Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

It should be another busy, holiday-shortened, week after a volatile one last week as markets whipsawed around big moves in Fed pricing and AI bubble risk fears.

It should be another busy, holiday-shortened, week after a volatile one last week as markets whipsawed around big moves in Fed pricing and AI bubble risk fears. Before we get to Thanksgiving, DB's Jim Reid writes that in the US, delayed post-shutdown data will be compressed into the first three days because of the holiday. Tomorrow brings September's retail sales and PPI, followed on Wednesday by jobless claims and durable goods orders. The claims data will be particularly important as they cover the November survey week, and the Federal Reserve is expected to lean heavily on these figures and other alternative indicators ahead of its December meeting, given there'll be no more payroll data prior to the FOMC.

Globally, attention will turn to inflation reports from Europe and Japan, as well as the long-awaited UK Budget, which could prove pivotal for the country's fragile fiscal outlook. Perhaps the most significant geopolitical development will be Ukraine's response to the US ultimatum to accept the 28-point peace plan agreed with Russia, with an ultimatum set for before Thanksgiving on Thursday, although the US seem to have indicated over the weekend that there is some room for negotiation.

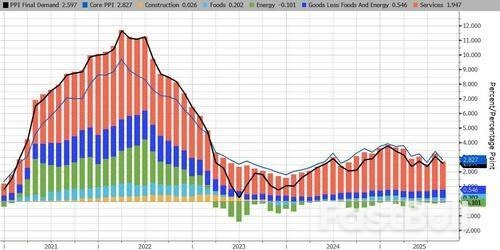

Let's start with the US, and for tomorrow's September PPI data, benign prints are expected by DB economists for headline (+0.2% vs -0.1% last) and core (+0.2% vs -0.1%), echoing recent CPI trends. Categories feeding into core PCE will be in focus, with forecasts pointing to a 0.26% monthly gain, keeping the annual rate near 2.9%. This will be the last inflation update before the Fed's December decision, as October CPI and November CPI have been pushed back to mid-December.

Retail sales are forecast by DB economists to show modest gains after strong summer spending: headline +0.1% (vs +0.6% last), ex-auto +0.2% (vs +0.7%), while retail control may dip slightly (-0.1% vs +0.7%). Even so, Q3 retail control growth is tracking at 6.8% annualized —the strongest since early 2023—supporting expectations for robust goods spending once GDP data is published. Factory sector updates arrive Wednesday with durable goods orders for September and the Chicago PMI for November (45.0 vs 43.8). Headline orders are expected to fall (-2.4% vs +2.9%), but ex-transportation (+0.2% vs +0.4%) and core orders (+0.2% vs +0.6%) should post moderate gains, implying a solid 5.3% annualised increase for Q3. Don't forget Black Friday where we will start to see early evidence of how strong consumer spending is into the important Christmas period.

No Fed speakers are scheduled at this stage. The blackout period begins on Saturday ahead of the December meeting but with Thanksgiving on Thursday, it will start a lot earlier than it normally would.

European data highlights include preliminary November CPI prints for Germany (2.6% YoY expected), France (0.92%) and Italy (1.23%) on Friday, alongside Q3 GDP releases for Norway, Sweden and Switzerland. Germany's Ifo survey kicks off the week today, followed by consumer confidence on Thursday and retail sales Friday. France will also report confidence and spending data that day. In the UK, the Autumn Budget on Wednesday will be the main event. Expectations point to roughly £35bn in fiscal consolidation, marking a second historic tax-raising budget under Chancellor Reeves. See our economist Sanjay Raja's preview here in what is one of the most hotly anticipated UK budgets in recent memory. Sanjay may need a lie down in a dark room after Wednesday as it's fair to say he's been in high demand of late.

From central banks, the ECB will publish its October meeting account on Thursday and its consumer expectations survey Friday. In New Zealand, the RBNZ meets Wednesday, with a 25bps rate cut anticipated. Elsewhere, Australia reports October CPI (Wednesday), Canada releases Q3 GDP, and China publishes October industrial profits. Japan's focus will be on November Tokyo CPI and October activity data (Friday).

Key points:

Australia is home for YouTube star Jordan Barclay, the place where he was born, went to school and built a company worth $50 million by age 23 that produces gaming content for 23 million subscribers.

Now, with a world-first social media ban on Australian children younger than 16 set to take effect on December 10, he is thinking of leaving his Melbourne studio and moving abroad.

"We're going to move overseas because that's where the money is going to be," said Barclay, whose seven YouTube channels include EYstreem, Chip and Milo, and Firelight.

"We can't afford to keep doing business if advertisers leave Australia."

Nine participants interviewed by Reuters in Australia's social media industry, estimated to generate annual revenue of A$9 billion ($5.82 billion), did not put a dollar figure on the ban's impact but agreed it could lead to a drop in advertisers and views.

YouTubers, who get paid 55% of ad revenue and up to 18 Australian cents per 1,000 views, could be hit hardest, said social media researcher Susan Grantham at Griffith University.

"If it is one clean sweep and all these accounts disappear, then instantaneously, it's going to be detrimental to the influencer economy."

The law requires companies to block the accounts of more than a million people under the cut-off age, punishing "systemic breaches" with penalties of up to A$49.5 million.

While teenagers can still watch YouTube without an account, the site's algorithm will fail to drive traffic to popular posts, reducing views.

Equally, creators on YouTube, TikTok and Meta'sInstagram stand to lose earnings through promotions if the number of their followers fall, Grantham said.

Advertisers are also on edge about campaigns targeting younger audiences, said Stephanie Scicchitano, general manager at Sydney-based talent agency Born Bred Talent.

Barclay's company Spawnpoint Media sells advertising to companies such as Lego and Microsoft, but clients' interest in sponsorship deals has declined as the ban approaches, he said.

"They're worried about what the ban could mean later," he said. "If it expands, if it grows ... it makes sense for us to invest overseas and not here."

The United States could be among his options, he said, pointing to more favourable laws and government support in such markets.

Some creators are already leaving to avoid the curbs, such as influencers the Empire Family, who told followers in October they were relocating to Britain.

The careers of those creating content featuring children younger than 16, such as family vloggers and child influencers, were particularly at risk, said Crystal Abidin, the director of the Influencer Ethnography Research Lab.

"They agree that in order to continue, it's an easy decision to immigrate," she said.

Children's musicians Tina and Mark Harris, whose Lah-Lah YouTube channel has 1.4 million subscribers, said, "Any negative impact on income is going to hurt."

But their main concern was lasting reputational damage from the government's description of YouTube's harm to children.

"Parents will get the jitters and stay away from YouTube in droves," Mark Harris said.

"Maybe that's hyperbole, we just don't know."

Initially exempted from the ban, Alphabet-ownedYouTube was added later at the urging of Australia's internet regulator, which said 37% of minors reported seeing harmful content on YouTube, the worst showing for a platform.

The ban "does a disservice" to creators of high-quality content for children, said Shannon Jones, who runs Australia's largest YouTube channel, Bounce Patrol, with more than 33 million subscribers.

Byron Bay creator Junpei Zaki, 28, whose output is mostly drawn from interactions with 22 million followers across TikTok and YouTube, expects the ban to cause a "guaranteed drop" in likes and comments from Australia.

"It ... does feel like I'm ignoring my Australian audience that helped get me here, because they can't interact."

Zaki estimates he will lose 100,000 followers to the ban, a blip in his global reach, but warned that smaller creators with domestic audiences would be hit harder.

At the House of Lim food stall in Sydney's west, 15-year-old owner Dimi Heryxlim has built a following by posting vlogs of his routine running the kitchen after school.

Losing access to his TikTok and Instagram accounts "will be a bad thing", he said, as some customers recognise him from his videos, but he plans to return as soon as he turns 16.

"If I can't get my account back, I'll just get a new account and start everything from scratch," said Heryxlim.

President Donald Trump is weighing whether to allow Nvidia Corp to sell advanced artificial intelligence chips to China and will be the one to make a final decision on the matter, US Commerce Secretary Howard Lutnick said.

The president is hearing from "lots of different advisers" in deciding on the potential exports, Lutnick said in a Bloomberg TV interview on Monday, noting that Trump understands Chinese President Xi Jinping "the best." Bloomberg News had reported on Friday that US officials are having early discussions on whether Nvidia can sell its H200 artificial intelligence chips to China.

"That kind of decision sits right on the desk of Donald Trump," Lutnick said in the interview. "He will decide whether we go forward with that or not."

At the same time, Lutnick acknowledged the tensions between promoting economic expansion and protecting national security. "Do you want to sell China some chips and keep them using our tech and tech stack, or do you say to them, 'Look, we're not going to sell you our best chips. We're just going to hold off on that, and we're going to compete in the AI race ourselves,'" he said.

Allowing H200 sales to China would mark a significant easing of restrictions first imposed in 2022 to prevent Beijing and its military from accessing the most powerful US technologies. Any move to sell a higher-calibre processor to China would provoke sharp opposition from national-security hawks in Washington, where some lawmakers are backing legislation to prevent such a move.

Nvidia chief executive officer Jensen Huang, who has forged a close relationship with Trump and calls him often, is eager to sell his products to China. The company remains shut out of the Chinese market for AI chips after authorities in Beijing told local companies not to buy the less-advanced H20 chips that Trump approved for sale earlier this year.

Lutnick said on Monday that Huang has "good reasons" for wanting to sell to China, adding that there are an "enormous number of other people" who agree it should be considered.

"It's a really interesting question," Lutnick said. "He's got all the information. He's got lots and lots of experts talking to him, and he's going to decide which way to go forward."

Key points:

For most of her life, 59-year-old farmer Tip Kamlue has irrigated her fields in northern Thailand with the waters of the Kok River, which flows down from neighbouring Myanmar before joining with the Mekong River that cuts through Southeast Asia.

But since April, after authorities warned residents to stop using the Kok's water because of concerns over contamination, Tip has been using groundwater to grow pumpkins, garlic, sweet corn and okra.

"It's like half of me has died," Tip said, standing by her fields in Tha Ton sub-district, and looking out at the river that she is now forced to shun.

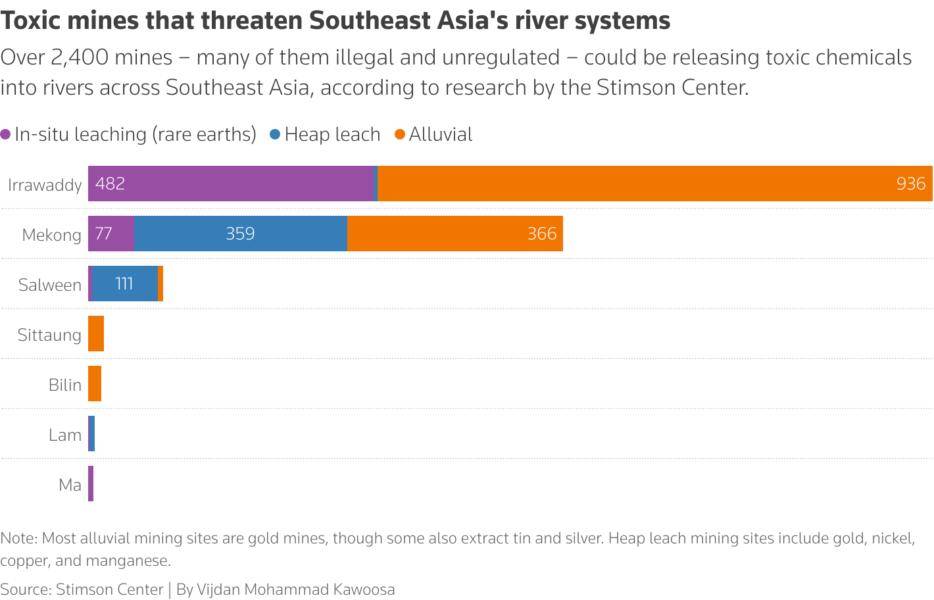

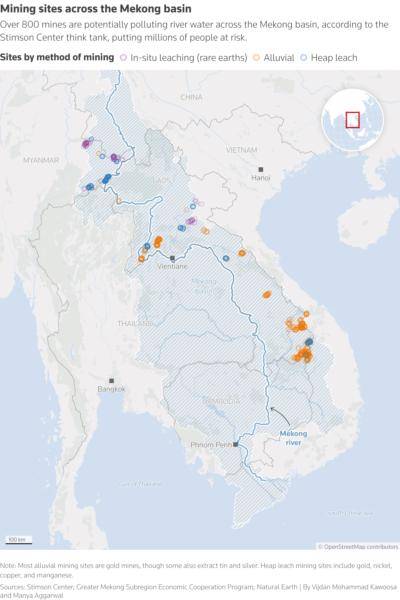

Across mainland Southeast Asia, more than 2,400 mines - many of them illegal and unregulated - could be releasing deadly chemicals such as cyanide and mercury into river water, according to research from the U.S.-based Stimson Center think tank released on Monday.

"The scale is something that's striking to me," said Brian Eyler, senior fellow at Stimson, pointing to scores of tributaries of major rivers, like the Mekong, the Salween and the Irrawaddy that are probably highly contaminated.

The Stimson report marks the first comprehensive study of potentially polluting mines in mainland Southeast Asia. Researchers analysed satellite imagery to identify mining activity including 366 alluvial mining sites, 359 heap leach sites and 77 rare earth mines draining into the Mekong basin.

Most alluvial mining sites are gold mines, though some also extract tin and silver. Heap leach mining sites include those for gold, nickel, copper, and manganese extraction.

The Mekong is Asia's third-largest river and supports the livelihood of more than 70 million people as well as the global export of farm and fisheries products. It was previously perceived to be a clean river system, said Eyler.

"Because so much of the Mekong Basin is essentially ungoverned by national laws and sensible regulations, the basin is unfortunately ripe for this kind of unregulated activity to occur at a high level of intensity and the huge scale that our data reveals," he said.

The toxic chemicals released through unregulated rare earths mining include ammonium sulphate, and sodium cyanide and mercury that are used for two different types of gold mining, according to Stimson researchers.

That exposes not only the millions of people who live along the Mekong in Southeast Asia to health risks, but also consumers elsewhere.

"There is not a major supermarket in the U.S. that doesn't have products from the Mekong Basin, including shrimp, rice and fish," said Eyler.

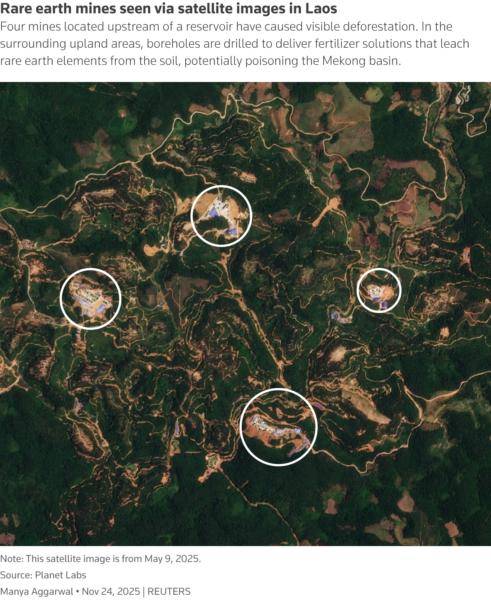

The emergence of new China-backed rare earth mines in eastern Myanmar, not far from the mountainous border with Thailand, initially set off concerns among researchers of the danger of downstream pollution along the Kok River, including areas like Tha Ton.

The contamination pattern on samples from the Kok River shows the presence of arsenic - linked to rare earth and gold mining - alongside heavy rare earths like dysprosium and terbium, said Tanapon Phenrat of Thailand Science Research and Innovation, a Thai government research agency.

"It has only been two years since the rise of rare earth and gold mining in Myanmar at the Kok River's source," said Tanapon, who conducted testing of the waters this year and warns of a sharp rise in contamination levels unless mining is stopped. Tanapon was not involved in the Stimson study.

Myanmar, which erupted in conflict after the military seized power in 2021, is one of the world's largest producers of heavy rare earths, critical minerals infused into magnets that power the likes of wind turbines, electric vehicles and defence systems.

From mining sites in Myanmar, the raw material is transported for processing to China, which has a near-monopoly over production of these vital magnets, with Beijing deploying rare earths as leverage in its tariff war with the U.S.

Mines across Myanmar and Laos use in-situ leaching for rare earth elements that was initially developed within China, according to Stimson's Eyler.

"In general, Chinese nationals work on these mines as managers and technical experts," he said.

In response to questions from Reuters, China's foreign ministry said it was not aware of the situation.

"The Chinese side has consistently required overseas Chinese enterprises to conduct their production and business operations in accordance with local laws and regulations, and to adopt stringent measures to protect the environment," it said.

The Thai government has established three new task forces to coordinate international cooperation, monitor the mines' health impact and secure alternative supplies for communities along the Kok, Sai, Mekong and Salween rivers, said Deputy Prime Minister Suchart Chomklin.

In northern Tha Ton, signs still hang on a bridge over the Kok River, calling for authorities to shut down the rare earths mines upriver, and farmers like Tip are desperate for an intervention.

"I just want the Kok River to be the way it used to be - where we could eat from it, bathe in it, play in it, and use it for farming," she said.

"I hope someone will help make that happen."

S&P 500 daily

S&P 500 daily S&P 500 4 hour

S&P 500 4 hour S&P 500 1 hour

S&P 500 1 hourWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up