Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

Iran's Supreme Leader Khamenei: If Americans Start A War This Time, It Will Be A Regional Conflict

Ukraine President Zelenskiy: Ukraine Is Recording Russian Attempts To Disrupt Logistics And Connectivity Between Cities And Communities

[Bitcoin Briefly Drops Below $78,000] February 1st, According To Htx Market Data, Bitcoin Briefly Dropped Below $78,000, And Is Now Trading At $78,184, With A 24-Hour Decrease Of 6.52%

India Budget: Targets 3.16 Trillion Rupees Dividend From Reserve Bank Of India, Financial Institutions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The euro's unusual surge won't prompt immediate ECB action, with economists citing minimal inflation impact.

The euro's recent surge has turned heads toward the European Central Bank, but economists argue that the currency's rapid appreciation is unlikely to force policymakers into immediate action.

Last week, the euro climbed to $1.20 against the U.S. dollar, a level not seen since mid-2021. According to analysis from Capital Economics, the speed of this move is historically unusual. The currency has only strengthened by a similar magnitude over a 10-day period a few times in the last decade, and its trade-weighted exchange rate has now hit an all-time high.

Despite the sharp rise, the immediate effect on the eurozone's inflation is expected to be minimal.

Capital Economics cites the ECB's own sensitivity analysis, which suggests that if the euro stays at its current level against the dollar, headline inflation would only be about 0.1 percentage points lower next year than the central bank projected in December.

While this tilts inflation risks slightly to the downside, analysts say it falls far short of the threshold needed to justify intervening in the foreign exchange market on grounds of price stability.

The ECB is expected to discuss the euro's strength at its upcoming meeting, but direct intervention appears highly improbable.

The central bank has the power to intervene in currency markets to counter disorderly conditions that could threaten price stability. However, Capital Economics notes the euro would have to rise much further before such a move would be considered. Even then, an intervention involving the purchase of U.S. dollars is seen as very unlikely.

Historically, the ECB has intervened in currency markets on only two occasions: in late 2000 and March 2011. Both times, the goal was to support a stronger euro, and the actions were coordinated with other major central banks. Today, Capital Economics finds that a coordinated effort to push the euro lower is extremely unlikely, particularly given the U.S. administration's stated preference for a weaker dollar.

So far, ECB officials have downplayed the currency's climb. Vice President Luis de Guindos previously described levels above $1.20 as "complicated" but also called the $1.20 mark "perfectly acceptable." Similarly, Austria's central bank governor reportedly referred to the recent rise as "modest."

Capital Economics expects ECB President Christine Lagarde may reiterate that policymakers are closely monitoring the euro but is unlikely to take active steps to talk it down.

While immediate action is not on the horizon, sustained gains in the euro could influence monetary policy over time.

According to ECB analysis cited by Capital Economics, a gradual rise to between $1.25 and $1.30 over the next three years would lower headline inflation by approximately 0.3 percentage points in 2028. In such a scenario, policymakers would more likely turn to stronger verbal warnings and interest rate cuts rather than direct currency market operations.

For now, economists believe the euro's strength is more a reflection of dollar weakness than fundamental momentum in the eurozone, which lessens the need for an ECB response. As a result, the central bank is expected to remain on the sidelines unless the currency's appreciation becomes significantly larger and more persistent.

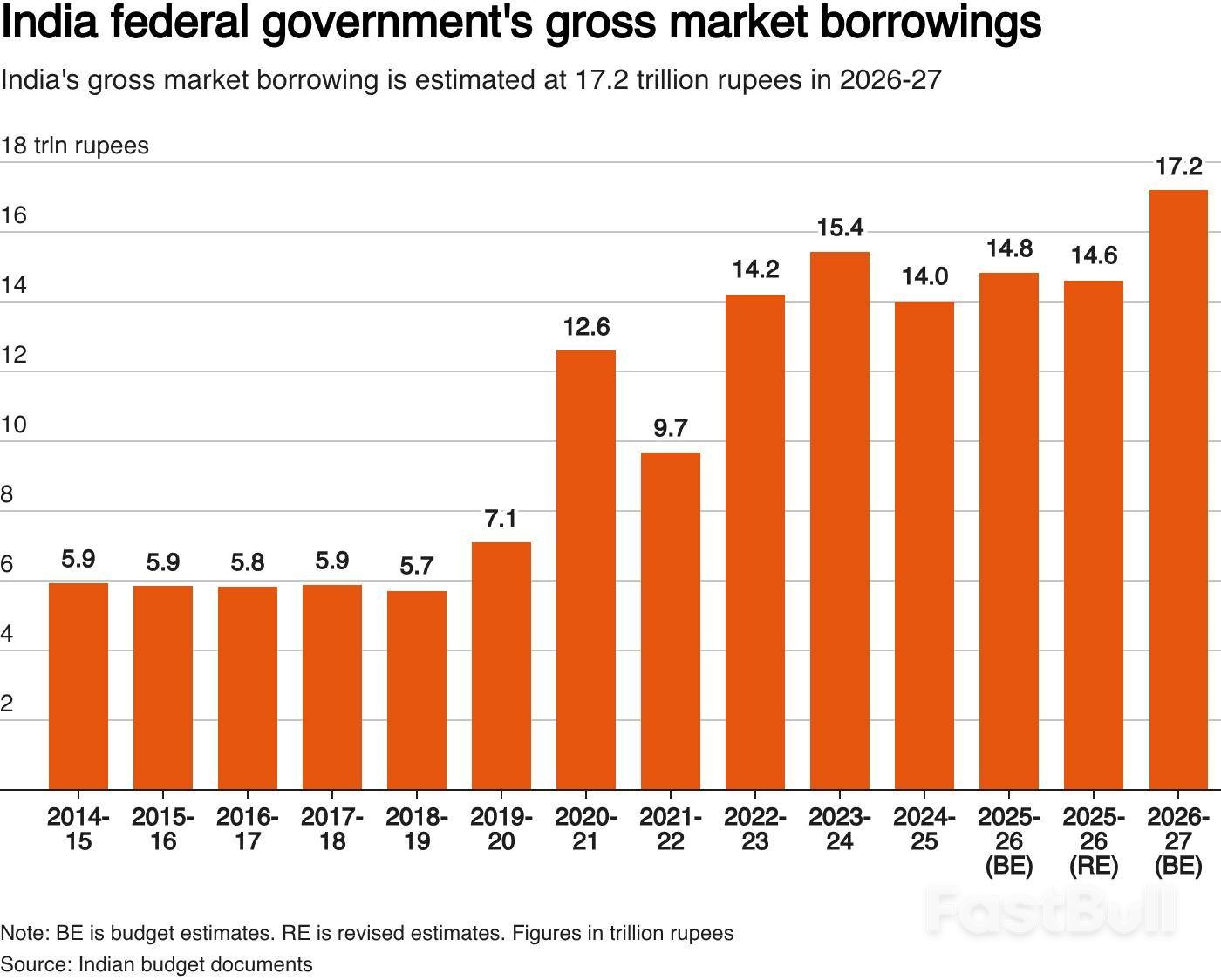

India's federal government plans to borrow a record 17.2 trillion rupees ($187.63 billion) in the 2026–27 fiscal year, a figure that surpasses most market expectations. The proposal was announced by Finance Minister Nirmala Sitharaman during her budget speech on Sunday.

For the upcoming fiscal year, the country's net market borrowing is projected to be 11.70 trillion rupees, which is slightly lower than the borrowing for the 2025-26 fiscal year.

The announcement comes as India's bond yields have already been climbing for months. The heavy borrowing by both federal and state governments has been overwhelming demand for government debt securities.

Even after the Reserve Bank of India cut its policy rate by 125 basis points, the benchmark 10-year bond yield has edged slightly higher since February of last year. Market analysts had anticipated gross borrowings to be in the range of 16 trillion to 17.50 trillion rupees, with a Reuters poll of 35 economists showing a median expectation of 16.3 trillion rupees.

Traders fear the substantial supply of new debt could continue to suppress demand and keep yields elevated. This concern persists despite significant support from the Reserve Bank of India, which has included record bond purchases and foreign-exchange swaps designed to inject more liquidity into the banking system.

With government bond markets closed on Sunday, the benchmark 10-year bond yield (IN10YT=RR) is expected to see a further increase when trading resumes on Monday. A trader at a private bank noted that any negative reaction might be partially offset by the central bank's choice of paper for its open market purchase scheduled for Thursday.

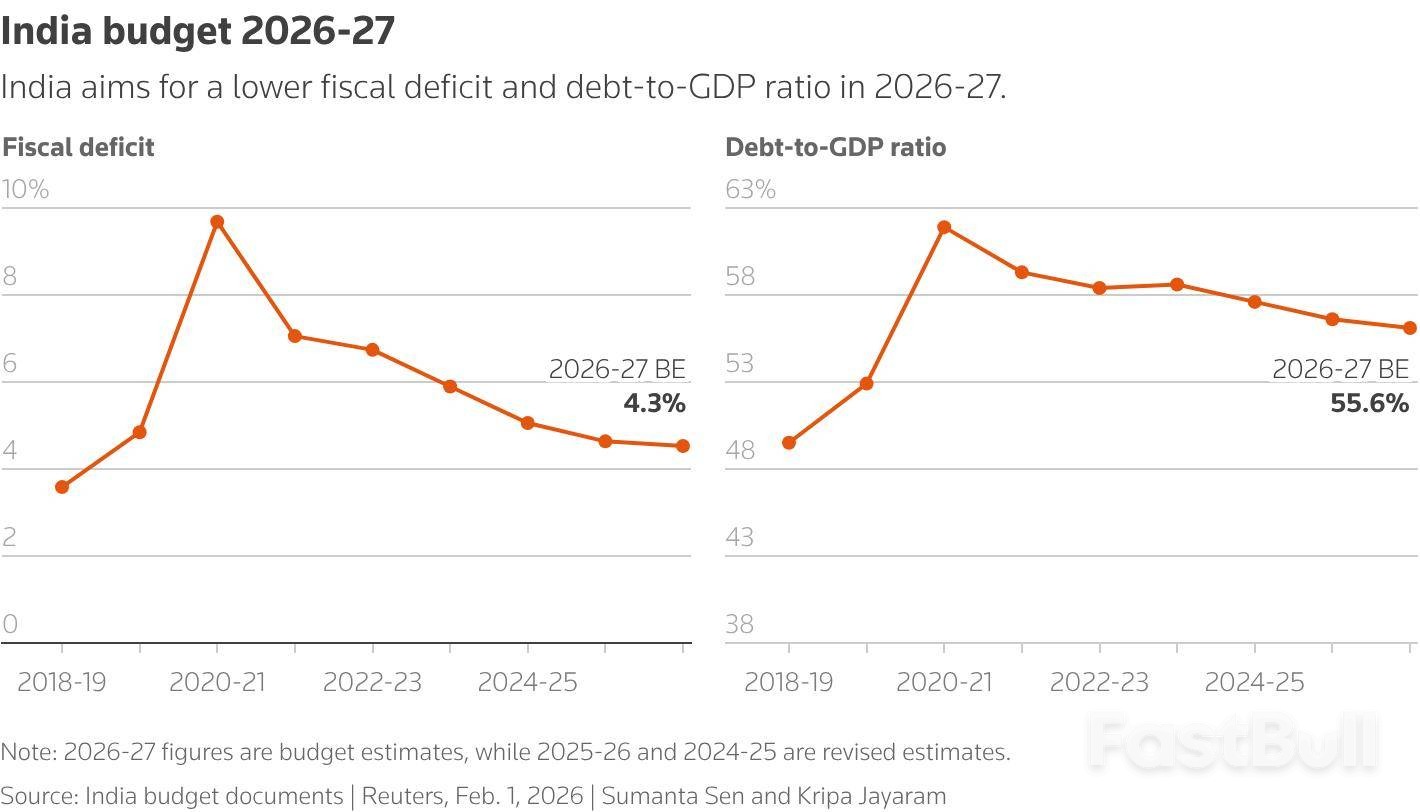

The government is shifting its fiscal policy to focus on a debt-to-GDP ratio target. The goal is to lower this ratio to 55.6% in the next fiscal year.

This strategy corresponds to a fiscal deficit target of 4.3% of the gross domestic product (GDP). The fiscal deficit, which measures the gap between government spending and revenue, is a critical metric for markets as it directly influences borrowing requirements, overall debt levels, and investor confidence.

($1 = 91.6710 Indian rupees)

India is set to unveil an annual budget designed to accelerate and sustain strong economic growth while enhancing business competitiveness in a volatile global climate. Finance Minister Nirmala Sitharaman announced that the government's priorities are geared towards long-term stability and expansion.

The upcoming fiscal year's budget will center on critical areas, including structural reforms, strengthening the financial sector, and increasing investment in advanced technologies like artificial intelligence.

The Indian economy is projected to grow at a rate of 7.4% in the current financial year, with inflation expected to remain near 2%. Meanwhile, the government's fiscal deficit for the year is anticipated to be 4.4% of GDP.

Looking ahead, the government's economic survey has forecast growth between 6.8% and 7.2% for the fiscal year beginning in April.

To stimulate private investment and demand, New Delhi has recently implemented a series of significant policy changes. More adjustments are expected in the forthcoming budget. Key reforms already rolled out include:

• Cuts to consumption and income taxes.

• A comprehensive overhaul of labor laws.

• Measures to open up the tightly controlled nuclear power sector.

Prime Minister Modi emphasized a shift in focus, stating, "The nation is moving away from long-term problems to tread the path of long-term solutions." He noted that such solutions create the predictability needed to foster global trust.

Modi added that India will push forward with "next-generation reforms," highlighting the next 25 years as crucial for achieving the goal of transforming the South Asian nation into a developed economy.

Revitalizing Domestic Manufacturing

A core component of this long-term strategy is a third major initiative to boost manufacturing's share of the economy, following two previous attempts. The government is also expected to ease regulations for investment in defense manufacturing to support this objective.

On the international front, India is actively pursuing new trade agreements to mitigate external economic pressures. A landmark trade deal with the European Union is a key example of this strategy.

This move is intended to offset the impact of the 50% tariffs that President Donald Trump's administration imposed on certain Indian goods exported to the United States.

The European Central Bank (ECB) is set to confront the issue of a surging euro at its first policy meeting in 2026, a development that analysts warn could push eurozone inflation further below its target. Officials in Frankfurt have already voiced concerns over this trend.

While the ECB has held interest rates steady since June and no immediate changes are anticipated, several critical issues are demanding the bank's attention. Developments since the last rate decision on December 18, including moves by the Federal Reserve, threats of new tariffs from US President Donald Trump, and a recent decline in the dollar, have all come under scrutiny.

Comments from President Trump, who stated he was not bothered by the US dollar's status, contributed to a significant drop in the currency. This slide propelled the euro to approximately $1.20, a level not seen since 2021.

In response, ECB officials have expressed concern about how this currency shift might be received. François Villeroy de Galhau, a key member of the ECB's Governing Council, emphasized that the euro will be a crucial determinant of future monetary policy. Another Governing Council member, Martin Kocher, confirmed the bank will closely monitor the currency for any continued upward movement.

The focus on the euro comes as eurozone inflation fell below 2% in December. Analysts forecast a further decline, predicting the figure will be around 1.7% when Consumer Price Index data is released on Wednesday, February 11.

The ECB had previously projected that price growth would naturally reach its target without further intervention. However, a persistently strong euro could undermine this outlook and potentially trigger a new round of discussions about rate cuts.

"Europe has started the year with many geopolitical issues, and the ECB will likely keep its focus on bigger problems," noted analysts. "This means they will probably overlook the recent US trade conflict involving Greenland, the slight drop in inflation below 2%, and the rising euro. However, these changes highlight that there are growing risks to the economic outlook."

The ECB is expected to release quarterly surveys on bank lending and expert economic forecasts soon, positioning it among several central banks scheduled to announce interest-rate decisions this week.

Globally, a mixed policy landscape is emerging:

• The UK, Mexico, and the Czech Republic are likely to hold rates steady.

• India and Poland are expected to implement rate cuts.

• The Reserve Bank of Australia might become the first major central bank to hike rates this year.

Meanwhile, this month's US jobs report will be a key data point, measured against the Federal Reserve's view that the labor market is stabilizing after a period of slow hiring late last year.

A senior Iranian official has indicated that diplomatic negotiations with the United States are making headway, a surprising development that contrasts sharply with a recent American military buildup in the region.

The signal for de-escalation follows US President Donald Trump's deployment of warships to the area and his public statements that an attack on Iranian soil was possible if the country refused to negotiate a "deal."

Ali Larijani, head of Iran's Supreme National Security Council, suggested that behind-the-scenes progress was being made. "Contrary to the hype of the contrived media war, structural arrangements for negotiations are progressing," he stated.

Larijani's comments followed a meeting in Tehran with Qatari Prime Minister Sheikh Mohammed Abdulrahman bin Jassim Al Thani. A statement from Qatar confirmed the two discussed "ongoing efforts to deescalate tensions in the region." Qatar, a major US ally with closer ties to Iran than other Gulf Arab nations, is positioned to act as a key mediator.

In a separate diplomatic push, Iranian President Masoud Pezeshkian emphasized a desire to avoid conflict during a phone call with Egyptian President Abdel Fattah el-Sissi, another close US ally. "The Islamic Repubic of Iran has never sought, and in no way seeks, war and it is firmly convinced that a war would not be in the interest of neither Iran, nor the United States, nor the region," Pezeshkian said.

Speaking to reporters aboard Air Force One, President Trump confirmed that Iran is talking "seriously" with the US. He expressed hope for an "acceptable" deal, outlining two primary conditions:

• Iran must commit to having "no nuclear weapons."

• The Iranian government must stop killing anti-government protesters.

The diplomatic overtures are occurring as Iran grapples with a severe economic crisis and widespread domestic unrest. Demonstrations that began in December, fueled by high unemployment, inflation, and a weakening rial currency, have spread nationwide.

The government's crackdown on these protests has resulted in significant casualties, according to human rights organizations.

• The Human Rights Activists News Agency reports 6,713 deaths, including 6,305 demonstrators.

• The Center for Human Rights Iran places the number of killed at 6,479.

• The Oslo-based Iran Human Rights watchdog estimates that "at least 40,000 people, including children, have been detained."

Last month, Trump encouraged the protests, telling Iranians that "help is on its way." However, he later softened his rhetoric on military action, claiming his shift was because Iran had decided not to execute protesters.

Japan is on the brink of facing market turmoil over its fiscal policy, with a former top currency diplomat warning that further tax relief could trigger a selloff in government bonds and the yen similar to the UK's "Truss shock."

Hiroshi Watanabe, a former vice finance minister for international affairs, stated that markets remain highly sensitive to any moves by the ruling Liberal Democratic Party (LDP) to expand sales tax cuts to secure voter support.

"We're somehow managing to hold the line for now, but it's right at the edge," Watanabe said in an interview. Watanabe, now a visiting professor at Tokyo Seitoku University, was in charge of Japan's currency policy from 2004 to 2007.

The warning comes as Prime Minister Sanae Takaichi seeks a new mandate for her economic reflation strategy in a snap election scheduled for February 8.

Investors are watching closely for any sign that the LDP might lean toward more tax cuts if the election campaign proves challenging. This political pressure is reviving concerns about fiscal discipline in a country where public debt is more than double the size of its economy.

A market rout last month provided a stark example after Takaichi pledged to cut the consumption tax on food for two years. The announcement triggered a sharp selloff in super-long Japanese government bonds and pushed the yen toward levels that had previously prompted government intervention.

Markets have stabilized since then, with the yen recovering to around 154 per dollar. This rebound followed speculation that Japanese and U.S. authorities conducted rate checks, a move often seen as a precursor to direct currency intervention.

Watanabe believes that top officials have taken note of the market's negative reaction. "I do think that Takaichi, as well as Finance Minister Satsuki Katayama, have registered the warnings coming from global capital markets," he said, suggesting that caution from U.S. and European investors has likely influenced policymakers' public statements.

However, he cautioned that investors would react strongly to any hint that tax relief could be expanded beyond the current pledges.

Looking ahead, Watanabe sees limited potential for a sustained recovery in the yen. While he noted that "there is a possibility that the yen could briefly move into the 140s per dollar," he does not foresee a prolonged period of appreciation.

Several key factors are expected to weigh on the Japanese currency:

• Persistent concerns over Japan's public finances.

• The country's structural trade deficit.

• A lack of clarity regarding the Bank of Japan's future interest rate path.

These combined pressures make it difficult to envision a scenario where "yen appreciation continues" for an extended period.

A second round of trilateral talks between Russia, Ukraine, and the United States is scheduled for February 1 in Abu Dhabi, according to Kremlin spokesman Dmitry Peskov. Russia's participation marks a significant policy shift, bringing the US directly into negotiations.

While details from the first round remain scarce, public statements and recent reports offer crucial clues into the high-stakes discussions. Here are five critical insights into the evolving diplomatic landscape.

Territory appears to be the central unresolved issue. On the eve of the initial talks, top Putin aide Yuri Ushakov stated that a lasting settlement was unlikely without addressing the territorial issue based on a previously agreed-upon formula.

This was echoed last week by US Secretary of State Marco Rubio, who told the Senate Foreign Relations Committee, "The one remaining item … is the territorial claim on Donetsk." This lends credibility to earlier reports that Russia is demanding Ukraine's withdrawal from Donbass.

Discussions are also underway regarding post-conflict security arrangements. Rubio revealed that "security guarantees basically involve the deployment of a handful of European troops, primarily French and the UK, and then a US backstop," a move that would require Russia's consent.

However, the US is still debating its commitment to a potential future conflict. This follows earlier signals from Steve Witkoff and Jared Kushner indicating American support for NATO troops in Ukraine. This topic will likely be a key focus in the upcoming second round of negotiations.

A potential trade-off may be emerging. According to the Financial Times, US security guarantees for Ukraine are contingent on its withdrawal from Donbass. The New York Times adds that the Kiev-controlled portion of the region could become a demilitarized zone or host neutral peacekeepers.

This suggests a possible deal: Ukraine cedes control of Donbass in exchange for US security guarantees and a NATO military presence. Russia might agree to such terms if neutral peacekeepers serve as a buffer.

Despite the promise of this potential arrangement, Ukrainian President Zelensky remains defiant about withdrawing from Donbass. For his part, President Trump has avoided publicly pressuring Zelensky with tangible consequences, such as halting arms sales to the EU destined for Ukraine.

This suggests there are clear limits to how far the United States is willing to go to secure a deal, even as it facilitates the talks.

Despite these limitations, the US diplomatic role has become indispensable. Russia's agreement to expand bilateral talks with Ukraine into a trilateral format is a major change in its foreign policy. This indicates that Moscow believes Washington is sincere in its efforts to negotiate an agreement, even if it won't use all its leverage.

With the US now formally at the table, the talks are unlikely to revert to a bilateral format unless the conflict is still ongoing by the time of a potential Trump 2.0 administration.

Overall, these developments suggest that President Putin may be considering significant compromises on the maximum goals set at the beginning of the special operation. While it is too early to draw definitive conclusions, any official agreement—whether a ceasefire, armistice, or peace treaty—will be heavily analyzed to understand the strategic calculations behind Russia's evolving position.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up