Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

BOE Governor Bailey: Falling Inflation Should Feed Into Expectations, That Should Give Me Confidence

Indonesia Central Bank: To Work With Government To Strengthen Communication With Markets, Maintain Market Confidence

Indonesia Central Bank: Financial Market Stability Is Also Expected To Remain Stable, Supported By Adequate Liquidity, Strong Banking Capital, Low Credit Risk

US News Website Axios Reports That The United States And Russia Are Close To Reaching An Agreement To Continue To Abide By The New START Treaty After It Expires On Thursday

Indonesia Central Bank: Rupiah Exchange Rate Is Expected To Remain Stable, Supported By Economic Prospects, Central Bank Stabilisation Commitment

BOE Governor Bailey: We Need To See More Evidence That We Are Going To Get Sustainable Return To Inflation Target

Indonesia Central Bank: Expects Indonesian Economic Prospects To Remain Solid With Improving Trend, Inflation Under Control

The US News Website Axios Reports That The US And Russia Are Negotiating An Extension Of The New START Treaty

Bank Of England Governor Bailey: If The Outlook Develops As We Expect, There Is Still Room For Further Easing In The Near Future

Bank Of England Governor Bailey: More Spare Capacity Could Lead To Inflation Falling Below Target

BOE Governor Bailey: On One Hand, Cutting Bank Rate Too Quickly Or Too Much Could Lead To Inflation Pressure Persisting

Bank Of England Governor Bailey: Institutions Expect Growth To Remain Sluggish Throughout The Year

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP GrowthA:--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)A:--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)A:--

F: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)A:--

F: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo Rate--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

No matching data

View All

No data

France's December factory dip, driven by volatile sectors, won't derail modest 2026 growth amid euro risks.

French manufacturing output registered a 0.8% decline in December, a reversal from the 0.5% growth seen in November. However, a closer look reveals the drop was concentrated in specific, highly volatile sectors and does not signal a broader industrial slowdown.

The negative headline figure was primarily driven by weaker production in transport equipment, a sector that makes up 13% of France's total manufacturing output. The aerospace segment, in particular, saw a sharp drop that erased the gains from the previous three months.

Such volatility is typical for the aerospace industry, and this one-month dip is not considered a cause for alarm. In fact, on a yearly basis, production of transport equipment is still up by a strong 12.4%.

While coke production also fell by 0.9% over the month, every other industrial sector reported an increase in output, underscoring the narrow scope of the December downturn.

Despite the monthly dip, the forecast for French industry in the first half of 2026 remains optimistic. A cyclical improvement is expected, supported by several key factors:

• Regional Recovery: A broader European economic recovery is gaining momentum.

• German Stimulus: Germany's stimulus plan is anticipated to boost regional demand.

• Business Confidence: Improving business sentiment and healthier order books point to higher industrial production in the coming months.

• Defense Spending: Rising defense budgets will continue to support the industrial sector.

• Aerospace Strength: Aerospace production is projected to remain a significant driver of growth.

However, the path forward is not without challenges. Several factors could weigh on economic activity and exports:

• Stronger Euro: The recent appreciation of the euro poses a risk to export competitiveness. The European Central Bank estimates that a further 4.3% rise in the euro against the dollar could reduce eurozone GDP growth by 0.1 percentage points.

• High Tax Burden: The high tax burden on French companies may constrain business activity.

• Weak Investment: Recent business surveys indicate that investment intentions remain very weak.

Balancing these positive drivers and potential headwinds, the overall outlook for 2026 is moderately positive. GDP growth is forecast to reach approximately 1%, a slight acceleration from the 0.9% growth recorded in 2025.

The S&P 500 is navigating a complex landscape. The economic impact of President Trump's tariffs, combined with high stock market valuations and the uncertainty of midterm elections, could trigger a significant decline or even a crash in 2026. For investors, understanding these interconnected risks is crucial.

In a January editorial for The Wall Street Journal, President Trump argued that his administration's tariffs have fueled "extraordinarily high economic growth." He also claimed that foreign exporters are footing the bill. However, a closer look at the data suggests a different narrative.

Deconstructing 2025 GDP Growth

The assertion of tariff-driven growth doesn't align with economic figures. Here’s a breakdown of the first nine months of 2025:

• Underwhelming Performance: Real GDP grew by 2.51%. This rate is actually below the 10-year average (2.75%), the 30-year average (2.58%), and the 50-year average (2.84%).

• The AI Factor: According to the Federal Reserve Bank of St. Louis, spending on artificial intelligence (AI) contributed 0.97 percentage points to GDP growth during this period. Without the boost from AI, the economy would have expanded by just 1.54%. Goldman Sachs noted that without AI, "U.S. GDP would have almost flatlined."

Who Really Pays for the Tariffs?

President Trump’s editorial also stated that foreign producers are absorbing "at least 80% of tariff costs," citing a Harvard Business School study. This appears to be a misinterpretation of the research.

The study he referenced explicitly concludes, "Our results suggest that U.S. consumers paid up to 43 percent of the tariff burden, with the rest absorbed by U.S. firms." The report does not suggest that foreign exporters paid a substantial portion of the tariffs.

The takeaway is clear: contrary to claims, GDP growth in 2025 was subpar and heavily propped up by AI investment, not tariffs.

Beyond the tariff debate, two historical patterns are signaling caution for the S&P 500 in 2026: elevated valuations and the midterm election cycle.

A Market Priced for Perfection

The S&P 500 currently trades at 22.2 times forward earnings, according to FactSet Research. This is a very expensive valuation from a historical perspective. In the last 40 years, the index has only sustained a forward price-to-earnings (P/E) ratio above 22 during two periods: the dot-com bubble and the COVID-19 pandemic. Both were followed by bear markets.

This high valuation is particularly risky because the forward P/E metric already incorporates Wall Street's optimistic expectations for accelerated earnings in 2026. If companies fail to meet these high forecasts as tariffs weigh on the economy, stocks could fall sharply.

Midterm Election Year Jitters

History shows that midterm election years often bring market volatility. The S&P 500 has experienced a median intra-year drawdown of 19% in these years. This pattern suggests there is a 50/50 chance the index could see a similar decline in 2026.

This volatility stems from the uncertainty that midterm elections create. The party in power typically loses seats in Congress, leaving investors to speculate about future fiscal, trade, and regulatory policies.

The stock market faces a convergence of headwinds in 2026. The combination of high valuations, the economic drag from tariffs, and the historical uncertainty of a midterm election year raises the probability of a bear market or even a crash.

However, there is a silver lining for long-term investors. Every past market drawdown has ultimately proven to be a buying opportunity, and there is no reason to believe this time will be different.

India's Trade Minister Piyush Goyal confirmed that a formal trade agreement with the United States is expected to be signed in March, a move that will see New Delhi reduce its tariffs on American goods.

Goyal laid out the first official timeline for the deal, which President Donald Trump first announced on Monday. A joint statement is expected within four to five days, which will trigger Washington to slash duties on Indian exports from 50% to 18%.

The agreement hinges on India halting its purchases of Russian oil and lowering existing trade barriers in exchange for more favorable tariff treatment from the U.S.

A core component of the deal is a commitment from India to import at least $500 billion worth of American goods over the next five years. The purchases will focus on high-value sectors, including energy, aircraft, and computer chips.

Goyal specified that orders from planemaker Boeing alone could amount to between $70 billion and $80 billion. He added that the total value of these aircraft deals would likely "cross $100 billion" when factoring in the cost of engines.

Investors are bracing for Japan's election, but analysts suggest a surprising outcome: a landslide victory for the ruling Liberal Democratic Party (LDP) could be the best news for the country's turbulent bond and currency markets.

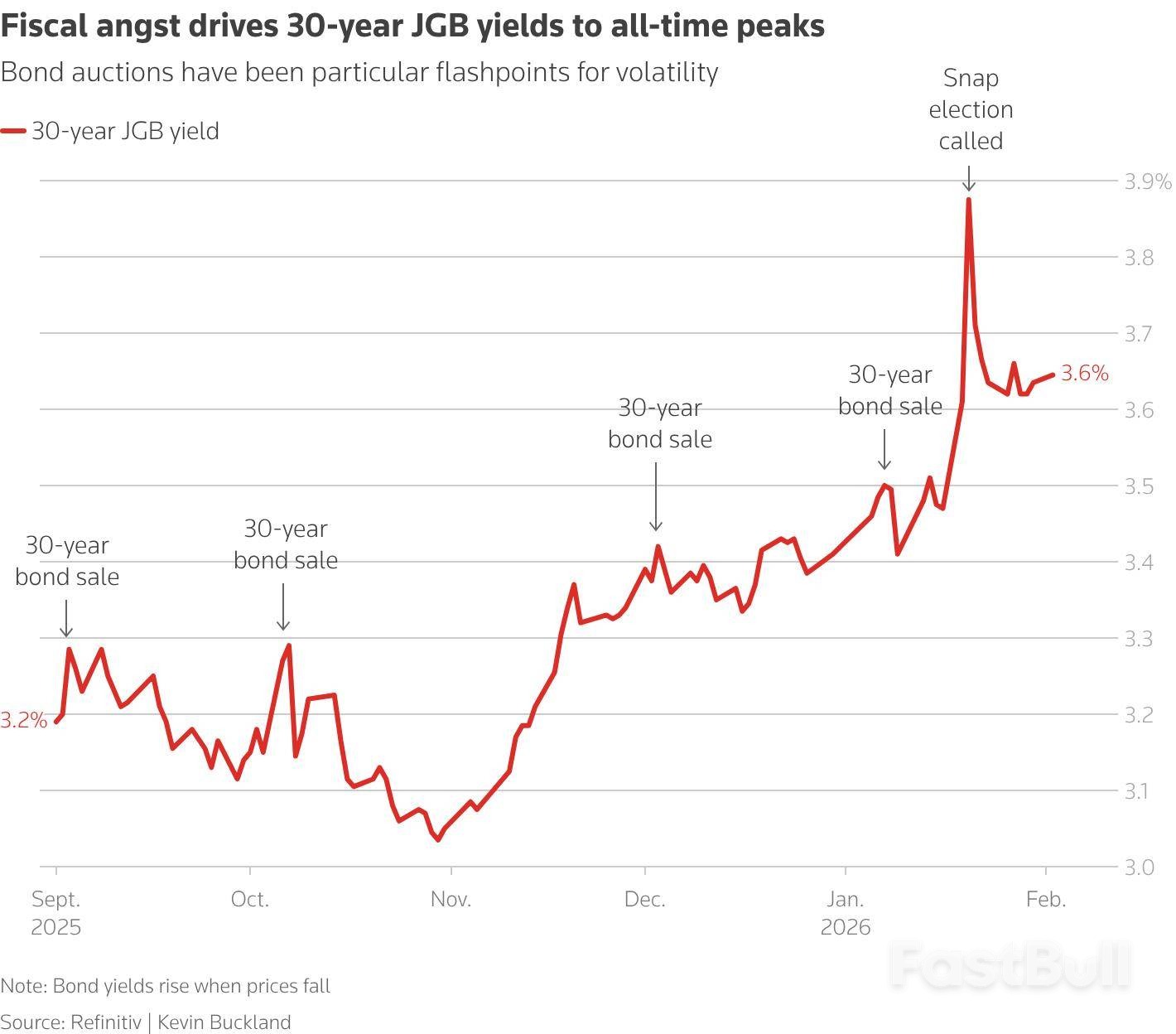

The vote has put markets on edge after fiscal worries recently triggered a sharp selloff in both the yen and Japanese government bonds (JGBs). This instability in Japan quickly spread, pushing up borrowing costs from the United States to Germany and reminding global markets of the high debt levels across major economies.

Paradoxically, an overwhelming LDP victory may ultimately benefit bonds and the yen. Analysts believe a strong mandate would free Prime Minister Sanae Takaichi from needing to negotiate with opposition parties, many of whom are demanding even deeper tax cuts and more aggressive government spending.

A comfortable majority would also give her more flexibility to respond to market pressure and adjust policies to prevent further yen weakness or a spike in borrowing costs—a pattern she has demonstrated in the past.

According to a recent poll, the LDP and its coalition partner Ishin could secure as many as 300 seats in the 465-seat lower house.

"I don't know if it's going to be a landslide, but certainly Takaichi finds herself in an advantageous situation," said Shoki Omori, chief Japan desk strategist at Mizuho Securities. "That's why she doesn't necessarily need to worry about further ramping up spending... Initially, I think the LDP and Takaichi were a little bit desperate, so to speak."

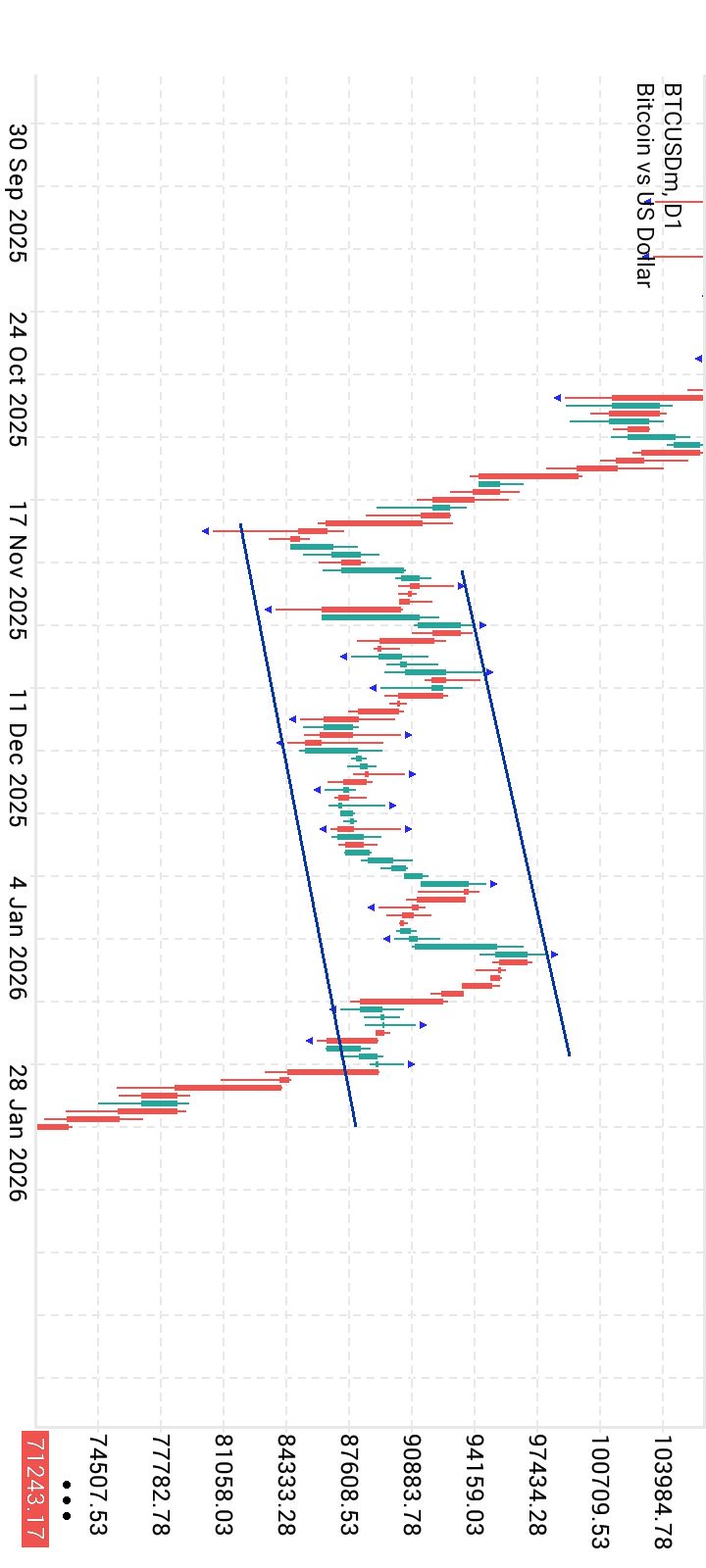

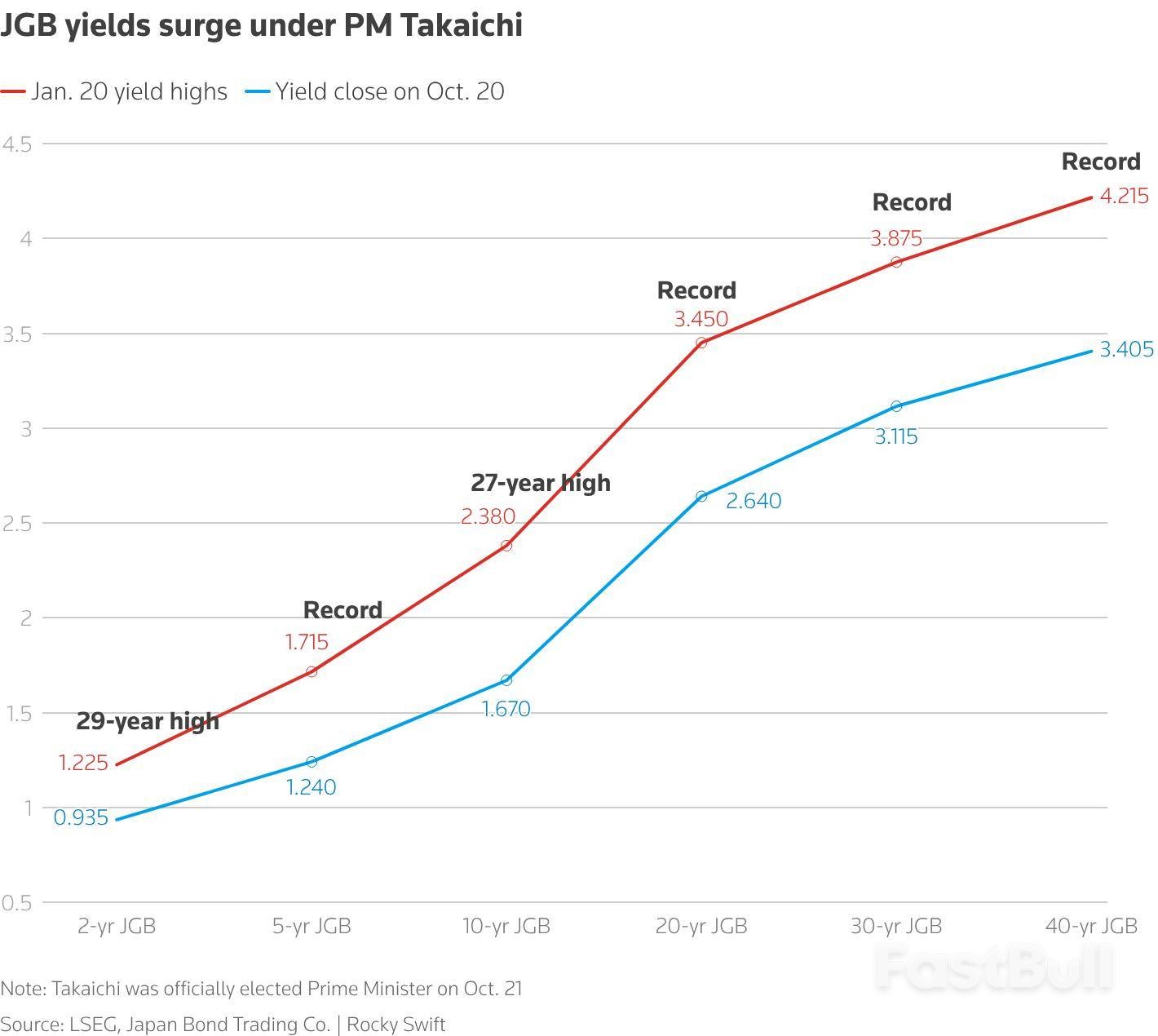

Since Takaichi—a fiscal dove and follower of former premier Shinzo Abe's "Abenomics"—won the LDP leadership in October, markets have been volatile. JGB yields have soared to all-time highs as bond prices have fallen.

Meanwhile, the yen has fallen to a near 18-month low against the dollar. This has prompted Japanese policymakers to repeatedly threaten market intervention to defend the currency.

The rising cost of living is a central issue in this election, and voters have increasingly blamed the persistent weakness of the yen for driving up the price of imports. At the same time, rising bond yields translate into higher mortgage rates and increased borrowing costs for businesses, with any debt market rout risking a spillover into Japanese stocks.

The turmoil has also drawn international attention. The United States has criticized the volatility in Japanese markets for its spillover effects and has urged Tokyo to restore stability—a task that could be easier with a large parliamentary majority.

"Although the administration may initially aim to strengthen its proactive fiscal expansion, pressure from the markets and the U.S. administration would compel it to exercise restraint," wrote Barclays analysts led by Shinichiro Kadota. "The reduced need for cooperation with the opposition would also support this shift."

Takaichi has shown a willingness to bend to market pressure. Earlier this week, she walked back campaign comments perceived as favoring a weak yen. In November, she was forced to clarify her fiscal stance after a 21.3 trillion yen ($135.72 billion) stimulus package rattled the bond market.

The so-called super-long bonds have been especially sensitive to any hint of loosened fiscal discipline in Japan, which is already the most indebted nation in the developed world.

On January 20, yields on 30-year bonds surged to a record 3.88% after Takaichi called the election and pledged a two-year suspension of the food tax. She did not specify how she would cover the estimated 10 trillion yen revenue shortfall, spooking investors.

While that selloff could resume, Takaichi's fiscal proposals are starting to look conservative compared to those from the opposition.

An analysis of campaign pledges reveals why a strong LDP mandate might lead to more fiscal restraint:

• Takaichi's LDP: Pledged to suspend the 8% food tax for two years.

• Centrist Reform Alliance: Wants to abolish the food tax entirely.

• Democratic Party for the People: Proposes slashing all value-added taxes to 5%.

This context suggests that if Takaichi secures a large majority, she may have the political cover to avoid implementing her most costly promises.

"What the LDP has promised is to 'work on' a reduction of the consumption tax on foods," noted Norihiro Yamaguchi, senior Japan economist at Oxford Economics, implying it is not a firm commitment. "If there is no longer a need to accommodate the opposition's demands, the necessity for doing so naturally diminishes."

Saudi Arabia has opened its stock market to all foreign investors, a landmark move under its Vision 2030 plan to liberalize the economy and reduce its dependence on oil revenue.

Previously, direct access to the Saudi Exchange, or Tadawul, was restricted to qualified institutional investors selected by authorities. As of February 1, that has changed. Smaller institutions, funds, family offices, and individual investors are now permitted to participate directly, without needing to use swap arrangements or exchange-traded funds.

The market has responded positively. The Tadawul All-Share Index has climbed approximately 10% since the Capital Market Authority (CMA) announced the reform on January 6, reversing a downtrend from the previous ten weeks. Mohanad Yakout, a senior market analyst at Scope Markets, noted that the jump shows investors view the policy as a "meaningful catalyst for revising up the market's valuation."

The Tadawul is the largest and most liquid stock market in the Middle East, with a capitalization of 8.8 trillion Saudi riyals ($2.35 trillion) at the end of 2025. Foreign stock ownership had already increased by 92 billion riyals to 590 billion riyals in the first three quarters of 2025.

Several benchmark index companies already have significant foreign investment.

• Al-Babtain Power & Telecom: 33.8% foreign-held

• Edarat Group: 24.6% foreign-held

• Etihad Etisalat: 23.74% foreign-held

While the 49% cap on foreign ownership in any single listed company remains in place, Yakout believes this liberalization intensifies "competition for regional financial primacy with the Emirati markets that have historically benefited from more permissive foreign ownership regimes."

This market opening is part of a broader national transformation. Over the past decade, Saudi Arabia has worked to soften its image by easing regulations, opening cinemas, and introducing tourist visas. It has also successfully bid for major global events like the FIFA World Cup 2034 and World Expo 2030. In January, a new law was implemented allowing non-Muslim foreigners to own property.

The push for economic diversification comes as the government faces pressure from lower oil prices. It more than doubled its 2025 budget deficit forecast to 5.3% of GDP and expects a deficit of 165 billion riyals, or 3.3% of GDP, for this year. This fiscal pressure is widely seen as a key driver for economic reforms.

Despite the opportunities, analysts caution that investing in the Saudi market carries significant risks, primarily because many of its largest companies are closely tied to the state.

Popular listings with Asian investors—including Saudi Aramco, Saudi Basic Industries, Al Rajhi Bank, and ACWA Power—offer growth at a reasonable price. However, these companies operate in strategic sectors like energy, chemicals, banking, and utilities, which are subject to intense government control.

"Competition is limited, government involvement is high, and decision-making reflects longer-term strategic priorities rather than short-term shareholder returns," said Alice Gower, a partner at Azure Strategy.

Other risks cited by analysts include the economy's heavy reliance on oil prices and a perceived lack of robust shareholder protections.

While risks exist, the sheer scale and liquidity of the Saudi market help mitigate them, particularly for long-term investors. In contrast, Dubai's stock market may offer higher potential returns but also comes with greater cyclical risk tied to real estate, retail flows, and shifting investor sentiment. This leads investors to adopt a more tactical approach in Dubai.

Saudi Arabia also offers a stable investment environment in other ways.

• No Formal Capital Controls: Foreign investors can generally repatriate capital and profits without restriction.

• Currency Stability: The Saudi riyal is pegged to the U.S. dollar, anchoring the exchange rate.

• Free Currency Conversion: Investors can convert currency freely.

These factors boost investor confidence. However, Pratibha Thaker, editorial director at the Economist Intelligence Unit, pointed out that "indirect constraints remain in the form of foreign ownership limits, sectoral restrictions and administrative frictions, which can still shape investment decisions and limit control-seeking strategies."

With the Vision 2030 agenda in full swing, some experts expect further liberalization. The most significant potential change on the horizon involves the foreign ownership cap.

"The biggest needle mover will be any changes to foreign ownership caps, which is considered a possible move later this year," said Gower. Such a reform could unlock another wave of foreign capital and further integrate the Tadawul into the global financial system.

China's foreign ministry has expressed regret over the expiration of the New START treaty, the landmark nuclear arms agreement between the United States and Russia. Beijing is now urging Washington to resume strategic dialogue with Moscow to maintain global stability.

The treaty, which for over half a century placed limits on the strategic nuclear arsenals of both nations, officially lapsed on Wednesday. In response, Russia stated it remains open to security discussions but will counter any emerging threats.

Foreign ministry spokesperson Lin Jian articulated China's position, describing the treaty's expiration as a regrettable development with serious implications.

"China regrets the expiration of the New START Treaty, as the treaty is of great significance to maintaining global strategic stability," Lin stated. He noted widespread international concern that the treaty's end could negatively impact the global nuclear arms control framework.

Following Russia's proposal to continue observing the treaty's core limitations, China has called on the United States to engage constructively.

"China calls on the United States to respond positively, handle the treaty's follow-up arrangements responsibly, and resume strategic stability dialogue with Russia as soon as possible," Lin added, emphasizing that this reflects the expectations of the international community.

The foreign ministry also took the opportunity to reiterate China's established nuclear policy. Lin emphasized that China adheres strictly to a self-defense strategy and maintains its nuclear forces at the minimum level required for national security.

"China has consistently adhered to a self-defense nuclear strategy, abided by the policy of no first use of nuclear weapons and has made unconditional commitments not to use or threaten to use nuclear weapons against non-nuclear-weapon states or nuclear-weapon-free zones," he explained.

Lin also addressed China's role in future arms control negotiations, stating that its arsenal is not comparable in size to those of Washington and Moscow. Citing this disparity, he confirmed that China will not participate in their bilateral disarmament talks at this stage.

Meanwhile, the White House indicated this week that President Donald Trump would determine the future of U.S. nuclear arms control policy and would "clarify on his own timeline."

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up