Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Iran's Araqchi Says Tehran Welcomes Talks With Regional Countries That Aims At Bringing Stability And Peace

Istanbul - Iran's Foreign Minister Araqchi Says Tehran 'Is Prepared For Resumption Of Talks With The US'

Istanbul - Iran's Foreign Minister Araqchi: Talks With His Turkish Counterpart Fidan Was Very 'Good And Useful'

Turkish Foreign Minister: Turkey Closely Following Integration Agreement Between Damascus-Sdf In Syria

Turkish Foreign Minister: Turkey Calling On US, Iran To Come To Negotiating Table To Resolve Issues

Turkish Foreign Minister: Turkey Opposes Foreign Intervention On Iran, We Tell Our Counterparts This

Turkish Foreign Minister: Iran's Peace And Stability Important For US, Turkey Saddened By Deaths During Protests

Chevron: Continue To Engage With The USA And Venezuelan Governments To Advance Shared Energy Goals

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)A:--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)A:--

F: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)A:--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key insights from the week that was. In Australia, all eyes were on the Q4 CPI print ahead of next week's RBA decision.

Key insights from the week that was.

In Australia, all eyes were on the Q4 CPI print ahead of next week's RBA decision. In the event, inflation printed above our expectations on both a headline and trimmed mean basis, rising 0.6%qtr / 3.6%yr and 0.9%qtr / 3.4%yr respectively. There were a number of subplots in the detail: strong seasonal demand for domestic holiday travel (9.6%yr), rising gold and silver prices boosting accessories (11.4%yr), and rebate-driven volatility in electricity prices (21.5%yr). Policy changes and administered price increases also buoyed inflation across childcare, education, water rates and property charges. There was some evidence of disinflation too, mainly in home-building costs and rents where inflation looks to have peaked. Overall though, it appears services inflation remains 'sticky' well above target (4.1%yr) and that goods inflation is no longer providing a disinflationary offset (3.4%yr).

Following the CPI report, Chief Economist Luci Ellis issued a change of rate call, with Westpac now anticipating the RBA to lift the cash rate by 25bps to 3.85% at next week's meeting. The RBA laid the groundwork for such a move in their communications over recent months in case of an upside surprise; and with two disappointing quarterly prints now received, there is little reason wait. How the policy outlook will evolve beyond February is set to depend on the response to the change in policy expectations and the economy's capacity, particularly labour market participation. The RBA's updated forecasts will shed more light on their baseline expectations and view of key risks; they are likely to continue to hold a relatively conservative view on supply and a cautious approach to communicating on the policy outlook.

The latest NAB business survey meanwhile reported a solid finish to 2025, the conditions and confidence indexes edging higher in December, consistent with other evidence of strengthening consumer demand. That said, the future path for inflation and interest rates is a clear threat to confidence in early-2026. Worthy of note too, perspectives differ across industries. In our latest Quarterly Agriculture Report, we discuss prospects for farm GDP following a bumper 2025.

In the US, the FOMC maintained its monetary policy stance at the January meeting as expected in a 10-2 vote, with Miran and Waller preferring to cut the fed funds rate by 25bps. The Committee's assessment of the economy was positive for growth (characterising it as "solid") notwithstanding weakness in housing; sanguine on the labour market ("the unemployment rate has shown some signs of stabilization") despite job gains having "remained low"; and cautious on inflation ("remains somewhat elevated").

The characterisation of risks was balanced, the statement simply noting that "Uncertainty about the economic outlook remains elevated", the "Committee is attentive to the risks to both sides of its dual mandate" and "prepared to adjust the stance of monetary policy as appropriate". In the press conference, Chair Powell made it clear that policy will be determined on a meeting-by-meeting basis on incoming data and did not show material concern over the potential evolution of conditions. Instead, risks were judged to have diminished.

Recent weakness in the US dollar was a key topic during the Q&A. Chair Powell made clear market movements do not dictate monetary policy, nor does the FOMC seek to manage the currency, with full employment and inflation-at-target their mandated focus. Chair Powell did not comment on recent tensions between the Administration and the Federal Reserve but took the opportunity to affirm the long-standing success of central bank independence and monetary / fiscal collaboration globally.

We expect one further cut from the FOMC in March to mitigate the lingering downside risks the labour market faces. But if activity growth proves stronger than expected at the beginning of 2026, the FOMC may skew their focus towards inflation risks, holding off on a further reduction in the fed funds rate.

Further north, the Bank of Canada also kept rates steady at 2.25%, maintaining an accommodative stance to support the economy as it navigates excess capacity and trade uncertainty. Governor Macklem noted that the "current policy rate remains appropriate, conditional on the economy evolving broadly in line with the [forecast] outlook …The Canadian economy is adjusting to the structural headwinds of US protectionism…[and] uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate." We anticipate the Council will keep policy accommodative while headwinds persist.

Summary: Trump comments turbocharged a weakening USD trend late Tuesday, although subsequent price action was choppy as these were likely casual remarks. This high momentum breakout has stolen focus from the JPY for the moment as the key USD pair on the move, and we face a nervous wait for the Japanese election on February 8.

Small update today as sources cited by all major media in Asian Friday suggest that Trump is set to nominate former Fed Governor Kevin Warsh as the next Fed Chair in Washington today to replace Chair Powell when his term ends in May. It's an interesting choice, given Warsh, who has been a top three candidate since the beginning of Trump's second administration, is not seen as particularly dovish or crying for large rate cuts, seemingly the only qualification for the job in Trump's eyes. After Wednesday's FOMC, for example, Trump took to social media to complaining about the need for a much lower rate and calling Powell a "moron".

The choice may reflect Treasury Secretary Bessent's council to choose someone with a steady hand and a thorough knowledge of the institution, suggesting to Trump that more Fed rate cuts could trigger a disorderly slide in the US dollar, with the advice weighing more heavily after the rough USD slide this week after Trump's own comments that shrugged off the recent USD weakness. Bessent may have also pointed out to Trump that the wild ramp in metals prices has a lot to do with the fear that his administration will manage its currency and fiscal situation poorly, a distinct inflation risk.

Warsh was a Fed governor from 2006 to 2011 and quit in protest over later rounds of deepening commitment to unconventional policy like quantitative easing. It will be very interesting to see how Trump spins this nomination. Let's remember, only Trump hatchet-man Stephen Miran and the dovish Christopher Waller (seen at one point as a front runner to replace Powell) argued for a rate cut at the FOMC meeting – it's a committee decision.

Market reaction: The reaction thus far has been quite modest, which should give the USD bears some comfort. EURUSD tested and held the first key 1.1900 area (arguably, 1.1800 is permissible without a full bull trend reversal), and USDJPY tested above 154.00 which likewise held as resistance (we still need to wait for the price action after the February 8 Japanese election for a strong read on the status of the yen). Elsewhere, the reaction was far stronger, with choppy risk sentiment crumbling again after the announcement, sending US equity market futures sharply lower. Likewise, precious metals are selling off once again and the Aussie, which had enjoyed the backdrop, was one of the weaker currencies overnight (more below).

AUDUSD has retrenched to the psychologically significant 0.7000 area after a fairly brutal run higher across many of the rest of the G10 currencies over the last two weeks. The apparent Trump choice of Warsh is weighing on USD bearish conviction as it appears a rather more responsible pick, given that Warsh is considered an inflation hawk and the most hawkish of the potential Trump picks to replace Powell. The next test for the Aussie is next Tuesday's RBA meeting – could the huge repricing of the currency weigh in the RBA's decision on Tuesday? The market is leaning for a hike, which is about two-thirds priced in. A no-go on a rate move could see a further consolidation in AUD pairs, seeing AUDUSD testing perhaps 0.6900 or lower, but a "hawkish hold" that firmly sets up an anticipated hike at the following RBA meeting could soften the damage for AUD pairs. Of course, the RBA could just steam ahead with a rate hike and AUD could find support at higher levels if commodities prices likewise find a low and the USD remains broadly weak. No anticipation of a major reversal and AUD unless we see a collapse in metals prices, an ugly risk sentiment in equity markets and a rally in global bonds.

Source: Saxo

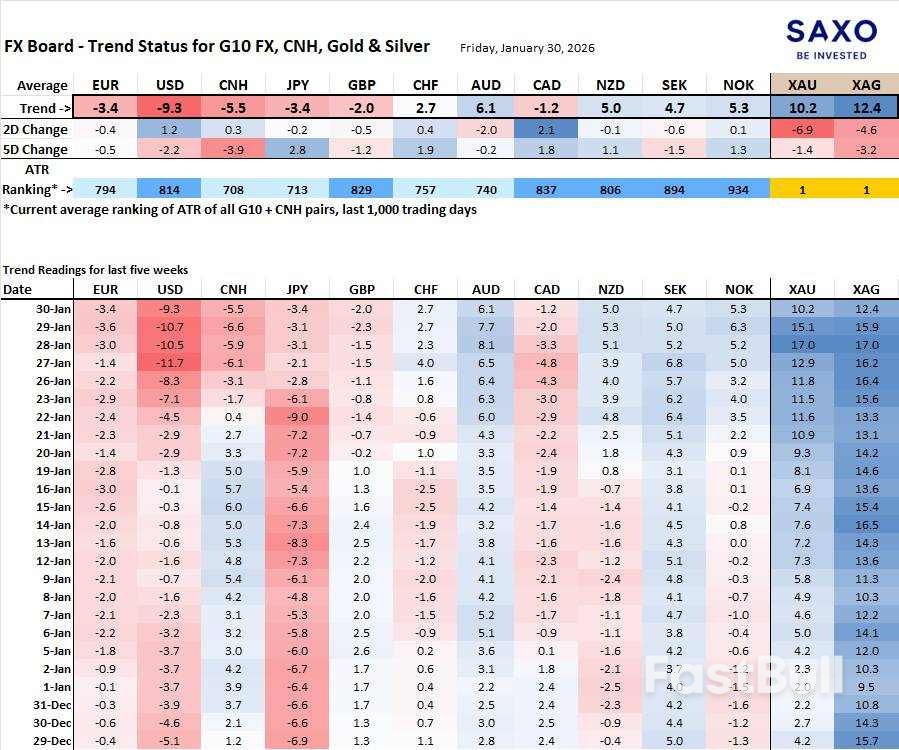

Source: SaxoFX Board of G10 and CNH trend evolution and strength.Note: If unfamiliar with the FX board, please see a video tutorial for understanding and using the FX Board.

US dollar weakness dominates – again, the reading is exaggerated because we have seen volatility expansion with this breakout, and our trend readings are volatility adjusted on a longer term time frame – so the reading does a good job of indicating how significant the move is relative to the prior quiet. Elsewhere, the AUD still a top performer, but note the loss of momentum over the last two sessions – next week is key for the currency.

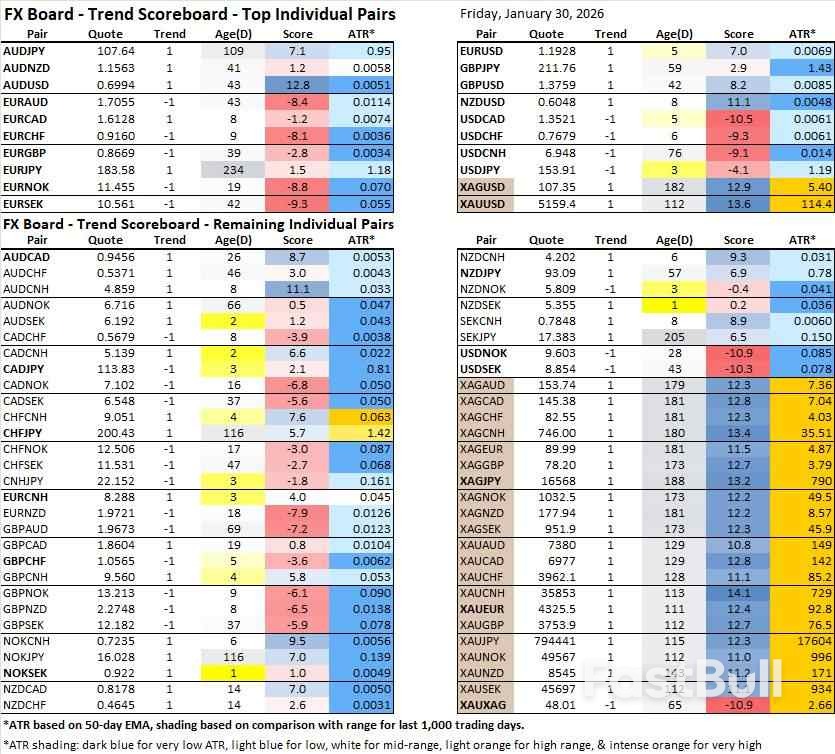

Table: NEW FX Board Trend Scoreboard for individual pairs.No brand new trends for the major individual pairs at the top of the table, although we will watch the JPY crosses closely in the coming week and beyond in anticipation of the Japanese election on February 8. Further down the table, note the NOKSEK attempt to establish a new uptrend after yesterday's close.

Dollar is consolidating within a narrow range today, reflecting a temporary balance between supportive near-term developments and persistent longer-term headwinds. Volatility has subsided, but price action lacks the conviction typical of a durable turnaround.

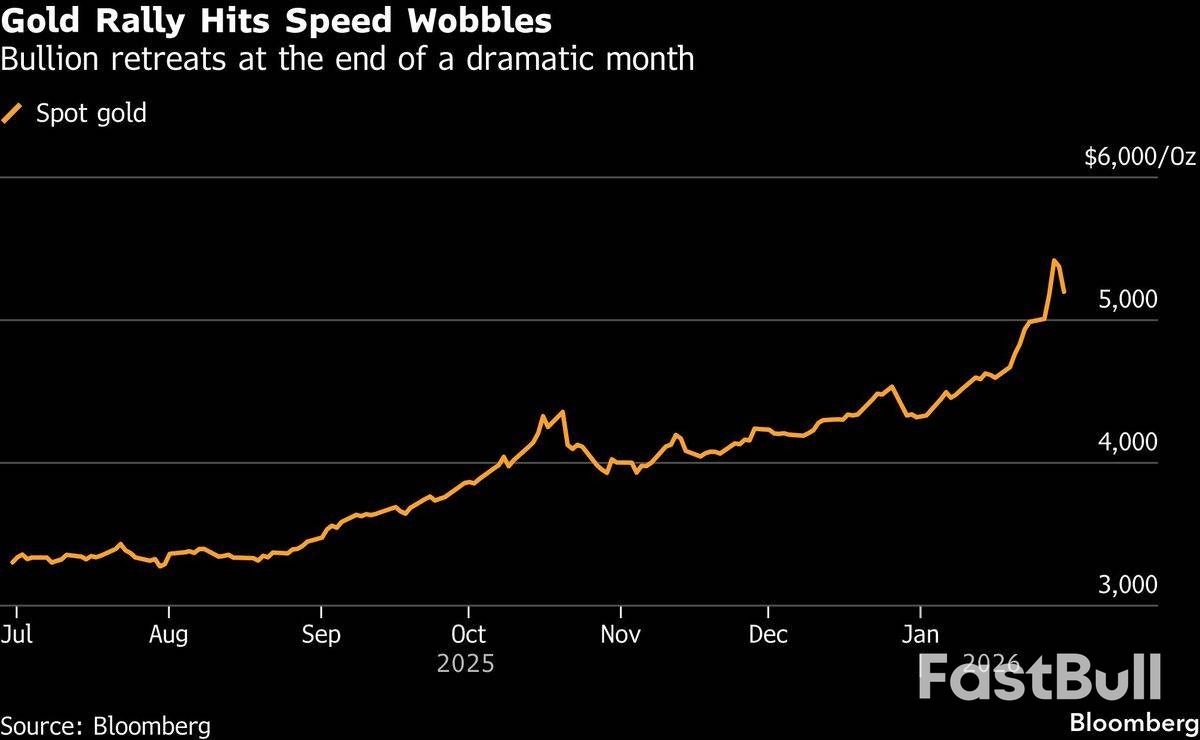

A sharp pullback in precious metals has played a key role in easing pressure on the greenback. Gold has retreated below 5,200 after printing fresh record highs above 5,500, with traders locking in gains after a steep and extended rally. That said, the broader trend in Gold remains intact. The correction appears technical in nature, offering relief to Dollar without undermining the longer-term appeal of hard assets as hedges against policy uncertainty. Equity markets also contributed to a slightly more cautious tone. Asian stocks traded lower following a brief US selloff, led by a sharp decline in Microsoft shares. However, broader US indexes stabilized quickly, preventing risk aversion from escalating.

Another notable source of support came from US political developments. President Donald Trump said he would announce his pick for the next Fed chair on Friday, adding that the choice is "somebody that could have been there a few years ago." The remark was widely read as a strong hint toward former Fed Governor Kevin Warsh. Warsh is viewed by many investors as a stabilizing choice, combining deep Fed experience with credibility as an orthodox central banker. His potential nomination is seen as reducing tail risks around overt political interference in monetary policy, even if pressure on the Fed is unlikely to disappear entirely.

At the same time, lawmakers moved to defuse a looming fiscal cliff. Senators reached agreement on a spending package designed to avert a partial government shutdown, easing a risk that had been weighing on sentiment. Trump endorsed the bipartisan deal publicly, signaling White House backing and reducing the likelihood of last-minute disruption, even as procedural hurdles remain in the House.

These factors collectively explain why the Dollar has managed to steady. The easing of near-term political and fiscal tail risks has encouraged traders to pause rather than press bearish bets aggressively. Yet the underlying narrative has not materially changed. Persistent uncertainty around US trade relations, foreign policy, and political interference continues to motivate diversification away from the Dollar into real assets and alternative currencies. In that sense, Dollar's current recovery looks tactical rather than structural. The broader trend toward Dollar erosion remains in place, with today's consolidation best viewed as a breather within a larger adjustment.

Performance tables reinforce that view. For the week so far, Dollar sits firmly at the bottom, followed by Euro and Sterling. Kiwi leads, with Swiss Franc next, while Aussie, Yen, and Loonie are clustered in the middle of the performance table.

Switzerland's KOF Swiss Economic Institute Economic Barometer eased from 103.6 to 102.5 in January, undershooting expectations of 103.2. Despite the pullback, the index remains comfortably above its medium-term average, suggesting the outlook has softened but is far from weak.

The decline was driven mainly by deterioration in hospitality and construction, where confidence faded at the start of the year. By contrast, sentiment improved in manufacturing as well as financial and insurance services, helping to cushion the overall slowdown.

Within the producing sector, signals were mixed. Employment prospects, profit expectations, exports, and assessments of production constraints came under pressure. However, brighter readings for order backlogs, general business conditions, and competitive positioning point to underlying resilience, reinforcing the view of moderation rather than a sharp downturn.

Japan's January Tokyo core CPI (excluding fresh food) eased from 2.3% to 2.0% yoy, undershooting expectations of 2.2% and marking a 15-month low. Core-core CPI (excluding fresh food and energy) also eased from 2.3% to 2.0% yoy. Headline inflation slowed more sharply from 2.0% to 1.5%.

The slowdown was driven largely by one-off factors. Food inflation excluding fresh food decelerated for a fifth straight month, while energy prices fell -4.2% yoy after gasoline subsidies and the abolition of a provisional fuel tax surcharge. Gasoline prices dropped -14.8%, with electricity and city gas bills also declining. Base effects from last year's food price surge further weighed on the data.

Despite the softer print, the figures are unlikely to derail the BoJ's normalization. While fuel subsidies may push core inflation below target in coming months, policymakers are expected to focus on whether firms continue to pass through higher import costs from a weak yen—an outcome that would keep underlying inflation pressures alive.

Japan's industrial production edged down -0.1% mom in December, a milder decline than expected -0.4% mom and consistent with a sector struggling for direction rather than deteriorating sharply. The Ministry of Economy, Trade and Industry maintained its assessment that output "fluctuates indecisively," reflecting uneven momentum across industries.

Forward-looking guidance from manufacturers remains volatile. Firms surveyed expect output to jump 9.3% in January, followed by a 4.3% decline in February, highlighting stop-start dynamics rather than a clear recovery trend.

Sector performance was split, with declines in production machinery, chemicals, and paper products offset by gains in general machinery, electronics, and motor vehicles. Supply-side indicators pointed to some imbalance. Industrial shipments fell -1.7%, while inventories rose 1.0%, suggesting demand has not kept pace with production and raising the risk of further output adjustments if sales do not improve.

That concern was reinforced by a sharp disappointment in consumption. Retail sales fell -0.9% yoy in December, far below expectations for a 0.7% increase.

Daily Pivots: (S1) 0.6981; (P) 0.7038; (R1) 0.7106;

A temporary top is firmed at 0.7093 in AUD/USD with current retreat. Some consolidations would be seen but risk will stay on the upside as long as 55 4H EMA (now at 0.6905) holds. Above 0.7093 will extend larger up trend to 100% projection of 0.5913 to 0.6706 from 0.6420 at 0.7213 next. Nevertheless, break of 55 4H EMA will confirm short term topping, and bring lengthier consolidations before rally resumption.

In the bigger picture, current development argues that rise from 0.5913 (2024 low) is reversing whole down trend from 0.8006 (2021 high). Further rally should be seen to 61.8% retracement of 0.8006 to 0.5913 at 0.7206. This will remain the favored case as long as 0.6706 resistance turned support holds, even in case of deep pullback.

The Netherlands continues to stand out as a top performer within the eurozone, a trend that likely held firm through the fourth quarter of last year. While the broader eurozone is expected to post GDP growth of just 0.2%, the Dutch economy has been powered by distinct internal and external drivers.

Two key factors have underpinned the Netherlands' recent economic strength: accelerated government spending and a robust export sector. Government expenditure has been a reliable engine for growth in recent years.

Simultaneously, exports have shown remarkable resilience. Despite headwinds from US tariffs and a stronger euro, Dutch exports have continued to grow, largely due to strong trade relationships within the eurozone and increased demand from Asia.

While the headline numbers are strong, the picture is more complex at the household level. Consumers have remained cautious, with spending growth holding at a moderate 0.3%. This hesitance persists even as purchasing power recovers from the recent inflation shock, as Dutch consumers remain concerned about high price levels and the uncertain global environment.

A more significant drag on the economy has been investment. The Dutch economy has been hampered by persistent bottlenecks that curb investment activity. This resulted in negative investment growth for the second consecutive quarter, following a large decline in Q3. Although the Q4 drop was more moderate, shrinking investment during a period of relatively strong economic growth is a rare and concerning signal.

Attention is now turning to the new coalition government, which is set to announce an agreement expected to include measures aimed at improving the investment climate.

Looking ahead to 2026, the outlook for Dutch businesses across various sectors is quite positive. However, overall GDP growth is expected to moderate from its current pace, as the significant boost from government spending is projected to ease during the year.

The Eurozone’s largest economies demonstrated remarkable resilience last quarter, posting modest but steady growth driven by a powerful shift toward domestic consumption and investment. This internal strength successfully counteracted struggling exports and the persistent uncertainty from unpredictable U.S. trade policies.

Despite predictions that the bloc of 350 million people would falter under the pressure of a trade war, fierce competition from China, and regional military conflict, the Eurozone delivered respectable growth each quarter last year. The expansion came even as its traditional engines, industry and exports, lost momentum.

Spain continues to be a primary driver of the bloc's expansion, with its economy growing by 0.8% in the last quarter, easily surpassing expectations of 0.6%. Germany, the Eurozone's economic powerhouse, also beat forecasts, expanding by 0.3% against predictions of 0.2%.

Other key economies also contributed to the steady performance:

• France: Grew by 0.2%, in line with predictions, showing that political instability did not derail sentiment.

• Italy: Expanded by 0.3%, just edging out forecasts.

• Netherlands: Posted a solid 0.5% growth rate.

These national figures suggest that the broader Eurozone growth numbers will align with economists' expectations of a 0.2% quarterly expansion and a 1.2% year-over-year increase.

Data indicates the bloc began 2026 on relatively strong footing. A key sentiment reading released Thursday showed an unexpected jump, fueled by optimism in France and Germany, with gains seen across all major sectors.

Further signs of stability are becoming apparent. The industrial sector is showing signs of stabilizing, while households are finally beginning to reduce their historically high savings rates. At the same time, unemployment remains near record lows, and inflation is holding firm around the European Central Bank's 2% target.

The economic outlook is further brightened by Germany's major spending initiatives in infrastructure and defense. While these projects may take time to fully launch, they are expected to have a measurable impact on growth starting from the second quarter.

This spending is poised to end three years of German stagnation and will likely create a positive ripple effect across Europe, as German industry relies on a vast network of suppliers spread throughout the continent.

A full recovery in exports is unlikely anytime soon. U.S. tariffs, intensifying Chinese competition, and the dollar's decline over the past year all point to a permanent shift in global trade patterns.

This reality places the burden squarely on the domestic economy to find new sources of expansion. However, economists argue that both consumer spending and intra-EU trade have significant untapped potential, keeping the overall outlook upbeat. Most projections now see the Eurozone growing in the 1.2% to 1.5% range for years to come, which is considered around the bloc's potential.

This stable economic environment puts the European Central Bank in a uniquely comfortable position. With inflation at its target, interest rates in a neutral setting, and growth meeting its potential, some policymakers have described the situation as the "nirvana of central banking." Consequently, investors widely expect interest rates to remain steady throughout the year, barring any unforeseen shocks to the system.

Gold prices dropped sharply on Friday, pulling back from a historic monthly gain after a report suggested the Trump administration is preparing to nominate Kevin Warsh as the next Federal Reserve chair. The news sent the U.S. dollar higher, putting immediate pressure on precious metals.

Silver experienced an even steeper decline, tumbling as much as 9.4%. Gold, which had been positive earlier in the day, reversed course and fell by as much as 4.8%, highlighting the market's volatility after a record-breaking run.

The catalyst for the reversal was a Bloomberg News report that President Donald Trump is expected to name Warsh, a former Fed governor, to lead the central bank. The president confirmed he would announce his nominee on Friday morning U.S. time.

Warsh is widely known as an inflation hawk but has recently aligned himself with the president by publicly arguing for lower interest rates. The prospect of his leadership boosted the U.S. dollar index by as much as 0.5%, making dollar-denominated commodities like gold more expensive for international buyers.

According to Christopher Wong, a strategist at Oversea-Chinese Banking Corp., the sell-off "validates the cautionary tale of fast-up, fast-down." He suggested that while the Warsh nomination news acted as the trigger, a market correction was inevitable after such a rapid ascent.

"It's like one of those excuses markets are waiting for to unwind those parabolic moves," Wong noted.

Even with Friday's pullback, gold remains on track for a roughly 19% gain in January, which would mark its strongest monthly performance since 1982. Silver's rise has been even more dramatic, with the metal up an astounding 48% so far this year.

The recent rally in precious metals has been largely fueled by significant geopolitical uncertainty stemming from the Trump administration's policies. Key drivers for safe-haven demand included:

• The seizure of Venezuela's leader.

• Threats to annex Greenland.

• Tariff threats against allies.

• Warnings of a possible strike on Iran.

• The prospect of levies on countries providing oil to Cuba.

Concerns about the Federal Reserve's independence have also played a crucial role. Renewed attacks on the central bank fueled dollar weakness and a "debasement trade," prompting investors to move away from currencies and sovereign bonds over fiscal fears.

A meltdown in Japan's debt market amplified these concerns, helping to accelerate the dizzying gains in precious metals. The rally was further magnified by a lack of market liquidity.

As of 4:13 p.m. in Singapore, market prices reflected the broad sell-off:

• Gold fell 4.3% to $5,146.58 an ounce.

• Silver tumbled 8.5% to $105.8566 an ounce.

• Platinum and palladium also slumped.

The Bloomberg Dollar Spot Index rose 0.2% on the day but remained down 1% for the week.

In other news, a potential U.S. government shutdown was averted after President Trump and Senate Democrats reached a tentative deal. The White House continues to negotiate with Democrats over new limits on immigration raids that have caused a national outcry.

Diplomatic tensions between Hungary and Ukraine have surged, leading both nations to summon each other's ambassadors amid accusations of election interference. Hungarian Prime Minister Viktor Orbán and Foreign Minister Péter Szijjártó have publicly accused Kyiv of attempting to influence Hungary's upcoming parliamentary elections, a charge Ukraine vehemently denies as cynical and false.

Prime Minister Orbán took to social media to claim Hungary has been facing "daily threats from Ukraine," specifically naming President Volodymyr Zelensky, Foreign Minister Andrii Sybiha, and Ukrainian security services as sources. He asserted that these actions would continue until the election, alleging that Kyiv is actively working to install "a pro-Ukrainian government in Hungary" by targeting him and his administration.

"We did not seek conflict, yet Hungary has been the target for days," Orbán stated, emphasizing that his government would not be swayed from its national interests. He outlined several key policy positions:

• No financial aid: "We will not send money to Ukraine, because it is in a better place with Hungarian families than in the bathroom of a Ukrainian oligarch."

• No energy sanctions: He reiterated his opposition to banning Russian oil and gas imports.

• No fast-tracked EU membership: Orbán argued that Ukraine's accession would "import war" into the European Union.

"As long as Hungary has a national government, these issues will not be decided in Kyiv or Brussels," Orbán declared.

Foreign Minister Reinforces Accusations

Foreign Minister Péter Szijjártó confirmed that Ukraine had summoned Hungary’s ambassador in Kyiv, noting that Budapest was "not surprised." He said Ukrainian officials objected to Hungary’s national petition regarding plans by Brussels and Kyiv to use Hungarian taxpayer funds to arm Ukraine.

Szijjártó added that Kyiv offered no explanation for what he termed President Zelensky’s "vulgar insults" of Orbán or for Sybiha's comparison of the Hungarian prime minister to "one of Hitler's henchmen."

He further warned that Kyiv was escalating its interference in Hungary’s April election to support opposition leader Péter Magyar's Tisza Party. "We understand that Ukraine wants the Tisza Party to win, but only the Hungarian people can decide Hungary's future," he said.

In response, Hungary summoned Ukraine's ambassador in Budapest. Szijjártó described the situation as an "open, shameless and aggressive interference campaign" and vowed to "defend our sovereignty by every possible means."

While not directly addressing Szijjártó's most recent comments, Ukrainian Foreign Minister Andrii Sybiha had previously responded to Orbán's accusations. In a social media post, he told Hungarian officials "not to be afraid of Ukraine," but of the Hungarian people.

Sybiha accused Orbán of cynicism and historical manipulation. "When Viktor Orbán says that he will not allow Ukraine to join the EU for the next 100 years, he is not really talking to the Ukrainian state," Sybiha wrote. "First and foremost, he is telling this to ethnic Hungarians in Transcarpathia."

He further charged that Orbán was using ethnic Hungarians in Ukraine as "hostages to his geopolitical adventures" and claimed that blocking Ukraine's EU path was "yet another crime against the Hungarian people and Hungary itself."

This diplomatic firestorm unfolds against the backdrop of Hungary's long-standing opposition to further arming Ukraine in its conflict with Russia. Budapest has criticized Brussels for what it sees as a reckless and costly strategy to achieve an unrealistic military victory for Ukraine.

The upcoming election on April 12 is considered a significant challenge for Orbán and his governing Fidesz party, with many in Budapest viewing it as their toughest political test to date.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up