Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Israeli media is reporting that around 60,000 Israeli reservists are set to receive call-up orders on Wednesday as the Israel Defense Forces (IDF) gear up for a major assault on Gaza City.

Israeli media is reporting that around 60,000 Israeli reservists are set to receive call-up orders on Wednesday as the Israel Defense Forces (IDF) gear up for a major assault on Gaza City.A report in Times of Israel notes that reservists will have up to two weeks before going to their duty stations, but not all will be directly involved in the Gaza City offensive, as some are needed replace Israeli forces currently stationed in other parts of Gaza.

Anadolu Agency

Anadolu AgencyThe controversial Netanyahu-ordered expanded offensive which aims to achieve total control of Gaza City is expected to displace over a million Palestinian civilians.The IDF is prepared to use artillery to forcibly remove them, and a ramped-up air campaign has already been underway. Arab media sources, including Al Jazeera, have said that areas with a lot of tent shelters for refugees have at times been directly struck.

Israel's military has issued evacuation orders, and is framing this as simply a mass transfer, while the Palestinian side along with international human rights monitors have decried an ethnic cleansing and land grab in progress.Reports in Israeli media have further described that after capturing the city, the IDF plans to spend over a year systematically demolishing it, which is precisely what previously happened in Beit Hanoun, Beit Lahia, and Jabalia.

The ostensible justification is for removal of "Hamas infrastructure" - but critics have said it is ultimately to pave the way for Jewish settlement of the Gaza Strip.The question remains, where will these Gazans go? Israel has been seeking to pressure some regional and even north African countries to take them in.To be expected, these conversations have gone nowhere especially as regional Arab states have already historically absorbed hundreds of thousands. For example, the majority of the population of Jordan actually has Palestinian roots.

The Trump administration has meanwhile appeared to greenlight the takeover plans, in a break from Europe - which has grown much more critical of Israeli policy and loud over the last months.Some EU states like Denmark are even mulling sanctions on Israel, and several major US allies are set to recognize the state of Palestine at the upcoming UN General Assembly meeting in September.

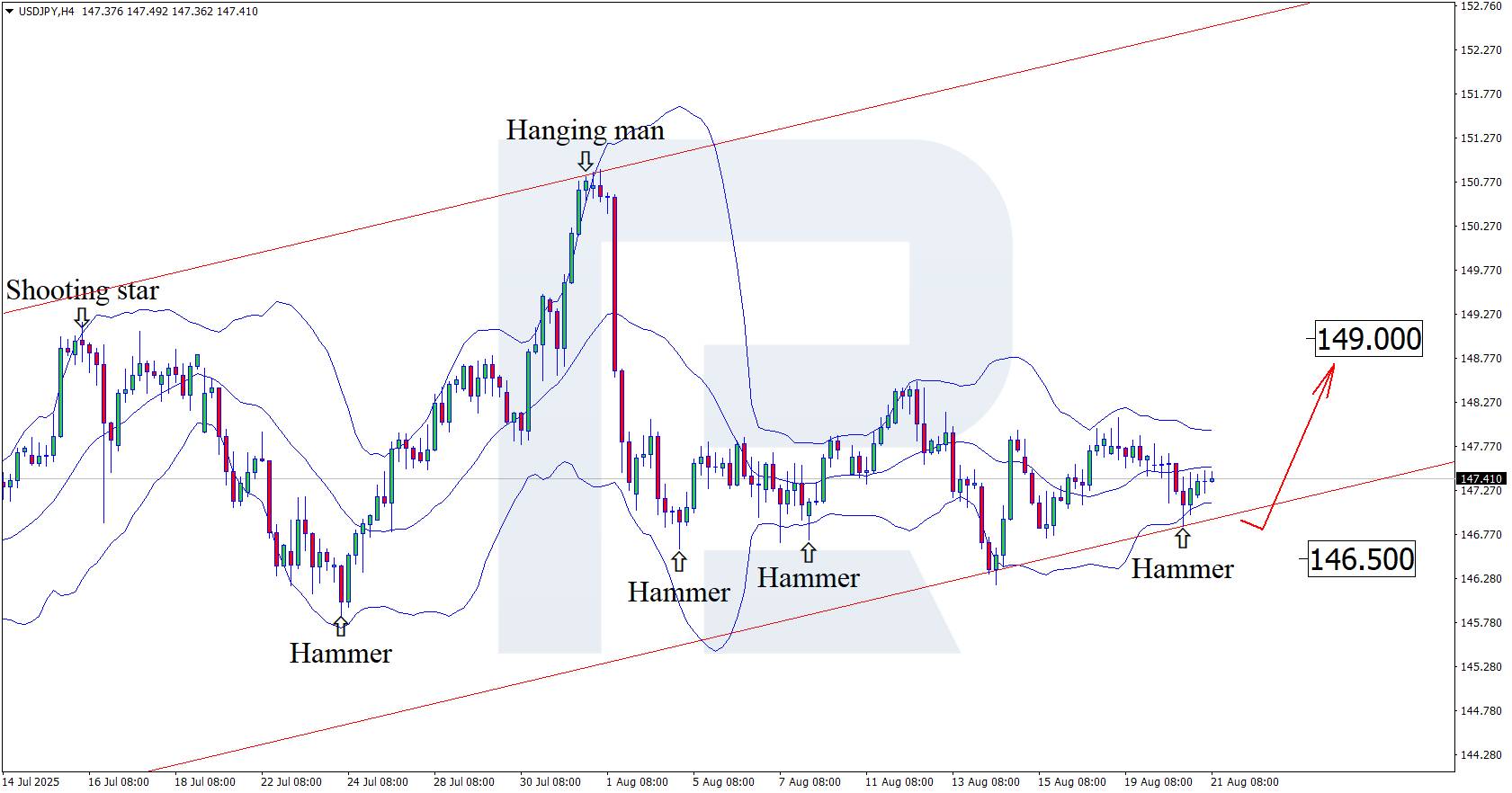

With Japan’s PMI declining and the US PMI remaining uncertain, the USDJPY rate may reach 149.00.

Fundamental analysis for 21 August 2025 shows the USDJPY pair holding steady, trading sideways near 147.40.

Japan’s services PMI covers a wide range of industries, including transport and communications, financial intermediation, business and household services, IT, hospitality and restaurants.

The USDJPY forecast for today does not appear optimistic for the yen, with the PMI down to 52.7 from the previous reading. Although the figure remains above the 50.0 threshold, which indicates expansion, the yen continues to lose ground against the US dollar.

In the US, the services PMI is forecast to ease slightly from 49.8 to 49.7. While such a move may not be critical, it is important to note that forecasts can diverge significantly from actual results, which could either strengthen or weaken the USD.

Having tested the lower Bollinger Band, the USDJPY pair formed a Hammer reversal pattern near 147.40 on the H4 chart. At this stage, the pair may continue its upward trajectory in line with the pattern’s signal. The USDJPY rate remains within an ascending channel, which supports the case for growth towards resistance near 149.00.

At the same time, the USDJPY forecast also considers an alternative scenario where the price dips to 146.50 before resuming its upward movement.

Fundamental data currently favours the USD, while USDJPY technical analysis points to growth towards 149.00.

Gold prices edged lower on Thursday after the U.S. Federal Reserve's July meeting minutes showed a majority consensus on holding interest rates steady, as investors look to the central bank's annual Jackson Hole symposium later in the day for further policy cues.

Spot goldwas down 0.2% at $3,340.09 per ounce, as of 0802 GMT. U.S. gold futuresfor December delivery also lost 0.2% to $3,382.30.

Minutes from the Fed's July meeting showed the policymakers who dissented against last month's decision to keep interest rates unchanged - Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller - were alone in advocating for a rate cut.

"FOMC minutes were hawkish, the Fed's board remains inclined to prioritize inflation control by keeping monetary policy tight rather than cutting the cost of money," said Carlo Alberto De Casa, external analyst at Swissquote.

Non-yielding gold typically performs well in a low interest rate environment.

The Fed has held rates steady since December, although investors still expect an 81% chance of a quarter-point cut by September, according to the CME's FedWatch tool.

Fed Chair Jerome Powell is expected to speak on Friday at the August 21-23 Jackson Hole symposium, with investors watching whether he backs measures to bolster the labour market or focuses on curbing inflation.

"A hawkish Fed could have an impact on the gold price, but as long as gold remains in the $3,270-3,440 range, there are no massive risks for big falls (given) that central banks are still buying tonnes of gold," De Casa added.

Meanwhile, President Trump called on Fed Governor Lisa Cook to resign over allegations made by one of his political allies about mortgages she holds, intensifying his efforts to influence the central bank. Cook said she had "no intention of being bullied to step down" from her position.

China's central bank added gold to its reserves in July, its ninth consecutive month of purchases, official data showed earlier this month.

Spot silverwas down 0.2% at $37.83 per ounce, platinumfell 1% to $1,326.93 and palladiumshed 0.8% to $1,105.12.

British American Tobacco for years fought the sale of unauthorised, disposable vapes in the U.S. - the world's largest market for smoking alternatives - lobbying lawmakers and arguing aggressively in court that they were illegal.But with rivals eschewing government licences and the market now worth billions, it's preparing a U-turn."Not having access to this world weighs on our company's bottom line," Luis Pinto, spokesman for BAT's U.S. unit Reynolds American, told Reuters as it prepared to test launch its first new disposable product in the United States since an influx of unregulated rivals hammered its sales.

Reynolds' disposable vape brand Vuse One uses laboratory-produced synthetic nicotine and has an application pending with the U.S. Food and Drug Administration. Pilot sales will start in late September or early October, Pinto told Reuters exclusively.Campaigners, however, accuse the company of putting profits above public health. And the FDA, which regulates nicotine products, told Reuters that going to market without an FDA licence, as BAT intends to do, would break the law.

"All new tobacco products ... that are on the U.S. market without the statutorily required premarket authorisation from the FDA are marketed unlawfully," it said.The agency did not comment specifically on BAT's strategy when asked by Reuters, but it said a pending application did not create a "legal safe harbour to sell a product."Pinto said BAT was not adding to the illegal market and its approach would differ to unauthorised rivals: its products have been subject to due diligence, will be sold via large national retailers and their features and marketing will follow stricter policies.

"It's not about, if you can't beat them, join them," he said.

Public health authorities and researchers are divided over how to weigh the potential benefits of vaping - mainly helping smokers switch away from cancer-causing cigarettes - against risks, including underage use.Booming sales of unregulated disposable vapes, often produced by Chinese companies, have exacerbated divisions. Some offer exceedingly high nicotine hits or flavours like "rainbow bubblegum" and "cookie butter" that critics say are targeted at youth.

The FDA is meant to assess vape products before they go to market and issue licences to those it finds to be, on the whole, beneficial to public health: reducing the burden of smoking without causing new problems, like a surge in youth sales.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up