Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina CPI MoM (Nov)

Argentina CPI MoM (Nov)A:--

F: --

P: --

Argentina National CPI YoY (Nov)

Argentina National CPI YoY (Nov)A:--

F: --

P: --

Argentina 12-Month CPI (Nov)

Argentina 12-Month CPI (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Industrial Output Final MoM (Oct)

Japan Industrial Output Final MoM (Oct)A:--

F: --

P: --

Japan Industrial Output Final YoY (Oct)

Japan Industrial Output Final YoY (Oct)A:--

F: --

P: --

U.K. Services Index MoM (SA) (Oct)

U.K. Services Index MoM (SA) (Oct)A:--

F: --

P: --

U.K. Services Index YoY (Oct)

U.K. Services Index YoY (Oct)A:--

F: --

P: --

Germany HICP Final YoY (Nov)

Germany HICP Final YoY (Nov)A:--

F: --

P: --

Germany HICP Final MoM (Nov)

Germany HICP Final MoM (Nov)A:--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Manufacturing Output MoM (Oct)

U.K. Manufacturing Output MoM (Oct)A:--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Oct)

U.K. Monthly GDP 3M/3M Change (Oct)A:--

F: --

P: --

Germany CPI Final MoM (Nov)

Germany CPI Final MoM (Nov)A:--

F: --

P: --

Germany CPI Final YoY (Nov)

Germany CPI Final YoY (Nov)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Malaysia's oil and gas sector could expect muted domestic activity outlook going into 2026, amid oil price volatility, lower upstream capital spending, scaling back of offshore work scope and potential delays to new projects including marginal field developments, said CIMB Securities.

Malaysia's oil and gas sector could expect muted domestic activity outlook going into 2026, amid oil price volatility, lower upstream capital spending, scaling back of offshore work scope and potential delays to new projects including marginal field developments, said CIMB Securities.

Limited job availability would also keep competition intense among service providers, it said, taking hint from national oil firm PETRONAS' upstream capex cut of 42% in 1H2025.

"Onshore plant turnarounds remain the primary near-term catalyst, benefitting companies with established capabilities and operational footprints," it said.

Brownfield maintenance works also "remain targeted and project specific", it said.

CIMB Securities is "neutral" on the sector, as core earnings are projectod to be at an over-a-decade low in 2025, followed by a recovery in 2026 but still at levels during the peak of the pandemic in 2020.

The ongoing dispute between PETRONAS and Sarawak state-owned Petroleum Sarawak Bhd (PETROS) also affected sentiment, it said.

"Key matters surrounding licensing, resource rights, and revenue entitlement [are] still unresolved," it said.

This contributed to delays in project sanctioning and dampened investor confidence, with oil producers "likely adopting a more cautious stance in committing to new developments", it added.

The sudden hawkish positioning by euro rate markets this week will likely face scrutiny. To justify the current position, growth numbers should continue to improve whilst inflation data may not start drifting below the European Central Bank's projections. Meanwhile, (geo)political risks should remain contained and Trump should not surprise Europe with new policy actions. That's a long list. And even though these are all part of our baseline forecasts, we doubt the ride will be perfectly smooth from here.

Interestingly enough, inflation swaps have not moved much in the broader repricing of rates. The 2Y inflation swap is still just below 1.8%, which captures the CPI undershoot anticipated by the ECB. The fact that real rates did most of the heavy lifting suggests that markets have changed their assessment of the ECB's reaction function. Whilst near-term disinflation is still anticipated, the ECB may simply see less need for further easing. We'll be interested to see if Schnabel's hawkish view is shared more broadly during next week's ECB meeting.

Reflecting on all this, markets may have turned a bit too hawkish too soon, and if sentiment faces even minor headwinds, we may well see part of the move fade. Keep in mind that broader market sentiment is particularly strong at the moment. The implied volatility of the euro STOXX equities index is at the lowest level this year, while the S&P 500 index in the US is eyeing new records. The question is whether investors are happy to stay risk-on going into the Christmas season. After a turbulent year, we can imagine sitting on the sidelines during Christmas gives us more peace of mind.

In the US, the 3mth SOFR rate is finally at or about the same level as the 10yr SOFR rate (just this week) and going forward the 3mth SOFR rate should drift lower, resulting in structural positive impact carry for fixed-rate receivers. It's the first time since the second half of 2022 (and briefly in January 2025) that the 10yr SOFR rate has been above most floating rates. For players who have baulked at the idea of swapping to floating on account of negative impact carry, that is going away (at least for as long as 10yr SOFR remains elevated). On the other side of the coin, one advantage of setting a fixed rate payer in the 10yr is the positive mark-to-market we anticipate as the 10yr SOFR rate heads towards 4%.

After the UK's monthly GDP estimates for October, the data calendar is very empty. We do have the Fed's Paulson and Goolsbee speaking about the US economic outlook. From Fitch we have a rating review for the EFSF and ESM.

Key points:

Thailand's rice prices rose to their highest in more than six months on flood-driven supply worries and expectations of stronger demand after China pledged to buy rice, while rates in India and Vietnam remained unchanged.

Thailand's 5% broken rice (RI-THBKN5-P1) was quoted at $400 per tonne, up from $375 last week. Prices were at their highest level since May 29.

Traders expect demand to rise as China moves to finalize a rice deal later this month, following its pledge to buy 500,000 tonnes of rice from Thailand.

"The deal with China and the prospect of more purchase from the Philippines makes the market livelier," a Bangkok-based rice trader said.

There has also been a decrease in supply because of recent flooding in many parts of the country, the trader added.

Indian rice export prices held steady this week, as the rupee's slide toward a record low helped traders offset rising paddy prices in the local market.

India's 5% broken parboiled variety was quoted this week at $347-$354 per metric ton, unchanged from last week. Indian 5% broken white rice was priced at $340 to $345 per metric ton this week.

Paddy prices are staying high because the government is buying at the increased minimum support price, which is also pushing traders to offer higher rates, said a Kolkata-based exporter.

The Indian rupee slid near a record low against the dollar on Thursday, lifting traders' rupee returns from overseas sales.

Vietnam's 5% broken rice (RI-VNBKN5-P1) was offered at $365-$370 per metric ton on Thursday, unchanged from a week ago, according to traders.

"Sales are slow amid weak demand," a trader based in Ho Chi Minh City said.

Vietnam's rice exports in November fell 49.1% from a year earlier to 358,000 tons, according to government data.

Meanwhile, Bangladesh approved the purchase of 50,000 tonnes of rice through an international open tender. The government continues to struggle to keep rice prices in check despite good stocks and yields.

As Chinese electric vehicle leader BYD's domestic sales suffer from competition in the low-priced cars that had driven its growth, the automaker is pinning its hopes of moving upmarket on other brands.

BYD's global new-vehicle sales slid 12% on the year in October to 441,706 units. This followed a drop in September that was BYD's first in 19 months.

BYD is struggling in the Chinese market, even as its sales abroad are growing. In October 2024, it sold about 470,000 passenger cars in China, but in October of this year, domestic sales topped out around 360,000 units, even including commercial vehicles.

To try to return to growth, BYD is playing up two brands: Denza and Fangchengbao.

The offroad-oriented Fangchengbao began delivering vehicles to customers in November 2023 and plans to expand its lineup to include a sedan in 2026. BYD positions it as an unconventional brand, appealing to a niche not covered by the company's mass-market autos like the Ocean and Dynasty series.

The Bao series of plug-in hybrid offroad vehicles tout high performance even on rough terrain. The Tai series, designed for both offroad and urban driving, debuted this year.

The Fangchengbao Bao 5 is more powerful than the newer Tai 7, but also more expensive. (Photo by Shizuka Tanabe)

The Fangchengbao Bao 5 is more powerful than the newer Tai 7, but also more expensive. (Photo by Shizuka Tanabe)The Tai 7 is a plug-in hybrid, like the Bao 5, and comparable in size. The model has less power and acceleration than the Bao 5, and its exterior design is simple and geared toward city driving. But its price starts at 179,800 yuan ($25,500), 60,000 yuan cheaper than the Bao 5.

The Tai 7 sold about 20,000 units in October, helping lift Fangchengbao's sales that month to 31,052 vehicles, a roughly 400% year-on-year increase. The Tai 7 became Fangchengbao's biggest hit to date.

"We currently have a six- to eight-week waiting period for delivery, so we're going to increase production capacity to meet demand," Xiong Tianbo, Fangchengbao's general manager, told Chinese media.

Denza faces sluggish sales of its flagship D9 minivan. D9 took a hit earlier this year when Great Wall Motor, under its Wey new energy vehicle brand, released a model called Gaoshan.

A version of the Gaoshan that is the same size as the D9 sells for 309,800 yuan, around the same price. Gaoshan also offers smaller and larger versions, expanding customer options and cutting into the D9's appeal.

Denza was overtaken by Fangchengbao in sales volume in June, as the latter became the second largest of the four brands in the BYD group. Fangchengbao sold over 140,000 units from January to October, while Denza sold over 120,000.

Xiong said Fangchengbao is expected to surpass 200,000 units this year.

To turn things around, Denza debuted an SUV called the N8L in late October. Positioning the N8L as a high-end family car, BYD hopes to differentiate it from Fangchengbao and other brands.

Luxury brand Yangwang -- the group's fourth group -- focuses on high-tech new energy vehicles in the 1 million yuan-range. Models include the U7 sedan, which can accelerate from zero to 100 kph in 2.9 seconds, and the U8 SUV, which can float and move through water.

BYD's net profit margin is shrinking, from 5.8% in July-September 2024 to 4% in the same quarter this year, eroded by price competition in the mass-market vehicle segment. To boost profitability, the price range above 150,000 yuan is becoming increasingly important.

As expected, the Swiss National Bank (SNB) kept interest rates on hold at 0.00% during their December meeting, despite inflation hitting the bottom of its target range.

SNB policymakers emphasized their commitment to avoiding negative interest rates and signaled that monetary policy could remain at its current state for an extended period.

Key Takeaways

The central bank also reiterated its willingness to intervene in foreign exchange markets "as necessary," though officials at the press conference emphasized that interest rates remain their primary monetary policy tool, marking a notable evolution from the pre-pandemic period when FX interventions were used more extensively.

Still, the central bank significantly revised down its quarterly inflation outlook, now expecting just 0.1% in Q1 2026, 0.2% in Q2, and 0.3% in Q3, down from 0.5%, 0.5%, and 0.6% respectively in the September projections.

At the subsequent press conference, Governor Martin Schlegel, joined by Vice Chairman Antoine Martin and Governing Board Member Petra Tschudin, reiterated their strong aversion to negative interest rates. The central bank has been explicit in recent months about the "undesirable effects" of negative rates, which include distortions to financial markets, pressure on bank profitability, and unintended consequences for savers.

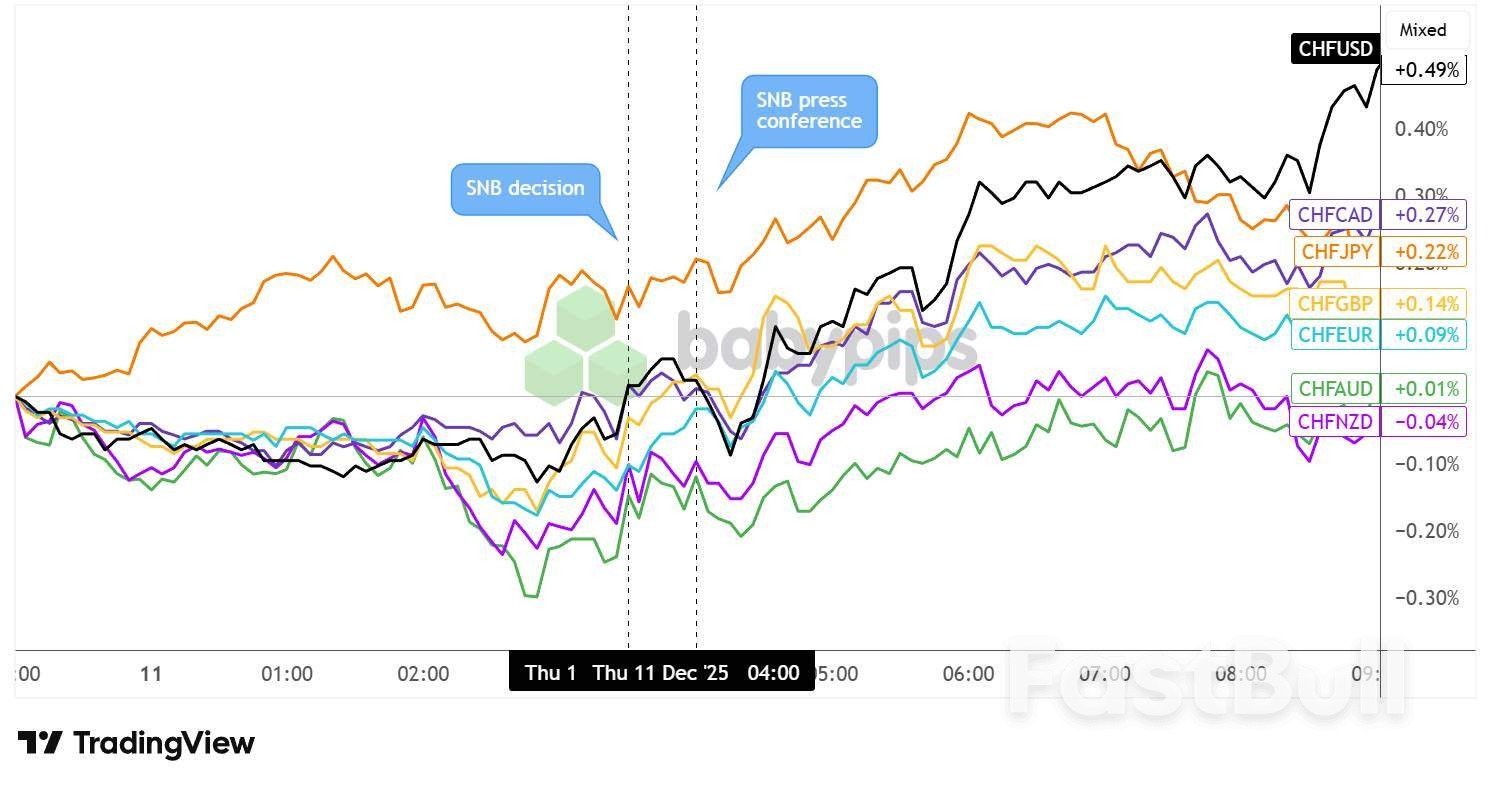

Swiss Franc vs. Major Currencies: 5-min

The Swiss franc, which had started to pull higher leading up to the actual SNB announcement, had an initial bullish reaction to the official decision since policymakers refrained from cutting rates to negative territory.

CHF briefly pulled back during the press conference, as traders likely weighed the implications of avoiding further easing amid a weaker inflation outlook, while also assessing the central bank's willingness to intervene in the currency market "as necessary."

Still, the Swiss currency managed to regain footing and sustain its rally as the London session went on, likely buoyed by dampened interest rate cut expectations until early 2026. CHF chalked up its strongest gains versus USD (+0.49%) followed by CAD (+0.27%) and JPY (+0.22%) while barely landing in positive territory versus AUD (+0.01%) and NZD (-0.04%) around the U.S. session open.

Key points:

Britons are set to spend 24.6 billion pounds ($32.9 billion) on presents and celebrations over the Christmas period this year, a 3.5% increase on 2024, despite a slow start to festive trading, according to a survey from PwC published on Friday.

With Britain's headline inflation rate running at 3.6% in October, PwC's forecast would indicate flat sales on a volume basis.

PwC said average spending per UK adult is forecast to rise to 461 pounds, with the top priorities being food and drink, Christmas dinner, and health and beauty products.

Of those consumers who said they are planning to spend less, the cost of living was cited as the main reason.

Survey data published on Tuesday showed British consumers kept a tight rein on their spending in November as they awaited finance minister Rachel Reeves' budget, while retailers said Black Friday sales disappointed.

Barclays said spending on its credit and debit cards fell by 1.1% in annual terms in November, the biggest drop since February 2021 when the COVID-19 pandemic still raged.

A separate survey from the British Retail Consortium (BRC) trade body showed spending at big retailers rose by 1.4% in annual terms last month, the slowest growth since May.

Analysts have also highlighted that a very mild autumn and early winter has been unhelpful for fashion retailers, particularly for sales of high-ticket items such as coats and boots.

"Post Budget, we should see clarity on personal finances easing some of the caution we have seen this Autumn, which has contributed to a slow start to the critical Golden Quarter for some retailers," Jacqueline Windsor, head of retail at PwC UK, said.

Last month, PwC forecast the steepest year-over-year drop in U.S. holiday spending since the pandemic, primarily fuelled by Gen Z shoppers pulling back amid economic uncertainty.

($1 = 0.7485 pounds)

Oil prices are lower this morning despite a less-hawkish-than-feared Fed cut and a double-whammy of relative optimism from OPEC and the IEA...

OilPrice.com's Tsvetana Paraskova reports that the oil market still faces record oversupply next year, according to the monthly report by the International Energy Agency (IEA), but the glut estimate is now trimmed by about 230,000 barrels per day compared to the November forecast.

The market is headed to as much as 3.84 million barrels per day (bpd) of supply exceeding demand in 2026, the IEA said on Thursday in its closely-watched report for December.

While this still is a considerable glut, it's lower than the 4.09 million bpd implied oversupply expected in the November report.

In today's report, the IEA said that the projected global oil surplus in the fourth quarter of 2025 has narrowed since last month's report, "as the relentless surge in global oil supply came to an abrupt halt."

Total global oil supply dipped by 610,000 bpd in November compared to October and by a whopping 1.5 million bpd from September's all-time high, the IEA noted.

OPEC+ accounted for 80% of the decline over October and November, reflecting significant unplanned outages in Kuwait and Kazakhstan, while oil output from sanctions-hit Russia and Venezuela plunged.

Russia's total oil exports are estimated to have plummeted by about 400,000 bpd in November to 6.9 million bpd, as buyers assessed the implications and risks associated with more stringent sanctions.

Buyers, especially in Russia's second-biggest crude oil customer, India, are steering clear of any Rosneft and Lukoil-related cargoes, for fear of running afoul of the U.S. Administration while India and the United States are still locked in difficult trade negotiations.

The IEA noted in its report the apparent disconnect between the current global oil surplus and inventories near decade lows at key pricing hubs.

Despite record volumes of oil piling up on water, benchmark crude oil prices eased only marginally in November, because "in stark contrast to the broader picture, crude and refined product stocks in key pricing hubs have seen only marginal builds," the agency said.

As Charles Kennedy reports at OilPrice.com, global oil demand will rise by about 1.4 million barrels per day (bpd) next year, supported by solid economic growth, OPEC said in its monthly report ton Thursday, keeping its demand forecasts unchanged from last month.

Unlike other forecasters, investment banks, and analysts, OPEC continues to expect robust demand growth in 2026 that will be higher than the estimated increase for 2025 of about 1.3 million bpd, forecasts in the cartel's Monthly Oil Market Report (MOMR) showed on Thursday.

Figures about the balance of supply and demand in OPEC's report also suggest that the cartel expects a balanced market next year.

Demand for crude from the OPEC+ producers is expected at 43.0 million bpd in 2026, up by 60,000 bpd compared to the projection for 2025, OPEC said.

At the same time, crude oil production by the countries in the OPEC+ pact averaged 43.06 million bpd in November, a rise by 43,000 bpd from October, compared to the available secondary sources in OPEC's report.

After December, OPEC+ producers will be pausing their targeted monthly production increases during the first quarter of 2026.

OPEC expects rival non-OPEC+ oil supply to grow by about 600,000 bpd next year, versus growth of some 1 million bpd expected for 2025.

The rise in non-OPEC+ output is expected to be driven by offshore start-ups across Latin America and the Gulf of Mexico, increased NGLs production in the U.S., Argentina's tight oil production, and the scaling of oil sands projects in Canada. Latin America is projected to lead non-OPEC+ growth, accounting for about two-thirds of the total, followed by Canada and the U.S.

This projection, while not new for OPEC, reiterates the cartel's view that U.S. oil production growth will slow down next year.

Signals have started to emerge in the shale patch and from industry executives that WTI crude prices below the $60 per barrel mark will put the brakes on America's shale growth.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up