Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Bank of Canada will hold its overnight rate on December 10, according to all economists polled by Reuters, a majority of whom predicted steady rates at least until 2027.With inflation easing and firmly within the central bank's target range and the economy growing at a robust pace, the need for further rate cuts has reduced significantly.Canadian home sales also regained momentum in October, suggesting low borrowing costs are helping the interest-rate-sensitive housing market, though further help from the central bank will be limited.

The Bank of Canada will hold its overnight rate on December 10, according to all economists polled by Reuters, a majority of whom predicted steady rates at least until 2027.

With inflation easing and firmly within the central bank's target range and the economy growing at a robust pace, the need for further rate cuts has reduced significantly.Canadian home sales also regained momentum in October, suggesting low borroing costs are helping the interest-rate-sensitive housing market, though further help from the central bank will be limited.

The BoC will keep the rate steady at 2.25% next week, according to all 33 economists in the December 2-5 Reuters poll, in line with market pricing.

After delivering 275 basis points of rate cuts, one of the most aggressive among G10 economies, the central bank signaled a halt in rate cuts in October, citing stable inflation.

"With the Bank (BoC) all but signalling that it believes it is done cutting rates, it's only natural that thoughts are now turning to when it may start going in the other direction," said Douglas Porter, chief economist at BMO Capital Markets.

"Given that the dark cloud of trade uncertainty is still hanging over the economy, and likely will continue to do so through much of 2026, we believe it's far too early for rate-hike talk."

A majority of economists, 18 of 29, predicted the BoC will hold rates steady at least until 2027.

That stable rate outlook partly hinges on an economy that has shown resilience in the face of U.S. tariffs, expanding at a better-than-expected 2.6% last quarter, boosted in part by government spending.

Despite massive rate cuts from the BoC, the housing market has broadly struggled this year with home prices declining around 3.2% so far.

But that fall is likely to stall soon, with prices forecast to rise 1.8% and 3.5% on average next year and in 2027, respectively, according to medians from a separate Reuters survey of 14 analysts.

Nine of 11 analysts in that poll said affordability for first-time homebuyers will also improve over the coming year.

"The BoC's interest rate cuts in September and October further improved affordability for buyers, lowering ownership costs at a time when home values have moderated in parts of the country in the past year," noted Robert Hogue, assistant chief economist at RBC.

"Rate reductions will likely draw more buyers to the market, unlocking some pent-up demand accumulated during the period of elevated borrowing costs."

The latest federal budget, Mark Carney's first as prime minister, proposed a total investment of C$280 billion, which includes C$25 billion in housing, over the next five years.

A strong majority of analysts, 8 of 10, who answered an additional question said the government initiatives in the recent budget to help build more homes and alleviate housing supply issues were a step in the right direction.

While two said they were nowhere near enough, none chose "helpful" or "very helpful".

"It is helpful to see a commitment by governments to take funding social housing seriously, though the quantum of funding so far is weak," said Peter Norman, chief economist at Altus Group.

"The 2025 budget will do little to assist in improving the currently stressed economics of improving new market housing supply in the major markets."

Markets are pricing next week's 25bp cut to the policy rate target as largely a done deal, but 2026 outlook for both rates and liquidity remains a lot less clear. We expect Powell to push back on expectations of sequential rate cuts continuing in early 2026, echoing the message heard in October and reflecting the widely varying views within the FOMC. Knowingly delivering a 'hawkish cut' is a consensus choice.

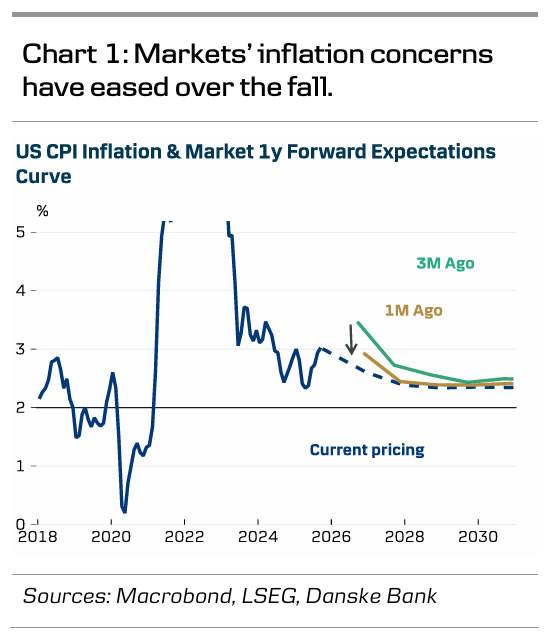

Even though incoming macro data has not delivered decisive signals since October, we believe that the decline seen in markets' inflation expectations makes another rate cut more palatable even for the hawks (chart 1). Overall financial conditions have tightened modestly as real short rates have moved higher.

Jeffrey Schmid is likely to repeat his dissent in favour of a hold and could potentially be joined by Susan Collins and/or Alberto Musalem. Chicago Fed's Austan Goolsbee also prepared markets in November by saying he sees 'nothing wrong with dissenting'. On the other side, Trump-nominated governors Waller, Bowman and Miran together with NY Fed's John Williams form the backbone of the dovish camp.

We see a good chance of the Fed pausing its easing cycle in January, as three of the four new 2026 voters – Hammack, Kashkari and Logan – have all vocally opposed the October decision to cut. In our base case, we expect final 25bp cuts in March and June. The updated dots are likely to reflect the growing diversity of views even by the end of 2026. Macroeconomic forecasts will see more cosmetic changes; we expect a small positive revision to 2026 GDP forecast while inflation outlook will likely remain mostly unchanged.

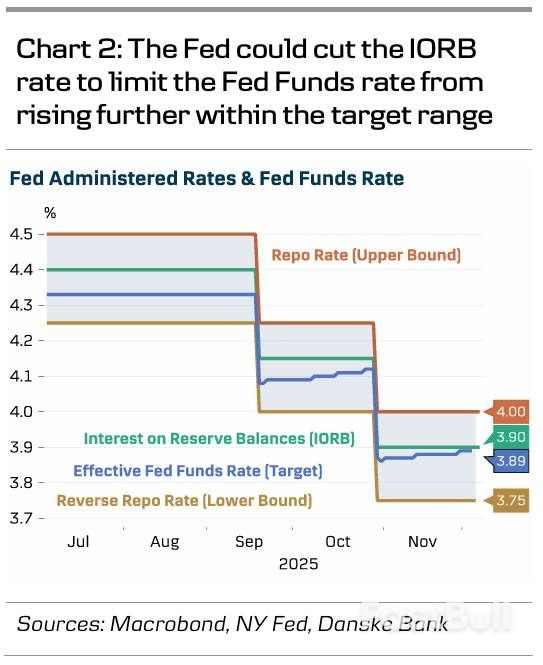

The Fed formally ended its balance sheet drawdown at the start of December, but liquidity conditions remain on the tighter side. The effective Fed Funds rate has risen modestly within the target range, and SOFR traded above the upper bound around month-end. While liquidity is not an imminent concern in our view, the Fed could pre-announce organic balance sheet expansion, or gradual QE, starting in 2026. Alternatively, the Fed could lower the interest rate of reserve balances (IORB) by additional 5bp to limit the Fed Funds rate from rising further, though we see the former more likely than the latter.

Russia has been relying on Iranian Shahed drones in its attacks on Ukraine with increasing frequency.

The use of drone warfare in the ongoing Russia-Ukraine conflict does not appear to be dwindling. In fact, Moscow recently fielded a brand-new iteration of the Shahed drone series that Russian forces have been using to strike Kyiv over the last three-plus years of conflict. A video this week has circulated on social media, depicting an air-to-air intercept of an R-60 armed Shahed-160 unmanned aerial vehicle (UAV).

The War Zone reported on the footage, which was shared by the Sternenko Community Foundation, a Ukrainian nongovernmental organization. According to the foundation's claims, the Russian-launched Shahed was destroyed by a Sting anti-drone interceptor. As showcased in images of the aftermath of the attack, the missile appears to have been mounted to a launch rail that had been installed on the Shahed's nose. Despite this instance of the Russian-launched UAV being intercepted, the Shahed drones continue to play a pivotal role in Moscow's war strategy against Kyiv.

The HESA Shahed-136 is an Iranian-designed loitering munition that has become popular due to its role in the ongoing Russia-Ukraine war. This type of lethal UAV is often referred to as a "suicide" or "kamikaze" weapon due to its ability to loiter around a target area before striking.

While the Shahed 136 is rather simple in design, Russia has been significantly ramping up the use of this UAV series since the war began. According to the Center for Strategic and International Studies, Moscow has increased its deployment of these Iranian drones from roughly 200 launches per week to more than 1,000 per week by early 2025. The Shahed-131 variant has also been used frequently in the Eastern European conflict. As an older version of its sister drone, the Shahed-131 features many of the same capabilities as the 136. The Shahed-131 is smaller, however, and it is powered by a reverse-engineered version of the Beijing Micro pilot UAV Control System Ltd MDR-209 Wankel engine.

Back in 2023, the White House released images depicting members of a Russian delegation visiting Iran's Karshan Airfield to view several different drone types. While the Iranian regime initially denied its UAV assistance to its Russian ally, the ongoing arms deliveries between the two nations have been confirmed. Early on in the war, the US Defense Intelligence Agency noted that Iran was becoming one of Russia's most critical military backers amidst its Ukraine invasion. Over the last few years, open-source intelligence trackers and analysts have been able to verify that the debris of Iranian-made UAVs like the Shahed have been discovered in the aftermath of attacks in Kyiv.

As the Iranian-Russian defense partnership continues to grow, additional Shahed drone deliveries should be expected.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up