Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)A:--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)A:--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)A:--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)A:--

F: --

P: --

Japan Unemployment Rate (Nov)

Japan Unemployment Rate (Nov)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Dec)

Japan Tokyo Core CPI YoY (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Dec)

Japan Tokyo CPI YoY (Dec)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Nov)

Japan Jobs to Applicants Ratio (Nov)A:--

F: --

P: --

Japan Tokyo CPI MoM (Dec)

Japan Tokyo CPI MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)A:--

F: --

P: --

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)A:--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Nov)

Japan Industrial Output Prelim MoM (Nov)A:--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Nov)

Japan Large-Scale Retail Sales YoY (Nov)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Nov)

Japan Industrial Output Prelim YoY (Nov)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Nov)

Japan Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Retail Sales YoY (Nov)

Russia Retail Sales YoY (Nov)--

F: --

P: --

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Pending Home Sales Index (Nov)

U.S. Pending Home Sales Index (Nov)--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Nov)

U.S. Pending Home Sales Index MoM (SA) (Nov)--

F: --

P: --

U.S. Pending Home Sales Index YoY (Nov)

U.S. Pending Home Sales Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Dec)

U.S. Dallas Fed General Business Activity Index (Dec)--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. Dallas Fed New Orders Index (Dec)

U.S. Dallas Fed New Orders Index (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)--

F: --

P: --

South Korea Industrial Output MoM (SA) (Nov)

South Korea Industrial Output MoM (SA) (Nov)--

F: --

P: --

South Korea Retail Sales MoM (Nov)

South Korea Retail Sales MoM (Nov)--

F: --

P: --

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold prices climbed to an all-time high of $4,530.60 per ounce in early Asian trading on Friday, driven by intensified demand for safe-haven assets and growing confidence in imminent U.S. Federal Reserve interest rate cuts....

Foreign companies operating in India have long grappled with complex regulations and confusing tax laws.

In the northwestern state of Rajasthan, some of the world's biggest beverage firms face the additional challenge of securing and managing dwindling water supplies while navigating strict government rules and grievances of some local people who only get the resource piped-in once a week.

Nearly two-thirds of Rajasthan is covered by the Thar Desert, and its groundwater extraction ranks among the highest in India, adding to the economic pressures for the state in balancing the needs of its 85 million people, booming tourism business, industry and its big agricultural sector.

Laws in India, the world's most populous nation, bar the movement of liquor across state borders without a special permit, effectively forcing companies to set up production in every state they want to sell in despite the water scarcity. So global giants like Diageo, Carlsberg and Heineken have to maintain factories in Rajasthan if they want to distribute their products in the state.

"(Water stress) is a growing issue in India," said Sonia Thimmiah, senior director of global sustainability at Heineken, the market leader, adding that a few years ago, water demand in some cities had come close to exceeding supply.

Heineken, Carlsberg and Diageo said that they are increasing water efficiency in Rajasthan and other water-stressed regions, have worked to improve communities' access to water and aimed to replenish 100% of the water their factories use back to its source.

The challenges for the brewers in Rajasthan mirror a wider crisis across India, which holds 17% of the world's population but just 4% of its freshwater. As the world's fastest-growing major economy, India's thirst for growth means more production and more strain on its scarce water resources.

The strain is evident in Rajasthan's industrial town of Alwar, about 150 km (100 miles) southwest of Delhi, where most of the beverage companies are centred. The wider Alwar district's groundwater extraction, driven mainly by irrigation, runs at nearly twice the rate its aquifers can recharge, government data shows.

Industry users consume just about 2% of Rajasthan's water, but under Indian law, all industrial and commercial entities seeking groundwater extraction have to install on-site rainwater harvesting and aquifer recharge systems.

In areas such as Alwar that the government classifies as "over-exploited" for groundwater, industries are further required to adopt the "latest water efficient technologies so as to reduce dependence on groundwater resources", a government order said in 2020, without specifying details.

"The water tables are declining and rains are variable," Diageo's Alwar head Sumit Walia told Reuters.

"We have a vision to reduce water consumption by 40% and to ensure that whatever water is withdrawn from the ground, 100% replenishment is there. We are recycling 100% of the wastewater and installing advanced technologies which consume less water", like using air to rinse bottles instead of water, he said.

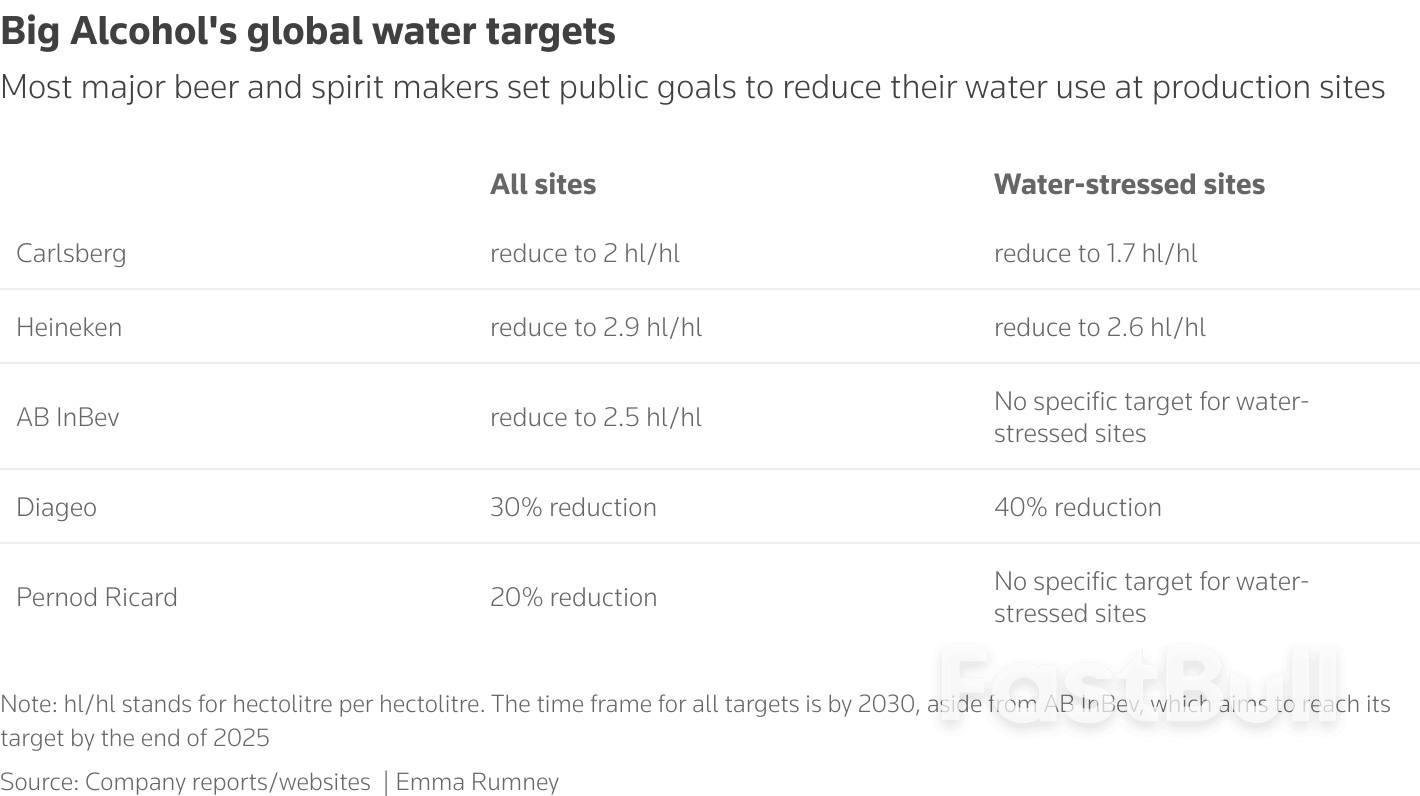

A table showing major alcohol producers' water use targets

A table showing major alcohol producers' water use targetsFederal authorities have permitted brewers in Alwar to draw up to about 4.6 million litres of groundwater daily under 2025 permits seen by Reuters, based on applications from the companies. The global firms account for around 65% of that with Heineken topping the list at 1.2 million litres.

A typical Indian household uses 500–600 litres a day but even getting that is difficult in Salpur village, next to the Alwar industrial cluster, where water is a luxury.

"The situation is very bad," said Imran Khan, head of the village of nearly 4,500 residents, who grows wheat and onion on his ancestral land. "We have to give several days of notice to the borewell owner to pump water for us - there's a queue."

He says he had to spend about 150,000 rupees ($1,700) to lay a 3-km (2-mile) pipeline from the borewell to his fields, and needs to pay 150 rupees for every hour of water supplied by its owner, a resident of another village.

Some locals blame the scarcity on the brewers.

"They are making alcohol there but locals do not have enough water to drink", said Alwar resident Haider Ali, who took several global and local alcohol companies to India's environmental court last year, alleging they were extracting water without permission.

A court-appointed inspection team later found that all factories complied with regulations. But the same court directed authorities in March to actively monitor groundwater abstraction and strictly enforce a 2020 government order prohibiting the issuance of new water permits to large industries in over-exploited areas.

Heineken and Carlsberg said there was no sign of community tension in Alwar beyond this court case, in part thanks to their work with locals on water. Diageo's Walia said he was not aware of the court case, but industries making paper, automobiles and other products consumed more water than the liquor companies.

The water problems are not limited to Rajasthan.

Reuters has reported how in the past decade India has lost several days of coal-power supply because water shortages forced plants to suspend generation.

In Coca-Cola's water security plan for 2023, reviewed by Reuters, the company says it operates nine factories in India in areas of "high or extremely high-water stress" and estimates that its annual costs of procuring water could rise by $180,000 to $2.7 million.

The company, which shut a factory in 2005 in the southern state of Kerala after protests over groundwater depletion, declined to comment.

Drinks makers say they are a small part of the problem in Rajasthan, and their water initiatives have significant positive impact.

Carlsberg's vice president for sustainability Simon Boas Hoffmeyer said its goals, including replenishing all water used, go beyond regulatory requirements. "If everybody did that, the industry's share of the issue would be very, very small," he said.

Diageo's global head of environment Michael Alexander said that in Salpur, the company has built small dams and planted 10,000 trees, while across Alwar it has desilted ponds, installed rooftop rainwater harvesting and funded boreholes and pipelines for communities.

Similar projects by Heineken had a positive impact in Rajasthan, said Subhransu Kumar Bebarta, partnerships lead at S M Sehgal Foundation, a non-profit that implements the company's water projects.

But big companies can go further, he said, adding larger infrastructure projects are needed in a state where some people struggle to find water to drink.

"They have improved the groundwater table. But still, there is always scope for more."

($1 = 90.2450 Indian rupees)

Foreign-branded smartphone shipments in China experienced contrasting figures for November, with Apple's iPhone driving a reported 128% increase, while other sources noted a 47% decline.

The discrepancy in data highlights the challenges in obtaining accurate market figures, potentially impacting investor decisions and consumer confidence in smartphone markets.

In November, foreign-branded smartphone shipments in China raised contrasting figures. Some reports indicated a significant 128% surge, driven by Apple, while others highlighted a 47% slump. Both interpretations are supported by raw data from China's official body CAICT.

Apple Inc. emerges as a key player, allegedly accounting for 6.93 million iPhones out of total shipments. This disparity in data highlights conflicting trends in the smartphone market. Further evaluations emphasize CAICT as the primary information source.

The conflicting reports have not received responses from industry leaders or affected stakeholders. The variability in data invites scrutiny regarding data collection and interpretation practices within the industry.

Potential outcomes include uncertainty among investors and market experts about the actual status of foreign-branded smartphones in China. Historical data consistency is questioned, possibly affecting market strategies for international brands like Apple.

Similar discrepancies in data reports have occurred previously, often highlighting variations in methodologies. Past occurrences usually resolved with independent verifications. Now, experts call for enhanced transparency and unified measurements.

Insights from Kanalcoin indicate that the dual interpretations may stem from varying analytical criteria. Historical trends show that accurate data reconciliation fosters investor confidence and stabilizes market outlooks. "It appears there are no direct quotes or statements from industry leaders or experts related to the conflicting reports on foreign-branded smartphone shipments in China for November. This situation has been characterized by mixed data from the China Academy of Information and Communications Technology (CAICT) without additional commentary or insights from stakeholders or analysts in the space."

Gold and silver surged to fresh record highs on Friday as investors flocked to safe-haven assets amid escalating geopolitical tensions and a weakening U.S. dollar, extending a powerful year-end rally in precious metals.

Spot gold was last up 0.6% at $4,506.76 an ounce by 21:55 ET (02:55 GMT), after jumping to a new record peak of $4,530.60/oz earlier in the day.

U.S. Gold Futures for February delivery rose 0.7% to $4,537.55.

Gold prices were set to jump nearly 3% this week as investors sought protection against rising global uncertainty.

Spot silver prices surged over 4% to hit a new record high of $75.14/oz, set to jump over 7% this week.

Geopolitical developments were a key driver of the move. Safe-haven demand increased after the U.S. stepped up pressure on Venezuela's oil exports, a move that raised concerns about supply disruptions and broader regional instability.

Adding to market unease, President Donald Trump said on social media that U.S. forces had carried out strikes against militant targets in Nigeria, highlighting Washington's willingness to use military force in multiple regions.

Silver tracked gold's gains, buoyed not only by its defensive appeal but also by its industrial use, particularly in electronics and clean-energy technologies.

Strong investment inflows and limited availability amplified price moves during holiday-thinned trading conditions.

The rally was further underpinned by weakness in the U.S. dollar, which slipped against a basket of major currencies.

The dollar has come under pressure amid growing expectations that the Federal Reserve will begin easing monetary policy in 2026 as inflation shows signs of cooling and economic growth moderates.

A softer dollar typically boosts demand for dollar-denominated commodities by making them cheaper for holders of other currencies.

Lower U.S. Treasury yields have also supported non-interest-bearing assets such as gold, as investors reassess the outlook for U.S. rates and shift portfolios toward stores of value.

With liquidity likely to remain thin through the holiday period, price swings could be exaggerated. Still, analysts said the broader fundamentals point to continued strength in gold and silver into the new year.

Gold’s rally since 2024 has followed a textbook expansion–consolidation rhythm. Each impulse wave has been respected by the market, and each pause has strengthened the overall structure.

Gold’s rally since 2024 has followed a textbook expansion–consolidation rhythm. Each impulse wave has been respected by the market, and each pause has strengthened the overall structure.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up