champagne will meet with his G-7 counterparts in Washington on Sunday and Monday. According to a statement from Ottawa, Treasury Secretary Scott Bessent will host the talks, which are focused on securing global supply chains for critical minerals.

The discussions will expand beyond the G-7 to include officials from Australia, South Korea, India, Mexico, and the European Union, signaling a broad-based effort to address the security of strategic raw materials.

The meeting comes as tensions escalate over China's new export restrictions, which have raised concerns in Japan and beyond. These measures were reportedly implemented after a dispute concerning comments made by Prime Minister Sanae Takaichi about Taiwan.

Japanese Finance Minister Satsuki Katayama confirmed she would use her trip to the U.S. to discuss the issue with her counterparts from other major industrial economies.

According to a report from Nikkei Asia citing sources familiar with the trade, China’s restrictions on rare earth shipments to Japan now also cover products intended for civilian use. The report noted that Chinese officials are either denying export permits or subjecting applications to unusually long reviews.

China's Foreign Ministry has not yet responded to requests for comment on the Washington meeting or the Nikkei report.

While official channels remain quiet, a different perspective has emerged from state-affiliated media. Lu Yaodong, deputy director of the Institute of Japanese Studies at the Chinese Academy of Social Sciences, told the Global Times that Japan’s claims of China "weaponizing" rare earths are misleading. Lu asserted that Beijing’s actions are a direct response to Japan's "remilitarization."

This is not the first time rare earths have become a focal point of geopolitical tension. China, the world's leading supplier, previously restricted exports to counter tariffs imposed by the Trump administration.

Although President Donald Trump and Chinese leader Xi Jinping agreed to a trade truce in October that included lifting those restrictions, Washington has continued to develop policies aimed at reducing its reliance on Chinese rare earth magnets. These components are vital for a range of consumer goods, from automobiles to electronics.

Last week, White House trade adviser Peter Navarro expressed confidence that American industrial innovation would eventually boost domestic production and break China's market dominance.

The effort is not limited to the U.S. Germany has also signaled its intent to play a key role. Before leaving for the meeting, Vice Chancellor and Finance Minister Lars Klingbeil stated that Germany is open to taking "joint action" with international partners to strengthen supply chains and guarantee access to critical manufacturing materials.

Former U.S. President Donald Trump has declared his intention for the United States to acquire Greenland, dismissing concerns that such a move could disrupt the NATO alliance.

Speaking to reporters aboard Air Force One on Sunday, Trump framed the potential acquisition as a strategic necessity to block geopolitical rivals. "If we don't take Greenland, Russia or China will. And I'm not letting that happen," he stated, adding, "one way or another, we're going to have Greenland."

Trump also suggested that Greenland should be the one to propose a deal to Washington for a takeover.

When questioned about potential opposition from NATO allies, Trump was dismissive, asserting the alliance's dependence on the United States. He claimed the treaty would not exist without his presidency.

"If it affects NATO, then it affects NATO," Trump said. "But, you know, they need us much more than we need them. I will tell you that right now."

In recent weeks, Trump had intensified his calls for a U.S. takeover, arguing that possessing the island was crucial for strengthening American security against both Russia and China.

Concerns over U.S. intentions have reportedly grown, particularly after a U.S. incursion into Venezuela that led to the capture of President Nicolas Maduro.

The United States already maintains a military footprint in Greenland, but Trump has advocated for expanding this presence. The island, a self-governing territory within the Kingdom of Denmark, is home to nearly 60,000 people.

Reports last week indicated that Trump and White House officials were exploring several methods to gain control of the island, including:

• Potential military action.

• Lump-sum payments to Greenland's residents to persuade them to secede from Denmark.

Leaders in Denmark and across Europe have widely rejected Trump's demands.

South Korea's central bank is widely anticipated to hold its key interest rate steady this week as it balances pressures from a weakening currency and an unsettled real estate market.

An overwhelming consensus among economists points to the Bank of Korea (BOK) leaving its benchmark rate unchanged at 2.5% during its policy meeting on Thursday. A survey by Yonhap Infomax found that all 25 analysts polled expect a rate hold. A separate poll by Yonhap News Agency of six additional experts revealed the same unanimous expectation.

If confirmed, this would mark the fourth consecutive meeting where the BOK's Monetary Policy Board has kept the rate steady, despite having initiated an easing cycle in October 2024.

Analysts argue that the current economic environment is not conducive to rate cuts, citing persistent threats to financial stability.

"Factors undermining financial stability persist, including the weak won and overheated sentiment in the property market," noted Yoon Yeo-sam, an analyst at Meritz Securities.

The key considerations for policymakers include:

• Economic Growth: The economy is projected to expand above the 2% range this year.

• Inflation: Price growth is running at a manageable low-to-mid 2% range.

• Currency Weakness: The Korean won continues to hover near the critical 1,450 per dollar mark.

Yoon added that these conditions make the environment "unfavorable for rate cuts."

The depreciation of the won remains a primary focus for authorities. Despite various measures to support the currency, it has struggled to gain ground against the dollar.

On Monday, the won opened at 1,461.3 per dollar, representing a decline of 3.7 won from the previous session and underscoring the ongoing pressure that complicates the BOK's monetary policy decisions.

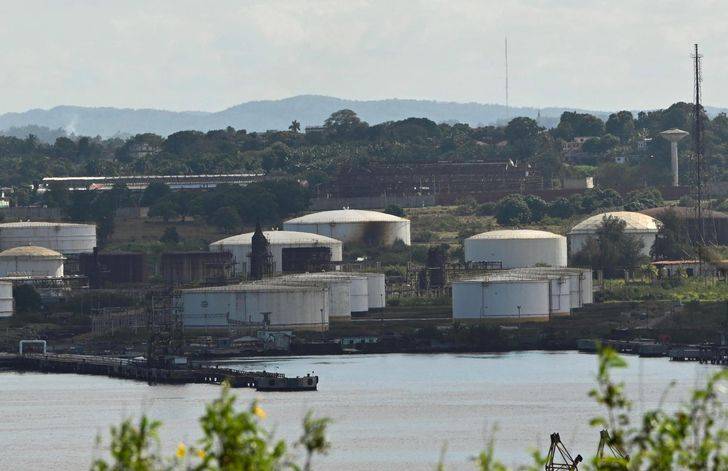

Former President Donald Trump issued a stern warning to Cuba's government on Sunday, signaling a major policy shift following the ousting of Venezuelan leader Nicolás Maduro. The move effectively cuts off Cuba, a long-time beneficiary of Venezuelan oil, from its primary energy supply.

U.S. forces have reportedly seized oil tankers to control the production and distribution of Venezuela's oil products, directly impacting the island nation.

In a social media post from his home in southern Florida, Trump declared that Cuba's era of benefiting from Venezuelan resources was over. He stated that Cuba had long provided security to Venezuela in exchange for oil and money, "BUT NOT ANYMORE!"

"THERE WILL BE NO MORE OIL OR MONEY GOING TO CUBA - ZERO!" Trump wrote. He urged the Cuban government to negotiate, adding, "I strongly suggest they make a deal, BEFORE IT IS TOO LATE," though he did not specify the terms of such a deal.

Cuban President Miguel Díaz-Canel quickly responded on the social media platform X, asserting that those who "turn everything into a business, even human lives, have no moral authority to point the finger at Cuba in any way."

Díaz-Canel defended his country's political model as a "sovereign decision" and criticized those who blame the "Revolution" for the island's severe economic shortages. He railed against the "draconian measures" imposed by the United States, which the Cuban government claims cost the country over $7.5 billion between March 2024 and February 2025.

The Cuban government also reported that 32 of its military personnel were killed during the American operation that captured Maduro. These personnel, from Cuba's two main security agencies, were stationed in Caracas under a bilateral agreement.

Trump framed the new dynamic as a form of liberation for Venezuela. "Venezuela doesn't need protection anymore from the thugs and extortionists who held them hostage for so many years," he said. "Venezuela now has the United States of America, the most powerful military in the World (by far!), to protect them, and protect them we will."

The Trump administration has consistently adopted an aggressive stance toward Cuba, which relied heavily on Venezuela for economic stability. Long before Maduro's capture, Cuba was already grappling with its worst economic crisis in decades, marked by severe blackouts and long lines at gas stations and supermarkets.

Trump has previously predicted that the Cuban economy, already strained by a long-standing American embargo, would collapse without Venezuelan support. "It's going down," he said of Cuba. "It's going down for the count."

In a separate social media interaction, Trump responded positively to a suggestion that his secretary of state, Marco Rubio, will become president of Cuba, saying, "Sounds good to me!"

The Federal Reserve appears ready to put its interest rate cuts on hold, with markets pricing in a near-zero chance of a reduction at the January 2026 FOMC meeting. Data from CME suggests only a 5% probability of a cut, signaling a significant shift in expectations after a series of monetary policy adjustments in 2025.

This potential pause comes after the Fed implemented three rate cuts during 2025. With unemployment data holding steady at 4.4%, policymakers seem to have enough room to step back and assess the economic landscape before committing to further easing.

Analysis from Guotai Haitong highlights that after the rate reductions in 2025, the central bank has the flexibility to pause. The December 2025 FOMC minutes hinted at this possibility, leading to a recalibration across financial markets.

A robust job market is a key factor supporting this decision. As Federal Reserve Chair Jerome Powell has stated, the central bank’s long-term goal is "to achieve maximum employment and inflation at the rate of 2 percent." Stable employment figures give the Fed less urgent cause to continue cutting rates. In response, treasury yields have risen as investors digest the reduced likelihood of immediate cuts.

Investor expectations have decisively shifted. The market consensus now points to rate cuts beginning in June 2026, a significant delay from previous forecasts. Projections have been revised to anticipate just two rate cuts for the entire year.

This new timeline reflects a broader reassessment of the Fed's trajectory, influenced by a combination of resilient economic data and the central bank's actions in late 2025.

The revised rate cut schedule has direct implications for global liquidity and the cryptocurrency market. A pause in cuts means that high-yield conditions will persist, which has historically created challenges for risk assets like Bitcoin (BTC) and Ethereum (ETH).

The expected timing of two cuts in 2026 will also influence the performance of DeFi protocols and modern Layer 1 platforms, which are highly sensitive to broader monetary conditions.

Adding another layer of complexity is the upcoming end of Chair Jerome Powell's term in May 2026. This leadership transition introduces uncertainty into the future direction of U.S. monetary policy, making long-term market forecasts even more challenging.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up