Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The stock market can experience sudden and extreme price movements due to various factors, including economic events, geopolitical tensions, and investor sentiment.

The stock market can experience sudden and extreme price movements due to various factors, including economic events, geopolitical tensions, and investor sentiment. To prevent excessive volatility and maintain market stability, regulatory bodies have implemented mechanisms known as circuit breakers. These measures temporarily halt trading when prices move beyond predetermined thresholds, giving investors time to reassess their decisions and preventing panic-driven sell-offs. In this article, we explore the meaning of circuit breakers, their mechanism, and how they could affect your trading.

Circuit breakers are regulatory mechanisms designed to temporarily halt trading on an exchange to prevent extreme volatility and panic selling. These measures were introduced following the 1987 stock market crash, also known as "Black Monday," to protect market stability and allow investors to reassess their positions during periods of excessive price fluctuations.

Circuit breakers apply to both individual stocks and entire stock indices, such as the S&P 500. They are triggered when prices move beyond predefined percentage thresholds within a given timeframe, pausing trading for a specified duration to provide a cooling-off period. This pause allows market participants to digest information, reassess their positions, and reduce the likelihood of impulsive or panic-driven trades.Circuit breakers are implemented in many stock exchanges; therefore, they can have different names and be based on different conditions.

In the US, for example, stock exchanges implement market-wide circuit breakers (MWCB), which are triggered based on percentage declines in the S&P 500 index, compared to the previous day's closing price. A decline to and below the specific threshold causes cross-market halts.

There is another mechanism called the Limit Up-Limit Down (LULD). It is designed to prevent individual stocks from experiencing extreme price swings in short periods. This system sets price bands based on the average stock price over the preceding five minutes, limiting how much a stock can rise or fall. If a stock's price moves outside the established range and doesn’t recover within 15 seconds, trading is paused for five minutes to stabilize price movements and prevent excessive volatility.

Stock exchanges set circuit breakers based on a stock’s volatility, liquidity, and past trading behaviour. More volatile or thinly traded shares usually have tighter limits, while highly liquid, large-caps may have wider bands. Exchanges periodically review and adjust these limits based on recent price movements and trading activity.

Some stocks have dynamic price bands, where circuit limits expand if a stock consistently trades near its upper or lower band. This prevents artificial price freezes and allows for better price discovery. Moreover, not all stocks have limits. Certain highly liquid derivatives and index-heavy shares may have no intraday price restrictions, as their deep order books naturally absorb volatility.Traders monitor circuit limits closely since stocks hitting these thresholds often indicate strong momentum or panic-driven moves.

When a stock touches circuit breakers, trading doesn't continue as usual.

If a stock reaches its upper band, buy orders often flood in, but sellers become scarce—most holders aren’t keen to part with their shares when prices spike suddenly. This creates an imbalance with lots of demand but very little supply. The exchange then temporarily halts trading or moves into a brief cooling-off period. During this pause, traders can reassess their positions, and new orders might line up, helping the exchange determine the appropriate price once trading resumes.

Conversely, when a stock hits its lower band, panic selling typically dominates, causing a sharp price drop. Buyers vanish as traders hold back, wary of further declines. Just like in the previous scenario, trading usually stops temporarily. Without buyers stepping in, traders can find themselves stuck with shares they're keen to offload but can't because of the halt.

Trading halts triggered by circuit hits can last from a few minutes to several hours, depending on exchange rules and how severe the price swings are. Sometimes, exchanges extend these halts repeatedly if imbalances persist, causing prolonged trading freezes. In some cases, limits are relaxed progressively, allowing trading to restart gradually and prices to stabilise through natural market forces.

Circuit breakers play a crucial role in shaping market conditions, affecting both stock investors and those trading derivatives, e.g. Contracts for Difference (CFDs). These price bands influence liquidity, risk exposure, and sentiment, making them key considerations for anyone dealing with price movements, whether in the underlying stock or through leveraged instruments like CFDs.

When a stock hits its upper band, sellers may disappear, leaving buy orders unfilled. Conversely, at a lower band, buyers vanish, creating a backlog of sell orders. For stock traders, this means difficulty executing trades at desired prices. For CFD traders, liquidity issues can be even more pronounced—since CFDs track the underlying stock, brokers may restrict trading or widen spreads when circuit limits are hit. If trading is paused, CFD positions can become temporarily untradeable, increasing exposure to further market swings.

Since CFDs often involve leverage, even small price differences can have outsized effects. If a stock is locked at a circuit limit for an extended period, the next available price when trading resumes can be significantly different from where it halted. This creates gaps, causing slippage—where orders execute at a worse price than expected. In extreme cases, stop-loss orders might not trigger until after a major price movement, leading to larger-than-anticipated losses.

Circuit limits help prevent excessive volatility, but they don’t remove risk. A stock that repeatedly hits its limit can leave traders unable to exit, leading to prolonged exposure. CFD traders face additional challenges, as margin calls can occur when positions move against them, potentially triggering forced liquidations once trading reopens.

Stocks consistently hitting circuit breakers often indicate extreme sentiment—either speculative interest or panic-driven selling. Traders analyse whether price moves are supported by high volume or driven by short-term speculation. If a stock is reaching its limits on low liquidity, the move may be unsustainable. Understanding these dynamics may help traders assess whether momentum is genuine or artificially fuelled.

Circuit breakers aren’t just theoretical—they’ve been triggered during some of the most dramatic market moves in history.

In March 2020, as COVID-19 fears sent global markets into freefall, the S&P 500 hit its Level 1 circuit breaker (7% drop) multiple times, triggering 15-minute trading halts. On 9th, 12th, 16th, and 18th March, panic selling caused these automatic pauses as investors rushed to offload assets amid uncertainty. Despite these measures, the market continued declining, proving that circuit breakers can slow momentum but don’t necessarily reverse sentiment.

During the GameStop short squeeze in early 2021, GME hit the limit up multiple times as retail traders fuelled an unprecedented rally. Trading halts were repeatedly triggered as GME soared from $20 to over $400 in weeks. However, when momentum reversed, limits down kicked in, with the stock plunging over 60% in a single session. This showed how circuit breakers can amplify volatility, trapping traders on both sides of extreme moves.

On 18th May 2009, the Sensex surged by 17.24% and the Nifty 50 jumped 17.33%, triggering the upper circuit twice in a single day. Trading was halted for two hours at 9:55 AM, and when the market reopened at 11:55 AM, another surge led to a second halt for the rest of the day. The surge occurred the day after the results of the 2009 Indian general elections, where the UPA (United Progressive Alliance) secured a decisive victory.

While circuit limits may help regulate extreme price swings, they also introduce risks that traders need to consider. These restrictions can affect liquidity, execution, and market behaviour, sometimes leading to unintended consequences.

FAQ

What Is a Circuit Breaker in Trading?

A circuit breaker in trading is a regulatory mechanism that temporarily halts trading in a stock or an entire market when prices move beyond a predefined percentage in a short period. This is designed to prevent panic selling or excessive speculation, allowing traders to reassess market conditions. Circuit breakers can apply at the index level (e.g., Nifty 50, S&P 500) or individual stocks.

What Is the Difference Between a Circuit Breaker and a Trading Halt?

A circuit breaker is a rule-based mechanism that automatically halts trading when the market or a stock moves significantly in a short time. It can trigger at different levels (e.g., 5%, 10%, 20%).A trading halt is a temporary suspension of trading imposed by exchanges or regulators due to specific events such as major announcements, news affecting a company, or regulatory concerns.Circuit breakers are predefined and automatic, while trading halts can be discretionary and event-driven.

Daily Light Crude Oil Futures

Daily Light Crude Oil Futures USDCHF Daily

USDCHF Daily USDCHF 4 hour

USDCHF 4 hour USDCHF 1 hour

USDCHF 1 hourFederal Reserve Bank of Kansas City President Jeff Schmid said he favors keeping interest rates on hold for the time being to prevent robust economic activity from adding to inflation pressures.

“With the economy still showing momentum, growing business optimism, and inflation still stuck above our objective, retaining a modestly restrictive monetary policy stance remains appropriate for the time being,” Schmid said Tuesday in remarks prepared for an event in Oklahoma City.

He added that he’s ready to change his views if demand growth starts “weakening significantly.”

Fed officials have left interest rates on hold at each of their five meetings this year as they waited to see how tariffs and other policies would impact the economy. With the latest data showing a sharp slowdown in hiring and relatively muted inflation, investors are pricing in a quarter-point rate cut at the next policy meeting in September.

Schmid, who votes on monetary policy decisions this year, said the current environment of moderate demand growth and a cooling labor market is helping temper the pass—through of tariffs to inflation, and that the Fed has a key role to play in that.

“The Fed cannot offset the effect of higher tariffs on prices, but what the Fed can do is monitor demand growth, provide space for the economy to adjust and keep inflation on a path to 2%,” Schmid said. “Overall, I am anticipating a relatively muted effect of tariffs on inflation, but I view that as a sign that policy is appropriately calibrated rather than a sign that the policy rate should be cut.”

A report released earlier Tuesday showed the consumer price index, excluding volatile food and energy prices, increased 0.3% in July from a month earlier. While that marked an acceleration, the data suggested the impact of tariffs on goods prices was more modest than in June.

Amid a blizzard of contradictory signals, it's becoming increasingly difficult to get any visibility on the U.S. labor market. But of all the numbers that feed into the all-important unemployment rate, the one worth paying most attention to may be continuing weekly jobless claims.

Federal Reserve Chair Jerome Powell has said that while he and his colleagues look at the "totality" of the data, the best gauge of the health of the labor market is the unemployment rate. That's currently 4.2%, low by historical standards, and consistent with an economy operating at full employment.

But it is a lagging indicator, meaning that once it starts to rise sharply, the economy will probably already be in a very precarious position. And it is also being depressed by labor demand and supply factors unique to the U.S.'s current high tariff, low immigration era.

Economic growth is slowing. Broadly speaking, it is running at an annual rate of just over 1%, half the pace seen in the last few years. Unsurprisingly, firms' hiring is slowing too.The latest Job Openings and Labor Turnover Survey, or JOLTS, showed hiring in June was the weakest in a year, while July's nonfarm payrolls report and previous months' revisions were so disappointing that President Donald Trump fired the head of the agency responsible for collecting the data.

But the unemployment rate isn't rising, largely because firms aren't firing workers. Why? Perhaps because they are banking on tariff and inflation uncertainty lifting in the second half of the year. It's also possible that firms are still scared form the post-pandemic labor shortages.Whatever the reason, the pace of layoffs simply has not picked up, the monthly JOLTS surveys show. Layoffs in June totaled 1.6 million, below the averages of the last one, two and three years.Meanwhile, lower immigration, increased deportations, and fewer people re-entering the labor force are offsetting weak hiring, thus keeping a lid on the unemployment rate. The labor force participation rate in July was 62.2%, the lowest since November 2022.

And what about weekly jobless claims, another key variable in the labor market picture? In previous slowdowns, rising layoffs would be reflected in a spike in the number of people claiming unemployment benefits for the first time.That's not happening either. Last week's 226,000 initial claims were right at the average for the past year, and only a few thousand higher than the averages over the past two and three years."It's a low fire, low hire economy," notes Oscar Munoz, U.S. rates strategist at TD Securities.

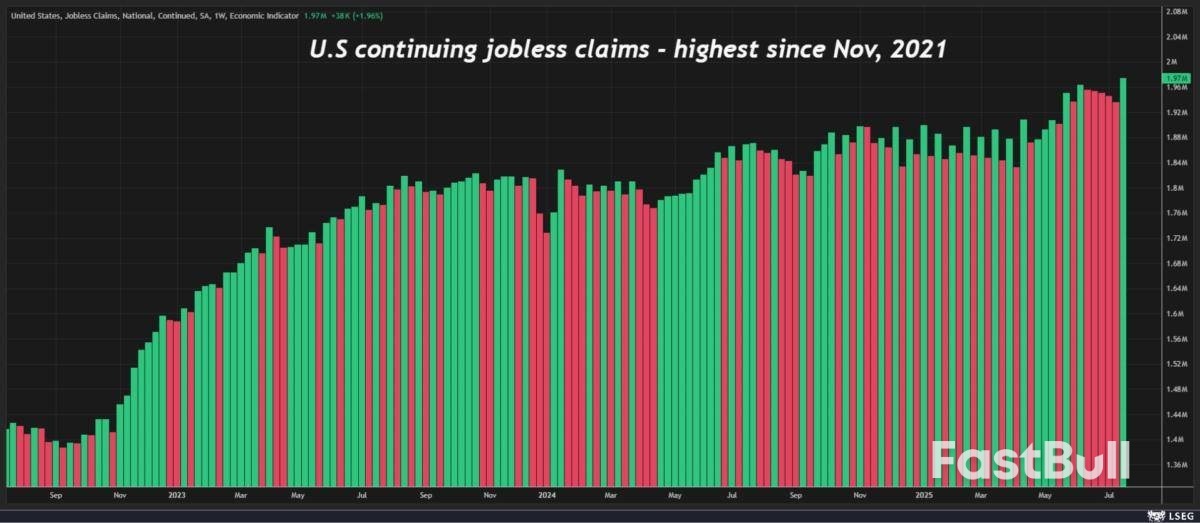

One high-frequency number that has gone under the radar, but which merits more attention is continuing jobless claims, which measures the number of workers continuing to file for unemployment benefits after losing their jobs. Rising continued claims suggest people actively looking for a job are struggling to get one, a sign that the labor market could be softening.

That figure spiked last week to 1.97 million, the highest since November 2021, which in theory should put upward pressure on the unemployment rate.Using the 'stock' versus 'flow' analogy, continuing claims are the 'stock,' and weekly claims are the 'flow'. Everyone will have their own view on what's more important, but right now initial claims are offering no guidance while continuing claims are pointing to softening in the job market.

Munoz and his colleagues at TD Securities estimate that continuing claims of around 2.2 million would be consistent with an unemployment rate of 4.5%, a level of joblessness most economists agree would prompt the Fed to trim rates.That's also the year-end unemployment rate in the Fed's last economic projections from June, a set of forecasts which also penciled in 50 bps of easing by December.An unemployment rate of 4.4% would probably tip the balance on the Federal Open Market Committee, while 4.3% would make it a much closer call, perhaps a coin toss.

Further muddying the picture, other indicators suggest the labor market is ticking along nicely. July's payrolls report showed that average hourly earnings last month rose at a 3.9% annual rate, consistent with the level seen in the past year. And the average number of hours worked was 34.3 hours, right at the mean for the past two years.These numbers and the JOLTS data are released monthly, and there will be one more of each before the Fed's September 16-17 policy meeting.But if the increased focus on the unemployment rate means investors want a more regular labor market temperature check, they should keep a close eye on weekly continuing claims.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up