Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina CPI MoM (Nov)

Argentina CPI MoM (Nov)A:--

F: --

P: --

Argentina National CPI YoY (Nov)

Argentina National CPI YoY (Nov)A:--

F: --

P: --

Argentina 12-Month CPI (Nov)

Argentina 12-Month CPI (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Industrial Output Final MoM (Oct)

Japan Industrial Output Final MoM (Oct)A:--

F: --

P: --

Japan Industrial Output Final YoY (Oct)

Japan Industrial Output Final YoY (Oct)A:--

F: --

P: --

U.K. Services Index MoM (SA) (Oct)

U.K. Services Index MoM (SA) (Oct)A:--

F: --

P: --

U.K. Services Index YoY (Oct)

U.K. Services Index YoY (Oct)A:--

F: --

P: --

Germany HICP Final YoY (Nov)

Germany HICP Final YoY (Nov)A:--

F: --

P: --

Germany HICP Final MoM (Nov)

Germany HICP Final MoM (Nov)A:--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Manufacturing Output MoM (Oct)

U.K. Manufacturing Output MoM (Oct)A:--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Oct)

U.K. Monthly GDP 3M/3M Change (Oct)A:--

F: --

P: --

Germany CPI Final MoM (Nov)

Germany CPI Final MoM (Nov)A:--

F: --

P: --

Germany CPI Final YoY (Nov)

Germany CPI Final YoY (Nov)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Asian markets steady as falling JGB and Treasury yields ease yen carry trade fears, boosting sentiment for US equity futures ahead of key Fed and BoJ signals.

Japanese Government Bond (JGB) yields dropped for three consecutive sessions on Thursday, December 11, easing fears of a yen carry trade unwind. However, rising bets on a December Bank of Japan rate hike continue to cushion the downside on 10-year JGB yields.

Meanwhile, overnight US jobs data showed a spike in jobless claims, supporting a more dovish Fed policy stance. 10-year US Treasury yields dropped to a four-day low before stabilizing.

Falling 10-year Treasury and JGB yields bolstered demand for risk assets such as US stock futures. Furthermore, easing concerns over a yen carry trade unwind supports a bullish short- to medium-term outlook for US index futures.

JGB 10-Year – Daily Chart – 121225

JGB 10-Year – Daily Chart – 121225Below, I'll outline the key market drivers, the medium-term outlook, and the key technical levels traders should watch.

Rising bets on a December BoJ rate hike collided with increasing speculation about the Bank's neutral rate. The neutral rate is where monetary policy is neither restrictive nor accommodative.

For markets and yen carry trades, a neutral rate would influence expectations of the number of rate hikes in the BoJ's policy tightening cycle.

A higher neutral rate would narrow US-Japan rate differentials more, making yen carry trades into assets less attractive. Conversely, a lower neutral rate would keep carry trades profitable, supporting the bullish short- to medium-term price outlook for US stock futures.

This week, former BoJ policymaker Hideo Hayakawa warned of multiple BoJ rate hikes and a 1.5% neutral rate. Bank of Japan Governor Kazuo Ueda previously stated that there was no consensus on the neutral rate, which remained in a wide range, between 1% and 2.5%. A 1.5% neutral rate would dampen interest in yen carry trades into US assets, but keep them profitable.

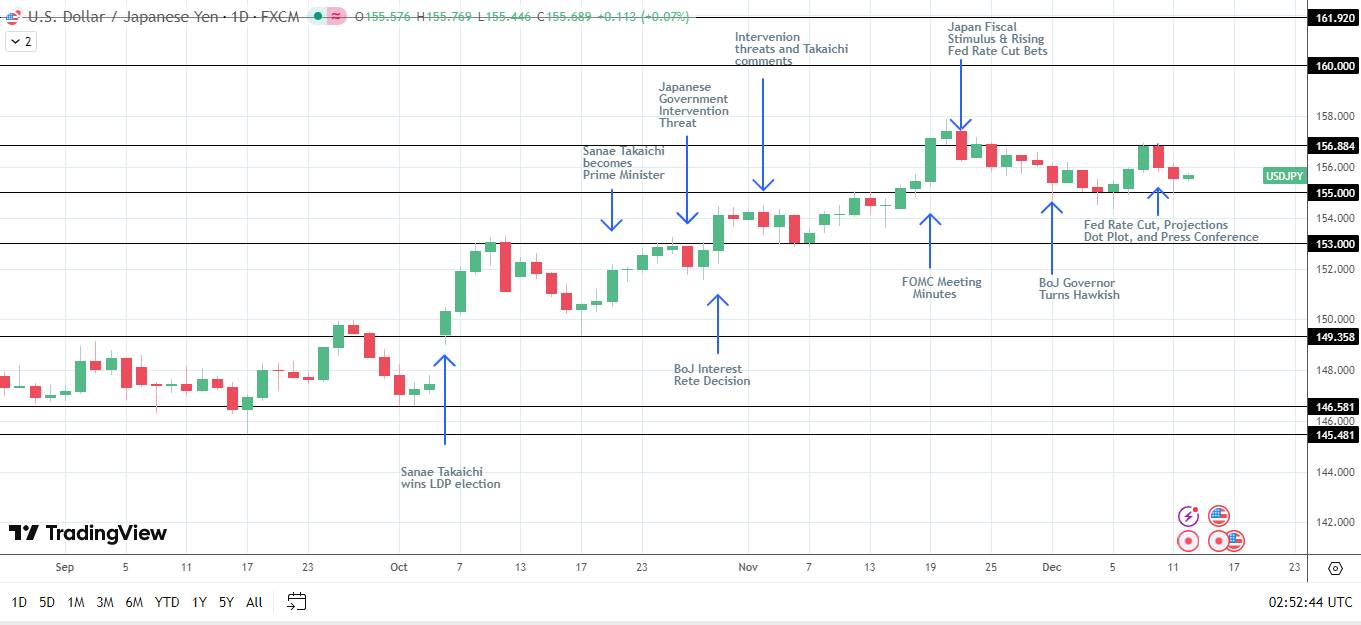

10-year JGB yield, USD/JPY, and Nikkei 225 trends suggest fading concerns about a yen carry trade unwind. The Nikkei 225 gained 0.89% in morning trading on Friday, December 12, while 10-year JGBs remained well below the December 9 high of 1.981% and USD/JPY edged 0.07% higher.

USDJPY – Daily Chart – 121225

USDJPY – Daily Chart – 121225Futures had a mixed Asian morning session. The Dow Jones E-mini rose 115 points, and the S&P 500 E-mini gained 4 points. Meanwhile, the Nasdaq 100 E-mini dropped 16 points, weighed down by Oracle and Broadcom. Oracle tumbled 10.83% overnight as investors reacted to the company's significant spending and weak forecasts, raising concerns about the timing of returns on investments.

Later on Friday, traders should monitor FOMC members' speeches after Wednesday's dot plot signaled a single 2026 Fed rate cut. Dovish Fed rhetoric would lift sentiment, supporting a bullish short- to medium-term outlook for US stock futures.

According to the CME FedWatch Tool, the chances of a March Fed rate cut increased from 42.2% on Wednesday, December 10, to 49.6% on December 11. Higher-than-expected US jobless claims raised bets on a March Fed rate cut, sending the Dow Jones E-mini futures to an all-time high.

Despite the mixed morning, the Dow Jones E-mini, the Nasdaq 100 E-mini, and the S&P 500 E-mini remained above their 50-day and 200-day EMAs, indicating a bullish bias.

Near-term trends will hinge on BoJ rhetoric, 10-year US Treasury and JGB yields, USD/JPY trends, and Fed commentary. Key levels to monitor include:

Dow Jones – Daily Chart – 121225

Dow Jones – Daily Chart – 121225 Nasdaq 100 – Daily Chart – 121225

Nasdaq 100 – Daily Chart – 121225 S&P 500 – Daily Chart – 121225

S&P 500 – Daily Chart – 121225In my opinion, the short- to medium-term outlook remains bullish despite the Fed's single 2026 rate cut and hawkish BoJ policy stance. Given easing concerns about a yen carry trade unwind, rate differentials will continue to influence the near-term trends.

Several scenarios could derail the bullish short- and medium-term outlooks, including:

In summary, a more dovish Fed policy stance would boost demand for US equity futures. However, traders should continue monitoring BoJ signals, JGB yields, the USD/JPY, and the Nikkei 225 for potential yen carry trade unwind warning signals.

Key levels would include a USD/JPY drop to 150 and 10-year JGBs at 2%, an important level to watch. These sharp moves would likely trigger a Nikkei 225 sell-off, weighing on broader risk sentiment.

The latest pullback in 10-year JGB yields provided some market relief. Nevertheless, yields remain elevated, exposing US stock futures to unwind risk.

At least three executives from Chinese bargain e-commerce platform Pinduoduo were detained by police last Friday after allegedly physically fighting with market regulators who were conducting an on-site inspection of the company's Shanghai headquarters, Nikkei Asia has learned.

One official was injured in the clash, people familiar with the matter told Nikkei. The cause of the alleged altercation and the latest status of the executives is not yet clear. Such incidents at a major company are rare in China, where authorities often have much more power.

Last week, staff from the State Administration for Market Regulation (SAMR) carried out a routine inspection at the company, part of the market watchdog's regular checks across various companies, including other Chinese tech giants. The length of such inspections can vary by project and sometimes last several days.

The inspection of records at Pinduoduo was part of a nationwide campaign targeting food-safety issues on platforms, according to people familiar with the matter. Pinduoduo sells a wide range of food products. SAMR said in late November that it had conducted 5.7 million food-safety inspections this year and found a substandard rate of 2.74%, with most issues involving excessive pesticide residue, improper use of food additives and microbial contamination.

"This account is false and bears no relation to reality," a Pinduoduo spokesperson told Nikkei Asia.

SAMR did not respond to an request for comment.

Pinduoduo, which means "together, more savings," was established in 2015 by Colin Huang, a former Google employee and the founder of multiple startups, including a gaming company. The online retailer started out selling cheap fresh groceries and swiftly diversified into other inexpensive product categories.

As China's consumer demand weakened and a culture of "consumption downgrade" took hold, Pinduoduo quickly gained traction by selling low-priced goods. In its early years, however, the platform faced numerous complaints from users about poor-quality products. In 2018, SAMR summoned Pinduoduo over the sale of counterfeit and property rights-infringing goods, instructing the company to strengthen product oversight on the platform.

Over the past three years, cases released by SAMR and the National Medical Products Administration have repeatedly cited merchants on Pinduoduo, sometimes along with those on other platforms, for selling fake or substandard items.

However, Pinduoduo has been working to shed its reputation for inferior goods by rolling out a series of measures in recent years to promote high-quality merchants and crack down on problematic sellers.

In late 2022, PDD Holdings launched cross-boarder e-commerce platform Temu to sell inexpensive products to the world. In 2023, the company's market capitalization once surpassed that of Alibaba to make it the most valuable U.S.-listed Chinese company. Now, PDD Holdings' market cap is less than half that of Alibaba's, which has been working hard on its large language model for artificial intelligence and has seen its share price surge amid China's DeepSeek-driven tech stock rally this year.

Even before the U.S. in late August effectively suspended its de minimis exemption, which allowed goods under $800 to enter the country duty-free, Temu and rival Shein had started to shift resources to other countries. However, both platforms are facing similar challenges in Europe.

Thailand was set for an earlier than expected election after its king endorsed Prime Minister Anutin Charnvirakul's bid to dissolve parliament on Friday, as a border conflict with Cambodia raged and the government moved to head off a no-confidence vote.

Anutin late on Thursday announced he was "returning power to the people", and King Maha Vajiralongkorn approved his petition to dissolve the house, according a royal gazette posting overnight, paving the way for an election as early as February.

Anutin's play comes as an armed border conflict between Thailand and Cambodia entered into a fifth day, with at least 20 people killed, close to 200 wounded and hundreds of thousands of people displaced.

Late on Thursday, U.S. President Donald Trump, who intervened in July the last time fighting erupted, reiterated his plan to call leaders of both countries and try to end the conflict.

Anutin's decision to dissolve the house came less than 100 days after he was sworn in as head of a minority government, and occurred amid high drama in parliament that raised expectations that the opposition People's Party, opens new tab, the biggest force in the house, would file a no-confidence motion against him.

The election, which must take place within 45 to 60 days, raises the spectre of even more political turmoil in Thailand, which for the past two decades has seen multiple elected governments and parties brought down by coups and court rulings in an intractable power struggle involving rival elites and progressive forces.

Anutin was elected prime minister by parliament in September after a court removed Paetongtarn Shinawatra, opens new tab from office, with his rise only possible due to a deal he struck with the People's Party to back him, on the condition that he starts the process of amending the constitution and then dissolves the house in late January.

But chaos ensued in a joint sitting of the legislature on Thursday over the voting process to amend the constitution. Opposition leader Natthaphong Ruengpanyawut said Anutin's party had reneged on an agreement and a government spokesperson said a no-confidence motion was being planned.

Anutin, an astute political deal-maker and Thailand's third prime minister in two years, faces an uphill struggle to be re-elected, with opinion polls consistently showing the liberal opposition to be the country's most popular party.

A forerunner to the People's Party won the 2023 election on an anti-establishment platform but was blocked from forming a government by lawmakers allied with the royalist military.

Anutin on Friday told reporters his decision to dissolve parliament would not affect management of the conflict with Cambodia and government spokesman Siripong Angkasakulkiat told Nation TV the caretaker administration has "full authority".

A cautious mood is back this morning, with local equities on track for a second straight weekly loss. Thursday's rebound came even as the rupee hit a fresh record low, but sentiment remains shaky thanks to persistent foreign outflows and that still-elusive US trade deal. A firmer tone across Asia may not do much to allay these concerns. In the primary market, ICICI Prudential Asset Management opens its $1.2 billion offering on Friday — a marquee listing that could make it India's second-most valuable mutual fund house on debut.

India's currency weakness sets the tone for broader market anxiety. The rupee hit a fresh low on Thursday, extending its relentless decline, which risks sparking a feedback loop. Currency traders say the latest drag is the outflow from both stocks and bonds — each renewed drop in the rupee makes global investors less keen to buy Indian assets. At the heart of the matter is the still-elusive US trade deal, which India's top economic advisor now says could finally happen by March. In the meantime, foreigners have yanked more than $17 billion from local shares for the year, surpassing the previous record set in 2022. They've also turned net sellers of bonds, threatening to break a five-month streak of inflows.

In contrast to the rupee's macro pressures, worsening pollution is driving swift policy action. Recent developments around clean fuel mandates in the Delhi-NCR region should revive growth of compressed natural gas, helping distributors such as Indraprastha Gas, according to Citi. The northern state of Haryana has issued a directive that all vehicle aggregators only add CNG or electric vehicles to their fleet from next year. A policy applicable in neighboring Uttar Pradesh as well. Adding to that, from November next year, only clean fuel buses will be allowed to enter Delhi. Worsening pollution will have second order effects for the market, throwing up new winners as well as casualties.

While some sectors face volatility, India's export industries are adapting to global shifts. Shrimp exporters, for instance, are quickly reading global trends and fine tuning their strategy. Despite tariff woes, India is steadily gaining market share in the US, while key rival Ecuador appears to be losing some of its cost edge, InCred Equities says. And even with uncertainty around US demand, India may benefit as trade talks with the EU and the UK advance, likely opening markets held back by tariffs and compliance rules. InCred's top sector picks include Apex Frozen Foods and Avanti Feeds, the latter already up more than 18% this year.

India's equity-market behavior tells its own story. Insiders are dumping shares at record levels, which suggests the market is starting to look pretty expensive — even though prices have been struggling for a while. Founder groups have sold more than $14 billion worth of shares this year, pushing the three-year total to nearly $40 billion. While retail inflows remain strong, a mix of insider selling and record initial public offerings is keeping the market on a leash

Oil prices rose in Asian trading on Friday after sharp losses in the previous session, supported by a report that the U.S. is preparing to intercept more tankers carrying Venezuelan oil, stoking supply disruption worries.

As of 20:50 ET (01:50 GMT), Brent Oil Futures expiring in February rose 0.5% to $61.61 per barrel, while West Texas Intermediate (WTI) crude futures gained 0.6% to $57.95 per barrel.

Unlock exclusive crude market insights, real-time revisions, and price forecasts with an InvestingPro subscription - get 55% off today

Both contracts declined 1.5% on Thursday, hitting over a seven-week low on Ukraine peace prospects and rising U.S. gasoline and distillate inventories.

Oil was set to lose more than 3% this week.

Prices firmed after a Reuters report, citing sources, said the U.S. is readying additional interdictions following this week's seizure of the tanker Skipper off Venezuela's coast.

The potential move marks a significant escalation in Washington's sanctions enforcement and has prompted shipowners to reassess voyages involving Venezuelan crude, the report said.

The U.S. has assembled a target list of several more sanctioned tankers for possible seizure, the report added.

The prospect of further disruptions to sanctioned flows added a risk premium to the market, helping Brent and West Texas Intermediate recover some ground.

However, gains remained capped as attention turned back to ongoing diplomatic efforts between Russia and Ukraine.

Any progress toward a negotiated settlement could eventually reshape sanctions policy on Russian energy exports and shift expectations around global supply.

Earlier this week, oil eased when early signs of movement in the talks emerged, underscoring the market's responsiveness to any de-escalation signals.

Uncertainty over European geopolitical diplomacy has kept crude directionally constrained.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up