Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

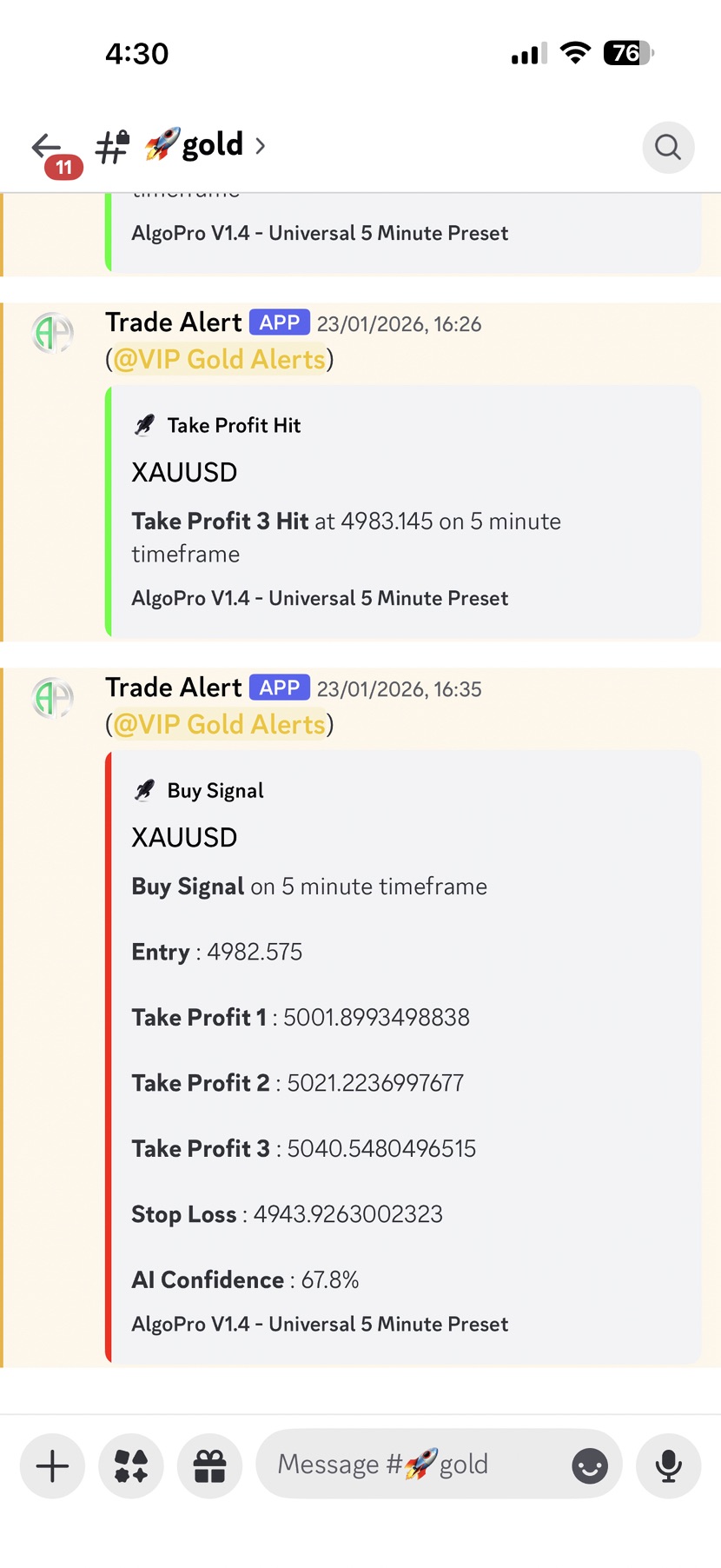

Gold's rally paused as easing US-Iran tensions and Fed stability curbed safe-haven demand, leading to a decline.

Gold prices declined in Asian trading on Thursday, snapping a three-day streak of record highs. The pullback was driven by comments from U.S. President Donald Trump that eased geopolitical tensions with Iran and reduced uncertainty surrounding the Federal Reserve, dampening demand for the safe-haven metal.

Spot gold fell 0.4% to $4,609.89 per ounce, while U.S. Gold Futures also dropped 0.4% to $4,615.10 per ounce. The move comes after gold reached an all-time high of $4,642.72 in the previous session.

A significant part of gold's recent rally was fueled by fears of escalating conflict in the Middle East. Investors worried that growing unrest in Iran could trigger U.S. military action, driving a flight to safety.

However, those concerns subsided after President Trump signaled a more moderate position. He stated that he had been assured Iranian authorities would stop killing protesters and that he did not believe large-scale executions were planned. These remarks lowered the immediate probability of a U.S. military response, reducing the geopolitical risk premium that had been supporting gold prices.

Gold also faced pressure after Trump addressed concerns about the independence of the U.S. central bank. In a Reuters interview, the president confirmed he had no intention of firing Federal Reserve Chair Jerome Powell, despite an ongoing investigation.

This statement helped ease investor anxiety over the stability and autonomy of U.S. monetary policy, diminishing another key reason for holding gold as a hedge against institutional uncertainty.

Analysts also attributed the price drop to simple profit-taking after the precious metal's sharp and rapid ascent pushed it well above key technical levels.

Despite Thursday's decline, the fundamental case for gold remains supported by several underlying factors:

• Expected U.S. Interest Rate Cuts: Anticipation of lower interest rates later this year continues to provide a floor for gold prices. Lower rates reduce the opportunity cost of holding a non-yielding asset like gold.

• Persistent Geopolitical Risks: While immediate tensions have cooled, broader global uncertainties remain a long-term tailwind.

• Strong Central Bank Buying: Consistent purchases from central banks around the world continue to generate steady demand.

The downturn was not limited to gold, as other metals saw even sharper declines. Silver prices plunged more than 3% to $89.76 per ounce, and platinum dropped 2.5% to $2,323.52 per ounce.

Industrial metals also fell. Benchmark Copper Futures on the London Metal Exchange slipped 1.1% to $13,087.20 a ton, while U.S. Copper Futures declined 1.6% to $5.99 a pound.

A year after Donald Trump’s return to the White House, a sweeping global survey suggests his "Make America Great Again" agenda is widely seen as making China great instead. The 21-country poll, conducted for the European Council on Foreign Relations (ECFR), reveals that the United States is less feared by its adversaries and viewed as increasingly distant by its traditional allies, particularly in Europe.

The study found that most Europeans no longer consider the US a reliable partner and increasingly support rearmament. In a notable shift, Russians now view the EU as a greater adversary than the US, while Ukrainians are turning more to Brussels than to Washington for support.

The poll, which surveyed nearly 26,000 people across Europe, the US, Asia, and other key nations, found a strong consensus that China's global influence will grow over the next decade.

Majorities in nearly every country surveyed shared this expectation, with figures ranging from 83% in South Africa and 72% in Brazil to 54% in the US and 53% across 10 EU states. Most EU citizens also anticipate China will soon lead the world in electric vehicles and renewable energy.

Despite this anticipated rise, few expressed significant concern. Only in Ukraine and South Korea did majorities see China as a rival or adversary. In fact, more people in South Africa, India, and Brazil now view China as an ally compared to two years ago. In South Africa (85%), Russia (86%), and Brazil (73%), clear majorities see China as either an ally or a necessary partner. The EU's view remained stable, with 45% considering China a necessary partner.

While China's image improves, perceptions of the United States as an ally have soured in almost all surveyed countries. India is now the only nation where a majority still feels the US is an ally that shares its values and interests.

The shift among EU citizens is particularly stark. Only 16% now see the US as an ally, while a striking 20% view it as either a rival or an enemy. Elsewhere, American prestige is also in decline.

At the same time, expectations for Donald Trump's presidency have fallen, sometimes dramatically. Compared to 12 months ago, fewer people believe his re-election is good for US citizens, their own countries, or global peace.

The survey, part of a series with Oxford University's Europe in a Changing World project, highlights how the shifting balance of power is altering perceptions, most notably in Russia.

As the war in Ukraine approaches its fifth year, a majority of Russians (51%) now see Europe as an adversary, up from 41% last year. Meanwhile, fewer Russians (37%) consider the US an adversary compared to 12 months ago (48%).

Ukrainians, conversely, are now more likely to view Europe as their key ally (39%) over the US (18%), a drop from 27% last year. This sentiment is echoed in China, where 61% of respondents see the US as a threat, but only 19% feel the same about the EU.

The survey's authors—Ivan Krastev, Mark Leonard, and Timothy Garton Ash—note that China does not seem to dismiss the EU's importance. A majority of Chinese respondents (59%) consider the EU a great power, and 46% see it as a partner—a view shared by 40% of Americans, despite Trump's anti-EU rhetoric.

However, Europeans themselves are less optimistic. A plurality (46%) do not believe the EU is a power capable of dealing with the US or China on equal terms, a sentiment that has grown since 2024.

European citizens are also worried about the future, with many expressing concern about:

• The future of their countries (49%)

• The future of the world (51%)

• Russian aggression (40%)

• A major European war (55%)

Reflecting these anxieties, more than half (52%) support an increase in defense spending.

The report's authors conclude that the poll reveals "a world in which US actions were boosting China." They argue that with Trump's approach, "Europe could end up squeezed or simply ignored." European leaders, they state, must recognize that their citizens see the old order is over and must find "new ways not just to manage in a multipolar world, but to become a pole in that world—or disappear among the others."

The UK economy grew by 0.3% in November, marking a rebound from the 0.1% contraction seen in October, according to official figures from the Office for National Statistics.

This modest return to growth follows a period of economic sluggishness, partly linked to a cyber-attack on carmaker Jaguar Land Rover earlier in 2025 that hampered vehicle production. While a recovery was anticipated, its materialization has been slow.

Despite the positive November figure, the economic improvement is unlikely to alter the Bank of England's course. Policymakers are still widely expected to press ahead with further interest rate cuts.

Chancellor Rachel Reeves has been a vocal proponent of more rate cuts as a key part of the government's strategy to lower the cost of living for households across the country.

The growth data comes after a period of considerable uncertainty surrounding the Chancellor's second tax-raising budget, which was delivered on November 25. In the lead-up to the announcement, intense speculation and fluctuating tax rumors were blamed by business groups for discouraging both investment and consumer spending.

Looking forward, more crucial economic indicators are on the horizon. Key inflation and unemployment data are scheduled for release next week, which will provide a clearer picture of the economy's health.

Separately, Reeves is expected to announce additional support for the hospitality industry in the coming days. This move follows a backlash from the sector regarding recent changes to the business rates system.

India's surge in Russian crude oil imports appears to be cooling, with purchases expected to either stabilize at lower levels or decline this month. This shift is forcing the world's third-largest oil importer to consider more expensive alternatives and leaving a growing number of Russian oil cargoes stranded at sea.

Ship-tracking data indicates a notable dip in India's intake of Russian crude. Imports in December already fell to a three-year low, dropping by a third from their peak in June.

According to data from firms Vortexa Ltd. and Kpler, India imported approximately 1.3 million barrels per day of Russian crude in December. Sources familiar with the matter suggest January's purchases are also facing pressure, with buying likely to plateau at volumes below previous highs.

Sumit Ritolia, a lead analyst at Kpler, forecasts that imports will likely range between 1.2 million and 1.4 million barrels per day this month. However, insiders caution that the final figures could end up being lower.

This slowdown is unfolding amid sustained pressure from the United States. The Trump administration has repeatedly criticized India for purchasing Russian oil, which Washington argues supports Vladimir Putin's war in Ukraine, and has imposed punitive 50% tariffs. With trade negotiations stalled, the U.S. is now weighing a sanctions bill that would penalize countries buying Russian hydrocarbons.

This pressure has prompted India’s refining sector—the fourth largest globally by capacity—to cut its reliance on discounted Russian feedstock. "Russia remains a core pillar in India's slate for now," Ritolia noted. "But buying becomes more opportunistic, more diversified, and more compliance-sensitive as geopolitics and trade mechanics continue to evolve."

In response, Indian refiners are actively adjusting their procurement strategies. They are increasingly sourcing non-sensitive substitutes from the Middle East, West Africa, and Latin America, which can replace Russia's flagship Urals blend, albeit at a higher cost.

Key developments include:

• Increased Saudi Purchases: Imports from Saudi Arabia, the world's largest exporter, are higher than usual this month.

• Diversified Sourcing: Indian Oil Corp., the country's biggest processor, recently made a rare purchase of Ecuadorian Oriente crude for late March delivery.

• New Tenders: The company also issued two tenders this week with options to buy "sour grades," which have a quality similar to Urals crude.

Refiners are also proceeding with caution regarding Venezuelan crude, holding back on formal bids until they receive clarity that such purchases would not violate any sanctions.

India’s government frames its energy policy as a delicate balance. Randhir Jaiswal, a spokesperson for the Ministry of External Affairs, stated Friday that the country's energy purchases are "dependent on the evolving dynamics in the global market as also the imperative for us to provide energy at affordable rates to our 1.4 billion people."

Meanwhile, with Russia's largest producers under sanctions, the fate of floating Urals cargoes remains uncertain. Few nations besides China are openly willing to defy the U.S.-led restrictions. For refiners still willing to take the risk, the grade is priced at an attractive discount of roughly $8 per barrel to the Dated Brent benchmark, making it one of the cheapest options available.

The Federal Reserve's latest Beige Book, released on January 14, paints a picture of a cautiously recovering U.S. economy. The report indicates slight to moderate economic growth across eight Fed districts, an improvement largely powered by strong consumer spending during the holiday season.

However, this positive momentum is tempered by persistent inflationary pressures directly linked to tariffs, creating a complex outlook for 2026.

The primary engine behind the recent economic uptick was consumer activity. Shoppers drove increased spending over the holidays, providing a welcome boost that contrasted sharply with previous reports showing nearly stagnant economic conditions.

Supporting this trend is a stable labor market. The Beige Book notes that employment levels saw limited change, continuing a pattern of stability that underpins the economy's resilience.

Despite the growth, a significant challenge looms: inflation caused by tariffs. Businesses across multiple districts reported rising costs, which are gradually translating into moderate price increases for consumers.

Analysts suggest this tariff-induced inflation could persist, potentially eroding consumer purchasing power in the quarters ahead. This remains the key risk factor overshadowing the otherwise favorable economic data.

The Federal Reserve's report signals cautious optimism, a notable shift from the minimal growth detailed in prior periods. This improved sentiment may encourage investment, but market observers remain watchful of several factors:

• Prolonged Inflation: The long-term impact of tariff-related costs is a primary concern.

• Fed Policy: Ongoing balance sheet adjustments by the Federal Reserve continue to influence market conditions.

• Political Influence: The process surrounding the nomination of the next Fed Chair is also being closely monitored.

For now, the economic trends outlined in the Beige Book are not expected to have a significant impact on cryptocurrency markets.

Washington's intervention in Venezuela is sending shockwaves through the global shipping market, causing regional oil tanker rates to surge to their highest levels in almost two years. The prospect of more Venezuelan crude heading to the United States is fundamentally redrawing key trade routes and squeezing the availability of mid-sized tankers.

The global oil industry is adapting to the new reality after U.S. forces seized Nicolás Maduro and Washington asserted control over the nation's energy sector. This move means more crude from the OPEC member will now flow to American refiners, primarily on mid-sized vessels.

For shipowners, the redirection of oil translates directly to higher profits on specific routes. Before the U.S. action, which included a naval blockade, the majority of Venezuela's crude exports were shipped to China using vessels from the so-called "dark fleet." Now, with Washington easing sanctions, that oil is set to cross the Caribbean instead of the Pacific.

The rerouting of Venezuelan oil is creating a new dynamic in the Atlantic basin. As Venezuelan crude flows north to the U.S. Gulf Coast, it is displacing some American-produced West Texas Intermediate (WTI) crude, which in turn is being pushed toward European markets. This two-way traffic is creating a bottleneck for the Aframax tankers used on these routes.

"The imminent re-direction of Venezuelan crude-oil flows from China to US Gulf seems to be causing a structural change in the Aframax segment," said Georgios Sakellariou, a chartering analyst at Signal Maritime. He noted that these mid-sized vessels, which carry around 700,000 barrels, are at the center of the market upheaval. "This is a typical trend that underscores how geopolitical developments become shipping reality."

The sudden demand for tankers in the Americas has sent freight costs soaring. Data from the Baltic Exchange reveals sharp increases across several key routes:

• Caribbean to U.S. Gulf (TD9): Rates on this route hit $78,795 per day on Wednesday, the highest price since early 2024.

• U.S. Gulf to Europe (TD25): The cost to ship oil to the Amsterdam-Rotterdam-Antwerp hub rose for five straight days, reaching $64,404.

• East Mexico to U.S. Gulf (TD26): Rates on this route spiked 21% in a single day, climbing to $90,681 on Wednesday.

At stake are significant volumes. In November, just before the confrontation, Venezuela exported 586,000 barrels of crude per day, a 37% increase from the prior month but still 12% lower than the previous year.

The lucrative new rates are attracting tankers from other parts of the world. Shipowners are now willing to sail vessels empty—a practice known as ballasting—across entire oceans to capitalize on the demand.

Brokers have pointed to specific examples of this trend. The tanker Front Siena is currently sailing empty from Spain across the Atlantic, heading toward Guyana, near Venezuela, while it awaits orders. Similarly, the Mare Siculum is also traversing the Atlantic without cargo and has been booked for a future route from the east coast of Mexico to Europe.

Shortly after the operation, President Trump announced that Venezuela would relinquish up to 50 million barrels of oil to the United States. He stated the proceeds from the sale would benefit both nations and convened a meeting with industry executives to encourage investment in rehabilitating Venezuela's neglected energy infrastructure.

Despite this push, the future of the country's oil supply remains uncertain. The head of Exxon Mobil Corp. described Venezuela as currently "uninvestable," highlighting the significant challenges in reviving production. In contrast, consulting firm Enverus has projected that the nation's crude output could surge by approximately 50% over the next decade, suggesting a potential for recovery if stability returns.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up