Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Key Republican Senator Scott: Powell Did Not Commit A Crime At The Hearing] U.S. Republican Senator Tim Scott Stated That Federal Reserve Chairman Jerome Powell Did Not Commit A Crime When Answering Questions At A Congressional Hearing Last Summer. "I Think He Made A Serious Error Of Judgment. He Wasn't Prepared For That Hearing. I Don't Believe He Committed A Crime At The Hearing," Scott Said

US Nuclear Regulatory Commission Says It Is Undergoing Reorganization In Line With Trump's Push On Licensing Of Nuclear Reactors

Ukraine President Zelenskiy: Ukraine's Western Partners Must Be Prepared To Put Pressure On Russia And Provide Guarantees For Kyiv

Ukraine President Zelenskiy: Talks Must Lead To Real Peace And Not Provide Russia With An Opportunity To Continue The War

Ukraine President Zelenskiy: After Start Of Latest Three-Sided Talks That Ukraine Expects A Prisoner Swap

General Motors CFO: We Hope That The U.S.-Mexico-Canada Trade Agreement (USMCA) Will Preserve North America As A (complete) Trade Area

French President's Top Diplomat Was In Moscow On Tuesday For Talks With Russian Officials - Source Aware Of The Matter

New York Fed Accepts $2.414 Billion Of $2.414 Billion Submitted To Reverse Repo Facility On Feb 04

Russian Foreign Ministry: USA Approach To Russia's Initiative On New Start Treaty Is Misguided And Regrettable

Russian Foreign Ministry On Expiring New Start Arms Treaty: We Assume That We And USA Are No Longer Bound By Central Quantitative Indicators Under The Treaty And Are Free To Choose Their Next Steps

Russian Foreign Ministry On Expiring New Start Arms Treaty: Russia Is Ready To Take Decisive Military-Technical Countermeasures To Counter Potential Additional Threats To National Security

Bessent: Says Has No Opinion On Whether Trump Has Authority To Fire Fed Chair Or Board Member Over A Policy Disagreement

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

No matching data

View All

No data

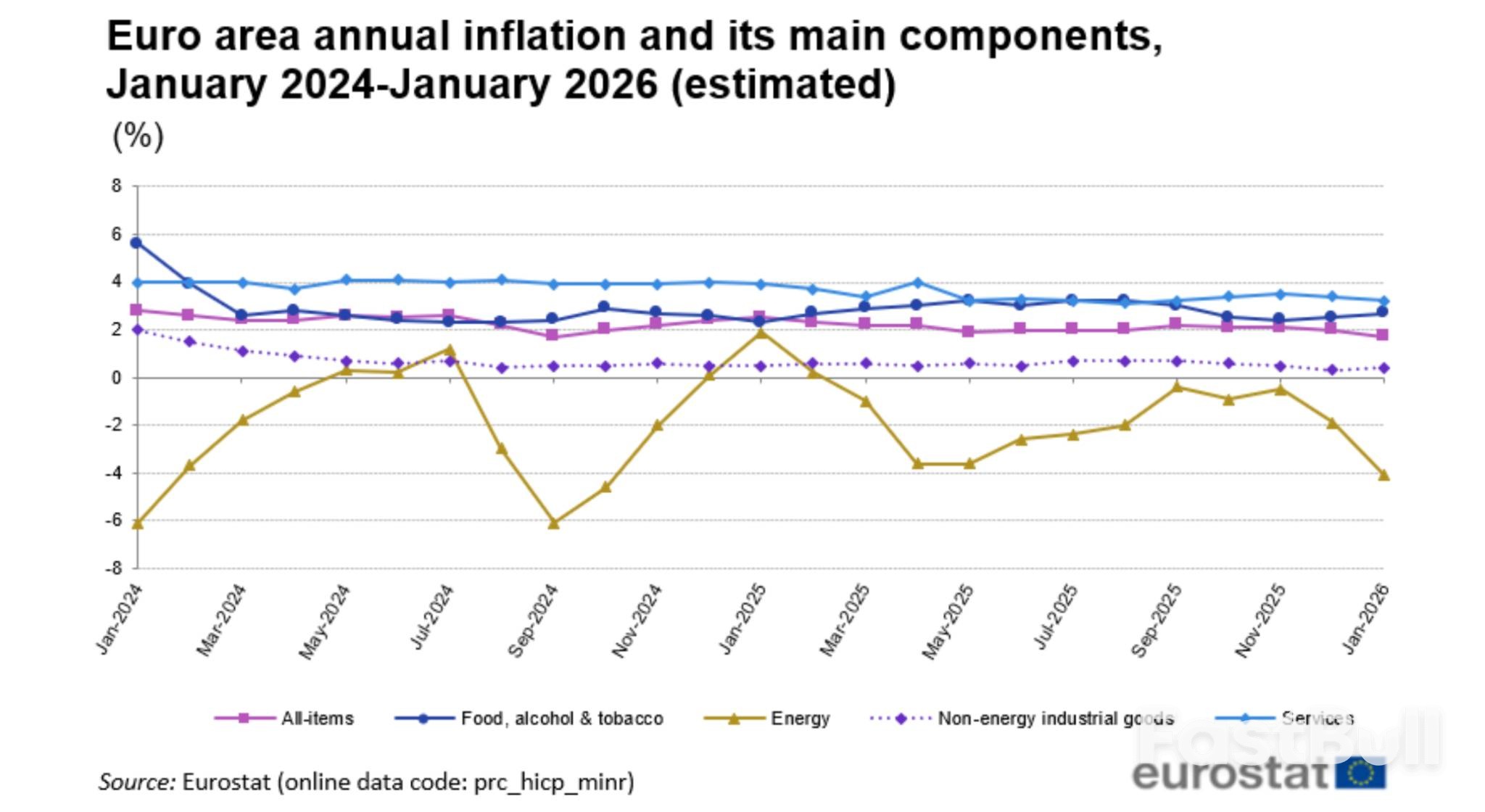

ECB's complex outlook: cooling inflation vs. resilient growth, sparking debate on 2026 rate hikes or cuts.

The European Central Bank is set to meet on February 5, 2026, and while no one expects a change in interest rates, the event is shaping up to be a pivotal moment for the euro. With EUR/USD trading below the key 1.20 level, all eyes will be on President Christine Lagarde's press conference for clues about the ECB's next major policy decision.

As cooling inflation and a strengthening currency cloud the outlook, policymakers and markets are divided. The central question is whether the ECB’s next move later in the year will be a rate hike or a rate cut. The answer will likely depend on the central bank's interpretation of an increasingly complex economic picture.

At its final meeting of 2025, the ECB presented a confident view of the eurozone economy. The central bank upgraded its growth forecasts, projecting 1.4% growth for 2025, followed by 1.2% in 2026, and a return to 1.4% in 2027 and 2028.

On the inflation front, the ECB's December projections showed prices normalizing around its 2% target. The forecast anticipated inflation averaging 2.1% in 2025, falling to 1.9% in 2026, and eventually settling at 2% by 2028. This outlook suggested that interest rates could remain unchanged throughout 2026, with the ECB describing its policy as being in a "good place."

However, recent data has complicated this narrative. January figures from Eurostat showed headline inflation in the euro area slowed to 1.7%, its lowest level since September 2024. More significantly, core inflation, which strips out volatile items, unexpectedly fell to 2.2% from 2.3%. This trend has fueled debate over whether disinflationary pressures are stronger than anticipated.

Two factors are at the center of this concern:

1. A Stronger Euro: The euro's recent appreciation against the dollar makes imports cheaper, dampening inflation.

2. Chinese Imports: An influx of lower-priced goods from China is putting downward pressure on prices across European markets.

ECB Governing Council member Gediminas Simkus recently noted the bank's success in bringing inflation back to target despite global challenges. Still, he warned that ongoing political instability remains a significant risk that could easily disrupt the ECB's current policy balance.

For the upcoming meeting, the market consensus is clear: the ECB will hold its key interest rates steady for the fifth consecutive time. The deposit facility rate is expected to remain at 2.00%, the main refinancing operations rate at 2.25%, and the marginal lending facility rate at 2.40%.

But beneath this surface-level agreement, a fierce debate is brewing over the direction of the next policy shift.

The Case for a Future Rate Hike

Despite inflation running below target, some ECB officials have not ruled out the possibility of raising rates later in 2026. This hawkish stance is driven by several considerations:

• Resilient Growth: The ECB's own upgraded growth forecasts suggest the eurozone economy could be more robust than expected. Sustained growth could generate fresh price pressures as economic capacity tightens.

• Sticky Inflation Risks: Some policymakers worry that the current 2% deposit rate may not be restrictive enough if inflation proves stubborn, especially with rising wage growth or a continued surge in energy prices. Oil and European natural gas prices have both climbed since the start of the year.

• Official Commentary: Recent remarks from key officials, including board member Isabel Schnabel, chief economist Philip Lane, and President Lagarde herself, have been interpreted by markets as keeping the option of a late-2026 hike alive.

The Argument for a Future Rate Cut

On the other side, a growing number of economists believe the ECB's next move is more likely to be a rate cut, potentially restarting the easing cycle paused in June 2025. The arguments for this dovish view include:

• Disinflationary Trend: With headline inflation at 1.7% and core inflation falling, both metrics are trending away from the ECB's 2% goal. If this continues, holding rates steady could become overly restrictive.

• Euro Appreciation: A stronger euro effectively tightens financial conditions by making imports cheaper. The ECB might need to offset this with lower interest rates if the currency continues to climb.

• Structural Pressures: The flood of competitively priced Chinese goods into Europe represents a persistent disinflationary force that could keep a lid on prices.

• Economic Fragility: Pockets of weakness remain in the eurozone, particularly in Germany's manufacturing sector, which is grappling with weak global demand and high energy costs.

The reality is that policymakers are genuinely split, with some officials stating that a hike and a cut are equally plausible outcomes depending on incoming data. This uncertainty reflects the unique position the ECB is in—having achieved its inflation target but now facing significant risks in both directions.

Diego Iscaro, head of European economics at S&P Global Market Intelligence, summarized the middle ground: "With underlying inflation still a little too high for comfort and expectations that the eurozone economy will regain momentum later in the year, we believe the most likely outcome is that the ECB will keep rates unchanged for the foreseeable future."

ECB chief economist Philip Lane articulated this balanced strategy in mid-January. He noted that the central bank will not debate a rate change in the near term if the economy stays on its projected course. However, he cautioned that new shocks could upset the outlook.

This statement perfectly captures the ECB's current posture: maintain the status quo for now, but stand ready to act decisively if economic conditions change.

The United States is hosting a high-stakes conference in Washington, D.C., gathering ministers from dozens of countries to address the future of critical mineral supply chains. The summit aims to build a global alliance to counter China's dominance over resources essential for defense, artificial intelligence, and the modern technology sector.

A central point of debate is a proposal to set a minimum price for critical minerals, an idea favored by many participating nations. However, reports suggest the U.S. is hesitant to support a price floor, creating a key tension point at the talks.

The meeting follows President Donald Trump's announcement of Project Vault, a strategic minerals stockpile for the U.S. This initiative will be capitalized with $2 billion from private sources and backed by a $10 billion loan from the U.S. Export-Import Bank.

The Critical Minerals Ministerial, hosted by Secretary of State Marco Rubio at the State Department, is a new U.S.-led effort to build a coalition that can diversify and secure the global supply of these vital resources. The main session is scheduled for Wednesday.

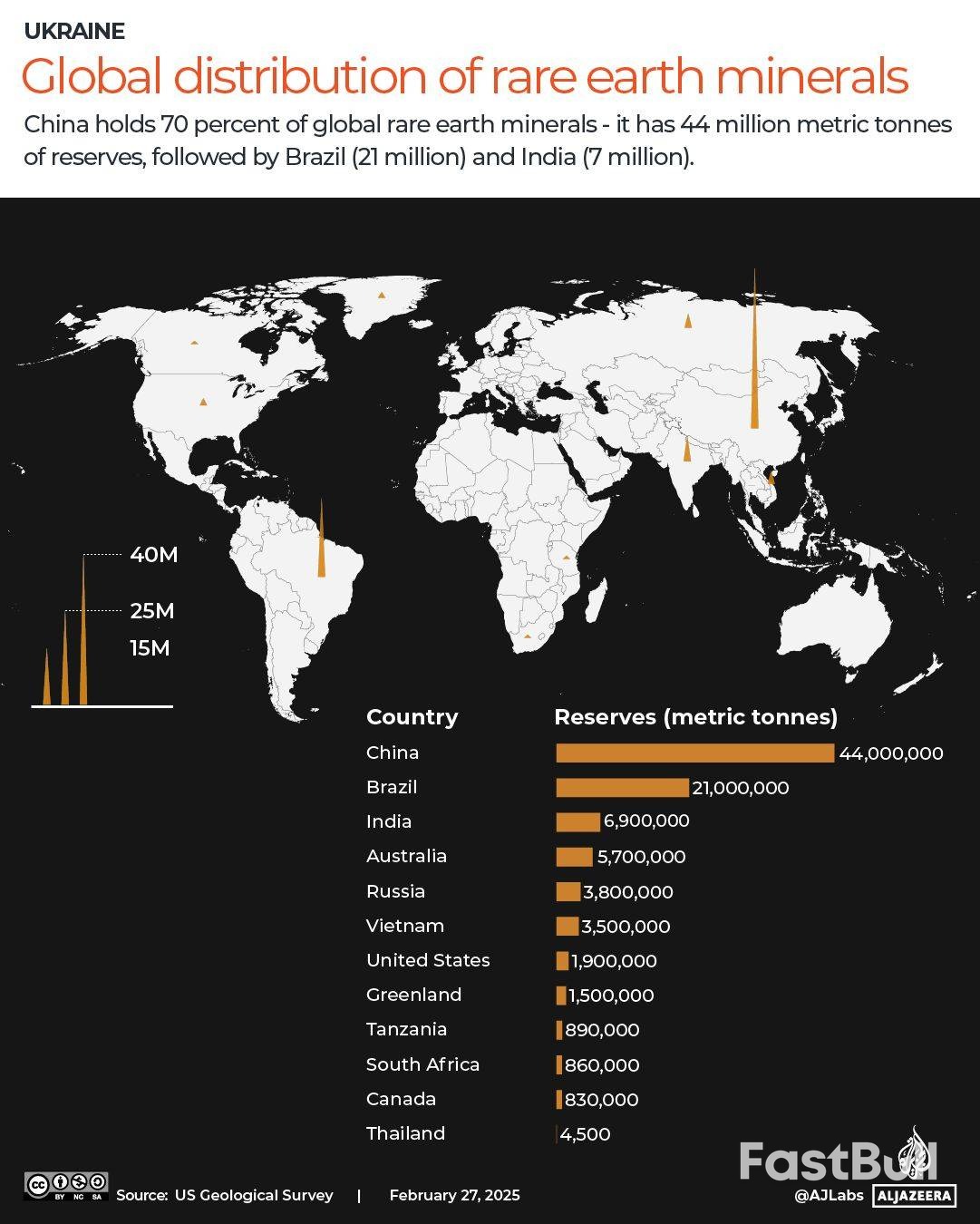

Currently, China dominates the landscape, controlling most of the world's rare earth minerals. It holds an estimated 60% of these minerals and, more importantly, processes 90% of the global supply, giving it immense leverage over everything from smartphones to fighter jets.

A Global Coalition Gathers

Delegations from over 50 countries are attending, including major economic powers like the G7 nations (Canada, France, Germany, Italy, Japan, the UK, and the US), the European Union, Australia, and New Zealand.

On the sidelines of the main event, Secretary Rubio held key bilateral meetings. He met with South Korean Foreign Minister Cho Hyun to discuss Seoul's commitments to investing in U.S. industries and securing mineral supply chains. He also met with Indian External Affairs Minister Subrahmanyam Jaishankar to explore cooperation on critical minerals.

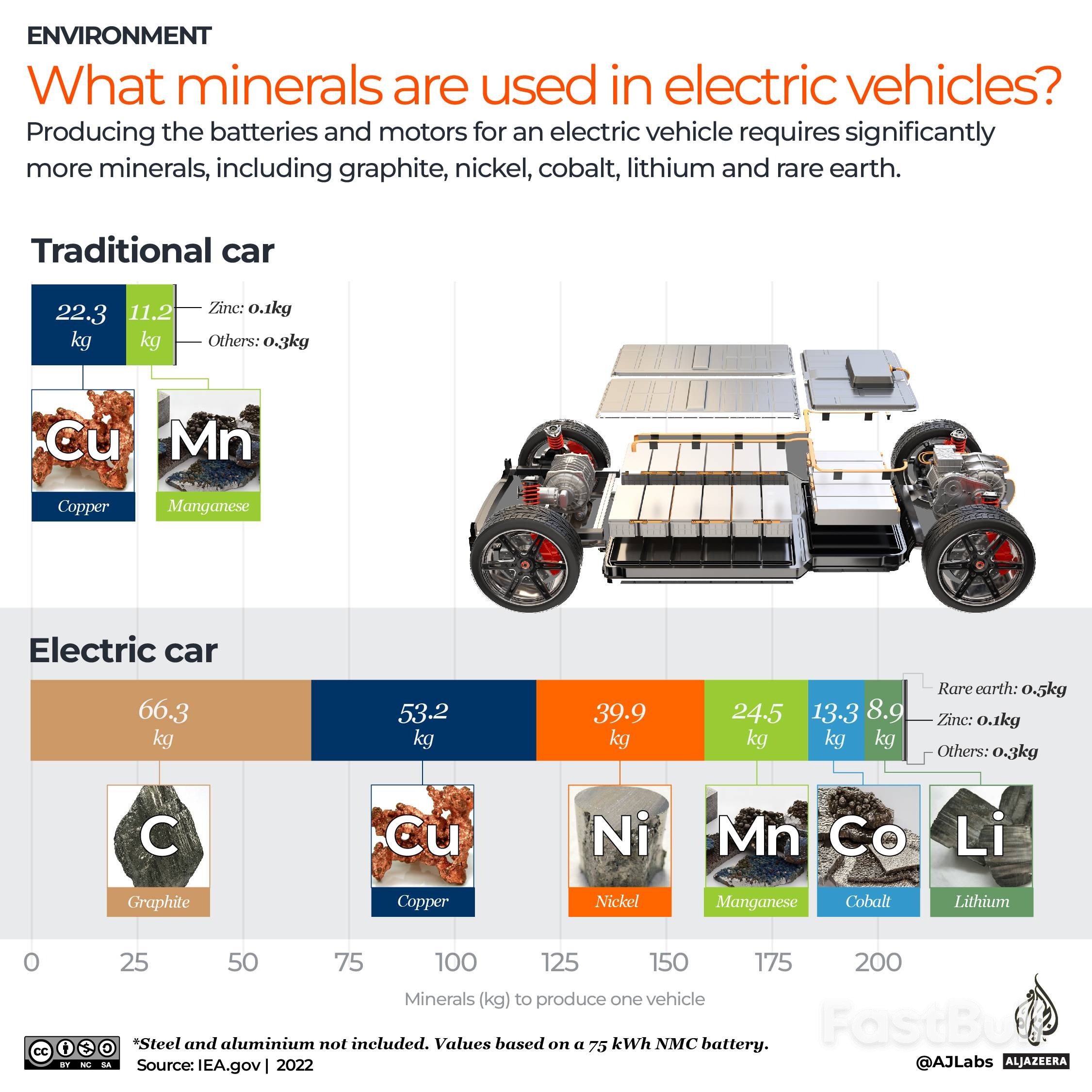

Critical minerals are non-fuel resources that form the backbone of modern technology. They are indispensable for manufacturing:

• Batteries and electric vehicles

• Semiconductors and advanced electronics

• Military hardware and defense systems

• Wiring and renewable energy generators

The U.S. government defines them as minerals "essential to the economic or national security" with supply chains that are "vulnerable to disruption." This vulnerability is stark: the U.S. is entirely dependent on imports for 12 critical minerals and imports at least half of its supply for another 29. Key examples include nickel, cobalt, lithium, aluminum, and zinc.

The Strategic Importance of Rare Earths

Within this group, 17 rare earth elements—which include the 15 lanthanides plus scandium and yttrium—are particularly crucial. China possesses deposits of 12 of these elements. Their unique magnetic properties make them necessary for producing the permanent magnets used in industrial automation, EV motors, wind turbines, and medical devices.

With Europe's supply of permanent magnets coming almost entirely from China, Western nations are increasingly concerned about their access to these materials. The high processing costs and the toxic environmental waste generated during mining add further complexity to developing alternative sources.

According to the U.S. Geological Survey (USGS), global rare earth reserves stood at approximately 110 million tonnes in 2024. A 2024 report from the Center for Strategic and International Studies described China's position as a "near monopoly," reinforced by thousands of patents for its advanced processing technologies.

Last year, Beijing began restricting exports of the 12 rare earth metals it controls, imposing curbs on seven in April and the remaining five in October. A temporary trade truce was reached between President Trump and Chinese President Xi Jinping in late October, where China agreed to pause the final five restrictions for one year in exchange for Trump dropping a threat of 100% tariffs on Chinese goods.

The ministerial's opening remarks will be delivered by Vice President JD Vance, Secretary Rubio, and other senior U.S. officials. A key topic for discussion is the implementation of a minerals price floor. Proponents argue that a minimum price would de-risk investment, encourage supply diversity, and prevent dominant players from using low prices to squeeze out smaller competitors.

However, Reuters reported that the Trump administration is backing away from guaranteeing a price floor. The news caused a drop in Australian mining stocks, as Australia has been a vocal supporter of the policy. With its own large rare earth reserves, Australia is positioning itself as a key alternative to China and is investing heavily in its processing capacity.

Analysts suggest the U.S. will use the conference to align partners with its own strategic goals. "The US is likely to push partner countries to sign minerals deals by which US companies get preferential or at least access to mineral deposits," Raphael Deberdt, a postdoctoral fellow at the Copenhagen Business School, told Al Jazeera.

Deberdt noted that while securing access is one goal, the U.S. also aims to encourage investment to expand production of rare earths, cobalt, nickel, and graphite. He added that the U.S. will likely promote a "reshuffling of critical minerals supply chains to orient processing towards its own territory and the territories of allied nations." However, he cautioned that this remains a long-term goal, as U.S. processing capabilities are still minimal compared to China's.

Besides Australia, which has the world's fourth-largest rare earth reserves, other regions are being explored. A critical minerals agreement signed by Prime Minister Anthony Albanese and President Trump in October gives the U.S. access to Australian minerals in exchange for investment. Still, Australia's reserves are only one-seventh the size of China's, prompting the U.S. to court other potential suppliers.

Greenland, which is rich in rare earth metals, is another potential source, though mining there is limited due to opposition from Indigenous Inuit communities.

In response to supply chain vulnerabilities, countries are increasingly stockpiling critical minerals. The U.S. Project Vault is part of a growing global trend:

• Japan: In March 2020, Japan reinforced its stockpiling system for rare earth minerals as part of its international resource strategy.

• South Korea: Maintains a long-running stockpile managed by a state-run corporation.

• European Union: In December, the European Commission adopted the RESourceEU Action Plan, which includes plans for a European Critical Raw Materials Centre to diversify supplies through stockpiling.

• Australia: In January, the government announced new details for its $1.2 billion Critical Minerals Strategic Reserve.

The International Monetary Fund's 2026 estimates show the world avoiding a recession, but the forecast paints a troubling picture of an economy stuck in a low-growth pattern defined by high debt, stubborn inflation, and poor productivity.

While the official data may not signal a recession, many people feel poorer as declining net real wages remain below pre-pandemic levels. This is largely because GDP growth in many developed nations is artificially inflated by government spending. This strategy leads to mounting debt and subsequent tax hikes that stifle private investment and productivity.

The IMF projects global GDP will grow by 3.3% in 2026 and 3.2% in 2027. These figures are slightly above the October 2025 projections but largely consistent with 2025's performance.

The United States stands out as the primary positive surprise in the IMF's latest report. Advanced economies are expected to grow by 1.8% in 2026 and 1.7% in 2027, but these averages are propped up almost entirely by strong US performance. In contrast, emerging markets are projected to grow around 4.2% and 4.1% respectively, even with a slowdown in China.

The IMF, which previously warned of significant risks, now calls this "resilient growth." This optimistic turn has surprised analysts who have learned to be wary when the Fund delivers bullish messages. Despite this, the IMF does acknowledge the poor state of economic development in other leading economies. The key drivers behind America's economic strength include:

• Investment related to Artificial Intelligence

• Accommodative financial conditions

• Private sector flexibility

These factors have successfully offset the negative impacts of geopolitical risk and trade tensions.

The Fund has sharply revised its US growth forecast to 2.4% for 2026—more than double its early 2025 expectation—before it moderates to 2.0% in 2027. The US is now positioned to be the only G7 economy to escape stagnation between 2025 and 2027, outperforming major peers like Germany, Japan, France, the UK, and Canada, which continue to use public spending and rising immigration to mask recessions in their private sectors.

Argentina is another major highlight, with the IMF forecasting growth of around 4% for both 2026 and 2027. This rate is significantly ahead of the 3.3% global pace and Latin America's projected 2.2% growth in 2026 and 2.7% in 2027.

This impressive trajectory follows an estimated 4.5% expansion in 2025 after a 1.3% contraction in 2024. The IMF explicitly credits these gains to the policies of President Milei and recent macro-stabilization efforts.

In the IMF's baseline scenario, Argentina transforms from a chronic underperformer into a clear regional leader, particularly as the outlook for Mexico and Brazil remains weak. The nation's focus on supply-side policies, private sector growth, and an end to energy sector interventionism positions it, alongside the US, as a key "pocket of strength" keeping global growth afloat.

For the euro area, the IMF projects moderate but slowly improving growth. Real GDP is expected to expand by 1.3% in 2026 and 1.4% in 2027. However, this weak performance is occurring despite the massive Next Generation EU stimulus plan and expected rate cuts.

Germany is forecast to recover from near-stagnation to 1.1% growth in 2026 and 1.5% in 2027, but this recovery is dependent on a debatable public spending program. France is expected to deliver real growth of just 1.0% and 1.2% over the same period, also driven by government spending. The underlying message is that the euro area remains a low-growth region held back by weak productivity, excessive regulation, and high taxes.

Other major economies face similar challenges:

• United Kingdom: Forecasted to grow by 1.3% in 2026 and 1.5% in 2027.

• Canada: Expected to expand by only 1.4% per year in 2026 and 2027.

• Japan: Projected to grow just 0.7% in 2026 and 0.6% in 2027, despite years of government stimulus.

These figures suggest that policies centered on "net zero," high taxes, and big government are a recipe for stagnation.

In Asia, the IMF highlights a diverging trend between a slowing China and a robust India.

China's growth is projected to cool to 4.5% in 2026 and 4.0% in 2027, down from 5% in 2025. Despite challenges in its real estate sector, China remains a primary engine of global expansion.

Meanwhile, India continues to be the fastest-growing large economy in the world. The IMF projects growth in the 6% range for both 2026 and 2027, powered by strong domestic demand. The Fund has identified India as the high-beta growth story in Asia.

The global economy may not be in a recession, but the pervasive weakness across developed and emerging economies points to a common cause: excessive government interventionism.

The IMF's own data suggests that the most dynamic economies are those focusing on supply-side, market-oriented policies that strengthen the private sector. Constant expansion of the public sector, in contrast, appears to hinder growth and create long-term financial vulnerability.

The Polish Monetary Policy Council (MPC) has adopted a dovish tone in its latest statement, signaling a clear readiness for further monetary easing despite holding interest rates steady for now.

Policymakers noted that incoming data suggests a potential drop in CPI inflation during the first quarter, with stabilization expected around the National Bank of Poland's (NBP) target level in the following quarters. The MPC also downplayed a recent jump in wage growth, suggesting the council views the uptick as temporary after a year of slowing growth. This interpretation points to a clear bias toward future rate cuts.

The decision to pause comes just three weeks after the MPC's January meeting, with no new official inflation data released in the interim. During this period, however, real economy data came in stronger than anticipated.

Key upside surprises included:

• Industrial and construction output: Growth in December was significantly stronger than market expectations.

• GDP growth: Preliminary estimates for 2025 suggest the economy expanded at a pace close to 4% year-on-year in the fourth quarter.

• Wage growth: December data also beat forecasts, interrupting a downward trend, though this was largely driven by annual bonuses in sectors like mining.

In light of this stronger data, the MPC has adopted a wait-and-see mode. The council requires more time to confirm that the declines in CPI inflation, core inflation, and wage growth are permanent trends.

Despite the pause, there appears to be substantial room for further interest rate reductions. The inflation outlook remains favorable, with forecasts indicating that inflation has likely already fallen below 2% year-on-year at the start of 2026.

Inflation is expected to remain below the NBP's target for almost the entire year, averaging 2.1% YoY. In some months of 2026, it could decline to around 1.5%, which is the lower bound of the tolerance range from the 2.5% target. This disinflationary pressure is supported by expectations of continued slowing wage growth, rising imports of inexpensive goods from China, and favorable developments in the food market.

The reference rate is projected to be cut from its current 4.00% to 3.25% before the end of 2026. Further rate reductions are expected to resume soon.

March is seen as a suitable moment for the next cut. By then, the MPC will have access to the preliminary inflation reading for January and an updated macroeconomic projection. This new information should reinforce policymakers' confidence that the current disinflation is durable, creating space for further monetary easing, albeit on a smaller scale than in 2025.

Mark Rutte, NATO's new Secretary-General, is an experienced and energetic politician. As the longest-serving prime minister in Dutch history, his political instincts would have been a perfect fit for the job in a previous era. But in today's geopolitical landscape, his worldview and approach are precisely what NATO does not need.

Since taking the helm, Rutte's primary goal has been clear: keep the United States unconditionally committed to European security. To achieve this, he appears willing to flatter U.S. President Donald Trump and discourage European efforts toward greater strategic autonomy. While the motive is understandable—relying on the U.S. as a first responder is a comfortable arrangement—his assessment of the strategic situation is deeply flawed.

Rutte recently told the European Parliament that Europe simply cannot defend itself without significant U.S. assistance, dismissing any alternative as a "dream." This statement serves as a direct rebuttal to Canadian Prime Minister Mark Carney's widely praised Davos speech, which called for medium powers to unite against the predatory behavior of great powers—a group that now includes the United States.

While Carney avoided naming Trump, his audience understood the message. Rutte, however, is doubling down on a policy of dependence, seemingly convinced that NATO allies have no choice but to follow the United States, no matter how erratic its leadership becomes.

This conclusion is built on at least four serious miscalculations that undermine European security and the future of the alliance.

1. Europe Can Defend Itself

First, Rutte is fundamentally wrong about Europe's defense capabilities. While the continent is currently over-reliant on the United States, this is a solvable problem, not a permanent state of weakness. European nations do not need to match America's global power projection. They simply need the capacity to deter or defeat an attack on their own territory.

The only significant military threat to Europe comes from Russia, which is not in a strong position itself. Consider the raw numbers:

• NATO's European members have a combined population more than three times that of Russia.

• Their collective GDP is nearly ten times larger.

• They already outspend Russia on defense annually.

The problem isn't a lack of resources but inefficient spending and coordination. Combined with the defensive advantages offered by modern technologies like drone warfare, a robust European defense independent of heavy U.S. support is well within reach, a point made by numerous defense analysts.

2. Appeasing Trump Is a Failed Tactic

Second, the strategy of appeasement isn't working. Rutte has gone to great lengths to flatter Trump, once even comparing him to a "daddy." The return on this effort has been minimal.

The Trump administration's National Security Strategy portrayed Europe as a collection of decadent nations in decline. Furthermore, Washington renewed its push to take over Greenland. History has repeatedly shown the dangers of appeasement, and Trump's actions demonstrate that the tactic often fails to produce the desired results.

3. Weakness Only Invites Contempt

Third, constantly highlighting European weakness and dependence reinforces the MAGA movement's contempt for democratic allies. This narrative paints them as strategic burdens, fueling arguments for abandoning the alliance altogether.

Trump respects strength and exploits weakness. A more capable Europe would be a more valuable partner, better positioned to push back against dangerous U.S. policies. By insisting on a position of compliance, Rutte is inadvertently making Europe an easier target for an administration that bullies the weak and backs down only when faced with resolve.

4. The Secretary-General's Role Has Changed

Finally, the job of the NATO Secretary-General has evolved. In the past, the role centered on managing American preferences. Today, it requires preparing the alliance for a future where the United States is less central or potentially even absent.

Instead of working to overcome the collective action problems that hinder European defense, Rutte's approach reinforces them. He is trying to preserve an outdated status quo at a time when the alliance needs to adapt urgently.

Mark Rutte has not yet grasped the structural shifts in global politics. During the Cold War, U.S. support for Europe was guaranteed by the shared goal of containing the Soviet Union. In the unipolar moment that followed, the risk of war seemed low, and Washington was willing to handle the heavy lifting.

That world is gone. The Trump administration has no commitment to liberal values and treats both allies and adversaries with a transactional, predatory approach. China has emerged as a major economic and military power, pulling U.S. attention away from Europe. In this new multipolar world, Europe is no longer Washington's primary focus and must learn to chart its own course.

Preserving NATO's old formula of U.S. dominance and European submission is an increasingly risky bet. The safest path forward is a new division of labor within the alliance.

European members must build up their defense capabilities as quickly as possible. The United States should transition from being Europe's "first responder" to its "ally of last resort." This shift won't happen overnight, but a more unified and capable Europe would command more respect from Washington and be better prepared for a future where it may have to stand on its own. Doubling down on an erratic and increasingly hostile United States is the last thing NATO should be doing right now.

A popular theory claims Donald Trump’s foreign policy is built on a simple premise: carve up the world into "spheres of influence" with autocratic rivals. Pundits and social media influencers circulate maps dividing the globe between Trump, China’s Xi Jinping, and Russia’s Vladimir Putin.

Headlines warn of this new world order, suggesting a grand bargain is in the works. But a closer look at the evidence reveals a different strategy entirely.

While Trump is fiercely protective of American dominance in the Western Hemisphere, he shows no interest in granting similar power to his main competitors. His approach looks less like a global carve-up and more like a traditional U.S. strategy: secure the homeland's neighborhood while preventing adversaries from dominating key geopolitical regions.

The term "spheres of influence" carries heavy baggage. Historically, it was a pragmatic way to manage great power rivalries. After World War II, for example, Washington and Moscow tacitly accepted each other's control over their respective parts of Europe to maintain a tense peace during the Cold War.

Today, the concept is viewed negatively. In a modern liberal system, smaller nations are expected to choose their own alliances and policies without coercion from powerful neighbors. Granting Russia a sphere of influence over Eastern Europe or China one over East Asia would mean consigning nations like Lithuania or Taiwan to subjugation.

When critics accuse Trump of pursuing this model, it’s an accusation, not a neutral observation. But the facts don't support the charge.

To be clear, Trump is unambiguous about one region: the Americas. His administration has explicitly called for restoring U.S. "dominance" in the Western Hemisphere, a policy some have dubbed the "Donroe Doctrine."

This isn't just rhetoric. His administration has actively worked to:

• Eject Chinese companies from operating ports in the Panama Canal.

• Seek the removal of President Nicolás Maduro in Venezuela.

• Apply pressure on the Communist regime in Cuba.

Trump's desire for an American sphere of influence is clear. The real question is whether he is willing to grant the same privilege to Russia and China in Eurasia. The evidence says no.

If Trump truly intended to grant Vladimir Putin a sphere of influence, the playbook would be straightforward. He would withdraw the U.S. from NATO, cut off military aid to Ukraine, and negotiate a peace deal that effectively hands Kyiv to Moscow.

Instead, his administration has done the opposite:

• Strengthened NATO: He has aggressively pushed allies to increase defense spending to as high as 5% of GDP.

• Armed Ukraine: He has provided weapons to Ukraine (with Europe footing the bill) and approved their use on Russian territory.

• Sanctioned Russia: He has ramped up economic pressure on Russia's critical energy sector.

This strategy is far more consistent with containing Putin and preventing a hostile power from dominating a critical region—a core tenet of long-standing U.S. policy.

The same pattern holds true in East Asia. A genuine plan to concede the region to Xi Jinping would involve cutting off arms to Taiwan, downgrading diplomatic relations, and weakening U.S. alliances with regional partners.

Again, Trump's actions point in the opposite direction:

• Prioritizing the Indo-Pacific: The National Defense Strategy identifies deterring conflict in the region—a clear euphemism for containing China—as the second-highest priority after defending the homeland.

• Boosting Military Spending: The administration passed the largest U.S. defense budget in history, focusing on capabilities designed for a potential conflict with China.

• Supporting Taiwan: Trump approved the largest arms package to Taiwan in history and the State Department dropped language opposing Taiwanese independence.

• Pressuring Allies: As in Europe, the administration is urging Asian allies to spend more on their own defense.

If this is a plan to grant China a sphere of influence, Xi Jinping is likely both perplexed and displeased. Elsewhere, from bombing Iran's nuclear program to amassing a naval armada in the Middle East, the policy is one of containment, not concession.

Some argue that Trump’s assertiveness in the Western Hemisphere gives a "permission slip" for Putin and Xi to do the same. This misunderstands geopolitics. Putin has already invaded his neighbors, and Xi considers Taiwan part of China; neither is waiting for an excuse. Precedent matters in a courtroom, not in the raw calculus of international security.

While Trump may not be as hard-line as some critics wish—he might seek a trade deal with China or avoid pursuing Putin for war crimes—these nuances are not evidence of a plan to cede entire regions to dictators.

Ultimately, Trump is not an international relations theorist remaking the global order. He is a pragmatist pursuing American self-interest. That pursuit is leading his administration down a well-worn path: ejecting hostile powers from the Americas while working to contain them in their own regions. This has been a central pillar of American grand strategy for decades.

Russia's government oil revenues crashed to their lowest level in over five years in January, as a combination of weaker global prices, steepening discounts for its crude, and a stronger ruble hammered the national budget.

According to finance ministry data, oil-related tax revenues were slashed in half to 281.7 billion rubles ($3.7 billion) compared to the previous year. When combined with gas, total energy revenue also fell by 50% to 393.3 billion rubles.

This sharp decline in proceeds from oil and gas—which together account for roughly a quarter of the budget—intensifies the financial strain on the Kremlin as the war in Ukraine approaches its fifth year. The January oil revenue figure marks the lowest point since June 2020.

While global Brent oil futures were down 15% year-on-year for the fiscal period, the market downturn was far more severe for Russia due to US sanctions.

The nation's flagship Urals grade traded at a discount of about $26 per barrel below the Dated Brent benchmark at its export point. This is a dramatic widening from the discount of just over $12 a barrel seen a year earlier, according to data from Argus Media.

These discounts expanded significantly after the US blacklisted Russia's two largest producers, Rosneft PJSC and Lukoil PJSC, in October. Further pressure could be on the horizon, as US President Donald Trump announced plans to cut import tariffs for India—a major buyer of Russian crude—if New Delhi stops purchasing oil from Moscow. The practical extent of India's cutbacks remains to be seen.

The revenue collapse starkly contrasts with the government's fiscal planning. Russia's finance ministry based its January revenue calculations on an average Urals price of $39.18 per barrel in December, which was a 38% drop from a year earlier. This price is far below the government's own budget forecast, which anticipated an average crude price of $59 per barrel in 2026.

According to Sergey Vakulenko, a senior fellow at the Carnegie Endowment for International Peace and a former Russian oil executive, the government’s take is highly sensitive to price. He estimates that Russia's budget receives 57 cents from every dollar of the oil price above $13.60 a barrel.

Based on this model, the government received only about $14.50 per barrel in taxes last month. Meanwhile, oil companies kept around $24.70, with an estimated $14-$18 of that going toward the costs of pumping crude and delivering it for export.

Adding to the fiscal pain is the appreciation of the Russian ruble. In December, the currency averaged 78.4368 rubles to the dollar, making it nearly 25% stronger than it was a year ago.

"What really hurts both the companies and the government is the exchange rate," explained Vakulenko, noting that their expenses are primarily denominated in rubles and are tied to domestic inflation. A stronger ruble means dollar-denominated oil revenues convert into fewer rubles, squeezing budgets further.

However, there was one minor positive side effect from the market dynamics. The lower global prices for crude and oil products allowed the Russian government to significantly reduce the subsidies it pays to domestic refiners. In January, these subsidy payments fell by almost 90% year-on-year to just 16.9 billion rubles, the lowest outlay since payments were paused in October 2023.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up