Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China halts rare earth exports; impact on U.S. industries.Increased costs for manufacturers reliant on rare earth.Potential long-term global supply chain disruptions reported.

Experts emphasize the move highlights China's strategic use of its dominance in rare earth production, potentially complicating global supply chain protocols.

The Chinese government halted exports of rare earth minerals, citing retaliation for U.S. tariff hikes on tech products. This action affects companies like Tesla, Apple, and military firms relying on critical resources.

President Donald Trump has imposed significant tariffs on Chinese goods, while a new Chinese licensing system is expected to cause further supply delays. Analysts worry global entities will be scrambling for alternatives as disruptions are anticipated.

American manufacturers and defense firms face increased costs due to limited U.S. rare earth reserves. Industrial disruptions may increase volatility in ETFs tied to rare earth materials.

The suspension affects multiple industries globally and could lead to immediate price increases. Historically, such actions have caused major fluctuations in related markets.

Companies worldwide may seek alternative sources, which could lead to increased demand for rare earth resources outside China. Past precedents indicate slow development of new supply chains and potential long-term shortages.

Analysts note a potential uptick in resource-driven inflation impacting broader markets and investor actions. The U.S. may enhance its strategic stockpiles or diversify through partnerships with other nations.

The AUDUSD is once again flirting with its 100-day moving average, currently near 0.62917, and the risk is that history repeats. The last two breaks above this key technical level failed to hold, both stalling at 0.6390 before rotating back lower. Today’s attempt showed even less momentum, with the high reaching just 0.6340 before sellers leaned in and the pair reversed.

If the pair can't hold above the 100-day MA, attention will shift back toward downside support targets. The first is the 200-hour moving average at 0.6259, followed by the 100-hour moving average at 0.6220. A move below both would confirm that the recent break was another false start—and place sellers firmly back in control.

The technical picture remains precarious. Buyers need to not just break the 100-day MA, but sustain momentum above it. Without that, the bias stays bearish and the AUDUSD may just be “doing it again.”

Key levels:

Resistance: 0.62917 (100-day MA), 0.6340, 0.6390

Support: 0.6259 (200-hour MA), 0.6220 (100-hour MA)

AUDUSD technicals.

Credit spreads reflect the perceived risk of corporate bonds compared to government bonds. The spread between risky corporate bonds and safer Treasury bonds remains narrow when the economy performs well. This is because investors are confident in corporate profitability and are willing to accept lower yields for higher risks.

Conversely, during economic uncertainty or stress, investors demand higher yields for holding corporate debt, causing spreads to widen. This widening often signals investors are growing concerned about future corporate defaults, which could indicate broader economic trouble.

The two charts above show that credit spreads are essential for stock market investors. Watching spreads provides insights into the health of the corporate sector, which is a major driver of equity performance. When credit spreads widen, they often precede liquidity events, reduced corporate earnings, economic contractions, and stock market downturns.

Widening credit spreads are commonly associated with increased risk aversion among investors. Historically, significant widening of credit spreads has foreshadowed recessions and major market sell-offs. Here’s why:

The recent market disruption caused by Trump’s trade war has undoubtedly widened spreads between “risk-free” treasury yields and corporate bonds. However, while those spreads have widened, they remain well below the long-term averages. With inflation and economic growth slowing, this week’s violent turmoil in the Treasury bond market is a signal of more than just recession concerns. As we noted in our Daily Market Commentary:

“On Monday, Treasury bonds had a sharp decline far beyond what the economic or tariff data suggested would be the case. We suspect that on Monday, there was forced liquidation through either margin calls or demand redemption of an institutional fund. The outsized selling and volume on a single day for bonds is highly unusual. The media excuses of “tariffs” or “economic concerns” are issues the bond market has known about for quite some time.”

That type of sharp liquidation has historically been the issue of some liquidity events in the bond market. In this case, it appears to be the heavily leveraged arbitrage trade used by hedge funds.

For a simple explanation of the basis trade, I asked Grok:

“The “basis trade” in the Treasury bond market is a strategy commonly used by hedge funds to profit from small price discrepancies between Treasury bonds (the cash market) and Treasury futures contracts. Here’s how it works: hedge funds buy Treasury bonds while simultaneously shorting Treasury futures (or vice versa), betting that the price gap, or “basis,” between the two will converge.

This trade relies heavily on leverage—often 20 to 56 times the initial investment—borrowed through the repurchase (repo) market, where Treasuries are used as collateral. The goal is to capture small, consistent profits from this arbitrage, amplified by the leverage while assuming the relationship between cash bonds and futures remains stable.”

While the Fed suggests that the hedge fund basis trades leverage is above 50x, the Treasury Borrowing Advisory Committee wrote in January that “20x appears to be a good approximation of leverage typically used in these trades.”

If you don’t understand that math, it simply means that a 5% loss at 20x leverage is a 100% loss on the trade.

Furthermore, just for context, when Long Term Capital Management (LTCM) blew up over an unexpected move in interest rates, it cost the Fed $100 billion to keep financial markets afloat. As shown below, the current magnitude of today’s hedge fund giants running these “basis trades” are multiples of LTCM.

As of this past week, the market liquidity event appears to be the “basis trade” unraveling. This turbulence is driven by hedge funds being forced to unwind their basis trade positions as Treasury prices drop (and yields rise.) That change in the value of the collateral backing those leveraged bets decreases, triggering margin calls from lenders.

To meet those margin calls, hedge funds must sell their Treasury holdings, which exacerbates the downward pressure on bond prices, increasing yields, which triggers more liquidations.

This “liquidation event” in the bond market is very reminiscent of the “Repo Crisis” in 2019 and the “Dash For Cash” during the COVID-19 pandemic. It also reminds us of the “Silicon Valley Bank Crisis” in 2023. In all three events, the Federal Reserve stepped in to provide liquidity to the Treasury market. As Deutsche Bank noted on Wednesday:

“As far as the market circuit-breakers go, if recent disruption in the US Treasury market continues we see no other option for the Fed but to step in with emergency purchases of US Treasuries to stabilize the bond market (“emergency QE”). This would be very similar to the Bank of England intervention following the gilt crisis of 2022. While we suspect the Fed could be successful in stabilizing the market in the short-term, we would argue there is only one thing that can stabilize some of the more medium-term financial market shifts that have been unleashed: a reversal in the policies of the Trump administration itself.”

For a deeper dive into the “basis trade,” watch the following excerpt from the RealInvestmentShow:

The reversal of Trump’s tariffs on Wednesday was not a “master class in negotiation.” It was the admission that a terrible mistake was made, and the bond market drove that reversal.

However, is the problem resolved? It does not appear to be due to yields continuing to rise. Both credit spreads and interest rates are sending warning signs but are not yet at levels suggesting the entire funding market is broken. The bond market is functioning, and the 10-year auction on Wednesday went well.

Furthermore, hopefully, the administration’s 90-day pause on tariffs is the first step in the right direction to end the trade war entirely or at least reduce it significantly.

Regardless, I doubt that we are done with market volatility. The damage done to the bond market so far is likely not over yet, and while we may get a short-term reprieve, I suspect there will be another round of bond market stress before we are done.

That is particularly the case given the recent triggering of our most crucial risk-management signal.

Last week, we noted that the market was not expecting retaliation from China.

“Rather than coming to the table to negotiate, China responded with a reciprocal 34% tariff on the U.S. plus export controls on rare earth metals needed for technological production. China is playing “hardball” negotiating tactics with Trump. This was a smart move from a negotiating standpoint by China, allowing President Xi to open tariff discussions from a point of strength. However, without some resolution to the extraordinary tariffs, the market will remain in turmoil for quite some time.”

That battle persisted this week as Trump raised tariffs on China to 104%, and China then retaliated with a further tariff increase of 84%. However, as we said last week, any good news would cause the market to rally sharply. On Wednesday, President Trump announced a 90-day pause on the full effect of new tariffs.

Interestingly, the same headline sent stocks surging on Monday but was quickly deemed “fake news” by the White House. I suspect that Monday was a “leak” by the White House to test the market response, and President Trump kept that announcement handy to stave off a further decline in the markets. Whatever the reason, the markets needed the break. Here is Trump’s full statement:

From a technical view, the market completed an expected retracement from the October 2022 lows. Last week, we laid out the potential correction levels.

“The market should be able to find some support at this level and muster a short-term rally next week. However, there is a downside risk to 4816, which would be a 50% retracement of the bull market rally. Any positive announcements over the weekend could spark a relatively robust reversal rally, given the more than three-standard deviation gap between where the market closed and the 50-DMA.“

That 38.2% retracement level, using the bull market from October 2022 lows, was broken early Monday morning as stocks plunged lower amid rising tariff concerns and a blowup in the bond market. However, the market finally tested the 50% retracement level on Wednesday morning.

Given the deep oversold condition, President Trump’s announcement to pause tariffs led to the 3rd largest single-day rally since WWII. For now, the market should be able to hold support at the previous lows and hopefully find a bit more relief into next week.

As I noted in the previous two weeks, we strongly lean toward the potential of the markets beginning a more extensive corrective process, much like in 2022. We will revisit that analysis in this weekend’s newsletter. However, while we are concerned about a continued correction process as markets realign prices to forward earnings expectations, there will still be strong intermittent rallies.

As noted last week, nothing in the market is guaranteed. Therefore, we continue managing risk accordingly, and as we stated last week and executed on Wednesday, we are now in “sell the rally” mode until the markets find equilibrium. When that will be, we are uncertain, so we continue to watch the technicals, make small moves within portfolios, and reduce volatility risk as needed.

This week, we will revisit the 2022 scenario and the “basis trade,” which threatens the financial markets.

Last Tuesday, I posted “Failure At The 200-DMA” which discussed the importance of the weekly “risk management” signal.

The chart below is a long-term weekly chart of RSI and MACD indicators. I have denoted when the indicators are trading in bullish and bearish trends. The primary signal is the crossover of the weekly moving averages, as noted by the vertical lines. While the MACD and RSI indicators provided early warning signals, the moving average crossover confirmed a market correction or consolidation. These indicators will not necessarily cause a risk reduction precisely at the top. However, they generally provide sufficient indications to reduce risk ahead of more significant market corrections and consolidations.

I have updated the chart for this week’s market close. The massive rally on Wednesday completed the 50% retracement from the low, which allowed us to reduce portfolio risk in portfolios. Most likely, the correction process that started with the break of the 200-DMA is likely not yet complete. We will discuss those actions in the “How We Are Trading It” section below.

The market tells us that the risk of a more significant correction or consolidation process is increasing, particularly as economic growth slows and valuations are repriced for reduced earnings growth expectations. As we noted in that article two weeks ago:

“While such does not preclude a significant counter-trend rally in the short term, the longer-term risks seem to be growing.”

So far, the current corrective cycle, including the massive reflexive rally this week, remains very reminiscent of the 2022 correction. If we enter another corrective period like 2022, given some of the same technical similarities, there is a decent “playbook” to follow despite substantial differences.

In 2022, the Fed was hiking rates, inflation was surging, and economists were convinced a recession was on the horizon. As noted above, earnings estimates were revised lower, causing the markets to reprice valuations. Today, the Fed is cutting rates, and inflation is declining; however, due to Trump’s trade policies, the risk of recession is rising, and earnings estimates likely remain overly optimistic. We must realize that the analysis can change as time passes.

However, let’s review the 2022 correction process. In March 2022, the market triggered the weekly “sell signal” as it declined. Notably, the market rallied sharply after the “sell signal” was initially triggered. Much to the same degree as we saw on Wednesday. Such a rally is unsurprising, as when markets trigger “sell signals,” they are often profoundly oversold in the short term. However, that rally was an opportunity to “reduce risk,” as the failure of that rally brought sellers back into the market.

The “decline, rally, decline” process repeated until the market bottomed in October. One of the defining things we will be looking to identify where the current market will bottom is the positive divergence of momentum and relative strength. Even though markets continued to struggle in the summer or 2022, the positive divergences suggested that market lows were near.

“With the market approaching decently oversold levels, I expect a rally to start as soon as this week or next.”

That rally occurred, and we are starting to track the initial “sell signal” process as of 2022. Such suggests we could see a further rally over the next week.

We used the rally this week to reduce portfolio risk and raise cash levels, and we will continue that process on a further rally. While no two corrections are the same, it is essential to understand that corrections do not occur in a straight line. With the weekly sell signal in place, investors should expect that we will likely see further declines, which will likely be punctuated by short-term rallies that allow investors to rebalance portfolio allocations and reduce risk as needed.

With that understanding, this is what we did this past week.

Last week, we stated:

“As noted, we expect a sizable rally soon. While such a rally will undoubtedly make investors more bullish on the markets, we will use that rally to reduce portfolio volatility until a more durable market bottom is identified. Furthermore, we are triggering an important weekly sell signal. Still, the markets are simultaneously three standard deviations below their longer-term moving average, challenging the rising trend line from the October 2022 lows. Such oversold conditions typically precede short-term rallies, allowing us to reduce exposure to equities between 5500 and 5700. While the rally could be more significant, we will use those levels to begin risk reductions.”

We followed our instructions from last week, which stated that we would:

All the trades are listed at the bottom of this week’s newsletter.

Those actions reduced equity exposure to 50% and increased cash to 17%. However, the portfolio has a 2.5% short-S&P 500 position, which brings the actual equity allocation to 47.5%.

Note: We expect the market to rally more from current levels over the next week or so and could challenge the 200-DMA. However, that is likely the point where sellers will re-enter the market. Markets rarely bottom without retracing toward the previous lows or setting new lows. Given the technical damage to the market, we suspect we will see a pullback before this correction process is over.

We will continue to monitor and adjust the portfolio accordingly. At some point, the valuation reversion will be complete, allowing us to reconfigure portfolio allocations for a more bullish environment. When that event occurs, we will reduce fixed income, shift income allocations to corporate bonds rather than government bonds, and overweight equity allocations in portfolios.

However, that is a conversation we will have in more detail in the future. For now, market conditions remain uncertain. Preparing and adjusting strategies can help investors navigate volatility confidently. As technical indicators flash warning signs, a well-structured risk management approach will protect capital and preserve long-term gains.

National Economic Council Director Kevin Hassett said Monday that "more than 10" countries have made "very good, amazing" trade deal offers to the United States after President Donald Trump imposed steep tariffs on imports from many nations.

Hassett also said in a Fox Business interview that there is no chance at all — "100% not" — that the U.S. will experience a recession in 2025.

And he denied there was any insider trading by Trump or White House officials ahead of the president's monthslong pause in so-called reciprocal tariffs last week.

Trump, U.S. trade representative Jamieson Greer, and Commerce Secretary Howard Lutnick are mulling whether offers of trade pacts from other countries are "good enough," Hassett said in the interview.

"The one question that I have open in my mind is, should we go one at a time, or should we announce a bundle all at once?" Hassett said.

He also said that business executives have been telling him that companies are pushing to move their overseas operations back to the U.S, while consumers are buying up foreign goods because they are "worried about future tariffs."

"So everything's through the roof, anecdotally," he said, adding that recent U.S. jobs report data is "really, really good."

An industry group survey published Monday found that 62% of U.S. CEOs now expect a recession or other economic downturn within the next six months. A day earlier, Bridgewater Associates founder Ray Dalio said on NBC News' "Meet the Press" that he was worried that turmoil from Trump's tariffs and economic policies will lead to "something worse than a recession."

Hassett's optimism about America's trade and economic trajectory came as stock market indices rose Monday morning.

The gains followed news over the weekend that Trump had granted an exemption on reciprocal tariffs imposed on imported electronics, including phones, computers, and semiconductors.

Trump later insisted Sunday in a Truth Social post that there was no exemption granted, and that tariffs on those items would be imposed in a different "bucket" later.

On Wednesday, Trump abruptly announced that his sweeping reciprocal tariffs on dozens of countries would be reduced to a 10% flat rate for 90 days.

The postponement, announced just hours after the steep tariffs took effect, sent stocks soaring after a four-day slide

That swing led Democrats to ask questions about possible market manipulation or insider trading.

Lawmakers pointed to Trump's Truth Social post declaring, "THIS IS A GREAT TIME TO BUY!!!" hours before announcing the tariff pause.

Sen. Cory Booker, D-N.J., said Sunday that "there's enough smoke here that should demand congressional hearings."

Congressional Democrats last week asked the Securities and Exchange Commission to investigate, noting, among other things, a "spike" in purchases of call options minutes before Trump announced the tariff delay. Call options give their holders the right to buy stock shares at a certain price, and act as effective bets that that price will be lower than the retail price of the shares at the time the options are executed.

Hassett, asked about Booker's push for hearings, said, "There was no insider trading at the White House."

But he said the large stock movements will be investigated by the proper authorities, he said.

"When there are big movements in markets, then there are people around town that investigate and make sure that nothing funny was happening," he said.

"But I'm sure it's not anything to do with the White House," Hassett added.

"We now expect the aluminium price to fall to a monthly average low of $2,000 (per metric ton) in Q3 2025," the bank said in a note.

Goldman expects prices to rebound to $2,300 per metric ton (/t) by December 2025, compared to its earlier forecast of $2,650/t. London Metals Exchange (LME) aluminium was trading at around $2,392/t as of 1300 GMT on Monday.

U.S. President Donald Trump has imposed or floated plans for a series of global tariffs since his return to office, including 25% tariffs on steel, aluminium and auto parts alongside major tariffs on Mexico, Canada and China.

Aluminium, a lightweight and corrosion-resistant metal, plays a critical role across industries including transportation, packaging, and electronics.

Trump said on Sunday that he would be announcing the tariff rate on imported semiconductors this week.

Goldman also forecast a global aluminium market surplus of 580,000 tons in 2025, versus its previous forecast of a 76,000 tons deficit.

It attributed this to a downward revision to its global total aluminium demand growth forecast to 1.1% year-on-year in 2025 and 2.3% in 2026, as the bank expects a hit from weaker global GDP growth. Previously it had expected demand growth of 2.6% this year and 2.4% in 2026.

Goldman said it still expects aluminium prices to go up after 2025, but not as much as it estimated before, as the extra supply built up during 2025–2026 will help soften the rise.

According to the note, aluminium prices will be at $2,720/t by December 2026, instead of $3,100 forecast previously, and average around $2,800 per ton in 2027, when Goldman sees the market entering a 722,000 tons deficit.

(Reporting by Anjana Anil and Brijesh Patel in Bengaluru; Editing by Kirsten Donovan and Andrea Ricci)

Oil demand growth was revised down to 1.3 million barrels per day, with the growth a "minor adjustment" that is mainly based on the expected impact of tariffs on the market, the Vienna-based body said in its report on Monday. Demand is expected to grow by 40,000 barrels per day, it said.

Demand in countries outside the Organisation for Economic Co-operation and Development (OECD) is projected to increase by nearly 1.25 million barrels per day, mainly to be supported by demand from China, the world's second-largest economy and largest consumer of energy, it said.

For 2026, Opec slightly revised its global demand growth forecast to about 1.3 million bpd. Demand in the OECD is expected to grow by about 100,000 bpd, while non-OECD countries will log an increase of 1.2 million bpd.

"In the OECD, oil demand is expected to be pressured by the likely impact of the new US tariffs on imports," Opec said. "In the non-OECD, despite having been burdened with considerable tariffs by the US, China is expected to drive oil demand, supported by strong mobility and industrial activity."

Opec's projections run counter to the US's view on the market: the world's largest economy and second-largest consumer of energy foresees "very strong" long-term growth in oil and gas demand, US Energy Secretary Chris Wright said in Abu Dhabi last week, without specifying a time period for the forecast.

Opec also downgraded its projections for global economic growth, forecasting a 3 per cent expansion this year and 3.1 per cent in 2026.

Oil, much like the stock markets, bore the brunt of Mr Trump's tariffs in their immediate aftermath of their announcement. Prices had plunged to their lowest levels in more than three years on April 4, as China hit back against the US tariffs with its own additional levies on American goods.

They plunged further on Wednesday after Mr Trump increased tariffs on China, nearing levels seen during the tail-end of the worst of the Covid pandemic four years ago, intensifying the market mayhem.

Prices have since rebounded. Brent, the benchmark for two-thirds of the world's oil, was up 1.22 per cent at $65.55 a barrel as of 4.20pm UAE time on Monday. West Texas Intermediate, the gauge that tracks US crude, added 1.32 per cent to $62.31. However, analysts have downgraded their projections for oil in 2025, citing vital factors such as soft demand, uncertainty from Opec supply and a decline in US shale stash.

The Swiss lender UBS reduced its Brent price forecasts by $12 a barrel to $68, while WTI has been lowered to $64 per barrel. Goldman Sachs, the fifth-largest US bank by assets, expects Brent and WTI to edge down and average $63 and $59 a barrel, respectively, for the remainder of 2025, then fall further to $58 and $55 in 2026.

"US tariffs and the trade war between the US and China will likely weigh on economic growth this year and are likely to result in oil demand growing at a slower speed this year," Giovanni Staunovo, a strategist at UBS, wrote in a note on Monday.

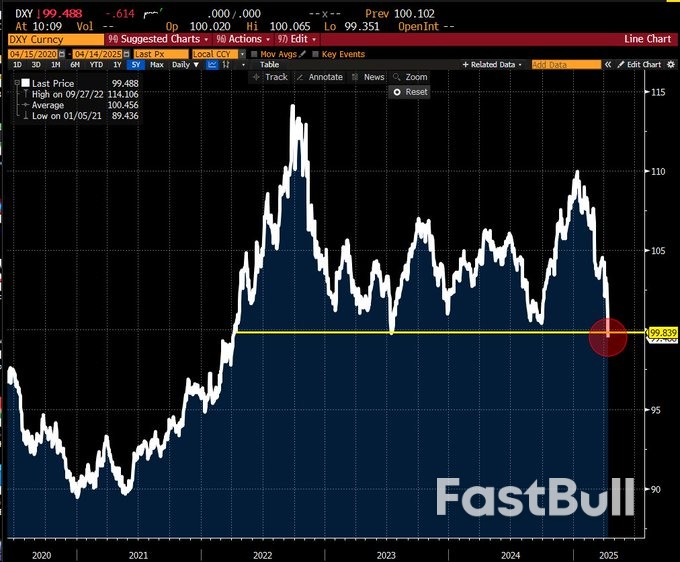

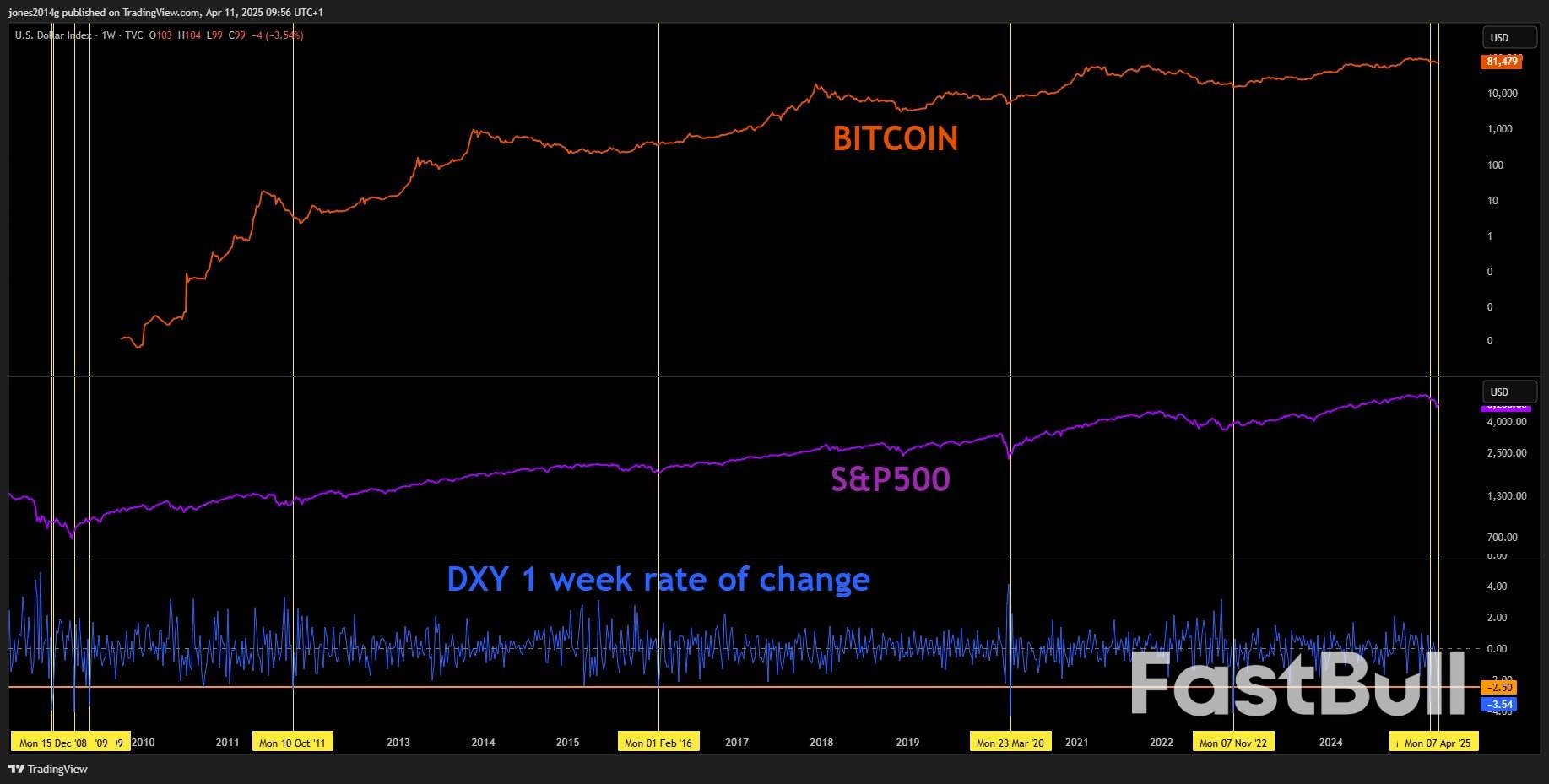

While far from constant, Bitcoin’s relationship with dollar strength tends to show that gains occur after major DXY losses — albeit with a delay of several months.

While far from constant, Bitcoin’s relationship with dollar strength tends to show that gains occur after major DXY losses — albeit with a delay of several months.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up