Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

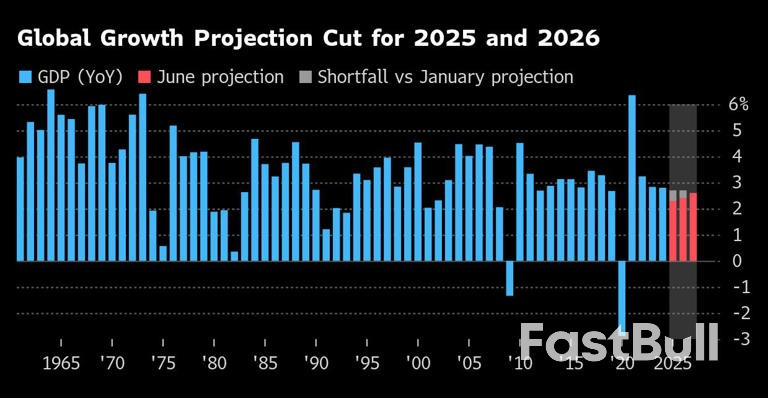

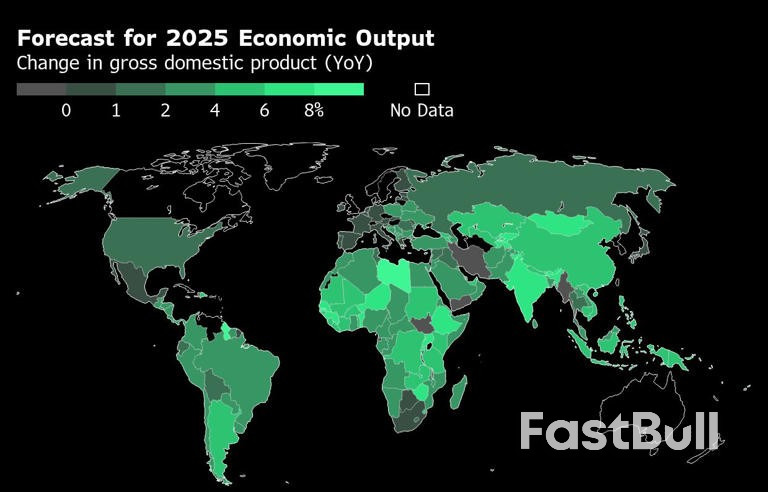

The World Bank lowered its 2025 global growth forecast to 2.3% and warned that the 2020s may witness the weakest economic decade since the 1960s, driven by trade tensions and policy uncertainty.

Wall Street's main indexes were mixed on Tuesday as investors awaited the outcome of ongoing trade talks between the United States and China aimed at cooling a tariff dispute that has bruised global markets this year.

U.S. Commerce Secretary Howard Lutnick said trade talks with China were going well as officials from the two sides met for a second day in London.

Investors are hoping for an improvement in ties after the relief around a preliminary deal struck last month gave way to fresh doubts when Washington accused Beijing of blocking exports critical to sectors such as aerospace, semiconductors and defense.

White House economic adviser Kevin Hassett said on Monday the U.S. was likely to agree to lift export controls on some semiconductors in return for China speeding up the delivery of rare earths.

"I think these issues will be resolved, but I think it's still early days ... but the fact that they're talking certainly is positive," said Mark Malek, chief investment officer at Siebert Financial.

"We're not making progress yards at a time, but inches at a time."

At 10:03 a.m. ET, the Dow Jones Industrial Average (.DJI), opens new tab fell 20.22 points, or 0.05%, to 42,742.88, the S&P 500 (.SPX), opens new tab gained 10.30 points, or 0.17%, to 6,016.18 and the Nasdaq Composite (.IXIC), opens new tab gained 53.92 points, or 0.28%, to 19,645.16.

Seven of the 11 major S&P 500 sub-sectors rose, led by energy (.SPNY), opens new tab with a 1.7% gain, tracking strength in oil prices. Communication services (.SPLRCL), opens new tab stocks added 0.9%.

U.S. equities rallied sharply in May, with the S&P 500 index (.SPX), opens new tab and the tech-heavy Nasdaq (.IXIC), opens new tab marking their best monthly gains since November 2023, helped by upbeat earnings reports and a softening of President Donald Trump's harsh trade stance.

The S&P 500 remains about 2% below all-time highs touched in February, while the Nasdaq is about 2.6% below its record peaks reached in December.

Investors are awaiting U.S. consumer prices data on Wednesday for clues on the Federal Reserve's rate trajectory.

The World Bank slashed its global growth forecast for 2025 by 0.4 percentage point to 2.3%, saying higher tariffs and heightened uncertainty posed a "significant headwind" for nearly all economies.

Shares of McDonald's (MCD.N), opens new tab fell 1.4%, weighing on the blue-chip Dow Index, after a report Redburn Atlantic downgraded the fast-food giant to "sell" from "buy".

Most megacap and growth stocks were mixed. Tesla (TSLA.O), opens new tab shares advanced 2.6%.

Insmed shares (INSM.O), opens new tab jumped 27.7% after the drugmaker said its experimental drug significantly reduced blood pressure in the lungs and improved exercise capacity in patients in a mid-stage study.

U.S.-listed shares of Tencent Music Entertainment Group advanced 2.2% after the Chinese company said it would buy domestic long-form audio platform Ximalaya (XIMA.N), opens new tab for about $2.4 billion in cash and stock.

Advancing issues outnumbered decliners by a 2.52-to-1 ratio on the NYSE and by a 1.76-to-1 ratio on the Nasdaq.

The S&P 500 posted 7 new 52-week highs and one new low while the Nasdaq Composite recorded 42 new highs and 29 new lows.

Daily E-mini S&P 500 Index

Daily E-mini S&P 500 Index Daily Taiwan Semiconductor Manufacturing Company Ltd

Daily Taiwan Semiconductor Manufacturing Company Ltd Daily Casey’s General Stores, Inc.

Daily Casey’s General Stores, Inc. Daily Insmed Incorporated

Daily Insmed IncorporatedThe crypto market is seeing positive growth due to signals from US regulators, stable international trade conditions, and the return of big investors. Recently, Bitcoin hit a value of $110,000 after briefly dropping to $100,000 last week. The cryptocurrency started the week strong, moving towards $110,000 and has been growing steadily since April.

A major reason for this growth is the renewed interest from large investors. On Monday, spot Bitcoin ETFs received $386 million, mainly from Fidelity Wise (LON:WISEa) Origin Bitcoin Fund (NYSE:FBTC), showing that market confidence is returning after recent outflows.

Another reason for the price increase is the closure of short positions in futures markets. Closing about $38 million worth of short positions helped push prices up, and a large purchase of 1,045 BTC (around $110 million) indicates that investor interest is on the rise.

Globally, the ongoing trade talks between the US and China in London are gaining attention. Their willingness to cooperate in key areas like rare earth elements and semiconductors is boosting global investor confidence and encouraging interest in alternative assets like Bitcoin. Additionally, the market’s anticipation of upcoming US inflation data is causing a shift towards riskier assets.

In the US, Securities and Exchange Commission (SEC) Chairman Paul Atkins’ supportive stance on crypto is being well-received by the market. His defense of personal control over crypto assets and his suggestion for an "innovation exemption" for DeFi platforms are creating optimism that regulatory pressure might ease. As a result, Bitcoin is gaining strength not only from technical factors but also from political and institutional support.

In the last week of May and the first week of June, Bitcoin experienced a dip, falling below $103,000. However, it quickly rebounded as buyers returned around the $100,000 mark.

Since May, Bitcoin has been in a consolidation phase, with ongoing volatility. As of this week, it has maintained the positive momentum seen over the past three months and is approaching the $111,000 mark, which is close to a record level.

Bitcoin might reach a new record this week, depending on current market conditions. According to technical indicators like the Stochastic RSI, the upward trend is likely to continue.

Bitcoin’s price is above its short and medium-term moving averages on the daily chart, suggesting it is in a positive position. If Bitcoin can remain in the $111,000 to $114,000 range and buyers manage to overcome any selling pressure, the next target levels could be $119,000 and then $125,000.

However, if Bitcoin faces strong resistance around $111,000, there might be an increase in profit-taking, potentially causing the price to drop back to around $105,000. If Bitcoin manages to find support between $103,000 and $105,000, a stronger upward trend could develop.

Current macroeconomic factors and market risk appetite might continue to support Bitcoin’s rise, but it’s important to keep an eye on the support zone during any potential pullbacks.

Ethereum is one of the assets directly benefiting from Bitcoin’s rise. After finding support around the $2,430 mark last week, ETH saw an increase of over 10% and reached the upper limit of its trading range.

For the past month, Ethereum has been fluctuating between $2,430 and $2,730, and it continues in this range thanks to strong institutional demand. Interest in Ethereum ETFs is strong, and on-chain data shows a significant increase in interest, with the number of weekly active wallets hitting an all-time high of 17.4 million.

This indicates that both individual and institutional buyers are becoming more active on the network. Additionally, a record 34.8 million ETH is locked up, suggesting that investors are choosing to stake rather than sell. This suggests the market may be entering another accumulation phase.

SEC Chairman Atkins’ recent statements at the DeFi meeting on June 9 clarified that staking activities won’t be classified as securities, a key legal development for Ethereum. This may speed up the approval process for ETFs with staking features.

For instance, BlackRock’s iShares Ethereum Trust ETHA has been steadily accumulating ETH for 23 consecutive trading days without any outflows, suggesting a strong base for ETH at its current levels over the medium to long term.

Although the positive winds continue to blow for Ethereum, which leads the altcoin market, the cryptocurrency has not yet found enough support to overcome its resistance in the $ 2,700 region.

After Ethereum rose to the $2,730 mark again earlier this week, it is seen that purchases have weakened at this point. However, the technical outlook continues to generate positive signals at the point of breaking this resistance level. According to the current outlook, a daily close above $2,730 or volume buying could quickly move ETH to the $3,000 region. Then the next target will be followed as the $ 3,400 area.

In the lower region, if $ 2,700 cannot be passed, we may see a new swing towards $ 2,430. On this path, the range of $ 2,540-2,580 may appear as an intermediate support. As a result, Ethereum is likely to move quickly towards the exit direction from the $ 2,400-2,700 range.

Britain and other allies imposed sanctions on two far-right Israeli ministers, Itamar Ben-Gvir and Bezalel Smotrich, on Tuesday over "their repeated incitements of violence against Palestinian communities", the UK's foreign ministry said.

Canada, Australia, New Zealand and Norway joined Britain in freezing the assets and imposing travel bans on Israel's national security minister Ben-Gvir - a West Bank settler - and finance minister Smotrich.

"Itamar Ben-Gvir and Bezalel Smotrich have incited extremist violence and serious abuses of Palestinian human rights. These actions are not acceptable," British foreign minister David Lammy, along with the foreign ministers of Australia, Canada, New Zealand and Norway said in a joint statement.

"This is why we have taken action now to hold those responsible to account."

Israel's foreign minister, Gideon Saar, said the move was "outrageous" and the government would hold a special meeting early next week to decide how to respond to the "unacceptable decision".

Smotrich, speaking at the inauguration of a new settlement in the Hebron Hills, spoke of "contempt" for Britain's move.

"Britain has already tried once to prevent us from settling the cradle of our homeland, and we cannot do it again. We are determined God willing to continue building."

Britain, like other European countries, has been increasing pressure on Israeli Prime Minister Benjamin Netanyahu's government to end the blockade on aid into Gaza, where international experts have said famine is imminent.

In Tuesday's joint statement, allies tried to soften the blow by saying Britain reiterated its commitment to continuing "a strong friendship with the people of Israel based on shared ties, values and commitment to [its] security and future".

"We will strive to achieve an immediate ceasefire in Gaza, the immediate release of the remaining hostages by Hamas which can have no future role in the governance of Gaza, a surge in aid and a path to a two-state solution," the statement said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up