Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices came under pressure yesterday, with ICE Brent settling about 2.1% lower. Some of the downward pressure is derived from reports that the US and Russia are working on a new peace plan for Ukraine.

Oil prices came under pressure yesterday, with ICE Brent settling about 2.1% lower. Some of the downward pressure is derived from reports that the US and Russia are working on a new peace plan for Ukraine. However, with suggestions that the plan is favourable towards Russia, it may be unlikely that Ukraine will back it. Signs that the US is still trying to work on a deal eases some concerns over further sanctions against Russia and also how strongly current curbs will be enforced.

The Energy Information Administration (EIA) released its weekly US inventory data yesterday, reporting that US commercial crude oil inventories fell by 3.43m barrels over the week. The decline was driven by stronger crude exports, which grew 1.34m b/d week on week. Refiners also increased run rates, leading to stronger crude oil inputs. Stronger run rates shouldn't be too surprising, given the strength in refinery margins, while refiners are also exiting maintenance season. Changes in inventory for refined products were more bearish. Gasoline inventories increased by 2.33m barrels, while distillate stocks edged up by 171k barrels. Implied gasoline demand was also weaker, falling by 500k b/d WoW. The more bearish gasoline numbers saw the Reformulated Blendstock for Oxygenate Blending (RBOB) crack coming under some pressure yesterday.

European gas prices also traded lower yesterday, with the Title Transfer Facility (TTF) settling almost 2.4% lower. Reports of peace talks between Russia and the US weighed on prices. However, colder weather has led to gas storage falling at a faster pace over the last few days. EU gas storage is now 81% full, down from a peak of just over 83% in mid-October. Meanwhile, the latest positioning data shows that investment funds cut their net long in TTF by 8.7TWh to 15.6TWh, the smallest net long since March 2024. This was driven by fresh shorts entering the market, with the gross short rising by 19TWh to 434.3TWh, yet another record gross short. It leaves the market vulnerable to a short-covering rally in the event of any supply surprises or extended cold snaps over the winter.

Chile, the biggest copper producer, raised its price forecasts for this year and next. The country's copper agency Cochilco cited global supply disruptions, lower interest rates, a weaker dollar and global economic resilience. Copper is expected to average $4.45 a pound this year and $4.55 in 2026, according to Cochilco's quarterly report. It previously forecast $4.30 for both this year and next.

Copper supply has been hit by a wave of disruptions this year, including an accident at El Teniente mine in Chile in July.

Cochilco now expects no production growth in Chile for the year, down from a previous forecast of 1.5%. In 2026, Chilean production is forecast to grow 2.5% to 5.6 million metric tonnes. However, a key assumption about next year's growth is that El Teniente will operate as normal, which Codelco says is unlikely.

Sugar prices rose yesterday before giving back all of these gains. Reports that India is considering raising ethanol prices provided support, as it could mean more sugar being diverted to ethanol production, helping to eat into the large global surplus expected. Meanwhile, in Brazil, mills should also be moving to favouring ethanol over sugar production, with sugar prices trading below ethanol parity.

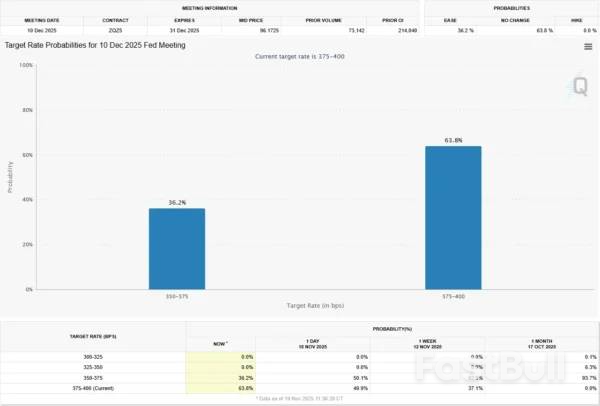

Markets are bracing for the release of September Jobs data from the US now that the US Government shutdown has come to an end. The report comes at a time when US rate cut expectations have fallen significantly since the Fed's October meeting thanks in part to a hawkish Jerome Powell and the lack of official Government data.

Expectations for a rate cut have declined from around 90% ahead of the Fed's October meeting to around 49% at the time of writing, which makes tomorrow's jobs report even more significant. Market participants have been tracking private data releases such as the ADP number which has shown persistent labor market weakness and yet rate cut expectations have continued to fall.

It was confirmed today that the October Jobs report will not be released, while the November report will only be released on December 16, 2025 which is after the December Fed meeting.

This means the Fed will have tomorrow's data only to peruse ahead of the Fed Meeting next month. Rate cut bets have fallen another 13% after the announcement, now down to 36%.

The September monthly jobs report from the Bureau of Labor Statistics (BLS) is finally coming out after the government shutdown. Since the October report might not be released, this September data is a key, possibly one of the last, major pieces of information about the job market before the Federal Reserve (FOMC) meets in December.

Economists and traders generally expect the report to show that the US added about 50,000 new jobs in September, that the average worker's pay increased by 0.3% compared to the month before (or 3.7% year-over-year), and that the main unemployment rate (U3) stayed the same at 4.3%.

The Federal Reserve is already in a difficult position heading into tomorrow's data release and market participants will be hoping for more clarity. This would require either a significant beat of expectations which may strengthen the case for no rate cut or a significant miss of expectations which could lead to an increase in rate cut expectations.

This would undoubtedly be the best case scenario as a reading in line with consensus could leave market participants with more questions than answers.

The market's reaction to the NFP report will not be uniform, but rather dependent on the deviation from consensus forecasts. These are the potential reactions we could see depending on how the data comes out and is received.

The US Dollar is at an interesting inflection point with tomorrow's data pivotal to the greenbacks immediate move.

The US Dollar Index (DXY) is at a critical inflection point having just risen back above the crucial 100.00 level and the 200-day MA.

This is the third time the index has risen above the 100.00 mark for the third time since the end of July. However, the index has failed to gain acceptance above this level with each foray above the level having been met by significant selling pressure.

Immediate resistance rests at 100.61 before the 102.00 handle comes into focus.

Acceptance above the 100.00 mark is needed if the DXY is to continue its advance. The overall trend remains bullish with a daily candle close below 99.20 invalidating the bullish narrative.

US Dollar Index (DXY) Daily Chart, November 19, 2025

Key points:

When President Donald Trump began an extraordinary campaign this summer pressuring Republican lawmakers to redraw state congressional maps, starting with Texas, some Democrats feared it could hand a dozen new seats to Republicans in next year's midterm elections.

Since then, however, a series of court rulings and aggressive moves by Democrats have dented Trump's plan, leaving the eventual winners of thenationwide redistricting warunclear.

With Republicans clinging to the smallest of majorities in the U.S. House of Representatives, even small shifts from state to state could impact the race for control of Congress in 2026.

Pending court cases and ongoing redistricting discussions may still improve one party's chances over the other, but analysts say the Republican advantage has diminished.

"I think you could argue that the parties have basically fought each other to a draw," said Michael Li, a redistricting expert at the Brennan Center for Justice at New York University. "The Democrats have played what many people thought was a weak hand really well."

Redistricting typically occurs once a decade to account for new U.S. Census data, and lawmakers from both parties have used that process to draw maps more favorable to their side, a practice known as gerrymandering. But Trump's push has prompted nearly a dozen states to undertake or consider redistricting mid-decade, shattering longstanding norms.

A divided three-judge panel on Tuesday threw out the new map passed by Texas Republicans – the centerpiece of Trump's effort – ruling that lawmakers had illegally diluted racial minorities' voting power.

That map was designed to flip as many as five Democratic seats to the Republican ledger, though the U.S. Supreme Court could still decide to leave it in place for 2026.

Meanwhile, a handful of Republicans in Indiana and Kansas have thus far resisted threats and pressure from Trump and his allies to draw new maps. In Ohio, a Republican-led commission approved a new map that boosted Republicans but fell far short of the more aggressive redistricting some analysts had expected.

On the Democratic side, California voters overwhelmingly approved Governor Gavin Newsom's proposal to sidestep an independent redistricting commission and implement a new map that targets five Republican incumbents in response to Texas, a gambit even some Democrats viewed as far-fetched when he first suggested it.

Virginia Democrats are advancing their own complicated constitutional maneuver to advance a new map that would take aim at two or three Republicans. And in Utah, a judge recently found a Republican-drawn map unconstitutional and replaced it with a new plan that is all but certain to give Democrats a new representative there.

Trump's redistricting effort was intended to brace the slim Republican House majority for significant headwinds, including his own unpopularity, a string of impressive Democratic election performances and the historical lesson that the party of the president usually loses seats in midterm elections.

The White House did not respond to a request for comment on Wednesday.

Justin Levitt, a professor at Loyola Law School and a redistricting expert, said that redistricting alone would not be enough to overcome a "wave" year.

"Redistricting is not destiny - it's more like a seawall that can stop mild tides from coming in," he said. "A tsunami will come right over the top of that seawall."

There remain plenty of uncertainties that could still alter the redistricting landscape ahead of the 2026 election.

Texas Attorney General Ken Paxton said the state will appeal Tuesday's decision to the Supreme Court. With the state's filing deadline less than three weeks away, the court is expected to move quickly.

"Texas' map was drawn the right way for the right reasons," U.S. Attorney General Pam Bondi said on Tuesday. "We look forward to Texas' victory at the Supreme Court."

Florida Governor Ron DeSantis has expressed support for a new map, which could target two or three Democratic representatives. Some Democrats in Maryland and Illinois have weighed launching their own redistricting efforts.

In Missouri, where Republicans passed a new map dismantling a Democratic district in Kansas City, Democrats are trying to put the measure to a voter referendum. The new maps in California and Utah could also be subject to further judicial review.

Looming over the entire national fight is a pending case before the Supreme Court challenging a key provision of the Voting Rights Act, which protects minority voters.

A decision striking down that section in the coming months could open the door for several Republican-controlled Southern states to eliminate a half dozen Democratic seats or more.

Erin Covey, a House analyst with the nonpartisan Cook Political Report, estimated that Republicans will gain three or four seats when all is said and done - if the Texas map is eventually upheld.

A best-case scenario for Republicans could see them pick up approximately seven seats, while a best-case scenario for Democrats would hand them around a five-seat gain, she said.

"The upside for Republicans looks increasingly small," she said.

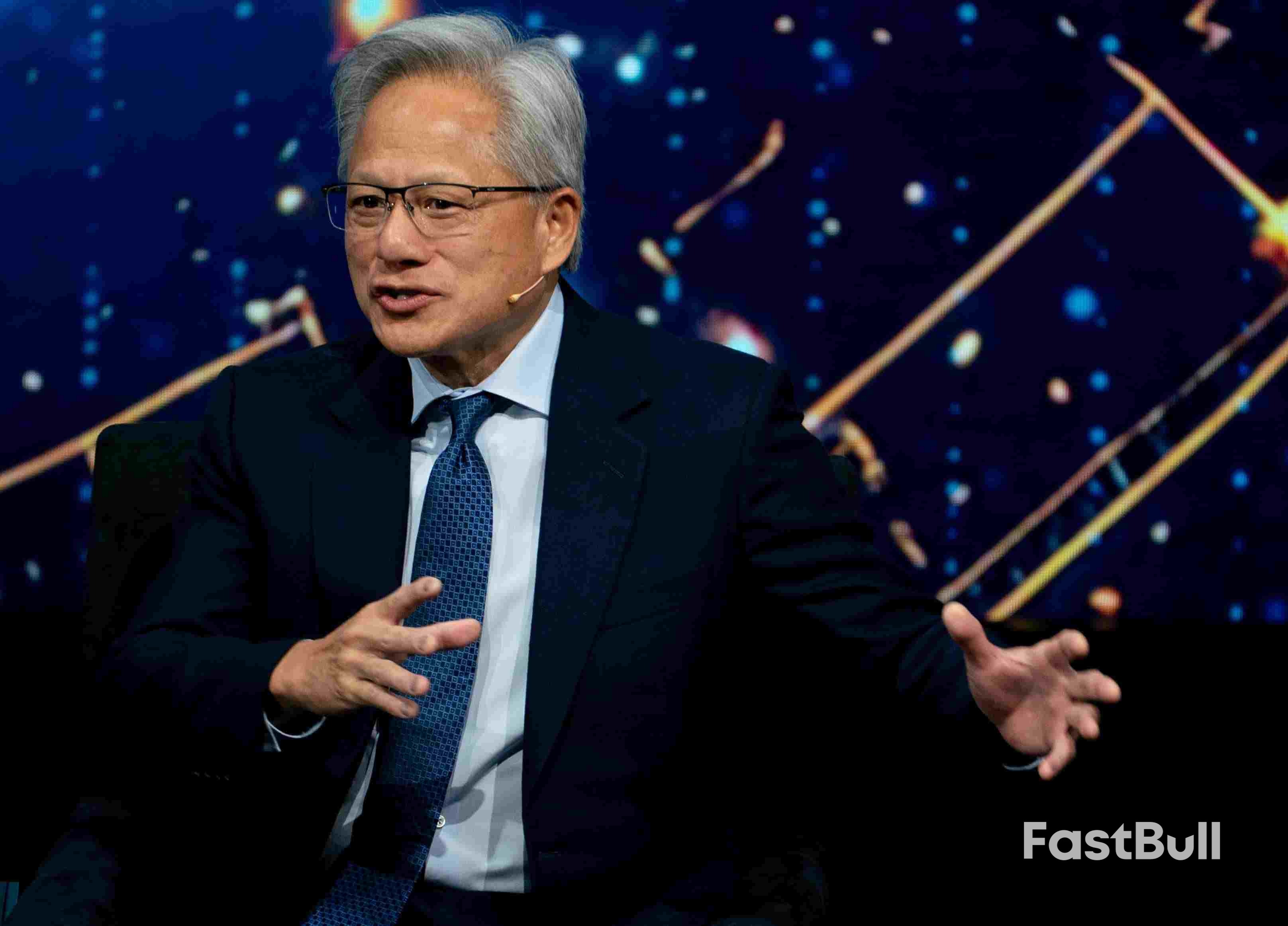

In the weeks leading up to Nvidia's third-quarter earnings report, investors debated whether the markets were in an AI bubble, fretting over the massive sums being committed to building data centers and whether they could provide a long-term return on investment.

During Wednesday's earnings call with analysts, Nvidia CEO Jensen Huang began his comments by rejecting that premise.

"There's been a lot of talk about an AI bubble," Huang said. "From our vantage point we see something very different."

In many respects, Huang's remarks are to be expected. He's leading the company at the heart of the artificial intelligence boom, and has built its market cap to $4.5 trillion because of soaring demand for Nvidia's graphics processing units.

Huang's smackdown of bubble talk matters because Nvidia counts every major cloud provider — Amazon, Microsoft, Google, and Oracle — as a customer. Most of the major AI model developers, including OpenAI, Anthropic, xAI and Meta, are also big buyers of Nvidia GPUs.

Huang has deep visibility into the market, and on the call he offered a three-pronged argument for why we're not in a bubble.

First, he said that areas like data processing, ad recommendations, search systems, and engineering, are turning to GPUs because they need the AI. That means older computing infrastructure based around the central processor will transition to new systems running on Nvidia's chips.

Second, Huang said, AI isn't just being integrated into current applications, but it will enable entirely new ones.

Finally, according to Huang, "agentic AI," or applications that can run without significant input from the user, will be able to reason and plan, and will require even more computing power.

In making the case of Nvidia, Huang said it's the only company that can address the three use cases.

"As you consider infrastructure investments, consider these three fundamental dynamics," Huang said. "Each will contribute to infrastructure growth in the coming years."

In its earnings release, Nvidia reported revenue and profit that sailed past estimates and issued better-than-expected guidance. Last month, Huang provided a $500 billion forecast for sales of the company's AI chips over calendar 2025 and 2026.

The company said on Wednesday that its order backlog didn't even include a few recent deals, like an agreement with Anthropic that was announced this week or the expansion of a deal with Saudi Arabia.

"The number will grow," CFO Colette Kress said on the call, saying the company was on track to hit the forecast.

Prior to Wednesday's results, Nvidia shares were down about 8% this month. Other stocks tied to the AI have gotten hit even harder, with CoreWeave plunging 44% in November, Oracle dropping 14% and Palantir falling 17%.

Some of the worry on Wall Street has been tied to the debt that certain companies have used to finance their infrastructure buildouts.

"Our customers' financing is up to them," Huang said.

Specific to Nvidia, investors have raised concerns in recent weeks about how much of the company's sales were going to a small number of hyperscalers.

Last month, Microsoft, Meta, Amazon and Alphabet all lifted their forecasts for capital expenditures due to their AI buildouts, and now collectively expect to spend more than $380 billion this year.

Huang said that even without a new business model, Nvidia's chips boost hyperscaler revenue, because they power recommendation systems for short videos, books, and ads.

People will soon start appreciating what's happening underneath the surface of the AI boom, Huang said, versus "the simplistic view of what's happening to capex and investment."

Mexican authorities on Wednesday announced the arrest of an alleged mastermind in the assassination of a popular opposition mayor, a vocal critic of the government's security policies whose murder has shocked the country and sparked mass protests.

Carlos Manzo, the mayor of Uruapan in the major avocado-producing state of Michoacan, was shot and killed during a public Day of the Dead celebration on November 1 while he was with his family. Manzo had repeatedly accused the federal government of failing to act against organized crime.

Security Minister Omar Garcia Harfuch identified the detainee as Jorge Armando 'N,' withholding his last name as is custom in Mexico. He said investigations linked the man to a criminal group in Michoacan that works for the powerful Jalisco New Generation Cartel.

"This arrest represents a key step in dismantling the criminal structure responsible for this attack," Garcia said at a press conference.

He added that an analysis of cell phones from previously detained suspects "allowed for the identification of a messaging group where the attack was coordinated."

Following the murder, President Claudia Sheinbaum deployed over 10,500 security force members to Michoacan under a new plan to combat extortion and dismantle criminal gangs. Manzo's wife has since succeeded him as mayor of Uruapan.

While several other suspects in the murder have been arrested or killed, including a minor, authorities have not yet clarified the motive for the attack.

Conservationists in Cambodia have for the first time released two captive-bred Greater Adjutant Stork chicks into the wild as part of an ongoing programme to revive a species under threat from poaching and habitat loss.

The nine-month-old storks - a male and a female - were fitted with GPS trackers before their release into the Siem Pang Wildlife Sanctuary, a protected area overseen by Cambodia's Rising Phoenix conservation group.

"This place is perfect because there are still wild Greater Adjutants in the area," said Jack Willis, who leads research at the Angkor Centre for Conservation of Biodiversity (ACCB).

"We're hoping by releasing them here that they could perhaps join a colony, but also this area is very well protected by Rising Phoenix and the Ministry of Environment."

The Greater Adjutant Stork, with its distinctive large black wings and long neck, was once listed as endangered on the International Union for Conservation of Nature's Red List. It is now classified as "Near Threatened" after decades of conservation efforts reversed a decline in population.

According to ACCB data, an estimated 1,500 mature Greater Adjutant Storks remain in the wild globally, including 200 to 250 in Cambodia, with the rest mostly in northeast India.

Willis said their future remained precarious.

"It could take one, one big event and we could lose an awful lot in Cambodia," he said in an interview, adding that captive breeding was necessary to head off the threat of extinction.

ACCB currently has three rescued pairs of Greater Adjutant Storks at its conservation centre in Siem Reap province, but only one pair has successfully produced chicks.

Storks rescued from wildlife traffickers lack the parenting skills learned in the wild, making it harder for them to rear their young.

The centre does not expect the newly released storks to join the wild population immediately. The birds normally head to breeding sites in the Prek Toal sanctuary in late October, but this migratory behaviour is usually learned from the adult members of a colony.

Though meticulous efforts have been made to acclimatise the birds to their new surroundings, Willis said it would be considered a success if they survive their first three to four months in the wild.

"This allows us to ideally develop the protocol for the conservation of Greater Adjutants and potentially similar species of storks like Lesser Adjutants," he said.

Australian shares advanced on Thursday, poised to snap three consecutive sessions of losses, as broad-based buying lifted most sectors, with heavyweight mining and banking stocks leading the rally.

The S&P/ASX 200 indexwas up 0.7% at 8,509.80, as of 2321 GMT, but still down nearly 7% since touching a record high on October 21. The benchmark fell 0.3% to close at a five-month low on Wednesday.

Minersrose nearly 1% on Thursday, moving in tandem with solid gains in iron ore and copper prices. Sector majors BHPand Rio Tintoadvanced 0.6% and 0.5%, respectively.

Gold minersalso added to the gains, up 1.1%, on higher bullion prices. Index leaders Northern Star Resourcesand Evolution Miningclimbed 0.5% and 1.5%, respectively.

Local lithium miners rose on the day, buoyed by a rebound in demand for the battery metal following Chilean miner SQM's upbeat quarterly results. Pilbara Mineralsand IGOsurged 3.5% and 4.2%, respectively.

Financialsrose 0.5%, with top lender Commonwealth Bank of Australiaedging 0.5% higher.

However, the banking sub-index is still down nearly 8% so far this month, eyeing its weakest monthly move since June 2022, as investors contended with margin pressures and fierce competition within the sector.

Technology stockssurged 4.1%, eyeing their strongest trading session since mid-April. The sub-index tracked its Wall Street peers higher after artificial intelligence darling Nvidiaforecast quarterly revenue above market estimates, temporarily calming investor nerves frayed over concerns that an AI boom has outrun fundamentals.

Logistics software maker WiseTech Globalrose 3.3%, while accounting software provider Xeroadvanced 3.2%.

Healthcare stocksrose 1% and the consumer discretionary sub-index (.AXDJ) advanced 0.9%.

Energy stocksbucked the broader gains, slipping 0.3%, as oil prices eased on a renewed U.S. push to end Russia's war in Ukraine, which tempered supply concerns. Woodside Energyfell 0.7% while Santosdropped 0.9%.

Across the Tasman Sea, New Zealand's benchmark S&P/NZX 50 indexinched 0.3% higher to 13,360.84.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up