Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

India hopes trade talks with the U.S. will continue even as the U.S. hiked tariffs on its exports to 50% due to New Delhi's purchase of sanctioned Russian oil, two lawmakers said on Monday.

Monthly U.S. inflation data is under increased scrutiny after President Donald Trump removed the head of the U.S. Bureau of Labor Statistics, a move that could undermine confidence in the $2.1-trillion market for Treasury debt designed to protect against inflation.

The Consumer Price Index, which will be released on Tuesday, will test investors' trust in the integrity of U.S. economic data after Trump fired the BLS head this month, accusing her of manipulating jobs numbers.

It is unclear who will replace former BLS Commissioner Erika McEntarfer. Still, any signs that lead investors to suspect data is being politicized could exacerbate concerns about CPI data collection.

In that case, investors are likely to demand higher compensation to hold TIPS, or Treasury Inflation-Protected Securities, whose value is linked to the CPI, and raise the federal government's cost of funding itself, analysts said. Rises in TIPS yields could be exacerbated by poorer liquidity compared to the much larger market for nominal Treasuries.

"This isn't just an academic discussion about getting the right numbers - these numbers matter for TIPS," said Michael Feroli, chief U.S. economist at JPMorgan Chase. "There's real money on the line here."

A White House official told Reuters, "historically abnormal revisions in BLS data over the past few years since COVID have called into question the BLS’s accuracy, reliability, and confidence," and that Trump plans to restore trust in the BLS. The bureau did not immediately respond to a request for comment.

Trump ordered McEntarfer's removal on August 1 after data showed a surprise weakening in the U.S. labor market last month. The BLS employment report revealed meaningful revisions to job figures for the prior two months that raised investor worries that the Federal Reserve may need to play catch-up with interest rate cuts.

The BLS is also responsible for the CPI report - a key data point for the Fed and investors to assess inflation dynamics that influence monetary policy decisions.

"That's a problem if you're a policymaker, (and) if you're an investor - TIPS are indexed to changes in the CPI. The Fed needs to know what inflation is," said Michael Gapen, chief U.S. economist at Morgan Stanley.

"It could be a situation where the signal is less credible, which could affect term premiums in the markets, but it may also worsen your ability to conduct not only good policy, but good policy in a timely fashion," he said.

What to Know:

Speculation surrounds Bo Hines as reports suggest his departure from the White House Crypto Post, though no official confirmation has been observed from primary sources yet.The uncertainty impacts market sentiment and anticipation, with stakeholders closely monitoring official channels for an announcement that could influence cryptocurrency regulation and policy direction.The reported exit of Bo Hines from the White House Crypto Council suggests potential policy shifts. Currently, no official statement confirms his departure. A successor has yet to be named, leaving policy direction unclear.

The reported exit of Bo Hines from the White House Crypto Council suggests potential policy shifts. Currently, no official statement confirms his departure. A successor has yet to be named, leaving policy direction unclear.

The crypto industry remains uncertain about the direction of U.S. policy. Stakeholders are eager to see if future leadership will maintain existing strategies. Market responses are speculative until official announcements confirm leadership changes.

Past high-profile digital asset leadership changes have often led to market fluctuations. Observing these events can provide insights into potential future impacts once Bo Hines' departure is confirmed.Currently, there are no primary-source confirmations regarding Bo Hines' resignation from his position at the White House Crypto Council, nor any statements from him, the White House, or any potential successor.

President Donald Trump said on Monday he was putting Washington's police department under federal control and ordering the National Guard to deploy to the nation's capital to combat what he said was a wave of lawlessness, despite statistics showing that violent crime hit a 30-year low in 2024.

"I'm deploying the National Guard to help reestablish law, order and public safety in Washington, D.C.," Trump told reporters at the White House, flanked by administration officials including Defense Secretary Pete Hegseth and Attorney General Pam Bondi. "Our capital city has been overtaken by violent gangs and bloodthirsty criminals."

Trump's announcement is his latest effort to target Democratic cities by exercising executive power over traditionally local matters. He has dismissed criticism that he is manufacturing a crisis to justify expanding presidential authority.

Hundreds of officers and agents from over a dozen federal agencies, including the FBI, ICE, DEA, and ATF, have already fanned out across the city in recent days.

The Democratic major of Washington, Muriel Bowser, has pushed back on Trump's claims, saying the city is "not experiencing a crime spike" and highlighting that violent crime hit its lowest level in more than three decades last year.

Violent crime fell 26% in the first seven months of 2025 after dropping 35% in 2024, and overall crime dropped 7%, according to the city's police department.

But gun violence remains an issue. In 2023, Washington had the third-highest gun homicide rate among U.S. cities with populations over 500,000, according to gun control advocacy group Everytown for Gun Safety.

The deployment of National Guard troops is a tactic the Republican president used in Los Angeles, where he dispatched 5,000 troops in June in response to protests over his administration's immigration raids. State and local officials objected to Trump's decision as unnecessary and inflammatory.

A federal trial was set to begin on Monday in San Francisco on whether the Trump administration violated U.S. law by deploying National Guard troops and U.S. Marines without the approval of Democratic Governor Gavin Newsom.

The president has broad authority over the 2,700 members of the D.C. National Guard, unlike in states where governors typically hold the power to activate troops. Guard troops have been dispatched to Washington many times, including in response to the Jan. 6, 2021, attack on the U.S. Capitol by a mob of Trump supporters.

During his first term, Trump sent the National Guard into Washington in 2020 to help quash mostly peaceful demonstrations during nationwide protests over police brutality following the murder of George Floyd. Civil rights leaders denounced the deployment, which was opposed by Bowser.

The U.S. military is generally prohibited under law from directly participating in domestic law enforcement activities.

BTC/USDT four-hour chart with RSI data. Source: Michaël van de Poppe/X

BTC/USDT four-hour chart with RSI data. Source: Michaël van de Poppe/X

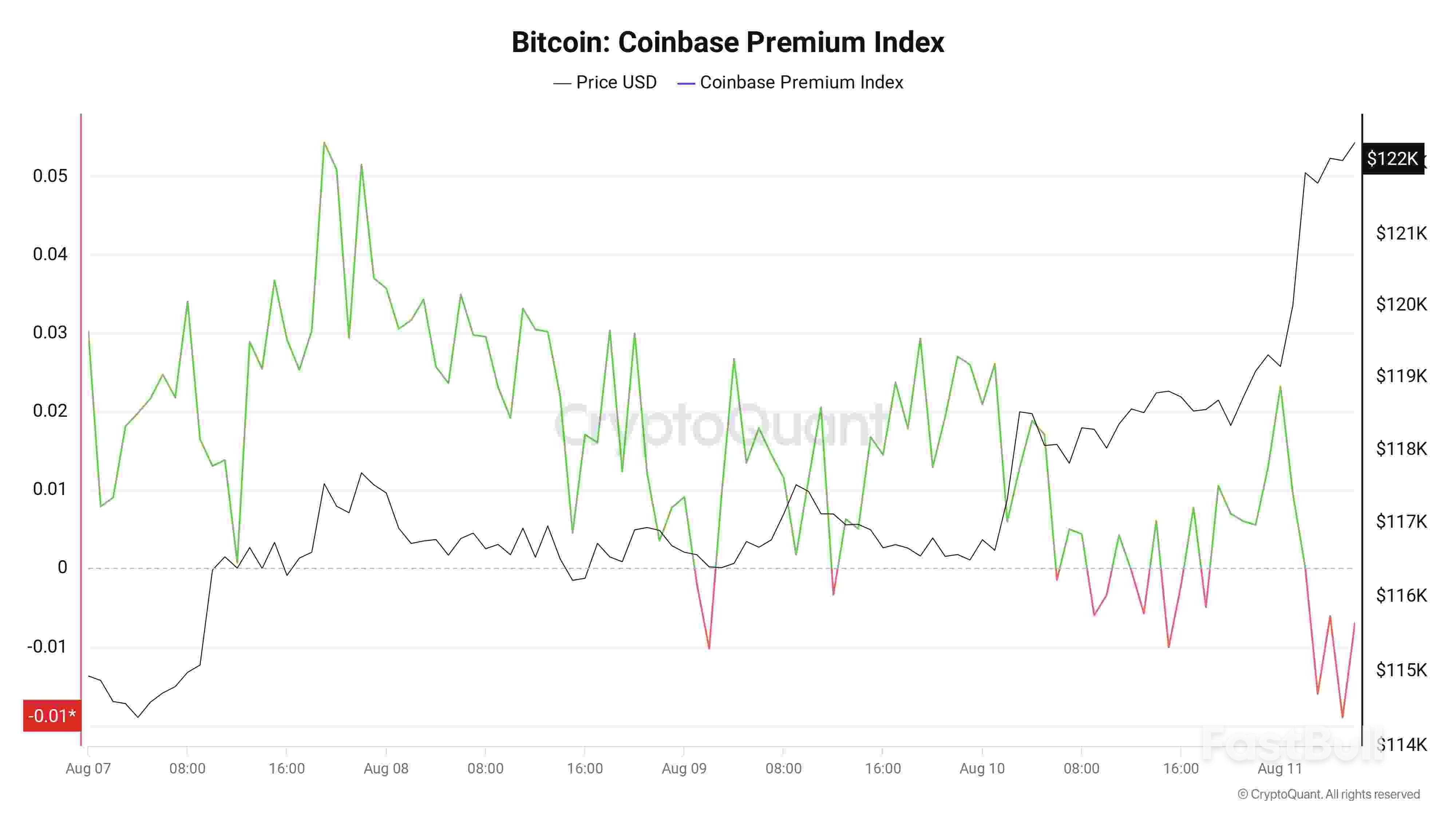

Bitcoin Coinbase Premium Index. Source: CryptoQuant

Bitcoin Coinbase Premium Index. Source: CryptoQuant ETH/USD one-hour chart with volume data. Source: Cointelegraph/TradingView

ETH/USD one-hour chart with volume data. Source: Cointelegraph/TradingViewUS President Donald Trump said he hopes China massively stepped up its purchases of American soybeans — comments that come a day before a trade truce expires.“China is worried about its shortage of soybeans,” Trump wrote on the Truth Social website on Monday. “I hope China will quickly quadruple its soybean orders. This is also a way of substantially reducing China’s trade deficit with the US.”

Trump also thanked Chinese leader Xi Jinping in the post, without saying why.Soybean futures in Chicago rose back above US$10 a bushel for the first time in a week, jumping more than 2% after the post.China has long fretted about its supplies of soybeans, which are a key element of the nation’s diet and livestock feed. Beijing faces an Aug 12 deadline for its tariff truce with the US to expire, though the Trump administration has signalled that is likely to be extended.China has stepped up purchases of soybeans from its top supplier Brazil, and is also testing trial cargoes of soybean meal from Argentina, to secure supplies of the animal feed ingredient amid the trade war with the US.

The world’s top buyer of the oilseed hasn’t booked any cargoes of US soybeans as of end July for the upcoming marketing year that starts in September, according to data from the US Department of Agriculture.China agreed to increase buying of US agricultural goods like soybeans during the so-called phase one trade agreement reached during Trump’s first term. Beijing fell well short of the purchase targets in that pact.While China and the US have been trying to work out a trade deal, other issues have been complicating their relationship. Last week, China defended its imports of Russian oil, pushing back against US threats of new tariffs after Washington slapped secondary levies on India for buying energy from Moscow.

In July, the Trump administration reversed course to allow Nvidia to sell the H20 artificial intelligence accelerator to China.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up