Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkish Foreign Minister: We Hope Solution Can Be Found To Avoid Conflict And Isolation Of Iran

Turkish Foreign Minister: Spoke With USA Envoy Witkoff On Thursday, Will Continue Speaking To USA Officials On Iran

Iran's Araqchi Says Tehran Welcomes Talks With Regional Countries That Aims At Bringing Stability And Peace

Istanbul - Iran's Foreign Minister Araqchi Says Tehran 'Is Prepared For Resumption Of Talks With The US'

Istanbul - Iran's Foreign Minister Araqchi: Talks With His Turkish Counterpart Fidan Was Very 'Good And Useful'

Turkish Foreign Minister: Turkey Closely Following Integration Agreement Between Damascus-Sdf In Syria

Turkish Foreign Minister: Turkey Calling On US, Iran To Come To Negotiating Table To Resolve Issues

Turkish Foreign Minister: Turkey Opposes Foreign Intervention On Iran, We Tell Our Counterparts This

Turkish Foreign Minister: Iran's Peace And Stability Important For US, Turkey Saddened By Deaths During Protests

Chevron: Continue To Engage With The USA And Venezuelan Governments To Advance Shared Energy Goals

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)A:--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)A:--

F: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)A:--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The U.S. reinstated South Korea to its currency watch list, deeming the won's depreciation "excessive."

The U.S. government has decided to keep South Korea on its foreign exchange monitoring list, a move that market analysts believe will have a limited immediate impact on the currency market. However, the decision sends a strong signal, with both Washington and Seoul now indicating that the Korean won's recent slide against the dollar is "excessive," fueling expectations of future appreciation.

The U.S. Treasury Department announced the decision in its semiannual "Report to Congress on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States." South Korea was removed from the list in November 2023 after more than seven years but was reinstated in November 2024, preceding the inauguration of the Donald Trump administration.

Treasury Secretary Scott Bessent linked the move to a broader policy shift. "In support of President Trump's America First trade policy, starting with this report, Treasury is strengthening its analysis of trading partners' currency policies and practices," he stated.

Officials in Seoul described the designation as a procedural matter. A senior presidential official noted the decision was made in a "mechanical manner" based on the U.S. Treasury's evaluation framework. "The Treasury reiterated in its report that the recent depreciation of the won does not correspond to Korea's economic fundamentals," the official said, adding that close communication between the two governments will continue.

This view was echoed by Korea's Ministry of Economy and Finance, which said the report reflects Washington's concern over the won's prolonged, one-sided weakening trend since the latter half of last year.

The U.S. Treasury report went beyond monitoring, identifying key drivers behind the won's weakness. It stated that the currency's decline in the latter half of 2025 was inconsistent with South Korea's strong economic fundamentals.

The primary source of downward pressure, according to the report, was capital outflows from the private sector. This trend was largely driven by a significant increase in overseas equity investments by individual Korean investors.

The report also pointed to several structural factors contributing to this capital flight:

• The dominance of large corporations in the domestic economy.

• Conservative corporate dividend policies.

• Limited return prospects in the domestic capital market.

These conditions have prompted both households and institutional investors to move capital abroad, adding to the depreciation pressure on the won.

Market experts agree that Korea's inclusion on the monitoring list is unlikely to cause significant short-term volatility.

"The impact of being placed on the list should be minimal," said Park Sang-hyun, an analyst at iM Securities. "What matters more is the U.S. Treasury's judgment that the won is undervalued relative to fundamentals, a view that has also been echoed by the presidential office. That assessment suggests upward pressure on the currency."

Lee Min-hyuk, chief economist at KB Kookmin Bank, also downplayed the immediate effect, calling the designation a "familiar issue" for markets. However, he emphasized the importance of the underlying message.

"With U.S. Treasury officials, including Secretary Bessent, having openly described the won's weakness as excessive... markets may interpret this as unease in Washington over current exchange-rate levels, potentially capping further increases in the rate," Lee explained.

In the Seoul foreign exchange market on Friday, the won-dollar exchange rate closed at 1,439.5 won, a rise of 13.2 won for the dollar.

France's economic growth slowed to 0.2% in the fourth quarter of 2025, a significant cooldown after a strong summer rebound, according to preliminary data from the INSEE statistics office.

The figure, which matched economists' expectations, marks a deceleration from the 0.5% growth recorded in the third quarter. The slowdown was primarily driven by softer domestic demand and a reduction in business inventories.

Despite the late-year slowdown, the French economy expanded by 0.9% over the full course of 2025. This performance outpaced the 0.7% growth assumption used by the government in its budget planning.

The stronger-than-anticipated annual result increases the likelihood that France's fiscal deficit will be slightly below the currently projected 5.4% of gross domestic product.

The economy demonstrated notable resilience, holding up better than many forecasters had predicted amid months of political turbulence in a deeply divided parliament that weighed on consumer and business sentiment.

"We're off to a good start in 2026," Finance Minister Roland Lescure said on TF1 television. "I hope we'll get at least the 1% (growth) we're expecting."

Some political uncertainty is expected to ease as Prime Minister Sebastien Lecornu prepares to push the 2026 budget through parliament, ending a protracted standoff over fiscal policy. No-confidence motions from opposition parties are expected but are considered unlikely to pass.

Analysts, however, caution that the prospects for a strong economic rebound remain limited. ING economist Charlotte de Montpellier described the outlook as "modestly positive," pointing to several potential drags on growth.

In a note, she stated the budget "remains unfavourable to businesses" and warned that higher taxes could curb investment and job creation. While early signs of improving business confidence are encouraging, a strong euro could also hinder French exports.

The fourth-quarter growth figure was shaped by several competing economic forces:

• Domestic Demand: Strong household spending and investment collectively added 0.3 percentage points to GDP growth.

• Foreign Trade: An increase in exports paired with a decline in imports provided a significant boost, contributing 0.9 percentage points.

• Inventories: A substantial drawdown in corporate stockpiles acted as the primary drag, subtracting 1.0 percentage point from the final growth rate.

Daily News

Economic

Middle East Situation

Political

Commodity

Data Interpretation

Remarks of Officials

Energy

Oil prices have surged 15% in January, fueled by a series of supply disruptions and rising fears of a U.S. strike on Iran. Despite this, crude remains stuck in a familiar trading range. Tough rhetoric from Washington and Tehran is adding a risk premium, but with the global market still well-supplied, it will take a major, sustained supply shock to push prices significantly higher.

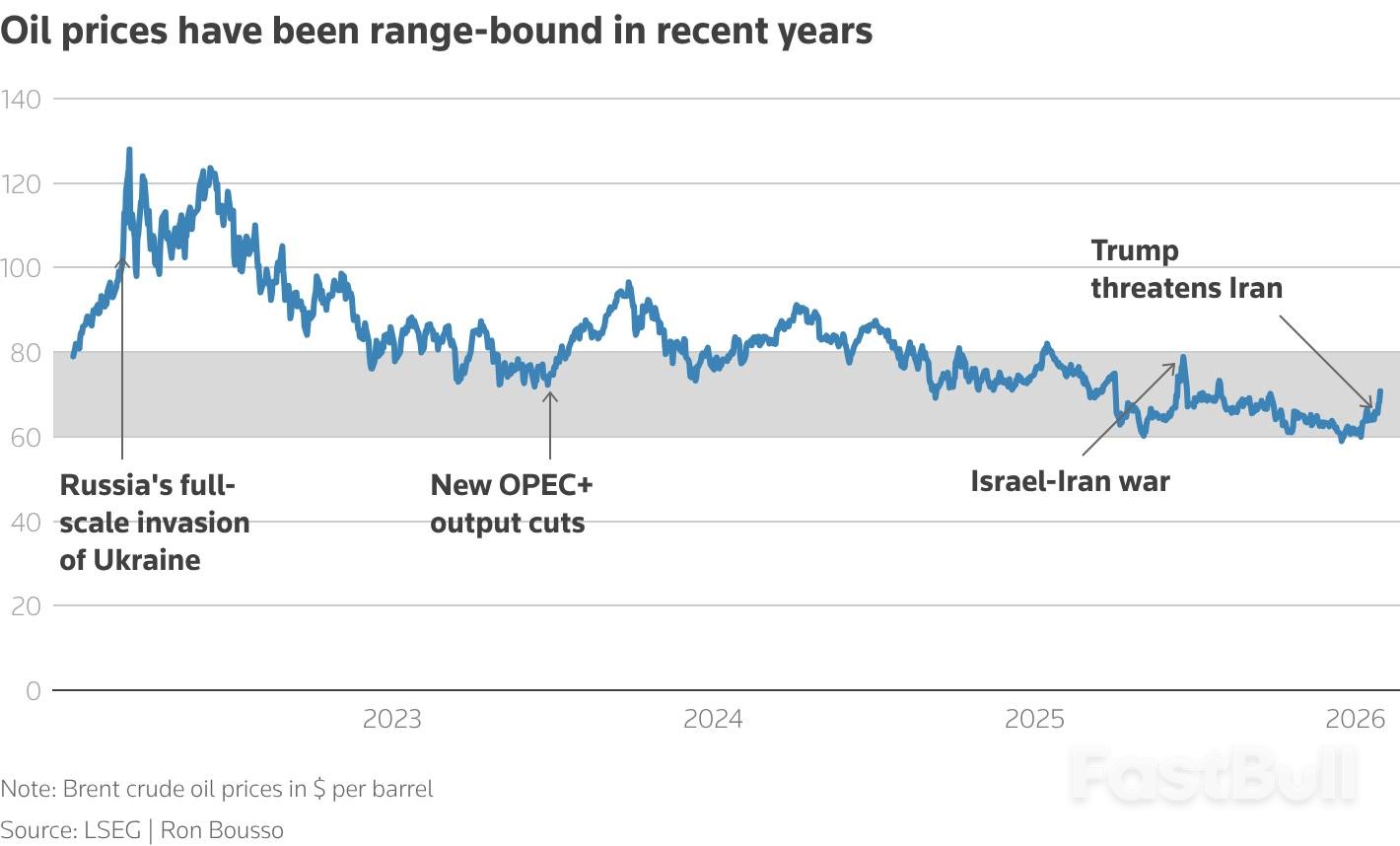

In January, Brent crude futures climbed above $70 a barrel for the first time since last July, putting the benchmark on course for its largest monthly gain since January 2022. This rally is the result of several supply setbacks coinciding with escalating geopolitical tension in the Middle East.

January saw a substantial hit to global crude supply from multiple, unrelated incidents, with some outages expected to last for weeks or months.

• Venezuela: Exports dropped to an average of just 605,000 barrels per day (bpd) following the U.S. arrest of Nicolas Maduro. This is well below the 2025 average of 780,000 bpd as the country's oil industry struggles.

• Kazakhstan: A power outage on January 18 halted production at the massive Tengiz field. While operations have resumed, output is not expected to return to its pre-outage level of over 900,000 bpd before mid-February.

• United States: A severe winter storm knocked out up to 2 million bpd of production, representing roughly 15% of the national supply, and the recovery is still underway.

While these disruptions have supported prices, the gains have been capped. The primary reason is the persistent reality of a global supply glut, driven by rising output from other regions, including key OPEC producers. This surplus has been putting downward pressure on prices for months.

Underscoring this trend, the International Energy Agency (IEA) forecasts a massive oversupply of 3.7 million bpd in 2026. This projection is supported by evidence of growing onshore and offshore inventories, which provide a significant buffer against short-term disruptions.

Adding to the bullish case, recent threats from President Donald Trump to strike Iran, coupled with a large U.S. military buildup in the region, have injected fresh anxiety into the market. The situation remains highly uncertain, with key questions about if, how, and when Washington might act—and how Tehran would retaliate.

The stakes for the oil market are extremely high. Iran, OPEC’s fourth-largest producer, pumped 3.3 million bpd in 2025, accounting for about 3% of global crude. Tehran has vowed to respond to any U.S. strike, potentially by attacking neighboring states. This raises the risk of a wider conflict that could disrupt energy exports from a region that supplies nearly 20% of the world's oil.

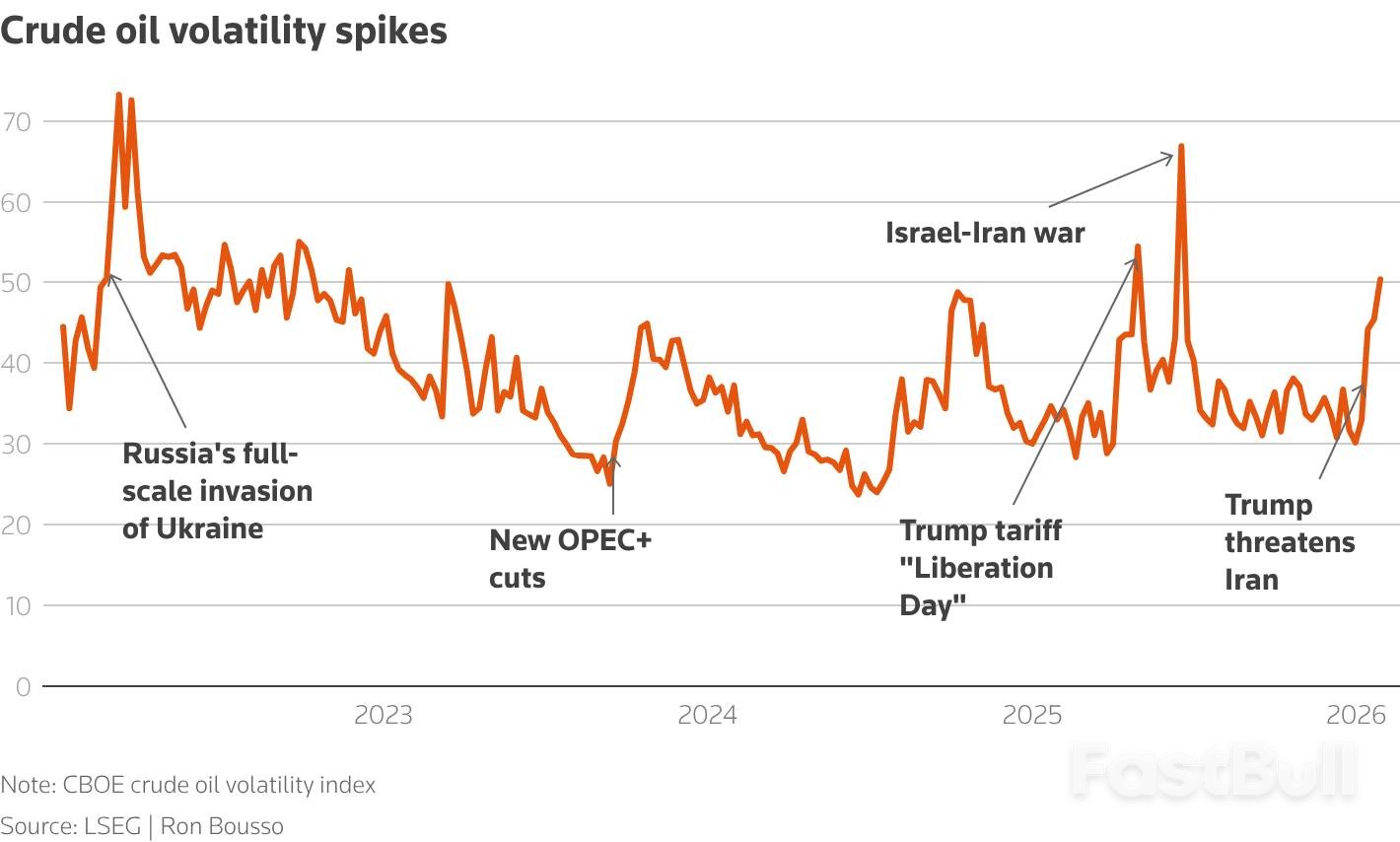

Market nervousness is clear. The CBOE crude oil volatility index (.OVX), a measure of expected price swings, shot up from 30 at the start of the year to over 50, its highest level since the Israel-Iran war last June.

With physical outages and Middle East tensions creating a bullish backdrop, why hasn't Brent crude broken out of the $60 to $80 per barrel band it has occupied for nearly two years?

The answer is that investors are only pricing in a modest geopolitical risk premium. The market's focus remains fixed on the prevailing global supply glut. Prices stayed within this same narrow range last year despite the Israel-Iran war, Ukrainian attacks on Russian oil facilities, and Trump's "Liberation Day" tariff announcement.

Ultimately, today's oil market is less responsive to political tensions than in the past. For prices to break into triple-digit territory, a doomsday scenario—such as a regional war that severely disrupts oil flows—would likely be required. For now, traders need to see actual supply losses large enough to erode the global overhang, and that remains a very high bar to clear.

Taiwan's economy expanded by 8.63% in 2025, marking its fastest pace of growth in 15 years, driven by relentless global demand for technology essential for artificial intelligence systems.

According to a statement from Taipei's statistics bureau, the full-year growth figure significantly outpaced the 7.5% median estimate from a Bloomberg survey of economists. This surge underscores the critical role of Taiwan's tech sector in the ongoing global AI buildout.

The economic acceleration was particularly pronounced in the final months of the year. Gross domestic product in the fourth quarter surged by 12.68% compared to the previous year, crushing the consensus estimate of 8.75%. This represents the most rapid quarterly expansion the economy has seen since 1987.

Confidence in Taiwan's economic momentum is expected to carry into this year. The sustained demand for AI-related hardware has prompted several financial institutions to revise their 2026 growth forecasts upward, with many now exceeding the central bank's projection of 3.67%. Goldman Sachs Group Inc. recently lifted its prediction for the year to 5.1%, a notable increase from its previous forecast of 4.4%.

This optimism is reinforced by major industry players. Taiwan Semiconductor Manufacturing Co. (TSMC), Asia's most valuable company, signaled its confidence in the longevity of the AI boom by earmarking up to $56 billion in capital spending for 2026—a projection that exceeded market expectations. The chipmaker also anticipates its revenue will grow by nearly 30% this year.

Beyond the AI boom, strengthening trade ties have provided another powerful tailwind. A trade agreement reached between the U.S. and Taiwan this month lowered tariffs on Taiwanese goods from 20% to 15%. The deal also includes provisions for Taiwanese companies to increase investment and financing for their American operations by as much as $500 billion.

These favorable conditions helped propel Taiwan's exports to record levels in 2025. A significant portion of these shipments—over 60%, including specialized advanced chips—were exempt from U.S. duties while the Trump administration conducted a probe into various key imports.

As a result, Taiwan's trade surplus with the United States climbed to a record $150.1 billion last year, more than doubling the $64.7 billion figure recorded in the prior year.

Ukrainian President Volodymyr Zelenskiy has announced that Kyiv is prepared to halt attacks on Russian energy infrastructure, provided Moscow agrees to a weeklong ceasefire proposed by the United States.

"If Russia does not strike our energy infrastructure—generation facilities or any other energy assets—we will not strike theirs," Zelenskiy stated to reporters in Kyiv. "We want to end the war and we are ready for de-escalation steps."

The offer follows a statement from U.S. President Donald Trump, who said he had asked Russian leader Vladimir Putin "not to fire into Kyiv and the various towns for a week, and he agreed to do that." However, the Kremlin has not yet confirmed any agreement to stop the missile and drone attacks that have crippled Ukraine's energy grid.

These Russian strikes have caused widespread power and heating outages during a period of extreme winter cold. With temperatures projected to fall below -20°C (-4°F), the blackouts have intensified the hardship for Ukraine's population.

Zelenskiy described Trump's proposal as "an opportunity rather than an agreement," adding, "Whether it will work or not, and what exactly will work, I cannot say at this point."

As the war approaches its fourth year with frontlines in the east and south moving slowly, Russia has increasingly targeted civilian infrastructure to weaken Ukrainian morale. In response, Ukraine has launched its own campaign against Russian oil refineries and other key facilities, aiming to disrupt Moscow's ability to finance its military operations through energy sales.

Despite the truce discussions, Russian attacks continued overnight with the launch of one ballistic missile and 111 combat drones, according to Ukraine's Air Force. The scale of this assault was notably smaller than some of Russia's more intense recent barrages.

Zelenskiy also criticized European allies for delays in supplying missiles for air-defense systems. He argued these delays have made Ukraine's energy infrastructure more vulnerable. "Imagine this: I know that ballistic missiles are incoming against our energy infrastructure; I know that Patriot systems are deployed; and I know that there will be no electricity, because there are no missiles to intercept them," he said.

The potential truce is being discussed as part of broader peace talks brokered by the U.S. Last week, negotiators from both sides met for two days in the United Arab Emirates. However, Zelenskiy said it remains unclear if a second meeting scheduled for Sunday in Abu Dhabi will take place.

The primary obstacle remains Russia's territorial demands. Moscow is insisting on a Ukrainian withdrawal from parts of the eastern Donetsk region that Russian forces have been unable to capture since fighting began in 2014.

Competing Visions for Donetsk

Two different solutions are on the table:

• The U.S. Proposal: Washington has suggested creating a "free economic zone" in the Donetsk region, which would entail a withdrawal of Ukrainian troops. Kyiv has rejected this idea.

• Ukraine's Stance: Kyiv has proposed halting the conflict along the current frontlines. "In my view, the least problematic possible solution is 'we stay where we are.' That is our position," Zelenskiy explained.

He emphasized that any agreement, including a free economic zone, must be fair and ensure Ukraine maintains control over the territories it currently holds. This issue was discussed in Abu Dhabi, and Ukraine is awaiting feedback from Russia at the next meeting.

Zelenskiy reiterated his readiness to meet with Putin and Trump for peace talks in any neutral country, excluding Russia and its ally Belarus. He dismissed a recent offer from Kremlin foreign policy aide Yuri Ushakov for him to visit Moscow.

"I can just as well invite him to Kyiv, let him come," Zelenskiy said. "I am publicly inviting him, if he dares, of course."

China’s government revenue contracted for the first time since 2020, dropping 1.7% in 2025 as a persistent downturn in the property sector and sluggish domestic demand hit the nation's finances.

According to the finance ministry, total fiscal revenue for the year stood at 21.6 trillion yuan (approximately $3.11 trillion). The decline marks a significant reversal from the 1.3% revenue growth recorded in 2024 and is the first contraction since the 3.9% drop seen in 2020 during the initial COVID-19 outbreak.

While revenue fell, government expenditure in 2025 rose by 1% to 28.7 trillion yuan. However, this represents a marked slowdown from the 3.6% growth in spending seen the previous year, signaling tighter fiscal conditions.

The pressure on public finances stems from a combination of weak economic drivers that are impacting the government's various income streams.

A detailed look at revenue sources reveals a sharply divided picture. The ongoing crisis in China's property market continues to erode a critical pillar of government income.

• Land Sales Decline: Revenue from land sales by local governments fell for the fourth consecutive year, dropping 14.7% in 2025. This followed a 16% fall in 2024. The prolonged slump in these revenues, historically a key engine for local economies, has severely strained municipal budgets and weighed on business activity.

• Mixed Tax Performance: Overall tax revenue saw a minor increase of 0.8%, but non-tax income slumped by 11.3%.

• A Stock Market Bright Spot: In stark contrast, revenue from stamp taxes on securities trading surged by 57.8%, fueled by a rally in the stock market.

Despite the fiscal headwinds, China's economy grew by 5.0% in 2025, meeting the official government target. This growth was largely supported by strong global demand for Chinese goods, an engine that economists warn may be difficult to sustain amid weakening domestic consumption.

In response to the challenging economic environment, Chinese leaders have committed to implementing a more proactive fiscal policy. The government plans to maintain the necessary fiscal deficit, debt levels, and expenditure scale to ensure broader economic growth.

Commodity analysts at Citi are dialing back fears of a major oil supply crisis stemming from escalating US-Iran tensions. The bank's view, reported by Reuters, is that any military action from the United States and Israel will likely be limited, avoiding a full-scale conflict that would disrupt global energy flows.

While a major war is seen as unlikely, Citi expects the ongoing friction in the Middle East to sustain a "geopolitical premium" on oil prices. The analysts highlighted that potential actions, such as tanker seizures, remain a consideration for Washington and could keep the market on edge.

This analysis comes as Brent crude recently settled above $70 per barrel for the first time in months. The price rally was fueled by a combination of the Iran escalation and separate oil production disruptions in the United States, where a cold spell has impacted major producing states.

In a recent note, Citi put the probability of limited US and Israeli military action against Iran at 70%. The bank's reasoning for this forecast points to several key factors:

• Energy Prices: The US is sensitive to the economic impact of higher energy costs.

• Political Will: President Trump has shown a preference for avoiding direct war.

• Diplomatic Potential: Ongoing domestic pressures within Iran could create an opening for a new deal.

The long-standing risk of Iran closing the Strait of Hormuz is also considered low. Such a move would significantly harm Iran's own economy and would likely trigger a swift response from the United States.

Looking ahead, Citi's best-case scenario involves a new nuclear deal between the US and Iran this year. Such an agreement could eliminate the geopolitical risk premium currently baked into oil prices, which the bank’s analysts estimate to be between $7 and $10 per barrel.

Reflecting the cautious market mood, analysts at ING observed that "one would have to be fairly brave to head into the weekend short the market," given Trump’s recent rhetoric. They also noted that the oil market appears tighter than many had anticipated, with market indicators contradicting widespread expectations of a large surplus.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up