Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The US Dollar Index Rose Approximately 0.7% In Late New York Trading On Monday (February 2nd), Reaching 97.641 Points. The Index Traded Between 97.008 And 97.733 Points During The Day, Maintaining A Slight Upward Trend And Hovering Around 97.100 Points Before Extending Its Gains. The Bloomberg US Dollar Index Rose 0.35% To 1192.42 Points, Trading Between 1187.02 And 1193.19 Points During The Day

US Treasury Says To Borrow $574 Billion In Q1, Sees End Cash Balance Of $850 Billion (Removes Extraneous Word "It")

US Treasury Says It Expects To Borrow $109 Billion In Q2, Sees End Cash Balance Of $900 Billion

[The Carlyle Group Joins Europe's Top Ten Oil Refiners] As Major Oil Companies Streamline Their Portfolios, The Carlyle Group Has Joined The Ranks Of Europe's Top Ten Fuel Manufacturers. The Private Equity Giant Holds A Two-thirds Stake In Varo Energy, Which Completed Its Acquisition Of The Lysekil And Gothenburg Refineries In Sweden In January. According To Data Compiled By Bloomberg, This Move, Combined With Its Existing Holdings, Elevates Carlyle To Ninth Place Among European Fuel Manufacturers

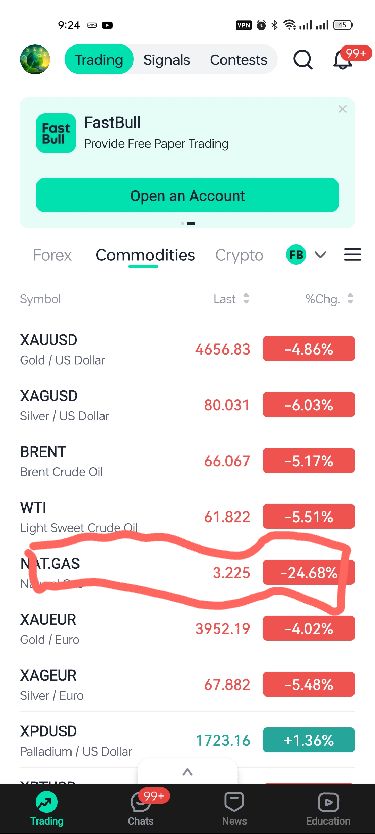

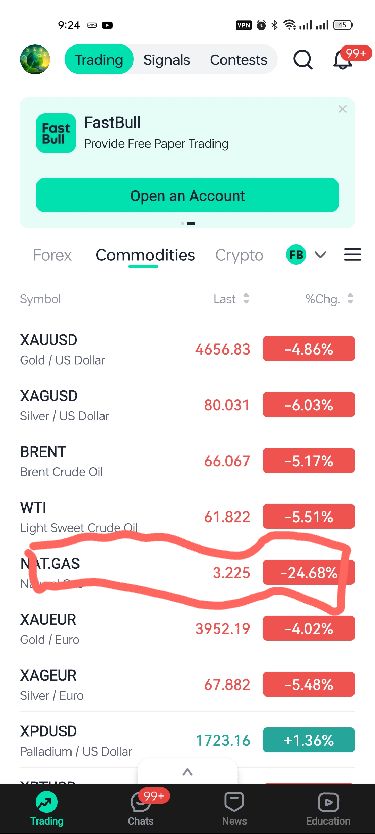

WTI Crude Oil Futures For March Delivery Closed At $62.14 Per Barrel. Nymex Natural Gas Futures For March Delivery Closed At $3.2370 Per Million British Thermal Units (MMBtu). Nymex Gasoline Futures For March Delivery Closed At $1.8514 Per Gallon, And Nymex Heating Oil Futures For March Delivery Closed At $2.3598 Per Gallon

Ukraine Designates Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization" On February 2nd. Ukrainian President Volodymyr Zelenskyy Announced That Ukraine Has Designated Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization." Iran Has Not Yet Responded

Intercontinental Exchange (ICE), The Owner Of Nasdaq (NYSE), Has Received Approval From The U.S. Securities And Exchange Commission (SEC) To Provide U.S. Treasury Clearing Services

Swiss National Bank Chairman: Expects Swiss Inflation To Rise In Coming Months, Sees Monetary Conditions In Switzerland As Appropriate

Rubio: US Looks Forward To Working Closely With Costa Rica's President-Elect Laura Fernández Delgado's Administration After Electoral Victory

German Chancellor Merz: Transatlantic Relationship Has Changed And No One Regrets It More Than Me

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

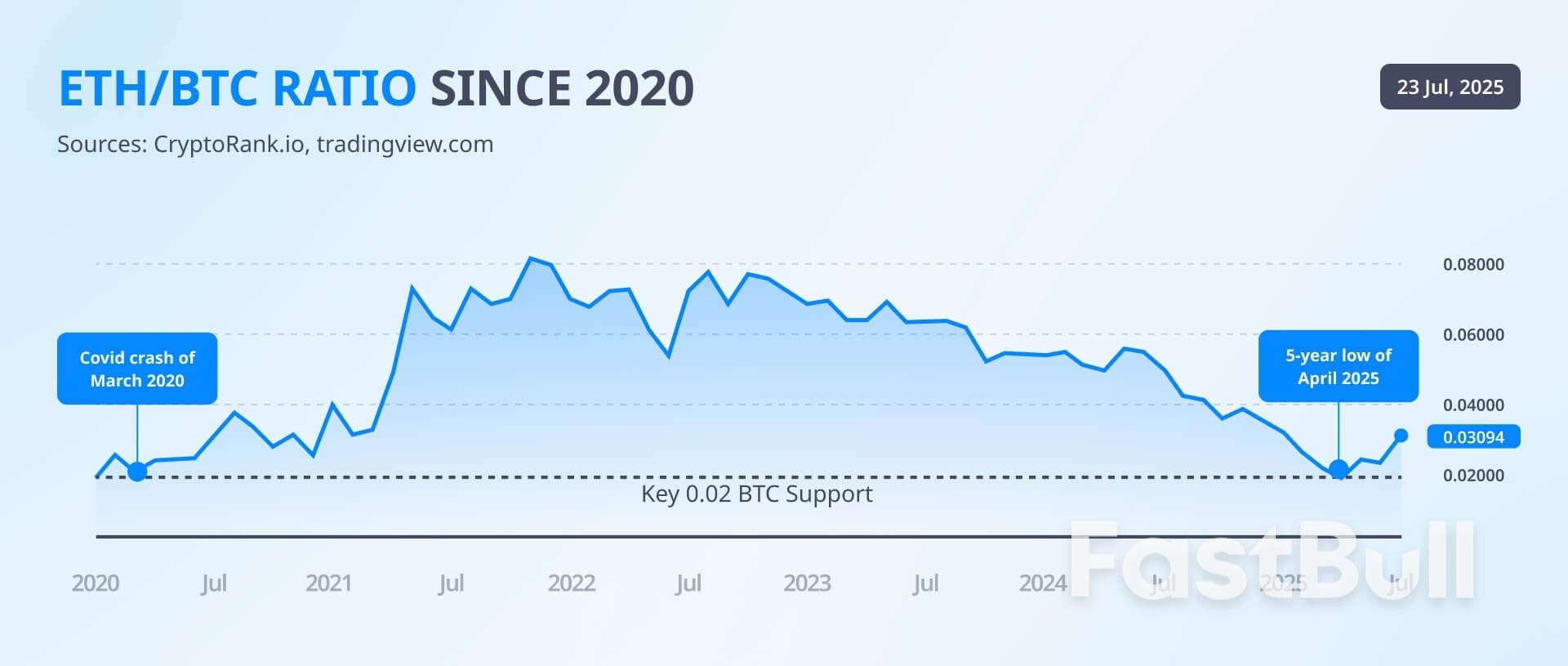

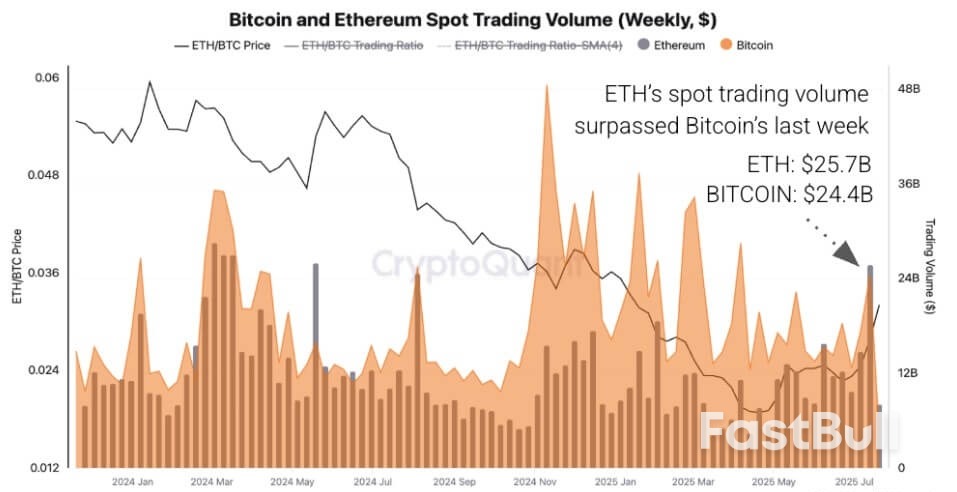

The ETH/BTC ratio has surged more than 70% since touching a five-year low of 0.018 in April—a level last seen during the COVID-19 market crash in March 2020.

The Canadian dollar weakened against its U.S. counterpart on Thursday as domestic data showed that retail sales declined in May, but the move was limited ahead of a Bank of Canada interest rate decision next week.

The looniewas trading 0.3% lower at 1.3635 per U.S. dollar, or 73.34 U.S. cents, after moving in a range of 1.3592 to 1.3646. On Wednesday, the currency touched its strongest intraday level since July 4 at 1.3573.

Canada's retail sales shrank by 1.1% in May from April as consumers curtailed car purchases and spent less at supermarkets, convenience stores and on alcohol. A preliminary estimate for June pointed to a rebound of 1.6%.

"This decline points to softening domestic demand, though markets remain relatively calm, with expectations that the Bank of Canada will maintain its 2.75% interest rate at next week's meeting amid persistent inflation pressures," said Tony Valente, senior FX dealer at AscendantFX.

The BoC has kept its benchmark rate on hold at 2.75% since March, after slashing it by two and a quarter percentage points in the previous nine months. Investors expect no change at a policy decision next Wednesday and are pricing in just 12 basis points of easing by the end of 2025, down from about 30 basis points before stronger-than-expected jobs data earlier this month.

"Despite this pullback, the CAD remains resilient, supported by positive broader risk sentiment and signs of USD fatigue against other major currencies," Valente said.

The U.S. dollarclawed back some of this week's decline against a basket of major currencies, while the price of oil, one of Canada's major exports, was up 0.8% at $65.75 a barrel on optimism over U.S. trade negotiations and after a sharper-than-expected decline in U.S. crude inventories.

The Canadian 10-year yield (CA10YT=RR) was little changed at 3.546%, pulling back from an earlier one-week high at 3.614%.

The Federal Reserve is working with the White House to accommodate President Donald Trump's unexpected visit to the U.S. central bank on Thursday, amid escalating tensions between the administration and the independent overseer of the nation's monetary policy.

"The Federal Reserve is working with the White House to accommodate their visit," a Fed spokesperson said.

Trump's visit to the Fed's headquarters in Washington, a rare appearance at the central bank by a U.S. president, was made public by the White House late on Wednesday.

The president has repeatedly demanded that Powell slash U.S. interest rates and has frequently raised the possibility of firing him, though Trump has said he does not intend to do so. On Tuesday, Trump called the Fed chief a "numbskull."

Trump will visit the Fed less than a week before the central bank's 19 policymakers gather for a two-day rate-setting meeting. They are widely expected to leave the central bank's benchmark interest rate in the 4.25%-4.50% range where it has been since December.

The visit also is taking place as Trump battles to deflect attention from a political crisis over his administration's refusal to release files related to convicted sex offender Jeffrey Epstein, reversing a campaign promise. Epstein died in 2019.

White House officials ramped up Trump's pressure campaign on Powell in recent weeks, accusing the Fed of mismanaging the renovation of two historic buildings in Washington and suggesting poor oversight and potential fraud.

The White House's budget director, Russell Vought, has pegged the cost overrun at "$700 million and counting," and Treasury Secretary Scott Bessent called for an extensive review of the Fed's non-monetary policy operations, citing operating losses at the central bank as a reason to question its spending on the renovation.

The Fed's operating losses stem from the mechanics of managing the policy rate to fight inflation, which include paying banks to park their cash at the central bank. The Fed reported a comprehensive net loss of $114.6 billion in 2023 and $77.5 billion in 2024, a reversal from years of big profits it turned over to the Treasury when interest rates - and inflation - were low.

The Fed, in letters to Vought and lawmakers backed up by documents posted on its website, says the project - the first full rehab of the central bank's two buildings in Washington since they were built nearly a century ago - ran into unexpected challenges including toxic materials abatement and higher-than-estimated materials and labor costs.

The White House's deputy chief of staff, James Blair, said this week that administration officials would be visiting the Fed on Thursday. Senate Banking Committee Chair Tim Scott, who has also raised questions about the buildings, will join the visit as well.

In a schedule released to the media on Wednesday night, the White House said Trump would visit the Fed at 4 p.m. EDT (2000 GMT) on Thursday. It did not say whether Trump would meet with Powell.

Market reaction to Trump's visit was subdued. The yield on benchmark 10-year Treasury bonds ticked higher after data showed new jobless claims dropped in the most recent week, signaling a stable labor market not in need of support from a Fed rate cut. Stocks on Wall Street were trading higher.

Trump's public criticism of Powell and flirtation with firing him have previously upset financial markets and threatened a key underpinning of the global financial system - that central banks are independent and free from political meddling.

His visit, against the backdrop of his antipathy for Powell, contrasts with a handful of documented previous presidential visits, including most recently former President George W. Bush's swearing-in of former Fed Chair Ben Bernanke.

Republican Senator Mike Rounds on Thursday said it's critical that Powell maintains his independence, but saw no problem with Trump's visit.

"I think the more information the president can glean from this, probably the better off we are in terms of resolving any issues that are outstanding," Rounds said, noting that Powell had indicated "that they have had a significant amount of money, just in terms of foundation work and so forth, that was not anticipated to begin with."

"I think he has to maintain his independence," Rounds said about Powell's role. "That's critical for the markets. I think he's done a good job of that."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up