Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)A:--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)A:--

F: --

Australia Employment (Dec)

Australia Employment (Dec)A:--

F: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)A:--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. PCE Price Index MoM (Nov)

U.S. PCE Price Index MoM (Nov)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Nov)

U.S. PCE Price Index YoY (SA) (Nov)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Nov)

U.S. Real Personal Consumption Expenditures MoM (Nov)--

F: --

P: --

U.S. Personal Income MoM (Nov)

U.S. Personal Income MoM (Nov)--

F: --

P: --

U.S. Core PCE Price Index MoM (Nov)

U.S. Core PCE Price Index MoM (Nov)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Jan)

U.S. Kansas Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Jan)

U.S. Kansas Fed Manufacturing Production Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Yen gains on hawkish BoJ policy and geopolitical tensions, contrasting Fed's likely rate cuts.

The Japanese yen gained against major currencies during Wednesday's early European session, driven by a combination of hawkish signals from the Bank of Japan (BoJ) and rising geopolitical tensions.

A key factor supporting the yen is the growing divergence in monetary policy between Japan and the United States. Markets are increasingly pricing in the likelihood that the BoJ will continue to normalize its policy, while the U.S. Federal Reserve appears poised for rate cuts.

Bank of Japan Governor Kazuo Ueda reinforced this hawkish outlook on Monday, stating that the central bank will keep raising interest rates if economic and pricing trends align with its expectations.

Ueda noted that adjusting the level of monetary support would allow the economy to achieve sustained growth. He added that wages and prices are likely to rise together moderately, signaling that the door remains open for further tightening.

In contrast to the BoJ's stance, weak U.S. economic data has spurred hopes for more rate cuts from the Federal Reserve.

Federal Reserve Governor Stephen Miran has argued for aggressive rate cuts exceeding 100 basis points in 2026, warning that the current tight monetary policy is dragging on the U.S. economy.

Investors are now awaiting key U.S. economic data this week, which could provide further clarity on the Federal Reserve's interest rate path. Adding to market sentiment are escalating tensions between China and Japan.

Recent data from Jibun Bank showed that Japan's services sector continued to expand in December, though at a slower rate. The services PMI registered 51.1, down from 52.0 in November.

The yen's strength was evident across the board in early trading:

• Against the U.S. Dollar (USD): The yen advanced to 156.30 from an earlier low of 156.81. The next resistance level is seen around 154.00.

• Against the British Pound (GBP): The yen reached a two-day high of 211.03, up from a low of 211.76. Resistance is anticipated near the 209.00 mark.

• Against the Euro (EUR): The currency climbed to a near three-week high of 182.71 from a low of 183.38, with potential resistance at 180.00.

• Against the Swiss Franc (CHF): The yen strengthened to 196.41 from 197.26, also a near three-week high. The next resistance level is eyed around 194.00.

Looking ahead, traders are focused on upcoming U.S. data, including MBA mortgage approvals, December PMI reports, October factory orders, and EIA crude oil figures. Canada is also set to release its December PMI report.

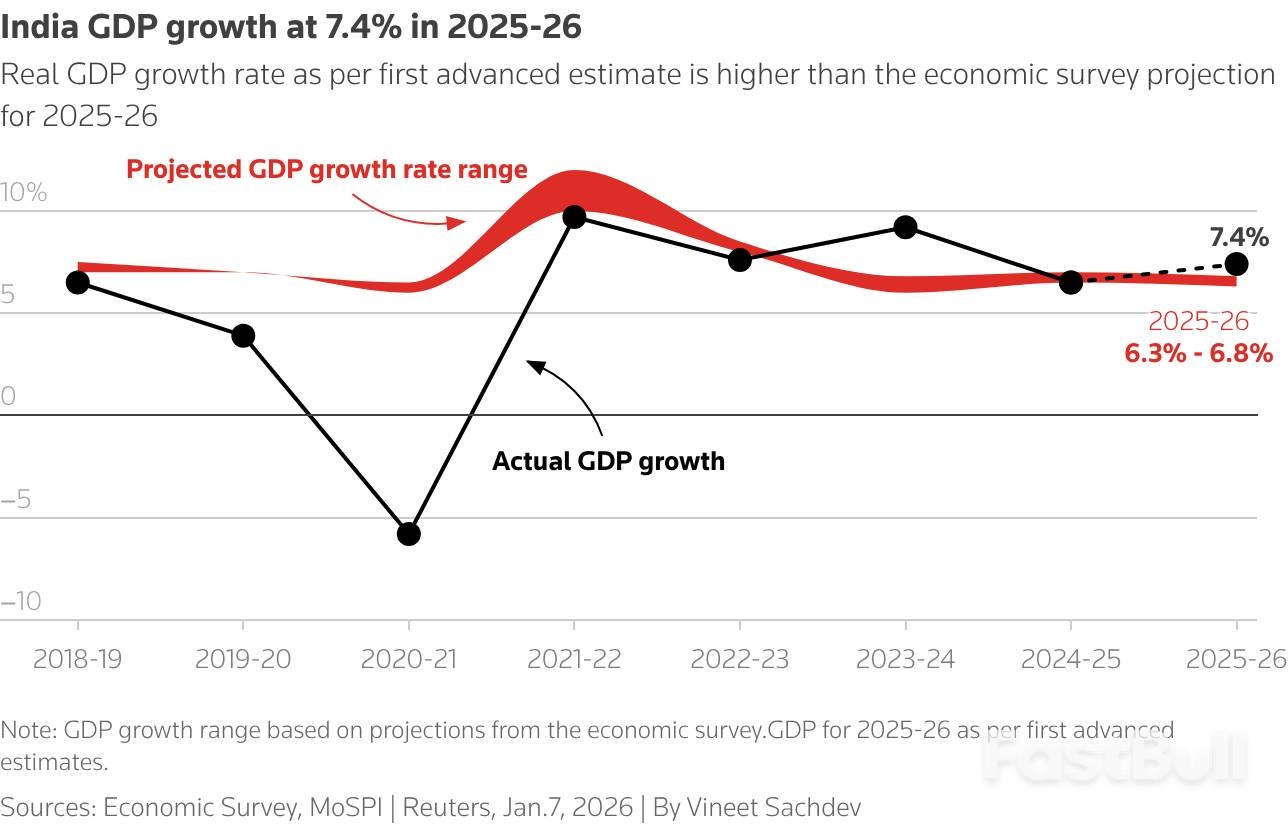

India's economy is on track for 7.4% growth in the fiscal year ending in March, a figure that surges past most initial forecasts. This robust performance is fueled by strong domestic demand and a significant uptick in government spending, providing a powerful buffer against global economic headwinds.

The new growth estimate, released by the National Statistics Office, marks a substantial increase from the government's earlier projection of 6.3%-6.8%. This positions the nearly $4 trillion economy for another year of expansion, following growth rates of 6.5% in 2024/25 and 9.2% in 2023/24.

The updated gross domestic product (GDP) figure will serve as a crucial baseline for the upcoming federal budget, scheduled for announcement on February 1.

This accelerated growth comes as India navigates an uncertain global environment, including punitive U.S. tariffs. In response, Prime Minister Narendra Modi's government has pushed forward with domestic reforms, such as overhauling consumer taxes and implementing long-awaited labor reforms, to strengthen the internal economy.

"This growth reflects that despite rising global uncertainties, India continued to perform well," noted Sakshi Gupta, an economist at HDFC Bank.

The strong performance has also elevated India's global standing. The government announced last month that India has surpassed Japan to become the world's fourth-largest economy, a development pending confirmation by the International Monetary Fund.

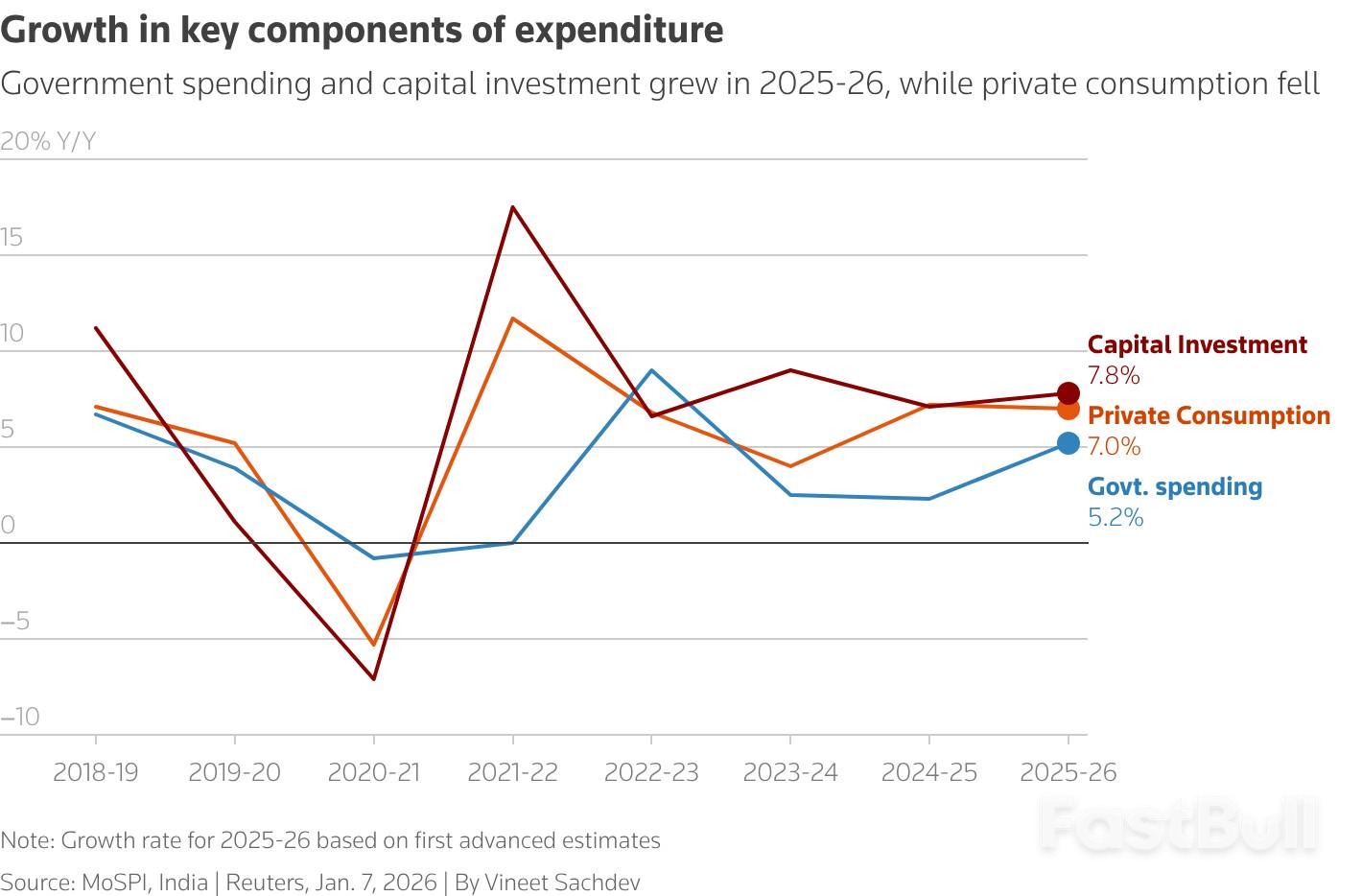

A closer look at the data reveals the core drivers behind the impressive growth numbers. Private consumption, private investment, and government spending all show solid year-on-year increases.

• Private Consumption: Making up about 60% of GDP, private consumption is forecast to expand by 7.0%, compared to 7.2% in the previous fiscal year.

• Government Spending: This component is estimated to rise by 5.2%, a notable acceleration from the 2.3% increase recorded a year prior.

• Private Investment: Growth in private investment is seen rising to 7.8%, up from 7.1% the previous year.

In nominal terms, which include inflation, the economy is expected to grow 8%.

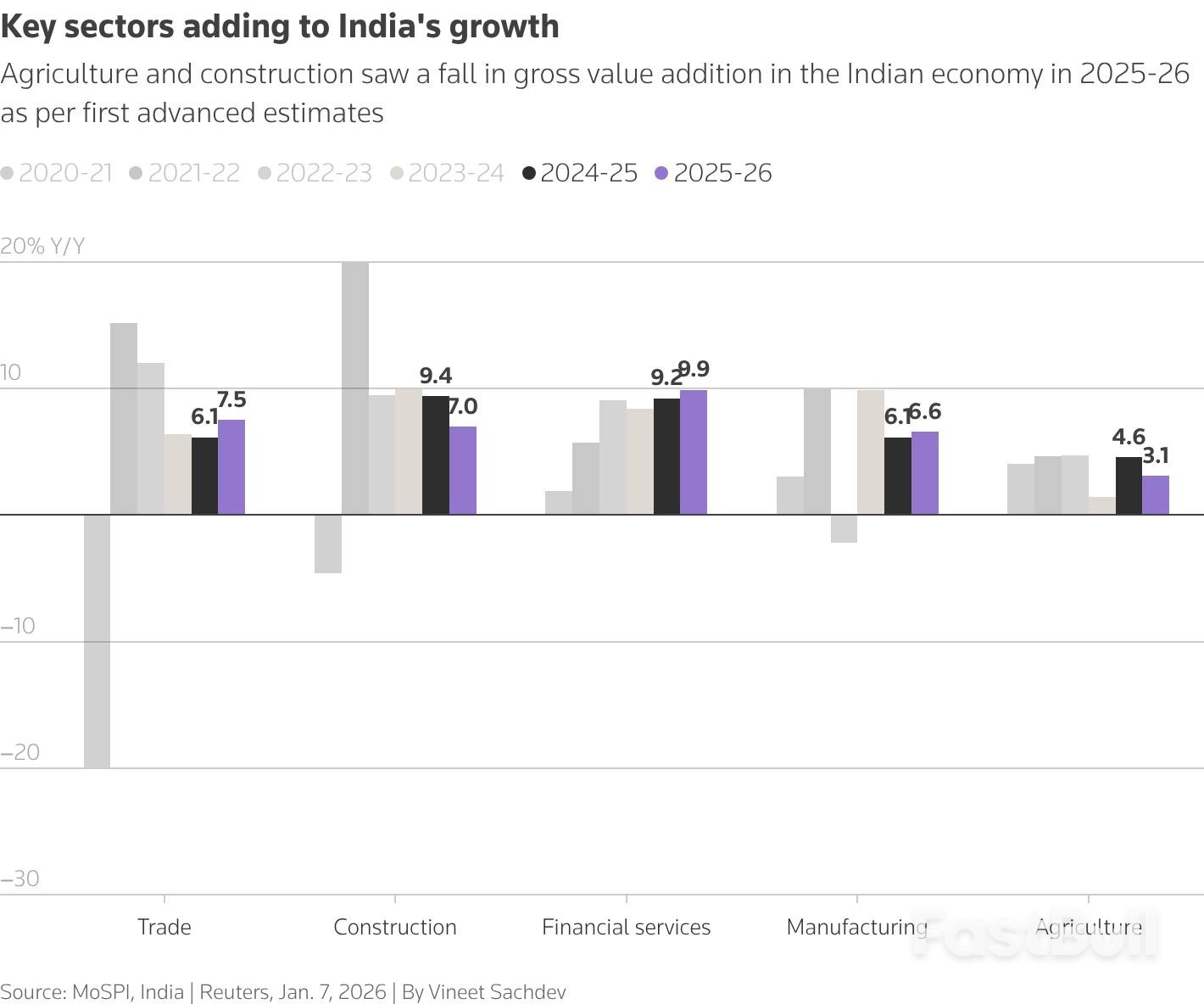

The expansion is broad-based, with key sectors contributing to the overall growth. The manufacturing sector has shown particular strength, helping to offset external pressures.

The United States has imposed 50% tariffs on some of India's key exports as a response to its purchases of Russian oil. However, Madhavi Arora, an economist at Emkay Global, suggests the impact on India's exports has been limited so far, which has helped stabilize manufacturing growth.

Key sectoral growth projections for 2025/26 include:

• Manufacturing: Expected to expand by 7.0%, a significant jump from 4.5% a year ago.

• Construction: Projected to grow by 7.0%, down from 9.4% in the previous year.

• Agriculture: The farm sector, which employs over 40% of the workforce, is estimated to expand by 3.1%, compared to 4.6% a year ago.

Since Russia's invasion of Ukraine in February 2022, India has become a pivotal player in global energy markets by importing an astonishing $168 billion worth of Russian crude oil. But this trend is now reversing, as mounting pressure from the United States begins to force a strategic shift among Indian refiners.

According to data from the Centre for Research on Energy and Clean Air (CREA), India’s oil imports from Russia have hit €144 billion, or $168 billion, since the war began. This buying spree has established India as the second-largest customer for Russian oil, surpassed only by China.

As the world's third-largest crude oil importer, India dramatically increased its intake of discounted Russian crude. For nearly four years, Russia became its single biggest supplier, responsible for approximately one-third of the nation's total imported crude oil.

While India secured cheaper energy, Russia has continued to collect massive revenues. CREA reported this week that as of January 2026, Russia has earned over €1 trillion from global fossil fuel sales since the start of its full-scale invasion.

These funds, which CREA notes are used to finance the conflict in Ukraine, flow not just from India and China but also from the European Union, thanks to exemptions for pipeline oil and the absence of sanctions on Russian gas. In response, the research organization is calling for measures to close loopholes like the "shadow fleet" and refining exceptions, urging nations to diversify away from Russian gas.

The dynamic is now changing due to direct U.S. intervention. U.S. President Donald Trump has specifically targeted India for its large-volume purchases of Russian crude, which support the Kremlin's energy revenues. To penalize the country, President Trump doubled a tariff on India from 25% to 50%, effective August 2025.

Though India initially appeared undeterred by the tariff, the situation escalated after the U.S. imposed sanctions on Russian energy giants Rosneft and Lukoil.

Indian Refiners Respond to Sanction Pressure

This direct targeting of Russian companies has proven effective. In the past two months, Indian refiners have significantly scaled down their purchases of Russian crude oil.

This reduction also aligns with India's diplomatic goals. The country is reportedly working to secure a trade deal with the United States and aims to demonstrate to the Trump Administration that it has curbed its intake of Russian oil.

China's top diplomat began his annual New Year tour of Africa on Wednesday, with a focus on the strategically important east, as the world's No.2 economy seeks to reinforce its influence on the continent.

Foreign Minister Wang Yi will travel to Ethiopia, Somalia, Tanzania and Lesotho on this year's trip.

Wang's visit to Somalia — the first by a Chinese foreign minister since the 1980s — is likely to provide Mogadishu with a diplomatic boost after Israel last month became the first country to formally recognise the breakaway Republic of Somaliland, a northern region that declared itself independent in 1991.

Beijing, which reiterated its support for Somalia after the Israeli announcement, is keen to buttress its influence around the Gulf of Aden, the entry to the Red Sea and a crucial corridor for Chinese trade heading through the Suez Canal to European markets.

Further south, Tanzania is central to Beijing's push to secure access to Africa's vast copper deposits. Chinese firms are refurbishing the Tazara Railway that runs through the country into Zambia. Li Qiang made a landmark trip to Zambia in November, the first visit by a Chinese premier in 28 years.

The railway is widely seen as a counterweight to the US and European Union-backed Lobito Corridor, which connects Zambia to Atlantic ports via Angola and the Democratic Republic of the Congo.

By visiting the southern African kingdom of Lesotho, Wang aims to highlight Beijing's push to position itself as a champion of free trade. Last year, China offered tariff-free market access to its US$19 trillion (RM76.95 trillion) economy for the world's poorest nations, fulfilling a pledge by Chinese President Xi Jinping at the 2024 China-Africa Cooperation summit in Beijing.

Lesotho, one of the world's poorest nations with a gross domestic product of just over US$2 billion, was among the countries hardest hit by US President Donald Trump's sweeping tariffs last year, facing duties of up to 50% on its exports to the United States.

The Eurozone's inflation rate cooled to 2% in December, marking a significant victory for price stability. However, this success is shadowed by major economic uncertainties, including the full impact of U.S. tariffs and a slow-moving stimulus plan in Germany, casting doubt on the bloc's growth prospects for 2026.

Despite facing challenges like trade tensions and competition from China, the Eurozone economy showed resilience last year, supported by domestic consumption and lower interest rates. But this stability is unlikely to transform into a boom, as deep-rooted structural issues continue to hinder growth and political will for deeper integration is lacking.

Taming inflation stands as a clear success for the 350-million-person currency bloc. Price growth eased to 2.0% last month, meeting expectations and signaling a trend that is likely to hold for years.

A key gauge of underlying prices, which strips out volatile food and energy costs, also softened to 2.3% from 2.4%. This was driven by a modest slowdown in both services and industrial goods inflation. These figures reinforce the view that the Eurozone is on solid footing entering 2026, even as it navigates exceptional uncertainty.

While inflation is under control, several key factors threaten the Eurozone's economic stability. The delayed effects of U.S. tariffs and the slow pace of German fiscal spending are primary concerns.

The Lingering Impact of US Tariffs

The full economic impact of U.S. tariffs has not yet materialized in price data. Businesses are still in the process of adjusting their supply chains, meaning the complete picture may not be clear until well into 2026.

JPMorgan highlighted this risk in a note to clients, stating, "We are very conscious that the impact of the current tariff levels is still feeding through in the data and that US trade policy may still change."

Germany's Slow Stimulus and Weak Economy

Another critical factor is Germany's planned fiscal stimulus. The government is increasing spending on defense and infrastructure, which economists widely expect to lift growth. However, the rollout has been slow, and it could take time for the effects to appear in economic data.

Currently, Germany, the bloc's largest economy, is narrowly avoiding a recession, and its labor market is in the weakest shape it has been in years. Deutsche Bank anticipates a fiscal boost equivalent to 1.4% of GDP this year, which could benefit the entire region.

"The spillover benefits to the rest of the euro zone are a function of the composition of German fiscal spending, the degree of spare capacity in Germany and economic confidence outside Germany," the bank noted.

Beyond specific policy risks, the Eurozone faces a series of broader drags on its economy.

Cheaper energy offers some relief by reducing costs and improving the bloc's terms of trade, given its heavy reliance on fossil fuel imports. Still, overall economic growth is projected to slow to around 1.2% this year from 1.4% in 2025. This is due to several persistent challenges:

• Trade Pressure: Tariffs will continue to weigh on exports.

• Chinese Competition: China is expected to keep crowding out European products in key export markets.

• Industrial Weakness: The industrial sector remains on the edge of recession due to high costs and fragmentation, which prevents it from competing effectively on a global scale.

After supporting the economy with a series of rate cuts over the past two years, the European Central Bank (ECB) is unlikely to provide further stimulus. With inflation at its 2% target, the outlook is considered balanced, especially over the medium term, which is the bank's primary focus. Any dips below 2% are expected to be temporary.

As a result, financial markets are pricing in no rate changes from the ECB for all eight of its meetings this year, with some anticipating a move toward tightening next year.

"We expect rates to remain stable this year and continue to think further easing would require significant downside surprises, either on the growth or inflation front," said Leo Barincou at Oxford Economics.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up