Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

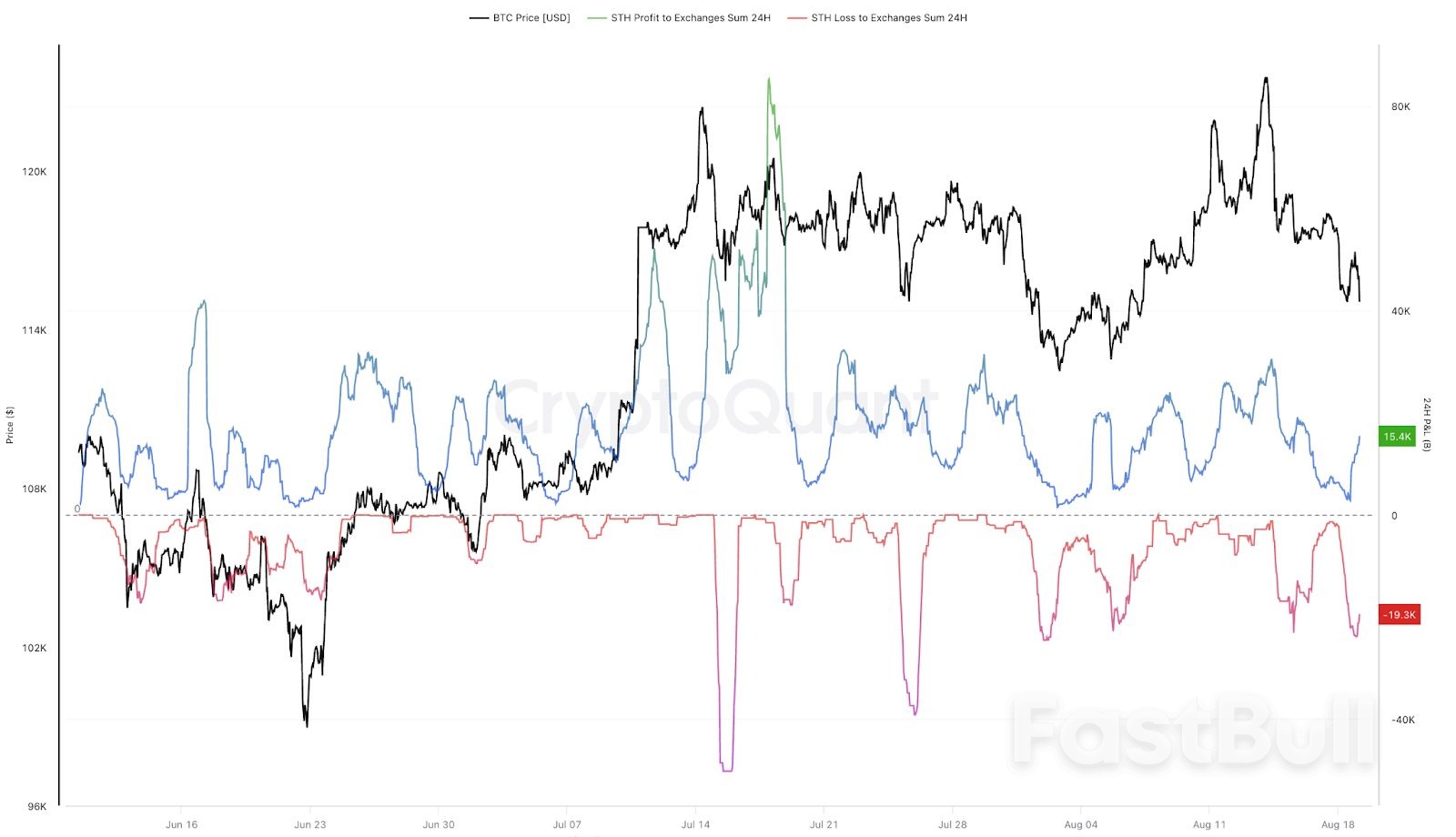

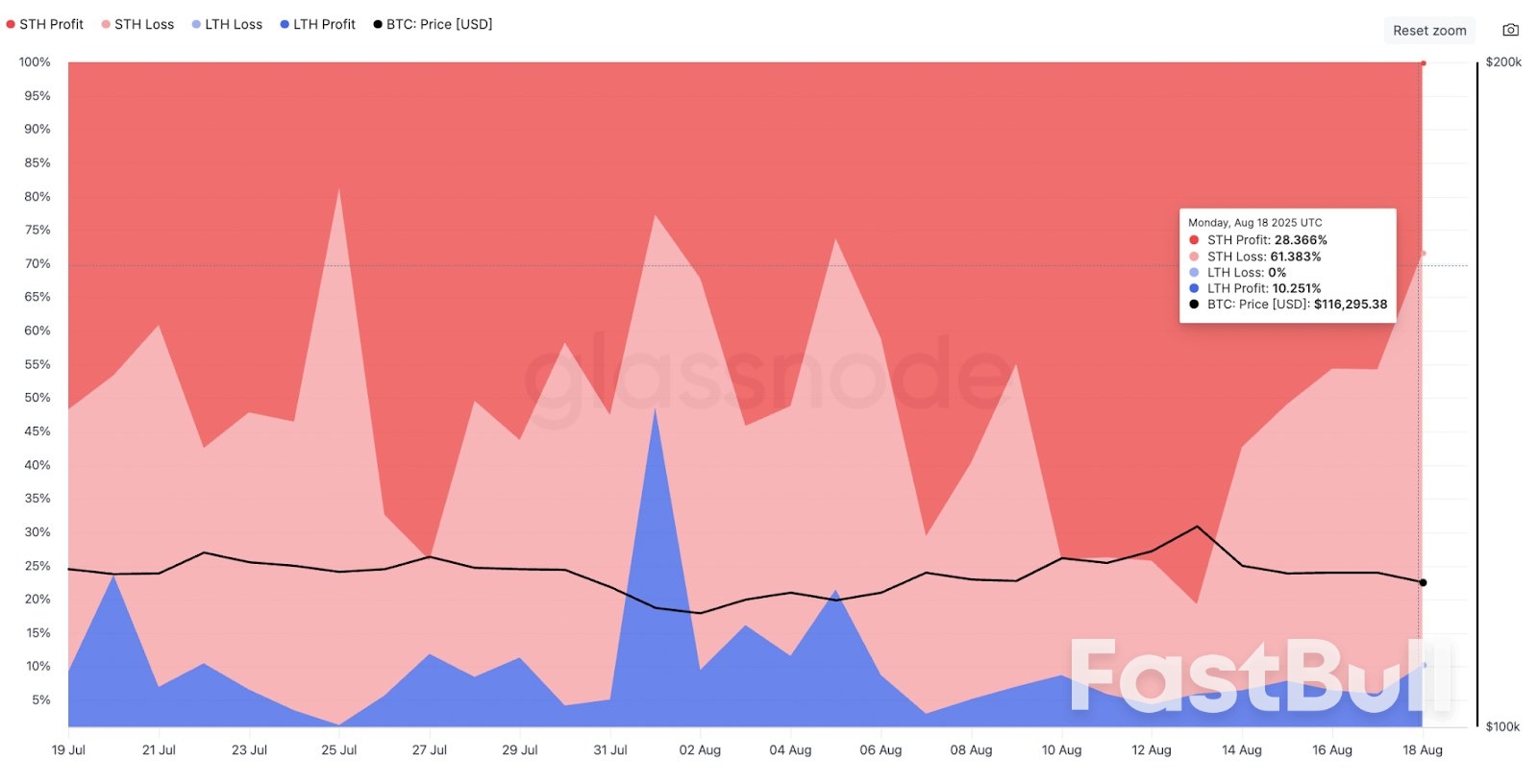

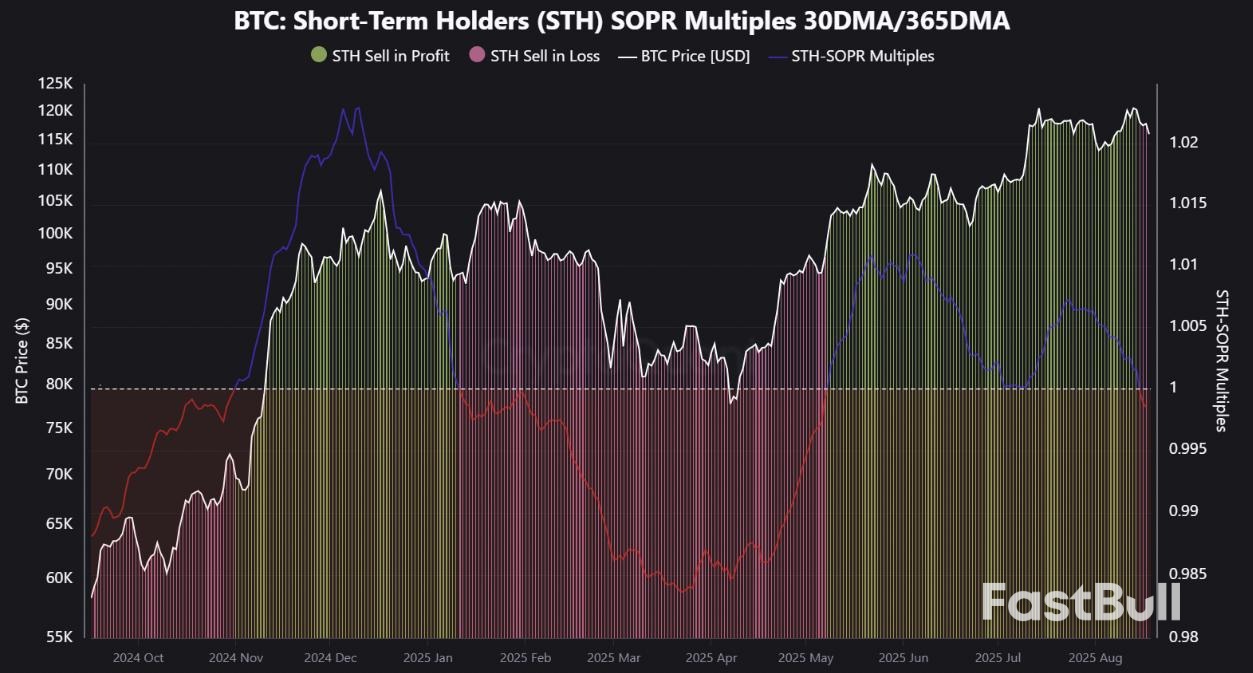

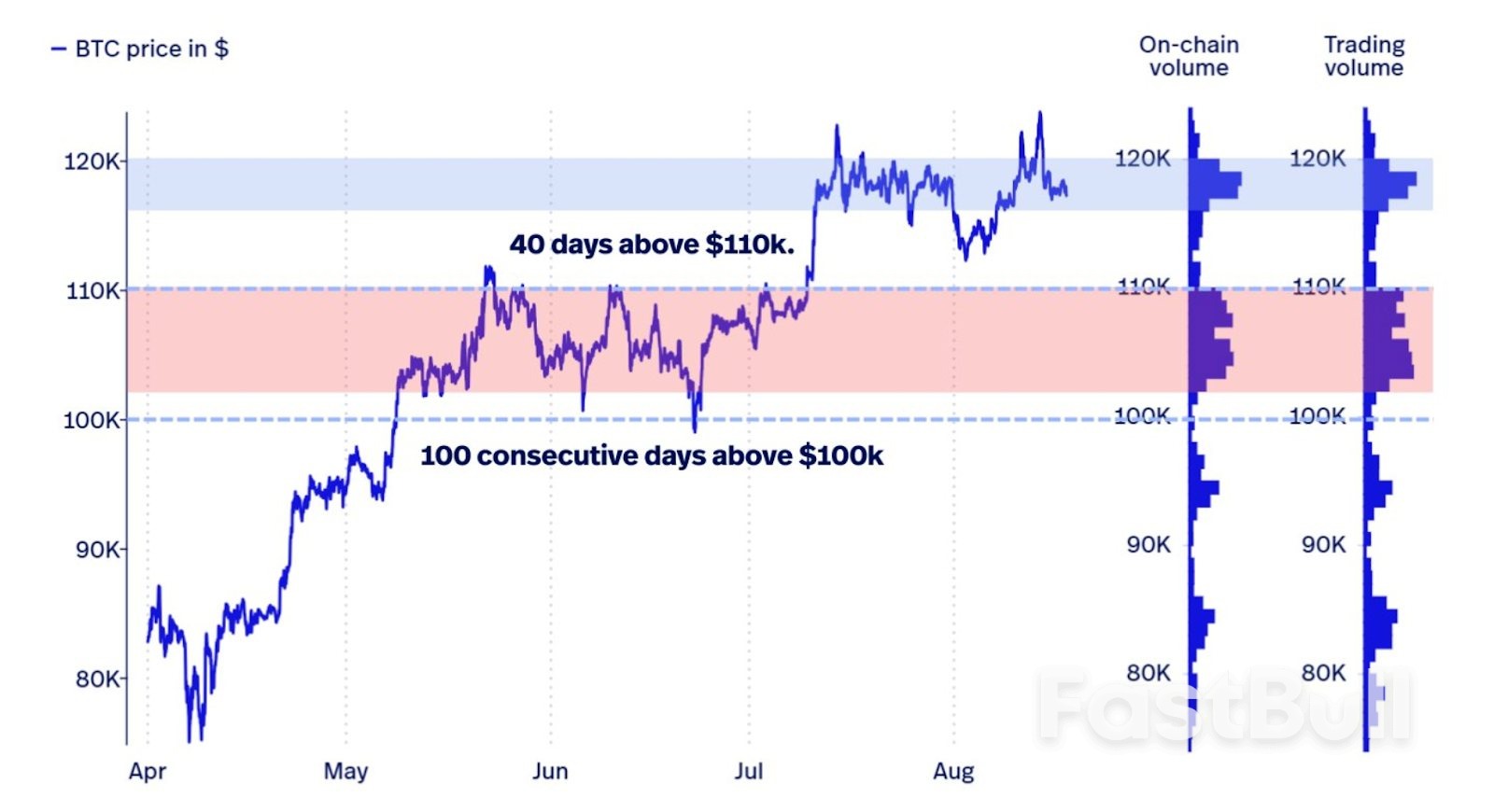

More than 20,000 Bitcoin were moved to exchanges at a loss by short-term holders this week, raising the odds for a BTC price dip toward $110,000.

Bitcoin STH SOPR Multiples 30DMA/365DMA. Source: CryptoQuant

Bitcoin STH SOPR Multiples 30DMA/365DMA. Source: CryptoQuant

President Trump has made it clear that he will not send American troops to enforce a possible peace agreement in Ukraine centered on 'security guarantees' - despite having appeared possibly open to the idea just a day earlier.

In a phone interview on Fox News Tuesday morning, Trump was asked what assurances he could offer that American forces wouldn't end up defending Ukraine's borders, and beyond his time in office. The question was based on his campaign and opening months in office - when he repeatedly vowed no more boots on the ground in entangling conflicts abroad.

"You have my assurance, and I’m president," Trump responded. European leaders are pressing for the strongest possible security guarantees for Ukraine, to ensure it can never be attacked in the future, once a peace settlement is reached.

A White House official additionally confirmed on Tuesday that Trump has definitively ruled out deploying US ground forces to Ukraine, according to CNN.

Security guarantees for Ukraine were a central focus between Trump, Ukrainian President Volodymyr Zelensky, and seven EU leaders - among them NATO Secretary General Mark Rutte.

The Europeans want clarity on what level of American military support Trump is willing to offer to prevent Russia from regrouping and pursuing further territorial advances after a potential peace deal.

British Prime Minister Keir Starmer, who was in the White House yesterday alongside France's Macron, is still vowing to press for the most robust guarantees possible.

"Turning to next steps, the Prime Minister outlined that Coalition of the Willing planning teams would meet with their US counterparts in the coming days to further strengthen plans to deliver robust security guarantees and prepare for the deployment of a reassurance force if the hostilities ended," a Downing Street spokesperson said in a statement.

"The leaders also discussed how further pressure – including through sanctions – could be placed on Putin until he showed he was ready to take serious action to end his illegal invasion," Starmer's office added. In some ways, this can easily be read as the Europeans saying they are actively trying to sabotage peace, as the fear is that it will be settled on Moscow's terms.

Additionally, Bloomberg is reporting that "Security guarantees for Ukraine will be formalized in the coming days and as soon as this week, European Council President Antonio Costa tells reporters in Lisbon following virtual meetings of 'Coalition of the Willing' and EU leaders.

President Putin has repeatedly emphasized that Russia will never allow Western boots on the ground in Ukraine as part of some peacekeeping force or entity patrolling frozen front lines. At least Trump is saying he's on the same page, and fully understands this, at least for now.

DUBAI - Saeed Mohammed Al Tayer, MD and CEO of Dubai Electricity and Water Authority (DEWA), announced the beginning of trial operation and electricity export from the pumped-storage hydroelectric power plant in Hatta to Dubai.This announcement was made during his visit to the project to review progress in the final stages of work, where the amount of energy produced during the past period of the station's operational testing exceeded 17,921 megawatt-hours.

The plant will have a production capacity of 250 megawatts (MW), a storage capacity of 1,500 megawatt-hours and a lifespan of up to 80 years. The peak electricity demand in Hatta is approximately 39 MW, and the surplus will be exported to Dubai.Al Tayer was accompanied by Nasser Lootah, Executive Vice President of Generation (Power & Water) at DEWA; Khalifa Al Bedwawi, Project Manager; and the project team.

Al Tayer affirmed that the project is in line with the vision and directives of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, to achieve comprehensive and sustainable development across the Emirate of Dubai. It also supports the Dubai Clean Energy Strategy 2050 and the Dubai Net-Zero Carbon Emissions Strategy 2050, which aim to provide 100 percent of Dubai's total energy production capacity from clean sources by 2050.During the visit, Al Tayer toured the power generation station building, which was constructed 60 metres underground, and was briefed on the operation of the station's two main water valves, each weighing approximately 110 tonnes. He also inspected the station's command and control centre and witnessed an operational test of the water pumping and power generation.

The visit included the upper dam, built by DEWA as part of the project, with a total water surface area of 210,000 square metres. The dam comprises two compressed concrete walls: a main wall 72 metres high and 225 metres long, and a side wall 37 metres high. The upper dam has a storage capacity of around 5.3 million cubic metres (1,166 million gallons) of water.Al Tayer highlighted that the hydroelectric power plant in Hatta, with an investment of approximately AED1.42 billion, is part of DEWA’s efforts to diversify energy production from renewable and clean sources in Dubai. These include technologies such as solar photovoltaic panels, concentrated solar power, and energy storage in batteries.

The project is designed to generate electricity using water stored in the Hatta Dam and the upper dam with a turnaround efficiency of 78.9 percent. It uses the potential energy of water stored in the upper dam, converting it into kinetic energy as it flows through a 1.2-kilometre subterranean tunnel.This kinetic energy rotates the turbines, converting mechanical energy into electrical energy, which can be supplied to DEWA’s grid within 90 seconds to meet demand.To store energy, clean power generated at the Mohammed bin Rashid Al Maktoum Solar Park will be used to pump water back to the upper dam, converting electrical power into kinetic energy in the process.

The morning NA session follows a quasi-dead European overnight trading.

This tends to happen when a lack of data adds to the Summer trading when volumes are typically subdued.

The Dollar Index had been in the middle of many headwinds, as per usual. After a stellar July followed by and N-shaped (for nope) downward spiral in the beginning of August, it has been difficult to spot where the Greenback is heading.

Forex volatility tends to calm during summers and lack of decisive trends exacerbate this rangebound trading – When the path is unclear, rangebound trading is typical (particularly in currencies.)

With Markets awaiting more developments after the White House gathered heads from Russia, Ukraine and the EU, the Dollar is forming a temporary bottom around the 98.00 Handle.

This region had already formed the post-Liberation day bottom (quickly broken in May).

The White House meetings went well and the US will now attempt to create a Putin-Zelenskyy meeting.

Donald Trump, the author of the Art of the Deal, is an unpredictable leader but one sure thing, he is a monster negotiator, and this is giving back some confidence in the US.

In our most recent DXY analysis, we mentioned an expectation of a more balanced Dollar as a lack of continuation upwards and a not-broken bottom show indecision.

Let’s see if this indecision shall continue, at least to the technical side.

Dollar Index Daily Chart

The US Dollar is holding its low-sloped ascending channel in a 5 day consolidation around the 98.00 handle.

The post-CPI data had created a new offer for the US Dollar as Markets rushed to price the September cut to 97% before the surprising PPI data changed the course of action.

With the future US inflation expectations rising considerably, the fundamental background for the Dollar (like its rate outlook) is more uncertain.

The Daily RSI is way into the Neutral territory and the Daily doji is an indecision one. All of this is also happening right around the 50-Day MA (currently at 98.065).

Such indecisive price action doesn’t warrant analysis across many timeframes – it is better in this environment to look at where we see the most.

The Dollar Index is stuck between the 97.60 Support and the 98.50 Resistance Zones.

With the Price action rebounding from the lows of the Daily upward Channel supplemented by the 2H MA 50 acting as support, it seems that the preferred path would be to the upside.

If things were so sure however, the Dollar would have risen already to test the following resistance zone.

Typically, in this environment, it is good to look at the highs (98.30) and lows of the session (97.94) to see where if the action breaks out from there.

To the upside, look at the 2H MA 200 currently at 98.515.

To the downside, look at the 97.60 Support Zone, then the 97.15 July upward pivot.

Levels to place on your DXY Charts:

Resistance Levels

Support Levels

Safe Trades!

World cocoa prices are currently on the rise, thus making the crop a commodity with high potential to generate lucrative returns.The Malaysian Cocoa Board (LKM) in a statement on Tuesday said that in 2024, the average price of dry cocoa beans grew by 141% to RM24,274 per tonne compared to RM10,073 per tonne in the previous year.“The Cocoa Cultivation Promotion Programme for the Plantation Sector will be implemented by the board from 2025 to 2030 with an allocation of RM550,000 per year.

“Via this programme, LKM will distribute high-quality cocoa seedlings for free, provide technical guidance, practical training and continuous monitoring to ensure that cocoa planting is carried out according to the best agricultural practices,” the board said.So far, it said, several Malaysian plantation companies have participated in the programme, with a total area of 360 hectares.Companies selected to participate in the programme would receive incentives in the form of 5,000 high-quality cocoa seedlings worth RM50,000, in addition to technical advisory services including nursery development, planting systems and others, it said.

“Within five years, the programme aims to expand the cocoa plantation area by 2,750 hectares nationwide.“The plantation sector is an important driver in increasing cocoa production sustainably to meet the demand of local manufacturers, while supporting efforts to make Malaysia a producer of premium cocoa and ‘single origin’ cocoa beans, which are increasingly gaining traction in the world market,” said LKM.Earlier, LKM organised the Cocoa Cultivation Promotion Engagement Programme for the Plantation Sector for the Sarawak Region here on Tuesday.

Officiated by the Ministry of Plantation and Commodities’s cocoa and pepper industry development division secretary Cheah Chee Fong, the event was attended by 94 participants, consisting of plantation companies, individual entrepreneurs, farmer groups, and representatives of relevant government agencies.It aimed to provide information on the incentives offered to plantation companies to cultivate cocoa crops, as well as the potential of the industry.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up