Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

BOE Governor Bailey: Falling Inflation Should Feed Into Expectations, That Should Give Me Confidence

Indonesia Central Bank: To Work With Government To Strengthen Communication With Markets, Maintain Market Confidence

Indonesia Central Bank: Financial Market Stability Is Also Expected To Remain Stable, Supported By Adequate Liquidity, Strong Banking Capital, Low Credit Risk

US News Website Axios Reports That The United States And Russia Are Close To Reaching An Agreement To Continue To Abide By The New START Treaty After It Expires On Thursday

Indonesia Central Bank: Rupiah Exchange Rate Is Expected To Remain Stable, Supported By Economic Prospects, Central Bank Stabilisation Commitment

BOE Governor Bailey: We Need To See More Evidence That We Are Going To Get Sustainable Return To Inflation Target

Indonesia Central Bank: Expects Indonesian Economic Prospects To Remain Solid With Improving Trend, Inflation Under Control

The US News Website Axios Reports That The US And Russia Are Negotiating An Extension Of The New START Treaty

Bank Of England Governor Bailey: If The Outlook Develops As We Expect, There Is Still Room For Further Easing In The Near Future

Bank Of England Governor Bailey: More Spare Capacity Could Lead To Inflation Falling Below Target

BOE Governor Bailey: On One Hand, Cutting Bank Rate Too Quickly Or Too Much Could Lead To Inflation Pressure Persisting

Bank Of England Governor Bailey: Institutions Expect Growth To Remain Sluggish Throughout The Year

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP GrowthA:--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)A:--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)A:--

F: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)A:--

F: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo Rate--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

No matching data

View All

No data

Japan's election holds a paradox: an LDP landslide could stabilize turbulent markets, giving PM Takaichi power to curb spending.

Investors are bracing for Japan's election, but analysts suggest a surprising outcome: a landslide victory for the ruling Liberal Democratic Party (LDP) could be the best news for the country's turbulent bond and currency markets.

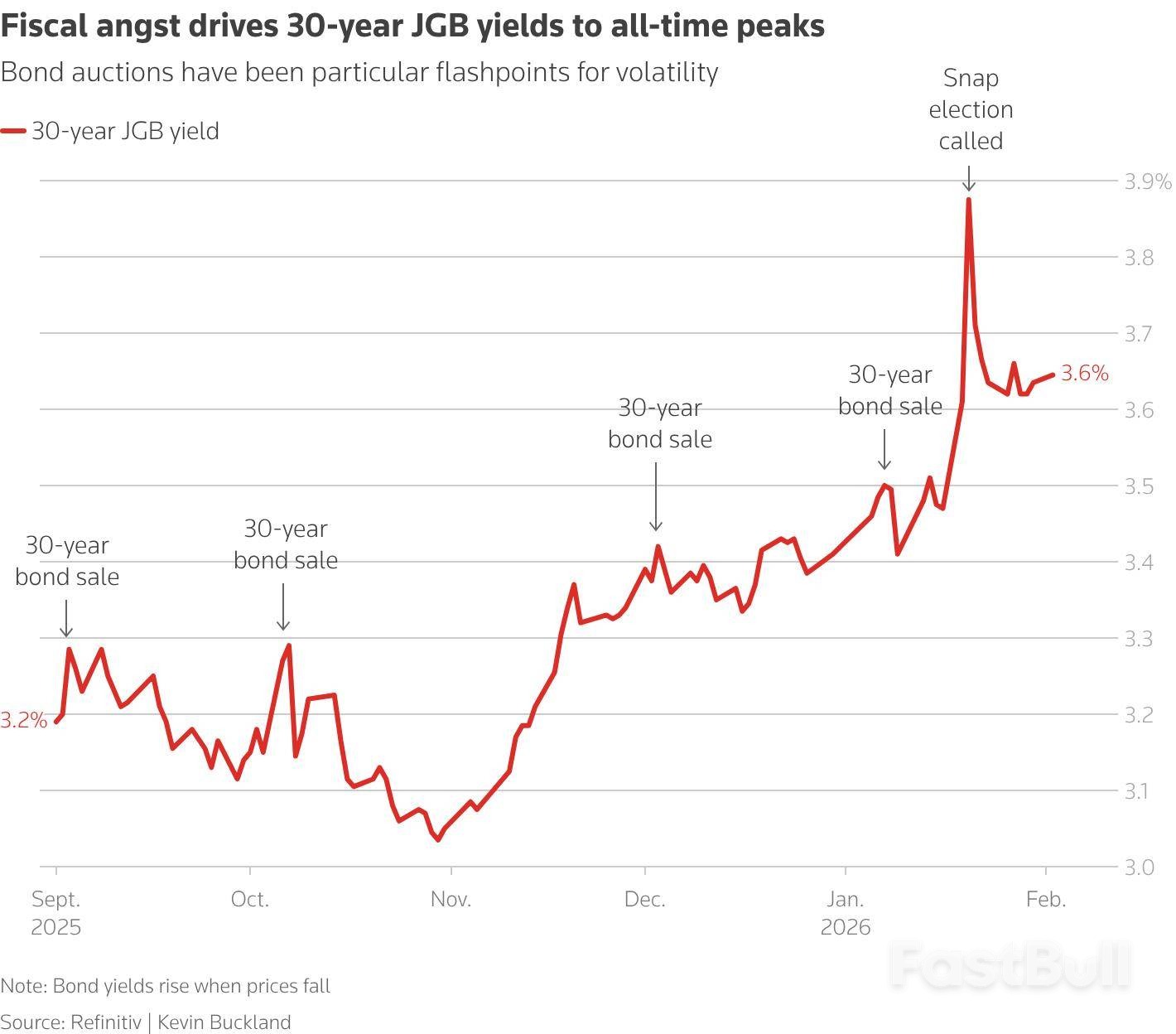

The vote has put markets on edge after fiscal worries recently triggered a sharp selloff in both the yen and Japanese government bonds (JGBs). This instability in Japan quickly spread, pushing up borrowing costs from the United States to Germany and reminding global markets of the high debt levels across major economies.

Paradoxically, an overwhelming LDP victory may ultimately benefit bonds and the yen. Analysts believe a strong mandate would free Prime Minister Sanae Takaichi from needing to negotiate with opposition parties, many of whom are demanding even deeper tax cuts and more aggressive government spending.

A comfortable majority would also give her more flexibility to respond to market pressure and adjust policies to prevent further yen weakness or a spike in borrowing costs—a pattern she has demonstrated in the past.

According to a recent poll, the LDP and its coalition partner Ishin could secure as many as 300 seats in the 465-seat lower house.

"I don't know if it's going to be a landslide, but certainly Takaichi finds herself in an advantageous situation," said Shoki Omori, chief Japan desk strategist at Mizuho Securities. "That's why she doesn't necessarily need to worry about further ramping up spending... Initially, I think the LDP and Takaichi were a little bit desperate, so to speak."

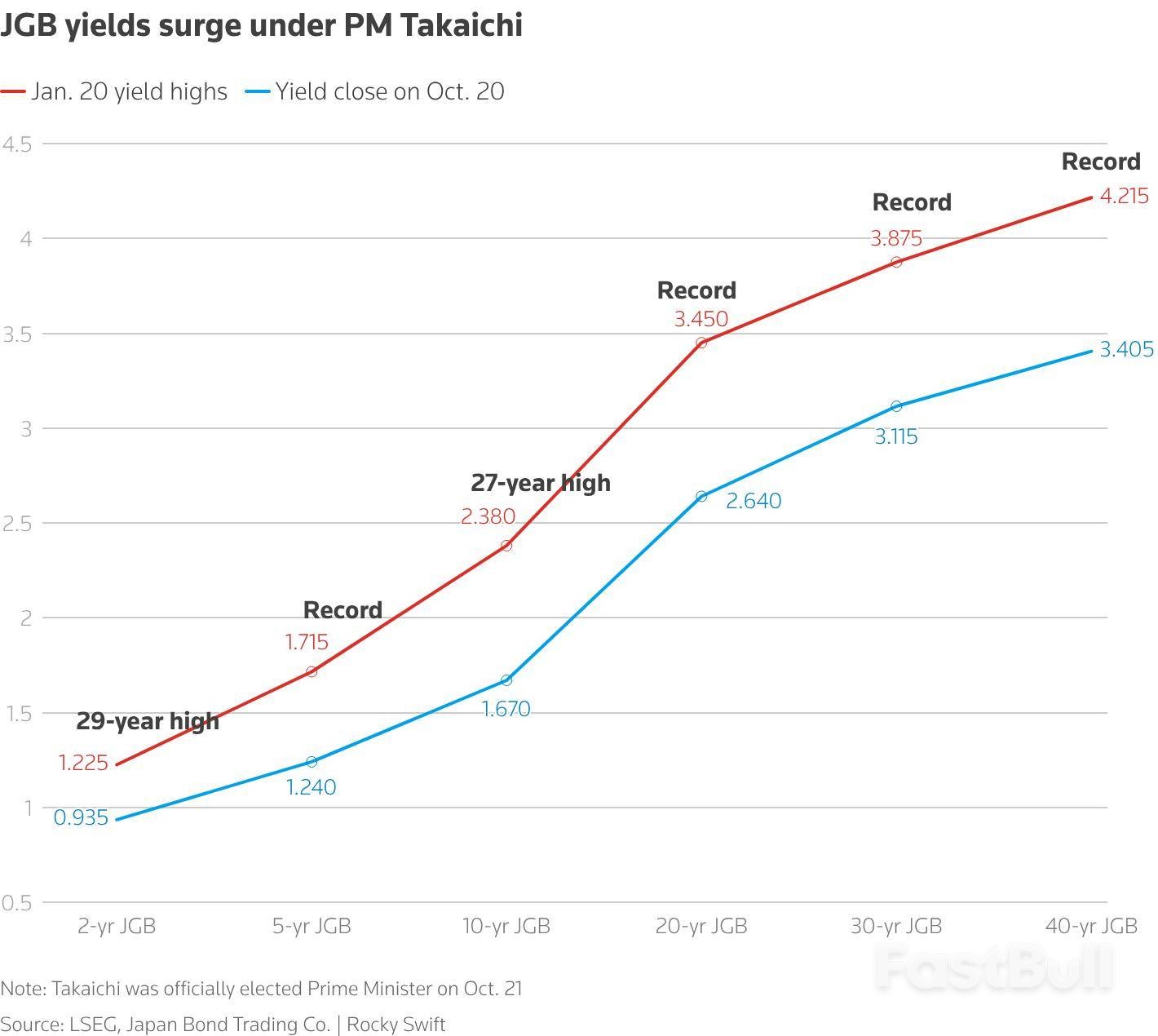

Since Takaichi—a fiscal dove and follower of former premier Shinzo Abe's "Abenomics"—won the LDP leadership in October, markets have been volatile. JGB yields have soared to all-time highs as bond prices have fallen.

Meanwhile, the yen has fallen to a near 18-month low against the dollar. This has prompted Japanese policymakers to repeatedly threaten market intervention to defend the currency.

The rising cost of living is a central issue in this election, and voters have increasingly blamed the persistent weakness of the yen for driving up the price of imports. At the same time, rising bond yields translate into higher mortgage rates and increased borrowing costs for businesses, with any debt market rout risking a spillover into Japanese stocks.

The turmoil has also drawn international attention. The United States has criticized the volatility in Japanese markets for its spillover effects and has urged Tokyo to restore stability—a task that could be easier with a large parliamentary majority.

"Although the administration may initially aim to strengthen its proactive fiscal expansion, pressure from the markets and the U.S. administration would compel it to exercise restraint," wrote Barclays analysts led by Shinichiro Kadota. "The reduced need for cooperation with the opposition would also support this shift."

Takaichi has shown a willingness to bend to market pressure. Earlier this week, she walked back campaign comments perceived as favoring a weak yen. In November, she was forced to clarify her fiscal stance after a 21.3 trillion yen ($135.72 billion) stimulus package rattled the bond market.

The so-called super-long bonds have been especially sensitive to any hint of loosened fiscal discipline in Japan, which is already the most indebted nation in the developed world.

On January 20, yields on 30-year bonds surged to a record 3.88% after Takaichi called the election and pledged a two-year suspension of the food tax. She did not specify how she would cover the estimated 10 trillion yen revenue shortfall, spooking investors.

While that selloff could resume, Takaichi's fiscal proposals are starting to look conservative compared to those from the opposition.

An analysis of campaign pledges reveals why a strong LDP mandate might lead to more fiscal restraint:

• Takaichi's LDP: Pledged to suspend the 8% food tax for two years.

• Centrist Reform Alliance: Wants to abolish the food tax entirely.

• Democratic Party for the People: Proposes slashing all value-added taxes to 5%.

This context suggests that if Takaichi secures a large majority, she may have the political cover to avoid implementing her most costly promises.

"What the LDP has promised is to 'work on' a reduction of the consumption tax on foods," noted Norihiro Yamaguchi, senior Japan economist at Oxford Economics, implying it is not a firm commitment. "If there is no longer a need to accommodate the opposition's demands, the necessity for doing so naturally diminishes."

Saudi Arabia has opened its stock market to all foreign investors, a landmark move under its Vision 2030 plan to liberalize the economy and reduce its dependence on oil revenue.

Previously, direct access to the Saudi Exchange, or Tadawul, was restricted to qualified institutional investors selected by authorities. As of February 1, that has changed. Smaller institutions, funds, family offices, and individual investors are now permitted to participate directly, without needing to use swap arrangements or exchange-traded funds.

The market has responded positively. The Tadawul All-Share Index has climbed approximately 10% since the Capital Market Authority (CMA) announced the reform on January 6, reversing a downtrend from the previous ten weeks. Mohanad Yakout, a senior market analyst at Scope Markets, noted that the jump shows investors view the policy as a "meaningful catalyst for revising up the market's valuation."

The Tadawul is the largest and most liquid stock market in the Middle East, with a capitalization of 8.8 trillion Saudi riyals ($2.35 trillion) at the end of 2025. Foreign stock ownership had already increased by 92 billion riyals to 590 billion riyals in the first three quarters of 2025.

Several benchmark index companies already have significant foreign investment.

• Al-Babtain Power & Telecom: 33.8% foreign-held

• Edarat Group: 24.6% foreign-held

• Etihad Etisalat: 23.74% foreign-held

While the 49% cap on foreign ownership in any single listed company remains in place, Yakout believes this liberalization intensifies "competition for regional financial primacy with the Emirati markets that have historically benefited from more permissive foreign ownership regimes."

This market opening is part of a broader national transformation. Over the past decade, Saudi Arabia has worked to soften its image by easing regulations, opening cinemas, and introducing tourist visas. It has also successfully bid for major global events like the FIFA World Cup 2034 and World Expo 2030. In January, a new law was implemented allowing non-Muslim foreigners to own property.

The push for economic diversification comes as the government faces pressure from lower oil prices. It more than doubled its 2025 budget deficit forecast to 5.3% of GDP and expects a deficit of 165 billion riyals, or 3.3% of GDP, for this year. This fiscal pressure is widely seen as a key driver for economic reforms.

Despite the opportunities, analysts caution that investing in the Saudi market carries significant risks, primarily because many of its largest companies are closely tied to the state.

Popular listings with Asian investors—including Saudi Aramco, Saudi Basic Industries, Al Rajhi Bank, and ACWA Power—offer growth at a reasonable price. However, these companies operate in strategic sectors like energy, chemicals, banking, and utilities, which are subject to intense government control.

"Competition is limited, government involvement is high, and decision-making reflects longer-term strategic priorities rather than short-term shareholder returns," said Alice Gower, a partner at Azure Strategy.

Other risks cited by analysts include the economy's heavy reliance on oil prices and a perceived lack of robust shareholder protections.

While risks exist, the sheer scale and liquidity of the Saudi market help mitigate them, particularly for long-term investors. In contrast, Dubai's stock market may offer higher potential returns but also comes with greater cyclical risk tied to real estate, retail flows, and shifting investor sentiment. This leads investors to adopt a more tactical approach in Dubai.

Saudi Arabia also offers a stable investment environment in other ways.

• No Formal Capital Controls: Foreign investors can generally repatriate capital and profits without restriction.

• Currency Stability: The Saudi riyal is pegged to the U.S. dollar, anchoring the exchange rate.

• Free Currency Conversion: Investors can convert currency freely.

These factors boost investor confidence. However, Pratibha Thaker, editorial director at the Economist Intelligence Unit, pointed out that "indirect constraints remain in the form of foreign ownership limits, sectoral restrictions and administrative frictions, which can still shape investment decisions and limit control-seeking strategies."

With the Vision 2030 agenda in full swing, some experts expect further liberalization. The most significant potential change on the horizon involves the foreign ownership cap.

"The biggest needle mover will be any changes to foreign ownership caps, which is considered a possible move later this year," said Gower. Such a reform could unlock another wave of foreign capital and further integrate the Tadawul into the global financial system.

China's foreign ministry has expressed regret over the expiration of the New START treaty, the landmark nuclear arms agreement between the United States and Russia. Beijing is now urging Washington to resume strategic dialogue with Moscow to maintain global stability.

The treaty, which for over half a century placed limits on the strategic nuclear arsenals of both nations, officially lapsed on Wednesday. In response, Russia stated it remains open to security discussions but will counter any emerging threats.

Foreign ministry spokesperson Lin Jian articulated China's position, describing the treaty's expiration as a regrettable development with serious implications.

"China regrets the expiration of the New START Treaty, as the treaty is of great significance to maintaining global strategic stability," Lin stated. He noted widespread international concern that the treaty's end could negatively impact the global nuclear arms control framework.

Following Russia's proposal to continue observing the treaty's core limitations, China has called on the United States to engage constructively.

"China calls on the United States to respond positively, handle the treaty's follow-up arrangements responsibly, and resume strategic stability dialogue with Russia as soon as possible," Lin added, emphasizing that this reflects the expectations of the international community.

The foreign ministry also took the opportunity to reiterate China's established nuclear policy. Lin emphasized that China adheres strictly to a self-defense strategy and maintains its nuclear forces at the minimum level required for national security.

"China has consistently adhered to a self-defense nuclear strategy, abided by the policy of no first use of nuclear weapons and has made unconditional commitments not to use or threaten to use nuclear weapons against non-nuclear-weapon states or nuclear-weapon-free zones," he explained.

Lin also addressed China's role in future arms control negotiations, stating that its arsenal is not comparable in size to those of Washington and Moscow. Citing this disparity, he confirmed that China will not participate in their bilateral disarmament talks at this stage.

Meanwhile, the White House indicated this week that President Donald Trump would determine the future of U.S. nuclear arms control policy and would "clarify on his own timeline."

Middle East Situation

Traders' Opinions

Energy

Political

Data Interpretation

Daily News

Remarks of Officials

Commodity

Oil prices fell more than $1 a barrel on Thursday as the United States and Iran confirmed plans to hold talks, easing market fears of a military conflict that could disrupt critical Middle East supplies.

Brent crude futures dropped $1.31, or 1.89%, to trade at $68.15 per barrel by 0714 GMT. Meanwhile, U.S. West Texas Intermediate (WTI) crude prices declined $1.24, or 1.90%, to $63.90.

The price drop marks a sharp reversal from Wednesday, when oil surged about 3% following a media report that the planned talks might collapse. Later, officials from both nations confirmed the meeting would proceed on Friday in Oman, though the agenda remains unsettled.

"The oil price has erased part of the geopolitical risk premium on the news of US-Iran talks," said Mukesh Sahdev, CEO of energy consultancy XAnalysts.

Despite the agreement to meet, significant disagreements persist. Iran has indicated it is open to discussing its nuclear program with Western powers. However, the U.S. aims to include a broader range of issues, including Iran's ballistic missiles, its support for regional proxy groups, and its domestic human rights record.

The wide gap between their positions suggests that market relief could be temporary. "It is likely that these talks will surface new differences and the risk premium will rise again soon," Sahdev noted.

Underlying the market's sensitivity is the continued risk of a wider confrontation. Concerns remain that U.S. President Donald Trump could act on threats to strike Iran, the fourth-largest producer within OPEC.

Such a conflict could jeopardize transit through the Strait of Hormuz, a vital chokepoint between Oman and Iran. Approximately one-fifth of the world's total oil consumption passes through this waterway. Major OPEC producers, including Saudi Arabia, the United Arab Emirates, Kuwait, and Iraq, rely on the strait to export most of their crude oil.

Other market factors also contributed to the downward pressure on oil. Analysts noted that strength in the U.S. dollar and volatility in precious metals weighed on commodity markets and overall risk sentiment on Thursday.

Separately, data from the Energy Information Administration on Wednesday showed that oil inventories in the United States, the world's largest oil producer and consumer, declined last week after a winter storm swept across large parts of the country.

Russia has signaled it sees no significant danger to its oil exports from a new trade agreement between the United States and India. The deal, finalized earlier this week, involves Washington lowering tariffs on Indian goods while New Delhi commits to buying more American oil and gas.

Despite the pact being widely interpreted as a move to squeeze Russian energy flows, Moscow maintains that its position in the Indian market is secure.

Kremlin spokesman Dmitry Peskov told reporters that Moscow is not surprised by the development, framing it as standard practice for New Delhi.

"We, along with all other international energy experts, are well aware that Russia is not the only supplier of oil and petroleum products to India," Peskov said. "India has always purchased these products from other countries. Therefore, we see nothing new here."

Beyond diplomatic confidence, Russia points to a key technical challenge for India. An expert from Russia's National Energy Security Fund highlighted the fundamental difference between the types of crude involved.

American exports consist of light shale oil, which is similar to gas condensate. In contrast, Russia primarily supplies Urals crude, a heavier and more sulfur-rich grade. This incompatibility means a simple one-for-one substitution is not feasible.

"India will need to blend U.S. crude with other grades, which incurs additional costs, meaning a simple substitution won't be possible," the expert explained.

Despite Moscow's assurances, the deal arrives as Russia's dominant position in the Indian market faces new pressures. For nearly four years, Russia has been India's single largest oil supplier, with its crude accounting for approximately one-third of the country's total imports—a dramatic increase from just 2% before 2022.

However, this trend has already started to shift. Indian refiners recently scaled back their purchases of Russian crude following the imposition of U.S. sanctions on major Russian oil companies Rosneft and Lukoil.

In response to the sanctions, Indian refiners have halted imports from the targeted entities and are now sourcing oil from non-sanctioned Russian suppliers as well as alternative cargoes. Key sources now include the Middle East, the Americas, and, to a lesser extent, West Africa, with purchasing decisions driven by price.

Analysts suggest the new trade pact with the U.S. could further broaden India's options. The deal may open access to oil from Venezuela and possibly even Iran as New Delhi looks to diversify its energy suppliers and reduce its reliance on Russian crude.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up