Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Institutional inflows, favorable social sentiment trends, and rising Fed cut expectations strengthen XRP’s path toward $2.35 while highlighting key technical risks.

XRP hit key resistance at $2.2 on Wednesday, December 3, as spot ETF net inflows approached $1 billion. US economic indicators eased stagflation risks while boosting bets on a December Fed rate cut, setting up a perfect storm for risk assets such as XRP.

The ADP reported a 32k drop in employment in November after a 47k rise in October, supporting a more dovish Fed rate path. Meanwhile, the all-important ISM Services PMI unexpectedly rose from 52.4 in October to 52.6 in November.

Services sector activity is key to the US economy, given that it accounts for around 80% of GDP. Crucially, the Prices Index dropped from 70 to 65.4, suggesting a softer inflation outlook, abating stagflation jitters.

XRPUSD – Hourly Chart – 041225

XRPUSD – Hourly Chart – 041225Easing fears of US stagflation, rising bets on a December Fed rate cut, and robust demand for XRP-spot ETFs support a more bullish short- to medium-term outlook.

Below, I will explore the key drivers behind the breakout, the medium-term (4-8 week) outlook, and the key technical levels traders should watch.

On Tuesday, December 2, XRP-spot ETFs reported $67.74 million in net inflows, down from $89.65 million the previous session. Nevertheless, the XRP-spot ETF market extended its inflow streak to 12 consecutive sessions, underscoring robust institutional demand.

Grayscale XRP ETF (GXRP) led the way on December 2, with net inflows of $21.17 million. Meanwhile, Canary XRP ETF (XRPC) led the inflow table since launch, with net inflows of $355.21 million, benefiting from a first-to-market advantage. There is a delay in the release of spot ETF flow data, with numbers for Wednesday, December 3, expected later today.

Crucially, the resilient demand for spot ETFs tilts the supply-demand balance in XRP's favor, supporting a bullish short- to medium-term price outlook.

SoSoValue – XRP Price and ETF Flow Trends

SoSoValue – XRP Price and ETF Flow TrendsFor context, Bitcoin (BTC) soared 169% to an October 6, 2025, all-time high of $125,761, driven by net inflows of $63.7 billion into BTC-spot ETFs from launch through October 6. Since October 7, 2025, ETF issuers reported net outflows of $3.5 billion, leaving BTC down 26% from its all-time high. BTC-spot ETF market flow trends underscored the significance of institutional demand on price action.

Spot ETF inflows and social media indicators align with the bullish short- to medium-term price outlook.

Market Intelligence platform Santiment gave insights into current investor sentiment on crypto across social media platforms overnight, stating:

"According to social media data across X, Reddit, Telegram, 4Chan, BitcoinTalk, & Farcaster, the enormous swings from greed to fear have perfectly told the story for Bitcoin's price."

Santiment shared a chart showing BTC price trends on positive and negative sentiment ratios on social media, explaining that:

"Red circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about $BTC (Greed Zone). Green circles indicate days where there are abnormally higher BEARISH comments compared to BULLISH comments, about $BTC (Fear Zone)."

Social media sentiment has proven a leading BTC price indicator, crucial for the broader market, given performance correlations with Bitcoin. Santiment described the inverse relationship between sentiment ratios and BTC price action, stating:

"Since we know markets move the opposite direction of the crowd's predictions, the days where comments dip into the Fear Zone have perfectly predicted upcoming bounces. And alternatively, the days where comments dip into the Greed Zone have perfectly predicted upcoming dips. This latest rise has made retail greedy once again, but it may calm down quickly if the rally comes to a quick halt."

Santiment – Retail Sentiment on Social Media and BTC Price Trends

Santiment – Retail Sentiment on Social Media and BTC Price TrendsThe Bitcoin Fear & Greed Index currently sits in the Fear Zone at 26, down from 28 the previous day, supporting further price gains.

BTC Fear & Greed Index – 041225

BTC Fear & Greed Index – 041225XRP consolidated its December 2 rally on December 3, reinforcing the bullish medium-term price outlook. Several key price catalysts are likely to boost demand for XRP, including:

According to the CME FedWatch Tool, the chances of a December Fed rate cut rose from 88.0% on December 2 to 89.0% on December 3. Meanwhile, the probability of a March 2026 Fed rate cut stands at 52.9%, up from 45.6% on December 2.

In my opinion, these price catalysts support a near-term (1-4 weeks) move to $2.35 and a medium-term (4-8 weeks) climb to $3.

Despite the positive outlook, several potential events could derail a Santa Rally. These include:

These events could push XRP below $2 and expose the November low of $1.82 before a sustained move toward $3.

In summary, the short-term outlook is cautiously bullish, while the medium- to longer-term outlook is constructive.

Technical Outlook: EMAs Signal Caution

XRP gained 2.03% on Wednesday, December 3, following the previous day's 6.04% rally, closing at $2.1973. The token underperformed the broader market, which advanced 2.92%.

Despite Wednesday's gains, XRP continued to trade below the 50-day and 200-day Exponential Moving Averages (EMAs), reaffirming a bearish bias. However, fundamentals have shifted from the technical trend, supporting a bullish outlook.

Key technical levels to watch include:

Holding above the $2.2 support level would open the door to testing the 50-day EMA. A sustained move through the 50-day EMA would bring the $2.35 resistance level into play. Crucially, a breakout from the 50-day EMA would signal a near-term bullish trend reversal, supporting a move to $2.35.

XRPUSD – Daily Chart – 041225

XRPUSD – Daily Chart – 041225Near-term price drivers include:

Positive market sentiment and a hold above $2.2 would support a move to the upper trendline. Breaking resistance at the upper trendline would align with the medium-term $3 price target.

However, a move below $1.8239 would invalidate the medium-term bullish structure.

XRPUSD – Daily Chart – 041225 – Bullish

XRPUSD – Daily Chart – 041225 – BullishXRP will come under increased scrutiny on Thursday, December 4. Robust inflows into XRP-spot ETFs and rising bets on multiple Fed rate cuts would support the current recovery toward $2.35.

However, traders should closely monitor the progress of the Market Structure Bill, US economic indicators, the BoJ, and the Fed, which will also influence risk sentiment.

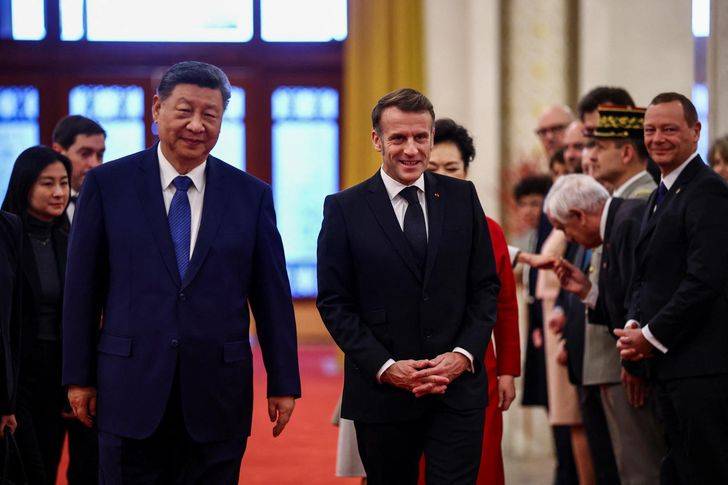

French President Emmanuel Macron met Xi Jinping in Beijing on Thursday, where he is expected to push the Chinese leader to help secure a ceasefire in Ukraine, and discuss trade relations.

Macron and his wife Brigitte were given a grand welcome by Xi and his partner Peng Liyuan to the Great Hall of the People, where the ceremony was moved indoors due to cold weather.

Macron blew kisses to children who held flowers and welcomed the president, while a band played the national anthems of both countries.

The French president, who is visiting China for the fourth time since taking office in 2017, is also expected to meet with Premier Li Qiang before travelling to Chengdu, where two giant pandas loaned to France were recently returned.

Macron has sought to pressure Xi to help secure a ceasefire in Ukraine, as the war with Russia drags into a fourth winter.

"We are counting on China, like us a permanent member of the Security Council... to lean on Russia, so that Russia and, in particular, Vladimir Putin can finally agree to a ceasefire," French Foreign Minister Jean-Noel Barrot said this week.

China regularly calls for peace talks and respect for the territorial integrity of all countries, but has never condemned Russia for its 2022 invasion.

Western governments accuse Beijing of providing Russia with crucial economic support for its war effort, notably by supplying it with military components for its defence industry.

The French presidency said Macron will tell Xi that China must "refrain from providing any means, by any means, to Russia to continue the war".

His three-day visit to Beijing follows a trip to Paris by Ukraine's President Volodymyr Zelensky, who urged Europe to stand by Kyiv as U.S. President Donald Trump pushes a plan to end the war.

"We share the view that the war must be brought to a fair end," Zelensky wrote on social media after Monday's talks with Macron, which also included phone calls with other European leaders.

Macron is also due to discuss trade with his Chinese hosts, with the European Union facing a massive trade deficit of $357 billion with the Asian powerhouse.

"It is necessary for China to consume more and export less... and for Europeans to save less and produce more," an adviser to Macron said.

Macron has previously called for the European Union to reduce its dependence on China and for a "European preference" in the tech sector.

Last month, he told a European summit of tech leaders and ministers from across the continent that the bloc does not want to be a "vassal" to U.S. and Chinese tech companies.

The French president will stay in China until Friday, with a final stop in Chengdu in the southwestern province of Sichuan.

Last week, two giant pandas loaned to France by China were flown to their ancestral home to retire at an animal sanctuary in the city.

The Chinese embassy promised new bears would soon be dispatched to make up for the popular pair leaving.

The Chengdu visit is "quite exceptional in Chinese protocol", the French presidency said, adding it was "appreciated as such" by Macron.

During his last trip to China, the French president was given a rock star welcome at a university in the southern city of Guangzhou, with students chanting his name and scrambling for selfies and high-fives.

Indian shares look set for another soft start this morning, even as most Asian markets track Wall Street's gains on hopes the Fed might cut rates next week. Back home, the big focus is on tomorrow's RBI policy decision — and on what the Governor has to say about the rupee after it slipped past the key 90-per-dollar level on Wednesday.

Tata Consultancy Services will also be in the spotlight after reports that OpenAI is in advanced talks with the company to help build out AI infrastructure, a headline that could stir up some excitement in tech stocks. IndiGo stock is likely to be in the spotlight, following news of flight cancellations as the carrier grapples with a pilot shortage and tech issues. Meanwhile, Russian President Vladimir Putin begins his state visit to India today, keeping geopolitics on investors' radar.

Tariff uncertainty continues to add pressure to the rupee, but analysts say further downside may be limited. According to Yes Securities, the currency now looks undervalued on a REER basis, which could reassure overseas investors sensitive to currency swings. The brokerage adds that overseas inflows into local shares often pick up when the rupee's depreciation exceeds the long-term average — and this year's 5.1% drop versus the dollar is already steeper than the 25-year annual average of 3%. Meanwhile, billionaire Uday Kotak said on X that with foreigners selling local shares and domestic investors buying, only time will tell which side is right.

It's not just the rupee — bank ownership rules are in focus again. State-owned lenders have been standout performers this year on strong loan demand and better asset quality. Their latest rally followed reports of a possible rethink on ownership limits, but the government denied any such plan on Tuesday, sending the Nifty PSU Bank index down 3% and pushing some lenders among Asia's worst performers. Even so, sentiment remains firm, as shown by strong demand for the government's share sale in Bank of Maharashtra.

The auto sector is also back in the spotlight as investors look for signs of a demand recovery. November sales eased after the festive surge, pulling the Nifty auto index down more than 1% on Wednesday — its sharpest drop in nearly two months.

Still, InCred Equities says the medium-term outlook is improving, helped by policy support such as income-tax cuts, lower interest rates and pay commission salary revisions, all of which could fuel a two-to-three-year demand upcycle. Forward price-to-earnings valuations are only slightly above their 10-year average, and InCred's preferred picks are Maruti Suzuki, Mahindra & Mahindra, Hero MotoCorp and Bajaj Auto.

The rupee hit 90 per dollar for the first time on Wednesday, and its slide from 80 to 90 happened at a quicker annualized pace than the previous milestone moves, according to DSP Mutual Fund.

When the currency first reached 80 in July 2022, and 70 in August 2018, the annualized depreciation rates were 3.5% and 3%, respectively, according to the asset manager. This year's 5% drop has made the rupee Asia's weakest performer, and Nomura says the 2025 decline reflects the RBI's effort to slow the drawdown of its reserves.

Peak-tariff pain in U.S. services may be easing, but Jefferies is not ready to call time on services inflation because the underlying wage and labor backdrop still points to sticky price pressures rather than a clean disinflation story.

The November ISM Services PMI rose to 52.6 from 52.4, hitting the highest reading since February, but the prices paid component of the index, an inflationary gauge, stole the show after falling to 65.4 from 70.0.

The fall in prices paid, points to "evidence that tariff pressure has probably peaked, though overall inflation pressure in the service sector remains significant," Jefferies economists Thomas Simons and Michael Bacolas said in a recent in note.

The call on 'peak tariffs' in services comes at time when there Are plenty of reasons to be optimistic by growth in the sector picking up pace.

"Tariffs are causing headaches in many industries, and pressuring prices for both goods and services, but the data suggest that this pressure has probably peaked," the economists said, pointing to lower uncertainty in early 2026, fiscal tailwinds, the government shutdown "in the rearview," and modestly lower interest rates as reasons to be "optimistic about a return to a solid trajectory of growth."

Still, the service sector is not out of the inflation woods as tariffs pressure were not only catalyst stoking inflation headwinds.

The threat of faster wage growth pushing inflation higher had been upstaged by tariff pressure, but now with the latter likely in the rearview, the tight labor market is likely to dominate attention.

Once the tariff impulse fades, "price pressure in services will fall back to wage pressure and the availability of labor," Jefferies said, pointing to weaker supply of labor as a concern.

While the rising unemployment rate suggests that the earlier labor scarcity that "was broadly pushing up prices for services" is easing, underlying wage and labor-supply dynamics mean services inflation will not drop quickly.

"Limited immigration flows and long-term demographic trends suggest that labor force growth is going to remain subdued in the months and years ahead," Jefferies said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up