Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

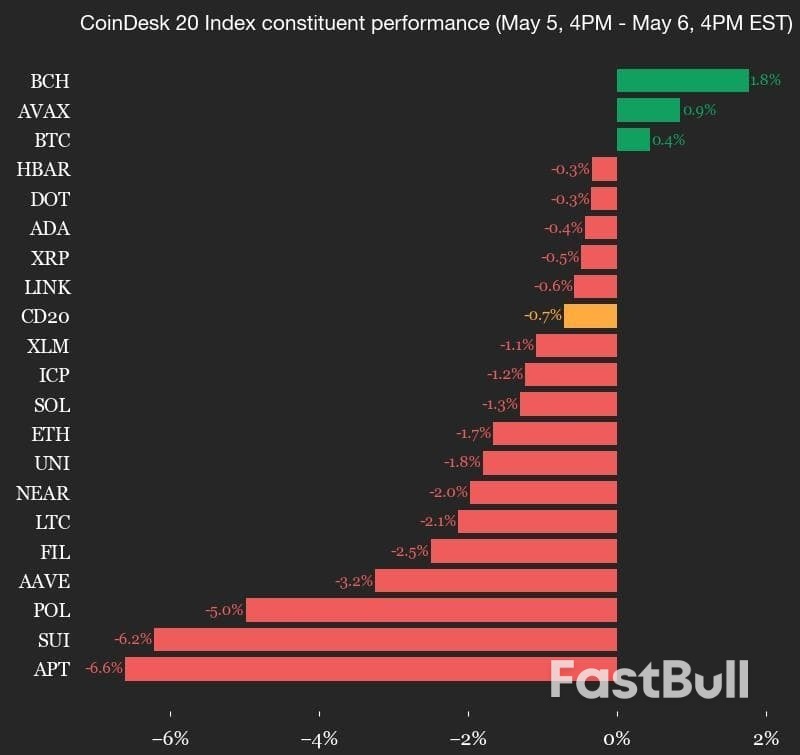

Crypto markets are in a holding pattern as capital rotation from altcoins pushed bitcoin's market share to fresh 4-year high.

Responding to the query, Varga told Rigzone, “after Houthi rebels launched an attack on Israel’s Ben-Gurion airport, Israeli planes struck Houthi targets in Yemen leading to a jump in geopolitical risk premium, hence the rally”.

In a video posted on the Associated Press website on May 5, Yahya Saree, who the video describes as the “Houthi military spokesman”, states, “the Yemeni Armed Forces announce that they will work to impose a comprehensive aerial blockade on the Israeli enemy by repeatedly targeting airports, foremost among them Lod airport, named by Israel as Ben-Gurion airport”. The video included subtitles. Saree describes himself on his X page as the “spokesperson of the Yemeni Armed Forces”.

In a statement posted on its X page on May 6, Israel Defense Forces (IDF) said IDF fighter jets “struck and dismantled” Houthi infrastructure at the “main airport in Sana’a”. The IDF added in the statement that “several central power plants were struck in, and surrounding, the Sana’a area”.

A statement posted on the IDF’s X page on May 5 announced that IAF fighter jets struck Houthi targets along the Yemen coastline.

In her response to Rigzone’s question, Babin said, “crude is up today largely because the market was very short heading into the OPEC meeting - not just on flat price, but particularly through put spreads”.

“While the 400,000 barrel per day increase from OPEC was widely expected, some participants were positioning for a more aggressive signal - specifically, guidance toward a full unwind of the 2.2 million barrel per day cut by October, which didn’t materialize,” Babin added.

“The relatively muted outcome triggered a fair amount of short covering, especially as the market had been leaning into the idea that this meeting could push WTI below $55 and establish a new, lower range,” Babin went on to state.

Babin told Rigzone that, “also supporting prices today is speculation that China may announce additional stimulus on Wednesday, following the unusual move by the government to schedule a press conference - raising hopes for further policy support”.

Babin went on to add that “commentary from U.S. producers may also be helping”.

“Lower capex and commentary that U.S. shale may be peaking (FANG) [Diamondback Energy] - this obviously does not impact supply immediately but maybe providing more confidence there is a floor in crude as U.S. production slows,” Babin added.

Rigzone has contacted OPEC, the State Council of the People's Republic of China, the American Petroleum Institute (API), and Diamondback Energy for comment on Babin’s statement. At the time of writing, none of the above have responded to Rigzone.

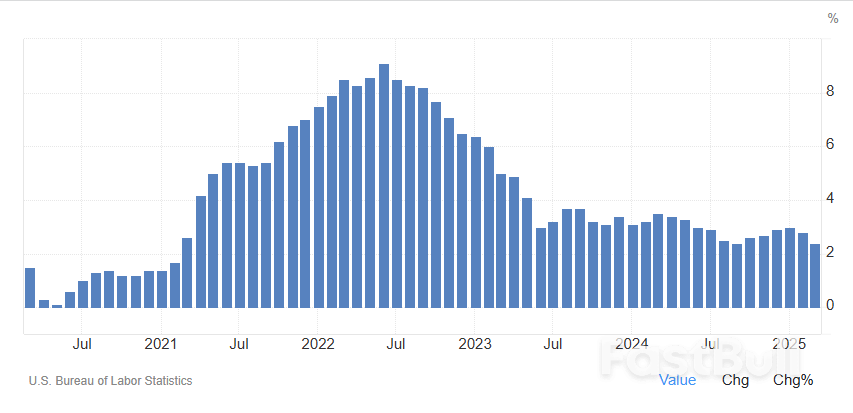

When the Federal Reserve last met to decide on interest rates, back in mid-March, Chair Jerome Powell played down concerns about US growth and the inflationary threat from anticipated tariffs, even hinting that any effect on prices could be transitory.

In the six weeks since that meeting, it’s fair to say a lot has happened.

President Donald Trump on April 2 declared “Liberation Day” by imposing the biggest tariffs in a century on imported goods. Financial markets went into a tailspin, and businesses big and small complained about the turmoil the move would cause to their operations. Trump eventually pressed pause on a chunk of his planned tariffs but pressed ahead with levies on sectors such as autos and steel, a 10% rate on most countries and a whopping 145% on most goods coming from China.

But the fallout continues. This week alone Ford Motor Co. suspended its full-year financial guidance and said Trump’s auto tariffs will take a toll on profit. Mattel Inc. withdrew its forecast for a return to sales growth in 2025, citing the effect Trump’s tariffs will have on its Barbie dolls, Hot Wheels cars and other toys.

How all of this ultimately affects the economy remains an intense debate. The White House says the shock-and-awe tariffs are forcing billions of dollars in corporate investment in the US that will create new jobs. The stock market rout turned into a historic rally as the S&P has unwound a wild selloff.

Which is why executives and investors are leaning on observers in the middle, who strive to stay above the political fracas, for guidance on where all of this is going. One of those observers is Powell, who on Wednesday will decide—with his policy board after a two-day meeting—on whether to lower interest rates.

Investors are betting rates won’t be cut, at least for now, given the economy continues to hold up (April’s jobs data suggest ongoing labor market strength) and inflation remains above the Fed’s 2% target.

Which means listeners to Powell’s news conference will want to hear not just his views on how businesses and households are handling the impact of tariffs right now but also, and more crucially, his thoughts on how they will be doing in the months ahead. The Fed in March lowered its growth projections for the economy, and Powell may be asked if another downgrade is coming.

There’s an extra political edge here too. The Fed chair has come under intense criticism from Trump, who has accused him of being too slow—“Mr. Too Late”—to cut interest rates and said Powell’s termination from office can’t come soon enough (even as he says he won’t fire him).

Against that backdrop, Powell won’t want to drag the Fed into the white heat of the political row over tariffs.

But neither will he get a pass from investors if he sticks to a line that it’s too soon to gauge how much pain the tariffs will inflict. Powell drew criticism for missing the buildup of inflation post-pandemic. He won’t want to be accused of misreading the tariff effect either.

Related: One Ship, $417 Million in New Tariffs: The Cost of Trump’s Trade War

Bliss Bednar’s 2023 Volkswagen Atlas was running just fine. Sure, it wasn’t the fanciest car she’d ever owned, but with home renovations to plan and rising construction costs already threatening her remodeling budget, the retired teacher in central Texas planned to stick with the three-row SUV for the foreseeable future.

Then President Donald Trump outlined 25% tariffs on auto imports, and she joined the millions of Americans racing to dealerships to snap up new models before the higher levies drive up prices by thousands of dollars.

“I was a little reluctant, because there was nothing wrong with the car I had,” says Bednar, 58. After offloading the VW, she purchased a 2025 BMW X3 for about $65,000 with a $20,000 down payment, leaving her with a $500 monthly bill. It’s affordable for now, but she worries she’ll feel squeezed if everyday prices continue to rise. “I was afraid of tariffs, and I was afraid prices were going to skyrocket. Then I was like, ‘Maybe I jumped on this too soon,’ ” she says.

Because of Trump’s tariffs, which went into effect on April 3 for finished cars and trucks but will take time to trickle down to the models on dealers’ lots, financial planners across the US say they’ve received an onslaught of inquiries from clients trying to purchase new vehicles. The president’s directives signed last week are meant to soften the car-tariff blow, in part by preventing multiple levies from piling on top of each other, but those buyers who raced to lock down vehicles are still on the hook for years of payments. For financially stable buyers, getting out ahead of price hikes can be a “prudent decision,” says Michael Girard, senior director for asset-backed securities in North America for Fitch Ratings Inc. But the high cost of new cars combined with the urgency to buy before tariffs hit could be a recipe for remorse should the economy slip into recession.

Claire Ballentine and Keith Naughton write about the potential for a financial hangover: Pre-Tariff Car Buying Frenzy Leaves Americans With a Big Debt Problem

Caroline Biddle thought she was doing the right thing when she opened up to her employer about her need for fertility treatment. Then she got her next paycheck and saw her salary had been docked for every time she had attended an appointment. Even more shocking, Biddle thought, her employer—a high school near Birmingham, England—wasn’t breaking any rules.

The law in the UK, like in most places, doesn’t afford any protection to people who take time out of work for in vitro fertilization, a process that can involve dozens of unpredictable appointments for scans, blood tests and procedures, alongside self-administered hormone injections that commonly cause mood swings, brain fog and intense fatigue.

The performing arts teacher remembers returning to work two days after a treatment, even though it was still painful to walk, because she couldn’t afford any more unpaid leave. Within a year, she’d quit her job and moved to a more supportive school, but after she finally had a child, she decided not to return to teaching. “I just remember feeling really devalued,” Biddle says. “I became really jaded with my whole career.”

Few would dispute that women drop out of the workforce or downgrade to less strenuous roles after having children. Less well known is that for many, the process starts long before a child’s birth.

Fertility treatment is specifically difficult on women’s responsibilities because there’s little flexibility as to when certain procedures take place. Natasha Doff writes about what that costs women: Why Juggling IVF With Work Can Be a Career Killer

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up