Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

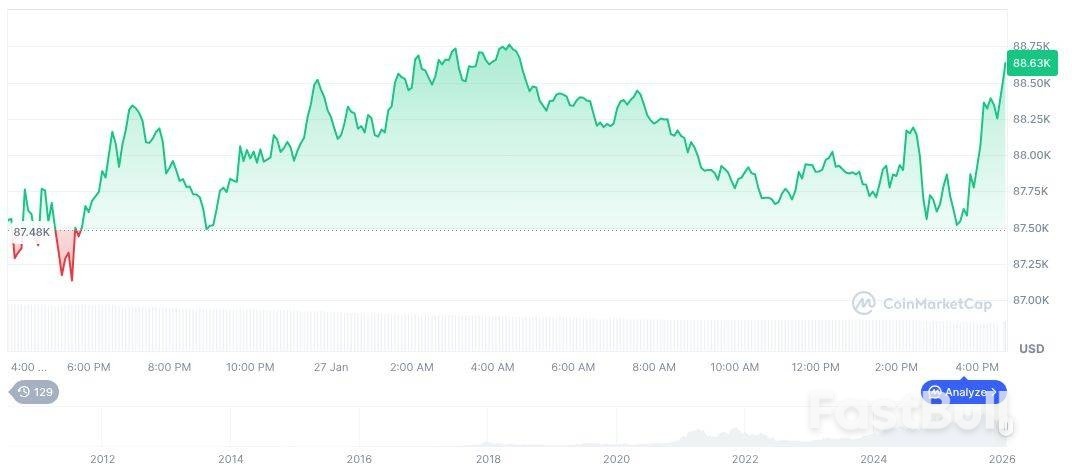

Key Points: Bitcoin's market exhibits increased resilience and reduced leverage. Institutional factors influence current Bitcoin market behavior. Options interest surpasses perpetuals...

Key Points:

In their latest report, 'Charting Crypto: Q1 2026', Coinbase Institutional and Glassnode noted Bitcoin's enhanced market resilience and diminished leverage post-Q4 2025, reflecting evolving market dynamics.

This shift signals Bitcoin's transition to a macro-sensitive asset, influenced by global liquidity and institutional strategies, potentially stabilizing cryptocurrency markets and fostering measured growth.

The latest report by Coinbase Institutional, in collaboration with Glassnode, outlines notable market evolution for Bitcoin. Labeled "Charting Crypto: Q1 2026," the study underlines Bitcoin's increasing stability and resilience. Following a notable deleveraging in Q4 2025, Bitcoin's market influence now leans more towards institutional factors rather than high-leverage trading cycles typically seen during speculative booms.

Evolving sentiment highlights a more cautious approach. Current market structures exhibit a preference for downside protection, with options open interest surpassing perpetual contracts. The ongoing market activity emphasizes portfolio strategies and institutional positioning. Investors show a heightened awareness of macro-level impacts by aligning with global liquidity trends.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

"We have a constructive view for 1Q26. We believe that crypto markets are entering 2026 in a healthier state, with excess leverage having been largely flushed." - David Duong, CFA, Global Head of Research, Coinbase Institutional, Bitcoin Forum

The community and industry experts are increasingly observing shifts in sentiment. Fueled by significant changes in the market structure, interactions on Bitcoin forums reflect the prevailing positivity for Q1 2026, while caution remains in anticipation of varying liquidity growth rates. Overall, experts express a measured optimism for Bitcoin's current market momentum.

Did you know? Bitcoin's maximum supply is capped at 21 million coins, making it a deflationary asset.

As of January 28, 2026, Bitcoin trades at $89,058.54 with a market cap of $1,779,508,882,244.47. Dominating 58.90% of the market, Bitcoin reflects a 0.29% increase over seven days despite recent price volatility. Circulating supply nears 19,981,340 against a max supply of 21,000,000, according to CoinMarketCap.

Source: CoinMarketCap

Source: CoinMarketCapThe Coincu research team emphasizes the potential for increased regulatory scrutiny as Bitcoin emerges as a macro-sensitive asset, reshaping traditional market perceptions. The report's data-driven observations suggest evolving investment landscapes and technological adaptability within the crypto sphere are resulting in strategic market positioning.

In a recent debate, media personality Tucker Carlson and economist Peter Schiff tackled the future of money, dissecting Bitcoin's potential to challenge the U.S. dollar amid rising inflation and government spending.

Schiff, a vocal cryptocurrency critic and gold advocate, argued that Bitcoin is little more than a speculative commodity with no real-world utility beyond its price chart.

During the exchange, Schiff dismantled the idea of creating a U.S. strategic Bitcoin reserve. He framed the proposal not as sound monetary policy but as a "taxpayer-funded bailout" designed to benefit early crypto investors.

According to Schiff, demand for Bitcoin is driven primarily by the expectation of selling it to someone else at a higher price later—a dynamic he equated to the "greater fool theory" rather than a productive investment.

The conversation expanded to the broader economic pressures facing households. Schiff told Carlson that official inflation statistics, like the Consumer Price Index (CPI), have been modified over the years and no longer capture the true increase in the cost of living.

He asserted that rising prices are a direct result of money and credit expansion, not corporate pricing decisions. Schiff criticized the fiscal policies of both Democratic and Republican administrations, specifically pointing to the "Big Beautiful Bill" proposed by President Donald Trump as a policy that worsened the deficit through a combination of higher spending and tax cuts.

Schiff traced today's economic challenges back to 1971, when the U.S. dollar was completely severed from the gold standard and became a pure fiat currency. He argued that the decades of low interest rates and monetary expansion that followed have systematically eroded purchasing power and distorted asset prices.

This system, he explained, has been propped up by the dollar's status as the world's primary reserve currency, which has allowed the United States to run persistent trade deficits.

However, Schiff warned that this arrangement is under strain. He pointed to sanctions on Russia as a key event that demonstrated the risks for foreign nations holding dollar-denominated reserves. As a result, central banks are diversifying into gold, a trend reflected in its recent price action. He also cited a recent drop in Bitcoin's price as evidence that investors still prefer traditional stores of value over speculative digital assets.

When Carlson asked directly if Bitcoin could replace the dollar as confidence in fiat currency wanes, Schiff flatly rejected the idea. He argued that Bitcoin is fundamentally unsuitable as a reserve currency because it lacks two critical features: intrinsic value and non-monetary demand.

While acknowledging that both fiat currencies and Bitcoin rely on confidence, Schiff drew a sharp distinction with gold. He defined gold as a tangible commodity with deep, established uses in jewelry, electronics, aerospace, and medicine, giving it a stable foundation of value that Bitcoin cannot match.

The debate highlights a core tension in modern finance. As U.S. national debt climbs past $37 trillion, Bitcoin proponents continue to position the cryptocurrency as "digital gold," citing its fixed supply and decentralized nature as the future of money.

Australia's inflation rate accelerated more than anticipated in December, challenging expectations for a steady decline and putting renewed pressure on the Reserve Bank of Australia (RBA).

The consumer price index (CPI) rose 3.8% year-on-year, according to data from the Australian Bureau of Statistics (ABS), outpacing forecasts of a 3.5% increase.

A key measure of underlying inflation, the trimmed mean CPI, also ticked higher, rising to 3.3% in December from 3.2% in the previous month. This figure remains well above the RBA’s target range of 2% to 3%, signaling persistent price pressures across the economy.

On a quarterly basis, the main CPI increased by 0.6% in the December quarter, aligning with expectations. However, the quarterly trimmed mean CPI grew 0.9%, a reading slightly above what analysts had forecast.

The latest inflation data reinforces a challenging environment for the RBA, effectively reducing the likelihood of near-term interest rate cuts. The central bank had already adopted a hawkish stance, holding rates steady in December following a rebound in inflation during the latter half of 2025. Officials at the time even floated the possibility of a future rate hike if price pressures did not subside.

With inflation proving stickier than hoped, some analysts are warning that the central bank might be forced to consider another interest rate increase as far out as 2026 to bring inflation firmly back to its target.

The release of this data comes as the ABS transitions its reporting methodology. The agency announced it is re-referencing its quarterly CPI figures as it moves toward a monthly calculation model. While quarterly data will still be published, the monthly CPI report is now considered Australia's primary inflation indicator.

Iran has activated emergency contingency plans to secure critical supplies and maintain government operations, signaling high alert over the possibility of new attacks from the US or Israel. The move follows President Trump's announcement that a "beautiful armada" of US warships, led by the USS Abraham Lincoln, has arrived in the region.

"In June, we obliterated Iran's nuclear capacity in Operation Midnight Hammer," Trump stated on Tuesday. "They were about a month away from having a nuclear weapon. We had to do it."

He added, "There's another beautiful armada floating beautifully towards Iran right now," expressing hope that Iran will "make a deal."

In response to the heightened threat, Iranian President Masoud Pezeshkian is implementing measures to shore up the country's resilience. According to a Financial Times report citing state media, Pezeshkian met with governors of border provinces on Tuesday to streamline the government's crisis response.

The orders aim to "eliminate redundant bureaucracy and accelerate the import of basic commodities."

"We are handing over authorities to provinces so that governors can contact the judiciary and officials in other organisations and make decisions themselves," Pezeshkian said.

The Trump administration is pursuing a two-track policy. A senior US official told Axios that Washington "is open for business" on negotiations, stating, "If they want to talk, and they know our terms, we are open to have a conversation."

However, alongside this stated openness to diplomacy, President Trump is reportedly considering a range of escalation options designed to force regime change in Tehran.

Washington is weighing several aggressive actions, moving beyond sanctions to more direct forms of pressure.

Precision Strikes on Leadership

According to a Middle East Eye report citing Arab officials, the US is actively considering direct military action. A Gulf official familiar with the talks stated, "The US is weighing precision strikes on 'high-value' Iranian officials and commanders who it deems responsible for the deaths of protesters."

Economic Blockade

Another option, reported by The Jerusalem Post, is a full blockade of Iranian oil exports. This strategy mirrors the playbook used against Venezuela, which involved an embargo, the seizure of oil tankers, and a military raid that captured President Nicolás Maduro.

Treasury Secretary Scott Bessent is a leading proponent of this economic warfare. The strategy aims to collapse Iran's economy, creating conditions that could trigger an internal uprising or starve the system until it breaks. The US Treasury has already begun imposing new sanctions on Tehran officials related to recent protests.

Limited Military Action

Other senior officials are pushing for a more kinetic but controlled approach. Members of Trump's cabinet have advocated for targeted military strikes on Iranian government and military assets, potentially limited in scope, similar to the June 12-day war involving Israel.

President Trump has reportedly received multiple intelligence reports indicating that the Iranian government's position is weakening. According to The New York Times, these reports suggest Tehran's hold on power is at its weakest since the 1979 revolution.

This assessment is emboldening hawks within the administration. However, Trump's advisors remain divided. While the president has warned he could strike Iran, some question the benefit of strikes, "particularly if they were simply symbolic," according to the NYT report.

A former US official told Middle East Eye that the odds of a strike are now higher than they were weeks ago. A major military buildup across the Middle East—including the aircraft carrier strike group, additional fighter jets, and advanced air defense systems—signals that all options are being seriously considered.

The current US strategy appears to be an ultimatum designed to be rejected, creating a pretext for military action. Jason Brodsky, Policy Director at United Against Nuclear Iran (UANI), suggests that while Iran may want a JCPOA-like deal, it is unlikely to accept Washington's terms.

"It is highly unlikely Khamenei will agree to the terms America is demanding because it would basically amount to a form of regime change," Brodsky wrote. He believes the Islamic Republic will feign negotiations to avoid an attack and "entrap the U.S. in endless negotiations."

From Tehran's perspective, there is little reason to trust Washington's intentions, especially after the first Trump administration unilaterally withdrew from the original JCPOA nuclear deal.

Federal Reserve Chair Jerome Powell is expected to guide the U.S. central bank to hold interest rates steady this week, signaling a pause after three consecutive reductions. The decision, set to be announced Wednesday, comes as the Fed navigates not just economic data but also intense political scrutiny.

Powell's press conference will be his first since the Fed received grand jury subpoenas and follows Supreme Court arguments over another governor's potential removal. This backdrop ensures that questions about political pressure and the central bank's independence will feature prominently.

After a series of contentious rate cuts, the decision to hold rates is likely to find broad agreement among policymakers on the Federal Open Market Committee (FOMC). While previous meetings saw a split between officials focused on a weakening labor market and those concerned about high inflation, the current environment has fostered a temporary truce.

"Now it's kind of like a 'Kumbaya' moment," said Tim Duy, chief economist at SGH Macro Advisors. "They can almost all come together and say, 'All right, well, that's done. We can sort of take a breather here and reassess our need for rate cuts if the data changes.'"

Since September 2024, the Fed has lowered its benchmark rate by 1.75 percentage points, bringing it to a range of 3.5% to 3.75%. Many officials believe this level appropriately balances the risks to both employment and inflation.

The economic data presents a mixed but stabilizing picture. The labor market has cooled over the past year, though the unemployment rate edged down from 4.5% to 4.4% in December. At the same time, inflation shows signs of softening but remains stubbornly above the Fed's 2% target.

Given these conditions, Powell may signal that interest rates are "in a good place for now," according to Karim Basta, chief economist for III Capital Management. Officials will be watching how fiscal stimulus and tariff policies impact prices and employment. Basta noted he is waiting to see if Powell views near-zero job growth as a concern or as a natural consequence of lower immigration.

Market watchers expect minimal changes to the Fed's post-meeting statement, though it may be updated to reflect the lower unemployment rate and stronger-than-expected economic growth from late last year.

While a rate hold is the base case, it won't be without opposition. Fed Governor Stephen Miran, who dissented in the last three meetings in favor of deeper cuts, may do so again. Governor Michelle Bowman could also dissent, having recently argued the Fed should remain prepared to lower rates.

However, many officials who previously advocated for cuts now appear comfortable with a pause. Governor Christopher Waller, who was the first to publicly lean toward rate cuts last June, has stated he sees "no rush" to act while inflation is still elevated.

This meeting also marks a rotation of voting members on the FOMC, including:

• Beth Hammack (Cleveland Fed President)

• Lorie Logan (Dallas Fed President)

• Anna Paulson (Philadelphia Fed's new President)

• Neel Kashkari (Minneapolis Fed President)

Hammack and Logan have been vocal about inflation risks, while Paulson has expressed more concern for the labor market. Kashkari recently said rates should remain unchanged at this meeting.

With no new economic projections scheduled for release, investor focus will be squarely on Powell's guidance about the duration of the rate pause. The median projection from December anticipated just one quarter-point reduction this year.

Beyond monetary policy, Powell is certain to be questioned about external threats to the Fed's independence. He recently issued a forceful statement asserting that Department of Justice subpoenas were an attempt to influence policy through intimidation.

The increased political friction has also fueled speculation about whether Powell will remain at the central bank after his term as chair expires in May. His seat on the board does not expire until 2028, but he has consistently declined to comment on his future plans.

The S&P 500 barely managed a record closing high on Tuesday, its fifth straight day of gains with investor optimism ahead of megacap earnings reports being countered by a mixed reception to the latest earnings reports and a massive selloff in health insurer stocks.

UnitedHealth (UNH.N), led losses in healthcare stocks and in the Dow Jones Industrial Average (.DJI), with a 19.6% tumble after the Trump administration proposed an increase in Medicare insurer payment rates. The plan was another woe added to the insurer's disappointing revenue forecast for 2026. Following suit were insurance peers Humana (HUM.N), opens new tab, down 21% and CVS (CVS.N), opens new tab, down 14.2%.

Investors were more encouraged by General Motors (GM.N), earnings, which saw its shares rally 8.7% after it reported higher fourth‑quarter core profit.

And with some high-profile earnings reports due out this week, technology stocks extended Monday's gains, with heavyweights Microsoft (MSFT.O), opens new tab, Amazon (AMZN.O), opens new tab, Nvidia (NVDA.O), opens new tab, Apple (AAPL.O), opens new tab, and Broadcom (AVGO.O), providing the market's biggest boosts.

With this, the Nasdaq touched its highest level since late October and the S&P 500 also touched an intraday record high and neared the 7,000 milestone, while also marking its fourth record closing high so far in 2026.

"There's a little bit of a bifurcated market today with the Dow down because of the announcements around Medicare premiums," said Phil Blancato, chief market strategist at Osaic Wealth in New York. "When you look at everything else, the market seems to be hanging in there waiting for a big week of earnings."

Also on Tuesday, U.S. consumer confidence unexpectedly deteriorated in January, slumping to its lowest level since 2014, but Blancato noted that surprisingly, the "pretty terrible number" didn't have much of an impact on the stock market.

Along with investor focus on earnings reports and U.S. policy decisions, Adam Rich, deputy chief investment officer and portfolio manager at Vaughan Nelson Investment Management noted that the recent decline in the U.S. dollar, including a drop of over 1% on Tuesday, is good news for U.S. equities as a weak dollar helps U.S. exports.

"This currency move is really positive for S&P earnings going forward," said Rich.

The Dow Jones Industrial Average (.DJI), fell 408.99 points, or 0.83%, to 49,003.41, the S&P 500 (.SPX), gained 28.37 points, or 0.41%, to 6,978.60 and the Nasdaq Composite (.IXIC), gained 215.74 points, or 0.91%, to 23,817.10.

The technology sector (.SPLRCT), rose 1.4% to lead gains among the S&P 500's 11 major industry sectors. Corning(GLW.N), was the biggest gainer in the S&P 500 and the technology sector with a massive 15.6% rally. The Gorilla Glass maker signed a deal with Meta (META.O), worth up to $6 billion for fiber-optic cables in AI data centers.

All eyes will be on Meta , Microsoft and Tesla (TSLA.O), on Wednesday when they kick off earnings reports for the so-called "Magnificent Seven" group of high-flying stocks. Their reports will test the resilience of the AI trade, which has underpinned Wall Street's rally for much of the past year.

In total, 102 S&P 500 companies are set to post earnings results this week. Of the 64 that had reported as of Friday, 79.7% have topped analyst expectations, as per data compiled by LSEG.

Elsewhere in earnings, trading in Boeing (BA.N), was choppy after it swung to a fourth-quarter profit due to a unit sale but reported bigger-than-expected losses in its two biggest divisions. Shares in the aerospace company ended down 1.6% after rising more than 2% earlier in the day.

And in airlines, American Airlines (AAL.O), closed down 7% with the weekend's winter storm expected to weigh on its first-quarter results although its 2026 profit forecast topped estimates. JetBlue (JBLU.O), shares tumbled 6.9% on a wider‑than‑expected quarterly loss as it cited bad weather and the government shutdown during the quarter.

Bellwether United Parcel Service (UPS.N), projected higher revenue for 2026 but by the end of the day its advance had dwindled to 0.2% while shares in rival FedEx (FDX.N), rose 2.6%.

As if that wasn't enough, investors were also waiting to hear from the U.S. Federal Reserve, which will make a policy announcement on Wednesday after its two-day meeting.

Investors have been broadly expecting the central bank to leave interest rates unchanged but attention will be on policymakers' guidance on rates and its commentary on the economy while traders will also be alert to any signals around the Fed's next leadership.

Advancing issues outnumbered decliners by a 1.61-to-1 ratio on the NYSE where there were 693 new highs and 95 new lows. On the Nasdaq, 2,725 stocks rose and 2,056 fell as advancing issues outnumbered decliners by a 1.33-to-1 ratio.

The S&P 500 posted 36 new 52-week highs and 13 new lows while the Nasdaq Composite recorded 104 new highs and 123 new lows.On U.S. exchanges 18.03 billion shares changed hands, just ahead of the 17.99 billion moving average from the last 20 sessions.

Reporting by Sinéad Carew in New York, Pranav Kashyap and Twesha Dikshit in Bengaluru; Editing by Krishna Chandra Eluri and Aurora Ellis

President Donald Trump announced on Tuesday that he will name his choice for the next head of the Federal Reserve soon, signaling that he expects interest rates to fall under the central bank's new leadership.

Speaking at a rally in Des Moines, Iowa, Trump stated his intention to appoint a new Fed chairman who would align with his goals for monetary policy.

"When we have a great Fed chairman, I think we're going to have one. I'll announce it pretty soon… you'll see rates come down a lot," Trump said.

The announcement comes as current Fed Chair Jerome Powell's term is set to end in May, giving the president an opportunity to select a successor in the coming months.

Trump has consistently and publicly pushed for the Federal Reserve to implement sharp cuts to interest rates, arguing that the central bank has moved too slowly to ease monetary conditions.

During his address on Tuesday, the president continued his criticism of Powell, whom he referred to as "too late Powell."

The tension between the White House and the central bank escalated earlier this month when Powell revealed he had been threatened with a criminal investigation by the Department of Justice over his cautious approach to cutting rates.

President Trump's persistent pressure on Powell has fueled significant concerns among investors about the independence of the Federal Reserve. These worries have had tangible market consequences, contributing to a sell-off in U.S. bonds and a decline in the value of the dollar as market participants weigh the implications of political influence on monetary policy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up