Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Thousands of Indianairline IndiGo passengers suffered flight cancellations and delays for the third day on Thursday, as the airline grapples with new government regulations that affect its staff's working hours.

Thousands of Indianairline IndiGo passengers suffered flight cancellations and delays for the third day on Thursday, as the airline grapples with new government regulations that affect its staff's working hours.

At least 175 IndiGo flights were canceled as of early Thursday, the Reuters news agency reported, with 150 more flights canceled on Wednesday. Passengers were left stranded at major Indian airports including New Delhi, Hyderabad, Pune and Bengaluru.

The airline accounts for 60% of domestic flights in India.

The Indian government announced last year new regulations for flying and staff that came into effect in early November.

They include:

It is unclear why the new regulations only started to affect IndiGo this week. Other Indian airlines, including Air India and Spicejet, have not had to cancel flights.

The airline, which has long prided itself on its punctuality, acknowledged the delays in a statement shared by multiple Indian news websites.

"A multitude of unforeseen operational challenges, including minor technology glitches, schedule changes linked to the winter season, adverse weather conditions, increased congestion in the aviation system, and the implementation of updated crew rostering rules (Flight Duty Time Limitations), had a negative compounding impact on our operations in a way that was not feasible to be anticipated," IndiGo said.

It said it has introduced "calibrated adjustments" to address the delays, suggesting the issue might last another 48 hours.

India's aviation watchdog, the Director General of Civil Aviation (DGCA), has scheduled a meeting with IndiGo officials on Thursday to further inspect the matter.

The two-decade old airline operates over 2,000 flights daily, utilizing a fleet of over 400 planes.

IndiGo staff often proudly announce "IndiGo Standard Time" when boarding has been completed ahead of schedule, a play on "Indian Standard Time."

The two-decade old airline operates over 2,000 flights daily, utilizing a fleet of over 400 planesImage: Pius Koller/imageBROKER/picture alliance

The two-decade old airline operates over 2,000 flights daily, utilizing a fleet of over 400 planesImage: Pius Koller/imageBROKER/picture allianceBritish construction activity contracted last month at the fastest pace since May 2020, with steep falls in civil engineering, residential, and commercial building, partly due to uncertainty ahead of the government's budget, a survey showed on Thursday.

S&P Global's monthly purchasing managers' index for the construction industry fell to 39.4 in November from 44.1 in October, extending its longest downturn since the global financial crisis and remaining well below the 50 mark that divides growth from contraction.

Residential construction activity was at its weakest since May 2020, when lockdowns during the COVID pandemic halted building work.

Activity in the commercial sector in November dropped at the sharpest pace in five-and-a-half years, with its subindex at 43.8. Civil engineering and new orders were also their weakest since May 2020.

"November data revealed a sharp retrenchment across the UK construction sector as weak client confidence and a shortfall of new project starts again weighed on activity," said Tim Moore, economics director at S&P Global Market Intelligence.

"Total industry activity decreased to the greatest extent for five-and-a-half years, led by steep falls in infrastructure and residential building work. Commercial construction also faced severe headwinds during November as business uncertainty in the run-up to the budget pushed clients to defer investment decisions.

Other recent business surveys have also shown similar concerns about investment, hiring and demand in the lead-up to finance minister Rachel Reeves' annual budget on November 26, which included 26 billion pounds ($35 billion) in tax rises.

S&P Global said the pace of job-shedding accelerated last month, with the employment index at its lowest since August 2020, with firms citing elevated wage costs and less work.

The survey's gauge of optimism struck a nearly three-year low, and cost pressure rose slightly.

The all-sector PMI, which combines the services, manufacturing and construction sectors, stood at 50.1 in November compared to October's 51.4.

($1 = 0.7525 pounds)

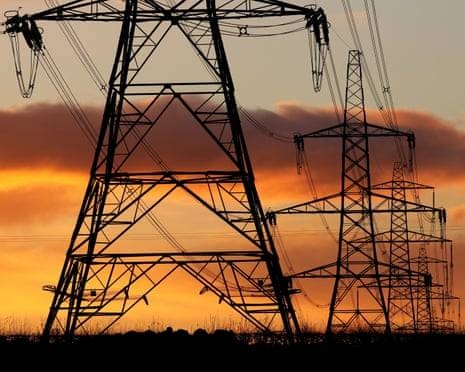

Plans to spend £28bn to upgrade Great Britain's electricity grid have been signed off, in a move that should improve the energy networks, speed the transition to new forms of energy…and increase household bills.

Energy regulator Ofgem has just announced that energy companies have been given approval to "strengthen the stability, security and resilience of our energy networks". by upgrading the energy grid.

The majority of the spending – £17.8bn - announced today is to maintain Britain's gas networks.

There's also £10.3bn to improve the nation's high-voltage electricity network – the biggest expansion of the grid since the 1960s.

In total, it's around £4bn more than was provisionally signed off in the summer.

Ofgem says the investment is the most cost-effective way to harness clean power, support economic growth and protect the country from a repeat of the 2022 gas price shock.

Customers will see the impact on their bills, which will rise to cover the cost of the investment. The regulator says £108 will be added to bills per year by 2031; £48 for gas and £60 for electricity.

But it claims, the investing will actually save customers £80 each compared to a word where the grid is not expanded.

So overall, the net increase in bills to cover all costs by 2031 works out at £30.

Jonathan Brearley, Ofgem CEO, insists the regulator isn't allowing "investment at any price", adding:

Every pound must deliver value for consumers.

Ofgem will hold network companies accountable for delivering on time and on budget, and we make no apologies for the efficiency challenge we're setting as the industry scales up investment.

We've built strong consumer protections into these contracts, meaning funds will only be released when needed and clawed back if not used. Households and businesses must get value for money, and we will ensure they do."

In the US, the Challenger report of November layoff and hiring announcements is due for release in the afternoon. While not usually a tier-1 market mover, it is one of the few timely data points on labour markets that will be available for the Fed before next week's meeting due to the delays caused by the government shutdown.

In Sweden, the preliminary inflation figures for November are released today. Our forecast is CPIF excluding energy at 2.8%, CPIF at 2.8%, and CPI at 0.8%. The monthly change in core inflation from October to November is estimated at -0.19, primarily attributed to Black Friday sales. Higher prices for electricity and petrol are expected to result in a monthly increase in CPIF of 0.25%.

What happened overnight

In Japan, Bank of Japan Governor Kazuo Ueda flagged uncertainty about how far rates can be raised due to the difficulty of estimating the country's neutral interest rate, which is currently projected between 1% and 2.5%. Ueda also hinted at a potential rate hike to 0.75% later this month as the central bank evaluates the "pros and cons" of tightening monetary policy.

In China, government advisers expect Beijing to stick to its 5% GDP growth target for 2026 as policymakers seek to counter deflationary pressures, a property slump, and weak consumer demand. Fiscal and monetary stimulus, including bond issuance and subsidies, are likely to continue, while leaders aim to gradually shift towards a consumption-led economic model over the next five years.

In the US, private sector employment decreased by 32k in November, according to the ADP report (cons: +10k). The decline was driven by manufacturing job losses, while services employment remained more resilient, aligning with weaker forward-looking signals from PMI and ISM data. This supports expectations for a Fed rate cut next week, with EUR/USD ticking higher. Meanwhile, ISM services PMI rose to 52.6 in November (cons: 52.1, prev: 52.4). Positively for the Fed, the price index declined sharply, suggesting easing inflation pressures, though the PMI index sent a conflicting signal. Looking across the two surveys, it seems that service sector activity continues to grow at a decent pace.

US Secretary of Treasury Scott Bessent advocated that Federal Reserve regional bank presidents must have lived in their districts for at least three years. This is an interesting headline because it suggests the administration is preparing to get involved with the (re-)nominations of Regional Fed presidents, due in February. Regional Feds elect their own presidents, but the picks are subject to the approval of Fed governors, who are nominated by US president.

In the euro area, the final composite PMI for November was revised up to 52.8 (flash: 52.4), driven by an upward revision in services PMI to 53.6 (flash: 53.1), while manufacturing PMI was slightly lowered to 49.6 (flash: 49.7). According to the PMIs, the services sector is now growing at its fastest pace in two and a half years, highlighting resilience in the domestic economy and supporting expectations for unchanged policy rates from the ECB.

In the UK, PMIs fell to 51.2 (prior 52.2) but came in stronger than consensus expectations at 50.5. It reflected the seventh consecutive month of expansion in the UK's private sector activity, with the upside surprise sparking a strengthening of the GBP.

In Switzerland, November inflation came in lower than expected. Headline inflation dropped to 0.0% (cons: 0.1%, prior: 0.1%) and core inflation edged lower as well to 0.4% (cons: 0.5%, prior: 0.5%). The SNB is still expected to remain firmly on hold at the next meeting in December, keeping the policy rate at 0%. SNB members have reiterated that inflation below 0% would be tolerable for a short period of time. We expect the first course of action to be FX intervention before resorting to a cut into negative territory.

In Sweden, services PMI rose strongly to 59.1 in November (prev: 55.9), signalling robust growth in the sector. Business volumes saw a significant jump to 65.2 (prev: 55.3), while the employment index edged higher to 49.9 (prev: 47.8). Overall, the data adds to the recent positive signals from the Swedish economy.

In Poland, the central bank cut its main interest rate by 25bp to 4.00%, marking the sixth rate cut this year, following a sharper-than-expected drop in November inflation to 2.4% y/y (cons: 2.6%). The Monetary Policy Council highlighted risks from fiscal policy, wage dynamics, and global inflation but indicated future rate decisions would depend on incoming data.

The European Commission unveiled an "economic security doctrine" aimed at cutting over-reliance on Chinese metals and other single-source suppliers. The REsourceEU Action Plan seeks to diversify supply chains, accelerate trade measures, and prioritise support for businesses reducing foreign dependencies in critical sectors.

Equities: Equities pushed higher again yesterday, led by the US but notably not driven by mega-cap tech. Instead, gains were broad-based, with the VIX edging lower and min vol stocks underperforming. Small caps materially outperformed, marking another classic shift towards a slightly more constructive investor risk-optic. In our view, somewhat interesting given that macro data was generally solid, particularly in Europe, while the US delivered a disappointing ADP print, which remains our primary concern. In US yesterday, Dow +0.9%, S&P 500 +0.3%, Nasdaq +0.2%, Russell 2000 +1.9%. Asian equities trade higher this morning, predominantly supported by Japan on renewed expectations of a fiscal "bazooka" and a persistently accommodative global monetary backdrop ex-Japan. European equity futures are modestly firmer, whereas US futures are essentially flat.

FI and FX: GBP was the top performer during yesterday's session as final November PMIs came in a lot stronger than expected. CHF was largely unfazed by lower-than-expected November CPI. EUR/USD rose to the 1.1670 mark supported by weaker US data while EUR/SEK and EUR/NOK tracked lower during yesterday's session. US yields moved lower during yesterday's session, both in swap and Treasury space, dropping 2-3bp across the curve. In euro space, the moves were very limited with yields largely trading flat across curves and tenors.

Futures tied to U.S. stock indices are subdued, with traders gearing up for key job market data and assessing the possibility of a cut to U.S. interest rates later this month. Salesforce lifts its full-year revenue and adjusted profit forecast, thanks to solid demand for its artificial intelligence agents. Elsewhere, crude prices edge higher after renewed Ukrainian attacks on Russian oil infrastructure.

U.S. stock futures hovered around the flatline on Thursday, paring back some earlier gains, as investors eyed upcoming economic data that could factor into expectations for a Federal Reserve interest rate cut later this month.

By 03:31 ET (08:31 GMT), the Dow futures contract was mostly unchanged, S&P 500 futures had dropped 5 points, or 0.1%, and Nasdaq 100 futures had fallen 38 points, or 0.2%.

The main averages on Wall Street climbed in the prior session. Traders assessed a decline in a measure of private-sector payrolls, as well as a separate survey from the Institute for Supply Management showing a contraction in services sector employment and a dip in a subindex of prices paid.

Taken together, the figures helped to bolster wagers that the Fed, gauging a waning labor market and signs of sticky but broadly steady inflation, would slash rates by 25 basis points at its December 9-10 meeting. The odds of such a reduction now stand at roughly 89%, according to CME FedWatch.

Markets were also shrugging off a media report that multiple divisions at tech giant Microsoft had lowered their sales growth targets for certain artificial intelligence-related products. Shares of Microsoft, who denied the report, fell by 2.5%.

Investors will have the chance to pour over more job market data on Thursday, when the U.S. Labor Department releases its weekly reading of first-time applications for unemployment benefits.

Economists anticipate that the reading will come in at 219,000, up marginally from 216,000 in the prior week but still hovering around recent levels.

Last week's numbers marked a seven-month low for the metric, indicating that while layoffs and firings remained low, demand for Americans looking for work has stayed muted.

Although there has been a relative dearth of more comprehensive official employment data due to a record-long federal government shutdown, the Fed argued at meetings in October and September that there is enough evidence of a slowing in the labor market to warrant easing in borrowing costs.

Shares of Salesforce rose by more than 2% in extended hours trading after the company lifted its fiscal 2026 revenue and adjusted income guidance.

Underpinning the upbeat outlook were projections for strong growth in demand for the company's AI-enhanced agent platform, especially among its enterprise clients.

The forecast highlights the benefits Salesforce is anticipating from a growing amount of businesses moving to adopt AI tools to help streamline their operations. Mega-cap tech groups, such as Oracle, have particularly used the firm's AI agents, which can both automate tasks and make some decisions.

In a statement, CEO Marc Benioff said its Agentforce and Data 360 products have been "the momentum drivers," notching annual recurring revenues of almost $1.4 billion, representing "explosive" growth of 114% year-over-year.

Gold prices edged lower, weighed by profit-taking even as investors grew more confident that the Fed will cut interest rates next week.

Spot gold was down 0.3% at $4,191.55 an ounce by 02:28 ET (07:28 GMT). U.S. Gold Futures for February delivery also slipped 0.3% to $4,219.46.

The prospect of lower interest rates tends to bode well for non-yielding assets such as bullion.

Along with the weekly initial jobless claims data due out later today, attention is on the delayed September Personal Consumption Expenditures price index -- the Fed's preferred inflation metric -- on Friday.

Oil prices rose after more strikes on Russian oil infrastructure raised threats to global supply, adding to the lack of progress in diplomatic efforts to end the war in Ukraine.

Brent futures climbed 0.4% to $62.92 a barrel, and U.S. West Texas Intermediate crude futures rose 0.6% to $59.29 a barrel.

A Reuters report on Wednesday, citing sources, said that Ukrainian forces struck the Druzhba pipeline in Russia's central Tambov region, reviving concerns over potential disruptions to Russian oil exports.

At the same time, high-level peace talks between U.S. and Russian officials concluded without any breakthrough earlier this week.

The US economy lost 32'000 jobs in November. And no, it's not AI's fault. Small companies with fewer than 50 employees shed 120'000 jobs last month, according to the latest ADP report. Those losses outweighed gains in bigger companies. Overall, 32'000 people lost their jobs — the fourth negative print in the last six months. On average, the big and beautiful US economy has added fewer than 20'000 jobs per month over the past six months — a level comfortably pointing at recession.

Add to that the big companies, like Apple and Microsoft, planning headcount reductions — this time citing AI — and you get a pretty… amazing picture for the financial markets.

The job losses will push the Federal Reserve (Fed) toward faster and deeper rate cuts. And if, on top of that, people slow their spending because they're out of work and inflation eases, that would be the cherry on top.

Odd, but that's exactly how markets process information.

Yesterday was a typical "bad news is good news" session. You could see the cheery mood across US assets: job losses sent the 2-year Treasury yield below 3.50%, the probability of a 25bp cut in December rose to 90%, and the S&P 500 traded at 6'862 — just 58 points, or less than 1%, below its all-time high.

Interestingly, technology stocks — normally more sensitive to yields because much of their valuation is based on future revenue discounted to today — barely moved. The Magnificent Seven stayed stoic. Microsoft was busy denying a report from The Information claiming it lowered growth targets for AI software sales after many salespeople missed their goals last fiscal year. Investors read it as: "They're not selling enough AI products, their targets are being lowered, and all these investments could be garbage." Microsoft shares closed 2.5% lower. Nvidia lost 1% despite news that it could get approval to sell chips to China — if China is still willing to buy, which is no longer guaranteed.

Tesla, on the other hand, gained more than 4% — for reasons I can't fully explain. Tesla sales are crashing in Europe, the company warned that UK sales are weakening, and Michael Burry called Tesla "ridiculously overvalued." I agree. Tesla has become a massive meme stock, with a PE ratio near 300: you buy the share for around $446.74 as per yesterday's close and earn roughly $1.50 per share. Expensive, yes — but some people like it. Plus, there was some non-EV-friendly news: Trump lowered climate goals, which sent Stellantis up almost 8% in Milan. Go figure why Tesla rallied.

Overall, the US session was solid. And the Japanese session was excellent, as a sale of 30-year government bonds drew the strongest demand since 2019 — at the current multi-decade high yield, near 3.40%. Given that pressure in JGBs has been a major risk to global risk appetite — even more so since the Bank of Japan (BoJ) head on Monday hinted at a possible rate hike this month — the rally in JGBs helped lift the Nikkei by 2%.

US futures, however, look mixed despite the rally in Asia. Nasdaq futures are slightly negative at the time of writing. Perhaps Morgan Stanley's news that it is considering offloading some data-center exposure didn't help. According to their calculations, the big cloud companies will spend around $3 trillion on data centers through 2028, but their cash flow can fund only half. Oracle's CDS — now a barometer of AI-related risk — spiked to a 16-year high, hinting that appetite is fading.

Investors are awaiting tomorrow's PCE numbers, which could further clear the path for rate cuts beyond December. At this pace of economic deterioration, the Fed may have little choice but to cut further. The question is whether softening Fed expectations will revive tech risk appetite, or if the rally will shift to non-tech and smaller companies. The Russell 2000, for example, rallied nearly 2% yesterday on the back of the weak ADP report. Fading AI enthusiasm due to high valuations, combined with lower yields, could push funds toward these companies.

In FX, the US dollar slipped below its 50-DMA and is testing a major Fibonacci support — if broken, it could enter a medium-term bearish zone. The broadly softening USD, on rising dovish Fed expectations, lifted the EURUSD above its 100-DMA. Europeans are unlikely to move rates next year, as inflation is around 2% and risks are two-sided. In Switzerland, zero inflation and strong demand for the franc continue to worry the Swiss National Bank (SNB), which doesn't want to cut rates below zero. If the Fed cuts enough to lift global risk appetite, it could reduce the rush to Swiss francs.

A Fed cut is also positive for European stocks: lower US yields lift equities, and a stronger euro enhances returns in USD terms.

Elsewhere, copper rallied more than 2% on COMEX, amid concerns that potential US tariffs could squeeze supply. Metals remain investor favorites as appetite for traditional currencies wanes.

As we head toward year-end: it's time to explore non-tech, non-US pockets of the market. Emerging-market indices benefit when the dollar softens, and European indices have performed very well this year to close the valuation gap. There's certainly more to take advantage of, though it's less flashy than the US tech story.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up