Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)A:--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)A:--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. PCE Price Index MoM (Nov)

U.S. PCE Price Index MoM (Nov)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Nov)

U.S. PCE Price Index YoY (SA) (Nov)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Nov)

U.S. Real Personal Consumption Expenditures MoM (Nov)--

F: --

P: --

U.S. Personal Income MoM (Nov)

U.S. Personal Income MoM (Nov)--

F: --

P: --

U.S. Core PCE Price Index MoM (Nov)

U.S. Core PCE Price Index MoM (Nov)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Czech National Bank spearheads a cautious global trend: central banks are adding Bitcoin to national reserves, signaling a new financial era.

In a landmark move for digital finance, central banks are beginning to add cryptocurrency to their balance sheets. The Czech National Bank (CNB) became the first to take the leap in late 2025, signaling a potential shift in how nations manage their reserves in an evolving global economy.

In mid-November 2025, the Czech National Bank made history with a direct, albeit experimental, $1 million investment in cryptocurrency. This purchase marks a critical step in the adoption of digital assets by official state institutions.

According to a press release, the CNB’s new test portfolio isn't limited to just one asset. It includes:

• Bitcoin

• A U.S. dollar stablecoin

• A tokenized deposit on a blockchain

This strategic diversification reflects a cautious but forward-looking approach. The CNB's decision comes as major corporations and hedge funds increasingly integrate Bitcoin into their own portfolios, prompting the central bank to prepare for a rapidly changing financial landscape.

The move toward digital assets isn't happening in a vacuum. A growing U.S. national deficit has raised concerns among central bankers globally. While the U.S. dollar remains the world's primary reserve currency, its perceived instability is driving many countries to diversify their holdings.

Historically, this meant stockpiling precious metals like gold and silver. Now, with the increasing legitimization of cryptocurrency, digital assets like Bitcoin are being considered as a new type of safeguard against financial uncertainty.

While the Czech Republic was first, other nations are exploring similar paths, though reactions vary widely across the globe.

Countries Exploring Crypto Adoption

Several countries have shown interest in adding Bitcoin to their reserves. The central banks of Brazil and Taiwan have reportedly discussed the idea, though no final decisions have been made. In the Philippines, new legislation has been proposed that would direct its central bank to strategically purchase a fixed amount of Bitcoin over the next five years.

The European Central Bank's Hesitation

The European Central Bank (ECB) has expressed opposition to buying volatile assets like Bitcoin. However, it isn't ignoring the underlying technology. The ECB is controversially developing its own Central Bank Digital Currency (CBDC), demonstrating a clear belief in the potential of blockchain.

A Divided United States

In the U.S., the situation is complex. The Trump Administration has been a major force in legitimizing cryptocurrencies, with the White House initiating plans for a Strategic U.S. Bitcoin Reserve and Digital Asset Stockpile.

Despite this, the U.S. Federal Reserve under Chairman Jerome Powell has remained opposed to adding Bitcoin to its balance sheet. This could change after Powell's term ends in May 2026. Given the administration's pro-crypto stance, his replacement is likely to be more aligned with its position on digital assets.

The push for central banks to adopt Bitcoin is backed by growing institutional analysis. A September 2025 report from Deutsche Bank projected a future where gold and Bitcoin could coexist as fundamental reserve assets by 2030.

The report highlights several key properties that make both assets attractive:

• Scarcity: Limited supply provides a store of value.

• High Liquidity: Both can be traded easily.

• Low Correlation: Their prices have a limited connection to traditional assets.

The report also noted that "de-dollarization" presents a strong use case for Bitcoin, as a weakening dollar has historically fueled investment in alternative assets.

As of January 2026, data from Coingecko shows that 35 countries already hold Bitcoin in their treasuries. This growing adoption, combined with clearer regulations, is making governments more comfortable with the asset's economic potential. Furthermore, Bitcoin's annualized price volatility has decreased from approximately 80% in 2020 to 50% by late 2025. If this trend continues, more central banks may find the risk acceptable, paving the way for wider adoption.

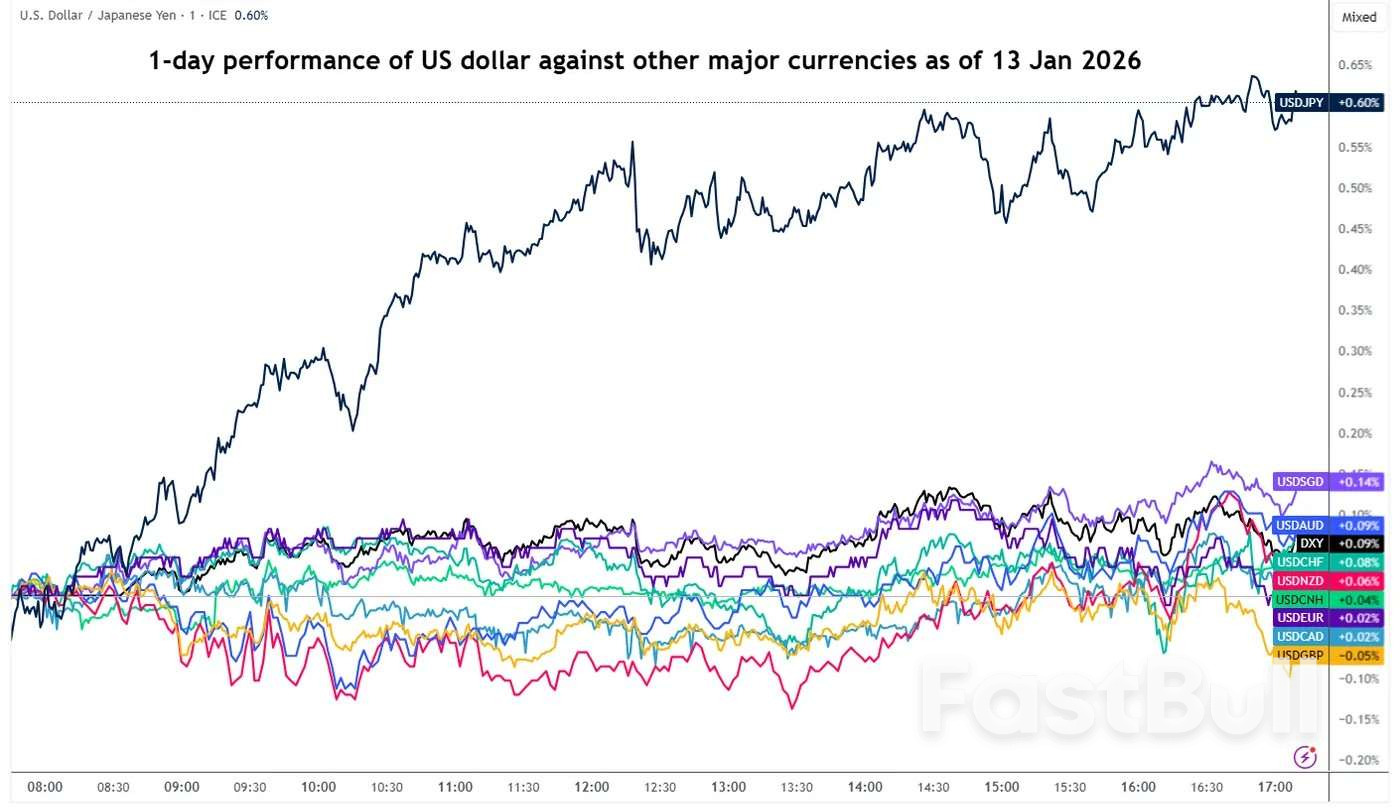

Fig. 1: 1-day rolling performance of the US dollar against major currencies as of 13 Jan 2026

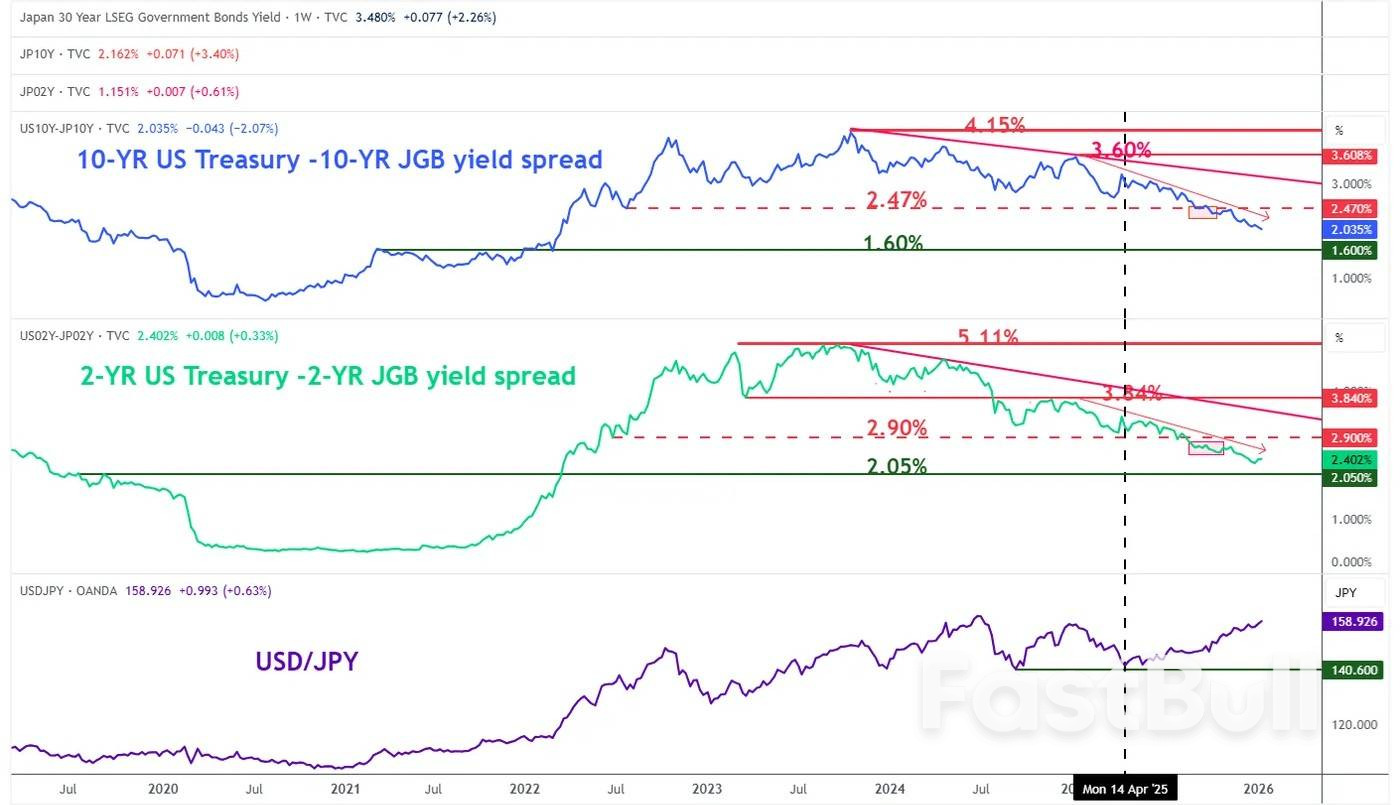

Fig. 1: 1-day rolling performance of the US dollar against major currencies as of 13 Jan 2026 2-year & 10-year US Treasury/JGB yield spreads major trends with USD/JPY as of 13 Jan 2026

2-year & 10-year US Treasury/JGB yield spreads major trends with USD/JPY as of 13 Jan 2026 Fig. 3: USD/JPY medium-term & major trends as of 13 Jan 2026

Fig. 3: USD/JPY medium-term & major trends as of 13 Jan 2026 Fig. 4: USD/JPY minor trend as of 13 Jan 2026

Fig. 4: USD/JPY minor trend as of 13 Jan 2026

Data Interpretation

Bond

Political

Forex

Remarks of Officials

Economic

Central Bank

Technical Analysis

Traders' Opinions

Stocks

Daily News

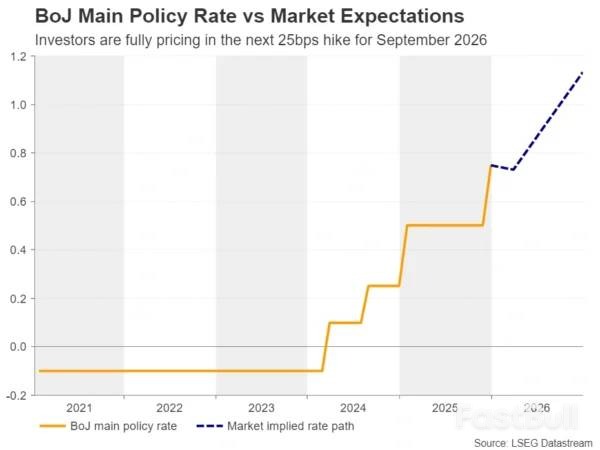

The Bank of Japan (BoJ) started 2025 with a hawkish stance, raising interest rates to their highest level in three decades and signaling more hikes could follow. However, this failed to lift the Japanese yen, as traders sought more specific timing for the next policy move.

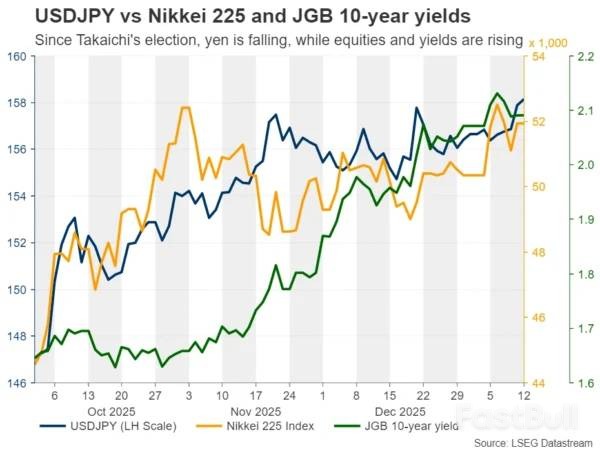

The yen's situation worsened dramatically after Kyodo News reported that Prime Minister Sanae Takaichi is considering a snap election in February. The news sent the currency into a steep decline, reaching lows not seen since July 2024.

With a 70% approval rating, Takaichi may be positioning for a decisive victory to push through her spending plans, which would further increase Japan's already large government debt. This prospect has triggered what analysts are calling the "Takaichi trade": a falling yen accompanied by soaring stock prices and Japanese Government Bond (JGB) yields. This trend could intensify if the ruling Liberal Democratic Party appears likely to secure a single-party majority.

Compounding the pressure on the yen is the market expectation that the BoJ will be reluctant to tighten monetary policy ahead of an election. This suggests the next interest rate hike may not come until after the spring wage negotiations, and only if they result in substantial salary increases.

As the USD/JPY exchange rate pushes back toward the psychological 160.00 level, talk of government intervention is resurfacing. Finance Minister Satsuki Katayama expressed concern over the "one-way weakening of the yen" during a meeting with US Treasury Secretary Scott Bessent, who shared her concerns and called for the BoJ to raise interest rates.

This follows Katayama's warning in December, when USD/JPY crossed 157.00, that Japan has a "free hand" to act. Her recent meeting with Bessent may have been to secure tacit approval from the U.S., making direct intervention near the 160.00 zone a more credible threat.

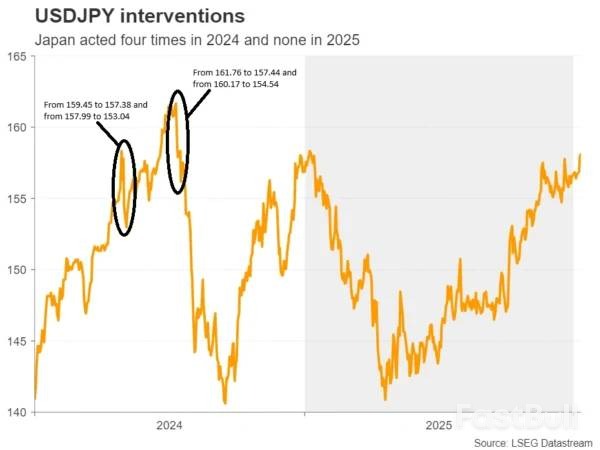

Despite these warnings, the yen has continued its slide, raising questions about the potential effectiveness of intervention. In 2024, Japanese authorities intervened four times to support the currency.

• April 2024: Two interventions provided only temporary relief before the yen resumed its decline.

• July 2024: Two more interventions had a more lasting impact, driving USD/JPY from around 162.00 to below 140.00 by September. This success was attributed to the intervention being followed by a BoJ rate hike.

Given Takaichi's agenda of increased spending, any currency intervention on its own may have a limited and short-lived effect. A lasting reversal for the yen likely requires a supporting rate hike from the BoJ, especially since a weaker currency could fuel inflation through higher export costs and ultimately harm economic growth.

However, financial markets are not convinced a rate hike is imminent. According to Japan's Overnight Index Swaps (OIS) market, a 25-basis-point hike is not fully priced in until September. If the BoJ holds off on tightening policy, intervention alone may not be enough to stop the yen's decline.

Without a policy shift, yields on Japanese debt will likely continue to rise as fewer investors are willing to finance the nation's growing debt. While Japanese equities have rallied on the prospect of fiscal stimulus, this may not last. Eventually, concerns about inflation and an economic slowdown could lead investors to sell off Japanese assets in a "Sell Japan" event.

Ultimately, unless the Ministry of Finance intervenes and the Bank of Japan follows with a rate hike, the yen is likely to extend its downtrend, with USD/JPY potentially trading above 160.00 soon.

From a technical perspective, the USD/JPY pair is currently challenging the 158.90 resistance level, which marks the peak from January 10, 2025. A decisive close above this level could open the door to a test of the 160.00 mark.

The broader uptrend, defined by the trendline drawn from the September 17 low, remains firmly in place. If the pair breaks above 160.00, the next major target would be the July 3, 2024 high of around 162.00. For the bullish trend to be questioned, bears would need to force a decisive break below the 154.55 support zone.

Top figures from global central banks and Wall Street have rallied in support of Federal Reserve Chair Jerome Powell after the Trump administration threatened him with a criminal indictment. Powell characterized the move as a form of intimidation, sparking a defense from financial leaders who underscored the critical importance of the Fed's independence.

The wave of support highlights the relationships Powell has cultivated and the central bank's vital role in global financial markets. It follows pushback from Republican lawmakers, including members of the Senate Banking Committee, who could block the nomination of a successor to Powell when his term ends in May.

The controversy escalated after Powell revealed on Sunday that the U.S. Justice Department had issued subpoenas concerning his testimony to Congress about the $2.5 billion renovation of the Federal Reserve's Washington headquarters. Powell stated that the investigation was a pretext designed to pressure the central bank into cutting interest rates, a long-standing demand from President Trump.

In a rare joint statement, the heads of 11 of the world's most influential central banks expressed their backing for the Fed chief. "We stand in full solidarity with the Federal Reserve System and its Chair Jerome H. Powell," the statement declared.

Signatories included leaders from the European Central Bank, the Bank of England, and the Bank of Canada, along with the central banks of Sweden, Denmark, Switzerland, Australia, South Korea, Brazil, and France. Officials from the Bank for International Settlements also signed on.

The group affirmed that Powell has acted with integrity and emphasized that central bank independence is a cornerstone of economic stability. "The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve," they wrote.

Leading Wall Street executives also voiced their concerns, warning that political pressure on the Fed could backfire.

JPMorgan CEO Jamie Dimon told reporters the probe "is probably not a great idea," predicting it could have "the reverse consequences of raising inflation expectations and probably increase rates over time."

BNY CEO Robin Vince echoed this sentiment. "Independent central banks with the ability to independently set monetary policy in the long-term interests of the nation is a pretty well-established thing," he said. Vince cautioned against actions that could shake confidence in the Fed's independence, which might ultimately push interest rates higher.

Independence from government has long been a foundational principle of modern central banking. However, President Trump has repeatedly broken with this tradition, publicly demanding lower interest rates and pressuring policymakers.

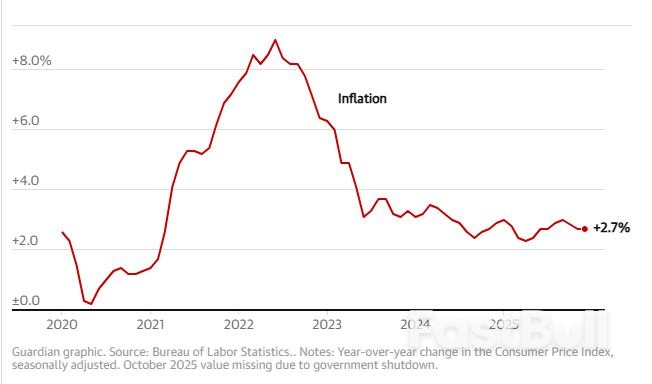

On Tuesday, Trump once again called on Powell to lower interest rates "meaningfully," following a government report that showed consumer prices rose 2.7% in December from the previous year.

Central bankers and analysts fear that political influence over the Fed could erode trust in its commitment to its inflation target, potentially leading to higher inflation and volatility in global financial markets. There are also concerns that a politicized Fed might be reluctant to provide the crucial dollar backstop that helps calm international markets during periods of stress. Such a scenario would likely rattle U.S. markets and export instability worldwide, making it harder for other central banks to maintain price stability.

Despite the political drama, traders are still largely betting that persistent inflation will keep the Fed on hold until at least June.

As tax season approaches, many filers could see larger refunds this year due to significant 2025 tax changes. This potential windfall isn't just good news for individual households; experts say it could have a noticeable impact on the broader economy.

The IRS will begin processing individual returns on January 26. The expected increase in refunds stems from President Donald Trump's "big beautiful bill," which introduced several tax-cutting provisions for 2025. Because the IRS did not update tax withholding tables to reflect these changes, many workers' paychecks remained the same throughout the year. The result is that the benefits of the tax cuts will largely be realized when filing returns in 2026.

President Trump projected that 2026 would be the "largest tax refund season of all time," and many tax experts and analysts agree that bigger refunds are likely. However, the final amount owed or refunded will depend on an individual's specific financial situation and how much tax they paid during the year.

The legislation signed by Trump reduced individual income taxes by an estimated $144 billion in 2025, according to the Tax Foundation. Several key provisions are behind this change:

• A larger standard deduction

• A more generous maximum child tax credit

• A higher limit for the state and local tax (SALT) deduction

• A new $6,000 tax break for seniors

• New deductions for auto loan interest, tip income, and overtime pay

Heather Berger, a U.S. economist at Morgan Stanley, stated on a January 2 podcast that these changes are expected to "increase refunds by 15% to 20% on average." For context, the average refund for individual filers was $3,052 as of October 17, 2025, with the IRS issuing about 102 million refunds by that date.

Experts are closely watching to see what Americans will do with this extra cash, as it could temporarily boost consumer spending.

"Our expectation is it would be a positive for consumption," National Economic Council Director Kevin Hassett told CNBC on January 9.

However, spending behavior often depends on income levels. A note from Piper Sandler on October 31 indicated that households earning between $30,000 and $60,000 typically spend about 30% of their refunds on discretionary purchases. In contrast, households earning $100,000 or more spend only about 15%.

Furthermore, a National Retail Federation survey of roughly 8,600 adults in 2025 found that 82% of taxpayers expecting a refund planned to use the money for paying off debt or for savings. Morgan Stanley's Heather Berger also noted that other economic factors, such as inflation from tariffs or higher health insurance premiums under the Affordable Care Act, could influence spending habits.

While increased spending can stimulate the economy, some analysts worry that a surge in consumer demand could also create inflationary pressure.

Jonathan Parker, an economist at the Massachusetts Institute of Technology who has researched consumer spending during stimulus cycles, said bigger refunds "could easily be inflationary." He told CNBC that the stimulus checks issued during the Covid-19 pandemic were "certainly correlated" with higher inflation and were a "contributing factor" to the subsequent price boom. The consumer price index peaked at a 9.1% year-over-year increase in June 2022, the fastest rate since 1981.

Former Treasury Secretary Janet Yellen acknowledged in January 2025 that stimulus spending may have contributed "a little bit" to inflation but also pointed to "huge supply chain problems" as a major cause.

When asked about the potential inflationary effects of larger refunds in 2026, Kevin Hassett expressed little concern. "We're not really worried about the inflationary effects of that because we [have] got so much supply coming online again," he said.

Nasdaq - daily

Nasdaq - daily Nasdaq - 4 hour

Nasdaq - 4 hour Nasdaq - 1 hour

Nasdaq - 1 hourWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up