Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

Russia PPI YoY (Nov)

Russia PPI YoY (Nov)A:--

F: --

P: --

Russia PPI MoM (Nov)

Russia PPI MoM (Nov)A:--

F: --

P: --

Australia Consumer Inflation Expectations

Australia Consumer Inflation ExpectationsA:--

F: --

P: --

South Africa PPI YoY (Nov)

South Africa PPI YoY (Nov)A:--

F: --

P: --

Euro Zone Construction Output MoM (SA) (Oct)

Euro Zone Construction Output MoM (SA) (Oct)A:--

F: --

Euro Zone Construction Output YoY (Oct)

Euro Zone Construction Output YoY (Oct)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Dec)

U.K. BOE MPC Vote Unchanged (Dec)A:--

F: --

P: --

Mexico Retail Sales MoM (Oct)

Mexico Retail Sales MoM (Oct)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

U.K. BOE MPC Vote Cut (Dec)

U.K. BOE MPC Vote Cut (Dec)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Dec)

U.K. BOE MPC Vote Hike (Dec)A:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit RateA:--

F: --

P: --

Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending RateA:--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing RateA:--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement Canada Average Weekly Earnings YoY (Oct)

Canada Average Weekly Earnings YoY (Oct)A:--

F: --

U.S. Core CPI YoY (Not SA) (Nov)

U.S. Core CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Real Income MoM (SA) (Nov)

U.S. Real Income MoM (SA) (Nov)--

F: --

P: --

U.S. CPI YoY (Not SA) (Nov)

U.S. CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. Core CPI (SA) (Nov)

U.S. Core CPI (SA) (Nov)A:--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Dec)

U.S. Kansas Fed Manufacturing Production Index (Dec)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Nov)

U.S. Cleveland Fed CPI MoM (Nov)--

F: --

P: --

Russia PPI MoM (Nov)

Russia PPI MoM (Nov)--

F: --

P: --

Russia PPI YoY (Nov)

Russia PPI YoY (Nov)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest Rate--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoY--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)--

F: --

P: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)--

F: --

P: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Shares of LG Energy Solution fell over 7% after Ford Motor Company terminated a major EV battery supply deal, citing shifting policies and a deteriorating EV demand outlook...

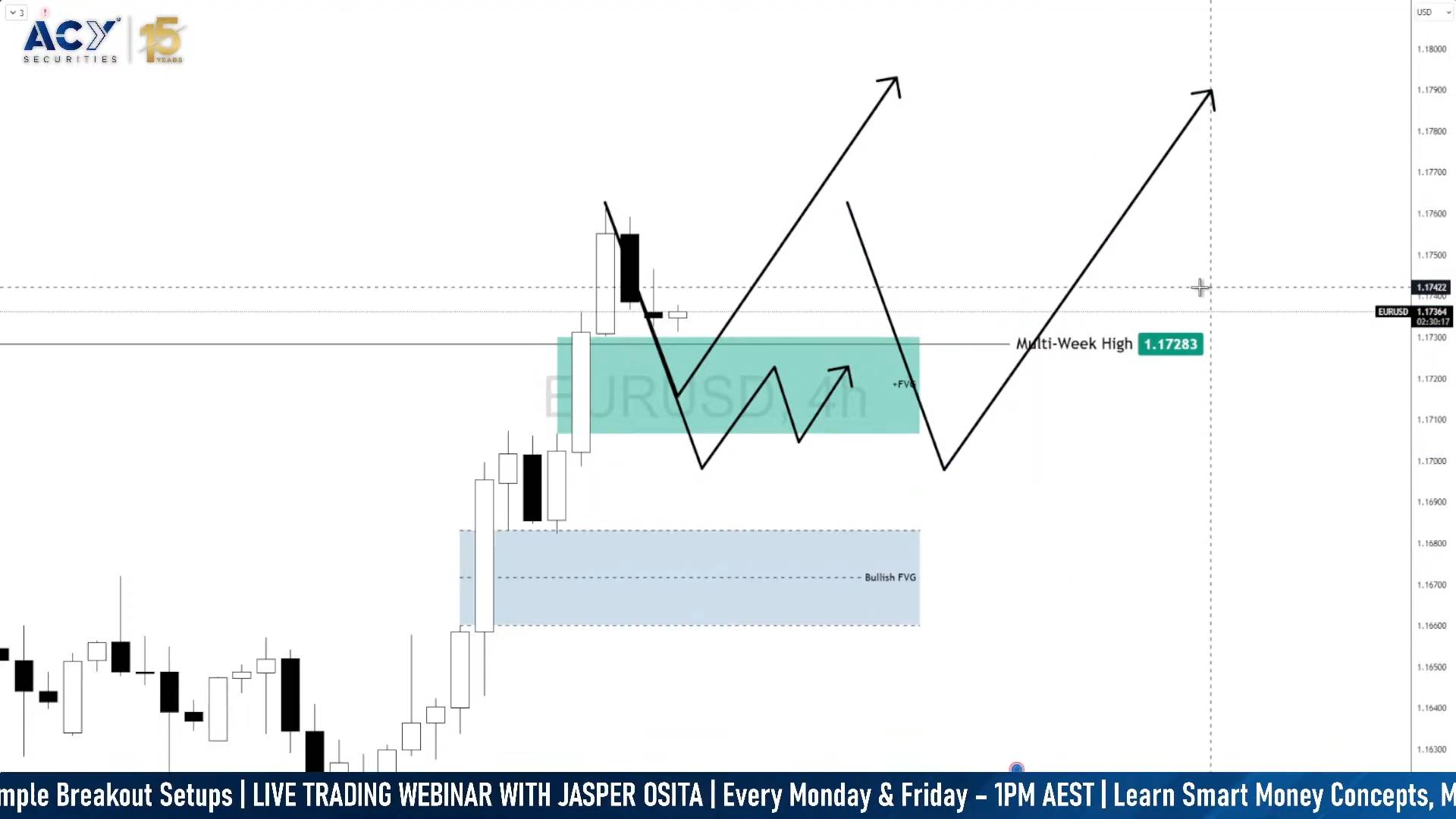

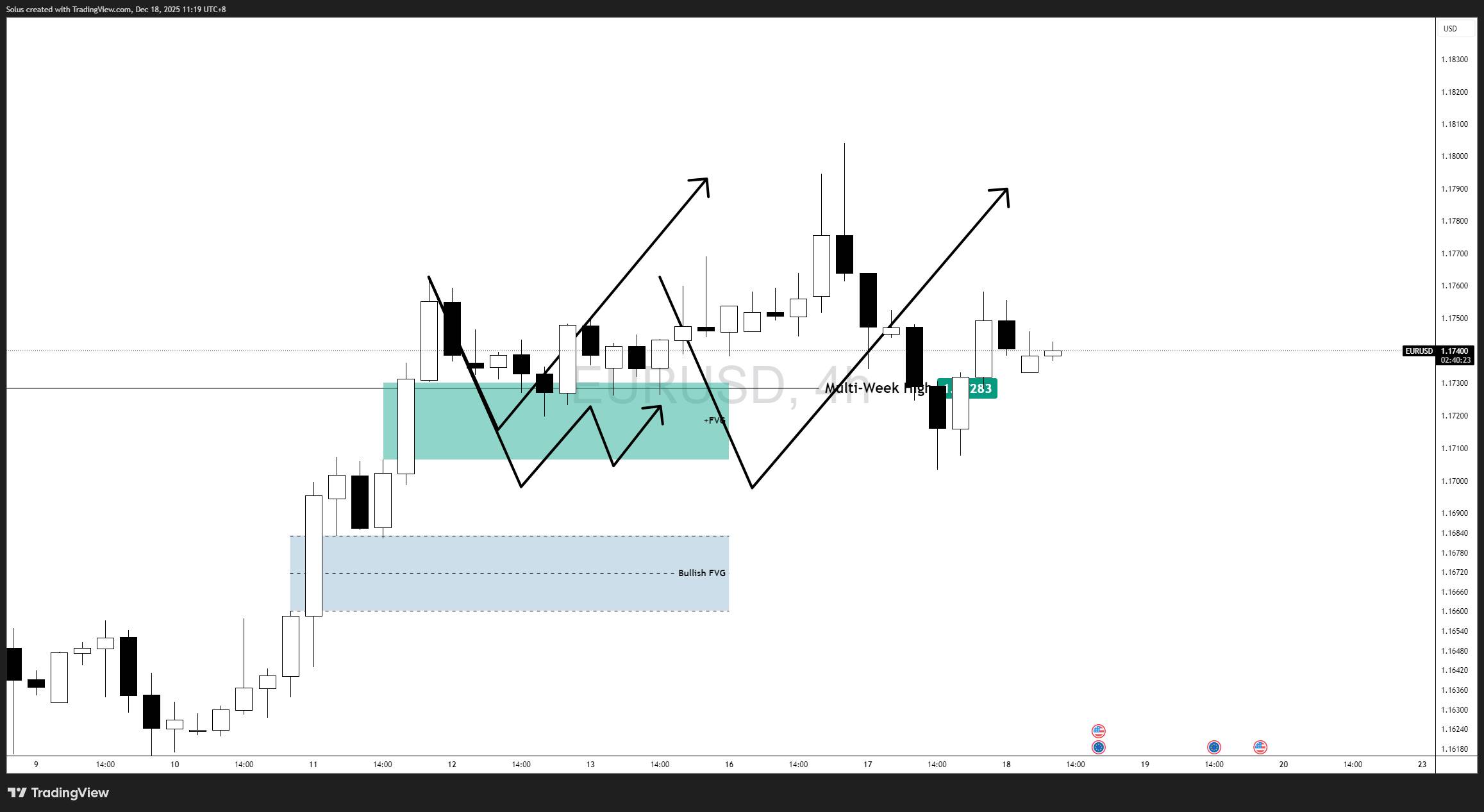

EUR/USD is currently transitioning from impulsive expansion into balance, consolidating above the 1.1728 multi-week high. This behavior reflects acceptance at higher prices, rather than exhaustion or trend failure.

After reclaiming a key structural level, the market has paused to allow two-sided trade — a natural and healthy process in trending environments. Importantly, price has not collapsed back below prior resistance, nor has it shown aggressive distribution. Instead, EUR/USD is oscillating within a defined range, signaling re-pricing rather than rejection.

From a macro perspective, this consolidation is occurring against a backdrop of persistent USD softness. The Federal Reserve's shift toward rate cuts and a more data-dependent stance has reduced the dollar's yield advantage, while expectations for aggressive ECB easing remain restrained. This narrowing policy divergence continues to favor EUR/USD on a medium-term basis.

As a result, the current price action should be viewed as digesting gains, not undoing them.

The prior EUR/USD forecast did not call for immediate continuation higher. Instead, it emphasized that acceptance above the multi-week high would be more important than chasing momentum.

Specifically, the expectation was for:

That scenario has materialized cleanly.

Following the breakout, EUR/USD pulled back into the highlighted re-pricing zone, held above the multi-week high, and formed higher lows rather than accelerating lower. Sellers failed to force acceptance back below prior resistance, while buyers consistently absorbed downside pressure.

This confirms that the breakout was structural, not false. The current consolidation reflects controlled digestion, aligning with the original expectation that the market would pause before determining its next expansion leg.

In short, the market followed process, not prediction — rewarding patience and structural alignment rather than aggressive positioning.

EUR/USD is now trading inside a defined range, with both buyers and sellers actively participating. In this environment, the most important reference is no longer the highs or lows — but equilibrium, or the middle of the range.

Equilibrium represents fair value. How price behaves around this level reveals intent.

The bullish scenario re-engages if EUR/USD breaks above the equilibrium level and holds above it.

Acceptance above the midpoint of the range signals that buyers are willing to transact at premium prices, not just defend the lows. In strong trends, equilibrium often acts as a launchpad, not resistance.

If price reclaims equilibrium and stays above it:

Rotation toward the range high, followed by a potential continuation toward new multi-week highs if momentum builds.

The bearish scenario develops if EUR/USD fails to reclaim equilibrium and consistently trades below the midpoint of the range.

In this case, equilibrium acts as resistance, suggesting sellers control fair value. This would likely lead to:

However, it is critical to distinguish correction from reversal. Even a sustained move below equilibrium would still be considered rebalancing, unless broader daily structure breaks decisively.

EUR/USD is not weakening — it is pausing with structure intact.

The market is currently balanced, and equilibrium is the line that separates continuation from deeper correction. Acceptance above it favors renewed strength, while failure keeps price rotational.

Until that decision is made, patience remains the edge.

China International Capital Corpshares jumped as much as 10% on Thursday after it detailed plans to buy two rivals in a share-swap deal worth about $16 billion, potentially creating China's fourth-biggest investment bank by assets.

Shares of acquisition targets Dongxing Securitiesand Cinda Securitiesalso surged.

State-owned CICC said the acquisitions would help broaden its business network, expand its client base and strengthen capital as it seeks to become a top-tier investment bank.

They would also answer a government call to build globally competitive investment banks through industry consolidation.

The acquisitions would create China's fourth-largest investment bank, with total assets of more than 1 trillion yuan ($142 billion), showed an estimate from Soochow Securities.

"The combined entity will have much bigger capital strength and will be more resilient operationally," China Merchants Securities said in a client note. The deals "could rekindle expectations of further industry consolidation," it said.

In an exchange filing late on Wednesday, CICC said it will issue 3 billion shares at 36.91 yuan ($5.24) each in exchange for all outstanding shares of Dongxing and Cinda.

That price is 6% higher than CICC's closing share price of 34.89 yuan on November 19, when trading of its shares was suspended pending details of the transaction.

The deal values Dongxing at 16.14 yuan a share, 23% above its market price of 13.13 yuan, and Cinda at 19.15 yuan, a premium of 8%.

CICC shares in Shanghai jumped 10% early on Thursday after the trading suspension was lifted, before paring gains to 5%. The bank is also listed in Hong Kongwhere its shares rose 4% on the resumption of trade.

Dongxing Securities shares jumped by their daily upper limit of 10%, while those of Cinda Securities climbed 5%.

All three companies are controlled by sovereign fund Central Huijin Investment (SASAWH.UL).

The government has been eager for consolidation to foster globally competitive investment banks. Domestically, about 150 participants make up a $1.6 trillion industry.

CICC said the acquisitions would boost outlets by nearly 80% to 436, increase retail clients and strengthen business in southern Fujian and northern Liaoning provinces.

"The restructuring would help the company develop into a globally competitive, first-rate investment bank," CICC said. It also said it will "support China's capital market reform and high-quality growth of the securities industry".

($1 = 7.0440 Chinese yuan renminbi)

When U.S. President Donald Trump signed an executive order to rebrand the Department of Defense as the Department of War, he was probably not thinking of corporate governance battles in South Korea. Nevertheless, his administration's decision to build a new zinc refinery stateside has dragged it into one of the country's messiest takeover feuds. The saga is another reminder of the pitfalls of state meddling in private firms.

There's little to fault the strategic rationale of joining forces with Korea Zincin a $7.4 billion refining project. The United States is keen to cut its reliance on China for materials vital to chips, electronics and weapons. The $18 billion Korean company is the world's top zinc smelter and produces 14 of the 54 critical minerals designated by Washington as essential to national and economic security. The latest agreement envisages Korea Zinc building and operating a large-scale facility in Tennessee that will begin producing zinc, lead and copper before expanding to strategic minerals like antimony and germanium. Commerce Secretary Howard Lutnick hailedthe initiative as a "big win for America".

The financial small print is messier. Korea Zinc will get access to up to $4.7 billion of loans plus $210 million in subsidies for the project. But in an odd move, it is also creating a joint venture that will inject $1.9 billion into Korea Zinc in return for a roughly 10% stake. The company will in turn take a similar shareholding in the joint venture, in which the Department of Defense will hold a 40% voting stake. The new unit will not directly own or operate the U.S. refinery, which will be wholly owned by Korea Zinc.

The company has yet to explain the reason for diluting investors or for creating a new circular shareholding of the type that many of South Korea's family-controlled conglomerates are unwinding. True, this joint venture would allow Korea Zinc to keep full control of the U.S. smelter, according to someone familiar with the matter. But the biggest beneficiary may be Chair Yun B. Choi, who since October last year has been locked in a fierce battle for control with the company's top shareholders, Young Poong and private equity giant MBK Partners. Issuing shares to a potential ally might tip the balance of power in Choi's favour.

It's not clear that the U.S. government realised it was potentially picking sides in a bitter corporate dispute. The Department of Defense did not respond to a request for comment. However, Young Poong and MBK are legally challenging the share issue, partly on grounds that it is designed to "preserve" Choi's grip over the company. The project's fate will now be decided by a court in Seoul.

The outcome could be an embarrassing hitch for Trump's administration, which is eager to buy shares in companies it deems strategic. In August, for example, the government took a 10% stake in ailing chipmaker Intel. Korea Zinc is a reminder that sometimes the art of the deal is not so different from the art of war.

Korea Zinc's two major shareholders, Young Poong and MBK Partners, announced on December 16 that they have filed for an injunction with the Seoul District Court to block the company's plan to issue new shares as part of a $7.4 billion critical minerals project with the United States government.

The pair, which together holds roughly 46% of Korea Zinc, said they were not opposed to the company's decision to build a new U.S. smelter but objected to the proposed issuance of new shares worth $1.9 billion to a joint venture backed by the U.S. government and unnamed U.S.-based strategic investors. The joint venture would own roughly 10% of Korea Zinc, diluting the two shareholders' holdings and helping the company's chairman cement control of the firm, the pair said.

Young Poong and MBK have been trying to wrest control of the company from current management led by Chairman Yun B. Choi. He and his backers have a 32% stake in Korea Zinc but have 11 members on the 15-strong board.

Korea Zinc on December 15 unveiled a joint venture with the U.S. Department of Defense and other unnamed investors. The company will issue 2.2 million new shares to the joint venture. It will also inject $89.99 million in capital in exchange for a 9.99% equity stake in the entity, in which the Department of Defense will hold a 40% voting right, according to filings.

Korea Zinc will then inject $2.5 billion into a wholly owned U.S. subsidiary that will build and operate a smelter in Tennessee. The Department of Defense and other financial institutions will contribute up to $4.7 billion in loans, while the Department of Commerce will contribute $210 million in subsidies under the CHIPS and Science Act. Besides zinc, the project also aims to refine copper and a range of other minerals considered critical by the U.S. government, including antimony and germanium.

As of mid-morning on December 18, Korea Zinc shares had fallen roughly 16% to 1,337,000 won since December 15. The Department of Defense did not respond to a request for comment.

Foreign investors bought the most Japanese bonds in eight months last week as rising yields attracted overseas demand.

Net purchases totaled ¥1.41 trillion ($9.1 billion), the largest since the period ended April 11, preliminary Ministry of Finance data showed Thursday. Demand was also evident in the Dec. 11 auction of 20-year notes, where the bid-to-cover ratio climbed to a five-year high.

Overseas funds are on track to purchase the most Japanese government bonds this year since at least 2005, lured by multi-decade-high yields and extra returns from hedging against the yen. With the Bank of Japan stepping back through quantitative tightening, foreign investors have increasingly filled the gap — a shift that could introduce more volatility into what was once a placid market.

"Overseas investors' demand for Japanese bonds has increased now that yields have reached sufficiently high levels," said Akira Moroga, chief market strategist at Aozora Bank Ltd. in Tokyo. "Even if the BOJ continues to raise interest rates, it may be the case that super-long yields are sufficiently high too."

The BOJ is expected to raise its policy rate by 25 basis points to 0.75% on Friday, according to economists' forecasts. Overnight-indexed swaps suggest the central bank will lift rates once more by October 2026.

The ministry's weekly data do not include details by bond type, investor category or geographic location.

China is dispatching a diplomat to Cambodia and Thailand as a new bout of violence between the two Southeast Asian nations threatens to derail a ceasefire brokered by President Donald Trump.

Deng Xijun, China's Special Envoy for Asian Affairs, will travel to Cambodia and Thailand on Thursday to conduct mediation, the Foreign Ministry in Beijing said in a statement.

"China closely follows the ongoing border conflict between the two countries," according to the statement. "Through its own way, China has been working actively for deescalation."

Trump has pushed for peace since the conflict spiked in July and has threatened both with trade retaliation if either nation violates the terms of an October peace declaration he orchestrated. While Deng has traveled at least twice to seek mediation, this is his first since the so-called Kuala Lumpur Peace Accords were signed.

Clashes along the 800-kilometer (497-mile) border resumed earlier this month, including Thai airstrikes on Cambodian military targets. More than two dozen people have been killed, including 16 Thai soldiers and 12 Cambodian civilians, and over half a million people have fled the area because of the fighting.

China has engaged with both sides since the start of the violence, but has kept a much lower profile than the US as Beijing generally avoids publicly intervening in conflicts, beyond seeking to facilitate discussions.

The Trump administration has sought to highlight that China hasn't played a role in the peace process. The White House didn't immediately respond to a request for comment sent outside normal working hours.

Trump called both leaders last week to push again for a ceasefire, although the fighting has since continued.

Malaysia's Prime Minister Anwar Ibrahim, who chairs Asean this year, said Wednesday that he's been in contact with the leaders as well, and that both told him they want to resolve their border clashes as soon as possible.

Deng's trip also comes as Cambodia's use of Chinese weapons comes into focus, following reports that the Thai military seized a large number of Chinese-made weapons from Cambodian soldiers.

China's Foreign Ministry spokesman Guo Jiakun didn't confirm nor deny the news at a press briefing Wednesday, but reiterated that Beijing has had "normal defense cooperation" with both countries and that such cooperation doesn't target any third party.

Thailand, which is a treaty ally with the US, has far larger and more sophisticated armed forces than Cambodia. Its attacks on Cambodia have included the use of American F-16 fighter jets.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up