Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Ethereum Drops Below $2300, Down 2.43% In The Past Hour] February 3, According To Htx Market Data, Ethereum Fell Below $2,300, Now Trading At $2,298.77, Down 2.43% In The Past Hour

[Hamas: Ready To Transfer Gaza Strip Administration] On February 2nd Local Time, Hamas Spokesman Hazem Qasim Issued A Statement Saying That Hamas Has Completed The Necessary Procedures Concerning The Gaza Strip Administration And Is Ready To Transfer It To The Palestinian Technical Bureaucratic Committee. The Statement Said That A Committee Composed Of Representatives From Various Factions, Families, And Civil Society In The Gaza Strip Will Oversee The Transfer Process. The Statement Called On All Parties To Facilitate The Work Of The Technical Bureaucratic Committee In Order To Initiate The Gaza Reconstruction Process

Vietnam Industry Ministry: Imposes Temporary Anti-Dumping Tariffs On Colourless Float Glass From Indonesia, Malaysia

[Trump Team Transfers Wallet To Bitgo Custodial Wallet Holding 5.267M Trump, Equivalent To $22.44M] February 3Rd, According To Onchain Lens Monitoring, Meme Coin Trump Team Allocation Wallet Transferred 5,267,000 Trump To Bitgo Custody Wallet, Worth Approximately 22.44 Million US Dollars

China Central Bank Injects 105.5 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

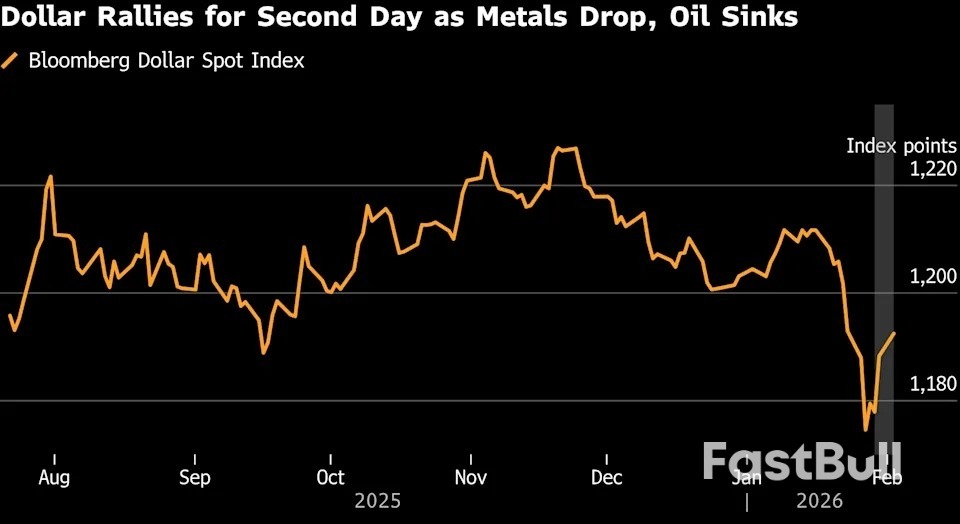

The world’s primary reserve currency rose against all of its major peers Monday, and a Bloomberg dollar gauge appreciated about 1.2% over the past two sessions.

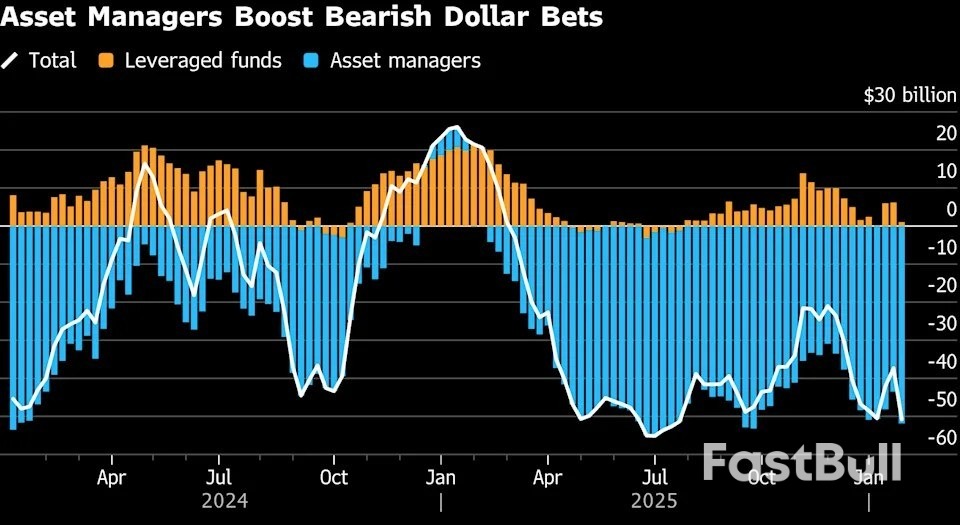

Foreign investors poured into the U.S. corporate bond market in January, buying debt at the fastest pace in nearly three years. According to data from JPMorgan Chase & Co., a combination of stable yields and lower currency hedging costs made American corporate credit an irresistible draw.

This surge in demand provides a sharp counter-narrative to fears that a weakening U.S. dollar might scare away international capital. So far, the flow of foreign money into corporate bonds has remained strong.

JPMorgan strategists Nathaniel Rosenbaum and Silvi Mantri reported that average net inflows from foreign buyers hit $332 million per day in January, the highest level recorded since February 2023.

While the pace moderated in the final week of the month—dropping 59% from the previous week to an average of $240 million—the overall monthly trend pointed decisively upward.

"Despite the concerns that a falling dollar is a sign of foreign investors selling US dollar securities, what we are seeing in credit so far seems to suggest the exact opposite," Rosenbaum noted. He highlighted "renewed very strong buying from Asia to start the year."

The U.S. dollar had a challenging January. A Bloomberg gauge tracking the currency fell 1.3%, its worst monthly performance since last summer, driven by geopolitical shifts and speculation of intervention to support the Japanese yen.

Typically, a falling dollar erodes the returns for foreign investors when they convert their assets back to their home currency. However, other factors proved more powerful. Rosenbaum explained that wide interest rate differentials between the U.S. and other nations, including Japan, have kept currency hedging costs low. This dynamic effectively neutralized the risk of a softer dollar, keeping U.S. debt attractive.

The momentum may be set to continue. Some Wall Street strategists are now predicting that corporate bond sales could reach record highs in February, driven by a rush to finance new artificial intelligence projects.

In a separate analysis, Rosenbaum's team projected that high-grade debt issuance from the technology, media, and telecommunications (TMT) sector could reach an unprecedented $400 billion in 2026 alone.

The White House has entered direct talks with leaders from the cryptocurrency and banking industries to tackle a critical issue holding up a major digital asset bill: the regulation of stablecoin yields.

Officials from the Trump administration convened the meeting to find a path forward for the Digital Asset Market Clarity (CLARITY) Act, a piece of market structure legislation currently under review in the Senate. According to The Digital Chamber, a crypto advocacy organization, its CEO Cody Carbone was among the representatives who met with administration officials to hash out the bill's provisions.

The CLARITY Act’s progress stalled in January after the Senate Banking Committee postponed a scheduled markup session. Lawmakers are still grappling with several complex topics before they can advance the bill, including:

• Tokenized equities

• Decentralized finance (DeFi)

• Ethics for elected officials investing in crypto

• Stablecoin rewards

Carbone described the White House meeting as "exactly the kind of progress needed" to resolve one of the bill's most significant obstacles. He added that he is "optimistic that as we continue to dive into the policy details, a fair playing field can be created for digital assets in the US."

This positive sentiment was echoed by White House crypto adviser Patrick DeWitt, who called the discussion "constructive, fact-based" and "solutions-oriented." He expressed confidence that officials and industry leaders would reach a solution soon. Other organizations present included the Crypto Council for Innovation, the American Bankers Association, and the Blockchain Association.

The high-level meeting occurred amid a partial US government shutdown, which entered its third day after lawmakers failed to agree on a funding bill.

The path for any crypto market structure bill is complex. The Senate is working through two separate but related legislative efforts that will eventually need to be reconciled.

Last week, the Senate Agriculture Committee passed its version of the bill, which focuses on the Commodity Futures Trading Commission's role. However, it did so without any Democratic support, as some members raised objections to rules concerning elected officials holding digital assets.

Meanwhile, the Senate Banking Committee is handling the sections of the bill that define how the US Securities and Exchange Commission will oversee the crypto space. For the legislation to reach a full floor vote, both committees will likely need to combine their respective bills into a single, cohesive package. The recent White House discussion signals a coordinated effort to clear the hurdles preventing that from happening.

President Donald Trump announced the creation of a U.S. critical mineral reserve late Monday, a move designed to reduce America’s reliance on China for materials vital to modern industry. The announcement immediately boosted the shares of domestic mining companies in after-hours trading.

The initiative, dubbed "Project Vault," will establish a strategic stockpile of critical minerals specifically for the U.S. private sector. According to a White House official, the plan is backed by a combination of $1.67 billion in private capital and a $10 billion loan from the U.S. Export-Import Bank.

The core objective is to secure a domestic supply chain for materials essential for electric vehicles, advanced defense systems, and other critical technologies, directly challenging China's dominance in the sector. The proposal was first reported by Bloomberg News earlier on Monday.

Investors reacted positively, betting the initiative will spur domestic demand and unlock government-backed financing for American mining operations. Key movers in extended trading included:

• MP Materials: The operator of California's Mountain Pass mine saw its shares climb over 2%.

• USA Rare Earth: The company's stock jumped by more than 2%.

• Critical Metals Corp.: Shares rose by over 1%.

Project Vault builds on a trend of increasing government intervention in the critical minerals industry. This strategic shift is highlighted by several recent developments.

USA Rare Earth has already engaged in discussions with Commerce Secretary Howard Lutnick, presenting its domestic mining and magnet production assets. These talks have led to a proposed deal that could provide the company with approximately $1.6 billion in funding, subject to certain conditions, and would also include an equity stake for the U.S. government.

This follows a landmark agreement made last summer between the Department of Defense and MP Materials. That deal involved the government taking an equity stake, setting a price floor for minerals, and committing to a long-term purchase agreement for a specific quantity of rare earth minerals and magnets.

A new Federal Reserve survey indicates that banks are gearing up for a surge in business loan demand across all categories this year. Lenders largely attribute this optimism to expectations of lower interest rates and a rise in corporate spending and investment needs.

The Fed's quarterly Senior Loan Officer Opinion Survey detailed a divided market in the fourth quarter. While demand for business loans from large and medium-sized companies increased, demand from small firms remained flat.

On the consumer side, households showed weaker demand for most types of loans. The notable exception was credit card demand, which held steady.

Although banks continued to tighten their lending standards for businesses in the fourth quarter, the survey suggests this trend is unlikely to continue. Most institutions reported that they do not expect to tighten standards further in the coming year, potentially removing a significant barrier to credit growth that was present in 2023.

One standout finding revealed a new lending preference: banks reported they are more likely to approve loans for firms with high exposure to artificial intelligence.

This survey was available to Federal Reserve policymakers during their recent meeting, where they decided to hold the benchmark short-term borrowing rate in its 3.50%-3.75% range. The Fed signaled that a stabilizing labor market and persistent inflation would likely delay any rate cuts, a decision informed by data like this report on credit conditions.

Former Texas congressman Ron Paul has issued one of his starkest warnings yet, arguing that the U.S. financial system is flashing red alerts that are louder, faster, and harder to ignore than ever before. In a recent interview with David Lin, Paul claimed that decades of unchecked government spending and monetary expansion are culminating in a crisis of confidence for the U.S. dollar.

According to Paul, the current environment is fundamentally different from past debt scares. He contends that the nation has not only consumed a vast amount of its wealth but has also squandered its credibility through reckless fiscal and foreign policy.

At the heart of Paul’s concern is the ballooning federal debt, which has surpassed $38 trillion. He views this not as a simple accounting issue but as a deep structural failure. In his analysis, the government no longer funds its obligations with real savings but instead relies on continuous money creation.

"They don't have the money," Paul stated, explaining that the system functions by "stealing the purchasing power of the dollar by increasing the money supply." This process, he argues, amounts to a quiet transfer of wealth from ordinary citizens to the state.

This constant creation of new money is the primary driver of widening income inequality, according to Paul. Those who receive the new money first—large financial institutions and politically connected entities—benefit before prices rise. Meanwhile, the wages and savings of the middle and lower classes are eroded by the subsequent inflation.

Paul describes inflation as a hidden and damaging tax. "The poor are being hurt the most," he noted, suggesting that this "inflation tax" is more destructive than direct income taxes.

Paul directly connects these systemic pressures to the dramatic rise in the price of gold. With the precious metal trading near $5,000 per ounce at the time of his interview, he sees its sharp movements as a clear signal of collapsing confidence in government-issued fiat currency.

"When you see gold going up over $100 in a day… it is different," he said, admitting that even he has been surprised by the recent speed of the market's reaction, despite having warned of this outcome for decades.

When asked if the fiat system is nearing its end, Paul was unequivocal. "Yes, it is dying," he said, aligning with recent comments from investor Ray Dalio that the current monetary order is breaking down. Paul emphasized that the debt trajectory alone makes the system mathematically unsustainable.

He also revisited his long-standing prediction that gold could reach $20,000 per ounce, framing it not as a bullish forecast but as a reflection of the dollar's potential collapse. "It went from $20 to $200 to $2,000," he said. "There's going to be another zero in our lifetime."

However, Paul added a crucial caveat: the system may not even survive long enough to see such a price. In a complete monetary breakdown, he explained, quoting prices in dollars would become meaningless.

The consequences of this instability extend far beyond financial markets, Paul warned. He argued that as governments struggle to manage the ensuing chaos, civil liberties often become the first casualty. He pointed to growing constraints on free speech as evidence that economic stress makes authoritarian responses more probable.

This financial fragility also has geopolitical implications. Paul suggested that alliances like NATO could become ineffective if the U.S. dollar loses its global dominance. "If you run out of money, you have to change your mind," he remarked, noting that financial exhaustion, not diplomacy, is often what brings wars to an end.

Despite the grim outlook, Paul expressed cautious optimism about a shift in public awareness. He observed that younger generations seem more open to the ideas of Austrian economics and are increasingly skeptical of centralized monetary control. He credits the internet with helping to spread these alternative viewpoints.

Now hosting the Ron Paul Liberty Report, he continues to argue that debt liquidation and monetary reform are inevitable. However, he stressed that the path forward will not be easy. "This shift… is very, very dangerous," Paul concluded, warning that the risk of social disorder only grows the longer policymakers avoid confronting the underlying problems.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up