Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

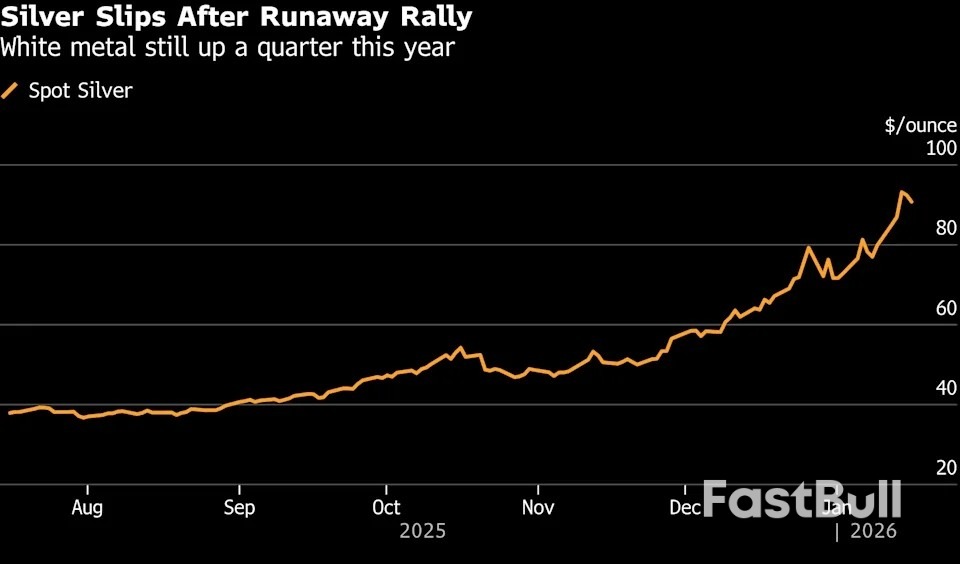

Silver slipped as a Chinese exchange cut position limits and authorities there clamped down on high-frequency trading, cooling sentiment in mainland futures that had helped push global prices to a record.

The race to lead the Federal Reserve has a new frontrunner, and markets are already reacting. Former Federal Reserve Governor Kevin Warsh is now the leading candidate to be the next Fed chair, a development that could signal a less aggressive path for interest rate cuts compared to his main rival.

Warsh’s odds in betting markets surged on Friday after President Donald Trump suggested he prefers to keep National Economic Council Director Kevin Hassett, previously seen as the top contender, in his current role. Speaking at a White House event, Trump praised Hassett's television performance, adding, "I actually want to keep you where you are if you want to know the truth."

Following the president's comments, Polymarket odds for Warsh winning the nomination jumped to 60%, while Hassett's chances fell to just 15%. This shift has significant implications for monetary policy, the economy, and the central bank's independence.

The selection of the next Fed chair is critical. Current Chair Jerome Powell's term expires in May, and his successor will inherit control over the federal funds rate, which influences borrowing costs across the entire economy. Both Warsh and Hassett have publicly advocated for lower interest rates, but their approaches and allegiances appear to differ.

Kevin Hassett: The Aggressive Rate-Cutter

Hassett has often aligned with President Trump in calling for steep cuts to interest rates. This has led many analysts to view him as the candidate most likely to push the central bank to follow the White House's policy preferences.

"In our view, Hassett would likely bring the greatest risk of politicization at the Fed," wrote David Seif, chief economist at Nomura, in an October commentary. "Hassett is widely viewed as a Trump loyalist and has consistently supported the president as an advisor in both his first and second terms."

Kevin Warsh: A More Measured Approach?

Warsh, a lawyer and banker, has also supported rate cuts. "We can lower interest rates a lot," he stated on Fox News in October.

However, many economists believe he may be less "dovish"—or inclined toward rate cuts—than Hassett. "Although Warsh has argued for lower rates recently, we do not view him as structurally dovish," noted Matthew Luzzetti, chief economist at Deutsche Bank, in a December analysis. This suggests Warsh might take a more independent stance once in office.

Financial markets seem to agree. Treasury yields rose slightly on Friday as Warsh's odds improved, indicating that investors believe interest rates may remain higher under his leadership than under Hassett's.

Whoever takes the helm at the Fed will face a challenging economic environment, provided they are confirmed by the Senate. The central bank's 12-person policy committee is currently divided on the best course of action.

The core dilemma is a slowing job market pulling against stubbornly high inflation. The weakening labor market calls for rate cuts to stimulate growth, while inflation running above the Fed's 2% annual target argues for keeping rates higher for longer.

Under Jerome Powell, the Fed has already cut rates by three-quarters of a point over its last three meetings—a pace slower than President Trump has demanded. With the Federal Open Market Committee (FOMC) widely expected to hold rates steady at its next meeting, whether more cuts are coming this year remains an open question.

The next chair won't just be managing the economy; they'll be defending the institution itself. President Trump's demands for rate cuts and his administration's criminal investigation into committee members have raised serious concerns about the central bank's independence from political influence.

Economists have long warned that if the public begins to doubt the Fed's commitment to controlling inflation, that belief could become a self-fulfilling prophecy. To counter this, the new leader may feel pressure to resist cutting rates simply to prove the Fed's credibility.

"Regardless of President Trump's choice, the market could look to test the next Fed chair's independence and the credibility of his commitment to achieving the inflation target," Lutezzi wrote. "These bona fides always need to be earned by an incoming chair."

The Trump administration is ready to implement a temporary 10% tax on all imports if the Supreme Court strikes down the emergency tariffs imposed in 2025, a top White House official confirmed.

"We can put a 10pc tariff right away to make up most of the room, and then use things like the 301 authorities, the 232 authorities, to backfill the things that we've already achieved," Kevin Hassett, director of the White House National Economic Council, told Fox Business on Friday.

This statement is the clearest confirmation yet of the administration's contingency plan as it awaits a crucial legal decision. While expressing confidence in their legal standing, officials are actively preparing a fallback strategy.

The Supreme Court announced it may issue a decision in a pending case on January 20 at 10 a.m. ET. This could be the moment the court rules on the tariff case, which was argued in early November.

Hassett's reference to a 10% tariff likely points to a potential use of Section 122 of the 1974 Trade Act. This provision allows the president to impose tariffs of up to 15% for 150 days to address a balance of payments problem.

However, any extension beyond this 150-day period would require explicit authorization from Congress. The administration would likely use that time to identify and prioritize which countries and industries to target with more durable measures.

These subsequent actions would rely on different legal authorities:

• Section 232: This allows the Commerce Department or the U.S. Trade Representative's office to restrict imports of a product on national security grounds.

• Section 301: This authority is used to investigate and target a specific country for discriminating against U.S. exports.

Both of these processes can take months to complete, as they require public consultation and allow U.S. importers to apply for exemptions.

The upcoming Supreme Court decision directly impacts a wide range of tariffs President Trump enacted by citing the International Emergency Economic Powers Act (IEEPA) of 1977. Previous presidents had used this law primarily for targeted economic sanctions, not broad tariffs.

The tariffs at risk include:

• Levies on goods from Mexico, Canada, and China, justified by an alleged economic emergency related to the flow of fentanyl into the U.S.

• Broad tariffs of 10% or higher on nearly every U.S. trading partner, imposed since April 5 to combat persistent trade deficits.

• Tariffs on imports from Brazil, citing alleged suppression of free speech.

• An additional 25% tariff on India in response to its purchases of Russian crude oil.

It is important to note that the court's decision will not affect existing tariffs on U.S. imports of steel, aluminum, cars, and auto parts, as those were imposed using different, well-established trade laws.

During oral arguments in November, even conservative justices expressed skepticism about the emergency tariffs, particularly regarding their function as a source of government revenue.

The U.S. Constitution grants Congress the power to levy taxes. Government lawyers argued that the tariffs are a tool of foreign and economic policy, not a tax.

The financial stakes are enormous. According to U.S. Treasury Department data, the government has collected nearly $260 billion in customs duties in the first 11 months of Trump's second term.

Hundreds of companies have already filed lawsuits to recover these tariff payments. President Trump warned earlier this week that refunding this money would be a complex and lengthy process.

"It would be a complete mess, and almost impossible for our country to pay," Trump stated on his social media network on January 12. "Anybody who says that it can be quickly and easily done would be making a false, inaccurate, or totally misunderstood answer to this very large and complex question."

In the chaotic spring of 2020, as the COVID-19 pandemic brought the global economy to a standstill, the U.S. Federal Reserve projected an image of unified, overwhelming force. It slashed interest rates and unleashed a firehose of liquidity through massive bond purchases.

But newly released transcripts from the Fed's closed-door meetings paint a more complex picture. They reveal that behind Chair Jerome Powell's decisive public stance, there was significant internal division over just how far and how fast the central bank should go. The documents show a tense debate shaped by a deep-seated concern: protecting the Fed's political independence at a moment of unprecedented crisis.

As financial markets began to spiral in early March 2020, Fed policymakers met twice to orchestrate their response. The first move on March 3, a 50-basis-point rate cut, was unanimous. Less than two weeks later, however, the consensus fractured.

At its March 15 meeting, the Fed pushed through a full 100-basis-point cut. While Cleveland Fed President Loretta Mester was the only official dissenter, the transcripts show she was not alone in her reservations. Three other influential members were not immediately convinced:

• Randal Quarles, then Fed Vice Chair for Supervision, worried the move would signal panic. "Lowering the interest rate will not open schools, and it won't finish the NBA season," he quipped.

• Raphael Bostic, President of the Atlanta Fed, argued that with a large fiscal stimulus package expected from Congress, the "urgency of our moving to a dramatically more accommodative stance" was reduced.

• Robert Kaplan, then Dallas Fed President, expressed sympathy for these arguments, though both he and Quarles ultimately voted for the cut.

The core concern was that such a drastic move could backfire, telegraphing alarm and worsening the very instability the Fed was trying to contain.

Despite the hesitancy, Powell forcefully argued for decisive action. "I feel that there is no useful purpose to be served in holding back today," he told his colleagues, successfully swaying the committee.

The group ultimately went even further than originally planned. Minneapolis Fed President Neel Kashkari suggested making the central bank's bond-buying program open-ended rather than capping it at a specific dollar amount.

"We should be erring on the side of doing too much," Kashkari urged, a sentiment that would become a public mantra for the Fed in the months that followed.

Even as they embraced aggressive measures, policymakers were acutely aware of the risks to the central bank's independence. With an array of new programs, including direct purchases of corporate credit, the Fed was entering uncharted territory.

Kashkari himself warned that the Fed needed to design these programs "in a way that can support the economy, without having us step out of our lane."

Philadelphia Fed President Patrick Harker was even more direct. "Given the declaration of a national emergency, our actions might also be viewed as bowing to political pressures," he stated, referring to the pressure being exerted by the Trump administration at the time. The key, he argued, was to communicate that the Fed's goal was providing relief, not economic stimulus.

One idea from Boston Fed President Eric Rosengren highlighted how far some were willing to think outside the box. He suggested encouraging the Treasury to issue more bills to keep short-term rates from falling below zero, though the idea did not gain traction.

By the summer of 2020, concerns over independence had become a central theme in Fed discussions. This was the primary reason policymakers ultimately rejected a proposal to implement yield curve control (YCC), a policy that would involve capping long-term interest rates.

While Vice Chair Lael Brainard had presented YCC as a potential next step, others saw it as a bridge too far. St. Louis Fed President James Bullard voiced a common view at the June meeting, arguing that YCC "may prove to be incompatible with central bank independence."

After extensive debate, the committee decided against the policy. The 2020 transcripts reveal a central bank that, while willing to act with unprecedented force in a crisis, was also intensely focused on drawing clear lines to protect its long-term institutional integrity.

The U.S. Department of Energy has officially rejected claims that it is considering a plan to use Venezuelan crude oil to replenish the nation’s Strategic Petroleum Reserve (SPR). The denial follows a report, citing two sources, that the Trump administration was exploring an oil swap with U.S. companies to bolster the emergency stockpile.

"This is false," a spokesperson for the Energy Department stated on Friday. "We are not currently considering using Venezuelan oil to refill the SPR." The spokesperson also confirmed that no such exchange is currently planned.

According to the two sources, the proposed plan involved a complex exchange designed to move Venezuelan oil into the U.S. market while simultaneously adding to the SPR. Under the arrangement, Venezuelan crude would be delivered to U.S. refineries. In return, participating companies would supply U.S.-produced medium sour crude directly into SPR storage facilities.

The sources indicated the administration was looking to transfer the Venezuelan crude to storage tanks at the Louisiana Offshore Oil Port for subsequent shipment to refineries. The United States has asserted it would control Venezuela's oil sales and revenue indefinitely following the capture of President Nicolas Maduro earlier this month.

The Strategic Petroleum Reserve, the world's largest emergency oil stockpile, is stored in a series of underground salt caverns along the Texas and Louisiana coasts. Replenishing it has been a stated policy goal for the Trump administration, which pledged on the first day of its second term to fill the emergency reserve as part of a broader energy support strategy.

Currently, the SPR holds approximately 414 million barrels, which is about 60% of its total capacity. However, efforts to refill the reserve have been hampered by a lack of funding and ongoing maintenance requirements.

The administration has been seeking creative ways to add crude to the SPR without direct government spending. U.S. Energy Secretary Chris Wright has previously stated that the administration was exploring alternative approaches, including potential deals with private companies to supply oil.

This search for alternatives comes as direct funding has been reduced. A major tax and spending bill last year allocated only about $171 million for SPR oil purchases and maintenance, a significant decrease from the $1.3 billion originally included in the legislation.

From a technical standpoint, Venezuelan crude is generally denser and has a higher sulfur content than the U.S.-produced crude that has traditionally filled the SPR.

Russian President Vladimir Putin is actively mediating the situation in Iran, aiming for a rapid de-escalation of tensions, the Kremlin confirmed Friday. The move follows direct phone calls between the Russian leader, Israeli Prime Minister Benjamin Netanyahu, and Iranian President Masoud Pezeshkian.

Moscow has also condemned threats of new military action from the United States, which came after protests broke out in Iran late last month.

During his call with Prime Minister Netanyahu, President Putin affirmed Russia's readiness to "continue its mediation efforts and to promote constructive dialogue," according to a Kremlin statement. Putin outlined his vision for enhancing stability across the Middle East, though further details of his mediation proposal were not disclosed.

In a separate conversation, Iranian President Pezeshkian briefed Putin on what the Kremlin described as Tehran's "sustained efforts" to normalize the internal situation.

The Kremlin reported that both Russia and Iran are aligned in their support for de-escalating tensions as quickly as possible. The two nations agree that any emerging issues, both concerning Iran and the wider region, must be resolved "through exclusively political and diplomatic means." Putin and Pezeshkian also reaffirmed their commitment to the strategic partnership between their countries and to ongoing joint economic projects.

The Shanghai Cooperation Organization (SCO)—a bloc that includes Russia, China, India, and Iran—publicly opposed any external interference in Iran’s affairs. The organization pointed to Western sanctions as a key factor creating the conditions for the recent unrest.

"Unilateral sanctions have had a significant negative impact on the economic stability of the state, led to a deterioration in people's living conditions, and objectively limited the ability of the Government of the Islamic Republic of Iran to implement measures to ensure the country's socio-economic development," the SCO declared in a statement.

The protests, which began on December 28, were triggered by soaring inflation in an economy heavily impacted by international sanctions.

In contrast to Russia's diplomatic approach, the U.S. Treasury announced fresh sanctions on Thursday. The new measures target Iranian officials, including Ali Larijani, the secretary of Iran's Supreme Council for National Security.

When asked what specific support Russia might offer Iran, Kremlin spokesman Dmitry Peskov emphasized Moscow's broader role. "Russia is already providing assistance not only to Iran but also to the entire region, and to the cause of regional stability and peace," Peskov stated. "This is partly thanks to the president's efforts to help de-escalate tensions."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up