Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Zelenskiy said in a social media post later Friday that he spoke with US Vice President JD Vance and Army Secretary Dan Driscoll, who traveled to Kyiv to discuss the issue, for almost an hour.

The $7 trillion market for securities linked to US inflation will employ fallback mechanisms for the first time after the longest government shutdown in history derailed economic data collection.

The nation's Bureau of Labor Statistics said it was cancelling its October consumer price index report, saying it was unable to retroactively collect some data. The inflation-protected segment of the US Treasury bond market and US inflation derivatives both use the CPI to determine how much investors get paid.

The lack of official data will trigger contingency plans written into legal documentation decades ago, with the added wrinkle that the bond and derivatives markets use different fallbacks.

The he cancellation was widely anticipated. White House officials Oct. 24 said October inflation data probably wouldn't be released, and the BLS said Wednesday that the October unemployment rate wouldn't be calculated because of the Oct. 1 to Nov. 12 shutdown.

"Even before the announcement, it was general consensus that the fallback would be activated for October, so the market had largely already priced this in," said Jon Hill, head of US inflation strategy at Barclays Capital Inc.

While past shutdowns delayed publication of economic data, until now the BLS hasn't failed to produce a major report.

The lack of data is a headache for investors in general at a time when US inflation — despite having receded from the generational highs reached in 2022 amid pandemic-related supply-chain disruptions — continues to exceed the Federal Reserve's 2% target. As a result, several Fed policymakers are opposed to lowering interest rates further after two cuts this year in response to signs of job-market stress.

That's increased the power of inflation data to move markets, and some Fed officials have said the lack of data is a justification for pausing rate cuts at their next meeting scheduled for Dec. 9-10.

The BLS said it will publish November CPI data on Dec. 18, meaning the latest official inflation data available to the rate-setting committee will be from September.

The BLS typically gathers pricing information from roughly 80,000 items across the country, mostly in-person. While the agency recalled staff to prepare the September CPI report — which was needed for US Social Security to calculate its annual cost-of-living adjustment — October data weren't collected.

The agency said it can acquire most of the non-survey data for October and "where possible" will publish such values in the November release.

For Treasury Inflation-Protected Securities, or TIPS, monthly CPI values are used to interpolate daily index ratios that determine — with a time lag — accrued interest, which is due to the seller of a bond by its buyer. The October CPI would be used to interpolate values for Dec. 2 to Jan. 1, 2026.

In the absence of a published CPI value, regulations for TIPS call for a synthetic number "based on the last available twelve-month change in the CPI," in this case from September 2024 to September 2025.

Inflation derivatives use a different fallback, creating a divergence between TIPS, a $2 trillion market, and swaps.

Standard inflation swap contracts — with a notional value outstanding of about $4.5 trillion at LCH, the clearinghouse unit of London Stock Exchange Group — employ International Swaps and Derivatives Association rules. If the derivative is not linked to a specific bond, ISDA's fallback calculation applies the September 2025 year-on-year change to the October 2024 level.

The difference in methodology leads to diverging payouts. For October, the TIPS fallback would produce an index reading of 325.604, while the swaps fallback would be 325.174, according to Bloomberg calculations.

TIPS maturing in January 2026 greatly outperformed inflation swaps in recent weeks, "reflecting the market pricing in a meaningful probability of the fallback being activated," Barclays' Hill said.

Earlier this month, ISDA issued guidance on how the swap fallbacks would be triggered "in the interest of mitigating market risk and the promotion of orderly valuation and settlement of positions by market participants."

The U.S. Labor Department will not release the October Consumer Price Index (CPI) due to a government shutdown, rescheduling the November report for December 18, 2025, as stated by Jin10 data.

This delay affects market volatility, influencing cryptocurrencies such as BTC and ETH, as U.S. CPI figures guide interest rate expectations and monetary policies.

The U.S. Labor Department cites the government shutdown as the reason behind the absence of the October CPI report. BLS leadership faces capacity challenges due to vacant positions, and essential staff are affected by ongoing hiring freezes. The immediate impact on financial markets is notable, given the relevance of CPI data to interest rate expectations and monetary policy decisions. Analysts anticipate a significant reaction in the prices of key cryptocurrencies, particularly those sensitive to U.S. economic indicators.

To date, no government officials have publicly commented on this specific report cancellation. However, the lack of critical economic data prompts discussions in financial sectors about its wider implications.

"The BLS calendar contains publication dates for most news releases scheduled to be issued by the BLS national office in upcoming months. ... The calendar is updated as needed with additional news releases, usually at least a week before their scheduled publication date." — U.S. Bureau of Labor Statistics, Official Entity, BLS

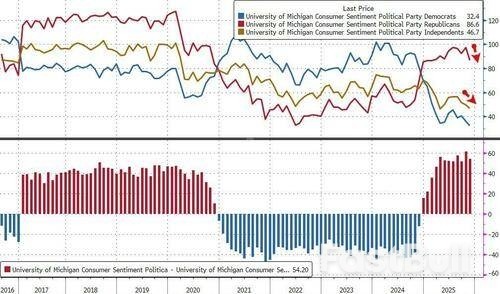

The weakness from the preliminary UMich data for November has been confirmed with the final sentiment print confirmed the so-called 'K-shaped' economy as sentiment slumps with stocks near record highs.

However, the small silver lining with today's UMich data was an improvement intra-month from 50.3 to 51.0 for the headline (but still at its lowest since June 2022).

After the federal shutdown ended, UMich Director Joanne Hsu notes that sentiment lifted slightly from its mid-month reading.

However, consumers remain frustrated about the persistence of high prices and weakening incomes.

Under the hood, Expectations picked up modestly from 50.3 to 51.0, just off record lows, while Consumer Expectations plunged to 51.1 - the lowest in the survey's history going back to 1977...

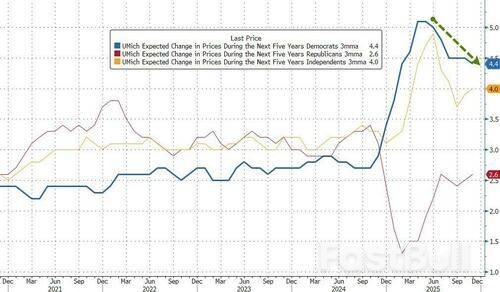

Interestingly, while Democrat's confidence remains vastly worse than the rest of the political cohorts, November saw Republicans and Independents lose some faith too...

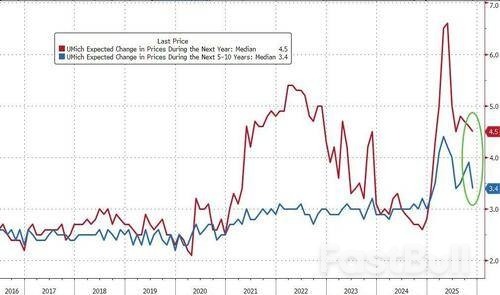

On the bright side, inflation expectations tumbled. After four months of sharp increases to start 2025, long-run expectations fell for three consecutive months through July, followed by three more months of small increases. Long-run expectations softened considerably this month. The November reading is well below peaks in monthly readings from June 2022 and April 2025, but still above 2024 readings.

Expectations exhibit substantial uncertainty, particularly in light of ongoing developments with economic policy and concerns that impacts on inflation are still to come.

Democrats continue to lead the fear of inflation (though dropped to January lows this month)...

However, this month, current personal finances and buying conditions for durables both plunged more than 10%...

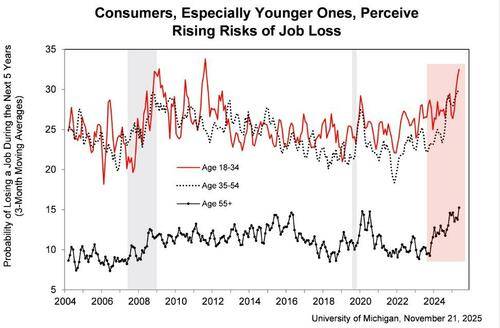

and young and old alike are worried about their jobs...

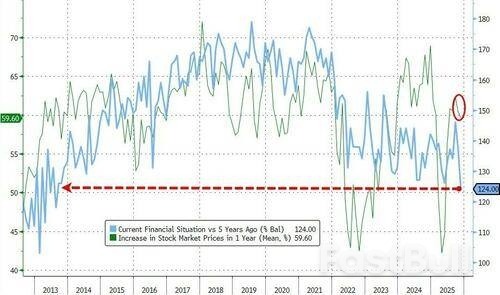

By the end of the month, sentiment for consumers with the largest stock holdings lost the gains seen at the preliminary reading.

This group's sentiment dropped about 2 index points from October, likely a consequence of the stock market declines seen over the past two weeks.

Key points:

Cryptocurrency markets have surged in recent years, in part fuelled by the Trump administration's pro-crypto stance which has encouraged wider acceptance among financial institutions.

With a total value of $3.2 trillion and around $197 billion of trading volume per day, cryptocurrencies represent a small part of global markets, crypto tracker CoinGecko estimates.

But regulators and investors are still worried about whether any problems in the lightly regulated crypto world could spill over into the wider financial system.

The biggest cryptocurrency, bitcoin, fell below $90,000 for the first time since April this week, and some $1.2 trillion has been wiped off the value of all cryptocurrencies in six weeks.

Bitcoin, generally moves in line with broader risk appetite. Its correlation with the S&P 500 on a one-month rolling basis this week was 0.84, its strongest in six weeks, LSEG data shows. Correlation is measured from -1 to 1.

Here's where crypto and mainstream markets intersect.

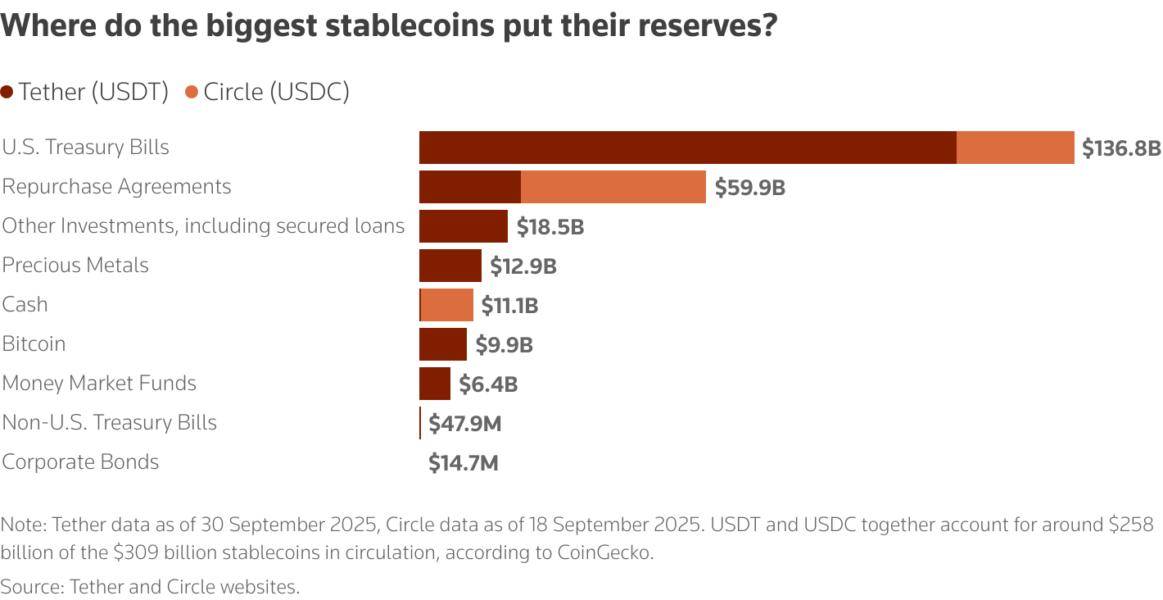

Stablecoins are cryptocurrencies pegged to a real-world currency, usually the U.S. dollar. Stablecoin issuers hold reserves to match the number of tokens they have created, and say that token-holders can swap their stablecoins back into dollars on demand.

Financial stability experts warn that a rush of redemption requests would cause a run on these reserves, affecting banks where cash is deposited, or even the assets that the reserves are invested in.

The stablecoin market is dominated by El Salvador-based Tether, which has around $181 billion in reserves, of which $112 billion is held in U.S. Treasuries. Rival Circle holds $24 billion in U.S. Treasuries.

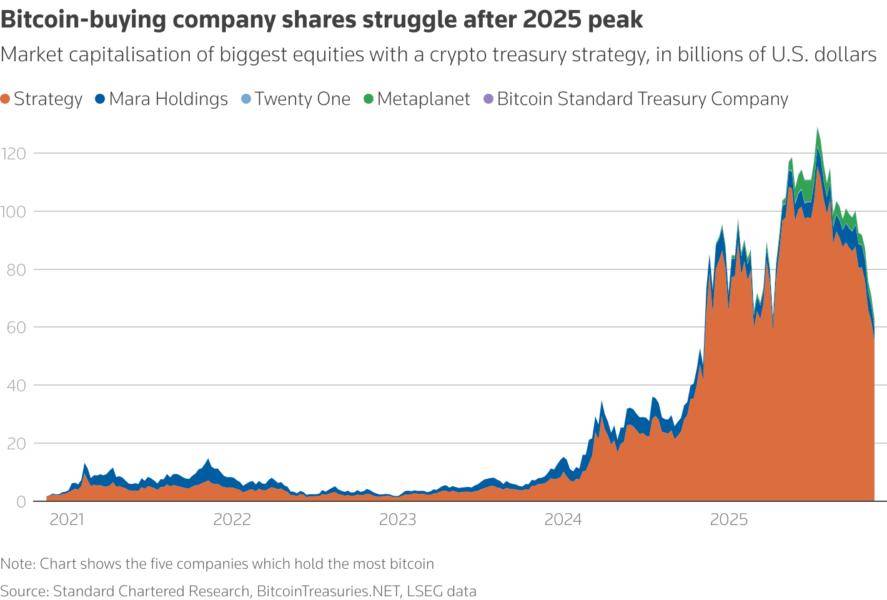

Crypto stocks have soared in 2025, and more crypto companies have gone public. But pure players remain a tiny part of the overall market.

The market cap of stocks in the "blockchain and cryptocurrency" and "cryptocurrency mining" category is $225 billion, just 1.8% of the global equities market, LSEG data shows.

This excludes so-called crypto treasury companies, whose business model is to buy and hold crypto. While the bitcoin buyers include major players like Strategy, dozens of penny stocks have this year been taken over by crypto enthusiasts to bet on rising prices.

Standard Chartered estimates that a bitcoin price below $90,000 leaves half of these companies' corporate treasuries holding bitcoin worth less than they paid for it.

Four of the 173 new U.S. public listings in 2025 have been crypto companies, raising a combined $1.2 billion, around 3.3% of the total funds raised from U.S. IPOs, LSEG said.

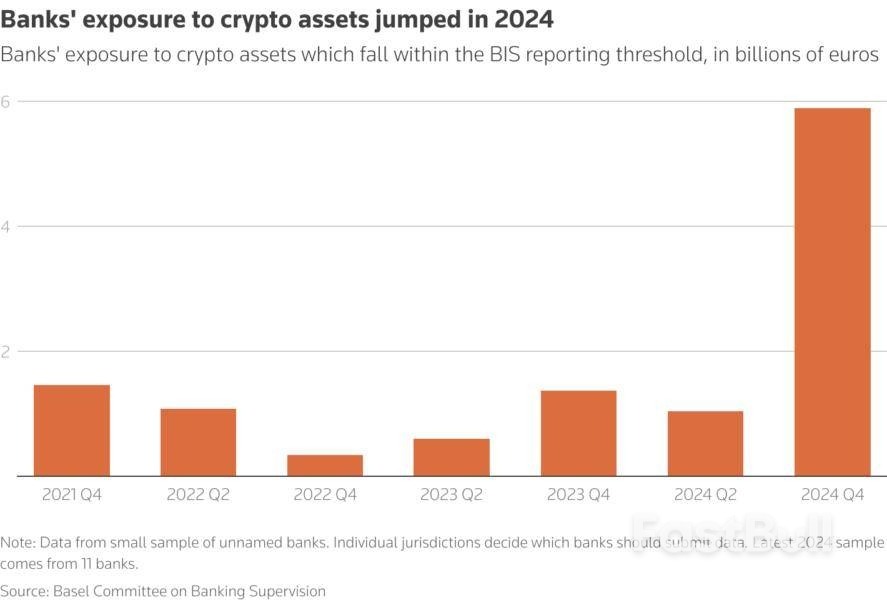

Banks gain exposure to the crypto world by taking on crypto-linked clients, holding stablecoin reserves, or offering crypto-related services such as asset custody.

Some small banks specialise in crypto, concentrating the risk, as seen in 2023 when crypto-focused U.S. bank Silvergate Capital collapsed after customers pulled deposits.

U.S. regulators this year made it easier for banks to engage with crypto-related activities, pressuring regulators elsewhere to rethink their approach.

Data on banks' exposure is hard to find, but what is available suggests it is small but growing.

The European Central Bank said in a May review that significant institutions in the euro zone provided 4.7 billion euros worth of crypto asset custody services in 2024, up from 400 million euros in 2023.

Basel Committee on Banking Supervision data shows 5.9 billion euros worth of prudential exposure to crypto in the second half of 2024, among banks from countries which volunteered data.

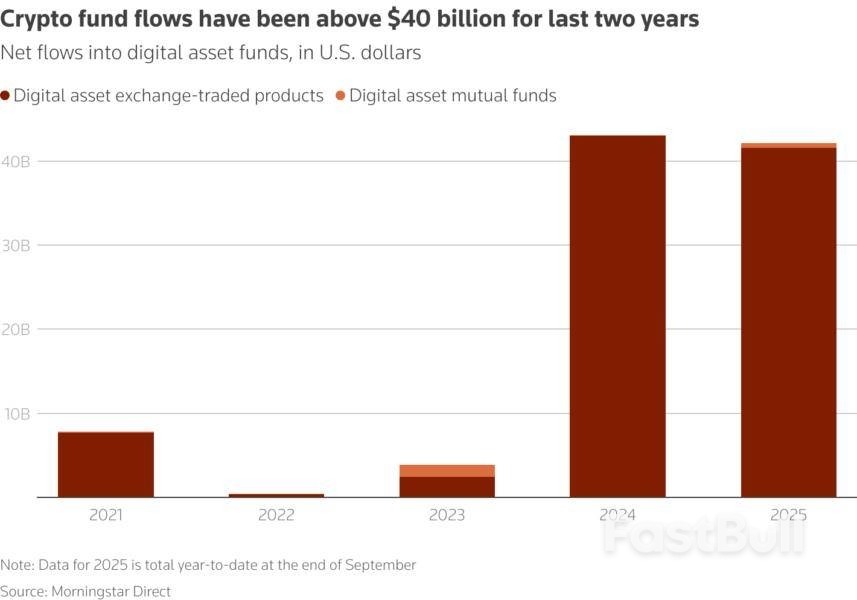

The January 2024 decision by U.S. regulators to allow bitcoin exchange-traded funds unleashed a new wave of buyers, including institutional investors such as sovereign wealth funds and pension funds pouring money into crypto.

The number of digital asset exchange-traded products worldwide has surged to 367 in 2025, up from 104 in 2021, according to Morningstar Direct data.

Still, with $222.3 billion in assets under management, crypto ETPs are tiny compared to the $17.4 trillion managed by the world's non-crypto ETPs, Morningstar estimates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up