Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

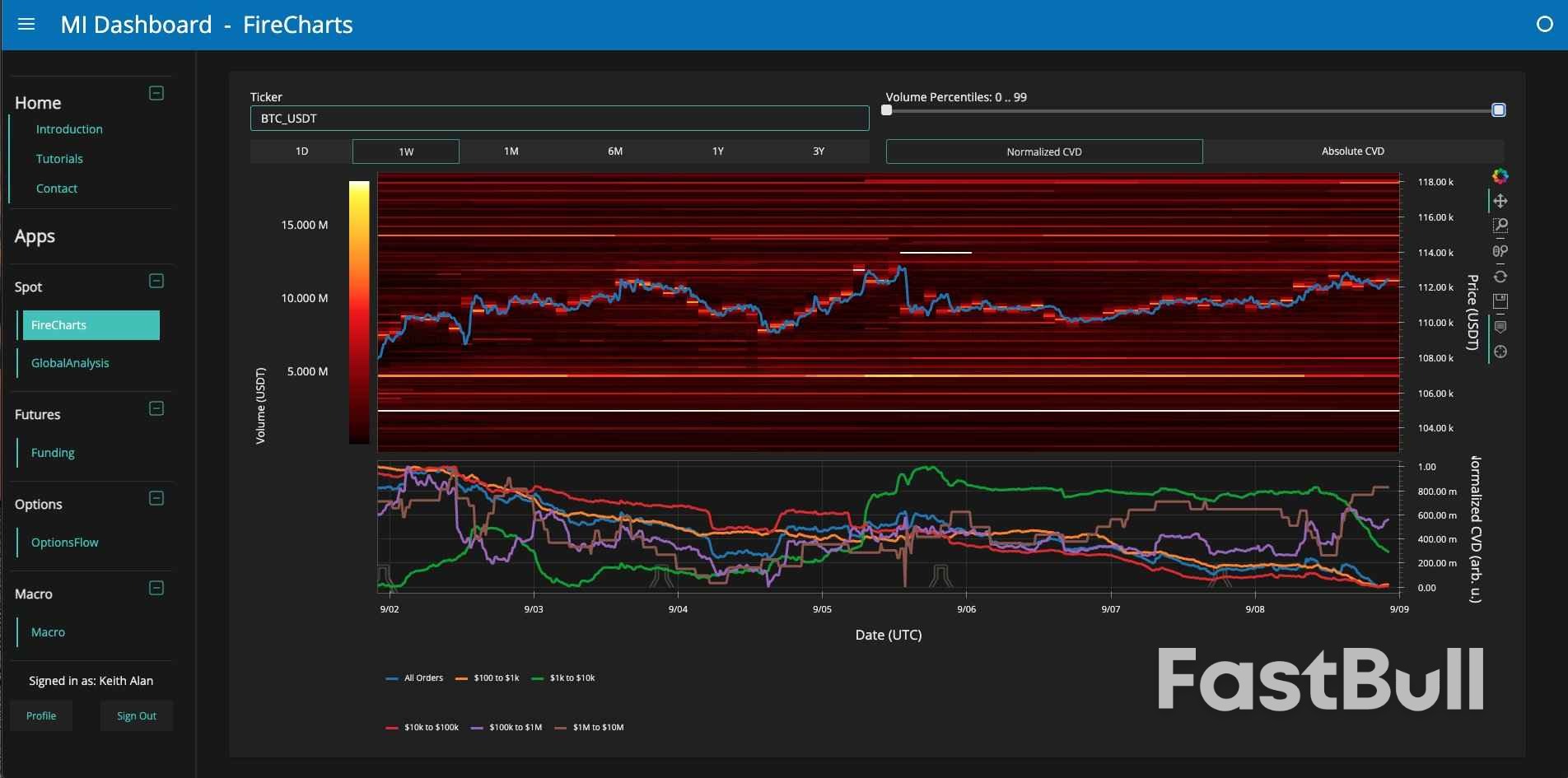

As of September 8, 2025, Bitcoin (BTC) trades near $110K after weaker U.S. jobs data dragged Treasury yields and the dollar lower factors that usually support crypto markets.

As of September 8, 2025, Bitcoin (BTC) trades near $110K after weaker U.S. jobs data dragged Treasury yields and the dollar lower factors that usually support crypto markets. Yet analyst Plan C warns that a Q4 halving isn’t automatic; historical trends show mixed outcomes, so seasonality alone is not a reliable signal.

In this bitcoin price prediction, confirmation remains the focus: defend $110K–$112K and then reclaim $117K–$118K with volume, and the door to higher moves opens; lose that floor and the setup leans toward chop or deeper retracement. In that case, many traders look to rotate into altcoins offering better upside, with fresh breakout patterns and cleaner risk–reward.

The big question is: will the next big leg come from BTC dominance, or is rotation into alternatives the smarter play right now?

The macro environment for bitcoin just brightened: the latest U.S. jobs report showed slower hiring, a rising unemployment rate, and negative revisions. This sent Treasury yields lower, pushed the dollar index down about 0.70%, and lifted expectations for a September Federal Reserve rate cut.

Easier policy usually helps BTC by weakening the dollar and reducing funding costs, which cuts downside risk even if Q4 enthusiasm fades. As one strategist noted, “labor-market weakness gives the Fed room to cut.” A dovish Fed can stabilize Bitcoin, but traders still want confirmation on the chart before leaning bullish.

Sources: U.S. BLS Employment Situation, Aug 2025, Reuters Instant View, Reuters Dollar Reaction, Reuters Fed Cut Expectations.

Sources: BLS Employment Situation — Aug 2025, Reuters: Instant View, Reuters: Dollar falls sharply after jobs data, Reuters: Investors look for more aggressive US rate cuts.

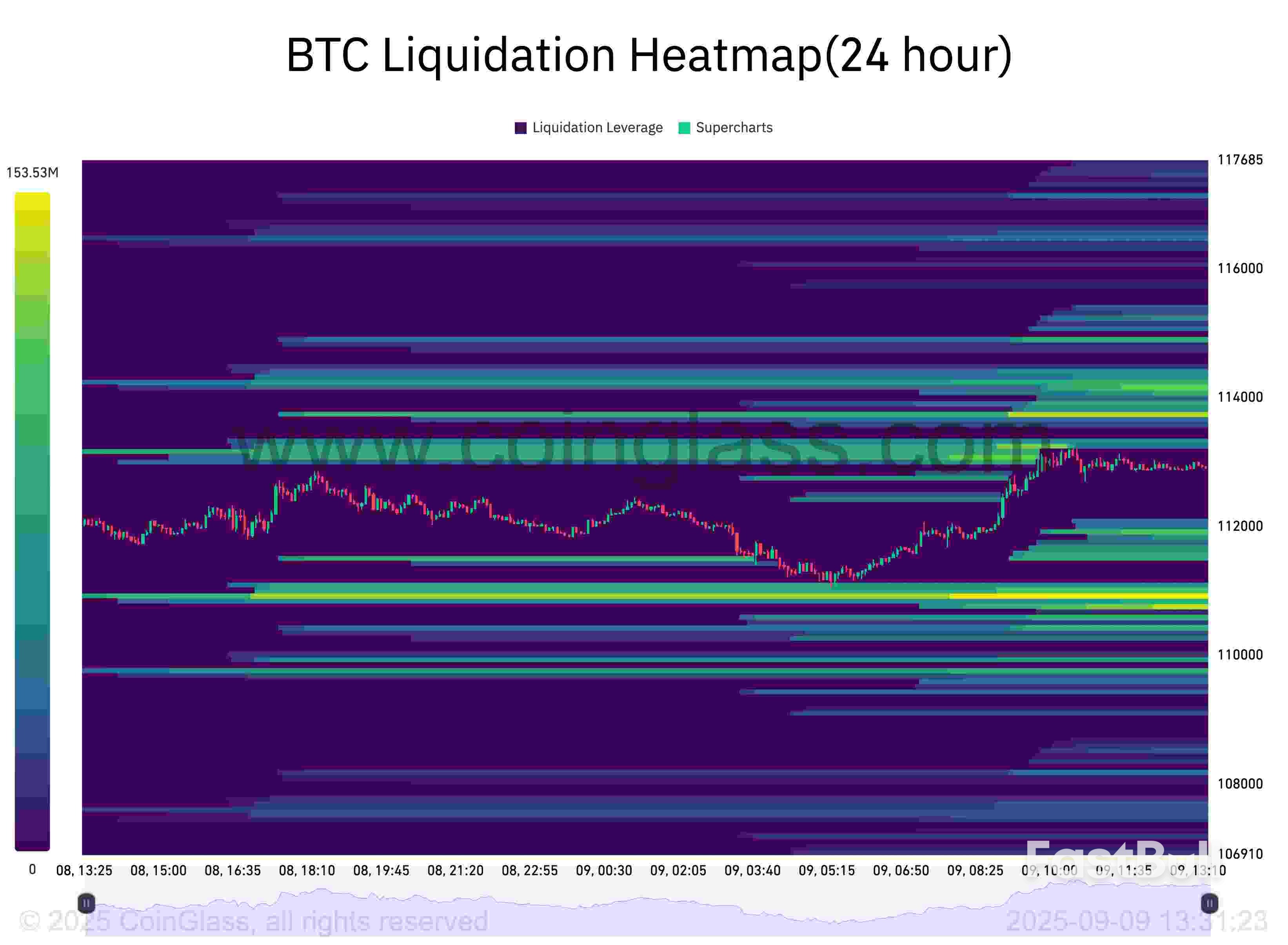

BTC is currently consolidating inside a $110K–$112K support band after its sharp retrace, with repeated wicks suggesting dip-buying even while momentum stays muted.

If buyers protect this range and a strong daily close holds inside or above the zone, or if BTC clears $117K–$118K on convincing volume, then $117K–$118K becomes the first upside target with scope for higher gains if momentum builds further.

But if the range fails on a decisive close, the door opens to $108K–$106K, with potential liquidity grabs into $103K–$101K. In short, this zone remains critical: it offers a tactical entry for medium-term bulls, but confirmation beats trying to catch a falling knife.

With the bitcoin price still stuck near $110K and no clear breakout yet, an altcoin rotation strategy can improve risk–reward. The idea: move part of a position from sideways BTC into coins showing stronger setups, visible catalysts (launches, protocol upgrades, adoption), and breakout potential, while still anchoring with Bitcoin. One candidate drawing attention right now is Pepeto, does it fit the criteria?

Pepeto (PEPETO) is positioned as a promising rotation choice. Its token powers PepetoSwap, a zero-fee exchange with no listing charges, designed to make token launches and trading cheaper while routing incentives through PEPETO. Alongside, it supports a cross-chain bridge enabling users to move assets and liquidity across networks within the app, broadening reach and deepening order flow.

Staking currently offers around 231% APY, attracting early adopters and helping to lock liquidity so markets remain stable post-listing. Momentum is strong: the presale has raised more than $6.6M already, with only a small allocation left, priced at $0.000000152 at the current stage and set to climb as each round fills.

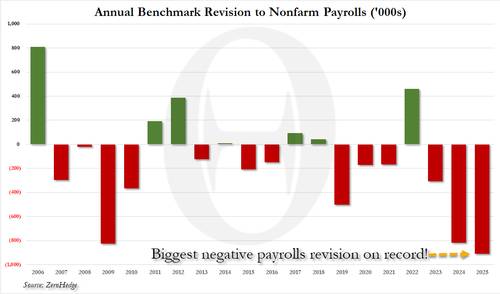

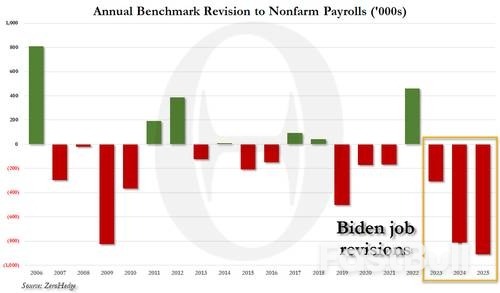

Two weeks ago, before both Bloomberg and Reuters, we told our subscribers to "brace for another huge negative payrolls revision"...

... and just like one year ago when we did exactly the same, we were spot on: moments ago the BLS reported that as part of its preliminary annual benchmark revisions, a record 911K payrolls for the period April 2024-March 2025 would be revised away.

Some more from the full press release:

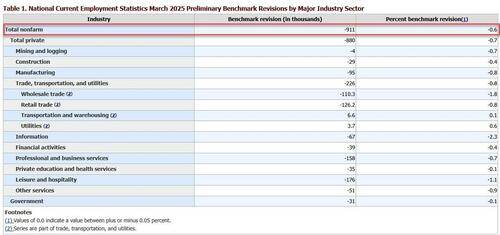

The preliminary estimate of the Current Employment Statistics (CES) national benchmark revision to total nonfarm employment for March 2025 is -911,000 (-0.6 percent), the U.S. Bureau of Labor Statistics reported today. The annual benchmark revisions over the last 10 years have an absolute average of 0.2 percent of total nonfarm employment. In accordance with usual practice, the final benchmark revision will be issued in February 2026 with the publication of the January 2026 Employment Situation news release.

Each year, CES employment estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW). These counts are derived primarily from state unemployment insurance (UI) tax records that nearly all employers are required to file with state workforce agencies.

What is more remarkable about today's print is that after last year's stunning 818K negative revision, which was the second biggest since the global financial crisis (and which we also warned ahead of time was coming), virtually nobody expected this year's number to be higher. It was not only higher, but it was the biggest negative revision on record!

No wonder the WSJ now reports that "White House Prepares Report Critical of Statistics Agency" in what is a clear effort at kitchen-sinking all the ugly, fake jobs numbers that were "created" by the Biden admin, and saddled Trump with relentless negative revisions. Expect 1-2 more months of painful job prints, and then another powerful rally higher into the 2026 midterms under a new BLS commissioner as all of Biden's fake baggage is expunged.

So what does it all mean? Couple things and we will follow up with a more extended analysis but here is the punchline:

Just as remarkable: 2 million jobs from the last 3 years of the Biden admin have now been revised away.

One thing that will never be revised away, however, is the trillions in debt accumulated over his period, and which we now learn encumbered future generations of Americans with massive amounts of debt only to create far fewer jobs than initially reported.

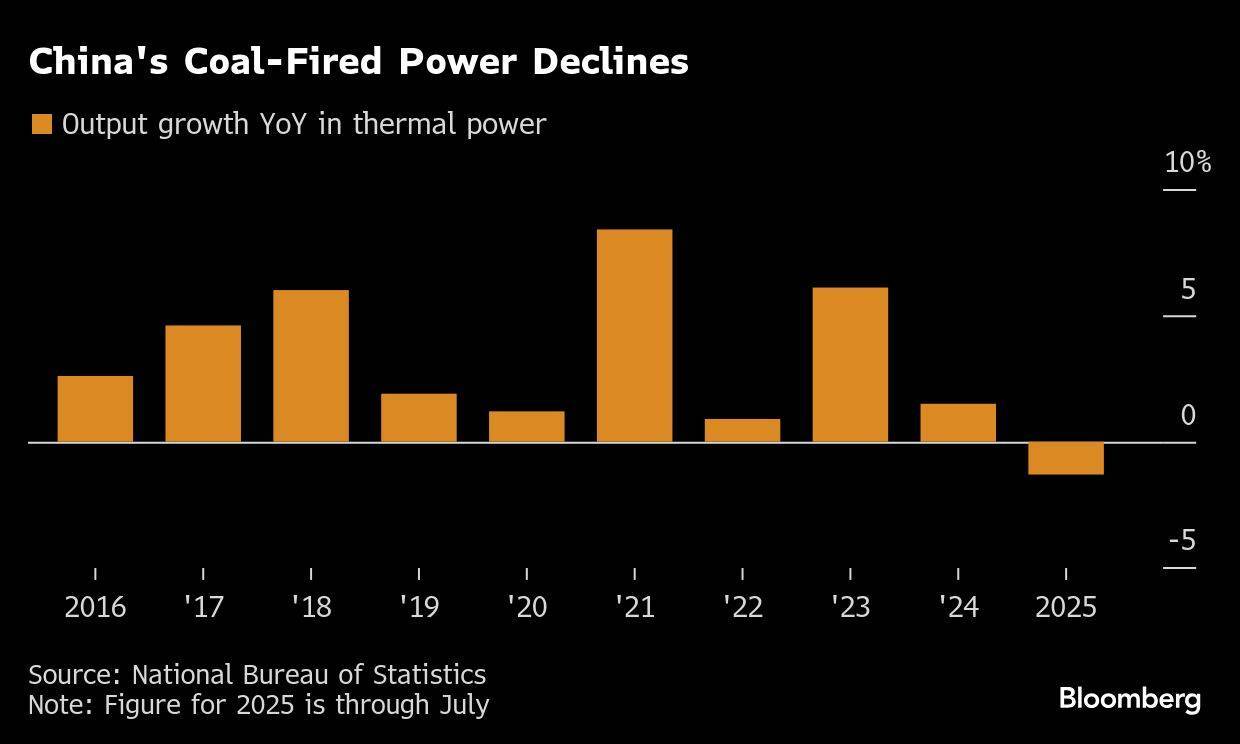

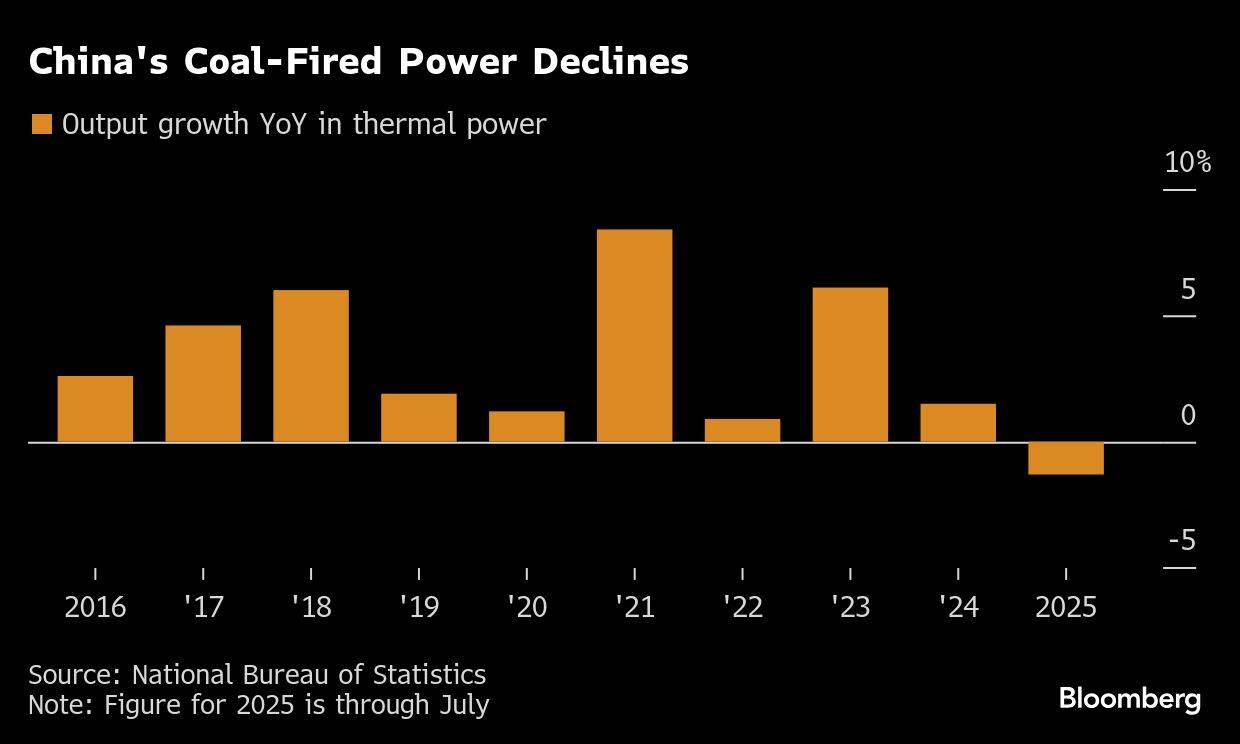

The stage may be set for the world’s use of fossil fuels to begin dropping in about five years time, thanks to China’s rapid adoption of renewables and its increasing reliance on electricity, clean energy think tank Ember said in a report on Tuesday.The researchers identified how fossil fuel consumption could be pressured into long-term decline, via the scale and pace of China’s own green transition, and its dominant role exporting clean energy to other countries. In 2023, one-quarter of emerging countries had leapfrogged the US in terms of the electrification of their economies, helped by the availability of cheap Chinese clean-tech, according to Ember.

A domestic milestone was reached in the first half of this year, when China’s solar and wind generation more than met demand growth for power, cutting fossil fuel usage by 2%, the researchers said. It follows a massive investment in clean energy, which totaled $625 billion last year or almost a third of the world’s total.“China’s surge in renewables and whole-economy electrification is rapidly reshaping energy choices for the rest of the world, creating the conditions for a decline in global fossil fuel use,” Ember said. If current trends hold, “it’s likely that the world’s fossil fuel demand will be in structural decline by 2030.”

Cutting fossil fuel use is necessary to reducing carbon emissions and avoiding the worst consequences of a hotter planet. But the path to net zero has been complicated by various factors, from indifference and even hostility to the energy transition in some countries like the US, to concerns over the costs of its implementation in others. That has put a huge onus on the world’s biggest polluter to effectively ride to the rescue.China has been responsible for most of the global growth in fossil fuel use for a decade, Ember said. In its reading, as that demand fades “the implications for governments basing their economic growth plans on exporting coal, oil and gas are plain to see,” it said.

Moreover, China is disproving the notion that green goals and economic growth are at odds, according to the report. Instead, it’s taken a path that has allowed the two to reinforce each other and create “self-sustaining momentum.”

Key points:

Ethiopia officially inaugurates Africa's largest hydroelectric dam on Tuesday, a project that will provide energy to millions of Ethiopians while deepening a rift with downstream Egypt that has unsettled the region.Ethiopia, the continent's second most populous nation with a population of 120 million, sees the $5 billion Grand Ethiopian Renaissance Dam (GERD) on a tributary of the River Nile as central to its ambitions for economic development.Begun in 2011, the dam's power generation should eventually rise to 5,150 MW from the 750 MW that its two active turbines are already producing.Prime Minister Abiy Ahmed has said Ethiopia will use the energy to improve Ethiopians' access to electricity while also exporting surplus power to the region.

Ethiopia's downstream neighbours, however, have watched the project advance with dread.Egypt, which built its own Aswan High Dam on the Nile in the 1960s, fears the GERD could restrict its water supply during periods of drought, and could lead to the construction of other upstream dams.It has bitterly opposed the dam from the start, arguing that it violates water treaties dating to the British colonial era and poses an existential threat.Egypt, with a population of about 108 million, depends on the Nile for about 90% of its fresh water.

Egypt would continue to closely monitor developments on the Blue Nile and "exercise its right to take all the appropriate measures to defend and protect the interests of the Egyptian people", Egyptian Foreign Ministry spokesperson Tamim Khallaf told Reuters on Monday.Sudan has joined Egypt's calls for legally binding agreements on the dam's filling and operation, but could also benefit from better flood management and access to cheap energy.Cairo's position received support from U.S. President Donald Trump during his first term. Trump said it was a dangerous situation and that Cairo could end up "blowing up that dam", but his administration failed to secure a deal on the project, over which years of talks produced no agreement.

Insisting that the project's development is a sovereign right, Ethiopia has pressed ahead. In 2020, it began filling the reservoir in phases while arguing that the dam would not significantly harm downstream countries."The Renaissance Dam is not a threat, but a shared opportunity," Abiy told parliament in July. "The energy and development it will generate stand to uplift not just Ethiopia."Independent research shows that so far, no major disruptions to downstream flow have been recorded — partly due to favourable rainfall and cautious filling of the reservoir during wet seasons over a five-year period.

In Ethiopia, which has faced years ofinternal armed conflict, largely along ethnic lines, the GERD has proven a source of national unity, said Magnus Taylor from the International Crisis Group think tank."The idea that Ethiopia should be able to build a dam on its own territory... and shouldn't be pushed around by Egypt is broadly something that most Ethiopians would get behind," he said.Ethiopia's central bank provided 91% of the project's funding, while 9% was financed by Ethiopians through bond sales and gifts, without any foreign assistance, local media has reported.

The dam's reservoir has flooded an area larger than Greater London, which the government says will provide a steady water supply for hydropower and irrigation downstream while limiting floods and drought.Rural Ethiopians, however, may have to wait a little longer to benefit from the extra power: only around half of them are connected to the national grid.While relations with Egypt over the dam have deteriorated in the last year, they can still get worse, said Matt Bryden from think tank Sahan Research.

Landlocked Ethiopia's plan to gain access to the sea via its old adversaries Eritrea or Somalia has seen Egypt throw its weight behind Asmara and Mogadishu.The idea of strategic rival Egypt dictating not only Nile water usage but access to the Red Sea, is clearly unacceptable to Addis Ababa, Bryden said.

Israel launched an audacious attack on Hamas leaders in Qatar on Tuesday, expanding its military actions that have ranged across the Middle East to include the Gulf Arab state where the Palestinian Islamist group has long had its political base.

Qatar, which has acted as a mediator alongside Egypt in talks on a ceasefire in the almost two-year-old war in Gaza, condemned the action as "cowardly" and called it a flagrant violation of international law.

Two Hamas sources told Reuters that Hamas officials in the ceasefire negotiating team survived the attack.

Israeli officials told Reuters the strike was aimed at top Hamas leaders including Khalil al-Hayya, its exiled Gaza chief and top negotiator.

Several blasts were heard in Qatar's Doha, Reuters witnesses said. Plumes of black smoke were billowing from the city's Legtifya petrol station. Next door to the petrol station is a small residential compound that has been guarded by Qatar’s emiri guard 24 hours a day since the beginning of the Gaza conflict.

Ambulances and at least 15 police and unmarked government cars thronged the streets around the blast site an hour after the strike.

Israel has killed several top Hamas leaders since the Palestinian militant group attacked Israel in October 2023, killing 1,200 people and taking 251 hostage, according to Israeli tallies.

Israel has also launched airstrikes and other military action in Lebanon, Syria, Iran and Yemen in the course of the Gaza conflict.

In Lebanon, it attacked the heavily armed Iran-backed group Hezbollah and in Yemen it launched air strikes on the Iran-aligned Houthi group. Both groups have launched strikes on Israel during the Gaza conflict.

An Israeli official confirmed to Reuters that Israel had carried out an attack on Hamas leaders in Qatar. Qatar's Al Jazeera television, citing a Hamas source, said the attack was aimed at Hamas Gaza ceasefire negotiators.

The assault is likely to deal a serious, if not fatal blow to efforts to reach a ceasefire, especially since it took place in the Gulf Arab country Qatar, which has hosted several rounds of talks.

Reporting by Andrew Mills in Doha, Jana Choukeir in Dubai and Steven Scheer and Maayan Lubell in Jerusalem, Writing by Michael Georgy, Editing by William Maclean

Francois Bayrou resigned as France’s prime minister Tuesday, putting the onus on President Emmanuel Macron to quickly name a new premier who can stabilize the country’s urgent fiscal situation.

Macron said he would tap a new prime minister in the coming days. AFP reported, without naming the source, that Bayrou submitted his resignation and will remain as a caretaker.

Whoever takes on the role will need to assemble a government and then find a way to pass a budget in a fragmented National Assembly, an exercise that’s toppled the last two prime ministers. Meanwhile public pressure is growing with nationwide protests planned.

While Macron doesn’t lack for people who might accept the role, selecting someone who can find common ground among the groups is far from obvious.

“Which party can one even recruit from?” Kathryn Kleppinger, George Washington University professor of French studies said in an interview on Bloomberg Television. “I fear we’re going to be dealing with more of the same.”

French bonds were little changed on Tuesday, with the 10-year benchmark yielding 3.48%. The CAC 40 Index fell about 0.1% at 11:15 a.m. in Paris, in line with the move in the Euro Stoxx 50.

The new premier will be France’s fifth in less than two years, a reflection of the irreconcilable blocs in the country’s fractured political landscape.

Several of the names floated in French media for the post are in Bayrou’s government, which limits their ability to appeal to parties beyond the centrist groups that had supported the outgoing premier. They include Defense Minister Sebastien Lecornu, who was a front-runner in the last reshuffle for the position, or Labor Minister Catherine Vautrin. Finance Minister Eric Lombard, who was instrumental in building bridges with Socialists to secure the 2025 budget, is another possibility.

Outside of Macron’s core group, Socialist leader Olivier Faure has said that he’s ready to be prime minister. Former Socialists could include Bernard Cazeneuve, a former prime minister under President Francois Hollande or the current head of the state audit court, 67-year-old Pierre Moscovici. If no political profile can work, Macron could try to find a prime minister seen as purely technocratic, but would be an implicit admission from Macron that politics has failed.

The Socialists were quick to propose their services following the vote. “I think it’s time for the left to again govern this country and break with the policies that have been implemented for the past eight years,” Faure said on TF1 television, referring to Macron’s time in office.

At the same time, on France 2 television, outgoing interior minister Bruno Retailleau, who also heads the center-right Republicans, said he wouldn’t take part in a government led by a Socialist prime minister. Speaking on the same channel, far-left firebrand Jean-Luc Melenchon also said he would not support a government led by Faure.

Bayrou called Monday’s confidence vote in an effort to get backing for his proposed €44 billion of spending cuts and tax hikes that would narrow France’s 2026 deficit to 4.6% of economic output from an expected 5.4% this year. He also floated an unpopular proposal to cut two public holidays as a way to reduce costs in Europe’s second-largest economy.

France’s deficit is the widest in the neuron area with debt rising by €5,000 ($5,840) a second, according to Bayrou. The cost to service its obligations is set to hit €75 billion next year, he has also said.

Eleonore Caroit, a lawmaker from Macron’s Renaissance party, said on Tuesday that her group would consider less rigorous budget proposals. “We need to cut more public expenditure, but if it takes moving from the €43.8 billion proposed by Bayrou to another figure, of course we are willing to do so.”

Marine Le Pen’s far-right National Rally as well as the leftist France Unbowed have both called for new legislative elections, something that Macron appears to have ruled out with his statement on naming a new prime minister. Some have also called for Macron’s resignation, but he has steadfastly said he will remain through the end of his term in 2027.

“For us, it’s a snap election or nothing,” National Rally President Jordan Bardella said on RTL radio Tuesday. “Any other prime minister appointed by Emmanuel Macron will be brought down.”

A union strike planned for Sept. 18 is putting pressure on Macron to have a new government in place by then. A separate, less centralized, protest is planned on Sept. 10.

On Friday, Fitch Ratings is scheduled to update its assessment of France’s creditworthiness.

The French president is solely responsible for picking a new premier, and there is no constitutional time limit for a decision. It took Macron two months to appoint the previous premier, Michel Barnier, who lasted only 90 days. Macron took more than a week to name Bayrou after Barnier was ousted. Once appointed, the premier must propose a cabinet to be signed off by Macron.

“The urgent need is for our country to have a budget by Dec. 31,” Gabriel Attal, former prime minister and president of the Renaissance group in the National Assembly, said on TF1. “Another snap election would be the worst solution.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up