Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Kugler did not attend this week’s rate-setting Federal Open Market Committee meeting, which is unusual.

President Donald Trump on Friday said that he ordered two nuclear submarines "to be positioned in the appropriate regions" in response to warnings made to the United States by top Russian official Dmitry Medvedev earlier this week.

"Based on the highly provocative statements of the Former President of Russia, Dmitry Medvedev, who is now the Deputy Chairman of the Security Council of the Russian Federation, I have ordered two Nuclear Submarines to be positioned in the appropriate regions, just in case these foolish and inflammatory statements are more than just that," Trump said in a Truth Social post.

"Words are very important, and can often lead to unintended consequences. I hope this will not be one of those instances. Thank you for your attention to this matter!"

Medvedev, in a post on X on Monday, wrote, "Trump's playing the ultimatum game with Russia: 50 days or 10… He should remember 2 things."

"1. Russia isn't Israel or even Iran. 2. Each new ultimatum is a threat and a step towards war," Medvedev wrote.

"Not between Russia and Ukraine, but with his own country. Don't go down the Sleepy Joe road!" Medvedev added, referring to former President Joe Biden.

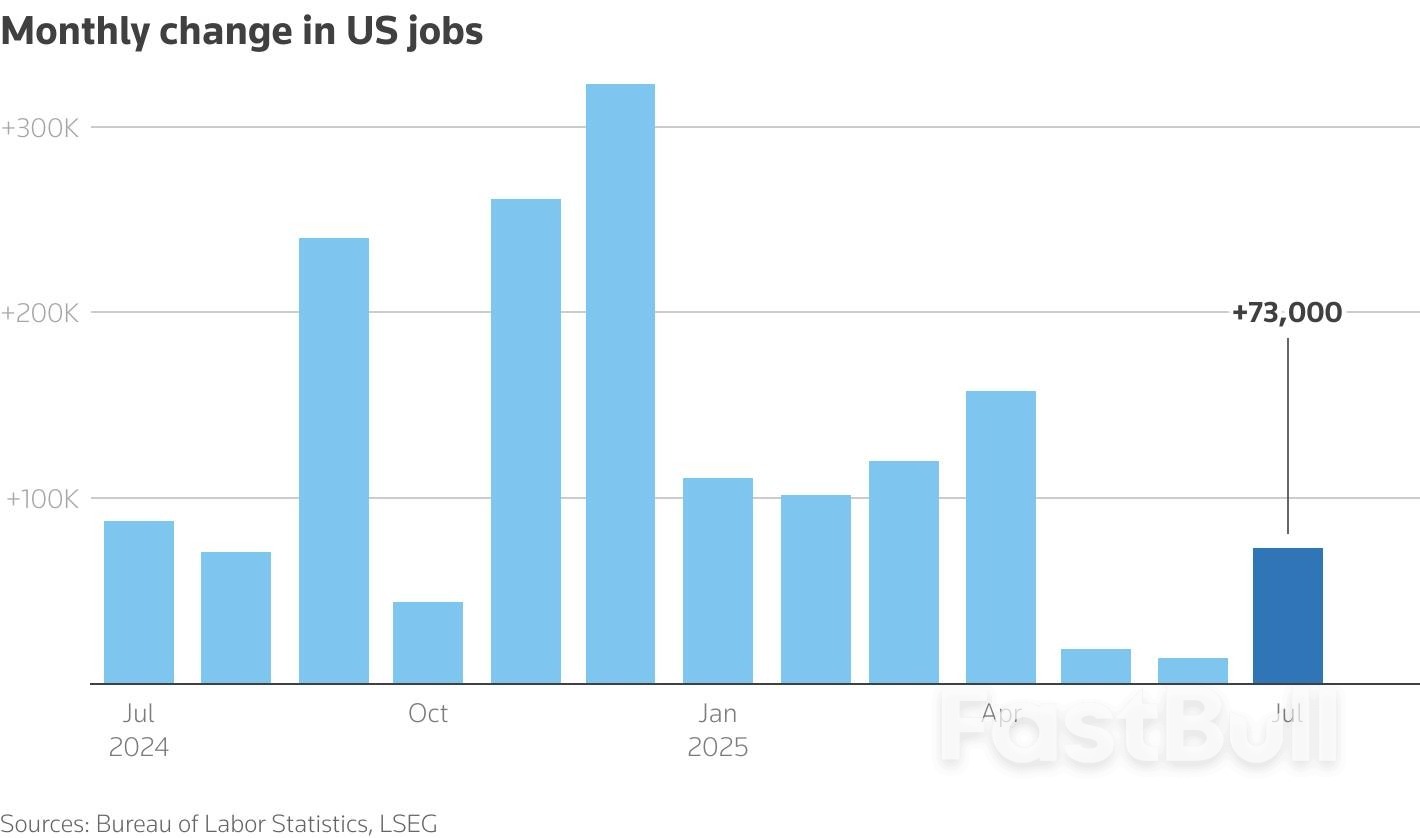

U.S. employment growth was weaker than expected in July while the nonfarm payrolls count for the prior two months was revised down by a massive 258,000 jobs, suggesting a sharp deterioration in labor market conditions that puts a September interest rate cut by the Federal Reserve back on the table.

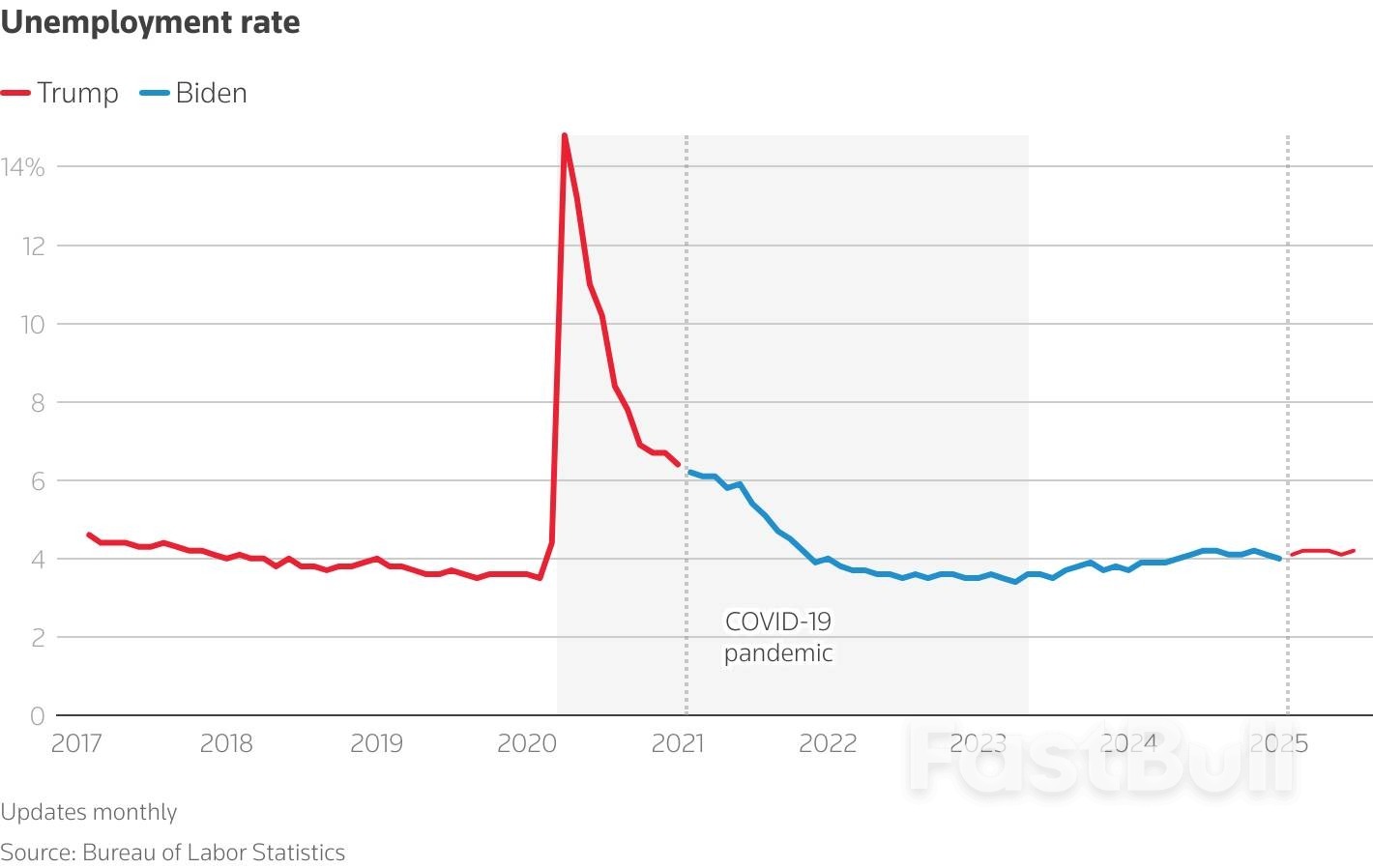

The Labor Department's closely watched employment report on Friday also showed the unemployment rate rose to 4.2% last month as household employment declined. Labor market resilience has shored up the economy amid headwinds from President Donald Trump's aggressive trade and immigration policies.

Import duties are starting to boost inflation, raising the risk that the economy could experience a period of tepid growth and high prices, known as stagflation, which would put the U.S. central bank in a difficult position. Domestic demand increased at its slowest pace in 2-1/2 years in the second quarter.

"The president's unorthodox economic agenda and policies may be starting to make a dent in the labor market," said Christopher Rupkey, chief economist at FWDBONDS. "The door to a Fed rate cut in September just got opened a crack wider. The labor market is not rolling over, but it is badly wounded and may yet bring about a reversal in the U.S. economy's fortunes."

Nonfarm payrolls increased by 73,000 jobs last month after rising by a downwardly revised 14,000 in June, the fewest in nearly five years, the Labor Department's Bureau of Labor Statistics said. Economists polled by Reuters had forecast payrolls would increase by 110,000 jobs after rising by a previously reported 147,000 in June. Estimates ranged from no jobs added to an increase of 176,000 positions.

Payrolls for May were slashed by 125,000 to only a gain of 19,000 jobs. The BLS described the revisions to May and June payrolls data as "larger than normal."

It gave no reason for the revised data but noted that "monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors."

Economists have raised concerns about data quality in the wake of the Trump administration's mass firings of federal workers.

Employment gains averaged 35,000 jobs per month over the last three months compared to 123,000 a year ago. Uncertainty over where tariff levels will eventually settle has made it harder for businesses to plan long-term, economists said.

Though more clarity has emerged as the White House announced trade deals, economists said the effective tariff rate was still the highest since the 1930s. Trump on Thursday slapped dozens of trading partners with steep tariffs, including a 35% duty on many goods from Canada.

Trump, who has demanded the U.S. central bank lower borrowing costs, stepped up his insults aimed at Fed Chair Jerome Powell, posting on the Truth Social media platform, "Too Little, Too Late. Jerome "Too Late" Powell is a disaster."

The Fed on Wednesday left its benchmark interest rate in the 4.25%-4.50% range. Powell's comments after the decision undercut confidence the central bank would resume its policy easing in September as had been widely anticipated by financial markets and some economists.

Powell is focused on the unemployment rate. Financial markets now expect the Fed to resume its monetary policy easing next month after pushing back rate-cut expectations to October in the wake of Wednesday's policy decision.

The case for a September rate cut could be reinforced by the BLS' preliminary payrolls benchmark revision next month, which is expected to project a steep drop in the employment level from April 2024 through March of this year.

The Quarterly Census of Employment and Wages data, derived from reports by employers to the state unemployment insurance programs, has indicated a much slower pace of job growth between April 2024 and December 2024 than payrolls have suggested.

Stocks on Wall Street were trading lower on the data and latest round of tariffs. The dollar fell against a basket of currencies. U.S. Treasury yields dropped.

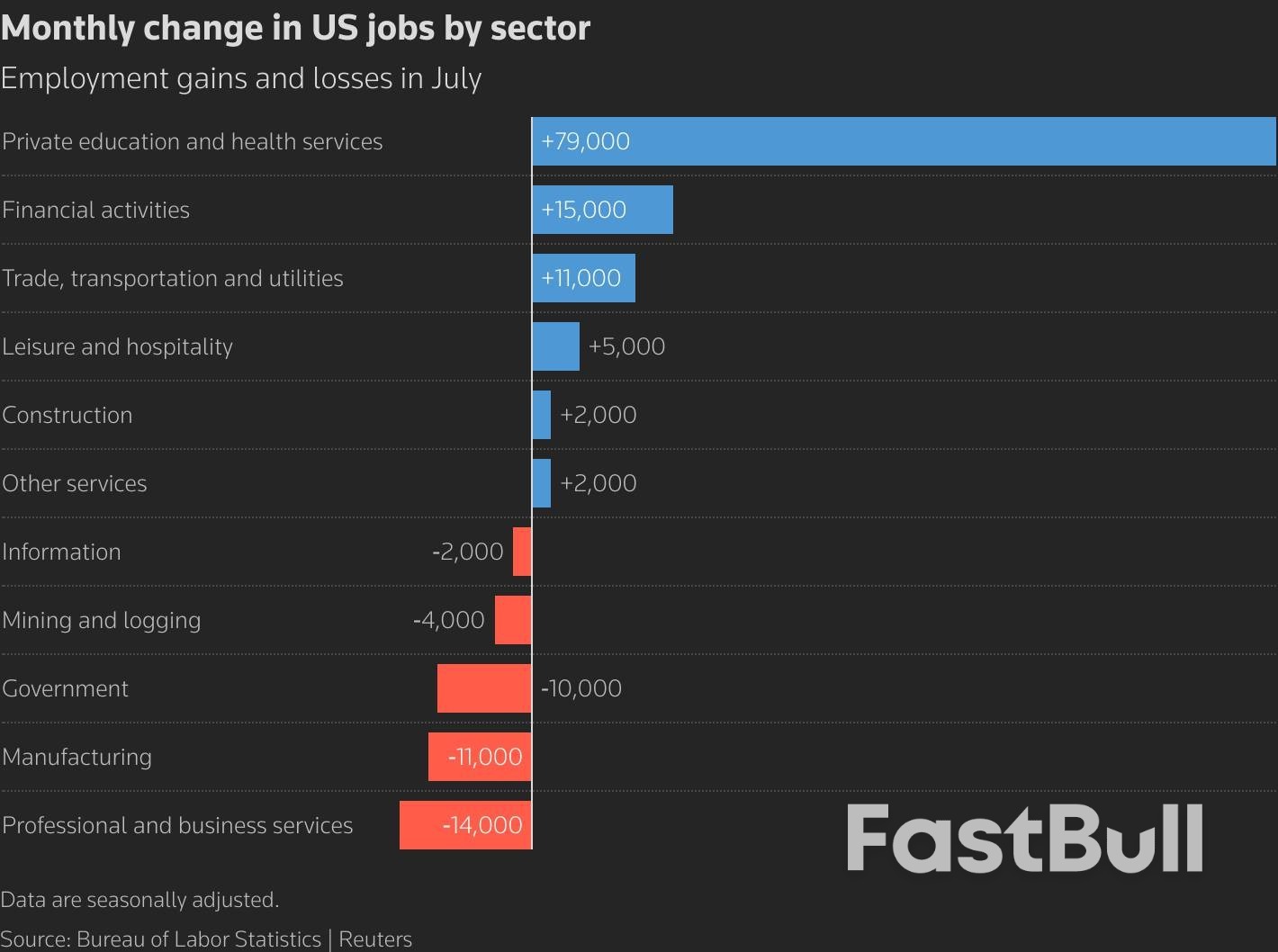

Job gains in July continued to be concentrated in the healthcare and social assistance sector, which added a combined 73,300 jobs. Retail employment increased by 15,700 jobs and financial activities payrolls rose by 15,000.

There were small job gains in the construction and leisure and hospitality industries, which economists attributed to ongoing immigration raids. Several industries, including manufacturing, professional services and wholesale trade shed jobs.

The share of industries reporting job growth, however, rose to 51.2% from 47.2% in June. Federal government employment dropped by another 12,000 positions and is down 84,000 since peaking in January. More job losses are likely after the Supreme Court gave the White House the green light for mass firings as Trump seeks to slash spending and headcount. But the administration has also said several agencies were not planning to proceed with layoffs.

The unemployment rate increased to 4.248% before rounding last month. It declined to 4.1% in June also as people dropped out of the labor force, and remains in the narrow 4.0%-4.2% range that has prevailed since May 2024.

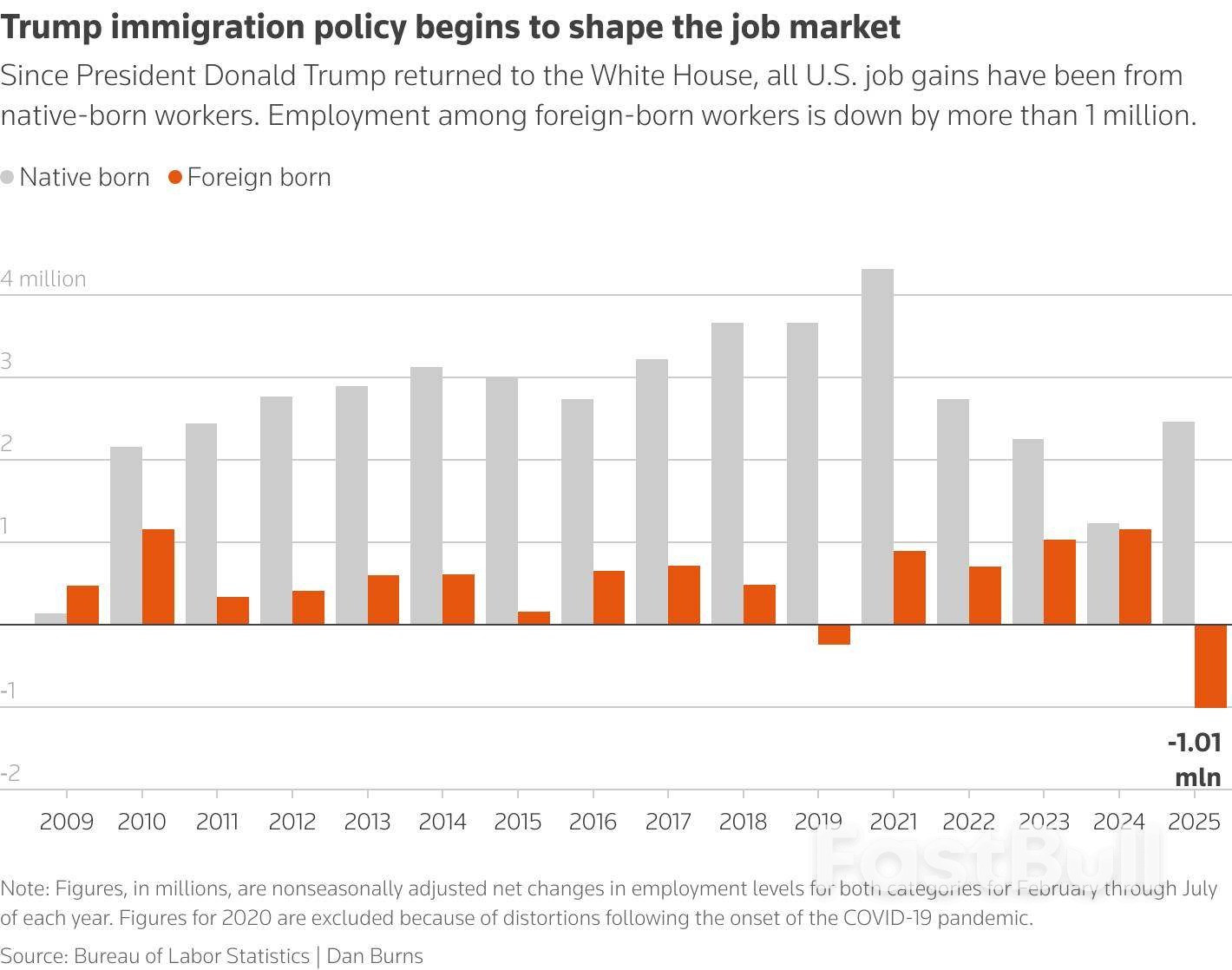

The government's immigration crackdown has reduced labor supply, as has an acceleration of baby boomer retirements. Economists estimated the economy now needs to create less than 100,000 jobs per month to keep up with growth in the working-age population.

About 38,000 people left the labor force, which was offset by a drop of 260,000 in household employment. The labor force participation rate fell to 62.2% from 62.3% in June, now down for three straight months and capping the rise in the jobless rate.

"Without the participation rate decline, the unemployment rate would have added another tenth to a solid 4.3%," said Michael Gapen, chief U.S. economist at Morgan Stanley. "Immigration restrictions have and will continue to have a chilling effect on participation and will continue to add to downward pressure on the unemployment rate."

The number of foreign-born workers fell by 341,000. Economists said this decline along with the drop in the labor force kept annual wage growth at a lofty 3.9%. There were more part-time workers and a jump in the number of people experiencing long bouts of unemployment. The median duration of unemployment increased to 10.2 weeks from 10.1 weeks in June.

"One gets the sense that due to trade and immigration policy the domestic economy and labor market are paying a price," said Joseph Brusuelas, chief economist at RSM US. "Stagflation is the best description of the domestic economy as we enter the second half of the year."

For months, Wall Street brushed off Donald Trump’s trade war and the Federal Reserve’s higher-for-longer stance — confident a resilient economy would keep propping up US markets.

This week, that confidence began to unravel. Weak job growth and Trump’s latest volley of tariffs rattled investors, intensifying pressure on Fed Chair Jerome Powell to lower interest rates and exposing a new unease with the White House’s protectionist push.

A three-month stretch of nearly unbroken market calm was shattered on Friday after a US report showed a sharp slowdown in the labor market. Traders rushed into the safety of government bonds — pushing down yields on two-year notes to 3.71% in the biggest drop since last August — while ramping up bets for a rate cut as soon as next month. The dollar fell and the S&P 500 Index retreated from an all-time high, poised for the worst week since May.

Volatility whipped up across markets as traders re-assessed the economic reality after $15 trillion was added to equity values since April. The Cboe Volatility Index, a gauge of options cost, jumped to approach the widely watched level of 20 for the first time since April’s tariff-induced rout. Similar measures on high-yield and investment-grade bonds also climbed.

“Lots of folks have their eyes on the exit door. Some frothy signs are appearing,” said Joe Saluzzi, co-head of equity trading at Themis Trading. “Weak job numbers should solidify the rate cut story for September, but there is some worry that the Fed is waiting too long.”

Friday’s market action marked a sharp reversal from July, when the dollar rallied, haven trades were abandoned and US equities outpaced their international peers, buoyed by stronger‑than‑expected earnings and a still‑healthy economic growth.

That narrative took a hit at the end of the week. Trump’s new tariffs — lifting the average US levy on global imports to 15%, the steepest since the 1930s — landed just as data showed job growth cooling more than expected. The prospect for a slowdown caused traders to ratchet up the likelihood for a rate cut in September to 88%, up from 40% earlier this week.

The specter of lower rates sent the dollar down as much as 1%, the worst intraday drop since April. Economically sensitive companies led the retreat in the S&P 500 amid growth angst. The Russell 2000 Index of small-caps extended declines for a fifth day, poised for the worst week in four months.

“Investors may have gotten too complacent while waiting for the impacts of slower economic activity resulting from tariffs and higher interest rates,” said Charlie Ripley, senior investment strategist for Allianz Investment Management. “The economic cooling associated to tariffs is beginning to take hold. Softer labor conditions should raise eyebrows at the Fed and knowing they have been a reactionary organization in recent years, we should expect a higher chance of Fed action in the coming months.”

The duo retreat in the US dollar and equities highlights July’s fragility of the resurgence in American exceptionalism. Betting against the dollar — voted as the “most crowded trade” for the first time on record in Bank of America Corp.’s survey of money managers — turned out to be one of the biggest blunders as the greenback posed its first monthly gain since Trump took office. US skeptics, who continued to dominate in BofA’s survey, also had a setback in stocks as the S&P 500 outperformed the rest of the world for a fourth straight month.

The renewed weakness likely marked a welcome development to those who stuck to a preference in non-US assets of late. Rich Weiss, chief investment officer for multi-asset strategies at American Century Investment Management, has continued to be underweight US equities, citing stretched valuations.

“There are significant potential negatives out there with the deficit, tariffs and inflation,” he said. “The overall volatility, which President Trump himself deduces into the whole equation, indicates we still should remain somewhat cautious.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up