Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone ZEW Economic Sentiment Index (Jan)

Euro Zone ZEW Economic Sentiment Index (Jan)A:--

F: --

P: --

Euro Zone Construction Output YoY (Nov)

Euro Zone Construction Output YoY (Nov)A:--

F: --

P: --

Euro Zone Construction Output MoM (SA) (Nov)

Euro Zone Construction Output MoM (SA) (Nov)A:--

F: --

Argentina Trade Balance (Dec)

Argentina Trade Balance (Dec)A:--

F: --

P: --

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)--

F: --

P: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Jan)

U.S. Kansas Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Jan)

U.S. Kansas Fed Manufacturing Production Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

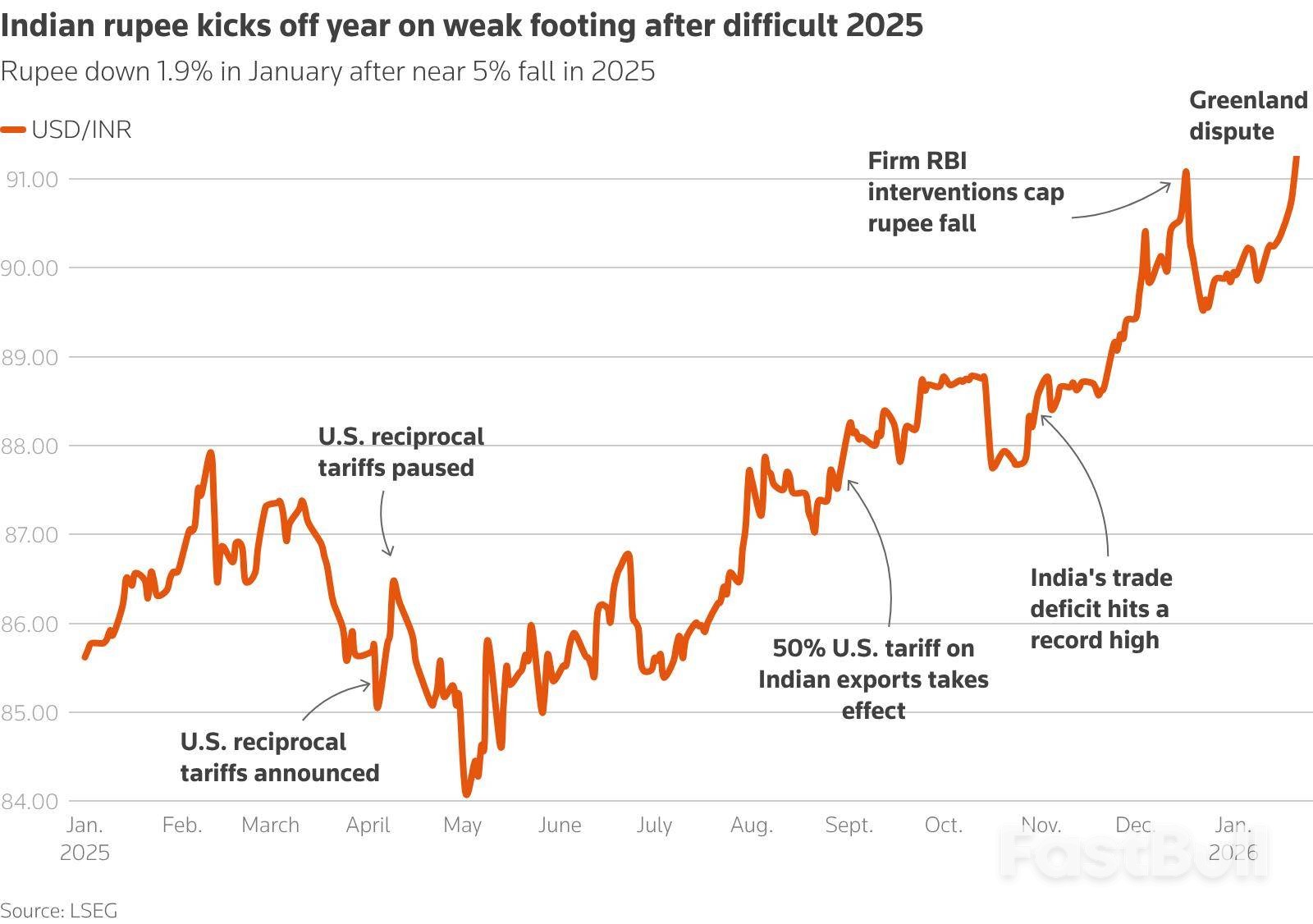

India's rupee plunged to a record low amidst a global bond sell-off and sustained capital outflows, with the RBI refraining from intervention.

The Indian rupee tumbled to a record low on Wednesday, marking its most significant single-day drop in two months amid a global bond sell-off and rising investor anxiety over capital outflows.

The currency fell for the sixth consecutive session, hitting an unprecedented 91.7425 against the U.S. dollar. It ultimately closed at 91.6950, a 0.8% decline from the previous day's 90.9750.

Market traders noted that the fall was amplified by the Reserve Bank of India’s decision to refrain from intervening with dollar sales. As the worst-performing currency in Asia for the day, the rupee has already weakened by 2% this month, extending the approximately 5% decline it registered in 2025.

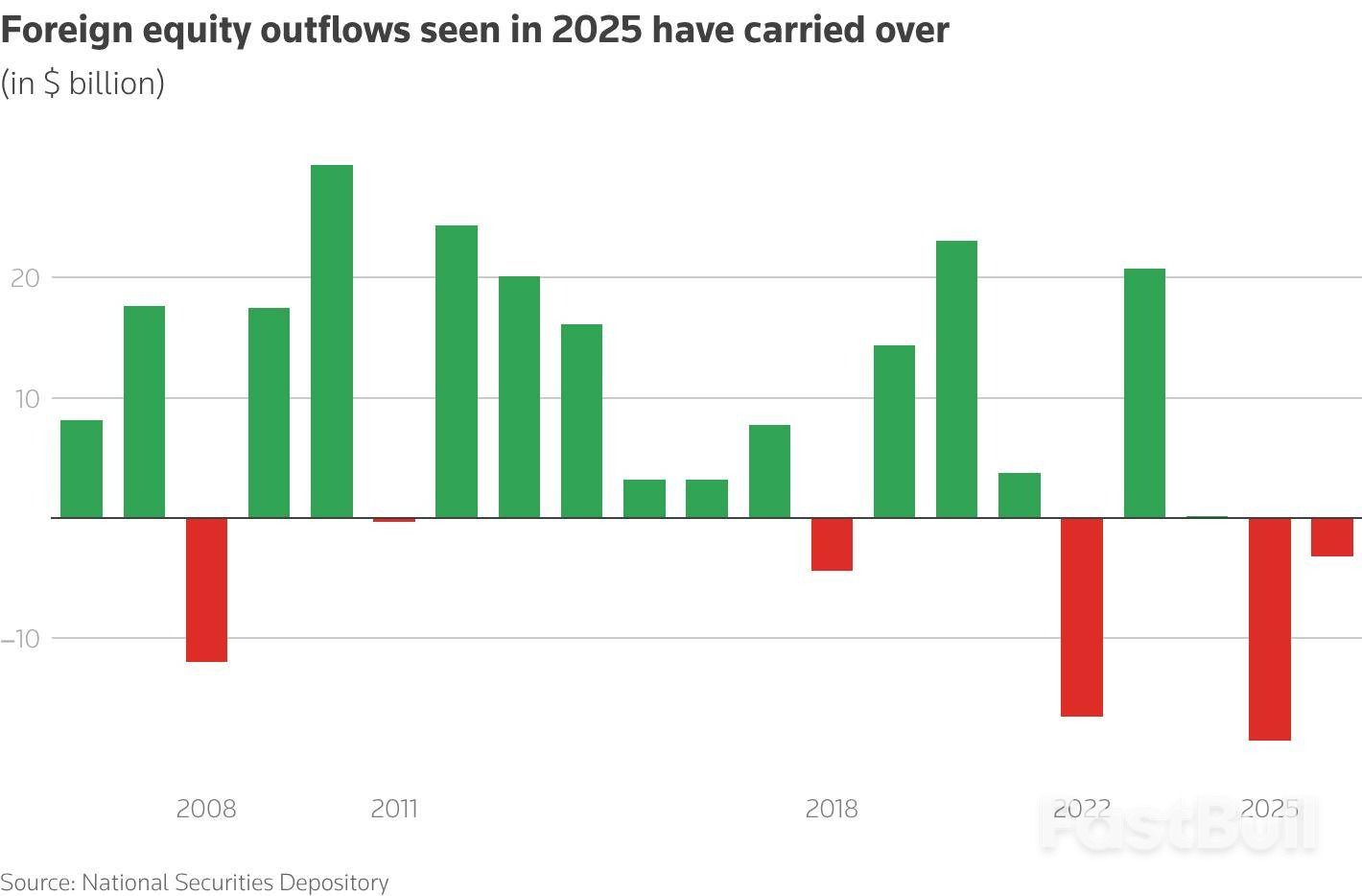

Many of the headwinds that pressured the rupee in 2025 have carried over into the new year. A key factor is the continued exit of foreign capital from Indian equities.

Foreign investors have already pulled around $3 billion from Indian shares in January, following record outflows of nearly $19 billion in 2025. This trend has put pressure on the domestic stock market, which fell 0.3% on Wednesday after its largest drop in over eight months the day before.

"Flows mainly drive the USD/INR pair, thus weakness may continue to persist with interim legs of intervention expected from RBI in case of excess volatility," said Kunal Sodhani, head of treasury at Shinhan Bank India.

Analysts point out that while India’s current-account deficit is manageable, a lack of sufficient capital inflows leaves the currency vulnerable. This situation is worsened by importers, who are more inclined to hedge their dollar exposure than exporters are, anticipating further rupee depreciation.

According to India Forex Advisors, the currency will remain sensitive to shifts in corporate demand and portfolio flows. An increase in global risk aversion, fueled by factors like a global bond rout and U.S. threats regarding Greenland, would likely accelerate outflows and intensify the downward pressure.

Adding to the currency's challenges this year are several external factors:

• Regional Weakness: Unlike in 2025, most of the rupee's Asian peers are also experiencing weakness, removing a potential source of relative stability.

• Trade Deal Stalemate: A lack of progress on a trade agreement with the United States has deprived the rupee of a potential catalyst for inflows.

With multiple pressures mounting, investors are now closely watching for U.S. President Trump's upcoming speech in Davos for further direction.

Germany's economy could see 1% growth in 2026, but only if it can avoid a new round of U.S. tariffs, the BDI industry association warned on Wednesday. The group stressed that despite the potential for growth, the outlook for the country's crucial industrial sector remains fragile.

Amid rising global uncertainty, the BDI urged the German government to center its policy agenda on improving competitiveness, stimulating growth, and creating jobs. The looming threat of fresh U.S. tariffs adds significant pressure to export-driven European economies like Germany's.

BDI President Peter Leibinger stated that Europe must meet these tariff threats with a united and confident response. He argued that only a competitive and resilient European Union can negotiate from a position of strength.

The BDI projects that Germany's industrial sector will likely expand at a slower pace than the overall economy this year, highlighting a key vulnerability.

"Only if we now give top priority to strengthening competitiveness and growth can we stop the downward trend in industrial production," Leibinger said.

To reverse this trend, the BDI outlined a series of reforms designed to invigorate the industrial base.

The association is advocating for measurable policy changes to unlock economic potential. Key proposals include:

• Cutting Bureaucracy: The BDI has already submitted 253 specific proposals to reduce red tape for businesses.

• Accelerating Permits: Speeding up the approval process for major industrial projects is seen as critical.

• Flexible Labor: The group called for allowing more flexible working-time models to adapt to modern economic demands.

Additionally, Leibinger suggested that bringing forward a planned cut in corporate tax could provide a direct growth impulse as early as 2026.

Ukraine has appointed a new defence minister with a clear mandate: overhaul Europe's largest military with a data-driven strategy designed to give its forces a decisive edge against Russia's larger army. Mykhailo Fedorov, formerly the country's digitalisation minister, was appointed last week by President Volodymyr Zelenskiy to drive innovation and fortify Ukraine's defenses.

Fedorov's plan centers on rewarding battlefield results and implementing advanced technology to counter Russia's superior equipment.

In his first remarks to reporters, Fedorov promised a sweeping reform of the defence ministry's management, emphasizing that performance will be the sole criterion for success. "If people don't demonstrate measurable results, they can't remain in the system," he stated.

His team has already compiled "high-quality data" to analyze ministry spending, identify potential savings, and address a significant budget gap. Fedorov stressed the importance of what he calls "the mathematics of war," underscoring that his approach will be built on systematic calculation and efficiency.

To translate this vision into action, the ministry will soon launch a mission control system for its drone operations. This platform will provide detailed data on the performance and effectiveness of drone crews, enabling better strategic decisions. A similar system is planned for artillery units.

"We need to see the full picture to simplify and speed up management decision-making," Fedorov explained. The ultimate goal is to increase Russian losses to an unsustainable level.

Ukraine plans to establish a system that allows its allies to use its vast repository of combat data to train their military artificial intelligence models. Since Russia's full-scale invasion in February 2022, Ukraine has accumulated an invaluable trove of battlefield information, including:

• Systematically logged combat statistics

• Millions of hours of drone footage

This real-world data is critical for training AI to recognize patterns and predict outcomes. Fedorov has previously described this data collection as one of Ukraine's key negotiating assets. Ukraine is already using AI technology from the U.S. data analytics firm Palantir.

Fedorov also noted that his team is receiving strategic advice from prominent think tanks, including the Center for Strategic and International Studies (CSIS) and RAND in the United States, as well as the Royal United Services Institute (RUSI) in the UK, as he seeks to more actively integrate allies into defense projects.

This month, Ukraine will begin testing a domestically produced replacement for China's widely used DJI Mavic drone, which serves as a primary reconnaissance tool for both sides of the conflict. The manufacturer's name was not disclosed.

This move addresses concerns about over-reliance on Chinese technology, especially given Beijing's close ties with Moscow. "We will have our own Mavic analogue: the same camera, but with a longer flight range," Fedorov confirmed.

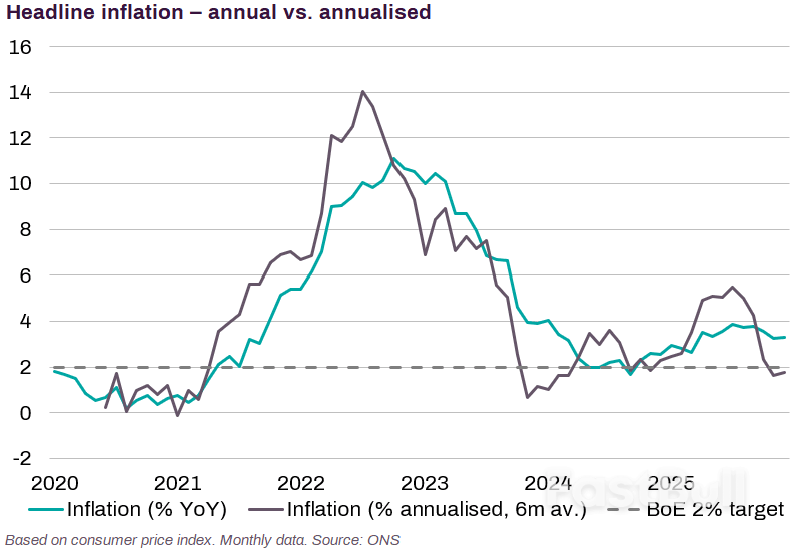

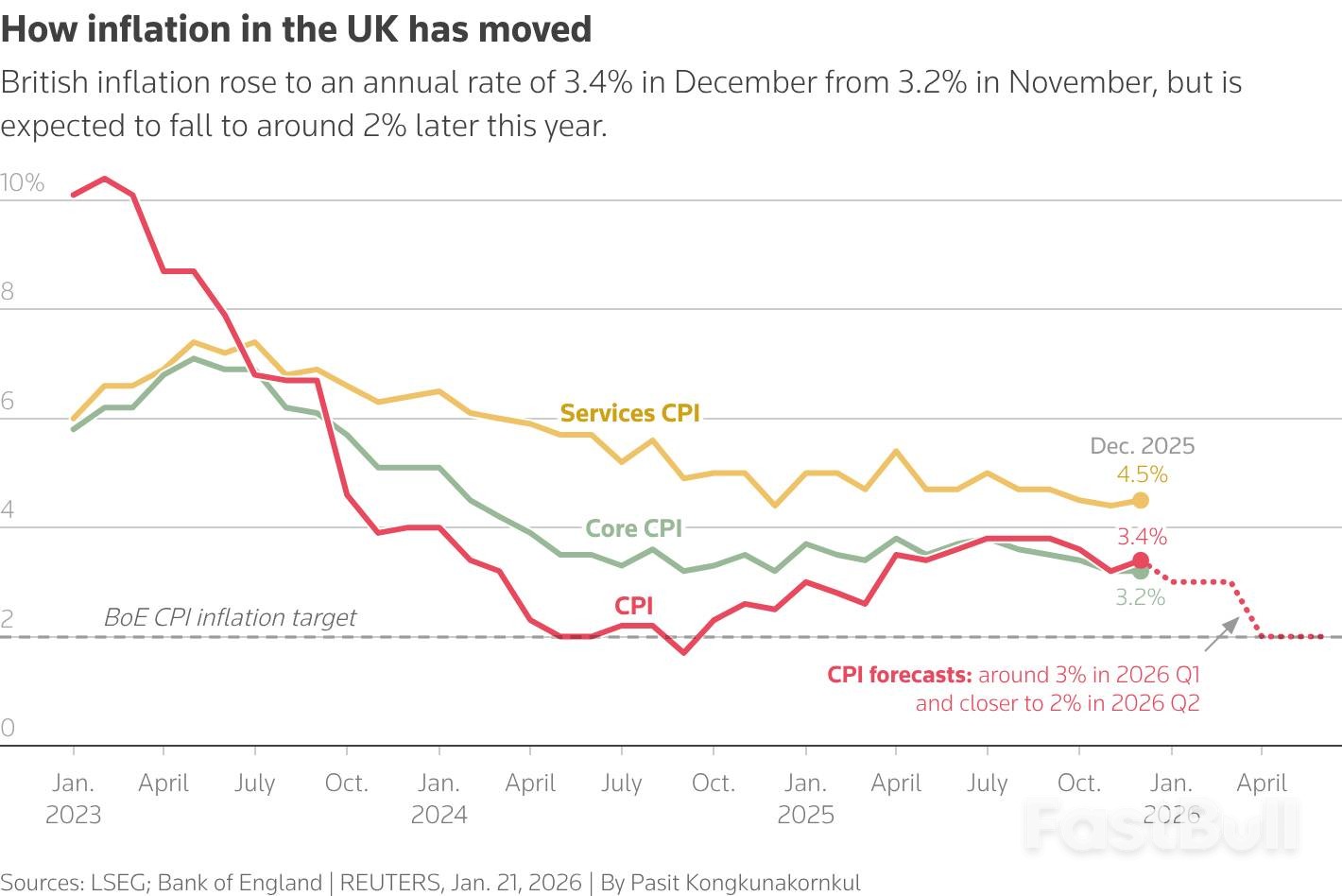

UK inflation unexpectedly climbed for the first time since July, hitting 3.4% in December and complicating the path toward price stability. Despite the increase, investors and economists largely believe the upward blip won't derail the Bank of England's plan to cut interest rates later this year.

Official data shows the Consumer Price Index (CPI) rose from 3.2% in November, surpassing the 3.3% that economists had forecasted.

Key takeaways from the latest report include:

• Headline Inflation: Reached 3.4% in December.

• Primary Drivers: Price hikes were mainly caused by increased tobacco duties and seasonal airfare costs.

• Market Reaction: Financial markets remained steady, with expectations for 2026 rate cuts unchanged.

• Services Inflation: A crucial metric for the central bank, services price inflation edged up to 4.5% from 4.4%, aligning perfectly with forecasts.

The primary forces behind the December inflation increase were higher prices for tobacco products, following a rise in duties, and the typical surge in airfares around the Christmas holiday period.

While the headline number was higher than expected, Adam Deasy, an economist at PwC, described the event as a "speed-bump, rather than an indication we are veering off course on the road to price stability."

This sentiment is shared across the market, as the underlying drivers are seen as temporary rather than a sign of persistent inflationary pressure.

Despite the uptick, the Bank of England (BoE) is widely expected to proceed with interest rate cuts in 2026. The central bank is focused on the broader trend, which still points toward a significant slowdown in price growth over the coming months.

BoE Governor Andrew Bailey has previously stated that he expects inflation to fall close to the bank's 2% target by April or May. Consequently, the latest data did little to move the pound or alter market bets on future monetary policy.

"The Bank of England will... not be worried by these numbers," noted Nicholas Crittenden, an economist from the National Institute of Economic and Social Research. He added, "We still predict one cut in Bank Rate in the first half of this year."

Financial markets are currently pricing in one or possibly two quarter-point rate cuts by the BoE in 2026. This reflects confidence that the disinflationary trend will overcome short-term volatility.

While the domestic inflation picture appears manageable, external factors pose a significant risk. Governor Bailey recently highlighted that the BoE is worried about how markets are reacting to geopolitical developments.

These concerns are materializing in energy markets. British natural gas futures have surged by approximately 25% in the last two weeks, partly due to deteriorating relations with the United States, a key supplier of liquefied natural gas. The tensions stem from President Donald Trump's threats of tariffs on European allies who oppose his Greenland takeover plan. An escalation could disrupt supply chains and push energy costs higher, complicating the BoE's inflation fight.

Even with the December surprise, Britain's consumer price and services inflation rates are running slightly below the BoE's own projections from its November forecasts. However, the UK continues to have the highest inflation rate in the Group of Seven, paired with sluggish economic growth.

Data on producer prices, which can be a leading indicator for consumer inflation, showed a sharp increase in the services sector during the fourth quarter, rising to 2.9% from 2.0%. Meanwhile, output price inflation for manufacturers remained stable.

The BoE's Monetary Policy Committee last cut the Bank Rate to 3.75% in December, but the decision was not unanimous. Nearly half of its members voted to hold rates steady, citing concerns about persistent inflation, a signal that the debate over policy easing is far from over.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up