Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

European leaders are close to finalizing a plan to leverage frozen Russian sovereign assets to support a €90 billion loan for Ukraine’s reconstruction...

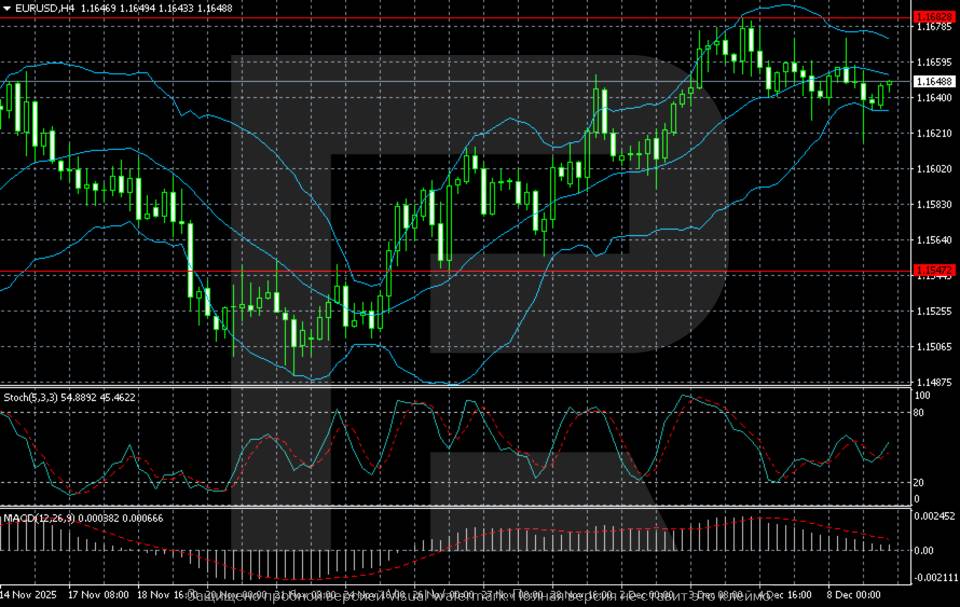

The EURUSD pair has risen to 1.1648. All eyes are on the Federal Reserve's December meeting.

The EURUSD rate is edging higher on Tuesday, reaching 1.1648. However, overall, the major currency pair continues to move sideways ahead of the two-day Federal Reserve meeting, where the market is nearly unanimous in expecting a rate cut.

The likelihood of a 25-basis-point rate reduction on Wednesday is estimated at about 87%, up from around 67% a month ago. Still, the outlook for 2026 remains uncertain. A hawkish cut is possible, in which Jerome Powell signals caution regarding further easing steps.

Investors are also awaiting key US macroeconomic releases. Today, the postponed JOLTS job openings report for October will be published, followed by initial jobless claims and the trade balance later in the week.

On the H4 chart, the EURUSD pair maintains a moderately bullish trajectory, but upward momentum has noticeably weakened. The price is consolidating below the 1.1682 resistance level, which has repeatedly capped attempts at growth. Quotes are currently moving along the middle Bollinger Band, indicating the absence of a strong trend. The upper band is slightly turning downwards, reflecting lower volatility.

The Stochastic Oscillator is in the mid-range around 45, giving no clear signals. The market is out of oversold territory but lacks a confident bullish trigger. MACD remains positive, yet its histogram is declining, underscoring weakening bullish momentum and a likely phase of sideways consolidation.

The nearest support level is located at 1.1547 – the level from which the previous strong recovery began. The resistance stands at 1.1682. A breakout above this level would open the path towards 1.1750. As long as the pair trades between these boundaries, the baseline scenario is consolidation within the range with a mild upward tilt.

The EURUSD pair is rising slightly, but very cautiously. The EURUSD forecast for today, 9 December 2025, suggests a mild upward move towards 1.1682.

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair's movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold's recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

British American Tobacco on Tuesday reaffirmed its 2026 growth targets but said performance will likely come in at the lower end of its 3% to 5% revenue growth range, as the London-based tobacco company navigates a transition to nicotine alternatives amid regional headwinds.

The company expects approximately 2% revenue and adjusted profit growth for fiscal year 2025, with New Category products, encompassing heated tobacco, vapor and nicotine pouches, accelerating to double-digit growth in the second half.

Chief executive Tadeu Marroco said the company remains "focused on establishing glo Hilo as a premium offering in the largest Heated Products profit pools" with launches in Japan in September and Poland in October, with additional rollouts planned for 2026.

BAT's U.S. operations showed the strongest momentum, with value share rising 20 basis points while volume share remained flat.

The company's Velo Plus nicotine pouch drove Modern Oral volume share up 920 basis points in the U.S. market, where BAT said it is on track for full-year profitability in its New Category business.

The Velo brand achieved 15.9% volume share of Total Oral products and 31.8% of Modern Oral products globally, representing increases of 460 basis points and 590 basis points respectively.

BAT's Vuse vapor brand, which maintained global leadership in tracked channels with value share in top markets up 10 basis points, showed improved second-half performance despite ongoing challenges from illicit products.

The company expects full-year Vuse revenue to decline in the high-single digits, compared to a 13% drop in the first half.

Regional performance varied significantly. The Americas excluding the U.S., led by Brazil, Turkey and Mexico, delivered strong results. However, the Asia-Pacific, Middle East and Africa region faced material fiscal and regulatory headwinds in Bangladesh and Pakistan that will impact adjusted profit growth.

The company's glo heated tobacco product line saw volume share in top markets decline 1.2 percentage points, impacted by competition in Japan.

BAT's Americas excluding U.S. volume share for glo declined 60 basis points as the company made resource allocation decisions ahead of the glo Hilo rollout.

Globally, BAT's group value share in top cigarette markets remained flat while volume share declined 10 basis points. The company projects global tobacco industry volume will decline approximately 2% for 2025.

BAT announced £1.3 billion in share buybacks for fiscal year 2026, up from £1.1 billion in 2025. The company expects operating cash flow conversion to exceed 95% in 2025, with gross capital expenditure of approximately £1.2 billion.

For fiscal year 2025, BAT projects mid-single digit New Category revenue growth at constant rates, with approximately 2% adjusted profit from operations growth at constant rates.

The company anticipates a roughly 3% translational foreign exchange headwind on adjusted profit from operations and approximately 4% on adjusted earnings per share. Net finance costs are projected at approximately £1.8 billion.

In the US, the delayed September JOLTs report is finally due for release in the afternoon. The number of job openings is a key measure of labour demand for the Fed, and the release will gather extra attention in light of the FOMC rate decision tomorrow. NFIB's small business optimism index for November and ADP's weekly private sector employment estimate will also be released today.

In Denmark, we expect foreign trade data and the current account for October. It will be interesting as exports remain the key driver of growth in Denmark.

In China, overnight, we will see CPI for November, which is expected to move more into positive territory (cons: 0.7% y/y, prior: 0.2% y/y). Core inflation has moved higher over the past six months as well. China still suffers from deflationary pressures in the producer prices, though, and PPI is expected to stay around -2.0% y/y in November.

What happened overnight

In Australia, the Reserve Bank held its cash rate at 3.60%, citing upside inflation risks and recovering demand. Governor Michele Bullock noted the board is considering the likelihood of rate hikes in 2026 and has not ruled out an increase as soon as its next meeting in February. The move resulted in higher yields and a slightly stronger AUD.

In the US, President Trump announced that Nvidia's H200 chips will be allowed for export to China, with Nvidia required to pay a 25% fee on sales, up from the initial 15%. Trump claimed that President Xi reacted positively to the decision, despite China expressing scepticism about such a deal last week. The decision has faced criticism from US lawmakers, who raised concerns over national security and the risk of the chips being used for military purposes in China.

In the euro area, the December Sentix indicator came in slightly better than expected at -6.2 (cons: -7.0, prior: -7.4), indicating investors have gotten less pessimistic about the economic recovery. Given how Sentix is the first sentiment indicator for December, the rise could signal improvements in other sentiment indicators to be released this month.

In Germany, industrial production increased by 1.8% m/m in October, significantly exceeding expectations and marking the second consecutive monthly rise. Growth was driven by construction and manufacturing, while the automotive sector detracted. Despite this sign of short-term stabilisation, soft indicators remain cautious. The Ifo Index fell in November as weaker expectations outweighed a slight improvement in the current assessment, and the Manufacturing PMI dropped to 48.2, its sharpest contraction since February. This highlights that while production shows improvement, weak demand and sentiment suggest recovery remains dependent on the impact of fiscal easing measures.

Equities: Equities had a slow start to the week and generally ended somewhat lower. The S&P 500 closed down 0.4% and the Stoxx 600 slipped 0.1%. Interestingly, the selling was again concentrated in defensives, similar to Friday. Hence, it was a slow day but not risk off emerging. Futures are little changed this morning.

One standout style yesterday was momentum, which has regained traction both on the day and over the past two weeks. One driver is the ongoing TPU-vs-GPU battle between Alphabet and Nvidia, which appears to have stalled. Alphabet fell 2% yesterday, while Nvidia and Microsoft both gained around 2%. After the close, the Trump administration announced that some of Nvidia's chip exports (H200 AI chips) to China may resume, which might have contributed to the rotation.

Another notable sector is health care: A top performer over the past three months—up roughly 8% in global terms. However, it has also been the sector investors have found financing in during the recent rebound, falling about 3% the last two weeks. This contributes to the divergence between defensives and cyclicals, both in risk-off and risk-on phases. Strong recent performance has narrowed global health care's valuation discount to global equities from 20% earlier this year to about 9% today. That is still one standard deviation below the 10-year average of 0%, and so we continue to recommend an overweight in this sector but admit that the upside has declined.

FI and FX: Yields are grinding higher despite the expectations of a Fed rate cut on Wednesday. Markets are seemingly getting a bit worried that the cut will be delivered with a more hawkish communication, and risk sentiment has also been dented with small declines in US and Asian equity indices overnight. EUR/USD declined towards 1.1620 yesterday afternoon as US yields temporarily spiked around 16.00 CET. With yields subsequently moving lower, EUR/USD settled around 1.1640-1.1650. The RBA kept the policy rate on hold at 3.60% as widely expected and signaled that risks from here are on the upside, resulting in a bearish steepening of the curve with the 2y point rising 9bp and the 10y rising 5bp, along with a stronger AUD.

Turkey arrested two players from its top football division and a former Super League club chairman as an illegal betting investigation widened to include executives and athletes, escalating a scandal that has already ensnared referees.

20 of 39 suspects were formally arrested, state-run Anadolu Agency reported. They include Galatasaray defender Metehan Baltaci, Fenerbahce midfielder Mert Hakan Yandas and Murat Sancak, the former chairman of Adana Demirspor — the club where Italian striker Mario Balotelli played in the 2021–22 and 2023–24 seasons.

Both players and Sancak denied the allegations during their testimony, local media reported. Galatasaray and Fenerbahce have not yet issued public statements.

Prosecutors sought the formal arrests of Yandas and Baltaci on match-fixing charges, according to Anadolu. Baltaci was first accused of betting on his own team, while Yandas allegedly placed bets through intermediaries on betting platforms. Sancak was detained after suspicious financial transactions were identified in his accounts.

The Turkish Football Federation said in October that its internal probe had uncovered hundreds of referees engaged in betting. The Federation's Disciplinary Board temporarily suspended more than 100 referees and players, covering both lower and top-tier leagues.

Istanbul prosecutors followed with detention warrants targeting match officials alleged to have wagered on games. Istanbul Chief Prosecutor Akin Gurlek signaled the investigation could expand to club presidents.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up