Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)A:--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan’s ruling LDP is preparing to dissolve parliament this month to call a snap election in February, aiming to consolidate power while Prime Minister Sanae Takaichi enjoys historic approval ratings above 75%....

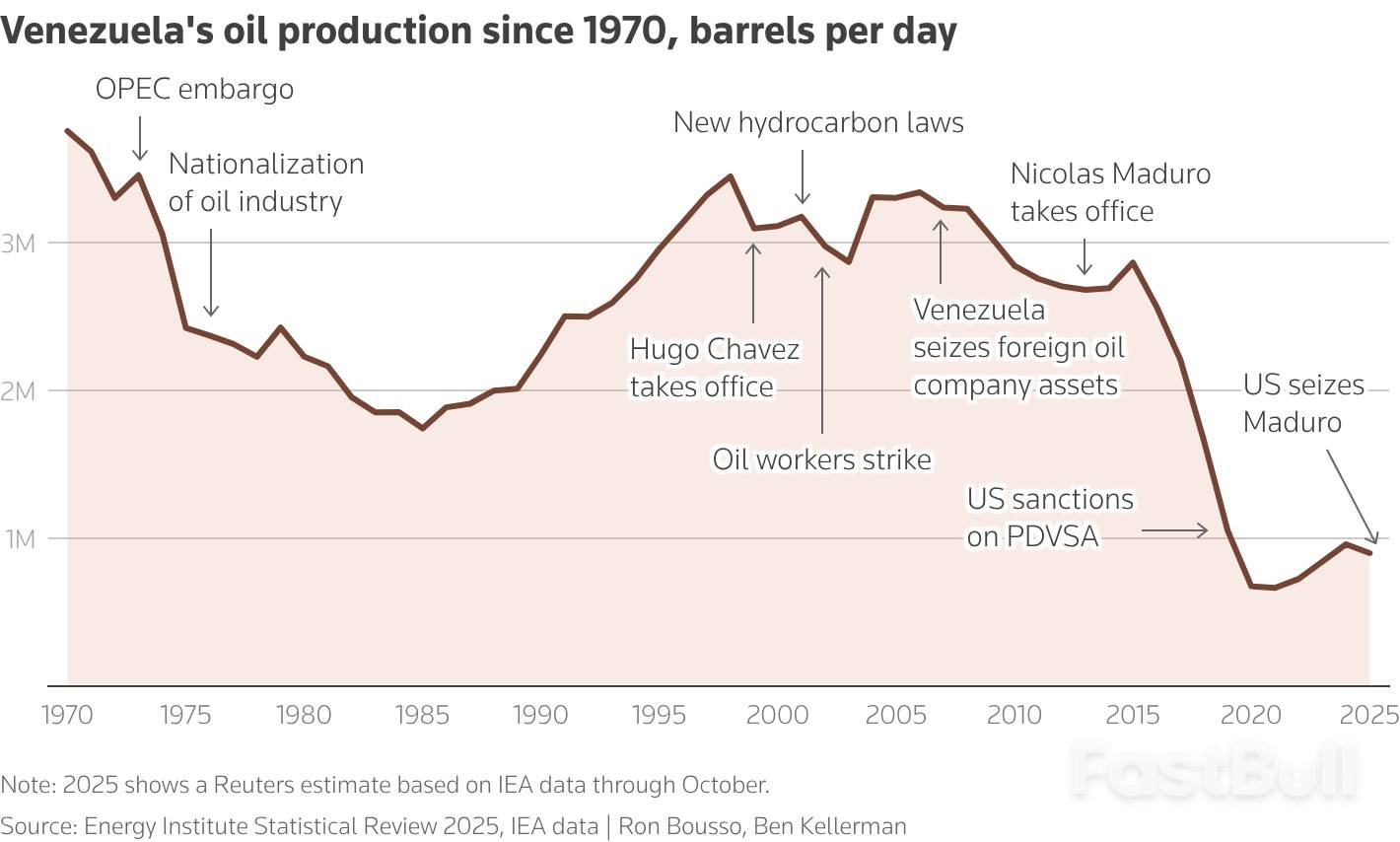

Goldman Sachs predicts that oil prices will likely decline this year as a surge in global supply creates a market surplus. While geopolitical tensions involving Russia, Venezuela, and Iran are expected to fuel market volatility, the investment bank sees the fundamental trend pointing downward.

This forecast follows a challenging year for oil, where both Brent and West Texas Intermediate (WTI) benchmarks saw their worst performance since 2020, dropping nearly 20%. As of the report, Brent crude futures were trading around $63 per barrel, with WTI holding at $59.

Goldman Sachs maintained its average price forecast for 2026 at $56 per barrel for Brent and $52 for WTI. The bank anticipates that prices will hit a low point in the final quarter of the year, with Brent reaching $54 and WTI at $50, as inventories in OECD countries build up.

The core driver of this bearish outlook is a projected market surplus of 2.3 million barrels per day (mb/d) in 2026. According to the bank, rebalancing the market will require lower oil prices to slow non-OPEC supply growth and stimulate strong demand, assuming no major supply disruptions or production cuts from OPEC.

Analysts at the bank noted that U.S. policymakers' focus on maintaining strong energy supplies and relatively low oil prices will likely prevent any sustained price increases, particularly ahead of the midterm elections.

While the fundamental picture points to a surplus, ongoing geopolitical risks will continue to introduce uncertainty and potential price swings.

Looking ahead, Goldman expects the market to begin a gradual recovery in 2027. The forecast suggests the market will shift back into a deficit as non-OPEC supply growth slows while demand remains solid.

For 2027, the bank projects an average price of $58 for Brent and $54 for WTI. This is $5 lower than its previous estimate, reflecting upgraded supply forecasts for the U.S. (+0.3 mb/d), Venezuela (+0.4 mb/d), and Russia (+0.5 mb/d).

A more substantial price recovery is anticipated later in the decade. After years of low investment in long-cycle projects, Goldman projects average Brent and WTI prices of $75 and $71, respectively, between 2030 and 2035, driven by demand growth through 2040. This long-term forecast is also $5 below the bank's prior estimate.

Goldman Sachs stated that the risks to its price forecasts are moderately skewed to the downside. A further increase in non-OPEC supply could exert additional pressure on prices. The bank's base case assumes no production cuts from OPEC, despite geopolitical risks and low speculative positioning in the market.

Based on this outlook, Goldman Sachs offered two key recommendations:

• Investors should consider shorting the 2026Q3-Dec2028 Brent time-spread to capitalize on the expected 2026 surplus.

• Oil producers should hedge against downside price risk for 2026.

With recent US operations targeting Venezuela and Greenland, President Donald Trump's attention now appears to be shifting toward Iran, where widespread domestic unrest has created a volatile new flashpoint.

For three weeks, Iran has been gripped by a wave of protests. The demonstrations, initially sparked by a sharp rise in inflation, have since grown into nationwide anti-government movements. In response, the Iranian government has moved to suppress the dissent, resulting in the deaths of more than 500 people, according to the U.S.-based Human Rights Activists News Agency.

President Trump addressed the situation in a Truth Social post on Friday, declaring that "the United States of America will come to their rescue," in a direct reference to the protestors.

This statement appears to be more than just rhetoric. According to reports from MS Now and other media outlets, White House officials have begun outlining potential courses of action for the president. Briefings are scheduled this week to review a range of responses, which could include military, cyber, and economic measures. As of now, no final decisions have been announced.

Any escalation with Iran carries significant consequences for the global economy. Iran is a major oil producer and exerts critical influence over the Strait of Hormuz, a narrow waterway that serves as a vital artery for nearly a third of the world's seaborne crude oil.

A disruption in this chokepoint would almost certainly send shockwaves through energy markets. "The complete closure of the Strait that can result in a $10 to $20 per barrel spike," warned Andy Lipow, president of Lipow Oil Associates.

Analysts also highlight that Iran is a far more formidable adversary than other recent U.S. targets. "Iran is far more capable of retaliating against the U.S., especially by attacking regional energy infrastructure," said Matt Gertken, chief geopolitical strategist at BCA Research.

Iranian officials have issued stark warnings of their own. Parliament Speaker Mohammad Baqer Qalibaf stated that Iran would retaliate if attacked by the U.S.

"In the case of an attack on Iran, the occupied territories (Israel) as well as all U.S. bases and ships will be our legitimate target," Qalibaf said, as reported by Reuters.

Several other major developments are shaping the global landscape:

• Fed Chair Powell Under Investigation: Federal prosecutors are conducting a criminal investigation into Federal Reserve Chair Jerome Powell concerning the $2.5 billion renovation of the Fed's headquarters. Powell stated Sunday that the probe is a result of the central bank's refusal to cut interest rates as fast as President Trump has demanded.

• US Blocks Venezuelan Oil to Cuba: President Trump announced that Cuba will no longer receive Venezuelan oil and signed an executive order to prevent the seizure of Venezuelan oil revenue held in U.S. Treasury accounts. Cuba has pushed back against the threat.

• Markets Post Gains: The S&P 500 and Dow Jones Industrial Average reached closing highs on Friday, capping a winning week. On Monday, Asia-Pacific markets were mostly higher, while oil prices rose and spot gold hit an all-time high.

China's efforts to pivot its economy toward high-tech industries like artificial intelligence and robotics are not enough to counteract the drag from its struggling property sector, leaving growth exposed to trade risks.

According to a Monday report from the U.S.-based research firm Rhodium Group, new industries such as AI, robotics, and electric cars added only 0.8 percentage points to economic output between 2023 and 2025. During the same period, traditional sectors, including real estate, experienced a combined decline of 6 percentage points.

While Beijing has prioritized high-tech development, it has done little to resolve a yearslong slump in real estate, a sector that once constituted over a quarter of the economy. A report last week from the China Real Estate Information Corp. noted that new home sales by floor area fell last year to levels not seen since 2009.

France's fragile government has been handed a crucial lifeline after the Socialist party announced it would not support two no-confidence motions filed by far-right and far-left opposition parties. The decision provides critical breathing room for the administration as it navigates intense political pressure over the EU-Mercosur trade deal.

Socialist party leader Olivier Faure made his position clear on Sunday, telling BFM TV that his party would not vote in favor of the motions. The proposed censure votes were aimed at the government's failure to block a landmark trade agreement between the European Union and the Mercosur group of South American nations, a deal that has been 25 years in the making.

"It would be absurd to censure the government on Mercosur," Faure stated, effectively neutralizing the immediate threat.

While analysts had already assessed the motions' chances of success as slim—particularly the one filed by the far-right National Rally (RN)—the political maneuvering highlights the precarious position of President Macron's government. With the 2027 presidential election on the horizon, polls suggest the RN has a credible path to victory, making every political challenge a high-stakes test.

Prime Minister Sebastien Lecornu has emphasized his commitment to stability, stating he wants to avoid both a government censure and a dissolution of the National Assembly. In an interview with Le Parisien newspaper on Saturday, Lecornu stressed, "My fight is for stability and to ward off disorder."

Despite this, his office has reportedly asked the Interior Ministry to prepare for potential legislative elections on March 15 and 22, signaling that the government is ready for a collapse if necessary.

Lecornu criticized the no-confidence motions as "cynical partisan posturing" in a message on X and warned that they send a "dramatic signal" internationally, especially at a time when the government is seeking compromise. The votes on the motions are scheduled for early next week.

The political drama unfolds as the government faces a separate, critical battle over its budget. Budget talks are set to resume Tuesday, but a parliamentary committee has already rejected the bill in its current form, underscoring the tough negotiations ahead.

In a last-resort effort to find a path forward, the government has invited political parties to a meeting at the finance ministry. However, the invitation notably excludes the far-right National Rally and the hard-left France Unbowed, the very parties pushing for the no-confidence vote.

Confirming his party's attendance, Faure expressed cautious optimism. "There is a meeting tomorrow... with those who are willing to discuss," he said. "I hope for a compromise."

Major oil companies are hitting the brakes on President Donald Trump's ambitious plan for a rapid, multi-billion dollar investment into Venezuela, citing a wall of security, commercial, and legal hurdles that make the country's oil sector a non-starter for now.

While a televised White House meeting on Friday with top U.S. and European energy executives appeared to be a public relations victory for the president, the conversation revealed a deep disconnect between political ambition and market reality. Despite praise from some executives, the industry delivered a dose of realism to Trump's goal of pouring $100 billion into Venezuela to boost its oil production from the current 900,000 barrels per day.

Exxon Mobil CEO Darren Woods was blunt, stating that from a commercial and legal standpoint, the Latin American nation is currently "un-investible."

Woods' assessment reflects a grim reality shaped by nearly a decade of U.S. sanctions and decades of internal corruption and mismanagement. Turning this around would be a monumental task, requiring a stable government that can guarantee physical security and provide fiscal confidence—a process that could take months, if not years.

The Trump administration is trying to move quickly. Treasury Secretary Scott Bessent confirmed on Saturday that Washington is working on lifting some sanctions to help stabilize Venezuela's economy and facilitate oil sales.

However, a partial rollback is not enough. According to Carlos Bellorin, an analyst at consultancy Welligence, more significant sanctions relief is needed to allow oil companies to legally engage with the national oil company, PDVSA. It would also be essential for major oil service providers like SLB and Halliburton to bring in critical drilling equipment.

Removing key restrictions could unlock investment in so-called "low-hanging" barrels. This includes funding to revive abandoned wellheads and overhaul basic infrastructure like pipelines and port facilities.

Some immediate, albeit modest, gains are possible:

• Chevron: The only U.S. company still operating in Venezuela under a special license, could increase its output by 50% from 240,000 barrels per day within two years by upgrading existing equipment, said Vice Chairman Mark Nelson.

• Repsol: The Spanish oil firm could triple its production of 45,000 barrels per day over two to three years, according to CEO Josu Jon Imaz.

Even with these gains, the total production increase would likely be less than 200,000 barrels per day over the next year—a fraction of the administration's vision.

A long and painful history haunts any potential new investment. Most international oil majors have been burned before in Venezuela, particularly during two waves of industry nationalization in the 1970s and 2000s that forced them out and left behind massive, unrecovered losses.

This history of expropriation creates a major trust deficit. "Oilfield service providers could be reluctant to commit resources in Venezuela because they're still owed massive amount of money," noted Bellorin. He added that a commitment from Venezuela to repay old debts would be a necessary first step.

President Trump, however, seemed to suggest the opposite. When ConocoPhillips CEO Ryan Lance mentioned his company is still owed about $12 billion from the 2007 nationalization, Trump proposed that Conoco could simply write off the debt, despite years of legal battles. Lance's proposal to involve the U.S. Export-Import Bank (EXIM) to restructure the debt was also seemingly rejected by the president.

To truly unlock Venezuela's potential—which peaked above 3.5 million barrels per day in the 1990s—requires rewriting the country's fundamental hydrocarbon laws.

Key structural reforms would include:

• Revisiting the requirement for mandatory state participation of over 50% in upstream joint ventures.

• Reducing the oil industry's high royalty (30%) and income tax (50%) rates.

• Modifying PDVSA's monopoly on marketing the country's oil.

Beyond the legal framework, geological and geopolitical challenges remain. Venezuela holds the world's largest proven reserves, but most of it is heavy oil, which is more expensive to extract. Furthermore, many of these reserves are tied up in joint ventures with Chinese and Russian companies.

For publicly traded companies with a duty to their shareholders, verbal assurances from the White House are not enough. As Exxon's Woods explained, "We take a very long-term perspective. The investments that we make span decades and decades. So, we do not go into any opportunity with a short-term mindset."

Despite their reservations, oil executives find themselves in a difficult position. Openly refusing to invest in Venezuela could draw the ire of an administration known for playing hardball with businesses it sees as uncooperative, as seen with its recent actions toward law firms and defense contractors.

Faced with this political pressure, some energy boards might decide that a modest investment in Venezuela is a pragmatic choice to avoid potential blowback, even if the financial case is weak.

But even a flurry of politically motivated activity is unlikely to restore Venezuela's oil industry to its former glory. For that to happen, the country will need concrete action and fundamental reforms, not just presidential promises.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up