Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Fed delivered a hawkish rate cut amid deep internal splits, signaling limited easing ahead, while upbeat forecasts lifted markets and uncertainty grew over Jerome Powell’s looming replacement and future Fed leadership.

International troops could be deployed in the Gaza Strip as early as next month to form a U.N.-authorized stabilization force, two U.S. officials told Reuters, but it remains unclear how Palestinian militants Hamas will be disarmed.

The officials, speaking on condition of anonymity, said the International Stabilization Force (ISF) would not fight Hamas. They said lots of countries had expressed interest in contributing and U.S. officials are currently working out the size of the ISF, composition, housing, training and rules of engagement.

An American two-star general is being considered to lead the ISF but no decisions have been made, the officials said.

Deployment of the force is a key part of the next phase of U.S. President Donald Trump's Gaza peace plan. Under the first phase, a fragile ceasefire in the two-year war began on October 10 and Hamas has released hostages and Israel has freed detained Palestinians.

"There is a lot of quiet planning that's going on behind the scenes right now for phase two of the peace deal," White House spokesperson Karoline Leavitt told reporters on Thursday. "We want to ensure an enduring and lasting peace."

Indonesia has said it is prepared to deploy up to 20,000 troops to take on health and construction-related tasks in Gaza.

"It is still in the planning and preparation stages," said Rico Sirait, spokesperson of Indonesian Defence Ministry. "We are now preparing the organizational structure of the forces to be deployed."

Israel still controls 53% of Gaza, while nearly all the 2 million people in the enclave live in the remaining Hamas-held area. The plan - which needs to be finalized by the so-called Board of Peace - is for the ISF to deploy in the area held by Israel, the U.S. officials said.

Then, according to the Trump peace plan, as the ISF establishes control and stability, Israeli troops will gradually withdraw "based on standards, milestones, and timeframes linked to demilitarization."

A U.N. Security Council resolution adopted on November 17 authorized a Board of Peace and countries working with it to establish the ISF. Trump said on Wednesday that an announcement on which world leaders will serve on the Board of Peace will be made early next year.

The Security Council authorized the ISF to work alongside newly trained and vetted Palestinian police to stabilize security "by ensuring the process of demilitarizing the Gaza Strip, including the destruction and prevention of rebuilding of the military, terror, and offensive infrastructure, as well as the permanent decommissioning of weapons from non-state armed groups."

However, it remains unclear exactly how that would work.

U.S. Ambassador to the U.N. Mike Waltz noted on Thursday that the ISF was authorized by the Security Council to demilitarize Gaza by all means necessary - which means use of force.

"Obviously that'll be a conversation with each country," he told Israel's Channel 12, adding that discussions on rules of engagement were under way.

Hamas has said the issue of disarmament hasn't been discussed with them formally by the mediators - the U.S., Egypt and Qatar - and the group's stance remains that it will not disarm until a Palestinian state is established.

Israel's Prime Minister Benjamin Netanyahu said in a speech on Sunday that the second phase would move toward demilitarization and disarmament.

"Now that raises a question: Our friends in America want to try and establish a multinational task force to do the job," he said. "I told them I welcome it. Are volunteers here? Be my guest," Netanyahu said.

"We know there are certain tasks that this force can perform ... but some things are beyond their abilities, and perhaps the main thing is beyond their abilities, but we will see about that," he said.

Reporting by Steve Holland and Michelle Nichols, additional reporting by Gribran Peshimam in Jakarta and Maayan Lubell in Jerusalem, Editing by William Maclean

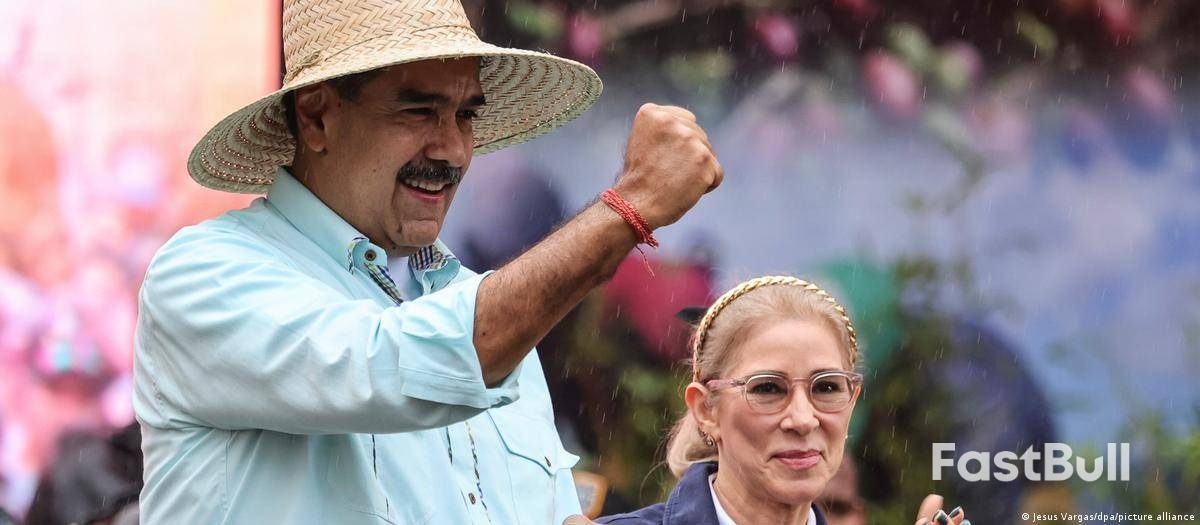

The US Treasury's Office of Foreign Assets Control published the list of sanctions on Thursday that included three nephews of Venezuela's president Nicolas Maduro and his wife Cilia Flores.

It is the latest move by the US in its ongoing political conflict with the Venezuelan regime and it comes a day after it seized an oil tanker off the country's coast.

Known in Venezuela as the 'narco-nephews' for their involvement in drug trafficking,Franqui Flores, Carlos Flores and Efrain Campo have all been denied access to any property or financial assets held in the US, and US companies and citizens can now be penalized for doing business with them.

Panamanian businessman Ramon Carretero, six firms and six Venezuela-flagged ships accused of transporting Venezuelan oil, were also included in the sanctions list.

The Treasury Department alleged that Carretero has had business dealings with Maduro's family and has also facilitated oil shipments on behalf of the Venezuelan government.

"Nicolas Maduro and his criminal associates in Venezuela are flooding the United States with drugs that are poisoning the American people," Treasury Secretary Scott Bessent said in a statement.

"Under President Trump's leadership, Treasury is holding the regime and its circle of cronies and companies accountable for its continued crimes," he added.

Flores and Campo had been jailed for years in the US on narcotics convictions. Flores had already been sanctioned in July 2017, but he was removed from Treasury's list in 2022 during the Biden administration, during an effort to promote negotiations for democratic elections in Venezuela.

Meanwhile, sources familiar with the matter said the US was preparing to seize more oil tankers from Venezuela.

Wednesday's tanker seizure was the first of its kind of an oil cargo or tanker from Venezuela, and it comes as the Trump administration has led a large military buildup in the Caribbean.

White House spokeswoman Karoline Leavitt told reporters she did not comment on the reports of future actions on oil tankers, focusing instead on the sanctions package.

"We're not going to stand by and watch sanctioned vessels sail the seas with black market oil, the proceeds of which will fuel narcoterrorism of rogue and illegitimate regimes around the world," Leavitt said.

A reduction or halt in Venezuelan oil exports would certainly strain the Maduro government's finances.

The total value of building permits increased 14.9% from the month before to a seasonally adjusted 13.82 billion Canadian dollars, the equivalent of $10.03 billion, Statistics Canada said Friday.

That was much stronger than the 1.4% drop expected for the month by economists, according to TD Securities, and builds on the upwardly revised 5.9% rise in permits in September.

On a year-over-year basis, the overall value of permits issued last month was up 9.6%.

Building permits provide an early indication of construction activity in Canada and are based on a survey of 2,400 municipalities, representing 95% of the country's population. The issuance of a permit doesn't guarantee that construction is imminent.

Housing starts across Canada slumped 17% in October from a month prior on a seasonally adjusted annualized basis, rolling back a 14% increase in September, Canada Mortgage and Housing Corp. said last month. The six-month moving trend for starts was down 3.0% for the month.

Statistics Canada's data showed construction intentions in the residential sector climbed 14.6% from the previous month to C$8.56 billion, following a 6.6% rise in the value of permits the month before.

Intentions to build multifamily dwellings surged 21.3%, buoyed by the province of Ontario, and specifically the Toronto metropolitan area. Intentions for single-family homes rose a more modest 1.8%, with the gains being primarily attributed to Alberta.

Across Canada, a total of 24,300 multi-family dwellings and 4,100 single-family homes were authorized in October, marking a 13.6% increase from the previous month. Year-to-date, the average number of multi-family dwellings authorized stood at 21,500 a month, up from 19,100 during the same period last year.

Permits for nonresidential buildings were also strongly higher for the month, rising 15.4% to C$5.25 billion, the data agency said. That included a rise in permits for commercial and institutional buildings, more than making up for a dip in industrial plans.

Federal Reserve Bank of Cleveland President Beth Hammack said she would prefer interest rates to be slightly more restrictive to keep putting pressure on inflation, which is still running too high.

"Right now, we've got policy that's right around neutral," Hammack said Friday during an event in Cincinnati. "I would prefer to be on a slightly more restrictive stance to help continue to put pressure" on the inflation side of the central bank's mandate, she said.

Fed officials delivered a third consecutive rate reduction earlier this week, but a large group of regional bank presidents signaled they opposed the cut. Two officials, Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeff Schmid, officially dissented against the move, saying they preferred to leave rates unchanged. And six policymakers penciled in rate projections suggesting they also opposed a cut.

Hammack didn't vote on monetary policy decisions this year but will vote in 2026. Asked if she supported this week's rate reduction, she didn't directly answer the question but said it was a "complicated decision" since officials are facing pressure on both sides of their mandate.

The Cleveland Fed chief cautioned last month that lower interest rates could prolong the period of above-target inflation. She has previously said that she opposed the rate cut in October and saw little reason for a reduction in December.

Hammack said she is grateful policymakers will receive key data on prices and employment in the coming weeks that should help them understand the trends in the economy — after their publication was delayed by a federal government shutdown. She also said the Fed doesn't have the appropriate tools to address structural changes in the economy.

Inflation has been running above the Fed's 2% target for several years, and has recently been stuck closer to 3%, Hammack said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up