Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The US Dollar Index Rose Approximately 0.7% In Late New York Trading On Monday (February 2nd), Reaching 97.641 Points. The Index Traded Between 97.008 And 97.733 Points During The Day, Maintaining A Slight Upward Trend And Hovering Around 97.100 Points Before Extending Its Gains. The Bloomberg US Dollar Index Rose 0.35% To 1192.42 Points, Trading Between 1187.02 And 1193.19 Points During The Day

US Treasury Says To Borrow $574 Billion In Q1, Sees End Cash Balance Of $850 Billion (Removes Extraneous Word "It")

US Treasury Says It Expects To Borrow $109 Billion In Q2, Sees End Cash Balance Of $900 Billion

[The Carlyle Group Joins Europe's Top Ten Oil Refiners] As Major Oil Companies Streamline Their Portfolios, The Carlyle Group Has Joined The Ranks Of Europe's Top Ten Fuel Manufacturers. The Private Equity Giant Holds A Two-thirds Stake In Varo Energy, Which Completed Its Acquisition Of The Lysekil And Gothenburg Refineries In Sweden In January. According To Data Compiled By Bloomberg, This Move, Combined With Its Existing Holdings, Elevates Carlyle To Ninth Place Among European Fuel Manufacturers

WTI Crude Oil Futures For March Delivery Closed At $62.14 Per Barrel. Nymex Natural Gas Futures For March Delivery Closed At $3.2370 Per Million British Thermal Units (MMBtu). Nymex Gasoline Futures For March Delivery Closed At $1.8514 Per Gallon, And Nymex Heating Oil Futures For March Delivery Closed At $2.3598 Per Gallon

Ukraine Designates Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization" On February 2nd. Ukrainian President Volodymyr Zelenskyy Announced That Ukraine Has Designated Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization." Iran Has Not Yet Responded

Intercontinental Exchange (ICE), The Owner Of Nasdaq (NYSE), Has Received Approval From The U.S. Securities And Exchange Commission (SEC) To Provide U.S. Treasury Clearing Services

Swiss National Bank Chairman: Expects Swiss Inflation To Rise In Coming Months, Sees Monetary Conditions In Switzerland As Appropriate

Rubio: US Looks Forward To Working Closely With Costa Rica's President-Elect Laura Fernández Delgado's Administration After Electoral Victory

German Chancellor Merz: Transatlantic Relationship Has Changed And No One Regrets It More Than Me

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Markets were volatile as a new Fed chair nomination, oil and precious metals swings, and divergent tech earnings shaped sentiment, while attention turns to major central bank meetings and U.S. jobs data.

as of 31 January 2026. Past performance is not a reliable indicator of future performance.

as of 31 January 2026. Past performance is not a reliable indicator of future performance. as of 31 January 2026. Past performance is not a reliable indicator of future performance.

as of 31 January 2026. Past performance is not a reliable indicator of future performance. as of 31 January 2026. Past performance is not a reliable indicator of future performance.

as of 31 January 2026. Past performance is not a reliable indicator of future performance.

The U.S. Treasury is poised to keep its auction sizes for notes and bonds unchanged for the eighth consecutive quarter this week, signaling a continued reliance on short-term bills to manage the nation's fiscal deficit.

While stability is the baseline expectation, investors are closely watching for any hints about future strategy. Key questions revolve around potential increases in coupon issuance down the road or any surprising cuts to long-dated debt auctions, a move that would align with the Trump administration's goal of lowering long-term borrowing costs.

Guneet Dhingra, head of U.S. rates strategy at BNP Paribas, anticipates that any initial increase in coupon auction sizes will be concentrated at the shorter end of the curve. "If they increase the coupon auction sizes, it's probably going to be in 2027 and it's going to focus on twos and threes," he noted, referring to two- and three-year notes.

This aligns with the Treasury's statement from its November refunding announcement, which mentioned that it was starting to consider future increases in auction sizes for notes and bonds but did not specify which maturities.

The Treasury will release two key documents this week:

• Quarterly borrowing estimates on Monday at 3 p.m. EST (2000 GMT).

• Quarterly refunding details on Wednesday at 8:30 a.m. EST (1330 GMT).

The refunding announcement will detail financing plans for the first and second quarters, setting the auction sizes for three-year notes, 10-year notes, and 30-year bonds. These forecasts will also provide crucial insight into the Treasury's assumptions for April tax receipts and clarify how the Federal Reserve's recent bill purchases are factoring into the government's debt issuance strategy.

In November, the Treasury projected it would need to borrow $578 billion in the first quarter of 2026, assuming an end-of-March cash balance of $850 billion.

However, analysts at J.P. Morgan recently forecast that financing needs for the quarter could be lower, at just $498 billion. This revised outlook is partly due to the Federal Reserve's reserve management purchases (RMPs), a program involving the purchase of $40 billion in short-term bills per month. By buying these bills, the Fed reduces the amount of debt the Treasury needs to sell to the private market.

While the Fed's bill-buying is expected to remain high until April before slowing, the potential nomination of former Fed Governor Kevin Warsh as the next central bank chief could lead to a reassessment of the program, as Warsh has previously advocated for shrinking the Fed's balance sheet.

Furthermore, Morgan Stanley analysts point to smaller-than-expected fiscal deficits projected for 2025–2027, driven by higher-than-forecast tariff revenues. A smaller deficit reduces the pressure on the Treasury to issue more debt, giving it greater flexibility to maintain current auction sizes for longer.

The Treasury's preference for T-bills over long-term bonds is a strategic response to current market conditions. With the Federal Reserve holding its benchmark interest rate in a 3.50%-3.75% range, the opportunity cost of holding longer-dated bonds has risen, forcing investors to demand higher yields for that part of the curve.

By issuing more short-term T-bills, which carry lower yields than long-term bonds, the Treasury can borrow money at a cheaper rate and reduce its immediate interest expenses. Treasury Secretary Scott Bessent has stated that increasing the issuance of long-term bonds at today's elevated yields is simply not cost-effective.

"I think the Treasury is particularly sensitive to making any adjustments to long-end issuance anytime soon," said Zachary Griffiths, head of investment grade and macro strategy at CreditSights. He added that the Treasury will likely "wait as long as possible as they explore these other avenues to finance what's ultimately an elevated deficit."

While unlikely, some market participants have speculated that the Treasury could take a more aggressive approach by cutting long-term bond auctions. The goal of such a move would be to reduce yields on the long end of the curve and, by extension, lower rates for things like mortgages.

However, analysts from J.P. Morgan and Morgan Stanley view this scenario as improbable. J.P. Morgan noted that such a decision "would be a significant pivot from last quarter's guidance" and that a "swift 180-degree pivot would not be consistent with a 'regular and predictable' approach to debt management strategy." For now, the focus remains on funding the government's needs through a steady and predictable supply of debt, heavily weighted toward the short end.

With 'hard' data sustaining signs of solid growth (e.g. factory orders and jobless claims), 'soft' survey data has been bouncing back since the start of the year

This morning we get the final Manufacturing PMI data from S&P Global and ISM for January.

A solid and stronger improvement in US manufacturing sector operating conditions (52.4 vs 52.0 exp) was signaled by January's S&P Global PMI data amid the joint-sharpest upturn in production since May 2022.

However, growth was in part driven by inventory building as new orders, despite returning to expansion in January, increased only modestly.

ISM's Manufacturing was expected to rise from 47.9 to 48.5 in January but instead it soared to 52.6 - its highest since Aug 2022. This is the first print above 50 since January 2025.

This was the biggest MoM surge in the ISM print since April 2020 (COVID rebound), led by a huge surge in new orders and rise in employment (highest in a year) and prices (though elevated) are stable...

"News of the joint largest rise in factory production since May 2022 is tainted by reports of ongoing subdued sales growth," says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Production growth consequently significantly outpaced that of new orders at the start of the year, resulting in a further accumulation of unsold warehouse inventory."

"Over the past three months, the survey indicates that factories have typically produced more goods than they have sold to a degree we have not previously seen since the global financial crisis back in early 2009."

This highly unusual situation is clearly unsustainable, hinting at risks of a production slowdown and a potential knock-on effect on employment, unless demand improves markedly in the coming months.

Williamson adds that "sluggish sales and order book growth are being commonly linked to customer resistance to high prices, in turn often blamed on tariffs, as well as increased uncertainty over the economic outlook."

While just below trend, business growth expectations for the year ahead are, however, holding up as firms anticipate improving demand, "thanks in part to lower interest rates, reduced import competition due to tariffs, and more government support."

However, as Williamson concludes, "political uncertainty remains a key drag on business sentiment."

The European Union's shift away from Russian gas was meant to secure its energy future. Instead, it has created a new and unsettling dependency on U.S. liquefied natural gas (LNG), and officials in Brussels are starting to sound the alarm.

EU Energy Commissioner Dan Jorgensen recently voiced the growing consensus among European leaders, stating, "I definitely hear this when speaking to energy ministers and heads of state from all over Europe that there is a growing concern." This anxiety marks a stark reversal from just a few years ago when the bloc celebrated its pivot to American energy.

In 2022, the EU made a decisive move to punish Russia for its invasion of eastern Ukraine by replacing Russian pipeline gas with U.S. LNG. At the time, officials hailed American suppliers as reliable partners and framed the decision as a major step toward energy independence.

That strategy has made the European Union the single largest regional buyer of U.S. liquefied gas. But this reliance comes at a high price, and with a different U.S. administration, the perception of America as a steadfast supplier has fundamentally changed.

A major complication comes from the EU's own climate policies. A new regulation requires strict monitoring, tracking, and reporting of methane leaks across the entire LNG supply chain. This policy is now clashing with the operational realities of the world's biggest gas producers.

U.S. Secretary of Energy Chris Wright has stated plainly that American LNG producers do not intend to comply with the EU's stringent rules. QatarEnergy has taken the same position, repeatedly signaling it will not invest in the required methane tracking.

With the world's two largest LNG exporters unwilling to meet its standards, the EU is finding its options severely limited.

The political landscape has also shifted dramatically, shattering the myth of a predictable transatlantic partnership. The "Greenland affair" served as a stark wake-up call for Brussels, demonstrating that the U.S. under President Trump operates on a different set of assumptions regarding trade and security guarantees.

European leaders had previously assumed business would continue as usual. Trump, however, has prioritized collecting on what he sees as debts, demanding higher NATO spending and imposing import tariffs. This transactional approach has eroded confidence in the U.S. as a stable, long-term energy partner.

As concerns mount, the EU is scrambling to find other sources. Commissioner Jorgensen mentioned exploring deals with Qatar, Canada, and Algeria. However, the path to diversification is filled with obstacles:

• Qatar remains non-compliant with the EU's methane regulations.

• Russia is off the table due to sanctions, with a full ban on Russian gas imports approved to begin next year.

• No other single supplier has the capacity to replace the sheer volume of LNG currently coming from the United States.

This leaves European gas buyers with the difficult task of scouring global markets for smaller volumes to piece together a diversification strategy, a far cry from the security they once sought.

Compounding the problem is a trade deal signed by Commission President Ursula von der Leyen and President Trump, which commits the EU to importing $250 billion worth of U.S. energy annually until 2027.

While the EU has not physically been able to purchase this amount, the deal has successfully pushed the bloc to buy record-high volumes of American LNG and oil. This agreement locks Europe into its U.S. dependency, leaving it with little room to maneuver. As President Trump has repeatedly shown, he plays by his own rules, leaving the EU to navigate an increasingly uncertain energy future.

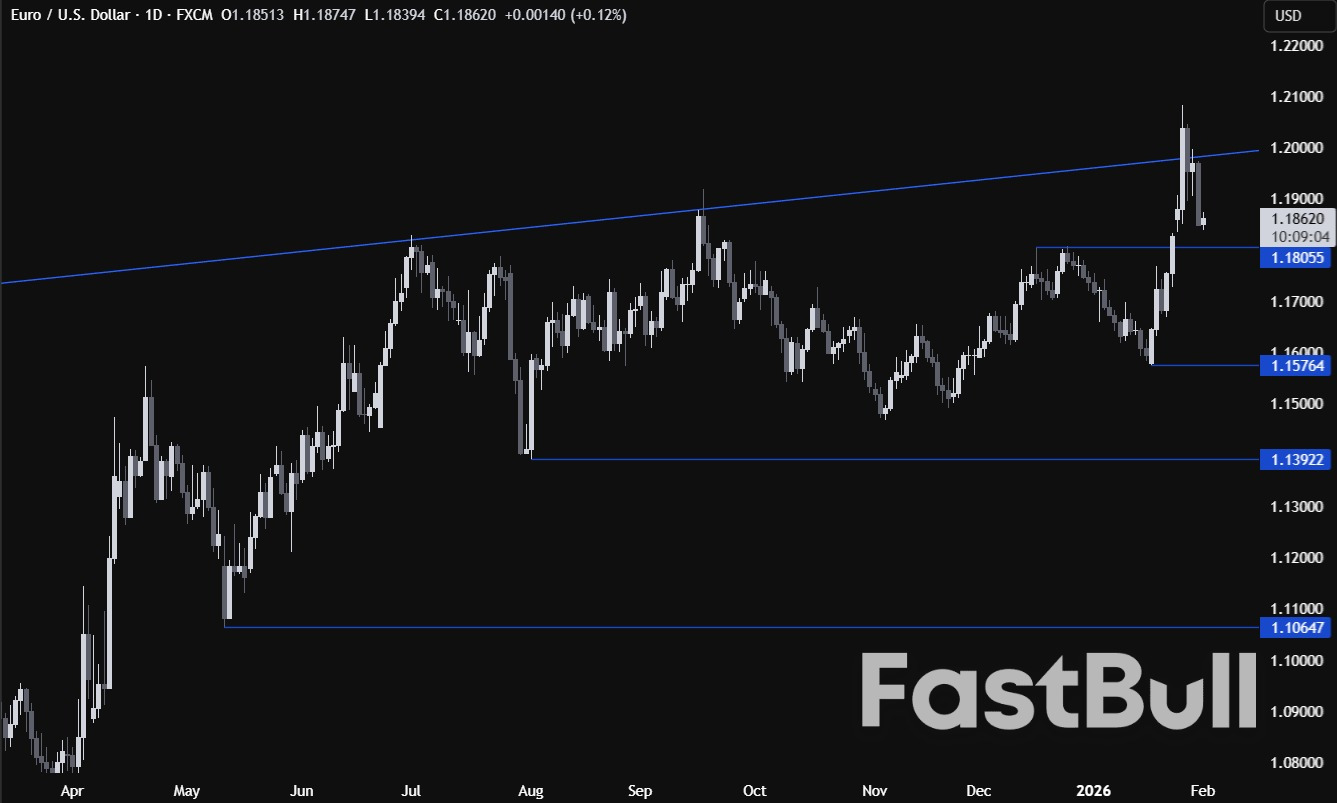

EURUSD - daily

EURUSD - daily EURUSD - 4 hour

EURUSD - 4 hour EURUSD - 1 hour

EURUSD - 1 hourThe Trump administration is launching a nearly $12 billion initiative to build a strategic reserve of rare-earth elements, a direct move to challenge China's dominance over minerals critical to modern technology and defense.

The White House confirmed on Monday that "Project Vault" is underway, aiming to shield American manufacturers from supply chain vulnerabilities. This stockpile is designed to protect key industries, including automotive, electronics, and defense, from potential disruptions.

The project will be funded by a combination of public and private financing:

• A $10 billion loan from the U.S. Export-Import Bank, structured over a 15-year period.

• Nearly $1.67 billion in private capital.

This initiative follows previous U.S. government efforts to foster a domestic rare-earths industry, which included taking stakes in miner MP Materials and providing financial support to companies like Vulcan Elements and USA Rare Earth.

The creation of the reserve was first reported by Bloomberg News. Signaling the plan's significance, President Trump is scheduled to meet with General Motors CEO Mary Barra and mining billionaire Robert Friedland on Monday.

The move comes after China demonstrated its leverage during trade talks last year by restricting exports of rare earths. These elements are indispensable for producing a wide range of products, from electric vehicles, laptops, and phones to advanced jet engines and radar systems.

China's overwhelming market position gives it a strategic chokehold:

• It accounts for approximately 70% of the world's rare-earths mining.

• It controls 90% of global rare-earths processing.

By creating a national stockpile, similar to the strategic reserve for petroleum, the U.S. aims to nurture alternative sources and reduce its dependency on China for these essential materials.

U.S. factory activity expanded in January, marking the first sign of growth in a year as new orders rebounded sharply. However, the manufacturing sector faces persistent challenges, with import tariffs driving up raw material costs and straining supply chains.

The Institute for Supply Management (ISM) announced Monday that its manufacturing PMI climbed to 52.6 last month. This is the first time the index has risen above the 50-point threshold in 12 months and its highest reading since August 2022, signaling a return to growth for a sector that accounts for 10.1% of the economy.

The January figure represents a significant turnaround from December's 47.9 reading, which capped a 10-month streak of contraction. The result also comfortably beat the 48.5 forecast from economists polled by Reuters.

The primary driver behind the recovery was a dramatic increase in demand.

• The ISM's forward-looking new orders sub-index soared to 57.1, a huge jump from 47.4 in December and the highest level since February 2022.

• Backlog orders also increased, and exports showed a modest recovery.

This improvement may be partially linked to new tax legislation, which made bonus depreciation permanent. Furthermore, the technology industry has shown pockets of strength, largely due to a boom in artificial intelligence investment.

Despite the positive headline number, underlying data reveals growing strains. The surge in new orders has placed stress on supply chains and driven up input costs.

The survey's supplier deliveries index rose to 54.4 from 50.8. A reading above 50 indicates slower delivery times, which can signal strong economic demand but may also reflect supply chain bottlenecks related to tariffs.

These frictions are feeding directly into higher prices. The prices paid measure increased to 59.0 from 58.5 in December, suggesting goods inflation has room to rise and could contribute to keeping overall inflation above the Federal Reserve's 2% target.

The January PMI data stands in contrast to the manufacturing sector's recent sluggish performance. Federal Reserve data showed that factory production contracted at a 0.7% annualized rate in the fourth quarter, and manufacturing employment fell by 68,000 jobs in 2025. The broad manufacturing renaissance that President Donald Trump envisioned with his tariff policies has not yet been realized.

The Federal Reserve is closely monitoring these price pressures. The U.S. central bank left its benchmark interest rate unchanged in the 3.50%-3.75% range at its last meeting. Fed Chair Jerome Powell attributed the inflation overshoot to tariffs, adding that he expects "tariff inflation topping out" sometime in the middle of the year.

Meanwhile, the factory labor market remains weak. Although the pace of decline slowed, employment in the sector continued to contract. The ISM's measure of manufacturing employment rose to 48.1 from 44.8 in December, but remains below the 50-point growth threshold. The ISM noted that companies are laying off workers and holding off on filling open positions "due to uncertain near- to mid-term demand," highlighting the fragile nature of the sector's recovery.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up