Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The job market is weak enough to warrant another quarter-point rate cut in December, though action beyond that depends on an upcoming flood of data delayed by the government shutdown, Fed Governor Christopher Waller said on Monday.

The job market is weak enough to warrant another quarter-point rate cut in December, though action beyond that depends on an upcoming flood of data delayed by the government shutdown, Fed Governor Christopher Waller said on Monday.

Since the last Fed meeting, "most of the private sector and anecdotal data that we've gotten is that nothing has really changed. The labor market is soft. It's continuing to weaken," with inflation expected to ease, Waller said on Fox Business' Mornings with Maria.

While that makes a December cut appropriate, "January could be a little trickier, because we're going to get a flood of data that's released. If it is kind of consistent with what we've seen, then you can make the case for January. But if it suddenly shows a rebound in inflation or jobs or the economy's taking off, then it might give concern" about more cuts, Waller said.

Fed officials are divided over whether to cut rates again at the December meeting, though recent comments from top policymakers - including New York Fed President John Williams on Friday - have shifted market expectations strongly in favor of another quarter-point reduction at their December 9-10 meeting. According to CME Group's FedWatch tool, the futures-market-implied probability of a quarter point reduction to a range of 3.50% to 3.75% is now about 83%, roughly double what it had been a week ago.

The Fed will remain information-constrained at that session, with government statistical agencies still digging through the backlog of work from the 43-day shutdown that ended November 14. The Bureau of Labor Statistics already has said it will not release a jobs or consumer inflation report for October, while the reports for November will not become public until after the Fed meets.

In the absence of those keystone data releases, officials are relying more heavily on information from private providers and on their own contacts in businesses and households around the country. Much of that information is compiled into a compendium known as the Beige Book that is released two weeks prior to each Fed meeting, with the next version due out on Wednesday.

"The labor market is still weak and ... we're getting no evidence telling me it's rebounding," Waller said. He downplayed the recently released September jobs report, showing the economy added a more-than-expected 119,000 jobs that month, as likely to be revised lower. The September report also showed the unemployment rate rose to 4.4% from 4.3% the month before.

One other policymaker joined Waller in voicing that concern on Monday. San Francisco Fed President Mary Daly, who had been on the fence over whether to support a third consecutive rate cut next month, told the Wall Street Journal she now backs a reduction.

"On the labor market, I don't feel as confident we can get ahead of it," she said in an interview Monday. "It's vulnerable enough now that the risk is it'll have a nonlinear change."

Daly, who does not have a vote on policy this year but like all Fed policymakers has a voice at the debate during meetings, now views an inflation surge as a lower risk.

By the time of the next meeting on January 27-28, however, Waller, Daly and their colleagues should be able to better gauge which of two views of the economy are starting to materialize - the one where inflation stays persistent with a risk of moving higher, a possibility that has led several regional reserve bank presidents to oppose further rate cuts, or the one where job growth remains weak and the unemployment rate increases, the outcome Waller finds most concerning.

Fed officials at the upcoming meeting will issue new economic projections that could reset expectations for any rate reductions next year. Policymakers were divided on the outlook in September, with the median official seeing only one further rate hike in 2026. Investors currently anticipate two to three cuts next year, according to data from the CME Group's FedWatch.

By the next meeting, the Fed should have in hand official estimates for jobs, the unemployment rate, and inflation through December.

"You may see a more of a meeting-by-meeting approach once you get to January," Waller said. "But I still don't think the labor market is going to turn around in the next six to eight weeks."

Prime Minister Mark Carney and Alberta Premier Danielle Smith have agreed to the broad terms of a deal that would support a new oil pipeline to Canada's west coast, the Canadian Broadcasting Corp. reported Monday.

Currently Canada has rules which Smith and industry observers say deter investors from committing to a new conduit to ferry Alberta's oil to the coast of British Columbia, and then to Asian markets. The most obvious legal block is a ban on tankers carrying oil off the northern British Columbia coast.

The federal and provincial leaders are set to announce a milestone deal granting special exemptions and "political support" to a new pipeline at a press conference in Calgary, Alberta, on Thursday, the report said, citing anonymous sources. Carve-outs would be contingent on commitments to stricter carbon pricing and a "multi-billion-dollar investment" in carbon capture from a group of oil sands companies called the Pathways Alliance, the story added.

Such a deal would mark a breakthrough in the tense relationship between the Ottawa-based-federal government, which strengthened environmental protections under previous Prime Minister Justin Trudeau, and the conservative oil-rich province.

A new oil pipeline is totemic for some Albertans who say the federal government holds back their province's economic potential. The idea has gained wider support as Canada attempts to diversify its exports away from the US, after President Donald Trump's tariffs and remarks about making Canada a US state. Currently, most all of Canada's oil — among the country's largest exports — is sent south. But adding export capacity runs up against the country's ambitions to cut greenhouse gas emissions.

"We hope to have more to share in the coming days," a spokesperson for Premier Smith's office said by phone, declining to elaborate on specifics. The Prime Minister's office declined to comment.

British Columbia Premier David Eby has expressed vehement opposition to a new pipeline, and cites Indigenous leaders from the region who are also against the idea. He's said forcing through a pipeline could jeopardize Indigenous support for other major projects in BC like liquefied natural gas facilities.

However, Eby does not have a legal veto power. BC was unsuccessful when mounted court challenges to the expansion of the Trans Mountain pipeline, which was completed last year and can carry 890,000 barrels of oil per day to the Vancouver area.

Bitcoin investors received an unexpected shock today as the leading cryptocurrency's price tumbled below the critical $88,000 threshold. According to real-time market data from Bitcoin World, BTC is currently trading at $87,975.05 on the Binance USDT market, marking a significant downturn that has caught many traders by surprise.

The sudden drop in Bitcoin price below $88,000 represents one of the most notable market movements this week. Several factors appear to be contributing to this downward pressure. Market analysts point to increased regulatory concerns, profit-taking by early investors, and broader economic uncertainties as potential catalysts. However, experienced cryptocurrency traders understand that such fluctuations are normal in the volatile digital asset space.

While any drop below a major psychological level like $88,000 grabs headlines, context matters greatly. The current Bitcoin price represents:

Many analysts suggest this could present a buying opportunity for long-term investors who believe in Bitcoin's fundamental value proposition.

Facing a declining Bitcoin price requires strategic thinking rather than emotional reactions. Consider these approaches:

Technical analysts are watching several key levels closely. The $85,000 zone represents major support, while resistance sits around $92,000. The current Bitcoin price action suggests we might see continued volatility in the coming days. However, many long-term indicators remain positive for cryptocurrency overall.

Experienced investors recognize that Bitcoin price movements often follow predictable patterns. The current correction, while concerning to newcomers, fits within historical market behavior. Previous cycles have shown that such dips often precede periods of consolidation and eventual recovery.

The recent Bitcoin price drop below $88,000 serves as a reminder of cryptocurrency's inherent volatility. While short-term movements can be dramatic, the fundamental case for Bitcoin remains strong. Technological adoption continues growing, institutional interest persists, and the network effect strengthens daily. Smart investors use these moments to reassess their strategies rather than panic.

Tyson Foods' decision to close a beef plant that employs nearly one third of residents of Lexington, Nebraska, could devastate the small city and undermine the profits of ranchers nationwide.

Closing a single slaughterhouse might not seem significant, but the Lexington plant employs roughly 3,200 people in the city of 11,000 and has the capacity to slaughter some 5,000 head of cattle a day. Tyson also plans to cut one of the two shifts at a plant in Amarillo, Texas, and eliminate 1,700 jobs there. Together those two moves will reduce beef processing capacity nationwide by 7-9%.

Consumers may not see prices change much at the grocery store over the next six months because all the cattle that are now being prepared for slaughter will still be processed, potentially just at a different plant. But in the long run, beef prices may continue to climb even higher than the current record highs — caused by a variety of factors from drought to tariffs — unless American ranchers decide to raise more cattle, which they have little incentive to do.

An increase in beef imports from Brazil, like President Donald Trump encouraged last week by slashing tariffs on the South American country, may help insulate consumers while ranchers and feedlots struggle with high costs and falling prices.

Here's what we know about the impact of the plant closure and the changing tariffs:

Clay Patton, vice president of the Lexington-area Chamber of Commerce said Monday that Tyson's announcement Friday felt like a "gut punch" to the community in the Platte River Valley that serves as a key link in the agricultural production chain.

When it opened in 1990, the Lexington plant that Tyson later acquired revitalized and remade the formerly dwindling town by attracting thousands of immigrants to work there and nearly doubling the population.

When the plant closes in January, the ripple effects will be felt throughout the community, undermining many first-generation business owners and the investment in new housing, Patton said. Tyson said it will offer Lexington workers the chance to move to take open jobs at one of its other plants if they are willing to uproot their families for jobs hundreds of miles away.

"I'm hopeful that we can come through this and we'll actually become better on the other side of it," Patton said.

Elmer Armijo was struck by how established the community when he moved to Lexington last summer to lead First United Methodist Church. He described solid job security, good schools and health care systems and urban development — all in doubt now.

"People are completely worried," Armijo said. "The economy in Lexington is based in Tyson."

Many local churches, Armijo's included, are already offering counseling, food pantries and gas vouchers for community members.

The prospect of losing a major buyer for cattle and increasing imports from Brazil, which already accounted for 24% of the beef brought into the country this year, only adds to doubts about how profitable the U.S. cattle business might be over the next several years, making it less likely that American ranchers will commit to raising more animals.

"There's a just a lack of confidence in the industry right now. And producers are unwilling to make the investment to rebuild," said Bill Bullard, president of Ranchers-Cattlemen Action Legal Fund United Stockgrowers of America.

Boosting imports from Brazil has the potential to affect the market — much more than Trump's suggestion to increase imports from Argentina — since the country sends more beef to America than any other. But for steak lovers, the sky-high price of the cut isn't likely to be affected regardless, as most imports are lean trimmings that get mixed into ground beef.

Kansas State University agricultural economist Glynn Tonsor said it's hard to predict whether imports will continue to account for roughly 20% of the U.S. beef supply next year. He pointed out that Trump's tariffs have changed several times since they were announced in the spring and could quickly change again.

The only constant in the equation has been that consumers have continued to buy beef even as prices soar. Tonsor said on average Americans will consume 59 pounds (27 kilograms) of beef per person this year.

There has long been excess capacity in the meat business nationwide, meaning the nation's slaughterhouses could handle many more cattle than they are processing. That has only been made worse in recent years as the government has encouraged more smaller companies to open slaughterhouses to compete with Tyson and the other giants that dominate the beef business.

Tyson expects to lose more than $600 million on beef production this year after already reporting $720 million of red ink in beef over the past two years.

Tonsor said it was inevitable that at least one beef plant would close. Afterward, Tyson's remaining plants will be able to operate more efficiently at closer to full capacity.

Ernie Goss, an economist at Creighton University in Omaha, said the Lexington plant likely wasn't measuring up in the industry increasingly reliant on technological advancements that enhance productivity.

"It's very difficult to renovate or make the old plant fit the new world," said Goss, who completed an impact study for a new Sustainable Beef plant. The Lexington facility "just wasn't competitive right now in today's environment in terms of output per worker."

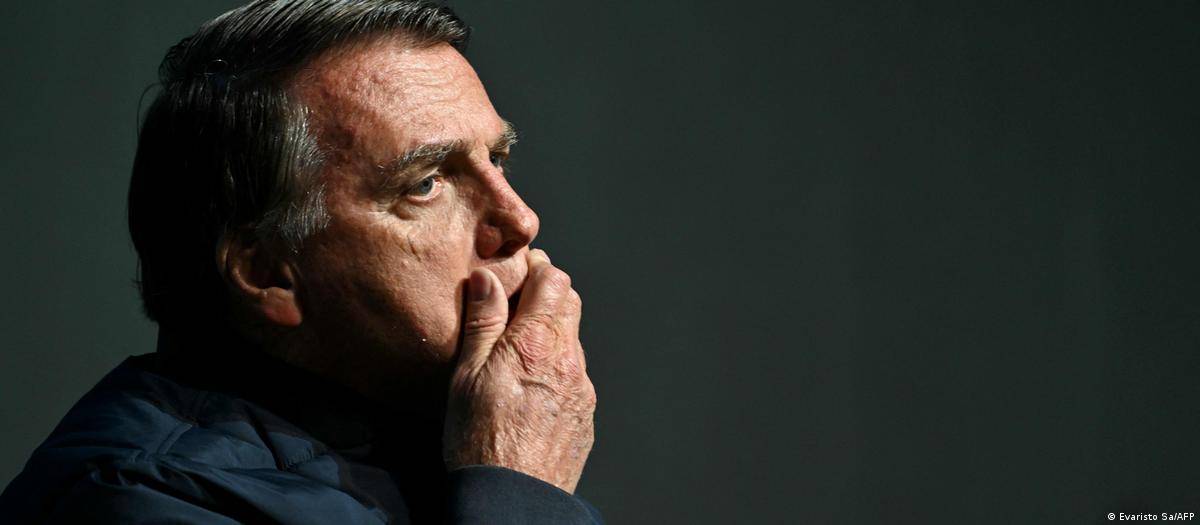

A panel of four Supreme Court judges unanimously upheld on Monday a decision to incarcerate Brazil's former President Jair Bolsonaro, after he was arrested over the weekend when he tampered with his ankle monitor.

Justice Alexandre de Moraes ordered Bolsonaro's detention on Saturday, citing fears he might try to escape custody if allowed to stay on house arrest, where he has been awaiting an appeal against his 27-year prison sentence for plotting a failed coup.

On Monday, Justices Flavio Dino, Cristiano Zanin and Carmen Lucia upheld de Moraes' order.

On Saturday, Brazilian authorities said the former, far-right president took a soldering iron to his ankle monitor.

De Moraes ruled on Monday that Bolsonaro had "willfully and consciously violated the electronic monitoring equipment."

The justice pointed at "very serious indications of a possible attempt to flee" during a vigil which Bolsonaro's son organized on Saturday outside his home, near the US embassy.

De Moraes added that the location and Bolsonaro's close ties to US President Donald Trump are further indicators that he may have tried to escape to the embassy to seek US asylum.

Authorities said the former, far-right president took a soldering iron to his ankle monitorImage: SEAPE/REUTERS

Authorities said the former, far-right president took a soldering iron to his ankle monitorImage: SEAPE/REUTERSOn Sunday, Bolsonaro told a hearing that he suffered medication-induced paranoia between Friday and Saturday, which was to blame for his tampering with the ankle monitor.

The former president said he "had no intention of fleeing."

The French AFP news agency cited another testimony by Bolsonaro in a video made public by the court, in which he reportedly said he used the soldering iron on the bracelet out of "curiosity."

Bolsonaro was convicted in September of plotting to overturn the 2022 election result that brought leftist President Luiz Inacio Lula da Silva to office.

U.S. President Donald Trump on Monday signed an executive order aimed at launching a pan-government venture to build an integrated artificial intelligence platform that will use federal scientific data.

The venture, which Trump called the "Genesis Mission," aims to boost scientific research and fast track discoveries by using AI and massive government scientific datasets.

"The Genesis Mission will build an integrated AI platform to harness Federal scientific datasets… to train scientific foundation models and create AI agents to test new hypotheses, automate research workflows, and accelerate scientific breakthroughs," Trump wrote in the order.

The effort will involve the Department of Energy, the National Science and Technology Council, and U.S. National Laboratories, the order said.

Trump instructed the DOE to create a government AI experimentation platform integrating U.S. supercomputers and data to create foundation AI models and also power robotic laboratories.

Trump has touted U.S. dominance in AI as a main goal for his administration, and has also prioritized beating China in the technology. He had earlier this year ordered his administration to produce an AI action plan to maker the U.S. the "world capital" in AI.

AUDUSD – Last Friday's bounce from new three-month low (bears were contained by the top of thick weekly Ichimoku cloud) was repeatedly obstructed by broken 200DMA (0.6458 – reverted to resistance)

Monday's action is moving within limited range and shaped in long-legged Doji candle and signals indecision.

Conflicting fundamental signals (the latest dovish comments from Fed official revived expectations of December rate cut but countered by still prevailing concerns about inflation that may keep the central bank's rates on hold next month) contribute to the current situation.

Investors also focus on Australia's inflation report (due on Wednesday and the first time to be released on monthly basis, replacing old system of quarterly reports).

Technical picture remains bearishly aligned on daily chart (MA's in bearish setup / negative momentum), with reaction on 200DMA to provide fresh signal.

Close above the moving average (0.6458, also Fibo 23.6% of 0.6580/0.6412) to add fresh optimism, though more work at the upside (lift above 0.6500 zone) needed to verify signal.

Conversely, repeated close below 200DMA to keep the downside at increased risk of violation of Aug 21 low (0.6414) and nearby Fibo 38.2% of larger 0.5914/0.6706 (0.6404).

Res: 0.6467; 0.6481; 0.6500; 0.6520

Sup: 0.6421; 0.6414; 0.6372; 0.6350

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up