Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China has injected more money into Hong Kong’s stock market this year than ever before, with investments through the Stock Connect scheme reaching HK$820 billion ($104 billion) so far, according to the Financial Times.

China has injected more money into Hong Kong’s stock market this year than ever before, with investments through the Stock Connect scheme reaching HK$820 billion ($104 billion) so far, according to the Financial Times.

That total already beats last year’s figure of HK$807.9 billion, putting Hong Kong’s stock exchange on track for its strongest year of mainland inflows since the program started.

At the same time, the investment surge highlights how closely Hong Kong’s markets are now tied to decisions coming out of Beijing. The city’s rebound after years of COVID-era stagnation is no longer about global inflows; it’s almost entirely powered by mainland cash.

The Stock Connect, launched in 2014, links the Shanghai and Shenzhen exchanges with Hong Kong. It lets mainland investors move funds across the border without violating China’s capital control laws. The program was designed to give limited, regulated exposure to foreign assets. But in 2025, it’s become the primary gateway for Chinese investors to access assets not available on the mainland.

Only individuals with at least Rmb500,000 ($70,000) can use it, but that hasn’t stopped them. HK$4.5 trillion has now flowed into Hong Kong through the platform, with over a third of that coming in just the last two years.

That kind of momentum is changing daily trading dynamics. Southbound activity, money going from mainland China into Hong Kong, now accounts for more than half of all trades on the main board of Hong Kong’s stock exchange. That’s a massive leap from 2019, when the same trades made up less than 20% of daily turnover.

The appeal of Stock Connect is that it also opens the door to tech firms like Tencent, Alibaba, and Baidu, companies based in China but listed in Hong Kong, where mainland investors normally can’t touch them. Their shares have rebounded sharply this year after DeepSeek, a Chinese AI start-up, released a new large language model and tensions between tech firms and China’s regulators started cooling off.

This entire wave of capital is getting a serious push from policymakers. At a Hong Kong conference in January, central bank governor Pan Gongsheng said China would back “more high-quality enterprises to list and issue bonds” in Hong Kong and would also “increase the proportion of national foreign exchange reserves allocated in Hong Kong.”

Pan’s comments followed earlier action from the China Securities Regulatory Commission, which in 2024 introduced measures to encourage mainland companies to list in the city and to make the link between China’s and Hong Kong’s markets even tighter. It worked! This year, Hong Kong’s IPO pipeline hit a record high, with a rush of mainland firms lining up for secondary listings in the city.

Investors, many of whom fled during earlier crackdowns on the private sector and a real estate market now in its fourth year of decline, are slowly returning. But it’s not global capital rushing in. It’s still mostly China reallocating within itself.

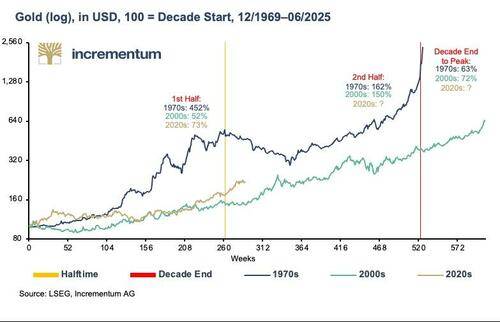

Since the price of gold was freed by the final separation of sovereign currencies from gold following the closure of the gold window on August 15, 1971, gold has experienced three bull markets: in the 1970s, in the 2000s and in the current decade. A comparison of these three major gold bull markets shows that history does not repeat itself: History does not repeat itself, but it does rhyme. Despite various differences, the structural similarities in the underlying conditions outweigh the differences. In the past two decades, gold proved to be a safe haven in the midst of inflation, economic turmoil and confidence crises and recorded enormous gains during these golden decades. Many of the factors that fueled the price of gold at that time, from negative real interest rates and excessive money supply growth to geopolitical tensions, are also present again in the 2020s. Developments in the first half of the 2020s support the theory that we are experiencing déjà vu and that the 2020s could become the third golden decade. Gold has already reached numerous historic highs in all currencies.

Gold’s performance has been particularly impressive over the past 1 ½ years. In 2024, gold gained 28.9% in US dollars, 35.6% in euros and 37.1% in Swiss francs. In the first half of 2025, gold achieved a further gain of 25.6% in US dollars, 10.5% in euros and 9.8% in Swiss francs. This results in a total gain of 61.9% in US dollars, 49.8% in euros and 50.4% in Swiss francs. This means that gold has outperformed almost all leading share indices over the past 18 months by a wide or very wide margin.

The second half of the past two gold bull markets showed remarkably similar price dynamics: In the 1970s, the gold price rose by 162%, while in the 2000s it increased by 150%. If the current cycle continues in a similar fashion, the gold price would increase from USD 2,624 at the midpoint of the decade at the end of December 2024 to around USD 6,800 by the end of the decade. In fact, past bull markets have always ended in an overshoot, with prices doubling within around 9 months.

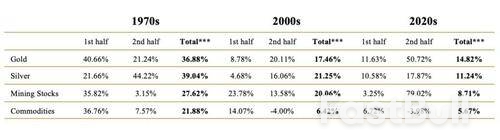

The following table provides an insightful comparison of the compound annual growth rate (CAGR) of gold, silver, mining stocks and commodities over the 1970s, 2000s and 2020s, broken down into first and second halves and for the period as a whole. Even though the data for the second half of the 2020s decade is naturally only available in rudimentary form, some interesting patterns can be identified.

CAGR of Gold, Silver, Mining Stocks, and Commodities in Bull Market Decades, in USD, 12/1969–06/2025

Gold has been the most stable performer over all three decades. In the 1970s, it achieved an annual gain of over 40% in the first half and still 21% in the second half. The pattern reversed in the 2000s. In the first decade of the new millennium, the second half was much more dynamic, with an annual gain of 20% in the first half and an annual gain of just under 9%. The CAGR development to date in the 2020s is particularly striking: After an annualized return of just under 12% in the first half of the decade, gold has so far achieved an average annual performance of just over 50% in the second half. On the one hand, this extraordinary momentum is due to the still short observation period, which is statistically more susceptible to outliers. On the other hand, it is a clear sign of cyclical momentum. Even if it cannot be assumed that gold will maintain its current pace over the entire second half of the decade, the development impressively underlines the intact upward momentum and the growing interest in the precious metal.

Silver traditionally presents itself as a cyclical laggard with a tendency towards explosive final spurts. In the 1970s, the second half, with an annual return of more than 44% was significantly stronger than the first half, with an annual gain of 21%. A similar pattern emerged in the 2000s. A strong performance has also been observed in the current decade, but the historical parallels suggest that the dynamic part of the cycle is possibly still to come.

Gold mining shares are regarded as a more volatile leverage variant of the gold price, with sometimes spectacular swings. In the 1970s, gold mining shares gained over 35% per year in the first half of the decade, but lost much of their momentum in the second half. In the 2000s, the first half was also much stronger than the second, with annual gains of just under 24%. The 2020s appear to be breaking this pattern for the time being: After a disappointing first half with an average annual gain of just 3.25%, the mining sector is currently recording a comeback with an annualized gain of almost 80% in the second half of the decade.

Commodities show a strongly cyclical picture. In the 1970s, they excelled in the first half with an annual increase of more than 36%, driven by oil price shocks and inflationary pressure. In the 2000s, performance was weaker overall, with the second half even turning negative due to the global financial crisis in 2007/08, bringing the commodity supercycle to an abrupt end. In the 2020s, the first half has so far been rather subdued. The second half began with a setback of almost -4% due to the Trump shock.

The historical analysis of past bull markets provides impressive evidence: gold, silver, mining stocks, and commodities prove to be particularly resilient in fragile macroeconomic and geopolitical phases. Based on this insight, we presented an enhanced 60/40 portfolio as a modern, more robustly structured alternative to the traditional model in last year’s In Gold We Trust report, The New Gold Playbook. The aim was to take account of the changed framework conditions and outline a modern allocation strategy.

In contrast to the traditional allocation of 60% equities and 40% bonds, the new model deliberately takes into account the changed risk landscape and expands the allocation framework to include liquid, alternative assets that cannot be inflated at will: 45% equities, 15% bonds, 15% safety gold, 10% performance gold, i.e. silver and mining stocks, 10% commodities and 5% bitcoin.

A look at the performance of the last twelve months compared to the classic 60/40 portfolio shows how this rebalancing has worked in practice since the publication of last year’s In Gold We Trust report.

A comparison of the two portfolios over the period from May 2024 to June 2025 shows that the new 60/40 portfolio significantly outperformed its classic counterpart over long stretches. After an initially subdued start, the performance of the new 60/40 portfolio picked up noticeably. While the traditional 60/40 portfolio came under increasing pressure as the year progressed, the new model remained much more stable and resilient, particularly in the volatile market phases of the current year.

The performance advantage over the period under review underpins the thesis that a modern portfolio architecture based on sound money components and inflation-resilient assets is superior to the traditional model, both in terms of stability and return potential. While gold has already reached new all-time highs, silver and mining stocks are still in the slipstream. However, experience shows that they catch up in the late phase of the cycle, which brings additional catch-up potential for performance gold.

Since the final separation of the international monetary system from gold with the closing of the gold window on August 15, 1971 by US President Richard Nixon, gold has enjoyed two golden decades with brilliant gold price rises: After the previous two golden decades, the 1970s and the 2000s, we are now in the middle of the third golden decade. Setbacks and longer pauses to catch your breath cannot be ruled out in a secular bull market and are even beneficial for long-term development. Such phases are suitable for additional purchases. Fundamentally, there is much to suggest that the 2020s will once again be a golden decade, not just a golden half-decade.

Against this backdrop, the new 60/40 portfolio presented last year not only remains relevant but also proves to be a strategically well-thought-out response to the requirements of an increasingly complex market environment. It combines sound money principles and reflects the insight that runs through all bull markets, as the historical pattern suggests: the first half builds up, the second escalates, and the curtain finally falls in the middle of the applause.

Brazil’s inflation edged up in early July as US President Donald Trump threatened to slap the South American nation with punishing tariffs, further complicating the consumer price outlook for the central bank.

Official data released Friday showed consumer prices rose 5.30% in the first two weeks of the month compared to a year prior, just above the 5.28% median estimate from economists surveyed by Bloomberg. Monthly inflation hit 0.33%.

Extremely tight monetary policy is starting to weigh on a Brazilian economy that’s been powered by hot consumer demand. But the brewing risk of a trade war with the US, which could kick off Aug. 1, has the potential to jolt prices and crimp growth at a time when policymakers are struggling to tame inflation.

In the first half of July, housing costs gained 0.98% — pushed up by higher electricity prices — and transportation picked up 0.67%. On the other hand, the price of food and beverages fell 0.06%, the statistics agency said.

Trump said Brazil could face 50% tariffs on all its goods and services unless it stops a “witch hunt” against former head of state Jair Bolsonaro, who will soon stand trial for his alleged role in a failed coup attempt to overturn the 2022 election. President Luiz Inacio Lula da Silva has shown no sign of heeding US demands and has threatened retaliatory measures.

Economists warn the feud could further stoke inflation — which is already running well above the central bank’s 3% target.

“We still expect headline inflation to average around 5.2% in the second half of the year, though the risks remain skewed to the upside,” Andres Abadia, chief Latin America economist at Pantheon Macroeconomics, wrote in a research note. The recent currency “volatility — triggered by tariff-related headlines — adds another layer of uncertainty, despite a slight improvement in recent days.”

Central bankers are expected to hold the benchmark Selic at a nearly two-decade high of 15% when they gather next week, pausing a months-long hiking campaign.

Russian Central Bank Governor Elvira Nabiullina and her deputy Alexei Zabotkin addressed a news conference on Friday after the central bank cut its key rate to 18% from 20%.

They spoke in Russian and the quotes below were translated into English by Reuters.

"If you look at our forecast for the key rate, it suggests that by the end of the year, at individual meetings, reductions of 100, 150 and 200 basis points are possible, as well as pauses. Here everything will depend on the incoming data. But such a uniform trajectory of reduction may be possible with a more convincing picture of inflation stabilization, inflation expectations at a low level and the absence of new inflation shocks. For now, we assume the possibility of various steps."

"We are on the path to returning inflation to target, but this path has not yet been completed. There are already initial results. They allowed us to reduce the key rate again today, smoothly adapting the degree of monetary policy tightness to reduce inflationary pressure."

"But returning to the target does not simply mean several months of current price growth near 4%. It implies a stable consolidation of inflation at a low level not only in actual data, but also in the perception of people and businesses."

"Monetary policy has ensured a downward reversal of inflation, and it must remain tight for as long as it takes to sustainably return inflation to 4% in 2026 and consolidate it near this level."

"In the aggregate, pro-inflationary risks continue to prevail. However, when making decisions, we also take into account disinflationary risks. The main one is a faster cooling of credit and demand than we expect in the baseline forecast."

"Budget policy remains an important input for our forecast. We assume that the budget rule will be followed this year and in the following years. If budget plans change, it may be necessary to adjust the key rate trajectory."

"Compared to April, we have lowered our forecast for Russian oil prices to $55 per barrel this year and next. We have also slightly lowered our forecast for exports and the current account of the balance of payments for the next two years."

"At the same time, the rouble exchange rate is affected by flows not only on the current account, but also on the financial account of the balance of payments. High interest rates support the attractiveness of rouble assets compared to foreign ones for Russian citizens and companies. This, combined with more moderate demand for imports, ensures the stability of the rouble exchange rate, despite a slight reduction in exports."

The Federal Reserve released a statement Friday thanking President Donald Trump and Republican lawmakers for visiting the central bank’s renovation project on Thursday.

“The Federal Reserve was honored to welcome the President yesterday for a visit to our historic headquarters,” the Fed said in the statement. “We appreciated the opportunity to share progress on the renovation with him and with Senators Tim Scott and Thom Tillis. We are grateful for the President’s encouragement to complete this important project.”

The two-building rehabilitation has drawn significant attack from Republicans over its $2.5 billion price tag. During his visit, Trump offered little criticism of the project but urged Fed Chair Jerome Powell several times to lower interest rates.

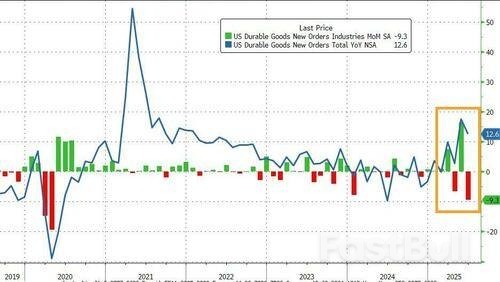

After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders were expected to tumble back to earth in preliminary June data... and they did.

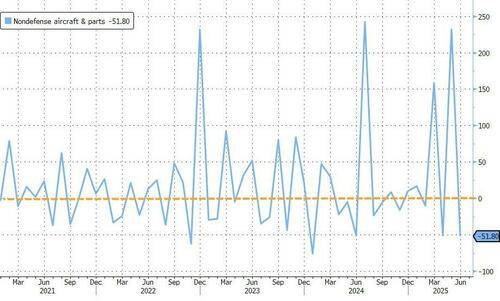

Durable Goods Orders plunged 9.3% MoM (slightly better than the -10.7% MoM expected) - the biggest drop since the COVID lockdowns. But as the chart below shows, it is a wildly noisy time series, almost entirely due to the lumpiness of aircraft orders...

Thanks to a swing from a 230% MoM rise to a 50% MoM decline in non-defense aircraft orders...

Excluding the noise of Boeing orders, the data was actually solid with a 0.25% MoM increase (better than the 0.1% rise expected) in durable goods orders (ex-Transports), pushing YoY orders uo 2.23%

Adding to the confusion, the value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military hardware, decreased 0.7% last month after an upwardly revised 2% gain in May

Capital goods shipments rose 0.4%, excluding defense and commercial aircraft, better than the +0.2% expected, adding to Q2 GDP growth hopes.

So much for the tariff-driven recession that every establishment economist was sure would happen...

Second-quarter earnings for European companies have come in ahead of expectations, with financials and U.S.-exposed sectors leading the surprise, Bank of America (BofA) analysts said.

"European EPS growth surprises to the upside so far on the back of low expectations," BofA wrote, noting that with one-third of companies reporting, Stoxx 600 earnings per share (EPS) are up 8% year-on-year, well above the 2% growth forecast by consensus.

The upside has been “dominated by financials,” which were expected to have a subdued quarter.

Analysts had lowered EPS estimates by more than 6% since April, setting a “relatively low bar” for Q2 performance, BofA said.

While currency headwinds were a concern, given the 3.5% year-on-year gain in the euro trade-weighted index, the bank said “the start of Q2 reporting helps to ease these concerns,” especially for tech and healthcare, which are “so far contributing to the upside surprise.”

Despite the strong headline EPS figure, breadth is said to remain a concern.

“Only 47% of companies have beat EPS estimates so far, the lowest breadth of EPS surprises in six quarters,” BofA noted, citing foreign exchange effects as a key drag.

EPS beats for cyclicals excluding financials fell to 36%, the lowest since at least 2013.

However, U.S.-exposed stocks are said to have bucked the trend with a 57% EPS beat ratio, “a two-year high,” led by healthcare names, where “beats are running at an eight-year high of 73%.”

“Stocks beating EPS estimates have been rewarded with median 1-day outperformance of 1.4%,” BofA said. They stated it is the best post-earnings performance since Q1 2020.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up