Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Oct)A:--

F: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Oct)A:--

F: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)A:--

F: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)A:--

F: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)A:--

F: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)A:--

F: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)A:--

F: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)A:--

F: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)A:--

F: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)A:--

F: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)A:--

F: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Dec)

Japan Domestic Enterprise Commodity Price Index YoY (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Dec)

Japan Domestic Enterprise Commodity Price Index MoM (Dec)--

F: --

P: --

Japan PPI MoM (Dec)

Japan PPI MoM (Dec)--

F: --

P: --

Australia Consumer Inflation Expectations (Jan)

Australia Consumer Inflation Expectations (Jan)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Dec)

U.K. 3-Month RICS House Price Balance (Dec)--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest Rate--

F: --

P: --

Saudi Arabia CPI YoY (Dec)

Saudi Arabia CPI YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Nov)

U.K. Services Index MoM (SA) (Nov)--

F: --

P: --

U.K. Services Index YoY (Nov)

U.K. Services Index YoY (Nov)--

F: --

P: --

U.K. Manufacturing Output MoM (Nov)

U.K. Manufacturing Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance (Nov)

U.K. Trade Balance (Nov)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Nov)

U.K. Monthly GDP 3M/3M Change (Nov)--

F: --

P: --

U.K. GDP MoM (Nov)

U.K. GDP MoM (Nov)--

F: --

P: --

U.K. Industrial Output MoM (Nov)

U.K. Industrial Output MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Nov)

U.K. Trade Balance Non-EU (SA) (Nov)--

F: --

P: --

U.K. Trade Balance (SA) (Nov)

U.K. Trade Balance (SA) (Nov)--

F: --

P: --

U.K. Manufacturing Output YoY (Nov)

U.K. Manufacturing Output YoY (Nov)--

F: --

P: --

U.K. Construction Output MoM (SA) (Nov)

U.K. Construction Output MoM (SA) (Nov)--

F: --

P: --

U.K. Industrial Output YoY (Nov)

U.K. Industrial Output YoY (Nov)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output YoY (Nov)

U.K. Construction Output YoY (Nov)--

F: --

P: --

U.K. GDP YoY (SA) (Nov)

U.K. GDP YoY (SA) (Nov)--

F: --

P: --

U.K. Trade Balance EU (SA) (Nov)

U.K. Trade Balance EU (SA) (Nov)--

F: --

P: --

France HICP Final MoM (Dec)

France HICP Final MoM (Dec)--

F: --

P: --

Germany Annual GDP Growth

Germany Annual GDP Growth--

F: --

Italy Industrial Output YoY (SA) (Nov)

Italy Industrial Output YoY (SA) (Nov)--

F: --

P: --

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Nov)

Euro Zone Industrial Output MoM (Nov)--

F: --

P: --

Euro Zone Trade Balance (SA) (Nov)

Euro Zone Trade Balance (SA) (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Nov)

Euro Zone Industrial Output YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Dozens of commercial ships have dropped anchor at a distance outside Iran's port limits in recent days, according to data and shipping sources, as tensions with the United States grow.

LONDON, Jan 13 (Reuters) - Dozens of commercial ships have dropped anchor at a distance outside Iran's port limits in recent days, according to data and shipping sources, as tensions with the United States grow.

Such movements were precautionary given the tensions amid ongoing protests in Iran, the shipping sources said. Port limits are significant because they run a higher risk of collateral damage in the event of air strikes on nearby infrastructure.

The U.S. is withdrawing some personnel from bases in the Middle East, a U.S. official said on Wednesday, after a senior Iranian official said Tehran had warned its neighbours that it would hit American bases if Washington strikes Iran.

The country relies on seaborne trade for imports using dry bulkers, general cargo and container ships as well as oil tankers for oil exports.

The number of tankers moving into Iran's exclusive economic zone (EEZ), a stretch of water along its Gulf and Caspian coasts that extends up to 24 miles and beyond local territorial limits of 12 nautical miles, jumped from 1 vessel to 36 tankers between January 6 and January 12, analysis by maritime intelligence solutions provider Pole Star Global shows.

At least 25 bulk carriers were stationary in Iran's EEZ off the major port of Bandar Imam Khomeini, data from ship tracking and maritime analytics provider MarineTraffic showed.

A further 25 ships including container and cargo vessels had dropped anchor further south off the port of Bandar Abbas, MarineTraffic data showed.

Israel launched air strikes in June 2025 on targets in Bandar Abbas, where at least 70 people were killed in unexplained blasts in April and authorities did not rule out sabotage.

As Iran's leadership tries to put down the worst unrest the Islamic Republic has faced, Tehran is seeking to deter U.S. President Donald Trump's repeated threats to intervene on behalf of anti-government protesters.

The level of interference with GNSS navigation systems, which included GPS, had increased to "substantial" in the Gulf and Strait of Hormuz area over the past week, the U.S. Navy's Combined Maritime Force said in a note on Monday.

"This is highly likely due to force protection measures being taken in relation to the ongoing political tensions in the region. Vessels transiting this area could be impacted," the note said.

Minneapolis Federal Reserve President Neel Kashkari delivered an optimistic forecast for the U.S. economy on Wednesday, anticipating continued growth even as inflation gradually declines.

"My outlook for the U.S. economy is one of pretty good growth going forward," Kashkari stated during a virtual event. While he believes inflation is on a downward path, the exact trajectory remains uncertain. "The question is, is it going to be two and a half percent by the end of the year, something short of that, or something above that? I don't know."

Kashkari described the overall economy as "quite resilient," noting that it "has not slowed as much as expected." He also characterized the current environment as a "K-shaped" recovery, pointing to uneven performance across different economic segments.

While acknowledging that inflation is still "too high," he emphasized that it is moving in the right direction and that the central bank does not expect a renewed surge. Kashkari expressed particular confidence that price pressures in housing-related sectors are set to ease. The Federal Reserve remains fully committed to its 2% inflation target.

Regarding the Fed's current strategy, Kashkari questioned just how restrictive monetary policy truly is at this stage.

He also clarified his stance on the Fed's balance sheet, stating that he sees no need for quantitative easing. Kashkari asserted that the central bank's current balance sheet expansion should not be mistaken for a new round of QE.

Kashkari addressed several key areas of the economy, weighing both risks and strengths.

On trade policy, he observed that tariffs have had less impact on consumer prices than initially anticipated. However, he cautioned that "another price bump related to tariffs could happen." While tariffs "haven't been the gut punch many feared," he noted their long-term effects are still unfolding.

From the consumer's perspective, Kashkari sees a stable picture. He described household balance sheets as "pretty good" and said he has not observed anything "very alarming" in borrowing patterns. He identified inflation as the primary cause of financial distress for households so far.

He also touched on the Fed's dual mandate of managing employment and price stability, describing the two goals as being "in tension." Kashkari welcomed the recent fall in unemployment but stressed the need to monitor both objectives carefully.

Kashkari also offered his perspective on several other trending topics:

• Artificial Intelligence: He believes most business applications of AI remain experimental and are not yet leading to significant layoffs.

• Cryptocurrency: He described digital currencies as "basically useless" for consumers.

• Housing Market: He identified supply constraints as the "biggest barrier" facing the housing sector.

Kashkari concluded by expressing confidence in the Fed's decision-making process and underscored the critical importance of central bank independence. "We all believe an independent central bank makes the best policy," he said.

The possibility of U.S. and Israeli airstrikes on Iran is growing, with escalating threats from President Donald Trump on social media and a stream of leaks from administration officials detailing preparations. Bolstered by perceived successes in Venezuela and previous strikes on Iran, the president appears to be dismissing experts who warn of the risks.

Reports suggest European allies have been consulted on potential targets, and some staff have been advised to leave U.S. bases in the Gulf. While an attack isn't guaranteed—sanctions and cyberattacks remain options—the signals are pointing toward military action.

So, why would the United States attack Iran now? The ongoing protests are a convenient trigger, but the motivation runs deeper.

Israel, led by Prime Minister Benjamin Netanyahu, has been pushing for military action against Iran's nuclear program, a case he reportedly made to Trump in a late December meeting. The protests and Iran's violent crackdown offer a timely pretext to pursue a decades-old policy goal shared by American and Israeli hawks: regime change. Many have convinced themselves that the Iranian government is on the verge of collapse and that a small military nudge could be all it takes to topple it.

This isn't about promoting democracy. President Trump's actions in Venezuela, Ukraine, and toward allies like the EU show little regard for democratic principles. While Iranians in the streets may desire democracy, they are unlikely to welcome a new leader installed by American bombs. Hawks may profess support for the Iranian people, but a fiercely nationalist public would likely reject any government that comes to power through foreign intervention.

If an attack happens, it could unfold in one of two ways, each with its own set of challenges and likely consequences.

1. The Decapitation Strike

Hawks in Washington and Tel Aviv dream of a precision strike that eliminates Supreme Leader Ayatollah Ali Khamenei and the senior leadership of both the Islamic Republic and the Islamic Revolutionary Guard Corps (IRGC). The model for this is Israel's successful 2024 attack that killed Hezbollah leader Hassan Nasrallah in Beirut.

However, replicating this success in Tehran would be difficult. Iranian leaders are well aware of this threat and have spent the last six months purging suspected spies and informants to prevent such an opportunity. Even if a strike succeeded, the most probable outcome isn't a democratic uprising but a new regime led by the hard-line IRGC and security forces.

2. The Degradation Campaign

A more likely scenario is a limited bombing campaign designed to weaken the IRGC and the Basij paramilitary force. The goal would be to reduce the state's ability to suppress dissent, creating an opening for protesters to overwhelm the remaining security apparatus.

In practice, this strategy is flawed. Regime forces are deployed where the protesters are, meaning any airstrikes would inevitably kill civilians and scatter the demonstrations. Bombing nuclear sites might advance counter-proliferation goals but would do little to embolden protesters. In fact, history shows that Iranians tend to rally around their government when attacked by the U.S. or Israel. Such a campaign would most likely suffocate the protest movement, not fuel it.

Beyond the strategic risks, there are significant logistical and geopolitical obstacles to a sustained bombing campaign against Iran.

Logistical Constraints:

• A large portion of American military assets is currently committed to the Venezuela campaign, leaving U.S. forces in the Gulf at a historic low.

• Stockpiles of critical munitions, including missile interceptors and smart bombs, are reportedly running low.

• Iran is unlikely to passively absorb an attack and could retaliate, risking a wider conflagration in the heart of the world's oil-producing region.

Geopolitical Opposition: Most Gulf states are seeking stability, not a conflict that could trigger state failure, refugee crises, and retaliatory attacks. Both Saudi Arabia and Qatar have publicly opposed an American strike on Iran.

Riyadh, in particular, has shifted its stance. The bloodlust for regime change that defined Crown Prince Mohammed bin Salman's early years has faded. The China-brokered diplomatic rapprochement between Saudi Arabia and Iran continues to hold, driven by the Saudi need for a stable environment to pursue economic development.

This desire for stability is amplified by growing Saudi concerns about an unchecked Israel, whose military actions are felt not just in Gaza but across the region. In response, Riyadh has turned sharply against the United Arab Emirates and is actively forming a new military alliance with Turkey, Pakistan, and Egypt to balance against this perceived threat. An attack on Iran would only intensify these regional anxieties.

Ultimately, U.S. military action against Iran is unlikely to achieve its stated goals of toppling the regime or protecting civilians. Even if the worst-case scenarios are avoided, the strikes would probably have little direct effect while generating significant negative consequences.

An attack would likely:

• Intensify fears of Israeli expansionism among Gulf nations.

• Delegitimize and demobilize the very protesters it claims to support.

• Further normalize military intervention without legal justification.

• Potentially undermine the global sanctions that contributed to the economic pressures fueling the protests in the first place.

The Trump administration has spent the last year aggressively reshaping the relationship between the U.S. government and private industry. This new approach involves a level of economic intervention rarely seen in modern American politics, from using tariffs and regulatory pressure to favor specific firms to taking direct ownership stakes in key companies.

This strategy marks a decisive turn toward state capitalism, a model more commonly associated with countries like China and Russia. The administration has directly negotiated for equity or a share of profits in nearly a dozen companies, funneling billions in taxpayer dollars to secure government influence. The trend appears set to accelerate, signaling a fundamental shift in U.S. economic policy.

Here is a breakdown of the companies where the Trump administration is now a significant investor.

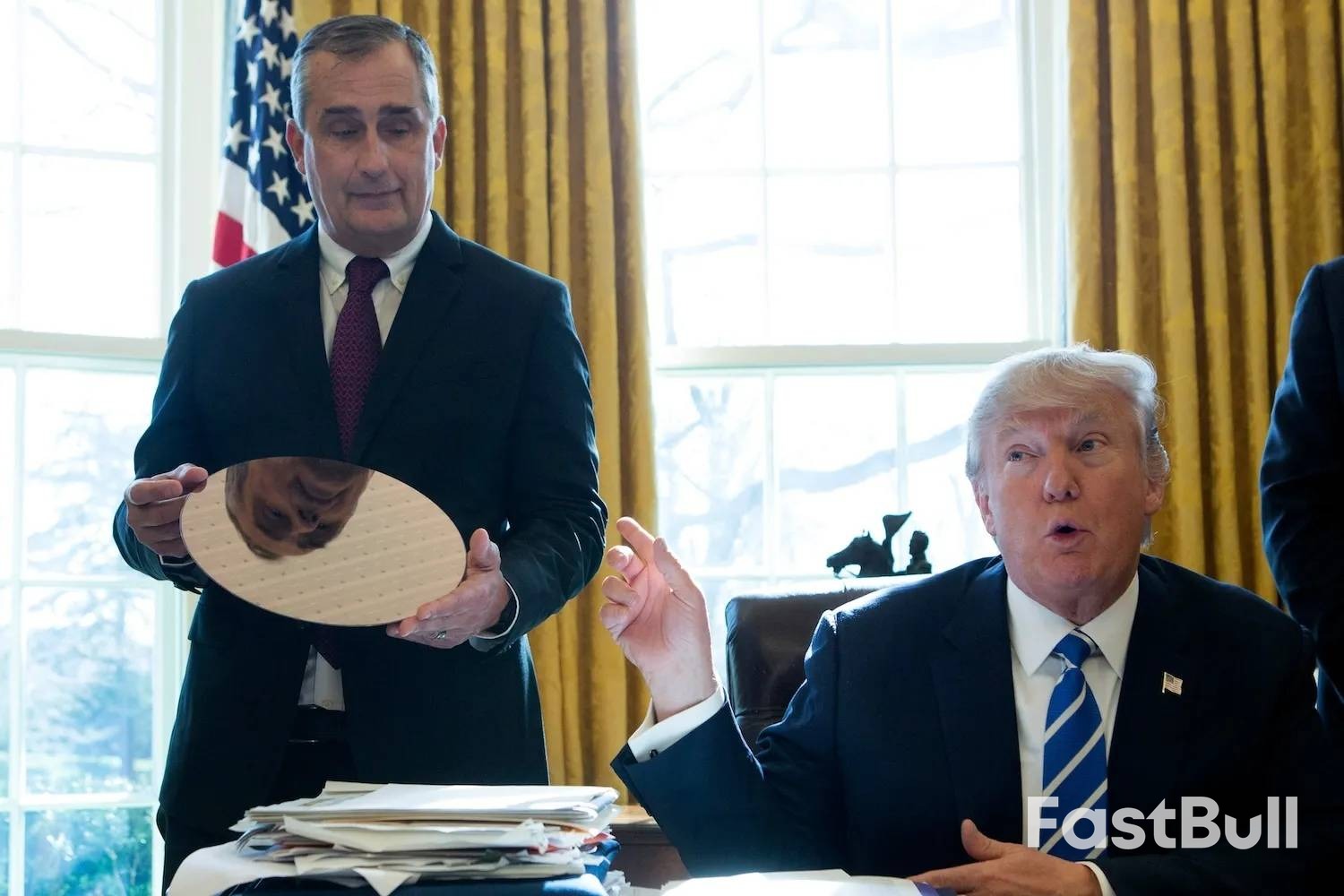

In the global race for technological supremacy, the administration has invested heavily to control the production of advanced semiconductors and AI technology.

Intel

In one of the most high-profile deals, the Trump administration acquired a nearly 10% stake in semiconductor giant Intel, valued at around $11 billion. This move made the U.S. government Intel's largest shareholder. While President Trump claimed the shares were acquired for "nothing," the deal was facilitated by grants approved under the Biden administration's CHIPS and Science Act, effectively trading taxpayer funds for government equity.

Nvidia

The administration has taken an unconventional approach with Nvidia, the world's most valuable chipmaker. In December, Trump reversed some of the Biden administration's export controls, allowing Nvidia to sell advanced chips to China. In return, the U.S. government will receive a 25% cut of all revenue from those sales. This deal expanded upon an earlier agreement for a 15% share of China-bound sales from both Nvidia and its competitor, AMD.

xLight

To bolster domestic semiconductor manufacturing capabilities, the administration took an equity stake in xLight, a Silicon Valley lithography startup. The Commerce Department has committed up to $150 million to the firm, which is developing advanced chipmaking processes. The exact size of the government's stake has not been disclosed.

A central pillar of the administration's industrial strategy is reducing America's reliance on foreign nations, particularly China, for essential raw materials. This has led to a series of government investments in mining and refining operations.

Atlantic Alumina Co. (ATALCO)

In January, the government announced a $150 million equity stake in ATALCO, a Louisiana-based gallium producer. Gallium is a critical component in chipmaking, and the U.S. currently has no domestic production. The investment aims to counter China's export restrictions on the metal, with ATALCO expected to eventually satisfy all of America's gallium demand.

Korea Zinc

The Trump administration secured a 40% equity stake in a new Tennessee refinery to be built by South Korean firm Korea Zinc. The deal also gives the U.S. government and American investors a 10% stake in the parent company. Set to open in 2029, the refinery is projected to produce 540,000 metric tons of critical minerals annually. Furthermore, Washington will gain priority access to Korea Zinc's global output starting in 2026.

Lithium Americas

The U.S. government now owns a stake in Lithium Americas, the company developing the Thacker Pass project—one of the nation's largest known lithium deposits. While the project received bipartisan support and a $2.3 billion federal loan under the Biden administration, the Trump administration re-evaluated the terms. The final deal involved releasing the loan funds in exchange for an equity stake for the government, aimed at reducing U.S. dependence on China for lithium processing.

MP Materials

To revive the domestic rare-earths industry, the administration struck a multibillion-dollar deal making the Defense Department the largest shareholder in MP Materials. The company operates the only active rare-earths mine in the United States. The agreement includes a 15% stake for the Pentagon, which will also purchase the output from a new rare-earth magnet factory and establish a price floor to guarantee its viability.

Trilogy Metals

In a push to expand domestic mining, the administration has invested tens of millions of dollars in Trilogy Metals, a Canadian firm behind a controversial copper and zinc project in Alaska. The project, which requires building a road through protected wilderness, was previously opposed by the Biden administration but is now moving forward with direct government backing.

Vulcan Elements & ReElement Technologies

As part of its rare-earths initiative, the administration has also taken stakes in two startups, Vulcan Elements and ReElement Technologies. The deal involves over $700 million in Defense Department loans and $50 million in federal incentives. In exchange, the Pentagon will receive warrants in both firms, and the Commerce Department will get a $50 million equity stake in Vulcan Elements. The companies aim to produce 10,000 metric tons of magnets annually.

The administration's intervention extends to traditional sectors like steel and nuclear energy, where it has asserted direct control over corporate decision-making.

U.S. Steel

The administration's first major foray into state capitalism involved the takeover of U.S. Steel by Japan's Nippon Steel. Instead of blocking the deal, Trump negotiated a "golden share," which grants the U.S. president veto power over the new company's investment and production decisions. Two Commerce Department officials were appointed to the board to represent the government's interests.

Westinghouse

To jump-start the civilian nuclear power industry, the U.S. government established a "strategic partnership" with Westinghouse Electric, the country's largest reactor manufacturer. The deal gives the government an option to take an 8% stake in the company, with the potential for a larger share if Westinghouse goes public. The partnership is designed to spur at least $80 billion in new investment in nuclear power.

The United States has announced the start of the second phase of President Donald Trump's peace plan for the Gaza Strip, aiming to build on a precarious truce that remains challenged by Hamas militants who refuse to disarm.

In a post on the social media platform X, U.S. Middle East envoy Steve Witkoff outlined the new stage. He stated the war-torn territory would now focus on "moving from ceasefire to demilitarization, technocratic governance, and reconstruction." Witkoff also warned Hamas of "serious consequences" if the group did not "comply fully" with its commitments.

A central component of this next phase is the appointment of a team of technocrats to help administer Gaza. This initiative is part of a broader U.S. effort to rebuild the enclave after more than two years of conflict with Israel.

Diplomats hope these appointed experts can restore essential public services and daily governance. Their work would be overseen by a proposed "Board of Peace," which is expected to be chaired by Trump and other world leaders, though its formation has not yet been announced.

Despite the plan's progression, the prospect of lasting peace remains uncertain. Hamas still controls nearly half of Gaza and continues to reject calls to disarm, and Witkoff's announcement provided few specifics on how to address this.

The situation on the ground is tense. Sporadic fighting between Israel and the Iran-backed militant group has persisted since the peace deal was brokered, including ongoing Israeli airstrikes.

Furthermore, a critical condition from the first phase of the Trump proposal has not been met. Hamas has yet to return the remains of the final hostage taken during the October 7, 2023 attacks, which initially triggered the conflict.

The advancement to phase two could cause disappointment in Israel, which had insisted that Hamas return all remaining hostages before the plan moved forward. According to Israeli officials, policeman Ran Gvili was killed while defending against the 2023 Hamas invasion, and his body was taken into Gaza.

In contrast, Mahmoud Abbas, president of the Palestinian Authority which governs the West Bank, expressed support. In a statement Wednesday, Abbas said he "welcomed the efforts made by President Donald Trump to complete the implementation of his peace plan" with the new Palestinian committee's announcement.

Atlanta Federal Reserve President Raphael Bostic issued a stern warning on Wednesday, emphasizing that the central bank's battle against high inflation is far from over and requires a continued restrictive monetary policy.

Speaking at an event in Atlanta, Bostic, who is set to retire early this year, stated plainly that inflation remains "still quite far" from the Federal Reserve's desired level. He cautioned that the "inflation challenge has not been won yet," pushing back against any premature declarations of victory.

Bostic expressed concern that the economy could accelerate through 2026, creating new upward pressure on demand and prices. He pointed to tax and fiscal policies enacted by the Trump administration last year as a key driver behind these potential economic tailwinds.

"As we go through 2026 the economy is likely to get stronger," Bostic noted. "That could put more upward pressure on prices and that is something we have to watch."

While describing the U.S. economy as "remarkably resilient," Bostic argued that its current strength does not justify a passive approach from the central bank. Instead, he sees this resilience as a reason to maintain a firm policy stance.

"Those are not characteristics that suggest to me a passive posture is appropriate, still need to be restrictive," he concluded.

Bostic also highlighted the difficult environment for economic forecasting, suggesting that a complete consensus on all policy decisions within the Federal Reserve should not be expected.

French Prime Minister Sebastien Lecornu’s government survived two no-confidence votes on Wednesday, overcoming a challenge from far-right and far-left parties over a contentious trade agreement. The motions failed because they did not secure the support of the Socialists, falling short of the majority needed to topple the government.

The challenges were initiated by Marine Le Pen’s National Rally and the far-left France Unbowed party. Both motions targeted the government's handling of a major trade deal between the European Union and the Mercosur bloc, which includes Brazil, Argentina, Uruguay, and Paraguay.

The EU-Mercosur pact, expected to be signed on Saturday, aims to create the world's largest free-trade zone, covering over 700 million people. However, the opposition parties' efforts to oust Lecornu stalled when the Socialists refused to join them. Socialist leader Olivier Faure described the attempt to bring down the government over a treaty the president himself opposes as "absurd."

In a complex political twist, President Emmanuel Macron has publicly opposed the trade deal. He argues that the agreement would subject French farmers to unfair competition from South American agricultural producers.

Despite Macron's position, his political rivals accused him of not doing enough to block the deal in Brussels. The National Rally, in particular, claimed the president had failed to adequately defend French interests, tapping into widespread protests by farmers across the country.

Having navigated the no-confidence votes, Lecornu now faces his next major test: passing the 2026 budget. His government operates without a majority in a deeply divided parliament, making legislative victories difficult.

The political gridlock is already severe. Lawmakers have not yet passed this year's budget, forcing France to run on special stopgap measures to prevent a government shutdown.

To push the 2026 budget through, Lecornu might resort to a special constitutional provision that allows the government to pass a bill without a parliamentary vote. While effective, this tool is politically risky and could trigger further no-confidence motions. This exact scenario led to the downfall of his two predecessors, Michel Barnier and François Bayrou, who were both removed from office following confidence votes over budget disputes.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up