Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)A:--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)A:--

F: --

Australia Employment (Dec)

Australia Employment (Dec)A:--

F: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)A:--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. PCE Price Index MoM (Nov)

U.S. PCE Price Index MoM (Nov)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Nov)

U.S. PCE Price Index YoY (SA) (Nov)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Nov)

U.S. Real Personal Consumption Expenditures MoM (Nov)--

F: --

P: --

U.S. Personal Income MoM (Nov)

U.S. Personal Income MoM (Nov)--

F: --

P: --

U.S. Core PCE Price Index MoM (Nov)

U.S. Core PCE Price Index MoM (Nov)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Jan)

U.S. Kansas Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Jan)

U.S. Kansas Fed Manufacturing Production Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Data Interpretation

Political

Commodity

Forex

Remarks of Officials

Economic

Central Bank

Middle East Situation

Energy

Daily News

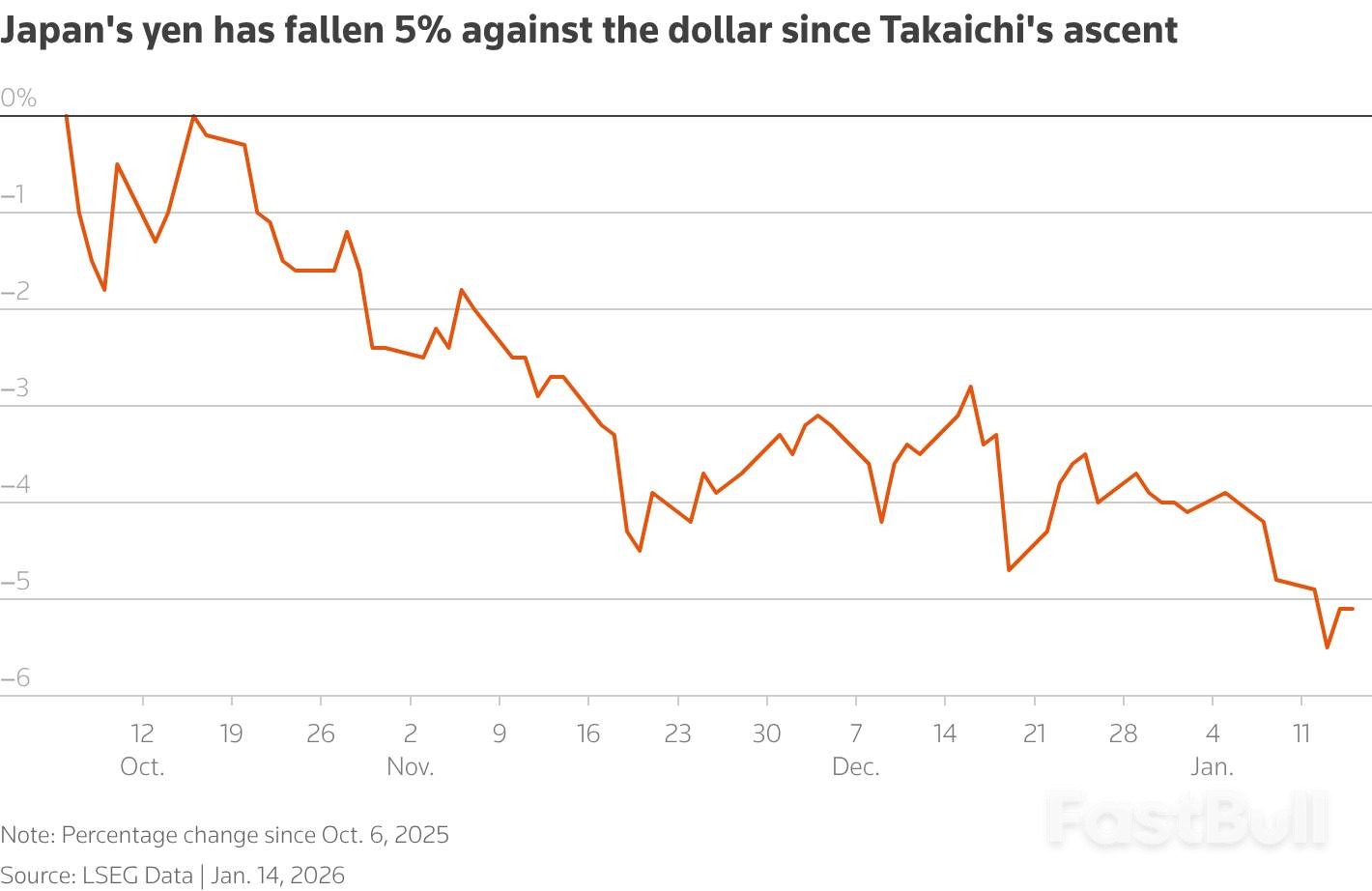

The yen's sharp decline ignites intervention fears, while global markets strengthen. Oil and safe havens cool as the dollar firms on waning Fed rate cut hopes.

Global markets showed signs of strength as the artificial intelligence trade found new momentum, but the main focus for investors has shifted to the Japanese yen and the growing possibility of government intervention.

Japanese Finance Minister Satsuki Katayama intensified market speculation on Friday, stating that Tokyo "won't rule out any options" to address the yen's ongoing weakness. This statement is the latest in a series of verbal warnings from Japanese authorities this week aimed at slowing the currency's decline, which has already fallen about 1% this year.

The yen did see a brief rally on Friday, partly boosted by a Reuters report suggesting some Bank of Japan policymakers believe an interest rate hike could happen sooner than markets anticipate. Despite this, the currency remains near the critical 160-per-dollar level after hitting an 18-month low earlier in the week, reviving talk that direct intervention could be imminent.

Recent pressure on the yen stems from the prospect of a snap election in Japan next month. Investors anticipate that Prime Minister Sanae Takaichi could secure a stronger mandate to implement additional economic stimulus. However, officials must weigh the benefits of a weaker yen against the rising cost of imported fuel, food, and raw materials, which could drive up consumer prices.

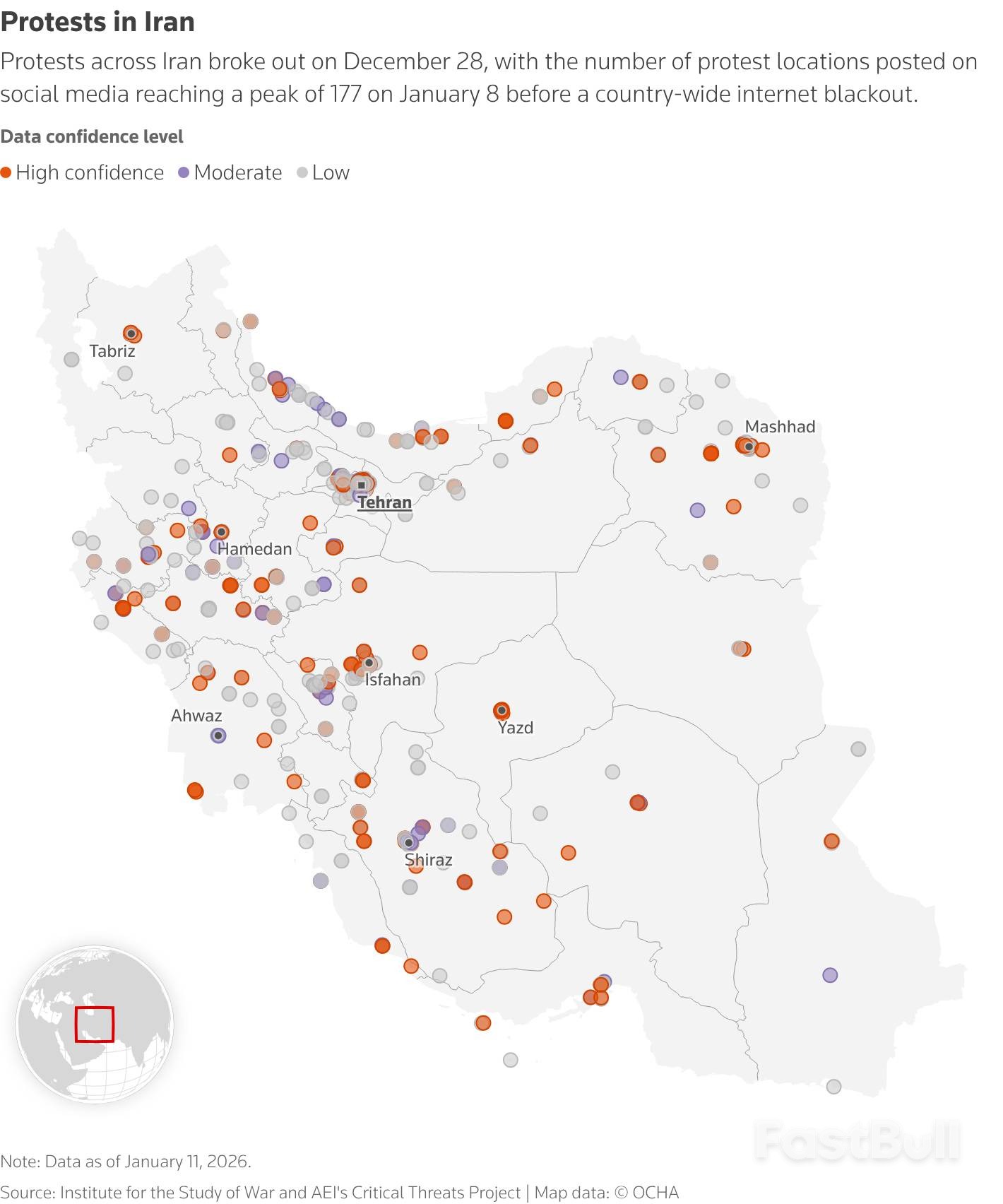

In other markets, oil prices continued their steep decline from the previous session. The rally in safe-haven assets like gold and silver also paused after U.S. President Donald Trump adopted a more measured stance on the unrest in Iran.

Trump commented that he was told the killings in Iran's crackdown on protests were subsiding and that he did not believe there was a current plan for large-scale executions. His wait-and-see posture eased immediate geopolitical tensions that had previously driven investors toward safer assets.

The U.S. dollar maintained its position near a six-week high as a string of positive economic data on Thursday led investors to scale back their expectations for Federal Reserve rate cuts this year.

According to the CME FedWatch tool, markets are now pricing in a 67% probability that the Fed will hold rates steady in April, a significant increase from 37% a month ago. The odds of rates remaining unchanged in June have also risen to 37.5%, up from 17% last month.

Traders will be monitoring several key developments that could influence markets on Friday:

• Speeches from Federal Reserve officials Collins, Bowman, and Jefferson.

• The release of U.S. industrial production data for December.

• The National Association of Home Builders' (NAHB) housing market index for January.

President Donald Trump’s ambition to acquire Greenland has ignited a fierce debate over America's global strategy, exposing deep divisions on how to best deter China in the Indo-Pacific. At a major security forum in Hawaii, this strategic clash was on full display.

Current and former U.S. officials argued that Washington's actions in the Western Hemisphere, from removing Venezuela's president to eyeing Greenland, are part of a coherent plan to weaken Beijing's global reach.

"Venezuela. Greenland. What is the overarching theme? Denying Chinese access, denying Chinese malign influence," stated Alexander Gray, a former chief of staff on the White House National Security Council during the first Trump administration.

According to this view, the strategy is fundamentally aligned with tackling the larger challenge from China. By ousting Nicolas Maduro, the U.S. removed one of Beijing's key allies and oil suppliers in Latin America. This has put other regional partners like Cuba—where the U.S. says China operates an intelligence outpost—under renewed pressure. Similarly, American leaders have been open about their goal of controlling Greenland to counter Chinese and Russian military threats emerging from the Arctic.

Some at the Honolulu Defense Forum suggested these moves demonstrate a powerful capability. Markus Garlauskas of the Scowcroft Center for Strategy and Security noted that operations like the removal of Maduro and strikes on Iranian nuclear facilities showed America's ability "to project power over great distances" with "relatively minimal" cost.

Despite these arguments, many participants at the annual gathering of military and government leaders expressed deep unease. Trump's challenge to Denmark, a fellow NATO member, over the sovereignty of Greenland has caused significant friction.

Lt. Gen. Chun In-bum, a retired South Korean army officer, captured the sentiment of longtime allies. "Now I'm in a situation where I must tell my people that we now have two evils," he said. "And we must choose the lesser evil."

While most allies quietly supported action against Venezuela's Maduro, the threats over Greenland have prompted a different reaction. Europeans are reportedly establishing a military presence on the island, and the controversy has raised questions about NATO's future. China has seized the opportunity to denounce the U.S. for adhering to "the law of the jungle" and called on nations to respect the UN charter.

Discussions in Hawaii covered methods to counter China's military expansion, including missile defense, artificial intelligence, and strengthening the defense industrial base. However, U.S. officials largely avoided direct criticism of Beijing, navigating a delicate trade truce ahead of a planned meeting between Trump and Chinese leader Xi Jinping in April.

This cautious approach has worried observers. Ely Ratner, who serves as assistant secretary of defense for Indo-Pacific Security Affairs in the Biden administration, argued that the Trump administration wasn't truly focused on strategic competition with China.

"You can't tell me that you're prioritizing the China challenge if you're not passing the grade in the Indo-Pacific," he stated.

U.S. military leaders at the forum pushed back, expressing strong support for America's alliance network in Asia. When asked about the impact of the Greenland issue, Indo-Pacific Command Commander Samuel Paparo said, "I think we're all going to be scrupulous about our alliances and partnerships. I think we're going to move together."

A central theme of the forum was China's ambition to gain control of Taiwan. Many U.S. military planners are focused on the 2027 target set by Xi Jinping for the People's Liberation Army to become a "world-class military," seeing it as a potential timeline for using force—a notion Chinese officials have dismissed.

Defense officials highlighted the urgent need for Taiwan to possess robust defense systems, including:

• Missile defenses capable of withstanding cyber and electromagnetic attacks.

• Resilient energy infrastructure and supply lines to defeat a potential maritime blockade.

Underscoring the high stakes, Gen. Xavier Brunson, the top U.S. military official in South Korea, said that U.S. Forces Korea was prepared to contribute in any conflict over Taiwan if called upon. South Korea hosts the largest U.S. military base in Asia.

The debate ultimately circled back to a fundamental contradiction. Can the U.S. project strength and uphold a global order at the same time? Trump's challenge to a NATO ally over Greenland has raised serious doubts about America's commitment to international law.

Courtney Stewart, a former Pentagon official now at the Australian Strategic Policy Institute, framed the dilemma sharply. "It's very hard to understand how America would support a rules-based order in this region if you can't uphold a rules-based order in the North Atlantic by challenging the sovereignty of Denmark's claim on Greenland," she said.

"America's always been viewed as sort of on the moral high ground and the good guy," Stewart added. "And this administration sees that that's not paying off for them, and maybe we need a bit more respect and we actually can throw our weight around a bit more."

A Polish central banker has signaled that the country could resume cutting interest rates as early as next month, citing a strengthening outlook for continued low inflation.

Ludwik Kotecki, a member of Poland's Monetary Policy Council (MPC), suggested a quarter-point rate reduction could be on the table in February.

"It is becoming increasingly clear that there is room for further rapid interest rate cuts," Kotecki said in an interview with Bloomberg. "I assume that in February the MPC will resume its activities from last year — the outlook for inflation is increasingly optimistic."

The 10-member MPC kept its benchmark interest rate unchanged at 4% this week. This hold follows a series of aggressive cuts last year, where policymakers lowered rates by a total of 175 basis points across six separate moves.

The easing cycle was prompted by a steady decline in inflation. The inflation rate fell within the central bank's tolerance range and ended 2023 at 2.4%, just under the medium-term target.

While Kotecki is eyeing a move next month, the council's leadership has indicated a slightly more flexible timeline.

Governor Adam Glapinski confirmed on Thursday that the slowdown in inflation appears sustainable and that there is "some scope" for further rate reductions. However, he did not commit to a specific date, suggesting that an easing could occur in February, March, or potentially even April.

Looking further ahead, Kotecki sees potential for at least 50 basis points in rate cuts over the course of 2026. He warned that the primary risk may soon shift, noting "it may turn out that actual inflation deviates too much from the target — this time on the low side." This suggests a growing concern that inflation could fall too far below the central bank's goal, justifying further easing.

The United States and Japan have agreed to significantly strengthen their defense partnership, announcing plans to jointly produce missiles and expand military drills in a direct response to rising pressure from China.

The new agreements were solidified during a meeting in Washington between Japanese Defense Minister Shinjiro Koizumi and Pentagon chief Pete Hegseth. The two nations also committed to closer cooperation on securing supply chains for critical minerals.

This move comes amid a heated diplomatic dispute between Tokyo and Beijing. The conflict was sparked in November when Japanese Prime Minister Sanae Takaichi suggested that Japan might intervene militarily if China were to attack Taiwan.

China, which considers Taiwan a part of its territory, reacted sharply by blocking exports of "dual-use" items with potential military applications to Japan. This has raised concerns in Tokyo that Beijing could also restrict its supply of essential rare earths.

A statement from Japan's defense ministry emphasized that the alliance remains "absolutely unwavering" in a security environment that is "rapidly growing severe."

The bolstered alliance focuses on two critical areas: advanced weaponry and operational readiness.

Joint Missile Production

The agreement formalizes plans to advance the joint production of key defense systems, including:

• Air-to-air missiles

• Surface-to-air interceptors

This step aims to enhance Japan's defensive capabilities and streamline logistics between the two allied forces.

Expanded Military Exercises

Japan and the U.S. will also expand the scope and complexity of their joint military drills. The plan calls for "more sophisticated and practical joint drills" to be held in various locations, with a specific focus on Japan's Southwest region.

Strengthening defenses around the Southwest islands, which include Okinawa, is a top priority for Japan's military planning.

Okinawa hosts the majority of American military bases in Japan and serves as a vital U.S. outpost for monitoring China, the Taiwan Strait, and the Korean peninsula. Both Tokyo and Washington have repeatedly stressed the island's strategic importance for regional stability.

In line with this focus, Prime Minister Takaichi's government approved a record nine trillion yen in defense spending for the upcoming fiscal year in December.

During his meeting with Koizumi, Pentagon chief Pete Hegseth praised Japan's increased budget. According to the U.S. Department of War, he called it "hard-nosed realism; a practical, common-sense approach that puts both of our vital national interests together."

The formal discussions were preceded by a joint morning workout. "The American military-style training was very tough," Koizumi later wrote on X. "But I did my best to labor my way through it, telling myself: 'this is all for the sake of strengthening the Japan-US alliance.'"

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up