Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Asian equities rose on Friday, mirroring Wall Street’s tech-led rally, while investors turned their attention to an anticipated Bank of Japan rate hike and its potential implications for the yen, bonds, and regional currencies...

The Indian rupee is likely to hold on to central bank-led recovery on Friday, with softer U.S. inflation offering incremental support, although doubts over the data and potential dollar demand from corporates may cap upside.

The 1-month non-deliverable forward indicated the rupeewill open slightly higher-to-flat versus the U.S. dollar, having settled at 90.24 on Thursday.

The rupee has rallied from around 91 per dollar to current levels, a move that began with heavy Reserve Bank of India intervention soon after the market opened on Wednesday.

Bankers said the central bank stepped in aggressively to disrupt the one-way depreciation pressure that had built up in the currency, triggering position unwinds.

"The RBI has, for now, broken the one-way (higher dollar/rupee) cycle. However, the recovery still looks tentative and more corrective than directional," a senior FX trader at a private bank said.

He noted that economists are flagging concerns over the U.S. inflation data, which caps the spillover benefit for the rupee, adding that he expects substantial dollar-buying interest in the 90–90.20 area.

U.S. consumer prices rose 2.7% year-on-year in November, slowing from a 3.0% increase in the 12 months through September and undershooting expectations of 3.1% print.

Data collection for October was disrupted by the federal shutdown, preventing the publishing of month-to-month changes for November's CPI - creating voids that economists said made the report less reliable than normal.

Economists at Morgan Stanley noted that the weakness in both goods and services could be partly due to methodological issues.

"If these technical factors are the main source of weakness, we could see a re-acceleration later," it said in a note.

While the downside surprise supports the case for further Federal Reserve rate cuts, uncertainty over the data due to the shutdown are likely to limit its impact to an extent, ANZ Bank said in a note.

A liquefied natural gas tanker linked to a Chinese company docked at a US-sanctioned Russian export project for the first time, the latest step by Moscow and Beijing to strengthen energy ties and skirt western curbs.

The Kunpeng, which earlier this year had its ownership and management transfered to little-known firms in China and the Marshall Islands, docked at Gazprom PJSC's Portovaya plant in the Baltic Sea, according to ship-tracking data compiled by Bloomberg. Portovaya is a relatively small export plant that was sanctioned in January by former President Joe Biden's administration.

China, which doesn't recognize the unilateral sanctions, is stepping up its efforts to import Russian gas blacklisted by western nations via so-called shadow fleet vessels. The Asian nation imported its first shipment from the Portovaya facility earlier this month.

The move comes as US President Donald Trump is increasing the pressure on Russia to end the war in Ukraine. Washington is preparing a fresh round of sanctions on Moscow's energy sector, including its shadow fleet, should President Vladimir Putin reject a peace agreement.

Nickel advanced for a third day, extending its rebound from an eight-month low on the prospect of reduced supply from top producer Indonesia.

The metal rose as much as 1.5% on Friday, two days after Indonesia proposed cutting nickel ore production in 2026. The government's work plan budget for next year envisages output of about 250 million tons, down from this year's goal of 379 million tons.

The planned reduction is a response to a slump in nickel prices. The metal, used in stainless steel and electric vehicle batteries, has fallen more than 3% this year and is the only industrial metal on the London Metal Exchange on track for an annual decline. As well as Indonesia, China has raised production at a level outpacing global demand.

Indonesia's plan presents "a risk" for bearish investors at a time when nickel prices have sunk to near the cost of production in the country, said Gao Yin, an analyst at China's Shuohe Asset Management Co. The exit of investors from arbitrage trades involving base metals such as copper and aluminum might also have contributed to this week's gains, she said.

In addition to the proposed reduction in mining, Indonesia's Ministry of Energy and Mineral Resources plans to revise its benchmark pricing formula for nickel ore in early 2026, a move that would classify byproducts such as cobalt as separate commodities subject to royalties, Bloomberg Technoz reported, citing Indonesian Nickel Miners Association Secretary General Meidy Katrin Lengkey.

Most industrial metals have risen this year. Copper has gained around a third, hitting a record $11,952 a ton last week, as robust global demand for a metal crucial to the green transition has coincided with supply disruptions and stockpiling of the metal in the US.

Nickel rose 1.5% to $14,855 a ton on the LME as of 11:10 a.m. in Shanghai. It has gained more than 4% since closing at $14,263 on Tuesday, its lowest since April 9. Copper slipped 0.4% to $11,732 and aluminum edged down 0.1% to $2,914.

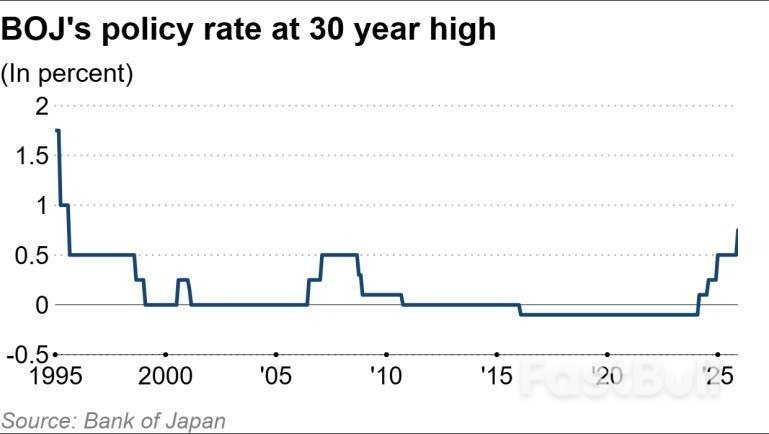

The Bank of Japan on Friday went ahead with the interest rate increase it had been foreshadowing, its first such move in 11 months and one that was made easier by wage growth momentum and receding uncertainty surrounding the impact of U.S. tariffs.

Following a two-day board meeting, the central bank announced that it will bump up its policy rate, an uncollateralized overnight call rate, by 25 basis points to 0.75%. This will be the BOJ's fourth interest rate increase since it exited from negative rates in March 2024.

The bank last hiked rates in January but then put its normalization cycle on pause due to U.S. President Donald Trump's tariff onslaught. Since then, Tokyo and Washington have reached a deal on tariffs, easing anxiety over policy uncertainty.

Board members have been laying the groundwork for a hike. Earlier this month, Gov. Kazuo Ueda hinted that an increase was on the table. At the BOJ's last meeting in October, two of the nine board members suggested a rate increase.

The BOJ's latest Tankan survey, released on Monday, reflected improving business sentiment among large manufacturers, in part thanks to the weak yen.

Wage-growth momentum has been another key measure Ueda has focused on. Positive signs in nominal wage growth -- major unions are preparing to demand a pay raise next fiscal year -- and a tight labor market supported the BOJ's decision to hike rates.

The market largely predicted the BOJ would move ahead with an increase. Data from Totan Research and Totan ICAP as of Thursday put the implied probability of a December rate hike at 97%.

The BOJ's decision comes after the U.S. Federal Reserve last week lowered interest rates for the third time this year.

All eyes are now on BOJ chief Ueda's press conference this afternoon. Market watchers will pay close attention to any comments that might indicate whether the board feels the terminally weak yen calls for the bank to speed up its rate hike cycle.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up