Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Federal Reserve officials left interest rates unchanged but downgraded their view of the US economy, a sign policymakers could be edging closer to lowering borrowing costs.

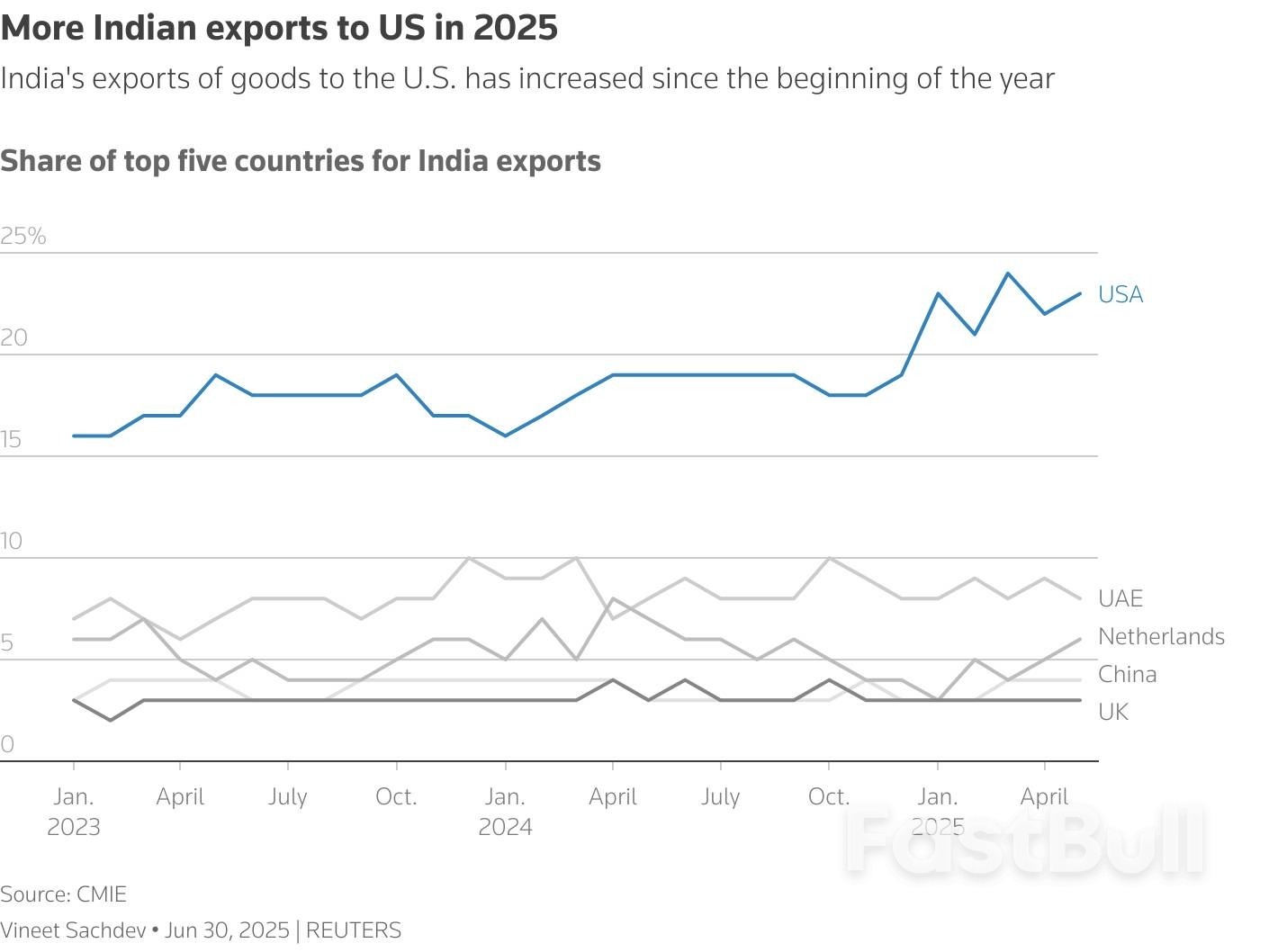

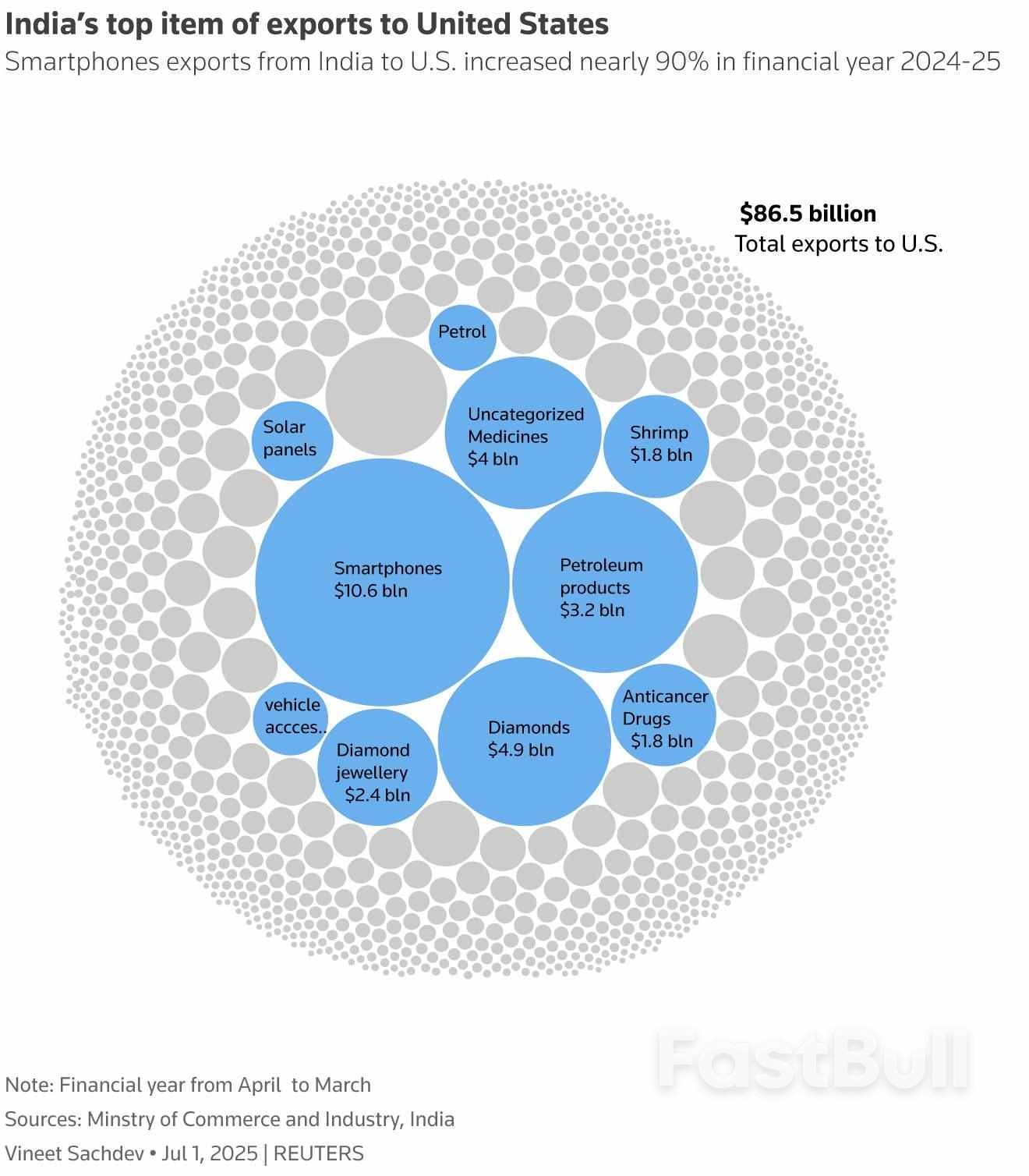

U.S. President Donald Trump on Wednesday imposed a 25% tariff on goods imported from India starting August 1, as well as an unspecified penalty for buying Russian arms and oil - moves that could strain relations with the world's most populous democracy.

The U.S. decision singles out India more severely than other major trading partners, and threatens to unravel months of talks between the two countries, undermining a key strategic partner of Washington’s and a counterbalance to China.

"While India is our friend, we have, over the years, done relatively little business with them because their Tariffs are far too high, among the highest in the World, and they have the most strenuous and obnoxious non-monetary Trade Barriers of any Country," Trump wrote in a Truth Social post.

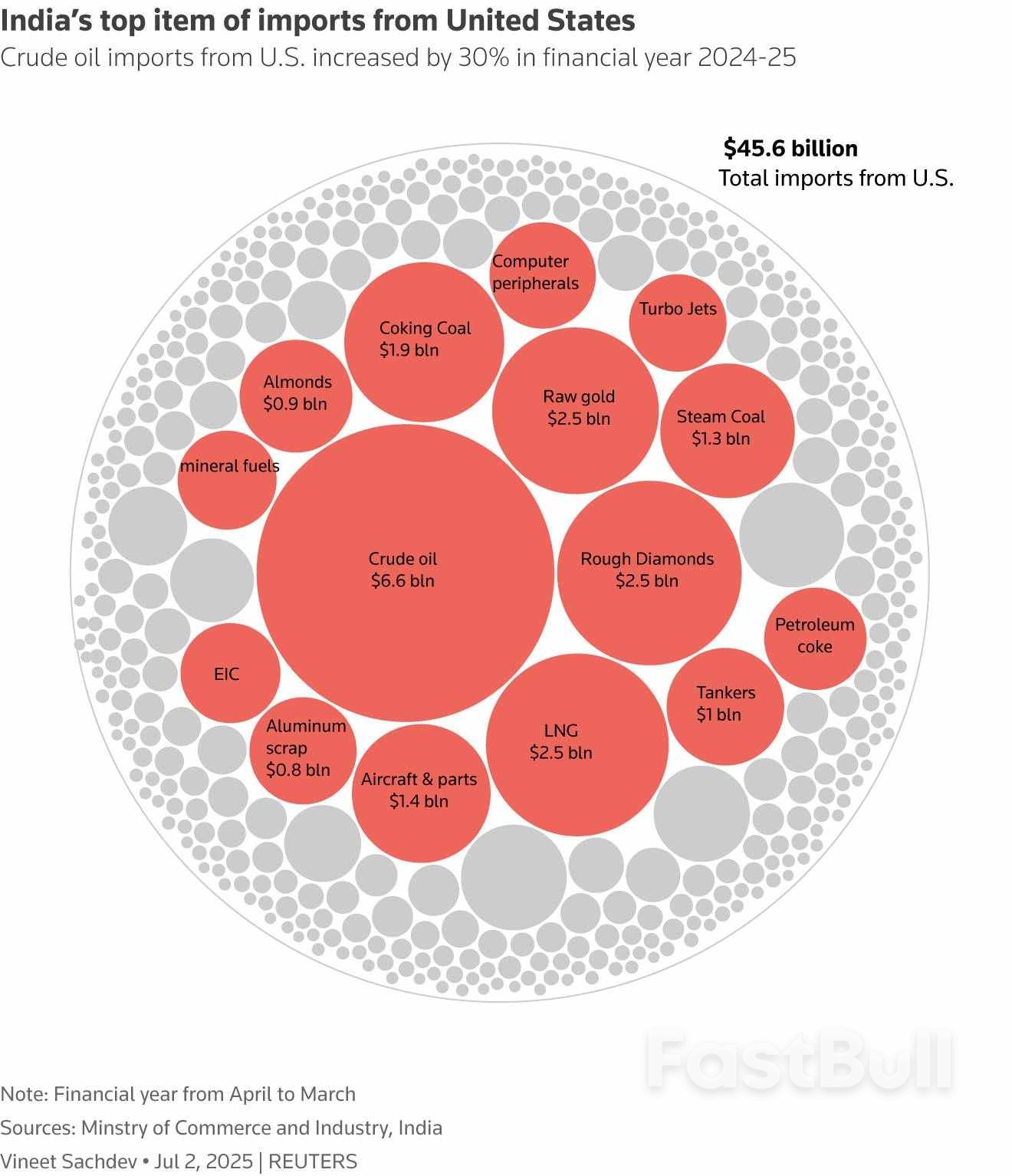

"They have always bought a vast majority of their military equipment from Russia, and are Russia’s largest buyer of ENERGY, along with China, at a time when everyone wants Russia to STOP THE KILLING IN UKRAINE — ALL THINGS NOT GOOD!"

In response, the Indian government said in a statement that it was studying the implications of Trump's announcements and remained dedicated to securing a fair trade deal with the U.S.

"India and the U.S. have been engaged in negotiations on concluding a fair, balanced and mutually beneficial bilateral trade agreement over the last few months. We remain committed to that objective," it said.

The White House had previously warned India about its high average applied tariffs - nearly 39% on agricultural products - with rates climbing to 45% on vegetable oils and around 50% on apples and corn.

Russia continued to be the top oil supplier to India during the first six months of 2025, making up 35% of overall supplies.

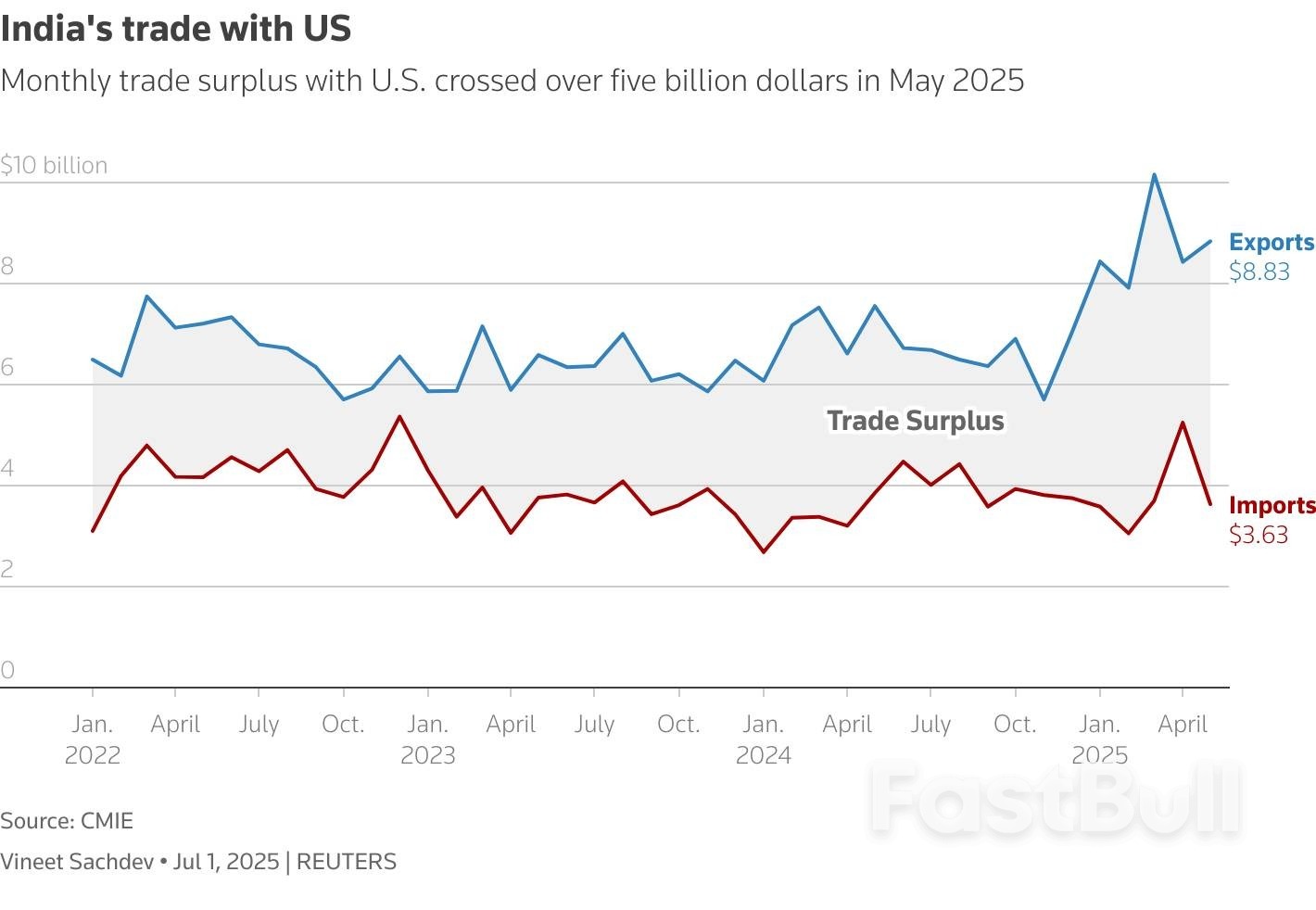

The United States, the world's largest economy, currently has a $45.7 billion trade deficit with India, the fifth largest.

White House economic adviser Kevin Hassett said Trump has been frustrated with the progress of trade talks with India and believed the 25% tariff announcement would help the situation. Hassett said more information on the additional penalty would be made "shortly."

The new U.S. tax on imports from India would be higher than many other countries that struck a deal with the Trump administration recently. Vietnam's tariff is set at 20% and Indonesia's at 19%, while the levy for Japan and the European Union is 15%.

"This is a major setback for Indian exporters, especially in sectors like textiles, footwear and furniture, as the 25% tariff will render them uncompetitive against rivals from Vietnam and China," said S.C. Ralhan, president of the Federation of Indian Export Organisation.

The news pushed the Indian rupee down 0.4% to around 87.80 against the U.S. dollar in the non-deliverable forwards market, from its close at 87.42 during market hours. Gift Nifty futures were trading at 24,692 points, down 0.6%.

U.S. and Indian negotiators have held multiple rounds of discussions to resolve contentious issues, particularly over market access into India for U.S. agricultural and dairy products.

In its latest statement, India said it attached the utmost importance to protecting and promoting the welfare of its farmers, entrepreneurs and small businesses.

"The government will take all steps necessary to secure our national interest, as has been the case with other trade agreements," it said.

The setback comes despite earlier commitments by Prime Minister Narendra Modi and Trump to conclude the first phase of a trade deal by autumn 2025 and expand bilateral trade to $500 billion by 2030, from $191 billion in 2024.

Since India's short but deadly conflict with arch South Asian rival Pakistan, New Delhi has been unhappy about Trump's closeness with Islamabad and has protested, which cast a shadow over trade talks.

"Politically the relationship is in its toughest spot since the mid-1990s," said Ashok Malik, partner at advisory firm The Asia Group. "Trust has diminished. President Trump's messaging has damaged many years of careful, bipartisan nurturing of the U.S.-India partnership in both capitals."

Besides farm products access, the U.S. had flagged concerns over India's increasingly burdensome import-quality requirements, among its many non-tariff barriers to foreign trade, in a report released in March.

The new tariffs will impact Indian goods exports to the U.S., estimated at around $87 billion in 2024, including labour-intensive products such as garments, pharmaceuticals, gems and jewelry, and petrochemicals.

Reporting by Susan Heavey, Katharine Jackson in Washington, Manoj Kumar and Aftab Ahmed in New Delhi; editing by Doina Chiacu, Bernadette Baum and Mark Heinrich

The GBPUSD is extending to a new low today, as bearish pressure intensifies technically. This move is significant because the pair is now trading below its 100-day moving average, currently at 1.33339. That level had acted as a temporary floor yesterday, with buyers stepping in to defend it. However, today's price action shows a shift in sentiment, with sellers gaining more control and pushing the pair lower.

The break below the 100-day moving average tilts the technical outlook more negatively. As long as price stays below that key moving average, bearish bias remains in play. The next major downside focus is the 38.2% retracement of the 2025 move up—from the low to the high—which comes in at 1.31403.

That retracement level is further supported by a key swing area between 1.3145 and 1.3202, making it an important target and potential support zone. If sellers can drive through that region, the downside momentum could accelerate. For now, the battle lines are drawn between the 100-day MA above and a wide target of 1.3140–1.3200 below.

The FOMC will meet later today with the Fed expected to leave rates unchanged. The question is will the Fed shift to a more dovish stance ahead of what will likely be a tick up in inflation due the tariff?

It’s safe to expect that we aren’t going to get a rate cut, and it’s safe to expect that the president will be unhappy about that. Besides that, probably the only drama to watch for will be whether we get dissents from Waller and Bowman. If that happens it would be the first time since 1993 that two Fed governors voted against the chair.

Anyway, one reason we’re not going to get a rate cut today is that basically the economy seems to be doing fine, or at least a lot better than expected. This morning we got the first look at second quarter GDP, and it came in at 3.0% vs. expectations of just 2.6%. We also got the ADP employment report, which showed that private businesses added 104,000 jobs in July, which was higher than the 76,000 that economists had expected.

Now yeah, sure, ADP doesn’t have a great track record of anticipating the government’s Non-Farm Payrolls report (which comes out Friday) but it adds to the data showing labor market resilience. Initial Jobless Claims have been coming down for weeks. Yesterday we got the Dallas Fed’s Services Activity survey, which showed a broad rebound across several measures, including hiring, which turned positive.

It’s not that the economy is doing great, per se, but with measures of inflation still on the warm side, there’s no acute sign of labor market distress that warrant immediate attention.

The other thing about rate cuts is that, even if we were to get them soon, they won’t accomplish what Trump wants them to, which is to make it easier for people to buy or refi their homes.

Here’s what he posted on Truth Social today:

You can lower rates in the short-term all you want, but if the market perceives that higher rates will be needed in the future in order to maintain the 2% inflation target, then rates at the long end (which is what mortgages or refis are linked to) will remain near today’s elevated level that constrains housing activity (and it is constraining housing activity, so Trump’s concern here is understandable).

Earlier in this spring, there were clearer signs of economic deceleration, but concerns over tariff policy were making the Fed reluctant to react aggressively. Noe the picture is different. While tariff policy still seems to be changing by the day, the range of potential outcomes is narrowing as various deals get announced or signed. Meanwhile, the underlying data just isn’t looking as wobbly as it was, giving the Fed further scope to be patient.

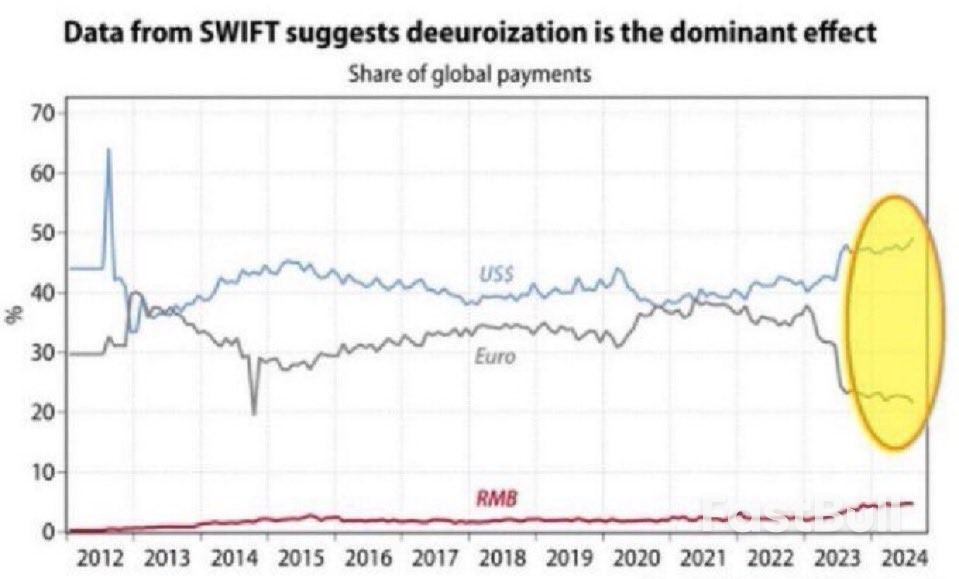

As the world anticipates a pivotal Fed Decision Impact, the ripples are already being felt across currency markets, signaling potential implications for Bitcoin and altcoins. This article delves into the current state of the dollar and euro, examining the forces at play and what the upcoming central bank announcements might mean for global finance.

The Federal Reserve, often simply called ‘the Fed,’ stands as the central bank of the United States, wielding immense power over global financial markets. Its mandate includes fostering maximum employment, stable prices, and moderate long-term interest rates. The decisions made by the Federal Open Market Committee (FOMC), particularly concerning the federal funds rate, resonate far beyond U.S. borders, directly influencing the US Dollar Strength and, by extension, the entire global economy.

So, why is this particular Fed decision so pivotal? In an environment grappling with persistent inflation and fluctuating economic growth, the Fed’s stance on monetary policy becomes a critical determinant of market direction. A hawkish stance (implying higher interest rates) typically strengthens the dollar as it makes dollar-denominated assets more attractive to foreign investors seeking higher returns. Conversely, a dovish pivot (suggesting lower rates or a pause in hikes) can weaken the dollar. The market’s anticipation of this decision, and any subtle shifts in the Fed’s language or ‘dot plot’ projections, can trigger significant currency movements even before the official announcement.

Historically, moments leading up to Fed decisions are characterized by heightened volatility. Traders and investors meticulously analyze every piece of economic data – from inflation figures like the Consumer Price Index (CPI) and Producer Price Index (PPI) to employment reports suchances as Non-Farm Payrolls and GDP growth – trying to predict the Fed’s next move. A decision to pause rate hikes, or even hint at future cuts, could signal a shift in the Interest Rate Outlook, potentially easing financial conditions and impacting everything from bond yields to equity valuations and, crucially, currency valuations.

The US Dollar Strength has been a defining feature of global finance for much of the past year, driven by aggressive interest rate hikes from the Federal Reserve aimed at taming inflation. However, recent economic data and evolving market expectations have started to chip away at this dominance, causing the dollar to slip slightly against a basket of major currencies. What factors are contributing to this conundrum?

This dynamic creates a complex environment for traders. While the dollar retains its status as a safe-haven asset during times of global uncertainty, its recent ‘slip’ suggests that the market is beginning to price in a more nuanced Interest Rate Outlook, potentially signaling a less aggressive Fed going forward. This shift is keenly watched by investors across all asset classes, including those in the volatile cryptocurrency market, as a weaker dollar can sometimes correlate with stronger commodity prices and, occasionally, a boost for risk assets like Bitcoin.

While the dollar has experienced a slight softening, the Euro Performance has been under considerably more pressure, setting it up for a potential monthly loss against the dollar and other major currencies. The Eurozone, a diverse economic bloc, faces a unique set of challenges that continue to weigh on its currency. What are these obstacles, and how do they impact the Euro’s trajectory?

The combination of these factors creates a complex economic environment for the Eurozone, making the Euro Performance a barometer of the region’s resilience. The challenges are multifaceted, ranging from structural energy dependencies to the ongoing geopolitical landscape, all of which necessitate careful navigation by the ECB and member states. For investors, understanding these dynamics is crucial for assessing the Euro’s future potential and its role within broader Global Forex Trends.

The movements of the US Dollar and Euro are not isolated events; they are integral components of broader Global Forex Trends that send ripple effects across the entire financial ecosystem. The interconnectedness of currencies means that a significant shift in one pair can trigger adjustments in others, influencing everything from trade balances to commodity prices and even the highly volatile cryptocurrency markets.

When the US Dollar Strength wanes, for example, it can make dollar-denominated commodities like oil and gold cheaper for holders of other currencies, potentially boosting their demand and price. This dynamic is crucial for commodity-exporting nations and can impact global inflation. Conversely, a stronger dollar makes imports more expensive for the U.S., potentially dampening inflation but also impacting corporate earnings for multinational companies.

Similarly, the struggles in Euro Performance can have widespread implications. A weaker Euro makes Eurozone exports more competitive but makes imports more expensive, contributing to domestic inflation. It can also impact cross-border investments and the profitability of companies operating within the Eurozone, affecting their global standing.

The concept of ‘carry trade’ is also a significant element in Global Forex Trends. This involves borrowing in a low-interest-rate currency and investing in a high-interest-rate currency. Divergent Interest Rate Outlooks between central banks can fuel or unwind these trades, leading to substantial capital flows and currency volatility. For instance, if the Fed maintains a higher rate than the ECB, it encourages capital to flow into dollar-denominated assets, bolstering the dollar and potentially pressuring the Euro.

Furthermore, currency volatility often spills over into other asset classes. In times of extreme uncertainty, the dollar traditionally acts as a ‘safe-haven’ currency, attracting capital from riskier assets. However, if the dollar itself is showing signs of vulnerability, investors might seek alternative safe havens, or conversely, be more inclined to take on risk in other markets, including the nascent but growing cryptocurrency space. The interplay between traditional forex markets and digital assets is becoming increasingly apparent, as macro-economic shifts can dictate the broader risk appetite that influences Bitcoin and altcoin prices.

The divergence in the Interest Rate Outlook between major central banks is arguably the most significant driver of current Global Forex Trends. While central banks worldwide have been engaged in a synchronized fight against inflation, their individual economic circumstances and policy mandates are leading them down increasingly divergent paths. This divergence has profound implications for currency valuations and the broader financial landscape.

The Federal Reserve, having embarked on an aggressive rate-hiking cycle, is now grappling with the question of whether its tightening has gone far enough to bring inflation under control without tipping the economy into a severe recession. The market is keenly watching for signals of a ‘pause’ or even future ‘cuts’ from the Fed, which would significantly alter the US Dollar Strength trajectory. A pivot towards easing would likely weaken the dollar as its yield advantage diminishes.

In contrast, the European Central Bank (ECB) has been more cautious, starting its rate hikes later and often at a slower pace than the Fed. The ECB faces a complex balancing act: fighting inflation while navigating the unique challenges of the Eurozone, including varied economic performance among member states and the ongoing energy crisis. The market’s perception of the ECB’s commitment to tightening relative to the Fed directly impacts the Euro Performance. If the ECB is perceived as lagging behind, the Euro is likely to remain under pressure.

Here’s a simplified comparison of their potential paths:

| Central Bank | Current Stance | Key Challenge | Potential Future Path | Currency Impact |

|---|---|---|---|---|

| Federal Reserve (Fed) | Aggressive tightening, now assessing impact. | Balancing inflation control vs. recession risk. | Potential pause or slower hikes; market eyeing cuts. | Dollar potentially weakens if cuts priced in. |

| European Central Bank (ECB) | Raising rates, but more cautiously. | Energy crisis, geopolitical risks, diverse Eurozone economies. | Continued hikes, but pace uncertain; ‘data-dependent.’ | Euro faces headwinds if perceived as lagging Fed. |

The implications of these divergent paths are far-reaching. They influence capital flows, as investors seek higher returns in currencies with more attractive interest rates. They affect corporate profitability, as businesses navigate varying borrowing costs and currency exchange rates. And for individual consumers, they impact everything from mortgage rates to the cost of imported goods. Understanding this intricate dance of central bank policies and their resulting Interest Rate Outlook is fundamental to comprehending the current state and future direction of global finance.

The current volatility in the forex market, driven by shifts in US Dollar Strength and Euro Performance amidst a changing Interest Rate Outlook, presents both significant challenges and unique opportunities for businesses, investors, and even individuals.

Challenges:

Opportunities:

Navigating these Global Forex Trends requires vigilance and a deep understanding of the underlying economic forces. It’s not just about predicting the next Fed move, but also about appreciating the broader macroeconomic narrative and its potential ripple effects across all markets.

In a landscape defined by a volatile Forex Market Alert and shifting central bank policies, how can investors and traders best position themselves? Here are some actionable insights:

The slight slip of the US Dollar and the sustained monthly loss for the Euro ahead of the crucial Fed decision underscore a period of significant transition and uncertainty in the global financial markets. The interplay between the Fed Decision Impact, the evolving narrative around US Dollar Strength, and the ongoing challenges affecting Euro Performance is creating a complex tapestry of Global Forex Trends. Underlying all these movements is the critical Interest Rate Outlook, as central banks worldwide navigate the delicate balance between taming inflation and avoiding economic downturns.

For investors, traders, and even the general public, understanding these dynamics is no longer a niche interest but a necessity. The ripples from currency markets can affect everything from the cost of goods to the value of investment portfolios, including digital assets. As central banks continue to adapt their policies in response to evolving economic data, the volatility in forex markets is likely to persist. Staying informed, exercising prudence, and adopting a holistic view of global finance will be key to navigating this unfolding narrative successfully.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up