Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Existing Home Sales MoM (Dec)

Canada Existing Home Sales MoM (Dec)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Nov)

Euro Zone Industrial Output MoM (Nov)A:--

F: --

Euro Zone Trade Balance (SA) (Nov)

Euro Zone Trade Balance (SA) (Nov)A:--

F: --

Euro Zone Trade Balance (Not SA) (Nov)

Euro Zone Trade Balance (Not SA) (Nov)A:--

F: --

Euro Zone Industrial Output YoY (Nov)

Euro Zone Industrial Output YoY (Nov)A:--

F: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)A:--

F: --

P: --

Brazil Retail Sales MoM (Nov)

Brazil Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Jan)

U.S. NY Fed Manufacturing Prices Received Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Nov)

Canada Wholesale Inventory YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Nov)

Canada Manufacturing Inventory MoM (Nov)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Import Price Index YoY (Nov)

U.S. Import Price Index YoY (Nov)A:--

F: --

U.S. Import Price Index MoM (Nov)

U.S. Import Price Index MoM (Nov)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Wholesale Sales MoM (SA) (Nov)

Canada Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)--

F: --

P: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)--

F: --

P: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

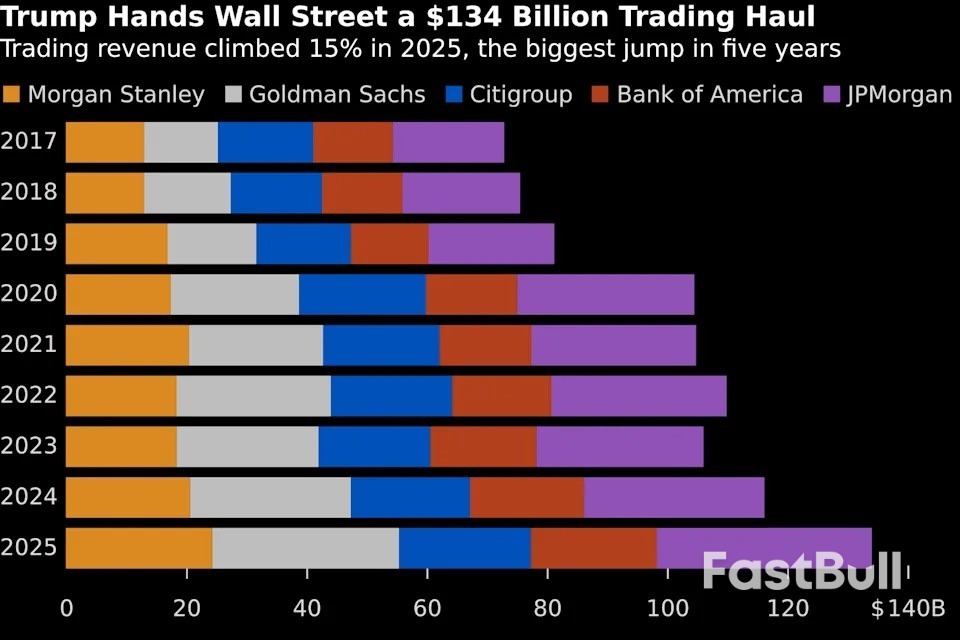

Goldman executives described their backlog for advisory, debt and equity underwriting as the highest in several years — and among the strongest ever.

The Federal Reserve has stopped shrinking its massive $6.5 trillion portfolio, sparking a critical debate over its ideal size. According to the central bank's own economists, this decision involves a fundamental trade-off that pits competing policy goals against each other.

In a recent paper, Fed researchers Burcu Duygan-Bump and R. Jay Kahn argue that central banks face a "balance sheet trilemma." This framework highlights the tension between the financial sector's demand for reserves and sudden shifts in market liquidity.

The trilemma suggests that a central bank can successfully achieve only two of the following three objectives at any given time:

• A small balance sheet

• Low interest-rate volatility

• Limited market intervention

The Fed’s decision to halt its balance sheet reduction in December followed a three-year effort. The move came after stress signals emerged in the $12.6 trillion short-term money markets, indicating that bank reserves were no longer abundant.

To manage these pressures, the Fed announced last month it would begin reserve management purchases to ensure its stock of reserves remains at an ample level while money market rates are elevated.

The Fed's current portfolio is a legacy of its responses to major economic shocks. Its balance sheet expanded from just $800 billion nearly two decades ago to a peak of $8.9 trillion in June 2022. This growth was driven by large-scale asset purchase programs launched during the 2008 global financial crisis and the COVID-19 pandemic.

Since 2019, the central bank has operated under an "ample-reserves regime," holding a large portfolio of Treasuries. Under this system, it pays interest on reserves that banks park with it and on cash that money market funds place at the Fed.

However, officials remain divided on the long-term strategy. Fed Vice Chair for Supervision Michelle Bowman, for instance, has advocated for shrinking the balance sheet as much as possible to return it closer to pre-crisis levels.

The trilemma forces policymakers to choose a strategy, with each option carrying significant consequences for financial markets.

Path 1: Maintain a Large Balance Sheet

A large balance sheet can act as a structural cushion, providing safe and liquid assets that prevent short-term rate volatility. This approach reduces the need for the Fed to conduct regular market interventions. The downside is a large and permanent central bank footprint in financial markets.

Path 2: Operate with Leaner Reserves

Shrinking the balance sheet would increase volatility in money markets, forcing participants to adapt to liquidity pressures on their own. However, the authors of the paper warn this could weaken the Fed's control over interest rates and complicate the transmission of monetary policy, particularly during an unexpected shock.

Path 3: A Hybrid Approach

Policymakers could also choose a middle path, tolerating some rate volatility around predictable events like quarter-end reporting dates. In this scenario, the Fed would respond with targeted market operations and maintain a slightly larger balance sheet. The risk, however, is that frequent interventions could distort market signals, creating problems similar to those associated with a permanently large balance sheet.

Ultimately, the choice of strategy will define the Fed's role in the market. As the economists noted, regardless of the path chosen, "the central bank will almost always have a footprint," either through its holdings or its market operations.

The appropriate long-term size of the balance sheet remains an open question, with no clear consensus among economists or policymakers.

Chicago Fed President Austan Goolsbee delivered a stark warning on Thursday, stating that any attempt to weaken the Federal Reserve's independence could unleash a new wave of inflation.

"Anything that's infringing or attacking the independence of the central bank is a mess," Goolsbee said. "You're going to get inflation come roaring back if you try to take away the independence of the central bank."

Goolsbee's comments come as Fed Chair Jerome Powell confirms he has been served a subpoena by the Justice Department. The investigation relates to a major renovation of the Federal Reserve's headquarters in Washington, D.C.

The Chicago Fed president supported Powell’s recent assertion that the investigation could be a pretext for Donald Trump to exert influence over interest rate policy.

Trump has consistently criticized Powell, using insults and publicly demanding lower rates. This pressure has continued even though the Fed has already cut its main interest rate three times since September 2025. Trump has nicknamed the Fed chair "Too Late," signaling his dissatisfaction with the pace of monetary easing.

While Powell's term as chair is set to end in May, he is eligible to remain a Fed governor until 2028.

Goolsbee, who joined the Chicago Fed in December 2022, directly addressed the unusual nature of a government investigation into its own central bank. He argued that such actions are not characteristic of stable, advanced economies.

"I know that there have been countries that had criminal investigations of their central banks," he noted. "But those countries are Zimbabwe and Russia and Turkey and a bunch of places that you would not characterize as advanced economies."

The underlying principle is that when a central bank loses its political independence, its credibility erodes. Historically, a loss of central bank credibility is often followed by a rise in inflation as the public loses faith in the institution's commitment to price stability.

Goolsbee, who previously served as an advisor to Barack Obama and Joe Biden, emphasized that his political past is irrelevant to his current role. "Once you've become a sworn member of the Federal Reserve, you're out of the elections business," he stated.

He also offered a strong endorsement of Powell's performance, calling him a "first-ballot Hall of Famer" for successfully bringing down inflation without triggering a recession. Goolsbee's comments frame the current conflict not just as a political dispute, but as a fundamental threat to the economic stability Powell has worked to achieve.

International Monetary Fund (IMF) chief Kristalina Georgieva has publicly defended the principle of central bank independence and offered her support for Federal Reserve Chair Jerome Powell, who is currently facing an investigation by the Trump administration.

In a Thursday interview with Reuters, Georgieva stressed that substantial evidence shows independent central banks serve the best interests of both businesses and households. She argued that evidence-based, data-driven decision-making is fundamentally good for the economy.

Voicing her personal respect for the Fed Chair, the IMF managing director stated, "I have worked with Jay Powell. He is a very good professional, a very decent man, and I think that his standing among his colleagues tells the story." Her comments align with a letter of support for Powell signed by her predecessor, European Central Bank head Christine Lagarde, and other major central bank leaders.

The show of support comes after Powell revealed on Sunday that the Trump administration has launched an investigation into him. The probe focuses on cost overruns related to a $2.5 billion project to renovate two historic buildings at the Fed's Washington headquarters.

Powell has denied any wrongdoing, describing the administration's actions as a pretext to pressure him for not yielding to President Trump's repeated demands for significantly lower interest rates.

This unprecedented move against a sitting Fed Chair has triggered widespread criticism from several key Republican senators, foreign economic officials, investors, and former U.S. government officials from both political parties.

President Trump has frequently criticized Powell's leadership at the Federal Reserve, often launching personal attacks over the pace of interest rate cuts.

On Wednesday, Trump dismissed concerns that eroding the central bank's independence could weaken the U.S. dollar and fuel inflation. When asked about these risks by Reuters, he replied, "I don't care."

The pressure extends beyond Powell. Trump has also sought to fire another Fed official, Governor Lisa Cook, who is challenging her termination in a legal case scheduled to be heard by the Supreme Court next week.

Georgieva noted that the IMF closely monitors issues like monetary and financial stability, as well as the institutional strength of member countries. The Federal Reserve receives special attention given the U.S. dollar's crucial role as a global reserve currency.

"It would be very good to see that there is a recognition ... that the Fed is precious for the Americans," she said. "It is very important for the rest of the world."

The International Monetary Fund (IMF) is preparing to seek board approval for a new $8.1 billion lending program for Ukraine within weeks, according to Managing Director Kristalina Georgieva. The announcement signals a major step in securing critical funding for the war-torn country's economy.

Speaking after high-level meetings in Kyiv with Ukrainian President Volodymyr Zelenskiy and other senior officials, Georgieva emphasized that while the fund is adapting to Ukraine's evolving situation, the core requirements of the program remain firm.

"I'm here to see how the country is doing in these unusually harsh times, because I want to make sure that what was agreed in November is implementable as it was agreed," she said. "We recognize that the direction to travel remains the same (but) the way we take these steps, we have to calibrate carefully."

A central condition for the new program is Ukraine's commitment to press forward with removing a value-added tax (VAT) exemption for consumer goods, a policy that has faced domestic resistance. Georgieva described the reform as a "must-have" requirement.

However, the IMF is showing some flexibility on the timeline. Before the new program can be approved, the fund will only require that the measure is introduced in parliament, not that it has already been passed into law.

"On the VAT exemptions, we made it very clear that this has to happen," Georgieva stated. "We cannot possibly have the Ukrainian economy lingering between market economy and non-market economy."

The IMF chief stressed to Ukrainian officials that the VAT reform is non-negotiable and essential for the country's long-term economic health and strategic goals.

"I was very clear. You know, this, you cannot touch it," Georgieva explained. "You need it for you. You need it for EU accession. You need it to attract the private sector to make the business environment more conducive."

The fund plans to assess which required measures can be implemented quickly and which need to be "calibrated" more carefully given the circumstances. In a sign of this calibrated approach, the IMF is discussing a one-year timeframe for Ukraine to build the necessary parliamentary support to pass the controversial tax law.

Trump administration officials have declared a clear policy goal: keeping the nation's coal-fired power plants fully operational to meet rising electricity demand and fuel an industrial revival.

"The goal is 100% open," stated Interior Secretary Doug Burgum. "That's the standard we're operating against."

This directive was announced during the first meeting of the National Coal Council, an advisory panel revived by President Donald Trump after being left inactive under Joe Biden. The move is a cornerstone of Trump's second-term energy strategy, which seeks to reverse the long-term decline of the coal industry.

While the administration projects a bullish future for coal, many analysts remain skeptical, pointing to the persistent economic advantages of natural gas and renewable energy. This policy push also comes as the administration confronts rising electricity prices, a critical issue for voters ahead of the November elections.

The administration is moving aggressively to support coal through a series of regulatory and executive actions. These efforts include:

• Rolling back regulations and subsidies that previously favored emissions-free renewable power.

• Issuing emergency orders through the Energy Department to force certain coal plants to continue operating.

• Blocking state-level closures, as seen when the Environmental Protection Agency rejected a proposal from Colorado to shut down a coal plant.

• Expanding access to resources by opening more federal land for coal leasing in North Dakota, Montana, and Wyoming.

Energy Secretary Chris Wright noted the immediate impact of these policies. "Seventeen gigawatts of coal generation are open today that would not have been open," he said, crediting the emergency orders. "You will not see those coal plants close during this administration."

Wright added that utilities are now proactively contacting the Energy Department to keep their plants online, even as some states advocate for their closure. Burgum, who leads the National Energy Dominance Council, went a step further, predicting the construction of new coal plants—a possibility most industry analysts have dismissed.

The renewed National Coal Council, which met to discuss strategies for maintaining and expanding the US coal fleet, is packed with industry heavyweights. The panel of roughly 60 members includes executives from top producers like Peabody Energy, Warrior Met Coal Inc., Hallador Energy Co., and Nacco Industries Inc. Other members include utility FirstEnergy Corp., railroad Norfolk Southern Corp., and Trump donor Joe Craft, CEO of Alliance Resource Partners. The group is chaired by Peabody Energy CEO Jim Grech and vice-chaired by Jimmy Brock, CEO of Core Natural Resources Inc.

Despite this unified industry front, coal faces steep market challenges. Once the source of over half the country's electricity, coal's share fell to approximately 17% in 2025 and is forecast to drop to 15% this year as utilities favor cheaper natural gas and renewables.

However, a recent surge in US electricity demand has given coal producers a temporary boost. Utilities have delayed some plant retirements, and federal orders have kept others running. This, combined with higher gas prices, led to a 13% increase in electric generation from coal last year. Government forecasts, however, predict the downward trend will resume in 2026.

Administration officials are framing the pro-coal policy as essential to broader national goals. During the council meeting, executives warned against over-reliance on natural gas and stressed the need to protect American mines and control electricity prices.

Wright connected a healthy coal sector to a thriving manufacturing base. Burgum linked it directly to the strategic competition with China over artificial intelligence, arguing that reliable power is critical to winning the AI race.

The effort to support coal has also extended to the financial sector. Wright warned that a court-ordered divestment of coal assets by the world's largest asset managers could severely undermine the industry.

This concern stems from a lawsuit led by Texas Attorney General Ken Paxton against BlackRock Inc., Vanguard Group Inc., and the asset management division of State Street Corp. The suit alleges that the firms violated antitrust laws by colluding through environmental, social, and governance (ESG) initiatives to suppress coal production.

Fossil fuel advocates have long criticized ESG principles for steering capital away from oil, gas, and coal. Former Trump Energy Secretary and Texas Governor Rick Perry estimated that a successful lawsuit could force the firms to sell off $18 billion in coal holdings. He warned such an outcome would pose "a direct threat to coal companies' ability to raise capital, finance infrastructure and support jobs."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up